EXECUTIVE SUMMARY

Janata Bank Limited (JB) is the second largest commercial bank in terms of net worth with 850 branches and fully owned by Government of Bangladesh. The mission of the bank is to actively participate in the socio-economic development of the nation by operating a commercially sound banking organization. Immediately after the independence of Bangladesh in 1971, the previous United Bank Limited and Union Bank Limited were nationalized and renamed as Janata Bank. Janata Bank is a state owned commercial bank which was incorporated as a Public Limited Company on 21 May 2007 as per Companies Act 1994 and took over the business of the then Janata Bank with all of its assets, liabilities, right, power, privilege and obligation on a going concern basis through a vendor agreement signed between the Peoples Republic of Bangladesh and Janata Bank Limited on 15 November 2007 with a retrospective effect from 1 July 2007.In the year end of 2009 the authorized capital of the bank at present remained at Tk. 20000 million (approx. US$ 283.33 million).Paid up capital 5000.00 million. Reserve fund & other fund Tk.10823.01 million and retained surplus Tk. 5167.18 million.

The data used to furnish this report have been collected from the primary sources and secondary sources. Among primary and secondary sources most of the data have been collected from the secondary sources. Organization part has been prepared based on secondary data collected from website of Janata Bank Ltd, Manual of JBL, Desk report of the related department and training sheets. “An Analysis of Loan Disbursement & Recovery System of Janata Bank Ltd. “A Study on Corporate Branch”. To evaluate this I prepare: To describe various loans & advance products of Janata Bank limited. To explain how the bank sanction loan to clients. To illustrate the loan recovery system of Janata Bank Ltd. To identify the problems related to loan and advance department of Janata Bank Ltd. Corporate Branch, Dhaka. To make some recommendations on the basis of the problems.

INTRODUCTION

Here I have presented the origins, orientation topic, purpose, scope, limitations, methodology of the study, and objective of the study, the data collection method and background ofthe study while creating this report.

ORIGIN OF THE REPORT

Prof.Dr.Iqbal Hossain is honorable lecturer and course instructor of ASA University Bangladesh has authorized to present a thesis paper on the topic “An Analysis of Loan Disbursement & Recovery System of Janata Bank Ltd.” It will be submitted on 31th December.

This report was prepared by

MD.Sanuar Hossain 091-12-0254

OBJECTIVES OF THE REPORT

The objectives of the study are as follows:-

1. To study the loans disbursement & recovery system of Janata Bank Ltd.

2. To identify problems related to various loans & advance products of JBL.

3. To explain how the bank sanction loan to clients.

4. To illustrate the loan recovery system of Janata Bank Ltd.

5. To make some recommendations on the basis of the problems.

SCOPE OF THE STUDY

This report has been prepared through extensive discussion with bank employees and with the clients. While preparing this report, I had a great opportunity to have an in depth knowledge of all the loans & advance by the Janata Bank limited. It also helped me to acquire a fast hand perspective of a leading bank in Bangladesh.

LIMITATIONS

To prepare a report on the achieved practical experience in a short duration is not an easy task. In preparing this report, some problems & limitations have encountered, which are as follows:

1. Large scale analysis was not possible due to constraints & restrictions posted by the banking authority.

2. This report is limited only to the Loans & Advance Department, it does not cover the general banking part of Janata Bank Ltd.

3. In many cases, up to date information was not published.

4. In some cases, access to relevant papers & documents were strictly prohibited.

5. In some other cases, access was denied to procedural matters conducted directly by the top management in the operations of loans & advance department.

METHODOLOGY OF THE STUDY

Approach: From educational background, every one learned different methodology in research process. Therefore, in this study, in the organization synopsis part information is presented in a Descriptive manner. Both the primary as well as the secondary form of information was used to prepare the report. The details of these sources are highlighted below:

Target population: The target Population is the Officers of Corporate Branch, Janata Bank Ltd.

Primary Source: The data is used for first time or not used before is called primary data. Primary data collected from the people by their views, opinion, comment etc.The primary data are collected by interviewing employees, managers by the process assigned by Janata Bank Ltd. observing various organizational procedures, structures. Primary data were mostly derived from the discussion with the employees & through surveys on customers of the organization.

Secondary sources: The data is used before is called secondary data. These kinds of data are collected from relevant books, newspapers, journals, websites, magazines etc. in this report the secondary data are collected from:

Internal Sources:

Janata Bank’s Annual Report – 2007, 2008, 2009, 2010, 2011,

Janata Bank’s Instruction Manual and Training manual.

Annual and journal report published by Janata Bank Ltd. of Bangladesh.

External Sources

Different books and periodicals related to the banking sector

Bangladesh Bank Circulars

Newspapers

Website Information

SAMPLE SIZE

A sample is a subgroup or subset of the population. The number of items or units included in the sample is technically called the sample size. In this report the sample is Five Officers of Corporate Branch. Janata Bank Ltd.

Random sampling is used in this report.

Methods of data collection: For this report Direct Interview method are used.

Sampling Method

Convenience sampling is used for this report Convenience Sampling is used for this report. The method of convenience sampling is also called chunk. A chunk is a fraction of one population taken for investigation because of its convenient availability.

BANKING HISTORY

The English word “Bank” is derived from Italian word “banco”. The Latin “bancus” and French word banque which means a bench. They are of the opinion that the medieval European bankers (i.e. money changers and money lenders) transacted their banking activities on the benches in market place. This money changing and money lending business is known as ‘’Banking business’’.Banks have to compete with local financial institution as well as foreign financial institution in the market place, banks has to develop appropriate financial structure and should periodically review and compare their performance with its competitor to build a sound banking institution. Banks are financial intermediary institutions. The core is to mobilize the financial surplus of saver in the form of deposits & allocate these savings to the credit worthy borrowers of different sector of economy in the form of loans & advances. The advance of the intermediary functions between the savers & investors would certainly in the lower level of savings & investment & thus lower the economic growth. That development of the financial intermediaries & instrument (both in case of deposit & advance) will lead to the development of the economy of a country.

BANKING IN BANGLADESH

Economy of Bangladesh is in the group of word’s most underdeveloped economics. One of the reasons may be its underdeveloped banking system. Modern banking system has been plays a vital role for a nations economic development. Over the last few years the banking world has been undergoing a lot of change due to deregulation, technological innovations, globalization etc. These changes also made revolutionary changes of a country’s economy. It is well recognized that there is an urgent need for better qualified management & better-trained staff in the dynamic global financial market. Bangladesh is no excepting in that trend. Banking sector in Bangladesh is facing challenges from different angles though its prospect is bright in the future.

Banks are the mainstay of the financial system of a country of a country like Bangladesh. Because of close relationship between economic and financial development, the banking system must be robust, resilient and sound for efficient inter-mediation of financial recourses. For this required sound and prudential financial regulations.

Although our banking sector is so strong and healthy, the role played by it in our economy is remarkable. Banking sector of Bangladesh exhibited a resilience performance in spite of comparative economic sluggishness. It has been playing a vital in the economy by providing credit for performing economic activities and at the sometime conglomerate the surplus capital from general public through different types of depository incentives. But for the sound lending management, appropriate strategies and well planned are required.

In the recent year, Government has taken initiatives to reform in financial sector, such as maintaining discipline in banking sector, steps for prevention of money laundering, loan write-off policy and effective measures to gain accountability and transparency in banking sector. These timely steps have made the banking operations more transparent, acceptable and modern. As a result, the image of banking sector has been elevated.

An OVERVIEW OF THE BANK

JANATA Bank Limited welcomes to all to explore the world of progressive Banking in Bangladesh. It is a state owned commercial bank and is catering the need of the mass business people. Immediately after the independence of Bangladesh in 1971, the erstwhile United Bank Limited and Union Bank Limited were nationalized and renamed as Janata Bank. It was corporazed on 15th November 2007. Janata Bank was born with a new concept of purposeful banking sub serving the growing and diversified financial needs of planned economic development of the country. The noble intention behind starting of this Bank was to bring about a qualitative change in the sphere of banking and financial management. Janata Bank is playing a significant role towards socio-economic development of the country by financing Non-Banking Financial Institutions dealing with Home Loan, Corporate Financing & Loan Syndication. Janata Bank is always vigilant to develop its market potentialities way before others are thinking/planning today. Janata Bank is the first among to start SWIFT operation to minimize transmission cost in lieu of the telex system and simultaneously increase remittance business and foreign trade. It has automated 92 branches and developed 20-application software by its own staff, which has reduced huge internal expenses and enriches operational efficiency as well. Janata Bank Limited operates through 864 branches including 4 overseas branches at United Arab Emirates. It is linked with 1202 foreign correspondents all over the world.

The Bank employs 15705 employees.

The mission of the bank is to actively participate in the socio- economic development of the nation by operating a commercially sound banking organization, providing credit to viable borrowers, efficiently delivered and competitively priced, simultaneously protecting depositor’s funds and providing a satisfactory return on equity to the owners. The Board of Directors is composed of 13 (Thirteen) members headed by a Chairman. The Directors are representatives from both public and private sectors. The Bank is headed by the Chief Executive Officer & Managing Director, who is a reputed banker. The corporate head office is located at Dhaka with 10 (ten) Divisions comprising of 37 (thirty seven) Departments.

International Award -“World’s Best Bank Award-2009 in Bangladesh

Janata Bank Limited was awarded Best Bank-Bangladesh in the Global Finance, World’s Best Bank Awards, 2009 by New York based Financial Magazine “Global Finance”. “Global Finance” has identified winning banks based on number of criteria including growth in Assets, Profitability, Strategic relationships, Customer Service, Competitive pricing and innovative products.

HISTORICAL STARTING

Janata Bank Limited (JB) is the second largest commercial bank in terms of net worth with 850 branches and fully owned by Government of Bangladesh. The mission of the bank is to actively participate in the socio-economic development of the nation by operating a commercially sound banking organization. Immediately after the independence of Bangladesh in 1971, the erstwhile United Bank Limited and Union Bank Limited were nationalized and renamed as Janata Bank. Janata Bank is a state owned commercial bank which was incorporated as a Public Limited Company on 21 May 2007 as per Companies Act 1994 and took over the business of the then Janata Bank with all of its assets, liabilities, right, power, privilege and obligation on a going concern basis through a vendor agreement signed between the Peoples Republic of Bangladesh and Janata Bank Limited on 15 November 2007 with a retrospective effect from 1 July 2007. All of its operational activities are governed by the Bank Companies Act 1991. The Bank provides all kinds of commercial banking services to its customers including accepting deposits, extending loan & advances, discounting & purchasing bills, remittance, money transfer, foreign exchange transaction, guarantee, commitments etc. The principal activities of its subsidiary are to carry on the remittance of hard-earned foreign currency to Bangladesh. Janata Bank Ltd. has a plan to switch over to a multi disciplinary financial institution by conducting Merchant Banking business and Islamic Banking. The authorized capital of the bank at present remained at Tk. 20000 million (approx. US$ 283.33 million). Paid up capital: Tk. 5000.00 million.

OBJECTIVE OF THE BANK

- To earn customer satisfaction through diversified banking activities and introduction of innovative banking.

- To improve the customer services in recent times by introducing a number of IT-based reform measures.

- To remain one of the best banks in Bangladesh in terms of profitability and Assets Quality.

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To maintain a healthy growth of business with desired image.

- To maintain adequate control systems and transparency in procedures.

- To ensure optimum utilization of all available resources.

VALUES OF THE BANK

- To have a strong customer focus arid build relationship based on integrity, superior service and mutual benefit.

- To work as a team to serve the best interests of the group.

- To work for business innovation and improvements.

- To value and respect the people and make decision based on the merit.

- To provide recognition and reward on performance.

- To be responsible, trustworthy and law-abiding in every sphere.

- To become the base bank in respect of service, profitability and strength.

- Provide greatest return to the shareholders by achieving sound profitable growth.

PRESENT SITUATION OF JANATA BANK LTD.

Authorized Capital: The authorized capital of the bank at present remained at Tk. 20000 million (approx. US$ 283.33 million).

Paid up capital: Tk. 5000.00 million.

Reserve fund & other fund: Reserve fund Tk.10823.01 million and retained surplus Tk. 5167.18.

IPO Size: Tk. 10,000 million.

Face Value: Tk. 100.00.

Offer Price: Tk. 1000.00 (including a premium of Tk. 900).

Net interest income: Tk. 3,646.71 mn and Tk. 4,490.98 mn year ended on 31.12.10 and 31.12.11.

Profit/ (Loss) after tax: Tk. (9,968.18) mn, Tk. 1,094.44 mn, Tk.

3,145.38 mn and Tk. 2,981.87 for the year ended on 31.12.08, 31.12.09, 31.12.10 and31.12.11 respectively.

Retained Earnings: Tk. 3,252.47 million as on 31.12.11.

Total Liabilities: Tk. 279,802.41 million as on 31.12.11.

NAV per share: Tk. 341.83 as on 31.12.11.

EPS (As per prospectus): Tk. 100.62 as on 31.12.11.

EPS (restated): Tk. 78.02 (considering bonus & rights issue).

Major Product: All kinds of commercial banking, the bank recently has got merchant banking license and also plan for Islamic banking operation.

Performance of the Bank: Despite various setbacks in economy, Bank’s performance may be termed as satisfactory in respect of deposit mobilization and profit earning The Bank has a total asset of Tk. 345233.92 million as on 31st December 2012.

Deposit: As December, 31, 2011, Bank’s total Deposit stood at tk.246175 million.

Credit: During the year total Advanced stood at tk.166.359 million. As Dec.31, 2011.

Credit Administration: The rate of classified loans during the year was 13423 million.

Investment: Investment figure of the Bank as on 31st December, 2011 stood at tk.72533 million.

Foreign Exchange Business: During 2011, the Bank handled Export and Import Business to the tune of tk.88653 million and tk. 118525 million respectively.

Treasury: through effective fund management, the Bank could earn tk. 18134 million during the year 2011 through dealing broom operation.

Capital Market Operation: The Bank has a separate Brokerage House established with a view to facilitating the investors to operate in capital market in a hassle free atmosphere. Its success inspired the Bank to open new work station at Uttara and Dhanmondi in 2011, & Dilkusha.

Operational Result: The operational profit of the Bank during 2011was 13860million.

Dividend: In the line of proposed appropriation of profit, the Board of Directors has been pleased to recommended 30% Bonus Share (Stock Dividend) for its valued shareholders for the year 2011 and for consideration of approval shareholder

Number of Branches: 864 branch and total number of employees 15705.

MISSION OF THE BANK

- To mobilize resources from within to the development and growth of the country.

- To play a catalyst role in the formation of capital market.

- Anticipating business solutions required by all our customers everywhere and innovatively supplying them beyond expectation.

- Setting industry benchmarks of world class standard in delivering customer value through our comprehensive product range, customer service and all our activities.

- Maintaining the highest ethical standards and a community responsibility worthy of a leading corporate citizen

- Continuously improving productivity and profitability and thereby enhancing shareholder value.

Information about the Administration of JB Ltd.

Office Automation Technology, computer, internet these thins brings a new generation of banking service to the customer. Eight to ten years ago customers cannot think about that they can withdraw or deposit money from their account at least within one hour. But now it takes only

at best five minutes for withdraw their money. This is the simple example what technology brings to banking sector. In before bankers has to maintain huge ledger book for their daily or any sorts of banking record. But now they can do it by on click and by strike of few buttons. They have web page (www.janatabank-bd.com). Customer can get detail information from the web page. JB Ltd also has credit card and ATM machine now a days.

Audit Inspection Recovery Distribution: Head Office Audit and Inspection Division comprising sufficiently experienced and skilled manpower carried out internal audit and inspection work on regular basis. In 2002, all the branches of the Bank were audited at least once. Surprise inspections were also undertaken in many branches. Bangladesh Bank audit teams also conducted comprehensive and foreign exchange related inspections on the affairs of many branches during the year under report.

Human Resource Division: In the Janata Bank, this department deals with the employees as the core resources of the organization. This department mainly emphasize on the recruitment, selection of the employees. They are also motivating the employee to work efficiently and effectively.

Information Technology Division: It is very significant to adapt with the ongoing information technology revolution to provide faster services to the clients. The Information Technology Division supervises the overall computerization of the banking operations and networking, provides system support, deals with data processing and data entry, procures and maintain hardware, maintain and develop software required by the bank to facilitate and support the day to day operations.

Training Division: The main objective of this division is to make the employees efficient. Usually this division offers training to their employee time to time. This is helpful to the employee to do their job efficiently and effectively.

Marketing Department: The Marketing department mainly works for to promote the different types of services of information to the people. To improve the marketing network through out the country. To implements the marketing strategies and the concept of Trade marketing.

Credit Department: The credit department mainly deals with different types of loan and advances. This department analysis the proposal, approvable, monitoring the credit, disbursement, credit recovery position and credit policy that is given by all branches.

International Banking Department: The foreign exchange department mainly deals with export, import and foreign currency of different branches of the Bank.

Common Services Department: They take care of Banks assets and utilize their assets properly.

Public Relation & Protocol Department:

This department deals with people & coveys people’s views to the management.

Dead Stock & Stationery:

This department prints all security documents of Bank & looks after of this security items.

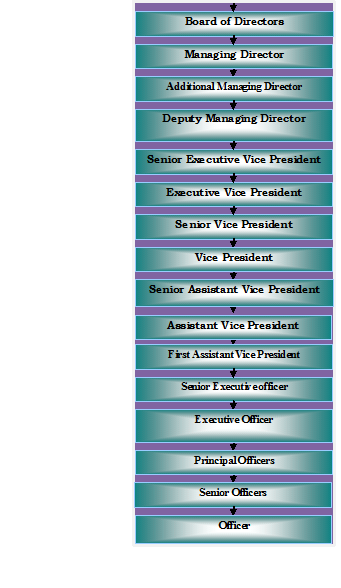

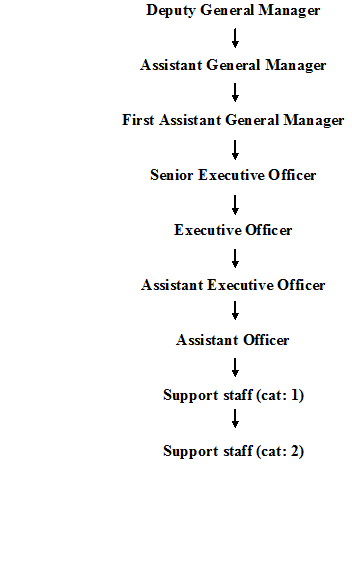

ORGANIZATIONAL STRUCTURE OF JANATA BANK LTD.

There are 13 members of Board of Directors manages Janata Bank Limited. For efficient operation of the bank the Board of directors forms an Executive Committee of 19 members. Besides, a management Committee looks after the affairs of the bank. The Bank maintains transparency in its entire works. All decisions of the management come through discussions in appropriate forum and required follow-ups are also made to see their effectiveness. Here are the management team given in a chart and he hierarchy of the JBL is given in next page-

ORGANIZATIONAL HIERARCHY OF CORPORATE BRANCH:

CORPORATE MISSION

CORPORATE MISSION

Janata Bank Ltd creates new opportunities for its clients. It gives customized services & maintains harmonies banker client relationship. To mobilize financial resources from within & abroad to contribute to agricultures, industry & socio-economic development of the country & to pay a catalytic role in the formation of capital market. It also contributes trade commerce & industry of the country. To carry on the business dealer in foreign exchange including buying & selling of foreign exchange, dealing in foreign currency notes, granting & issuing of letters of credit & negotiating & discounting of export documents & all other matters related to foreign exchange business.

CORPORATE VISION

To become the bank of choice in serving the nation as a progressive & socially responsible financial institution by bringing credit & commerce together for profit & sustainable growth. And to be a leading Bank in South Asia.

CORE VALUES

For Customers: To become most caring bank by providing the most courteous & efficient service in every area of our business.

For Employees: By providing the well-being of the members of the staff.

For Shareholders: By ensuring fair return on their investment through generating stable profit.

For Community: By assuming our role as a socially responsible corporate entity in a tangible through close adherence to national policies & objectives.

PRODUCTS & SERVICES OFFERED

| General Service | Savings Account Current Account Corporate Account Short term Deposit | |

| Deposit Service

| Fi Fixed Deposit Scheme Special Savings Scheme Special Deposit Scheme Monthly Income Scheme Monthly Savings Scheme Education Saving Scheme | |

| Loan Scheme | Loan General | |

| Terms Loan | ||

| Transport Loan | ||

| Project Loan | ||

| Loan against Imported Merchandise | ||

| Loan against Trust Receipt | ||

| Loan Against Packing Credits | ||

| Loan Against HouseBuilding | ||

| Housing Loan Scheme | ||

| House Repairing Loan Scheme | ||

| Consumers Finance Scheme | ||

| Festival Small Business Loan Scheme | ||

| Festival Personal Loan Scheme | ||

| Small Business Loan Scheme | ||

| Personal Loan Scheme | ||

| Cash Credit | ||

| Security Overdraft | ||

| Payment against Document | ||

| Others | Remittance, Money Gram, T.T, D.D | |

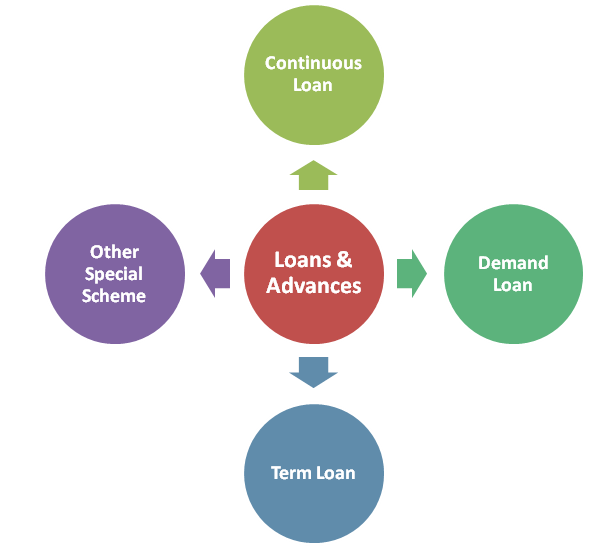

LOANS AND ADVANCES

In common parlance the loan “document” means any written record which serves as an evidence in respect of a transaction and be described as anything obtained for recording a transaction. Documentation may be described as the process or technique of obtaining the relevant documents. A banker must obtain proper documents executed from the borrower to protect himself against willful defaults. Moreover, when money is lent against security of some assets, the documents must be got executed in order to give to the banker a legal and binding charge against those assets. Documents contain the precise terms of granting loans and advance and they serve as important evidence in law counts if the circumstance so require. It is, therefore, absolutely necessary for a banker to obtain proper documents from the borrower while granting a loan or advance to him. In banking system, loan interest is calculated in daily basis.

Janata bank is one of the leading largest commercial banks in our country. It has been playing a vital role in our economy flourishing industrial sector by providing financial support. Following the guidelines of Bangladesh Bank, credit facilities have been extended to productive and priority sectors. In consideration of the importance of rural sector on overall economy of the country Janata Bank has been involved in Rural Financing through the vast branch network spread all over the country. The main objectives of the rural credit policy and programs of the bank have been designed to cover all segments of rural population whether skilled or unskilled such as farmers, landless, laborers, women, unemployment educated and vocational trained youths, weavers, and other rural dwellers and artisan. A good number of micro credit programs have been launched for poverty reduction sponsored by the bank on its own and in collaboration with local and foreign agencies. Emphasize has been given on entrepreneurship development and Gender Equality in the credit programs. Besides, the bank has also given emphasis on agro-based industries. Most of the rural and micro credit programs are collateral free. Interest has been fixed up at 10%. To provide co-operation and necessary counseling to the rural entrepreneurs, bank has opened “Micro Enterprise Wing” at Head Office, Regional Office and branch level.

