The reserve ratio, also known as the bank reserve ratio, the bank reserve requirement, or the cash reserve ratio, is the proportion of deposits that a financial institution must have in cash reserve. It alludes to the part of all-out stores that the business banks are committed to keep up with the national bank as money hold, and it won’t be accessible for any business loaning. It refers to the share of reservable liabilities that commercial banks must keep rather than lend or invest.

The prerequisite for the save proportion is chosen by the national bank of the country, like the Federal Reserve on account of the United States. A bank’s hold generally comprises of cash it has and is held in its vault. Banks likewise have cash kept in their record at the central bank. The reserve requirement is the minimum amount of reserves that a bank must retain, and it is frequently used interchangeably with the reserve ratio.

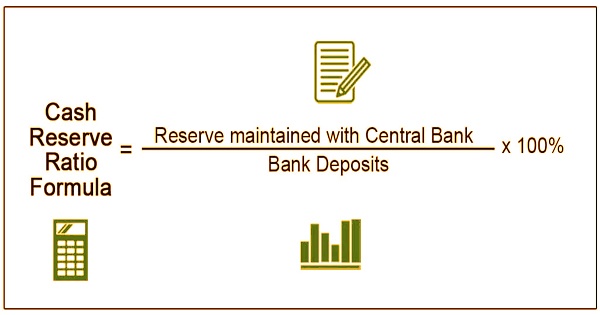

The computation for a bank is made by dividing the cash reserve held with the central bank by the bank deposits and expressing the result in percentages. Regulation D of the Federal Reserve Board establishes the reserve ratio. Regulation D established consistent reserve requirements for all depository institutions having transaction accounts, as well as requiring banks to report to the Federal Reserve on a regular basis. The reserve ratio is typically employed in monetary policy planning to limit the amount of cash that banks may convert into loans.

Also, focal money-related specialists utilize the proportion to shield banks from an unexpected decrease in liquidity, which can bring about a monetary emergency. The Fed brings the save proportion down to give banks more cash to loan and lift the economy and expands the same proportion when it needs to diminish the cash supply and control swelling. While some nations, such as Australia and the United Kingdom, do not have reserve ratios, others, such as Lebanon and Brazil, have reserve ratios of 30% and 20%, respectively. The numbers are significant because they ensure that each country’s economy can be regulated and protected.

Reserve Ratio Formula is represented as,

Reserve Ratio = Reserve maintained with Central Bank / Bank Deposits × 100%

The reserve ratio is one of the Federal Reserve’s most important monetary policy instruments. The Fed may decide to decrease the reserve ratio in order to boost the economy’s money supply. Lower reserve ratios allow banks to lend more money at lower interest rates, making borrowing more appealing to clients. The following steps can be used to calculate the reserve ratio:

- Determine the reserve amount – To begin, identify the bank’s reserve amount with the central bank, which may be found simply in the bank’s disclosure.

- Determine the bank deposits – Next, figure out how much the bank borrowed in bank deposits. Net demand and time liabilities are other names for it.

- Calculation for a bank – Finally, a bank’s calculation is determined by dividing its cash reserve with the central bank (step 1) by its net demand and time obligations (step 2), then multiplying by 100%.

A higher loan fee harms security proprietors, as financing costs have an opposite relationship with the worth of bonds. The securities exchange likewise will in general act contrarily when loan fees flood since it’s more costly for organizations to get the ideal degree of financing. The Fed, on the other hand, raises the reserve ratio requirement to lower the amount of money that banks must lend. By slowing the economy and reducing the quantity of money in the economy, the Fed is able to manage inflation.

The idea of reserve ratio is crucial to grasp from the standpoint of banking economics since it is used to preserve the reserve to prevent any lack of money in the event that a large number of depositors decide to withdraw their accounts, which is commonly referred to as a bank run. Specifically, banks struggle when the national bank changes the hold proportion up on the grounds that there is a cutoff to the measure of cash banks can loan and, along these lines, to the measure of revenue they can acquire. When the central bank decreases the reserve ratio, the opposite is true. Banks have more money to lend, resulting in higher interest rates.

Reserves must be held in cash in bank vaults or as deposits with a Federal Reserve Bank. A fixed amount of money is given to banks as interest on their reserves in some nations. The technique is typically advantageous to banks, although it is dependent on current interest rates. The measure of hold to be kept up with is controlled by the national banks of every district based on their past experience in regards to cash interest during a bank run. Truth be told, the national bank utilizes the save proportion to deal with the cash supply in the economy.

Reserve ratios must be closely monitored by international investors, particularly in economies where reserve requirements are used to regulate monetary policy. In many situations, investors can predict when reserve ratio changes will occur by looking at macroeconomic tendencies. In addition, there is an interest rate on excess reserves (IOER), which is paid on any cash deposited with the Federal Reserve in excess of the reserve requirement. When a country’s inflation rate rises, its reserve ratio generally rises as well.

A financial backer can support such dangers by putting resources into various areas and nations. A financial backer can likewise move his interests into regions that are not impacted by changes in the ratio. When a central bank believes that a Contractionary Monetary Policy is suitable for the economy, it will raise the reserve ratio in order to decrease bank lending and therefore limit money supply in the market. When a central bank believes the economy requires an Expansionary Monetary Policy, on the other side, it will reduce the reserve ratio in order to enhance market liquidity.

Information Sources: