The retention ratio, also known as the net income retention ratio or the plowback ratio, is the percentage of earnings that are held in the firm as retained earnings. The retention ratio is the percentage of a company’s profits that are reinvested in the business rather than given out as dividends to shareholders. The payout ratio, on the other hand, represents the percentage of earnings distributed to shareholders as dividends.

A high retention level shows that the administration accepts there are utilizes for the money inside that gives a pace of return higher than the expense of capital. A low maintenance level implies that most profits are being moved to financial backers as profits. After profits have been paid out, the measure of benefit left over is known as held income. Investors can use the retention ratio to figure out how much money a firm keeps to reinvest in its operations. This ratio shows how much earnings is maintained as profits for the company’s development and how much is dispersed as dividends to shareholders.

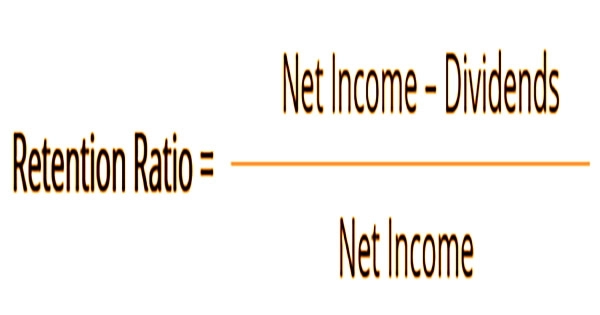

Developing organizations regularly have high maintenance proportions as they are putting income back into the organization to develop quickly. The ratio is utilized by development financial backers to find those organizations that give off an impression of being furrowing cash once again into their tasks, on the hypothesis that this will bring about a possible expansion in their stock cost. The retention ratio may be calculated using a simple formula: divide a company’s retained income by its net income. The stages are shown in the formula below:

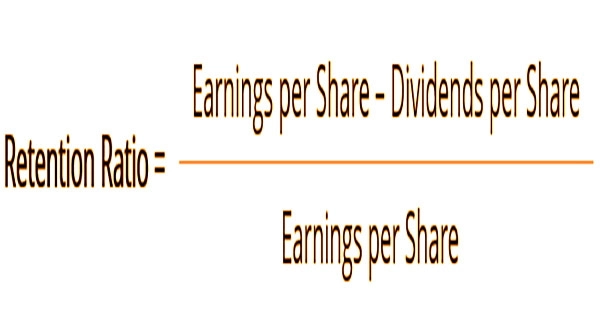

The net income figure may be found at the bottom of a company’s income statement, while the dividend figure can be found in the balance sheet’s shareholder’s equity part of the cash flow statement’s financing section. Organizations that create a gain toward the finish of a financial period can utilize the assets for various purposes. The maintenance proportion recipe is a significant part to other monetary equations, especially development recipes. The ratio can also be calculated on a per-share basis, using the following formula:

The company’s management has the option of paying dividends to shareholders, keeping the profit to reinvest in the firm for development, or doing a combination of the two. Retained earnings refer to the percentage of a company’s profit that it decides to keep or store for later use. A large drop in the retention ratio may indicate that management has realized there are no more viable investment options for the company.

- The size of the retention ratio will attract different types of customers/investors.

- A smaller plowback ratio would be expected by income-oriented investors, since it indicates a strong dividend potential for owners.

- A high retention ratio indicates that the business/firm is making successful internal use of its earnings, which attracts growth-oriented investors. Stock prices would rise as a result of this.

The retention ratio is backward of the profit payout ratio, which estimates the extent of net gain delivered out to financial backers as profits or stock buybacks. Held income is like a bank account since it’s the combined assortment of benefits that is held or not paid out to investors. Benefits can likewise be reinvested once again into the organization for development purposes.

The retention ratio formula considers how much money is maintained by the corporation rather than distributed to ordinary stockholders. It aids investors in determining how much money a business keeps to reinvest in its operations. Earnings growth may be hampered if a corporation pays all of its retained earnings as dividends or does not reinvest in the business.

More modest organizations will in general focus on business advancement and interests in innovative work, which can be a motivation behind why they are bound to hold their profit as opposed to appropriate them as profits. Likewise, an organization that isn’t utilizing its held profit successfully has an improved probability of assuming extra obligation or giving new value offers to fund development. In the early phases of a fledgling firm, sales may be slow, resulting in less money to distribute to shareholders, leading in a greater retention ratio.

It is important to comprehend the financial backer assumptions and capital prerequisites differ starting with one industry then onto the next. Subsequently, a correlation of plowback proportions will bode well when a similar industry and additionally organizations are being made. New businesses don’t usually pay dividends since they’re still developing and require funds to expand. Established corporations, on the other hand, often pay out a portion of their retained earnings as dividends while simultaneously reinvesting a piece back into the business.

Analysts compare the ratio to the ratios of similar firms in the same industry in order to derive significant conclusions. This makes comparing one firm to another in terms of earnings retention much easier. There is no set range in which the retention ratio should fall, and a variety of other criteria must be evaluated before drawing any conclusions about a company’s future prospects.

Financial backers might forego profits if an organization has high development possibilities, which is normally the situation with organizations in areas like innovation and biotechnology. Proportions can likewise be checked out throughout some stretch of time to notice patterns and year-over-year changes in the measurement. Analysts can use this information to assess changes in the company’s performance over time. It should only be regarded as an indication of the company’s perspective intentions.

Information Sources: