Body of the Report:

Introduction of UBL at Fakirapul Branch:

This branch was established 3rd June, 1984 it is situated at the 1st floor of Bhaban, 3 Inner Circular Road Fakirapul, Dhaka-1000. The bank is designed under one floor. It has been providing banking services for the customers of Fakirapul area.

Objectives:

- To provide banking service to the people within the commanding area.

- To expand business.

- To keep position in the competitive market.

- To contribute in profitability of UBL

Department of the Branch:

- Account opening department

- Cash department

- Accounts department

- Investment department

- Foreign exchange department

- Clearing department

- Remittance department

A list of Employees of the UBL Fakirapul Branch:

SL. | Designation | Number of Employer | |

01 | Assistant General Manager (AGM) & Manager | 1 | |

02 | SPO | 2 | |

03 | PO | 4 | |

04 | Senior Officer (SO) | 8 | |

05 | OG | 8 | |

06 | Account Officer (AO) | 3 | |

10 | Staff | 5 | |

| Total | 31 | ||

General Activities of the organization:

General banking:

General Banking is the starting point of all banking operation. It is a combination of activities of different sections.

General banking has some section in the bank. These sections are as follows:

Accounts Opening Section.

Cash Section.

Clearing Section.

Remittance Section.

Accounts Section.

Others.

Accounts Opening Section:

Opening account with a bank is the way of creating a banker customer relationship. In other words, it is a contract between banker and customer. With this contract, bankers enter into certain obligations and responsibilities.

Proper introduction serves as a precaution against fraud and forgeries and safeguard against inadvertent overdraft to bank. Obtaining proper introduction may absolve the banker from the charges of negligence for conversion. So, while opening a new account, emphasis would be given without exception to introductory reference and inquiry. The following instruction to be followed while opening account: –

1) Introduction of Account to be obtained from a respectable client acceptable to bank.

2) The introduction shall be obtained in writing in the respective column of Account opening form.

3) For opening savings bank account of individual either singly or jointly, passports and identity cards may be accepted for introduction, but subsequently proper introduction may be obtained.

4) Introduction of Current Account by members of the staff may be allowed but shall be discouraged as far as possible.

5) Current Account shall preferably be introduced by another Current Account holder acceptable to bank.

Documents for opening some special account:

The following documents duly completed shall be obtained from the customer at the time of opening different types of accounts as applicable:

- Individual/ joint:

- Account opening form as applicable duly filled in.

- Specimen Signature Card.

- Two photographs duly attested by introducer.

- Nominee Form (if nomination given by the account holder).

- Mandate or Authority Form (if a third person is authorized to operate the account).

- Proprietorship Firm:

- Account Opening Form.

- Specimen Signature Card.

- Copy of Trade License

- Two photographs duly attested by introducer.

- Proprietorship Rubber Stamp against all signatures of the proprietor.

- Partnership Concern:

- Account Opening Form.

- Specimen Signature Card.

- Copy of Trade License

- Partnerships Deed

- Two photographs of each partner duly attested by introducer.

- Partnership Rubber Stamp against all signatures of partners operating the accounts.

- Partnership letter.

Limited Company:

Private Limited Company:

- Account Opening Form.

- Specimen Signature Card.

- Copy of Trade License.

- Copy of Memorandum and Articles of Association duly attested by the Managing Director/ Chairman of the Co.

- Certificate of Incorporation.

- List of Director as per return of Joint Stock Company with signature.

Public Limited Company:

a) Account Opening Form.

b) Specimen Signature Card.

c) Copy of Trade License.

d) Photograph of Directors and account operators other than Director.

e) Certified copy of Memorandum and Articles of Association.

f) Certificate of commencement of business.

g) List of Directors as per returns of Joint Stock Company with their signature.

h) Resolution of the Board for opening account with the Bank.

i) Certification of incorporation.

Clubs/ Association/ Society etc. (Non-Trading Concerns):

a) Account opening Form for current account or SB accounts.

b) Specimen Signature Card.

c) Certified copy of Bye laws/ constitution of the organization.

d) List of the Executives of Managing Committee with their signature and present and permanent address.

e) Resolution of the Committee for opening account with the bank.

f) 2 Photographs of each operator of the account.

Savings account Individual or joint:

- Account opening form as applicable duly filled in.

- Specimen Signature Card.

- Two photographs duly attested by introducer.

- Nominee Form (if nomination given by the account holder).

- Mandate or Authority Form (if a third person is authorized to operate the account).

- Corporation/ Autonomous Bodies/ Govt. Organization:

a) Account Opening Form as applicable.

b) Specimen Signature Card.

c) Copy of the Act or Ordinance Showing authority to open account.

d) Letter from the authorized persons in absence of the Board.

- Account Of Constituted Attorney:

a) Account Opening Form (As applicable)

b) Specimen Signature Card

c) Power of Attorney

Other products and services:

Along side traditional banking product and services, the bank has some tailor made products in liability and asset sides. Of those mentionable are Monthly Savings Scheme and Double Benefit scheme etc. for deposit mobilization in one hand and consumer credit scheme, lease finance, personal loan, Uttara house repairing and renovation Scheme and SME financing in other hand. Besides, the Bank has also some electro-products based on information technology of which Q-cash UBL ATM Debit cards are to be mentioned for providing 24 hours services to customers.

Different Banking Sectors Limited:

Uttara Bank is a major player in Bangladesh wholesale banking industry to offer the full scope of innovative, customized solutions and services. We offer service at the highest level. Our focus is not on short-term profit, but on building long-term relationships and standing by our clients whenever they need us.

e have a unique business focus on enabling project financing, trade, investment and supply chain financing for clients. We aim to be a one-stop gateway for corporate and financial institutions looking to extend their business. And we are committed to using our country wide network to facilitate our clients’ growing trade and investment flows and supply chain financing needs across our business footprint.

We focus exclusively on corporate and institutional clients domiciled or conducting business in our footprint, offering clients access to our extensive branch network and award-winning suite of state of the art services.

Uttara Bank fully understands the importance of time, convenience and efficiency to the success of your business. We make easy the complex financial world for you and help you maximize every opportunity.

Working Capital Finance:

Overdraft:

A convenient and flexible form of short-term financing for routine operating expenses and overheads of your company

Guarantees and Bonds:

Uttara Bank issues a full range of Performance Guarantees, Advance Payment Guarantees, and Financial Guarantees and Bid bonds for supporting the underlying business of our customers.

Trade Finance:

Uttara Bank’s trade finance is tailored to meet the individual needs of your business. We can help even if your company has limited unstructured credit lines, due to reasons such as limited financial resources or sudden spike requirements. That’s because our risk evaluation focuses more on your performance track record, existing performance and collateral valuation

Imports:

- Letter of Credit

- Back-To-Back Letter of Credit

- Deferred Letter of Credit

- Import bills for collection

- Shipping Guarantee

- Performance bonds and other guarantees

- Import Financing

Exports:

If you are in the export business, we can help you with Export L/C advising, L/C Safekeeping, L/C Confirmation, L/C Checking and Negotiation. For financing solutions, tap on to Pre-shipment Export Finance, Export Bills for Collections, Invoice Financing. Outsource your administrative functions to Uttara Bank’s document preparation service.

**Export letter of credit advising

*Export letter of credit safekeeping

*Export letter of credit confirmation

*Pre-shipment export financing

*Letter of credit checking and negotiation

*Export bills for collection

*Export invoice financing

*Document preparation

Short & Mid-term Finance:

Short Term Financing:

As the responsive player in market, you may anytime need fund to utilize for a very short time due to either emergency or short term projects. In such case, Uttara Bank is there to facilitate you. This can be a Short Term Loan or a Short Term Revolving Loan. You can get it either for your inland business or cross-border payment in foreign trade.

Mid Term Financing:

Uttara Bank can also equip you the required fund for a longer period. If you worry about fund requirement for a bit longer, ‘Uttara Bank Term Loan’ will make you feel confident that, you got a friend for this.

