3.3.6 Supplier Finance

SUPPLIER FINANCE is a loan facility for the enlisted Suppliers of various large retailers, marketing companies, distributors, exporters etc. This product’s main objective is to help various Suppliers to meet their short-study cash flow shortages or bridge the fund-flow gaps.

Eligibility

- If you are an enlisted supplier of a corporate house with which BRAC Bank has a corporate tie-up

- Have minimum 3 years of continuous operation

- Have 1 year continuous relationship with the purchasing firm Maximum Amount

Minimum

- BDT 3 lac up to maximum BDT 30 lac

Features

- Equal monthly installment and revolving loan facility

- 1% of loan amount as the processing fee

3.4 SME Network Coverage

3.5 Highlights of SME Banking Division of BRAC Bank

Particulars | Year 2010 | Year 2009 | Growth Rate |

| No. o Branch | 71 | 56 | 26.78% |

| No. SME Services Centre | 60 | 30 | 100% |

| No of SME Unit Office | 421 | 429 | -1.86% |

| No of ATM | 203 | 150 | 35.33% |

| No of CDM | 30 | 30 | 0 |

| No of remittance distribution Pint | 1800 | 1800 | 0 |

| Number of Staff | 2242 | 2104 | 6.56% |

| No of Loan disbursed (cumulative) | 305223 | 202101 | 51.02% |

| Cumulative Disbursement (in million BDT) | 135475.52 | 84,170.31 | 60.95% |

| No. of outstanding Account | 114,520 | 120,685 | -5.11% |

| Portfolio in amount (in million BDT) | 45,663.52 | 32,996.18 | 38.39% |

| Amount of Deposit (in million BDT) | 5,562.5 | 3,352.6 | 65.91% |

BRAC Bank serves the Small and Medium Enterprises through its 421SME Unit Offices situated at different parts of the country. Customer Relation Officer (CRO) operates the SME Banking at the Unit offices. Some units comprise a Zone which is headed by a Zonal Manager. Again Zones comprise a Territory headed by a Territory Manager. All the Territories across the country monitored by Four BDMs. And the central SME division monitors all of them.

The central SME division has following wings for monitoring and controlling SME Loans distributed by the unit offices across the country:

1) General Unit

2) Large Business Unit

3) Business Unit

4) ADFC (Supplier and Distribution Finance Unit)

5) Monitoring Cell

6) Commercial credit Unit

3.6Correspondence Banks:

Where BRAC Bank does not have any unit offices, it distributed SME loans through its correspondence Banks namely The City bank Ltd, Janata Bank, Krishi Bank, Pubali BankLtd.SME Banking Division is confident enough to continue its ever increasing growth to take the bank ahead of its imagination and to erect newer and starling milestones in banking industry.

3.3.7A. Categories of loans;

All loans and advances will be grouped into 4(four) categories for the purpose of classification, namely a) Continuous Loan, b) Demand Loan, c) Fixed Term Loan, d) Short-term Agriculture & Micro Credit.

a) Continuous Loan : The loan accounts in which transaction may be made within certain limit and have an expiry date for full adjustment will be treated as Continuous Loan. Examples are CC, OD(over draft).

b) Demand Loan : the loans that becomes repayable on demand by the bank will be treated as Demand loan. If any contingent or any other liabilities are turned to forced loan( i.e. without any prior approval as regular loan) those too will be treated as Demand Loan. Such as forced Lim, PAD,FBP and IBP etc.

c) Fixed Term Loan: The loans, which are repayable within a specific time period under a specific schedule will be treated as Fixed Term Loan.

d) Short-term Agricultural & Micro Credit: Shot-term Agricultural Credit will include the short-term credits as listed under the Annual Credit Program issued by the Agricultural Credit and Special Program Department (ACSPD) of Bangladesh Bank. Credit in the agricultural sector repayable within 12 months will also be included herein.

e) Short-term Micro Credit will include any micro credit not exceeding Tk.25000 and repayable within 12 months, be those termed in any names such as Non-agricultural credit, self-reliant Credit, Weaver’s Credit or Bank’s individual project credit.

B. Basis for Loan Classification:

Objective Criteria:

1) Past Due/Over due

i)Any Continuous Loan if not renewed/repaid within the fixed expiry date for repayment will be treated as past due/overdue from the following day of the expiry date.

ii) Any Demand Loan if not repaid/rescheduled within the fixed expiry date for repayment will be treated as past due/overdue from the following day of the expiry date.

iii) In case of any installment(s) or part of installment(s) of a Fixed Term Loan (not over five years) is not repaid within the fixed expiry date, the amount of unpaid installment(s0 will be treated as past due/overdue from the following day of the expiry date.

iv) In case of any installment(s) or part of installment(s) of a Fixed Term Loan(over five years) is not repaid within the fixed expiry date, the amount of unpaid installment(s) will be treated as past due/overdue after six months of the expiry date.

v) The Short-term Agricultural and Micro-credit if not repaid within the fixed expiry date for repayment will be considered past due/over due after six months of the expiry date.

2) All classified loans other than Special Mention Account (SMA) will be treated as Standard.

3) A Continuous credit, Demand loan or a Term Loan which will remain overdue for a period of 90 days or more, will be put into the “Special Mention Account(SMA)” and interest accrued on such loan will be credited to Interest Suspense Account, instead of crediting the same to Income account. This will help banks to look at account with potential problems in a focused manner and it will capture early warning signals for accounts showing first sign of weakness.

4) Any continuous loan will be classified as:

‘Sub-standard’ if it is past due/overdue for 6 months or beyond but less than 9 months.

‘Doubtful’ if it is past due/over due for 9 months or beyond but less than 12 months.

‘Bad/Loss’ if it is past due/over due for 12 months or beyond

5) Any Demand loan will be classified as:

‘Sub-standard if it is remains past due/overdue for 6 months or beyond but not over 9 months from the date of claim by the bank or from the date of creation of forced loan.

‘Doubtful’ if it is remains past/ due/overdue for 9 months or beyond but not over 12 months from date of the claim by the bank or from the date of creation of forced loan.

‘Bad/Loss” if it is re

mains past/overdue for 12 months or beyond from the date of claim by the bank or from the date of creation of forced loan.

6) In case of any installment(s) or part of installment(s) of Fixed Term Loan is not repaid within the due date, the amount of unpaid installment(s) will be termed as ‘defaulted installment’.

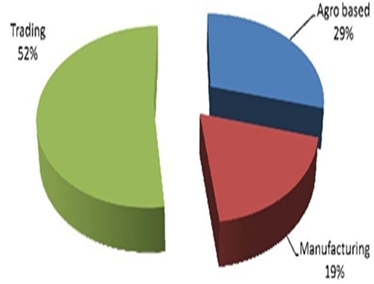

3.7 Sector wise Distribution of SME Banking

3.8 Obstacles and Challenges faced BRAC Bank Limited in SME

At the beginning phrase of the SME, BRAC Bank Limited faced lots of obstacles and challenge. There was a shortage of capital, absence of high technology, high employee turnover, lack of Skills entrepreneur, no trade license of businessman etc. These problems are described in brief below:

3.8.1 Financial Constraint

At the very beginning of the SME, BRAC Bank have financial constraints. BRAC Bank does not have enough liquid money so that they failed to satisfy every customers need.

3.8.2 Absence of High Technology

Absence of high technology was another constraint for the BRAC Bank limited. At that time they do not have strong inter-banking software so that they failed to contact with different SME service centre.

3.8.3 High Employee Turnover

In 2001 employee turnover rate was pretty high. BRAC Bank does not have any legal bindings to their employees. Employees quit their job according to their wish. So it also hampers the SME Service.

3.8.4 Lack of Skills Entrepreneur

At that time entrepreneurs were not educated enough. They do not have sufficient skills about the different types of paper requirement. It hampers the loan processing time.

3.8.5 Trade License

Trade license was another major problem for BRAC Bank. Most of the business man does not have their business trade license. Without proper documents it was quite hard to sanction the loan.

3.8.6 Poor Physical Infrastructure

Inadequate supply of necessary utilities like electricity, water, roads and highways hinder the growth of SME sector.

3.8.7 Employee Skills

At that time employees do not have sufficient knowledge about SME. It was costly to train all the employees. So lack of proper training to employees was another obstacle for SME growth.

3.8.8 Lack of Information

At that time SME just got a new shape in our country. So no one has clear idea about it. So vague and wrong information were passed among the people.

3.9 Steps Taken to Overcome the Obstacles

In order to overcome the above mentioned obstacles BRAC Bank started follow some steps, these steps were –

3.9.1 BRAC Bank started to expand their SME network

In 2001 BRAC Bank Limited their SME loan business with 4 SME sales and service center. Gradually they have started to expand their network. Now they have 421 SME sales and service center.

3.9.2 Training Session for employees

At the very beginning of SME operation employees do not have sufficient knowledge to handle the customer. Besides at that time there were lack of educate employees to join this sector. So BRAC Bank started to train up employees those who have started to join in SME division.

3.9.3 Orientation Session for Borrowers

Besides training with the employees BBL also started to train the borrowers also. Most of the borrowers are not educate at all. Even they don’t pass the S.S.C or H.S.C. So BBL started to organize orientation session for a group of borrowers.

3.9.4 Tried to Overcome Financial Constraint

At the very beginning BBL investment was low in the SME loan. Gradually they have started to invest huge in the SME. As they have a strong background of shareholders.

3.9.5 Educate the Entrepreneurs

At that time most of the entrepreneurs just passed the S.S.C or H.S.C level. So they have a very poor knowledge about the banking transaction. They come for the loan but they don’t have any trade license. So educate the entrepreneurs were other steps to overcome the obstacles.

3.9.6 Employee Commitment

As employee turnover was quite high so BBL started to give handsome remuneration to their employees. They started to provide some extra facilities to their employees. Besides they also started to take contract sign for 2 or 3 years from the employees.

3.9.7 Advancement of Technology

BRAC Bank Limited also started to develop their technology. In consequent of this they have transfer their software from MBS to Finacle. Now the respective department can easily find out whether the particular borrower paid his installment or not.

3.10 Selection of Potential Enterprise for SME

3.10.1 Enterprise selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise), the following attributes should be sought:

1. The business must be in operation for at least one year

2. The business should be environment friendly, no narcotics or tobacco business

3. The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

4. The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

5. The business must have a defined market with a clear potential growth

6. The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower’s that are required.

7. Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business.

3.10.2 Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

1. The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

2. The entrepreneur must have the necessary technical skill to run the business, i.e. academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

3. The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (doesn’t cheat anyone, generally helps people), and morally sound (Participates in community building)

4. The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

5. Suppliers or creditors should corroborate that he pays on time and is general in nature

6. Clear-cut indication of source of income and reasonable ability to save.

3.10.3 Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should posses the followings:

1. The guarantor must have the ability to repay the entire loan and is economically solvent (check his net worth)

2. The guarantor should be aware about all the aspect of SEDF loan and his responsibility

3. Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

4. Police, BDR and Army persons, political leaders and workers, and religious leader cannot be selected as a guarantor.

5. The guarantor should know the entrepreneur reasonable well and should preferably live in the same community.

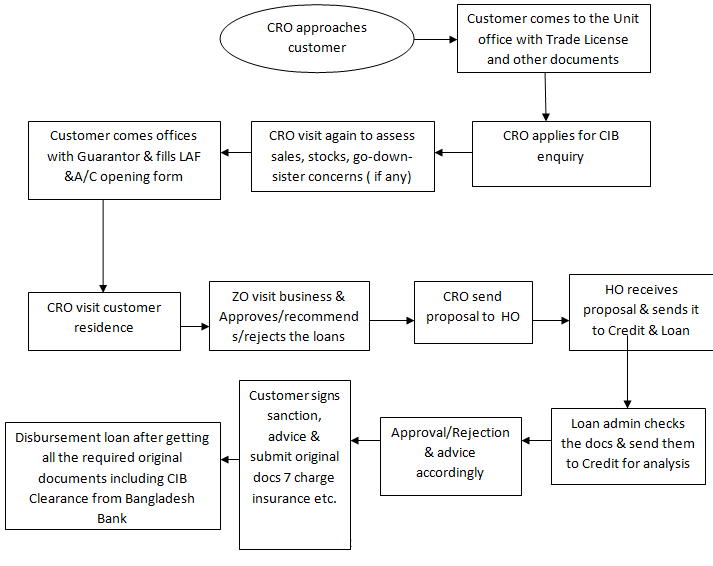

3.11 SME Loan Process Flow

When a customer comes to the unit office for a loan request, first he/she meets with the customer relationship officer to discuss about the loan, which loan product is suitable for him/her. After then the following process takes place.

Flow Chart for Processing

3.12 Terms and Condition of SME Loan

The SME department of BRAC Bank will provide small loans to potential borrower under the following terms and condition:

• The potential borrowers and enterprises have to fulfill the selection criteria

• The loan amount is between Tk 2 lacs to 30 lacs.

• SME will impose loan processing fees for evaluation/ processing a loan proposal as following;

| Loan Amount | Loan Processing Fee |

| 2 lacs to 2.99 lacs | Tk 5000 |

| 3 lacs to 5 lacs | Tk 7500 |

| 5.01 lacs to 15 lacs | Tk 10000 |

| 15.01 lacs to 30 lacs | Tk 15000 |

• Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

- Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

- The loan will be realized by 1st every month, starting from the very next month’s whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C. With Bank’s named and branches name

- The borrower has to issue an account payable blank cheque in favor of BRAC Bank Limited before any loan disbursement along with all other security.

The borrower will install a signboard in a visible place of business or manufacturing unit mentioned that financed by “BRAC Bank Limited”. - The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

- SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.