TYPES OF LOAN

LOAN PRODUCTS

1. Continuous Loan:

- Secured Over Draft Against Financial Obligation [SOD(FO)]

- Secured Over Draft Against Work Order [SOD(G)]

- Cash Credit (Hypothecation)

- Cash Credit (Pledge)

- Export Cash Credit (ECC)

2. Demand Loan:

- Loan general

- Demand loan against ship breaking

- Payment against documents (pad)

- Loan against import merchandise (LIM)

- Loan against trust receipt (LTR)

- Forced loan

- Packing credit

- Secured over draft against cash incentives

- Foreign documentary bills purchased (FDBP)

- Local documentary bills purchased (LDBP)

- Festival business loan

3. Term Loan

- Project loan

- Transport loan

- House building loan

- Small business loan

- Consumer finance loan

- Lease finance

- Personal loan

Table of Loan classification:

| Loan Type

| Unclassified (Month) | Substandard (MONTH) | Doubtful (Month) | Bad (Month) |

| Continues Loan Demand Loan | Expiry up to 5 month | 6 to 8 month | 9 to 11 month | 12 month + |

| Term Loan Up to 5 years | 0 to 5 month | 6 to 11 month | 12 to 17 month | 18 month + |

| Term Loan more then 5 years | 0 to 11 month | 12 to 17 month | 18 to 23 month | 24 month + |

| Micro Credit | 0 to 11 month | 12 to 13 month | 36 to 59 moth | 60 month+ |

Source: Documents from Head Office

Current interest rates:

Types of deposit Rate of interest offered (%)

Savings Urban 05.00

Rural 06.00

Savings Deposit from Foreign Rmtt. 06.00

Short Term Deposit 03.50

Term Deposits:

3 months & above but < 6 months 07

6 months & above but < 1 year 07.50

1 year & above but < 2 year 07.75

2 year & above but < 3 year 08.00

Janata Bank Limited Sanchaya (Savings)

Pension Scheme: (5 years) 09.00

DPS 15.00

SOD (FO)

Advance is granted to a client against financial obligations. The security of advance is granted to the person to whom the instrument belongs. The discharged instrument is surrendered to the bank along with a letter signed by holder/holders. The bank’s lien is prominently noted on the face of the instrument under the signature of an authorized bank official.

Interest rate is 13% to 15%.

SOD (G)

Granted against the work order of government departments, corporation’s autonomous bodies and reported multinational private organization. To arrive at logical decision, the client’s managerial capability, equity strength, nature of scheduled work is to be judged. Disbursement is made after completion of documentation formalities, besides usual charge, documents like a notarized irrevocable power of attorney to collect the bills from the concerned authority and a letter from the concerned authority confirming direct payment to the bank is also obtained. The work is strictly monitored to review the progress at each interval.

Interest rate is 13% to 15%

Cash Credit (Hypothecation)

The mortgage of movable property for securing loan is called hypothecation. Hypothecation is a legal transaction where by goods are made available to the lending banker as security for a debt without transferring either the property in the goods or either possessing. The banker has only equitable charge on stocks, which practically means nothing. Since the goods always remain in the physical possession of the borrower, there is much risk to the bank. So, it is granted to parties of undoubted means with highest integrity.

Interest rate is 13%

Cash Credit (Pledge)

Transfer of possession in the judicial sense of essential in the valid pledge. In case of pledge, the bank acquire the possession of the goods or a right to hold goods until the repayment for credit with a special right to sell after due notice to the borrower in the event of non-repayment.

Interest rate is 13%.

Consumer Credit Scheme

This scheme is aimed to attract consumers from the middle and upper middle class population with limited income. The borrower should have saving or current deposit account with the bank. Minimum 25% of the purchase cost of the product is to be deposited be the borrower with the bank is equity before the disbursement of the loan. The rest 75% is to be kept as cash collateral (FDR, Shanchay Patra etc.) with the bank. Loan amount is disbursed through a/c payee pay order/demand draft directly to the seller after submission of the indent, deposit of client equity and completion of documentation formalities.

Loan (general)

JBL considers the loans, which are sanctioned for more than one year as loan (g). Under this facility, an enterprise of financed from the stating to its finishing, i.e. from installment to its production. JBL offers this facility only to big industries.

Working Credit

Loans allowed to the manufacturing unit to meet their working capital requirement, irrespective of their size big, medium or large fall under the category.

Staff Loan

Bank official from senior officer and above is eligible for this loan. The maximum amount disbursed is Tk. 50,000/- for a period of 2 years.

House Building Loan

This loan is provided against 100% cash collateral, besides; the land & building are also mortgaged with the bank. Interest rate is 17% p.a.

Small Loan Scheme

JBL introduced three new small loan scheme are:

a) House Renovation Loan

b) Personal Loan

c) Small Business Loan

House Repairing/Renovation Loan Scheme

This loan is offered for renovation and modernization of the house/building/flat which are acquired by inheritably or purchasing and other ways to make the properties liable and durable.

Interest rate is 14%

Personal Loan for Salaried Person

This loan is provided to fixed salaried persons in various organizations to meet any emergency cash needs at various events- treatment/operations of critical disease, matrimonial, maternity expenditure etc. Interest rate is 10% p.a. and maximum credit ceiling is Tk1, 00,000/-

Small Business Loan Scheme

This loan is offered to the small and promising entrepreneurs to meet their capital requirement and enable them to operate and expand the business purposely.

Maximum credit ceiling is Tk 5.00 lac with interest rate is 10% p.a.

Loan against Imported Merchandise (LIM)

Advances allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge fall under this type of advance, when the importer failed to pay the amount payable to the exporter against import L/C, than JBL gives loan against imported merchandise to the importer. The importer will bear all the expenses i.e. the godown charge, insurance fees, etc. and the ownership of the goods is retaining to the bank.

Interest rate is 16%

Loan against Trust Receipt (LTR)

Investment allowed for retirement of shipping documents and release of goods imported through L/C fall under this heard. The goods are handed over to the importer under trust with the arrangement that sale proceeds should be deposited to liquidate the investments within a given period. This is also a temporary investment connected with import and knows as post-import finance and falls under the category “Commercial Lending”.

Interest rate is 16%

Payment Again Documents (PAD)

This facility originates payment of Import bills on lodgment of CLEAN shipping documents received from FOREIGN correspondent against Letter of Credit opened on behalf of the customers. This is an obligation which the bank shall extend strictly on the merit of shipping document and which must conform to the terms & conditions of LC.

Loan documentary Bill Purchase (LDBP)

Payment made against documents representing sell of goods to local export oriented industries, which are deemed as exports, and which are deemed as exports, and which are dominated in local currency/foreign currency falls under this head. The bill of exchange is held as the primary security. The client submits the stance bill and the bank discounts it. This temporarily liability is adjustable from the proceeds off the bill.

Interest rate is 10%

Loan against Other Securities (LAOS)

Loan against other securities is a 100% secured advance, which requires no sanction from the Head Officer. It is sanctioned by marketing lien of FDR, ICB Unit Certificate.

Interest rate is16%

Heir Purchase

Heir Purchase is a type of installment investment under which the Purchaser agrees to taka the goods on hire at a stated rental, which is inclusive of the repayment of principal as well as profit for adjustment of the investment within a specified period.

Inland Bill Purchase (IBP)

Payment made through purchase of inland bills/cheques to meet urgent requirement of the customer falls under this type of investment facility. This temporary investment is adjustable from the proceeds of bills/cheques purchased for collection. It falls under he category “Commercial Landing”

Foreign Bill Purchase (FBP)

Payment made to customer through Purchase of Foreign Currency Cheques/Drafts fall under this head. This temporary investment is adjustable from the proceeds of the cheque/draft. Foreign Exchange Department deals with Letter of credit (L/C) operation and foreign remittance. L/C operation divided into import operation, export operation and inland trade. Janata Bank offers two types of credit facilities to its customers. Such as:

- Funded Credit and

- Non Funded Credit

Funded Credit

The credit facility in which the fund of the Bank is directly invested is known as funded credit. Such as cash credit, secured overdraft etc.

Non Funded Credit

The credit facilities in Bank’s funds are not directly invested are known as non funded credit such as –Letter Of Credit (L/C), Guarantee etc.

To accelerate the economic space, Janata Bank has the following credit schemes:

A. Micro Credit Programs:

1. Small Farmers & Landless Laborers Development Project (SFDP)

Target Group : Small Farmers & Landless

Objectives: To increase production and to create employment amongst rural poor by providing credit.

Security: No collateral is required.

Interest : 10%

Repayment : loan repayable by installment.

2. Swanirvar Credit Scheme: This type of credit facility is given to the poor and landless rural people. The objective of this scheme is to create employment opportunity amongst poor. The interest is 10%. It is repayable by 52 weekly installments.

3. Co-operative Credit for rural poor: This credit is given to the members of Co-operative Association to create employment to the rural poor co-operators. The Association gives guarantee. Interest rate is 10%.

4. Diversified Credit Programs:

All segments of rural and urban poor people are eligible getting this loan. The main objectives of this scheme are to create self-employment among the asset less and landless poor with view to reduction of poverty. Up to75000/-, no collateral is required. It is repayable by weekly/monthly installment.

5. Grain Storage Credit:

It is given to the marginal producers so that they could get fair price of their products. Hypothecation of cereal crops is stored in godown as security of the loan. It is repaid by 6 months.

B. Entrepreneurship Development Program:

1.Women Entrepreneurship Development Credit Program: Women Entrepreneurs Development Scheme has been introduced to encourage women in doing business. Under this scheme, the bank finances the small and cottage industry projects sponsored by women. Interest rate is 10%. It is repayable in monthly installment within 3 years that star from the 4th month after obtaining loans

2. Cyber Café loan: This type of loan is given to the trained youth in computer technology in order to create employment opportunity for the unemployed trained youth and expansion of information business in the country. Up to tk. 300000, no collateral is required. It is given through personal guarantee at 10%.

3. Doctor’s Loan: Doctor Credit scheme is designed to facilitate financing to fresh medical graduates and established physicians to acquire medical equipments and set up clinics and hospitals and to create employment opportunity of Doctor’s possessing certificate. Interest rate is 10%.

4. Small business development loan scheme: This scheme has been evolved especially for small shopkeepers who need credit facility for their business. This credit facility is given to the small business by third party guarantee that is acceptable to the bank at 11% interest rate. It is to be repaid in 5 years in 60 monthly installments in case of term loan or 1 year in working capital. Besides, bank also extends credit facilities for the goat farming, seed development program, forestry/horticulture Nursery, flower plantation & garden, handicapped/disable people to make them self-reliant

C. Other special credit programs:

1 .Credit for Employees: This type of credit is given to the employees of the bank to meet up the emergency needs at 12% interest rate. Advance cheques of monthly salary are considered as security that is repaid within 2 years in 24 installments.

2. Consumer Credit Scheme: Consumer Credit Scheme is related to relatively new field of collateral free finance of the Bank. People with limited income can avail of this credit facility to buy household goods including computer and other consumer durables. Interest rate is 12% that is repaid between 1 and 2 years.

3. Personal Loan Scheme: Personal Loan Scheme has been introduced to extend credit facilities to cater to the credit needs of low and medium income group for any purpose. Government and semi-government officials, employees of autonomous bodies, banks and other financial organizations, multinational companies, reputed private organizations and teachers of recognized public and private schools, collages and universities are eligible for the loan facilities.

4. Financing in IT Sectors: Today, we are living in the age of information that is Internet. To accelerate the growth of information and expanding IT business in our country and to attract young energetic in IT professions JANATA BANK has launched a new credit scheme titled “Financing Computer Software Development & Data Export.” The maximum loan amount is take. 10 million, with debt to equity ratio being 80:20. The rate of interest is 10%. But anybody with export market exposure can get the benefit at 9% interest rate. The main feature of this scheme is to set up industrial based IT projects for development of software for data export. No collateral is required. if anyone wants to show interest to provide collateral security, they will be given priority.

5. Car Loan Scheme: Car Loan Scheme has been introduced to enable middle-income people to purchase Cars/SUVs/Jeeps. Governments and semi-government officials, employees of autonomous bodies, banks and other financial organizations, multinational companies, reputed private organizations, teachers of recognized public and private universities and businessmen are eligible for the loan facilities.

6. Gharoa Prokalpa: Performance of on going micro-credit programs has encouraged Janata Bank authority to undertake a new product. ‘Gharoa Prokalpa’ which is a package of facilities employment and retain them in the rural areas. It was launched on 25th July 2000.

7. Financing of Industries: Janata Bank Limited entrusted with the responsibility of developing industries within the frame work of Industrial policy of the Government of Bangladesh and credit norms of Bangladesh Bank as well as by the Investment Board. If the project is managerially, marketing Pont of view, technically, commercially and financially viable, then Janata Bank Limited finances the project. Sponsors/companies having prior experience in the related field are given priority.

Loan Limit: Janata Bank Limited may be financed up to Tk. 129.60 million in single project a year. But if any project required above the limit, the project may be financed under consortium/syndication arrangement with other financial institutions.

Rate of Interest: Rate of interest of project loan ranges from 11%-13%. Working capital rate of interest is 12% to 13.50% and with that in export oriented industries ranges from 7% to 14%(changeable).

Debt Equity Ratio: Normally debt equity ratio is 50:50. But higher equity ratio sharing is given preference. Above all, Bankers/Customers relation is also considered in fixing debt equity ratio.

Repayment Mode and Period: 5 years to 10 years with 6-24 months grace period inclusive of construction period. Project loan is repayable by half yearly installment. Working capital loan and export credit are sanctioned for 1 (one) year and they are renewable every year.

Security: The project land, building, machineries and others i.e. project assets are considered as primary security against term/project loan. But if the project is to be set up on rented premises, collateral securities is obtained obtained minimum 1.3 times of project loan.

Sanctioning Authority: Janata Bank Limited, Head Office, Dhaka.

8. Ready Cash: Janata Bank Limited has entered into an agreement with American International Investment (AII) to provide financial plastic card services to Janata Bank Limited’s clients. This product is a “Debit Card” called the Ready Cash. Currently, the Ready Cash system is operating in Dhaka and will soon be expanded to other urban areas of Bangladesh. Cardholder’s primary benefits are Safety, Shopping at a wide merchant network, Payment of Utility Bills, flexible saving plan and the convenience of not having to carry cash. As the only micro-processor chip based debit card available in Bangladesh for financial payment. It combines the most desirable aspects of the credit card, together with the advantages of the Debit or ATM card. It is the first step that most Bangladeshi citizens will take on the path to a cashless economy. Ready Cash is a debit card as it allows the cardholder to spend no more money than he/she has in his/her Bank account – unless a credit line Page 30has been extended. It increases the consumption base and allows the cardholder to establish a credit history. For these and many other reasons, the Ready Cash card is the fastest growing system in Bangladesh.

9.Financing in SME Sector: From the very inception of Industrial credit financing of Janata Bank (Currently Janata Bank Limited) SME division has sanctioned term loan in small and medium industries sector in 4535 projects of taka 941.36 crore. Among which taka 548.69 crore has been disbursed against 4310 projects. Outstanding as 31.12.2007 is taka 446.12 crore and recovery of loan is 70%.

10. Loan to Travel Agencies:

Eligibility : Annual business turnover should be satisfactory

Loan Sanction : On a case to case basis

Nature of Loan : CC (HYP).

Purpose of Loan : For running travel agency business

Rate of Interest : 15%

Security : Hyp. Of receivables/tickets, all office furniture and equipments Collateral to be twice the value of the loan

Mode of repayment : Sale proceeds of tickets.

Duration of the Loan: One year

11. Loan to Diagnostic Centers:

Eligibility: Annual business turnover should be good; the diagnostic centre should have been set up as per Govt. health policy and this must be confirmed by the loanee.

Loan Sanction : On a case to case basis

Nature of Loan : CC (HYP).

Purpose of Loan : For running a diagnostic centre

Rate of Interest : 15%

Margin : 40%

Security : Hyp. Of all chemical and medical equipments; Value of collateral security to be twice that of loan.

Duration of the Loan: One year

INTEREST RATE

The interest rates of various types of loans are as follows:

| Types Of Loans & Advances | Interest Rate | Collateral Required | Loan limit |

| C.C(PLEDGE) | 15% | Not Compulsory | 100000-200000 |

| C.C(HYPOTHECETION) | DO | Do | Do |

| OVER DRAFT (O.D) | DO | Bank Deposit | 50000-100000 |

| REAL ESTATE (Resident) | 12% | Documents of Assets | No limit |

| REALESTATE(Commercial) | 15.5% | Do | Do |

| PALLI RIN | 10% | Personal Guarantee | <50000 |

| SERVICE LOANS | 12% | Check of monthly | <50000 |

| CONSUMER CREDIT | 13% | Personal Guarantee | <50000 |

| DOCTOR’S LOANS | 10% | Do | <50000 |

| SYBER CAFÉ LOAN | 10% | Do | <50000 |

| PRATIBONDI LOAN | 10% | Do | <50000 |

| GENERAL LOAN | 10% | <50000 |

APPROACHES TO THE BANK

When a borrower approaches to JBL for a loan, he or she is required to fulfill the following criteria: He or she has to be a client of the bank. He or she needs to apply properly describing the purpose of the loan amount needed & his/her capacity of repayment.

BANK GUARANTEE

Suppose one party get a project or construction work then employer may want guarantee. This guarantee is required because whether party can give financial support to finish the whole work or not. Bank will give such guarantee against their client it is also called contingent liability. There are three type of bank guarantee:

Bank Guarantee

- Bid Bond

- Performance

- Advance payment

Bid bond: This type of BG is issued only for tender.

Performance guarantee: Depending on the reliability of the client’s transaction bank will sanction guarantee.

Advance payment guarantee (APG): It may be happened that one party doesn’t complete their work within the fixed time. And this client already issued a BC from bank. In this circumstances party may request advance payment from their employer. If bank sanction APG against that party employer may give advance payment to them. This type of loan is sanctioned only few reliable parties.

Requirements of the clients: Client must have SB/CD a/c in that bank.

Interest and other charges: No interest is charged for BC. Bank charge commission @ 0.5% over the total amount. Quarter and VAT (commission @15%) and stamp cost.

Security: After getting approval of the BC a margin amount will be transfer from parties CD/SB a/c as security. At the time of issuing BC a liability will be created to the party a/c. The liability amount is equal to the amount they are showing as BG.Counter guarantee: Bank will take a counter guarantee document from the party as a security. By this way bank will receive guarantee form the party.

Discretionary power: BC will be sanctioned from the Head Office.

Returning procedure: After finishing the work party will return the BC to the bank. Bank will reverse the liability and return margin to party a/c.

GENERAL PROCEDURE FOR INVESTMENT:

The following procedure is applicable for giving advance to the customer. These are:

A. Duly fill-up first information sheet

B. Application for Investment

C. Collecting CIB report from Bangladesh Bank

D. Making Investment proposal

E. Project appraisal

F. Head office approval

G. Sanction letter

H. Documentation

I. Charges on Securities

J. Recovery

A. First Information Sheet

First information sheet is the prescribed form provides by the respective branch that contains Janata Bank information of the borrower. It contains following particulars: –

- Name of the concern with its factory location,

- Officer address and Telephone number,

- Name of the main sponsors with their educational qualification,

- Business experience of the sponsors,

- Details of past and present business, it achievement and failures,

- Name of all the concerns wherein the sponsors have involvement,

- Income tax registration number with the amount of tax paid for the last three years,

- Details of unencumbered assets personally owned by the sponsors,

- Details of liabilities with other Banks and financial institutions including securities held there against,

- Estimated cost of the project & means of finance.

B. Application for Investment

After receiving the first information sheet from the borrower Bank official verifies all the information carefully. He also checks the account maintains by the borrower with the Bank. If the official becomes satisfied then he gives application or Investment form to the prospective borrower.

C. Collecting CIB Report from Bangladesh Bank

After receiving the application for advance, Janata Bank sends a letter to Bangladesh Bank for obtaining a report from there. This report is called CIB (Credit Information Bureau) report. Janata Bank generally seeks this report from the head office for all kinds of Investment. The purpose of this report is to being informed that whether the borrower has taken loan from any other Bank; if ‘yes’ then whether the party has any overdue amount or not.

D. Making Investment Proposal

After receiving CIB report, concern branch prepare an Investment proposal, which contains terms, and conditions of Investment for approval of Head Office or Head of the concerned branch. Following documents are necessary for sending the Investment proposal:

- Loan application

- Declaration of the borrower

- Photograph of the borrower duly attested

- Bio data of the borrower

- Limit sanction

- Credit report

- Legal opinion

- Memorandum of article

- Trade license

- Copy of title deeds

- Tax clearance certificate

If the officer thinks that the project is feasible then he will prepare a proposal. JBL prepares the proposal in a specific form called Investment proposal. It contains following relevant information:

- Borrower,

- Date of establishment, constitution,

- Main sponsor/director with background,

- Capital structure, address,

- Account opening date, introduced by type of business, particulars of previous sanctions,

- Security (existing and proposed),

- Movement of accounts,

- Components on the conduct of the account,

- Details of deposit, liabilities of allied concerns, liabilities with other Banks,

- CIB report,

- Rated capacity of the project (item wise),

- Production/purchase during the period,

- Sales during the period,

- Earning received for the period,

E. Project Appraisal:

It is the pre-investment analysis done by the officer before approval of the project. Project appraisal in the Banking sector is needed for the following reasons:

- To justify the soundness of an investment,

- To ensure repayment of Bank finance,

- To achieve organizational goals,

- To recommend if the project is not designed properly.

Techniques of Project Appraisal:

An appraisal is a systematic exercise to establish that the proposed project is a viable preposition. Appraising officer checks the various details submitted by the promoter in first information sheet, application for Investment and Investment proposal.

Janata Bank Ltd. considers the following aspects in appraising a proposal.

- Technical viability

- Commercial viability

- Financial viability

- Economic viability

The Head Office (HO) mainly checks the technical, commercial and financial viability of the project. For others HO is dependent on branch’s information. But when the investment size is big, then the HO verifies the authenticity of information physically.

F. Head Office Approval: Upon receipt of the Investment proposal from the branch, the Head Office aging appraises the project. If it seems to be a viable one, the HO sends it to the Board of Directors for the approval of the Investment. The Board of Directors (BOD) considers the proposal and takes decision whether to approve the Investment or not. If the BOD approves the Investment, the HO sends the approval to the concerned branch.

The respective officer of Head Office appraises the project by preparing a summary named “Top Sheet” or “Executive Summary”. Then he sends it to the Head Office Credit Division for the approval of the Loan. The Head Office Credit Division considers the proposal and takes decision whether to approve the Investment or not. If the committee approves the Investment, the HO sends the approval to the concerned branch with some conditions. These are like:

- Drawing will not exceed the amount of bill receivables.

- All other terms and conditions, as per policy and practice of the Bank for such advance to safeguard the Banker’s interest shall also be applicable for this sanction also.

- Bank may change/alter/cancel any clause (s) of the sanction without assigning any reason whatsoever and that shall be binding upon the client unconditionally.

- Branch shall not exceed the sanctioned limit.

G. Sanction Letter

After getting the approval of the HO the branch issues sanction letter to the borrower. A sanction letter contains the following particulars amongst other details:

- Name of borrower

- Facility allowed

- Purpose

- Rate of interest

- Period of the Investment and mode of adjustment

- Security

- Others terms and condition

H. Documentation

If the borrower accepts the sanction letter, the Documentation starts. Documentation is a written statement of fact evidencing certain transactions covering the legal aspects duly signed by the authorized persons having the legal status. Following are the most common documents used by the JBL for sanctioning different kinds of Investment:

- Joint Promissory Note

- Letter of Arrangement

- Letter of Disbursement

- Letter of Installment

- Letter of Continuity

- Trust Receipt

- Counter Guarantee

- Stock Report

- Letter of Lien

- Status Report

- Letter of Hypothecation

- Letter of Guarantee

- Documents Relating to Mortgage

I. Charges on Securities

There are 6 types of moods of charging on securities:

Pledge: Pledge is the bailment of goods as security for payment of a debt or performance of a promise. A pledge may be in respect of goods including stocks and share as well as documents of title to goods such as railway receipts, bills of landing, dock warrants etc. duly endorsed in Bank’s favor.

Hypothecation: In case of hypothecation the possession and the ownership of the goods both rest the borrower. The borrower to the Banker creates an equitable charge on the security. The borrower does this by executing a document known as Agreement of Hypothecation in favor of the lending Bank.

Mortgage: According to section (58) of the Transfer of Property Act, 1882 mortgage is the transfer of an interest in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, existing or future debt or the performance of an engagement which may give rise to a pecuniary liability. In this case the mortgagor dose not transfer the ownership of the specific immovable property to the mortgagee only transfers some of his rights as an owner.

Lien: Lien is the right of the Banker to retain goods of the borrower until the loan is repaid. The Banker’s lien is general lien. A Banker can retain all securities in his possession till all claims against the concern person are satisfied.

Assignment

Assignment means transfer of any existing or future right, property or debt by one person to another person. The person who assigns the property is called assignor and the person whom it is transferred is called assignee. .

ually assignments are made of actionable claims such as book debts, insurance claims etc. In banking business, a borrower may assign to the Banker (1) the book debts (2) money due from government’s debt (3) insurance policy.

Set-off

Set-off means the total or partial merging of a claim of one person against another in a counter claim by the latter against the former. Set-off arises when a debtor or his creditor wishes to arrive at the net figure owing between them when separate accounts or debt are involved.

| Pledge | Movable property (Goods/Stocks/Shares/Debentures etc.) |

| Hypothecation | Movable property (Raw materials of factories/stocks in a godown, showroom /motor vehicles etc.) |

| Mortgage | Immovable property (Land/Building/Factory) |

| Lien | FDR/DPS/Sanchay patra/ICB Unit Cert./Wage Earners Bond etc. |

| Assignment | Insurance Policy/Money due from govt. Dept./Work order etc. |

| Set-off | ******** |

CALCULATION OF INTEREST ON CLASSIFIED ADVANCES

Interest on sub-standard and doubtful loan accounts should be credited to “Interest Suspense Account” instead of crediting the same to the interest income account.

Calculation of interest on Bad/loss loan accounts should be deferred instead of calculating the same on those accounts.

If there is any recovery on the above accounts that recovery/ portion of recovery will be treated as interest recovery, not principal recovery. After adjustment of interest due, principal portion of respective loan account will be adjusted later on. Cost of application form and processing fee will be credited to bank’s income A/c “Service and other charges”.

Base for Provision =Outstanding of CL—Interest Suspense—Eligible Securities

List of eligible securities

All financial Obligation (FDR, DPS, SPS, All other deposit, SP, WEDB)-100%

Gold and Gold Ornaments –100% of Market value

Guarantee/Counter Guarantee BB/Govt –100%

Goods with pledge/LIM –50% of Market value

Land and Building up to 50% of Market value

LIMITATION OF LOAN SECTION:

There are some limitations in the advance section of this bank. Among them the major limitations are-

- Lack of good party.

- Party characteristics are not good all time

- Party all time not keep their word

- Some time pressure from top level though the party condition is not good.

- Here there is lack of enough loan scheme that are effective now a days.

- Many old payment of loan is due, that creates pressure now.

- Lack of information about old loan, that creates problems to continue the case of default loan.

- Lack of proper docomentation about loan.

- Loan Interest rate is very competitive.

- Lack of Technological advantage

- Lack of promotional activities about loan product.

ANALYSI OF LOAN DISBURSEMENT,OUTSTANDING, CLASSIFIED AND RECOVERY SCENARIO:

It is the duty of the recovery department of the Bank to recover the landed fund within the stipulated time and if the borrower fails to repay the money within the said period Bank will declare him as a defaulter and recover the fund by selling the securities given by the borrower or by freezing his account or make a suit against him.

The total outstanding Loans and advances of Janata Bank from 2005 to 2009 are given below:

Tk In Million

| Particulars | 2007 | 2008 | 2009 | 2010 | 2011 |

| Amounts | 124467 | 138493 | 121200 | 144678 | 166359 |

Source: Janata Bank’s Annual Report

Graphical representation:

Comment: In the above figure we see that the total Loan & advances of Janata Bank from 2007 to 2011 is increasing trend that indicates better performance in providing Loan & advances. In the total Loan & advances of Janata 25% to 30% Loan is Industrial sector Loan. Industrial sector of Janata Bank consists of Jute industries, Tannery Industries, Textile Industries, Agro Industries and Industrial credit etc.

Sector wise Loans and Advance:

Taka in Million

| SI | Name of Sector | 2011 2010 | +/(-) +(-) TK. % | ||

| 1 | Jute Sector | 9368 | 8909 | 459 | 5.51 |

| 2 | Textile Ind. & trade | 11076 | 11325 | (249) | 2.20 |

| 3 | Steel & Engineering | 2218 | 1515 | 703 | 46.40 |

| 4 | Food & Allied | 4692 | 3903 | 789 | 20.22 |

| 5 | Export Credit | 19083 | 1555 | 3533 | 22.72 |

| 6 | Import Credit | 32704 | 32510 | 194 | .60 |

| 7 | Industrial Credit | 22372 | 17160 | 5212 | 30.37 |

| 8 | Rural, ME&SP. Financing | 12855 | 11496 | 1359 | 11.82 |

| 9 | Housing | 2362 | 2490 | (128) | 5.14 |

| Others | 49629 | 39820 | 9809 | 24.17 | |

| Grand total | 166359 | 144678 | 21681 | ||

Source: Annual Report of the Bank

Graphical Presentation:

Comment: In the above figure and graph we see that the percentage of Loans in the Textile Ind. has decreased from 2%.Because of the high Interest rate. On the other hand Janata bank ltd loans process need long time. On the other hand, the flow of Loans and advances increased in case of import credit, Industrial Credit and Rural, ME&SP Financing sectors.

Geographical area-wise Loans and advances:

The overview of geographical area-wise Loans of Janata Bank is given bellow:

| Region | 2008 | 2009 | 2010 | 2011 |

| Dhaka | 89143 | 94889 | 101537 | 115096 |

| Chittagong | 15005 | 16629 | 17750 | 21772 |

| Khulna | 8533 | 8577 | 10516 | 12720 |

| Rajshahi | 8789 | 9830 | 11531 | 12984 |

| Sylhet | 838 | 888 | 944 | 1092 |

| Barishal | 1136 | 1158 | 1290 | 1433 |

| Overseas Branches(UAE Branches) | 750 | 990 | 1110 | 1262 |

Comments

From the table and graph, we see that the flow of Loans and advances of Janata Bank is showing an increasing trend from 2008 to 2011. It indicates a better performance in extending credit facilities. Bank disburses Loans more in Dhaka region than other regions. And loans Recovered in avg.35%.

Performance of Industry Sector: 2009

| Items | Taka in million |

| No. of Project ( Sanction) | 123 |

| Sanction | 18123 |

| Disbursed | 13239 |

| Outstanding | 9633 |

Loan Disbursement, Recovery & Classification of Industrial sector of Janata Bank Ltd. From 2008 to 2011 according to various sectors wise is given below:

Textile Industry

(Figure in crore)

| Year | Loan Disbursement | Classified | Recovery |

| 2011 | 443.21 | 217.17 | 118.51 |

| 2010 | 439.60 | 211.16 | 112.68 |

| 2009 | 369.95 | 141.78 | 130.15 |

| 2008 | 372.72 | 133.52 | 101.16 |

Source: Janata Bank’s head office document

Graphical representation

Comment:

In the above figure we see that the Loan disbursement on industrial credit of Janata bank is increasing at a decreasing rate from 2008 to2011.

Jute Industry

(Figure in crore)

year | Loan Disbursement | Recovery |

2011 | 801.02 | 634.43 |

2010 | 790.31 | 570.64 |

2009 | 543.35 | 235.19 |

2008 | 469.95 | 130.26 |

Comment:

In the above figure we see that the Loan recovery on industrial credit of Janata bank is upward increasing rate from 2008 to 2011, which indicates better performance in industrial Loan recovery. The main reason of this better performance of Janata bank is that the bank uses LRA format before providing industrial Loan.

Table of Rural, Micro and Special Program Financing:

Sl. no | Name of products | No. of loanee | Disbursement | Recovery |

1 | Crop loan program | 346528 | 5765.20 | 2582.23 |

2 | Agriculture & irrigation equipment | 229 | 13.90 | 10.01 |

3 | Fisheries & Shrimp Culture Credit | 321 | 130.30 | 90 |

4 | Cyber Café loan | 13 | 1.70 | .95 |

5 | Credit for Forestry | 751 | 16.90 | 12.03 |

6 | Credit Program of employees | 78368 | 1907.20 | 1653.2 |

7 | Financing Women Entrepreneur | 267 | 43.92 | 35.63 |

8 | Financing Goat & sheep Farming | 11370 | 77.70 | 67.4 |

9 | Gharoa Project | 3812 | 74.80 | 61.24 |

10 | Doctors Loan | 66 | 12.96 | 9 |

11 | Small Business Development loan | 161 | 14.63 | 11.79 |

12 | Credit for disabled people | 113 | 1.59 | .80 |

13 | Consumers credit | 1069 | 45.80 | 41.8 |

14 | Agro-based Industry | 1567 | 540.90 | 517.23 |

15 | Others | 140699 | 4225.20 | 3789 |

Comment: In 2011 there is no bad loan loss. Rural, Micro and Special Program recover at most all loans.

Scenario of Doubtful & bad Loan of Janata Bank Ltd:

Debt which is considered doubtful & bad of Janata Bank from 2009 to 2011 is given below:

(Figure in crore)

| Year | 2011 | 2010 | 2009 |

| Total Amount | – | 893500000 | 702500000 |

Comment:

In the above figure we see that the Debt that is considered doubtful & bad of Janata Bank on total Loan disbursement from 2008 to 2011.There is no doubtful & bad loan in 2011,. So, it is clear to us due to use of LRA format in industrial credit default risk is less and recovery rate is well but in the other sector’s recovery is good enough.

EVALUATION OF INVESTMENT PROPOSALS

Financial Statement

Financial spreadsheet provides a quick method of assessing business trends and efficiency.

- Assess the borrower’s ability to repay

- Realistically show business tends

- Allow comparisons to be made within industry

Borrowers that provide Financial Statement are more likely to be good borrowers.

Lending Risk Analysis (LRA) Lending risk analysis (LRA) constitutes an important set of activities that has been prescribed for minimizing and averting risk in funds in business of local Banks. It was identified by the experts and Banks that high risk involved in providing loan to a particular borrower is the main reason for failing to recover the Bank’s money and the issue of risk analysis remains as one of the main factors in determining the status of investment in terms of recovery. The LRA forms describe how to assess the risk that the Bank does not fully recover an Investment. It is a systematic and structured way of assessing lending risk.

Credit Information Bureau (CIB) Due to the irregular and insufficient flow of credit information into the Banking system the proportion of classified loan in relation to the total credit is very high. This proportion of classified loan generated bad influence in the Banking sector. In order to eliminate the bad culture and to equip the Banks with proper credit information for loan application processing, proposal for creation of Credit Information Bureau (CIB) was put forward by different comities and groups such as National Commission for Money, Banking and Credit, 1986, the World Bank Report, 1987 and Financial Sectors Task Force Reports, 1990. In the backdrop of the above proposal Bangladesh Bank approved the CIB in 1992.The main objectives of the CIB are to collect all shorts of information in respect of the borrowers (having outstanding balance of Tk. 10 lac and above) from the scheduled Banks, and other non Banking financial institutions and creation of computer database in order to feed back the same information to the Banks for quick processing of new loan applications, rescheduling etc. and preparation of various reports for MIS purposes to be used in Bangladesh Bank and Ministry concerned.

RECOVERY PROCEDURE OF INVESTMENT

Recovery procedure of Janata Bank is the ultimate combination of time, effort of money. It follows four procedural steps to recover the lending amount, which is joint effort of Bank, society and legal institutions, which are shown below:

PRINCIPLES OF SOUND LENDING

A. Safety

Janata Bank exercises the lending function only when it is safe and the risk factor is adequately mitigated and covered. Safety depends upon:

- The security offered by the borrower.

- The repaying capacity and willingness of the borrower is to repay the advance.

B. Liquidity

The liability of a Bank is repayable of demand or at a short notice. So the Bank has to maintain its liquidity at a sufficient level. Investment on building, plant, machinery, land etc. cannot be recovered quickly, so it is less liquid.

C. Profitability

Profit is needed to pay interest to depositors, depreciation, and maintenance, declare dividend to share holders, provide or reserve against bad and doubtful debts etc. so like all other Banks Janata Bank also disburse advances to earn profit.

D. Security

To ensure safety of advances, Banks takes different types of securities like MTDR, Sanchaypatra, land, work order etc. Banker should ensure that the securities are adequate, marketable and free from encumbrances.

DIVERSIFICATION IF RISKS

It is very risky for a bank to invest all its assets into a particular sector or a single borrower or to one particular region. If somehow the business of that sector or area or borrower collapses, the bank may fall in a critical situation. So it is better to invest in different sectors/borrowers and spread over the country. That’s why Janata Bank invests its fund in various sectors.

LOAN CLASSIFICATION

Loan classification attempts to categorize the debt information in a systematic manner. Loan classification is defined in terms of degree of risk associated with loans. Classification of loans mean and include only such assets of the balance sheet of a bank which do not yield interest income and which have remained past due for some quarters. Loans are generally categorized in two types

Loan

- Classified Loan

- Unclassified Loan

Classified loan: If any continuous credit is not adjusted/ renewed within expiry date, the loan will be treated as classified/ irregular loan from the next day of the expiry date. Loans are classified which are judge to have a reduced chance of repayment. Classified loan can be three types:

Classified loan

- Substandard

- Doubtful

- Bad/ loss

Substandard: If the loan unadjusted for six months or more but less than nine months, the loan will be treated as “substandard”.

Doubtful: For nine months and above but less than twelve months the loan will be treated as “doubtful”.

Bad: If the period is twelve months or more, the loan will be classified as “bad”. The above time frame is applicable in respect of demand loan also.

Unclassified loan: Unclassified loan are those which are repay regularly. Objectives of loan classification:

- Find out net worth/ adjust capital of a bank

- Help for assessing financial soundness of a bank.

- Calculate the required provision and the amount of interest suspense

- Put the bank on sound footing in order to develop sound banking practice in Bangladesh.

Loan Provisioning:

A certain amount of money is kept for the purpose of provisioning. This percentage is set following Bangladesh Bank rules.

| Loan Type

| uC

| SS

| DF | Bl

|

| Continues Loan | 1% | 20% | 50% | 100% |

| Demand Loan | 1% | 20% | 50% | 100% |

| Term Loan Up to 5 years | 1% | 20% | 50% | 100% |

| Term Loan more then 5 years | 1% | 20% | 50% | 100% |

| Micro Credit | 5% | 5% | 5% | 100% |

Source: Documents from Head Office

Importance of loan classification:

- Strengthen credit discipline

- Improve loan recovery position

- Make planning for future course of loan

Basis for loan classification: All loans and advances are classified on the basis of two criteria:

- Qualitative judgment criteria

- Objective criteria

DISCOURAGED SECTORS OF INVESTMENT

Investment in following sectors is discouraged by Janata Bank.

- Military equipment/Weapons Finance

- Highly Leveraged transactions.

- Finance of Speculative Investment.

- Logging, Mineral Extraction/Mining, or other activity that is Ethically of Environmentally Sensitive.

- Lending to companies listed on CIB black list or known defaulters,

- Counter parties in countries subject to UN sanctions..

- Taking an Equity Stake in borrowers.

- Lending to Holding Companies.

LOAN MONITORING

Investment monitoring implies that the checking of the pattern of use of the disbursed fund to ensure whether it is used for the right purpose or not. It includes a reporting system and communication arrangement between the borrower and the lending institution and within department, appraisal, disbursement, recoveries, follow-up etc.

- The borrower’s behavior of turnover.

- The information regarding the profitability, liquidity, cash flow situation and trend in sales in maintaining various rations

- Regular checking the balance of SB/CD/STD accounts of the borrower.

- Periodical visit with the customers to maintain relationship and supervision of supplied articles

- Legal action to be taken after failings all possible efforts to recover the bank’s due.

- Issuance of legal notice to the defaulter customers and guarantors prior to classification of the loans.

Following steps will be taken against a defaulter:

- Reminder the party to repay the loan after validity dates

- Send final notice

- Send legal notice

- Eventually sue a case against the party.

PROBLEMS IDENTIFIED

While doing the internship in the Janata Bank Ltd. Corporate Branch, some findings were found those are completely personal views for this report.

Janata Bank Limited finance up to Tk. 129.60 million in single project per year. Where some other banks provide more than Janata Bank Ltd. For this low investment in projects they loose some of their clients.

In corporate branch, sometimes small loans are not provided to small investors, for that reason this bank loose those small investors.

Janata Bank Ltd. Charges high interest rate on loans which hinders customers to take loan.

The number of officers in lone & advance department is insufficient to provide service to huge number of customers of Corporate Branch Janata Bank Ltd.

In most of the loan disbursement is centrally controlled from the Head Office, Which sometime creates problem for the branch in choosing the right client.

The credit proposal evaluation process is lengthy .Therefore, sometimes valuable clients are lost.

Small range of products offered by Janata Bank Ltd, Corporate Branch is another problem in diversifying its loan risk.

Before sanctioning loan, sometimes CIB report is not obtain from Bangladesh Bank timely.

The website of Janata Bank Ltd.dose not contains all required information about loan and advance.

RECOMMENDATIONS

Janata Bank Ltd. should increase their finance on different projects to achieve more clients.

Janata Bank Ltd. should provide more small loans in corporate branch, so that they can attract small investors.

Janata Bank Ltd. Should decrease interest rate on loans to attract customer’s attention to take loan.

The loan & advance department needs to recruit more expert people to provide good customer services in Corporate Branch.

The Principle Branch should decentralize it rights of choosing clients.

The credit proposal evaluation process should be shortened so that valuable customer is not lost.

Janata Bank Ltd. Should increases their loan products to compete in the market.

Janata Bank Ltd. Can give attention to the foreign exchange and remittance services to maximize profit.