Project Finance:

Uttara bank has been very active in the finance in a Project:

Our project financing solutions:

- Mitigate sponsor exposure to project risk.

- Enhance use of leverage to increase project returns by lowering the weighted average cost of capital.

- Provide access to significantly longer tenor debt financings.

- Create optimum financing structures (source of debt, currency, derivatives) that take into account your company’s particular capital needs as well as industry specific issues.

Lease and Long Term Loans:

We can customize a Term Loan or Lease to finance the fixed assets that your business needs (such as land, new premises, equipment and machinery). It may be a Greenfield project or an expansion of an existing plant, which may be financed at competitive floating rate of interest.

Islamic Finance:

With over 1.5 billion Muslims in the world, the global Islamic funds market is currently valued at USD 750 billion and is expected to grow exponentially every year.

Innovative Shariah compliant banking solutions:

At Uttara Bank our dedicated Islamic Banking team combines Shariah expertise with strong business acumen to offer customers the best of both worlds – comprehensive international banking services and a wide range of Shariah compliant financial products based on Islamic values.

At Uttara bank, we’ve blended Shariah principles with our rich banking heritage of more than 150 years to provide banking services that support your business while respecting your beliefs.

Our diverse range of Islamic Banking products are designed to give you greater flexibility while conducting business through Shariah-compliant process.

Our Products:

Bai Muajjal:

For financing procurement of raw material where goods are kept under customer’s custody.

Bai Murabaha:

For financing procurement of raw material where goods are kept under bank’s custody.

Hire Purchase under Shirkatul Melk:

For financing procurement of capital machinery.

Bai Salam:

For financing pre-shipment expenses by purchasing exportable goods in advance.

Structured of Finance:

A leading provider of cost-efficient, lease-based and asset-based financing solutions to businesses in Bangladesh, we can create and tailor the right structured solutions for your business needs in order to enhance shareholders’ wealth and your market competitiveness.

These solutions include:

Structured financing solutions:

Principal to principal structured capital market transactions optimizes investment returns and reduces effective funding costs.

Syndications:

This normally involves getting a group of banks together (forming a syndicate) to provide the loan amount required by the customer under a set of common terms and conditions laid down in a loan agreement.

Choose Uttara Bank and you gain access to full loan origination, distribution and trading capabilities, together with an unrivalled ability to match lenders and borrowers. Our leadership position and world class distribution capability result from the team’s ability to read the market, and to provide superb sell down coverage.

Cash Management:

In today’s competitive financial environment, effective cash management has become a critical success factor. This is the right time to have integrated cash management solution.

Our cash management services include local and cross border payments, collections, information management, account services, liquidity management and investment services for both corporate and institutional clients.

Payment Services:

We can help you save time and money by reducing processing costs while providing a value-added service to your suppliers.

Uttara Bank’s payment solutions can help to reduce your overall processing costs – for domestic and global payments – saving you time and money while providing a value-added service to your suppliers. Our comprehensive payment services will be tailored to enhance your accounts payable process. This will eliminate many manual tasks involved in making payments, allowing you and your staff to spend more time focusing on your core business needs.

We understand that most of your effort in the payment cycle is directed towards initiation; difficulties in the subsequent reconciliation process can jeopardize the whole process. With Uttara Bank Channels you can now track the exact status of each payment through timely reports that can be uploaded seamlessly into your company’s system.

Collection Services:

We have a comprehensive branch network and the local knowledge to help you with lower costs and greater efficiency.

The Uttara Bank Collections Solution leverages the Bank’s extensive regional knowledge and widespread branch network across our key markets to specially tailor solutions for your regional and local collection needs.

This Collections Solution, delivered through a standardized international platform, has the flexibility to cater to your local needs, thus enabling you to meet your objectives of reducing costs and increasing efficiency and profitability through better receivables and risk management. The key components of our solution include the following:

Liquidity Management:

Let us help you to get the most out of your company’s cash resources with physical sweeping, notional pooling, interest reallocation and investment.

Investment Banking:

We are a market leader across our footprint in innovative, landmark deals, multi-jurisdiction solutions and sophisticated product structuring for corporate and institutional clients. We hold leading positions in fixed income local currencies and loan syndications. Our in-depth understanding of the local regulatory framework in the domestic debt and loan markets, product expertise and wide geographic reach, help you achieve your financing and investment objectives.

Debt Capital Market:

Our proven knowledge, product capabilities and global reach make us well-suited to matching investors’ needs with the funding requirements of international and domestic issuers.

Asset Backed Securities:

We structure, arrange and distribute asset-backed and future flow transactions for clients and our track record of innovative deals puts us at the forefront of developing securitization markets in our footprint.

Credit Derivatives:

We offer investment tools and a range of local currencies to provide structured asset solutions to meet specific investment needs, achieve target yields on your portfolio and manage risk exposure.

Convertible Bonds / Equity Derivatives:

Our convertible bonds and equity derivatives teams open avenues of financing and investing linked to the equity asset class – all underpinned by local market knowledge, deep client relationships and innovation.

Account Section:

Individual Account:

Most of the accounts of a branch are individual. As such they deserve regular attention of the members of the staff of a branch. An individual account holder may nominate his near and dear ones to inherit his deposit in case of his death. He/ she can also give mandate or authority to operate his account in his short absence.

Joint Accounts:

- At the time of opening accounts in the name of two or more persons, clear and specific instructions shall be obtained regarding operation of the account and payment of balance to the survivor(s) or surviving members in the event of death of one or more joint account holders.

- The instructions as far as possible shall be obtained in the hand writing of the parties concerned, under the signatures of all the joint account holders.

- If the account is opened in the name of two persons instruction may be: Either or Survivor or singly or jointly.

- If the account is in the names of more then two persons instructions may be: By either or Survivor singly or by any two or more of them or by all of them.

- Incase of death of any joint account holders, if the specific instructions are either a or b, the balance will be payable to the survivor(s).

- In the absence of specific instructions in the “Either or Survivorship” form, balance of the joint account will be payable to the survivors and the legal representatives of the deceased joint account holders.

- Account payee cheque in the name of one of the account holders may be deposited in their joint name account for collection.

- In the event of any of the Joint Account holders becoming bankrupts, all operation in the joint account shall be stopped until fresh instructions are given by the remaining solvent account holders jointly under their signature and the official assignee.

- In the event of death of any joint account holders, the survivor or survivors shall be requested to close the old account and open a new account in the name of surviving account holders.

Account of Proprietorship Concern:

- While opening accounts in the names of proprietorship concern care should be exercised that the person opening account is the proprietor of the firm. Obtaining trade license issued by Municipal Authority/ Union Parishad can be a proof. On specific instruction the account may be operated by persons authorized by the proprietor.

- In case of death of proprietor, all operations in the account shall be stopped. Procedure laid down in Para (r) may be followed. On the death of the proprietor authority given by him ceases and the authority holder can not be allowed to operate the account.

Accounts of Partnership Firm:

A partnership account shall be allowed to be opened and operated by any one partner of the firm under his signature provided a partnership letter has been signed by all the partners of the firm in their individual capacity.

- Partnership Deed or Partnership Letter should be thoroughly studied to know the names and address of all the partners.

- In case of death of partner, if the deceased partner was operating the account singly, the balance shall be paid to the heirs of the deceased and the surviving partners as per orders of the Court agreement or arrived at between the surviving partners and heirs of the deceased. In the later case, the recipient shall execute indemnity bond as explained in Para ® regarding deceased account.

- If a partnership Deed is submitted the same should be accepted and recorded with the bank.

- In case of death of a partner who was not operating the account the surviving partners shall be advised to close the partnership account and open a new account.

- An operating partner may give mandate to a third person to operate the account in place of him.

Accounts of Joint Stock Companies:

- A Joint Stock Company is a separate legal entity. The shareholders may die or become insolvent. The company shall continue to exist unless the number of share holders falls below the minimum number of members.

- The minimum number of members is two and maximum is 50 excluding employees and ex employees. Private Limited Company cannot invite public to subscribe to its shares and therefore, not required to issue a prospect us. Right to transfer share is restricted. It can commence business as soon as it receives certificate of incorporation. It need not obtain “Certificate of Commencement of Business”.

- No cheque book shall be issued or withdrawals allowed from the account of the newly floated companies unless a certified copy of commencement of business is produced by the company.

- If the company fails to produce such certificate as mentioned at Para (v), the deposits accepted by the bank on their behalf representing share money, received in anticipation of the commencement of business, shall be refunded in lump sum to the Directors of the company obtaining a joint receipt from all of them subject to prior approval of Head Office.

- Account of Limited Companies operated by the Managing Agents of the company shall not be opened or allowed to be operated unless a certified copy of the Managing Agent’s, Agreement is obtained and the authority of the persons signing on behalf of the firm or company or the Managing Agent is verified.

Death of Constituent/ Deceased Account:

While releasing the balance in the deceased account the following procedure and precaution shall be observed. The Branch Manager should at first be satisfied about the benefited of the beneficiary/ Legal heirs of the deceased and obtain the following papers/ documents. Notice on knowledge of death, insolvency or insanity of a constituent precludes the bank from paying further cheques on his account even though these are dated prior to his death. If the information is authentic, the same should be noted in the record of banks and payment on the account be stopped. In case of any doubt, immediate inquiries are made to ascertain the correct position.

- Application of the legal heirs of the deceased.

- Succession Certificate

- Death Certificate

- Union Council / Pourashava Chairman/ Ward Commissioner Certificate.

- Certificate as to the balance of the deceased account (given by the branch).

- Liability position of the deceased if any duly certified jointly by two attorneys.

- Letter of authority or Power of Attorney is to be obtained in case the amount of one heir is to be with drawn by another heir.

- Legal Guardian or an Executor appointed by them may withdraw the money of a minor legal heir without guardianship Certificate.

- Where the balance in the deceased account is up to Tk.25, 000/- the same may be released without succession certificate, but other formalities to be observed.

Handling of Dormant Accounts:

Dormant Accounts: Current or Savings Bank Account, if remains inoperative for a certain period, will be treated as Dormant Account. In case of Current Account the period is 12 months while in case of Savings Bank Account the period is 24 months.

The dormant accounts should be identified annually during the month of January by applying computer programmed which marks each dormant account with remark “Dormant” against the account in the daily/ monthly periodical print out. In case computer facility is not available, dormant ledger is to be maintained.

The following procedures and precautions shall be taken to avoid fraudulent withdrawals/ transfer of funds from such accounts.

- All individual Current Account and Savings Bank Accounts shall be classified as Dormant if it falls within the criterion as mentioned in the foregoing paragraph.

- The account of Proprietorship and Partnership concerns, Joint Stock Companies, Local Authorities, Semi Government and Government Institutions shall not be treated as Dormant Account even if no withdrawal/ deposits take place for such period. Rather efforts should be made to revive those accounts so that they remain regular accounts.

- The Branch Manager shall scrutinize and ensure genuineness of the instruction/ advice before authenticating action in the Dormant Account on the following:

- Ø Transfer of fund to any account of the branch.

- Ø Transfer of Dormant Account to another branch

- Ø Transfer of fund from Dormant Account to another branch/ bank.

- Ø Closure of account.

- Ø Change of Address.

- Ø Issuance of fresh Cheque Book.

Unclaimed Accounts:

- Current and Savings Bank Accounts dormant/ inoperative for 5 years may be treated as unclaimed accounts.

- Overdue Fixed Deposits, Demand Draft Payable, T.T. Payable, Sundry Deposits, Pay Order outstanding for 3 (three) years and above may be treated as unclaimed accounts.

- All these accounts be listed out and retained in file for reference.

- No interest shall be applied to Savings/ Fixed Deposit Account if treated unclaimed.

- However, Branch shall follow Bangladesh Bank and Head Office circulars on the above from time to time.

Inter Branch Transfer of Account:

In case of transfer of Savings or Current account to another branch, a letter of request should be obtained and action be taken after verification of the signature and taking proper approval of the Manager. The request of the account holder desiring the transfer of the account shall be taken an application.

- When the application is received Manager of the branch will check up the same and if found in order will approve transfer of the account. The relative specimen signature cards and account opening form shall then be taken out from file for transfer by the concerned department.

- The following entries shall be passed by the branch transferring the account.

- Debit : Party’s account.

- Credit : UBL General Account (Transferee branch).

- The transferring branch should not recover any charges from the account holder for transfer of the account.

- The forwarding letter as per the following specimen shall be singed by the Manager.

- At the time of transferring the account the branch may retain photocopy of AOF and SS Card together the application and preserve in Account transfer file.

- Entries shall be made in the Account opened and Closed Register and a note to this effect “Account Transferred to ………….. Branch on…………. shall be made therein.

- Measures to be taken by the Transferred Branch.

Issuance of Cheque Books:

General Service Division of Head Office will supply required Cheque Books to branches against their requisition from time to time. On receipt of these cheque books/ other security stationery, the branch shall record the stock in the Security Stationery Stock Register. While recording the stock, the Prefix number shall invariably be mentioned.

- Separate folios will be opened in the Cheque Book issue Register for CD/ SB/ STD account cheque books.

- The requisition slip shall be sent to the respective Computer Terminal for posting in the respective account.

- All subsequent Cheque Books shall be issued against Cheque Requisition Slips extracted from the previous cheque books issued to the customer; however, the requisition slip pasted with subsequent cheque book on its first page shall be destroyed.

- The cheque requisition slip duly filled in by the customer shall be forwarded to cheque posting Terminal to ascertain:

The average balance maintained by the customer.

Whether previous cheque leaves are properly consumed.

Cheques are not frequently returned for insufficient funds in the account.

Payment of Cheque is not frequently stopped.

The manner in which the account is operated.

The account is not dormant.

Balance Inquiries & Statements:

Balance Inquiries.

- The account holder may enquire about his/her balance in the account. The client may be advised to fill and sign the Balance Requisition Slip (BRS) or to produce the Letter of Authority (LOA) duly signed by the account holder.

- The signature of the account holder shall be verified on the BRS or LOA before disclosing the balance.

- If a slip is required to be sent by mail or hand, it shall be sent in a closed envelope addressed to the account holder.

Balance Certificate.

In the event of a balance certificate required by an account holder, he/she may be provided with such certificate as per computer print report recorded by the branch against his/her written request. Certificate may be delivered as per instruction of the account holder.

Balance Confirmation.

- In a computerized system of accounts, the computer program will provide print report of balance confirmation of Accounts along with a sub-joined part. It will contain the full address of the account holder. The balance confirmation shall be dispatched to account holder in a window envelope. Follow-up should be made to get back the sub-joined part duly signed by the account holder.

- On receipt of the confirmation from the party regarding his/her balance duly signed, it shall be preserved in a file after verification of signature.

- Balance confirmation for debit balances in case of over-draft, cash Credit and/or loan accounts shall be dealt with separately. The sub-joined part to be received from clients duly signed by them and preserved in their document file after verification of signature.

Closing of Accounts:

For different reasons, the account holder(s) may request for closure of his/ their account with the bank. On receipt of such letter of request for closure of account, the Manager should ascertain the reasons to satisfy himself that the constituent is not severing his relations for grievance from the bank which may possibly be redressed. If for genuine reason the account holder(s) approach for closure of his/their account, the following steps shall be taken:

- I. The application shall be received together with unused cheque leaves.

- II. The signature of the account holder shall be verified

- III. The number of unutilized cheque leaves shall be noted on the letter.

- IV. The Manager shall approve closure of the account and ascertain liability position (if any) and closing charges at prescribed rate to be recovered.

- V. The account holder may be requested to withdraw the balance on deduction of the charges. Other wise the balance payable may be paid by way of pay Slip / Pay Order in favour of the account holder

- VI. After closure of the account, “Account Closed” Stamp shall be affixed on the account opening form, S.S. Card and in the Account Opened and Closed Register with date under signature of an authorized officer.

- VII. The Account opening form together with S.S.Card and the request letter shall be retained in Account closed file to be maintained in branches for Current and Savings Accounts separately.

- VIII. If the balance is paid by way of Pay Slip/Pay order, the debit advice may be delivered to the account holder either by hand or by mail.

- IX. The unused cheque leaves shall be destroyed by authorized officer and shall be recorded on the application for reference under joint signature.

- X. The unused cheque leaves shall be entered in the A/C Opening Register and the running number of the account shall be drawn reducing the closed account on each day.

Deposit Section :

The bank’s deposit stood Tk 50,817.0 million as on December, 2008 compared to Tk 43,586.4 million in 2007, thus recording 16.59 percent growth. Competitive interest rates, attractive deposit products, deposit mobilization efforts of the Bank and confidence reposed by the customers in the Bank contributed to the notable growth in deposit. The Bank evolved a number of attractive Deposit Schemes to cater to the requirement of small and medium savers. These helped to improved not only the quantum of deposits but also to bring about qualitative changes in deposit structure.

Types of Deposit Accounts:

The branches may accept deposits from the public in the following accounts:

- I. Current Deposits

- II. Savings Bank Deposits

- III. Fixed Deposits (Term Deposit)

- IV. Short Term Deposits

- V. Monthly Term Deposits

- VI. Any other deposits as may be approved/ advised by Head Office.

Current Deposit Account:

- I. Minimum balance to be maintained in the account is Tk.2,000/-

- II. Customer willing to open Current Deposit Account shall fill up the Account Opening Form (AOF) applicable to him/ her and Specimen Signature Card (SS Card). The customer will sign in the space provided under “Yours faithfully” and on the specimen signature cards.

- III. In case of proprietorship and partnership firms the relevant account opening form is to be filled in and signed by the proprietor/ partner in their individual capacity in the space provided under “Yours faithfully” and on the specimen signature card in their official capacity.

- IV. In all other cases including companies etc. the persons opening the account shall fill in the relevant Account Opening Form and sign the Form in the space provided under “Yours faithfully” and in the specimen Signature Card in their official capacity.

- V. Introduction of acceptable clients to be obtained as per guidelines.

- VI. The Manager’s approval for opening account shall be obtained by the concerned staff member.

- VII. A Current Deposit Account may be opened by individual, firm, company, and club, association, body corporate etc.

Savings Bank Deposit Account:

Savings Bank Account may be opened in the name of adult individual who are mentally sound and also jointly in the names of two or more persons payable to either or both or all of them or to the survivor or survivors.

- i. Savings Bank Account may be opened in the name of a minor also.

- ii. Saving Bank Account may be opened in the names of clubs, societies, association and similar institutions and even by government and semi-government offices.

- iii. Account shall be opened with at-least a minimum initial deposit of Tk.1, 000/-.

- iv. Interest at the rates fixed by Head Office from time to time is applied half-yearly on the balances held on daily product basis.

- v. Not more that one account be allowed to be opened in the same name. But this will not be applicable to parents willing to open more than one account in his/ her name in respect of each minor child.

- vi. Savings Bank Account shall not be allowed to be overdrawn under any circumstances.

- vii. Account opening formalities like Current Account should be followed.

- viii. Savings Bank Account should not be allowed to be operated like Current Account

- ix. Not more than 25% of the balance can be withdrawn without 7 days notice. Withdrawals in the account shall be allowed twice in a week.

Short Term Deposit Account (STD):

Deposits held in this account are payable on short notice. Normally corporate bodies, bank and financial organizations invest their funds temporarily. Now-a-days, private individuals having sound financial means also open this type of deposit accounts. The following rules shall apply:

- I. Deposits held in STD Account are payable in 7 (Seven) days notice.

- II. Cheque books may be issued to account holders for withdrawal of funds.

- III. Repeated withdrawal without notice shall be discouraged.

- IV. Interest is payable on balance held on daily product basis as per computer program used by bank.

- V. For opening STD Account, AOF used for Current Deposit Account shall be used.

- VI. Other formalities are similar to Current Deposit Accounts.

Fixed Deposit Account:

Fixed Deposit is neither transferable nor negotiable.

- I. Fixed Deposit Account may be opened by individuals, firms, companies, corporate body etc.

- II. Fixed Deposit Account shall be opened for a fixed period ranging from 3 months to 36 months or above as determined by Head Office from time to time.

- III. Rate of interest payable to Fixed Deposit Accounts shall be approved/ advised by Head Office from time to time.

- IV. Interest on deposits shall normally be payable on maturity along with principal.

- V. Customers may however, have the option of withdrawing interest accrued after every six months provided that the account is for more than 24 months period.

- VI. FDR may be encased before maturity on written request of the depositor. For payment of interest, branch shall follow Head Office instruction in this regard from time to time.

- VII. In case of FDR in joint names, written consent of all holders shall be obtained before premature encashment, irrespective of instruction provided for operation of the account.

Monthly Term Deposit Account:

In order to extend better opportunity for investment of funds for short period to the existing and potential clients, Uttara Bank Limited has introduced this deposit scheme. The salient features of the scheme are as follows:

- I. A minimum deposit of Tk.50, 000/- and its multiple shall be accepted by branch for one month.

- II. All other formalities similar to Fixed Deposit Account shall be followed.

- III. In case of premature encashment within 15 days of issue, no interest shall be paid.

- IV. In case of premature encashment i.e. after 15 days of issue but before maturity, interest at the STD rate shall be paid.

- V. MTD will be renewed automatically if no instruction otherwise is received by the branch.

- VI. Credit facility may be allowed against MTDR.

- VII. Interest on MTD shall be fixed by Head Office from time to time.

Clearing section:

out ward clearing:

All cheques, demand drafts and other credit instruments tendered for the credit of customers account will be delivered by the depositor at the clearing counter. Any deposits received by post will also be sent over to the clearing counter. The counter officer shall at the time of receipt examine such deposits carefully to ensure that:

- The name of the account is very clearly written on the Deposit slips.

- The particulars of deposits such as cheque numbers, names of bank etc. are properly entered on the deposit slip.

- The depositor has signed the Deposit Slip.

Inward Clearing:

I. Local Office/Main Branch shall receive cheques etc drawn on Uttara Bank Limited branches from the Clearing House. On receipt of the cheque etc. they shall segregate the same branch-wise and issue IBDA on branches against total amount of cheque etc. and shall arrange delivery of the UBL together with the cheques etc. within Clearing House time schedule.

II. Branches shall send the cheques dishonored by them supported by UBL issued on Local Office/Main Branch, within Clearing House time schedule for enabling Local Office/ Main Branch to return these instruments in the 2nd Clearing House.

Transfer Delivery:

- All such instruments drawn on easily accessible local Branches of UBL (say within Dhaka city) and deposited for credit of customer’s account shall be treated as “Transfer Delivery”.

- Uttara Bank Limited is yet to introduce transfer delivery system of collection amongst its branches in Dhaka. Till such time the branches shall continue to collect proceeds through outward bills for collection procedure as laid down in bills chapter.

- Transfer Book shall be maintained for entering transfer cheques/ vouchers.

- Serial number shall be allotted both on the debit and credit side of the book, which shall be required for recording the daily transactions. The same serial number shall be noted on the voucher entered in the book including their contra credit and debit voucher and or a set of credit or debit vouchers of a transaction.

- Entries in the debit and credit column of the book shall be directly made from the respective debit and credit vouchers. At the end of the banking hours the total of the debit and credit shall be arrived at and tallied with the computer figure in Transfer Head.

- IV. Transfer Stamp is affixed on the face of voucher; Vouchers are released from Transfer book. It is balanced and signed by the writer and Book is checked and signed by the authorized officer.

- V. In a computerized system scroll is done by the computer system. But branch shall maintain the Transfer Book manually as a safe guard against easy detection of mistakes and issuing vouchers if any.

Internal Transfer:

Cash section

Receipt of Cash:

Cash may be deposited either by deposit Slips for SB/ CD/ CC accounts or by other credit voucher like single credit voucher, pay order/ Draft/ T.T. application forms. Branches shall ensure the following:

- Cash receiving officer shall check the deposit slip/ credit voucher/ application form as to its title of account, number and amount in words and figures.

- The cash currency notes shall be counted physically /by cash counting machine as per denominations of the currency notes on the back of the voucher /deposit slip. The officer will enter the particulars in the cash Receiving Register and sign on the related deposit slip/voucher and affix “Cash Received” Stamp with date.

- At the close of business the cash receiving officer shall add all the entries in the register and if agreed with the actual cash received by him, shall hand over the register for checking by officer-in-charge.

- Receiving Cash officer will hand over the cash to the entire cash in-charge duly checked by him.

Payment of Cash:

Cheques, Cash Debit Vouchers, Fixed Deposit Receipts, Monthly Term Deposit Receipts, Bearer Certificates of Deposit, Demand Drafts, may be placed for payment at the counter by clients, beneficiaries and various departments for encashment. Branches shall ensure the following:

- The instrument is checked for any apparent discrepancy and evidence of posting and cancellation.

- Specimen Signature of cancellation officer shall be available with cash paying officer for convenience of payment.

- On being satisfied, the cash paying officer shall count cash for payment and the denominations of notes are written on the reverse of the instrument invariably.

- Signature of the bearer is obtained on the reverse of the instrument and compared with the signature already obtained from the bearer while presenting the instrument.

- “Cash Paid” Stamp is affixed on the face of the instrument and signed by the cash paying officer.

- Particulars of the instrument are entered in the cash payment register.

Dishonor of Cheques/ Instruments:

Bankers are under legal obligation to honor customer’s cheque if funds permit. If they honor a cheque through oversight when there are no funds to the credit of the drawer’s account Bank may lose the money. On other hand, if they dishonor it through inadvertence they may pay damage for wrongful dishonors.

Therefore, it is incumbent upon the bankers to proceed with caution in the matter of dishonoring cheque drawn on them. A banker is not under statutory obligation to give a written answer on a dishonored cheque. But as per practice, as well as agreement of Banker’s Clearing House a banker should return it with Return Memo giving the appropriate reason for the dishonor.

While giving such reasons, due care should be taken to see that the credit of the customer is not damaged by an unwarranted/ exaggerated answer. It should also be ensured that such reason does not mislead the payee.

In the event of dishonoring a cheque it must be entered in the Cheque Returned Register and the authorized officer must sign in the register and the Cheque Return Memo.

The following reasons are generally used for returning cheques/ instruments:

- Effects not cleared, please present again.

- Not arranged for

- Payee’s endorsement required.

- Payee’s endorsement irregular.

- Payee’s endorsement illegible.

- Drawer’s signature differs from specimen recorded in the office.

- Endorsement requires bank’s confirmation.

- Alteration requires drawers signature in full.

- Cheque is post dated.

- Cheque is out of date.

- Exceeds arrangement.

- Amount in words and figures differ.

- Crossed cheque must be presented through bank.

- Payment stopped by the drawer.

- Full cover not received.

- Vernacular endorsement requires confirmation

- Instrument Mutilated/ requires confirmation.

FOREIGN EXCHANGE OPERATION OF UTTARA BANK LTD:

Meaning of Foreign Exchange:

Foreign Exchange means Foreign Currency. It is a process, which is converted one national currency into another and transferred money form one country to another. If we consider ‘Foreign Exchange’ as a subject, then it means all kind of transaction related to Foreign Currency, as well as currency instruments, such as Draft, MT, TT, TC, and Payment Order & Foreign Trade.

Necessity of Foreign Exchange:

No country is self-sufficient in this world. Every one is more or less dependent on another, for goods or services. Say, Bangladesh has cheap manpower whereas Saudi Arabia has cheap petroleum. So Bangladesh is dependent on Saudi Arabia for petroleum and Saudi Arabia is dependent on Bangladesh for cheap manpower. People of one country are going to another country for Education, Medical Service etc. One-country export Agricultural commodities, another country exports Industrial products, all these transactions needs Foreign Currency & are related to Foreign Exchange.

Function of Foreign Exchange:

The Bank actions as a media for the system of foreign exchange policy. For this reason, the employee who is related of the bank to foreign exchange, especially foreign business should have knowledge of these following functions:

Rate of exchange works.

How the rate of exchange works.

Forward and spot rate.

Methods of quoting exchange rate.

Premium and discount.

Risk of exchange rate.

Causes of exchange rate.

Exchange control.

Convertibility.

Exchange position.

Intervention money.

Foreign exchange transaction.

Foreign exchange trading.

Export and import letter of credit.

Non-commercial letter of credit.

Financing of foreign trade.

Exchange Arithmetic

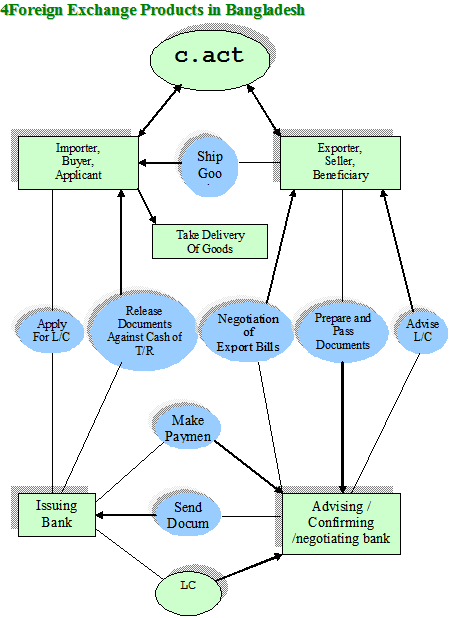

Foreign Exchange Products in Bangladesh:

Activities of Foreign Exchange:

There are three kinds of Foreign Exchange transaction:

Import

Export

Remittance

Mechanism of foreign Exchange:

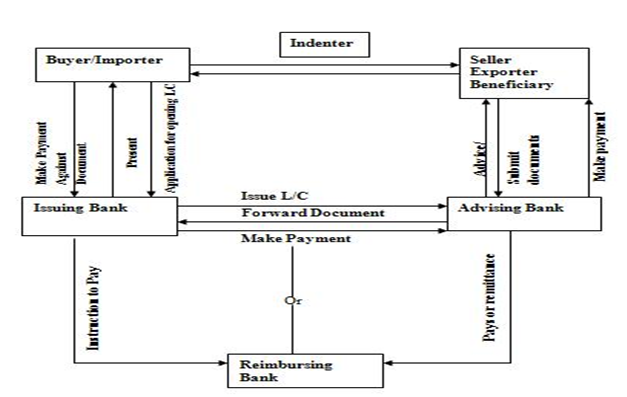

Definition of L/C:

A Letter of Credit is a definite undertaking of the Issuing Banks, to make the payment for the import, on behalf on the importer; in other words, it is a letter of the issuing Bank to the beneficiary, undertaking to effect payment under some agreed conditions. It is an undertaking of the Issuing Bank to the Beneficiary to make payment or to accept bill of exchange. It is also an authorization of the Issuing Bank to effect payment or to negotiate bill of exchange, against stipulated documents, complying credit terms. L/C is called documentary Letter of Credit. Because the undertaking of the Issuing Bank is subject to presentation of some specified documents. The Uniform Customs and Practice of Documentary Credit (UCPDC), 600, govern International Letter of Credit.

Classification of L/C:

In different considerations there are many kinds of L/Cs. Few of them are:

Irrevocable L/C

Revocable L/C

Add-Confirmed L/C

Back to Back L/C

Revolving L/C

Transferable L/C

Restricted L/C

Red Clause L/C

Green Clause L/C

Clean Letter of Credit

Documentary Letter of Credit

Straight Documentary Credit

Irrevocable Negotiation Documentary Credit

With recourse & Without recourse to drawers

UTTARA Bank Ltd, FAKIRAPUL Branch deals with the following L/C:

Sight L/C

Sight Local L/C

Deferred Foreign L/C

Back to Back L/C

Party Involved With L/C Operation:

A letter of credit is issued by a bank at the request of an importer in favor of an exporter from whom he has contracted to purchases some commodity or commodities. The importer, the exporter and issuing bank are parties to the letter of credit. There are however, one or more than one banks that are involved in various capacities and various stages to play an importer role in the total operation of the credit.

The following parties are involved with L/C operation procedures:

v The Opening Bank.

The Advising Bank.

The Buyer and the Beneficiary.

The Paying Bank.

He Negotiating Bank.

The Confirming Bank.

1. The Opening Bank: The opening Bank is one that issues the letter of credit at the request of the buyer. By issuing a letter of credit it takes upon itself the liability to pay the bills drawn under the credit. If the drafts are negotiated by another bank, the opening bank reimburses that bank. As soon as the opening bank, issuing a letter of credit (L/C), it express its undertaking to pay the bill or bills as and when they are drawn by the beneficiary under the credit.

2. The Advising Bank: The letter of credit is often transmitted to the beneficiary through a bank in the letters country. The bank may be a branch or a correspondent of the opening bank. The credit is some times advised to this bank by cable and is then transmitted by it to the beneficiary on its own special form. On the other occasions, the letter is sent to the bank by mail or SWIFT and forwarded by it to the exporter. The bank providing this service is known as the advising bank. The advising bank undertakes the responsibility of prompt advice of credit to the beneficiary and has to be careful in communicating all its details.

3. The Buyer and the Beneficiary: The importer at whose request a letter of credit is issued is known as the buyer. On the strength of the contract he makes with the exporter for the purchase of some goods that the opening bank opens the letter of credit. The exporter in whose favor the credit is opened and to whom the letter of credit is addressed is known as the beneficiary. As the seller of goods he is entitled to receive payment, which he does by drawing bills under the letter of credit.

4. The Paying Bank: The paying bank only pays the draft drawn under the credit but under takes no opening bank, by debating the letters accounts with it there is such an account or by any other measured up, between the two bankers. As soon as the beneficiary has received payment for the draft, he is out of the picture and the rest of the operation concerns only the paying bank and the opening bank.

5. The Negotiation Bank: The negotiating ban has to be careful in scrutinize that the drafts and the documents attached there to be in conformity with the condition laid down in the L/C. Any discrepancy may result in reused on the part of the opening bank to honor the instruments is such an eventuality the negotiating bank has to look back to the beneficiary for refund of the amounts paid to him.

6. The Confirming Bank: Sometimes an exporter stipulates that a L/C issued in his favor be confirm by a bank in his own country. The opening this country to add its confirming to the credit the bank confirming the credit is known as the confirming bank and the credit is known as confirmed credit.

Document Required For Open A L/C:

The importer after receiving the preformed invoice from the exporter, by applying for the issue of a documentary credit, the importer request his bank to make a promise of payment to the supplier. Obviously, the bank will only agree to this request if it can rely on reimbursement by the applicant. The applicant must therefore have adequate funds in the bank account or a credit line sufficient to cover the required amount. Banks deal in documents and not in goods. Once the bank has issued the credits its obligation to pay is conditional on the presentation of the stipulated documents with in the prescribed time limit. The importer should submit the following documents for opening L/C:

Valid Import Registration Certificate (commercial/industrial).

Tax Identification Number Certificate (TIN)

VAT Registration Certificate.

Membership Certificate of a recognized Trade Association as per IPO.

A declaration, in triplicate, that the importer has paid income-tax or submitted income tax returns for the year preceding year.

Pro-forma Invoice or Indent duly accepted by the importer.

Insurance Cover Notice with money paid receipt covering value goods to the imported.

L/C Application form duly signed by the importer.

Letter of Credit authorization Form (LCAF) commercial or industrial as the case may be duly signed by the importer and incorporation new ITC number of at least 6 digits under the Harmonized system as given in the import Trade Control schedule 1998.

IMP UTTARA BANK LTD – 170) Form duly signed by the importer.

Proposal of L/C:

Preparing a L/C proposal is fundamental function of a letter of credit operation. Preparing a L/C proposal a lot of information is needed. For this purpose the client should co-operate the bank. Otherwise the bank will not able to complete the proposal successfully. However, the following papers/documents are required to process L/C proposal.

Completion of A/C opening as per Bank’s form under terms and condition stipulated thereon.

Completion of L/C agreement form as per bank’s format.

Valid trade license.

VAT Registration Certificate.

TIN Certificate.

Valid/Renewed IRC – IRC to be properly Transferred/N.O.C from previous bank.

Membership Certificate form Chamber of Commerce.

Undertaking bearing Exchange Fluctuation.

Undertaking having no overdue liability with bank’s / financial institute.

Indent/P.I having address, Tel, Fax, E-mail address of Exporter/Indenter & Importer duly to be signed by both with acceptance and mentioning actual date of delivery, shipment date, ports with terms and condition.

L/C Operation of Uttara Bank Ltd:

Today UTTARA BANK LTD is one of the leading and most successful Banking enterprises in the country. It plays great role in the economy of the country. By export-import business the bank play a great role to the economy of Bangladesh. UTTARA BANK LTD is one of the greatest banks in export – import business.

Foreign trade plays a vital role in the economic advancement process of a nation. So the trend of country’s foreign trade, i.e. import & export is of a great concern to the government of a country. Fluctuation in the parameters of foreign trade immediately brings about some impact on the total economy. As such the nature, trend and the volume of foreign trade are required to keep peace with the national economic needs and objective. There may be some areas where emphasis is to be given while there may be others which deserve restrictions or discouragement. Moreover the items of import & export value and volume of the same, the corresponding time period, sources of fund far payment and receipt, all these factors are to be considered very carefully for making necessary adjustment to match with the national economic policies as well as achieve balanced economic growth through the inter policy and inter policy co-ordination.

International trade policy relates to commercial policy, which has two main components of Import policy relates to commercial policy, which has two main components of Import policy and Export policy. With a view to achieving favorable balance of payment position as well as to encouraging or well to encouraging or well regulated and need based foreign trade of the country, the government formulated the national commercial policy i.e. import and export policy for a certain period considering all the favorable & unfavorable aspects of the nation’s previous trade performance as well as the future requirement and prospects.

The main purpose of the policy is to conserve scare foreign exchange & to ensure its utilization for the import of goods and services, which have national priority. The selected persons on institutions those who have got valid Import Registration Certificate (IRC) form the Chief Controller of Import and Export (CCI & E) can import and they are known as importers.

These importers can import goods as entitled in each year as per import policy by opening letter of credit (L/C) through bank i.e. Authorized Dealer (AD). Authorized Dealer means the Branches of commercial banks, those that are authorized by the Bangladesh Bank to deal in foreign exchange. Letter of Credit may be defined as the letter of undertaking or letter of guarantee issued by the L/C opening bank on behalf of the importer submits all the documents as mentioned in the L/C submits all the documents as mentioned in the L/C within the time schedule to his bank i.e. exporters bank.

Before opening L/C in favor of the exporter the entitlement of the importer to be registered with Bangladesh Bank. For this purpose the importer is to apply through L/C Authorization form. After filled up and signed up the appropriate column of the LCA form, the importer will submit it to Authorized Dealer who in turn forwards the same to Bangladesh Bank for registration where fund is purchased from Bangladesh Bank. After registration Bangladesh Bank forward the 1st and 2nd copy of LCA form to the Authorized Dealer, 3rd and 4th copy to CCI & E and keep the 5th copy as their office copy.

Now the importer will come to his bank with a request to open a L/C along with the following documents:

L/C application and agreement form with adhesive stamp of Tk. 150.

Indent / Pro-forma Invoice/ Contract- 3 copies.

Insurance cover note with premium paid receipt.

IMP form one set duly signed by the importer.

Any other documents if necessary.

Authorized Dealer will scrutinize the documents and open the L/C in favor of the exporter by converting the Bangladesh Taka into foreign currency at the existing B.C selling rate of exchange. Care must be taken so that the limit of Bangladesh Taka is not exceeded in any way. The foreign currency value of the L/C must correspond the equivalent amount of Bangladesh Taka if LCA registered with Bangladesh Bank.

The Authorized Official of the Authorized Dealer will check the L/C very carefully and signed the same jointly and forward the 1st and 2nd copy to their foreign correspondent situated at the nearest place of the exporter. Thus Bank is known as Advising Bank. On receipt of the L/C the Advising Bank after verification of the duplicate copy at their end.

On getting the L/C the exporter prepares the goods and ship the same as per instruction of the L/C and obtain a Bill or Lading from the shipping Authority. The exporter will prepare bill of exchange, invoice and other documents as specified in the L/C and submits the same along with the original copy L/C to his bank within the time mentioned in the L/C. The Bank with whom the exporter submits the documents is known a Negotiating Bank as this negotiates the documents i.e. makes payment to the exporters.

The negotiating bank will scrutinize the documents with terms and conditions of the L/C very carefully. If every thing is in order the bank will make payment of the amount of L/C to exporter in their local currency by debiting to their own account. Subsequently the negotiating bank will claim the L/C with whom the Head Office of L/C opening bank maintained foreign currency.

This is known as Reimbursing Bank. Reimbursing Bank will make payment to the negotiating bank by debit to L/C opening bank’s head office A/C. Simultaneously the negotiating bank will forward all the documents submitted by the exporter to the L/C opening bank as per instruction of the L/C. The date of forwarding letter of negotiating bank should be date of negotiating of documents.

After taking delivery of documents from the L/C opening bank, the importer will clear the goods which has already been arrived or due to arrive from the customs authority on submission of these documents along with the custom purpose copy of LCA from.

Import:

Import Trade of Bangladesh is controlled under the Import & Export control Act 1950. Authorized Dealer Banks will import the goods into Bangladesh following import policy, public notice, F.E circular & other instructions from competent authorities from time to time. Goods are being imported for personal use, commercial purpose or industrial use.

Import Procedures:

Registration of importer: In terms of the importers, Exporters and Indenters order, 1981 no person can import goods into Bangladesh unless he is registered with the Chief Controller of Import & Export from the provisions of the said order. Only commercial & industrial importer must have registration from CCI & E.

To obtain import Registration certificate (IRC), the applicant will submit the following paper/documents to the CCI & E through this nominated Bank.

Questionnaire duly filled in & signed by applicant.

Trade license.

Membership certificate from chamber of commerce or any other trade Association.

Nationality certificate.

Income tax registration certificate.

Partnership deed/Certificate of registration with the register of joint stock companies where applicable.

On being satisfied the CCI & E issues IRC obtaining original copy of treasury Challan for payment of registration fee

3.23.1.2 Import Policy: At the beginning of each financial year, the Chief Controller of Imports and Exports announces the Import policy covering various aspects of imports in the coming year. The main points covered by the Import Policy are the following:

Items eligible for imports during the shipping period.

Items importable against – Cash foreign Exchange, Foreign aid and barter, Wages Earners Scheme.

The Procedure for induction of new comers into the import trade.

The procedure for imports by industrial consumers and commercial importers and for import under Wages Earners scheme.

Procedure for formation of groups.

The procedure for submission of application for Repeat License.

The dates for opening Letter of Credit, and shipment and the rules for revalidation of the License/LCA and the L/C.

Licensing for Imports: Most imports into Bangladesh require a license from the licensing authority. In recent years, however, the task of licensing has increasingly been delegated to the commercial banks. Beginning from the shipping period 1983-84, the commercial banks have been entrusted with the responsibility of licensing imports in both industrial and commercial sectors. Licensing is done by the commercial banks by means of a specially designed form known as Letter of Credit Authorization or simply LCA. The following documents are required to be submitted by the importer to his banker:

LCA form properly filled in and signed.

LC application.

Purchase contract in the shape of an indent or pro-forma invoice.

Insurance cover note.

Membership certificate from a Chamber of Commerce and Industry or registered Trade Association.

Proof of renewal of Import Registration Certificate for the current year.

Making the purchase contract: After being licensed, the next task for the importer is to make a contract with an overseas supplier or the letter’s local agent. The contract usually consists of a

pro-forma invoice issued by the supplier or his local agent and signed by the importer in token of having accepted the contractual terms.

Amendment of Letter of Credit: Not infrequently, the letter of credit opened by a bank needs amendment either because the terms and conditions incorporated in the L/C conflict with those of the underlying contract between the buyer and the seller or the buyer and seller agree, at a later date, to vary terms keeping in view the emerging circumstances.

Scrutiny and Lodgment of Documents: On shipping the contracted goods the beneficiary sets about the task of collecting and preparing the documents stipulated in the L/C. He collects Bill of Lading etc. from the carrier company, prepares the invoice, certificate of origin, packing list, bill of exchange and so on and present these to his banker. Unless the L/C restricts negotiation through any particular bank, the bank receiving the documents from his customer would negotiate these keeping in view the terms of the L/C. After that, the negotiating bank forwards the shipping Documents to the opening bank, simultaneously realizing payment by debiting the opening bank’s account.

Verification and Lodgment of Document by the opening Bank: On receipt of the shipping documents from the negotiating bank, the L/C opening bank should carefully examine these to ensure that they confirm to the terms of the credit; in particular, the following are the main points that should be looked into:

The documents have been negotiated within the stipulated dates.

The amount drawn dose not exceeds the amount authorized in the credit.

The bill of exchange is drawn in the manner stipulated in the credit; the amount is written in figures and words and corresponds to that of the invoice, and properly endorsed.

The merchandise in properly invoiced in the name of the opener of the credit i.e. the buyer or the importer with full description of the merchandise indicating, where applicable, the unit price. The invoice is signed and bears Bangladesh Bank’s Registration number.

The Bill of Lading is clean, shipped ‘on board’ showing freight prepaid and endorsed to the order of the issuing bank.

The certificate of origin given by the supplier is in conformity with that mentioned in the credit.

Other documents like weight list, packing list, pre-shipment inspection certificate etc. have been received and are in accordance with the terms of the credit.

Preparatory Steps for Opening L/C:

Before opening the L/C Uttara BANK LTD will takes the following steps:

Applicant to be Bank’s A/C Holder: Bank will open the L/C on behalf of a person who has an account with the Bank. Unknown person will not be allowed to open L/C.

Registered Importer: Before opening the L/C Bank must confirm that the L/C applicant is a registered importer or personal user and the IRC of the importer has been renewed for the current year.

Permissible Item: The item to be imported must be permissible and not banned item. If the item is from conditional list the condition must fulfill to import the same.

Market Report: Bank will verify the marketability of the item & market price of the goods. Some times the importer may misappropriate the Bank’s money through over invoicing.

Sufficient Security or Margin: Price is some items fluctuate frequently. In case of those items Bank will be more careful to take sufficient cash margin or other security.

Business Establishment: Bank should not open an L/C on behalf of a floating businessman. The importer must have business establishment, particularly he must have business network for marketing the item to be imported.

Restricted Country: Goods not to be imported from Israel. Credit report of the beneficiary. In the amount of L/C in one item exceeds Tk. 500 Lac. Supplier’s credit report is mandatory. Bank will collect credit report of the beneficiary through its correspondent in abroad.

Applicant of the client to open the L/C: The client will approach to open the L/C in Bank’s prescribed form duly stamped & signed along with the following paper & documents.

Indent/Pro=forma invoice.

Insurance cover note with money receipt.

LCAF duly felled in & signed.

Membership certificate from chamber of commerce/Trade Association.

Tax payment certificate/declaration.

IMP & TM form signed by the importer.

Charge documents.

IRC pass book, Trade license, Membership certificate & VAT registration certificate in case of new client.

Export L/C in case of Back-to-Back L/C.

Permission from ministry of Commerce: If the goods to be imported under CIF (cost insurance & finance), then permission from ministry of commerce to be obtained.

Creditability of the Client: In consideration of all the above points, if Bank becomes satisfied regarding the client then L/C may be opened on behalf of the client. Before opening the L/C Bank will issue & authenticate a set of LCAF in the name of the importer.

Importer points to prepare an L/C:

To prepare an L/C the Ads should take care on the following points:

L/C Number, Place & Date of issue, Date & Place of expiry, Shipment date, Presentation period, Applicant, Beneficiary, Advising Bank Account, Part-shipment & Transshipment, Availability, Port of Shipment, & Port of destination, Tenure of the Draft, Documents required, Payment, UCP, Bill of lading, Bill of Exchange, Pre-shipment Inspection, Data content, Special Conditions, Authenticity of the credit.

- Scrutiny of Import Documents:

After shipment of the goods, the exporter will submit the export documents to the negotiating Bank. Negotiating Bank will check & will send the documents to the Issuing Bank after negotiation. Upon receipt of the import documents Issuing Bank will examine the documents. Bank will decide within 7 banking days, following the day of receipt of the documents. Whether it will accept the documents or will reuse. If the Issuing Bank fail to communicate the refusal to the negotiating Bank writhing 7 days, the documents deems to be accepted.

At the time of scrutiny the following points to be checked specially:

- Scrutiny of Draft

Whether the Draft is drawn on the Issuing Bank or not?

Whether the amount of draft with the invoice & credit value and not over drawn.

- Scrutiny of Invoice

Whether the description of the goods as per credit terms.

Whether the data contain such as, HS code number, unit price, quality & quantity of the goods, LCA number, Importer & Inventor’s Registration Number, country of origin and any other information are as per credit terms.

Custom Invoice and /or consular invoice to be presented as per credit terms.

- Scrutiny of Transport Documents

Transport documents must ensure that:

It is presented in full set as called for the L/C. In how many number of documents are issued for mentioned.

The date of shipment on the transport documents must not later than the date stipulated in the L/C.

Shipped on Board’ ‘Freight Prepaid’ notations must be appeared on the B/L as called for in the L/C.

B/L must be ‘clean’ not ‘caused’.

Transshipped B/L not to be acceptable unless allowed by the L/C.

Stale B/L is not acceptable, if not permitted in the L/C.

The port of shipment & destination must be as per credit terms.

B/L must bear the name of carrying vessel and the flag.

Carrier must sign L/C.

- Scrutiny of pre-shipment inspection report

Bank will examine and scrutinize the following:

Whether the entire document required by the credit is submitted.

Documents to be consistent with one another.

Documents to be presented with in the stipulated time.

Documents to be issued by the authorized person as stipulated in the credit.

Documents to be examined as per credit terms & international standard Banking practice.

After examination, if the documents become discrepant. Issuing Bank will serve refusal notice to the negotiation/presenting Bank with seven banking days. The notice must stale all discrepancies and must also state whether it is holding the documents at the disposal of or is returning them to the presenter.

- Lodgment of Import Documents:

If import documents found in order, it to be made entry in the bill register and necessary voucher to be passed, putting Bill number on the documents, this process is called Lodgment of the bill. The word ‘Lodgment’ means temporary stay. Since the documents, stay at this stage for a temporary period i.e. up to retirement of the documents, the process is called Lodgment, Bank must lodge the documents immediate after receipt of the same, not exceeding 7 banking days, following the day of receipt of the documents.

- Procedures of Lodgment:

Bill register: Bank wills entry the documents in the bill register. Bill register must include date of Lodgment, Bill No., Bill of Exchange No, Amount, and Name of the Negotiation Bank, B/L no & date, merchandise, retirement date & other particulars.

Application of rate: Foreign Currency would be converted at B.C selling rate ruling on the date of Lodgment.

Exchange Control Form: IMP & Tm form must be filed in and signed by the importer at the time of Lodgment.

Endorsement of LCAF: LCA form must be endorsed showing utilization of shipment.

Noting on the File: Utilized amount showing bill no to be noted on the printed format of L/C file.

Retirement of Documents:

Importer is to be advising on the date of lodgment of documents with full particulars of shipment to entire the documents against payment or to dispose the import documents as per pre-arrangement, if any. Subsequent reminders are also to be issued very week till retirement of the bill. Such bills will be considered and be reported as overdue if the importer fails to retire the documents with 21 days of arrival of the relative import-consignments at the port of destination.

When the importer intends to retire the documents, the branch will prepare following retirement vouchers for adjustment of PAD liabilities there against:

Dr. Party’s A/C

Cr. PAD A/C

Cr. SWIFT charges

Cr. Income A/C: Interest on PAD

Thereafter the documents may be handed over to the importer against proper acknowledgement after certification endorsement.

Issuance and Disposal of LCAF:

All imports transacted through the bank shall require LCA form. The LCAs are issued in sets of six (6) copies each. Of these, the one marked, “For Exchange Control Purchase” should be used for opening L/C and for effecting remittance.

The branch should not issue blank LCAFs to their clients. The importer should himself sign the LCAF in the presence of an officer of the branch. An authorized official of the branch should put his signature with date and seal on the LCAF, evidencing verification of the importer’s signature and import entitlement as per current IPO.

If foreign exchange is intended be bought from the Bangladesh Bank against an LCAF it has to be registered with Bangladesh Bank’s Registration Unit.

Where no F.C fund is required from Bangladesh, LCAFs are needed not to be the registered with Bangladesh Bank; the branch will send the third & fourth copies LCAF along with the copy of the L/C and amendments thereto to the area office of the CCI & E within 15 days retaining other copies with the branch.

LCAFs issued for import of capital machinery and spares will remain valid for remittance for 18 months subsequent to the month of issuance.

When L/Cs is opened, full particulars thereof must be endorsed on the bank of the Exchange Control copy of the LCAF under the stamp and signature of the branch.

LCAFs can normally be utilized on CRF basis. Full LCAF value is therefore not remittable as F.O.B value goods. The branch should also give a certificate to the importers to the effect that the amounts of freight, handling charges. etc. has been endorsed on the relative LCFA.

Back-To-Back L/CS:

The branch may open back to back import L/Cs against export L/Cs received by export oriented industrial units opening advise the beneficiary under the bonded warehouse systems, subject to observance of domestic value addition requirement prescribed by the NBR/Ministry of Commerce from time to time. The following instructions should be complied with while opening Back-to-Back Import L/Cs:

The unit requesting for this facility should process valid IRC, ERC and valid bonded warehouse license.

The branch shall hold the Master Export L/C affixing bank lien stamp thereon and be kept in safe for security purpose.

The master export L/C should have validity period adequate to the time needed for importation of inputs, manufacture of merchandise, and shipment to consign.

The Back-to-Back L/C value shall not exceed the admissible percentage of net FOB value of the relative mater export L/C.

The Back to Back import L/C shall be opened on up to 180 days usance (DA) basis except in case of those opened against Export Development Fund administered by Bangladesh Bank in which case the back to back L/C will be opened on sight (DP) basis.

Interest for the usance period shall not exceed LIBOR or the equivalent interest rate in the currency of settlement.

All amendments of the master export L/C should be noted down carefully to rule out chances of excess obligation under the back-to-back import L/C.

Back-to-Back L/C can either be local or foreign. Inland BTB L/Cs denominated in foreign warehouse system up to value limits applicable as per prescribed value additional requirement.

Accounting Procedure:

1. Creation of L/C liability:

Dr. Customer’s liability on BTB L/C

Cr. Banker’s liability on BTB L/C

2. Commission and other charges:

Dr. Customers A/C: Commission for 180 days + FCC+ Postal/SWIFT + Misc.

Cr. Income A/C: Commission on L/C foreign

Cr. Income A/C: Postal/SWIFT Recoveries

Cr. Income A/C: Miscellaneous earning (handling charges, stationary etc.)

Cr. Sundry deposits A/C: F.C.C.

Cr. Stamp in hand.

3. Amendment Charges:

a) If the L/C value is increased: