Executive Summary

NCCBL bears a unique history of its own. The organization started its journey in the financial sector of the country as an investment company from 25th November 1985. NCCBL is a banking company registered under the Company Act 1913. The aim of the company was to mobilize resources & invest them in such way so as to develop countries Industrial & Trade Sector & playing a catalyst role in the capital market as well. Its membership with the Stock Exchange helped the company to a great extent in this regard. The investment company operated up to 1992 with 16 branches & thereafter, with the permission of the Central Bank

Was converted into a fully fledged private commercial Bank in 1993 with paid up capital of Tk.39.00 crore to serve the nation firm a broader platform. Now NCCBL Established 80 branches so far to provide financing, investment, counseling, underwriting among guarantee, portfolio management etc. along with traditional banking. Since its inception the bank has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment. The Bank has set up a new standard in financing in the Industrial Trade & Foreign Exchange business. Its various deposits & credit products have also attracted the clients both corporate & individuals who fell comfort in doing business with the Bank.

NCCBL is a highly capitalized new generation bank with an authorized capital of the bank is now TK. 5000 million. The bank raised its paid up capital from Tk1, 201.79 million during the year 2005 to Tk. 2,248.90 million during the year 2009. With the increase of paid up capital to Tk. 5000 million the capital base of the bank has become strong. NCCBL is now positioned to best suit the financial needs of its customers & them partners of progress.

In the 1st chapter At first I have mentioned the main reason for preparing this report after that I have give an idea about role of bank in one countries economy. The main objective of the study is to develop an insight of e-banking & SME prospect of the bank to identify the internet banking system & loan facilities of the NCC Bank Limited. In scope it seems that the report is based on NCC Bank’s e-banking & SME sectors. In preparing this report various limitations are faced the major was restriction in collecting internal information and the way of using various information source for preparing this report also mentioned.

2nd chapter provides an over view of NCC Bank Limited. It is arranged in a manner that will give a sequential idea of NCC Bank’s background, organization, mission, vision, goals and objectives, information, values also the product and services of NCC Bank Limited. It incorporates the discussion on different departments of the bank and the products and services offered by the NCC Bank Limited. Where it’s found that NCC Bank always thinks to provide high quality products and services to the customers.

3rd chapter deals with the main topics of the report the E-banking & SME services of NCC Bank Limited. Here the different service of e- banking provided by the bank are ATM, debit card, credit card, online banking, visa card their services & facilities interest. SME financing provides the definition, growth rate, interest, characteristics, objectives of SME, background of SME, supportive side by the Bangladesh Bank & whether SME are good or bad are describe here.

4th chapter contains the discussion of SME financing of the NCC Bank which means the impact of SME in GDP. The targeted people, criteria for loans their purposes & modes. The security, interest charged by the bank. The difference between the SME & other banking services. Loan monitoring actions. Distribution of loans and advances & their types of NCC Bank Limited .The types of loans & advances include Continuous Loan, Term Loan, and Demand Loan & Loan under SME. Their processing system of loans & advances. The trend of loans & advances, import & export, & operating profit which show an increasing rate through the last five year performance of the NCC Bank are given though bar diagram. In last I discuss about the future prospect of SME services of the bank.

In 5th chapter Findings, Recommendations & Conclusions are given. In findings I have discussed about some problems of NCC Bank Limited to operate their business and also recommended how to remove these problems to operate NCC Bank’s business smoothly in upcoming years and at last Bibliography. Where I mentioned the sources of collecting information for my report.

The banking sector of Bangladesh is passing through a tremendous reform under the economic deregulation and opening up economy. Currently this sector is becoming extremely competitive with the arrival of multinational banks, technological infrastructure, effective management, higher performance level and utmost customer satisfaction. NCC Bank Limited follows the policy and practices set by the management and the guideline set by the Bangladesh Bank. As a result, they are performing well in reducing the high classification rate and achieving the profit target of the bank.

1.1 Background of the Study:

Bangladesh is a developing country of the third world. The economic condition of this country is not enough. The country is not yet been industrialized. Large portion of population lives under the poverty limit. In spite of these limitations, some sectors are emerging since the last 10 years. Banking sector is one of those rising sectors.

In recent times, Small and Medium Enterprises (SMEs) have come into the forefront of development agenda due to the recognition of their contribution in fostering growth, sustaining global economic recovery, generating employment & reducing poverty. Growth of SMEs can reduce poverty through acceleration of economic growth, removal of biases against labor incentive production, creation of employment opportunities for the low-skilled workers & formation of linkages with small supplies.

SMEs are in general labor–intensive industries with relatively low capital strength. As such Bangladesh being a labor abundant & capital scare SMEs have a natural comparative advantage. In recognition of the strategic importance of the development of the SMEs in promoting economic –growth, employment generation & poverty alleviation the SME sector has been declared as a priority sector in the Government’s industrial policy 2005 & various measures have been initiated to help maximize the SMEs growth potential.

There are many small and medium entrepreneurs in the country that have innovative idea, sprit and potentially to do something productive for local consumers as well as export abroad. They can generate income and contribute to the GDP. They may also provide employment. Development and growth or small and medium enterprise is vital for national development. Such type of beneficial enterprising borrower cannot go a long way for want of financial support because they have no access to institutional credit facilities.

I have conducted my internship program in National Credit and Commerce Bank Limited and accordingly prepared this internship report on “Emphasis on E-Banking & SME Banking Prospect Of NCC Bank Limited”. I made this report on the basis of my observation and findings during the period of my internship program.

1.2 Objectives of the Study:

There are some objectives in behind this study. They are mentioned hereunder:

- The first reason is to complete the BBA degree as the internship program is a partial requirement to obtain the degree.

- To observe & analyze the performance of the specific Bank as a whole.

- To know about the products and services offered by the Bank.

- To know the literary meaning of SME & SME finance and its importance in Bangladesh economy.

- To be acquainted with SME Financing by a private commercial bank i.e. NCC Bank Limited.

1.3 Scope of the Study:

This report has been prepared through extensive discussion with my colleagues & with the clients. While preparing this report, I had a great opportunity to have an in depth knowledge on Emphasis on E-Banking & SME Banking Prospect Of NCC Bank Limited”. The scope includes:-

- Origin & background

- Loan & advances

- Products & services

- Performance

1.4 Methodology of the Study:

In order to make the report more meaningful and presentable, two sources of data and information have been used widely. The sources are:

1.4.1 Primary Sources:

- Observation of banking activities.

- Conversation with the Head Office & Branch officials of related desk.

- Informational conversation with the clients.

- Practical work exposures on different desks of the branch covered.

1.4.2 Secondary Sources:

- From prior research report.

- Annual report (2009-2010) of NCC Bank Limited.

- Periodicals Published by Bangladesh Bank.

- Different kinds of data regarding from loan & advances & SME Finance.

- Published reading materials and books.

- Different circulars issued by Head Office & Bangladesh Bank.

- Different prospects and brochure published by the bank.

- Related issues published in Newspapers and Internet.

- Website of Bangladesh Bank, NCC Bank, Ministry of Finance & other related organizations.

- SME Foundation office and their web address.

1.5 Limitations of the Report:

In preparing this report some problems and limitations were encountered which are as follows:

- The main constrain of the study was insufficiency of appropriate information, which was required for the study.

- Some data are not disclosed due to security and other corporate obligations.

- Incorporation of up-to –date data was not possible due to unavailability of the latest data in sources i.e. annual report, web site etc.

- Due to time limit many aspects could not be discussed in present report.

2.1 Historical Background:

National Credit and Commerce Bank Ltd. bears a unique history of its own. The organization started its journey in the financial sector of the country as an investment company back in 1985. The aim of the company was to mobilize resources from within and invest them in such way so as to develop country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well. Its membership with the browse helped the company to a great extent in this regard. The company operated up to 1992 with 16 branches and thereafter with the permission of the Central Bank converted in to a fully fledged private commercial Bank in 1993 with paid up capital of Tk. 39.00 crore to serve the nation from a broader platform. At present the amount of paid up capital is Tk 2,284.90 Crore which is 30% higher than that of previous year.

Was converted into a full fledged private commercial Bank in 1993 with paid up capital of Tk.39.00 crore to serve the nation firm a broader platform. Now NCCBL Established 79 branches so far to provide financing, investment, counseling, underwriting among guarantee, portfolio management etc. along with traditional banking. Since its inception the bank has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment. The Bank has set up a new standard in financing in the Industrial Trade & Foreign Exchange business. Its various deposits & credit products have also attracted the clients both corporate & individuals who fell comfort in doing business with the Bank.

NCCBL is a highly capitalized new generation bank with an authorized capital of the bank is now TK. 5000 million. The bank raised its paid up capital from Tk1, 201.79 million during the year 2005 to Tk. 2,248.90 million during the year 2009. With the increase of paid up capital to Tk. 5000 million the capital base of the bank has become strong. NCCBL is now positioned to best suit the financial needs of its customers & them partners of progress.

The activities of NCCBL encompass a wide range of services including accepting deposits, making loans, discounting bills, conducting money transfer, foreign exchange transactions & performing other related services such as safekeeping collection, issuing guarantees, acceptances, & letter of credits through its branches in Bangladesh & foreign. They also involved in buying & selling of securities for its customers through Brokerage House. The bank carries out all these activities by busing a membership share of DSE Ltd. & CSE Ltd.

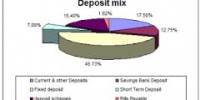

NCCBL is the pioneer of lending loan on diversified area on Working Capital Financing, Commercial & Trade Financing, Long Term (Capital) Financing, House Building Financing, Retail & Consumer Financing, SME Financing, Agricultural Financing, & on Import & Export Financing. NCCBL has divided its loan into four parts on Continuous Loan, Term Loan, and Demand Loan & under SME. Before disbursing loan NCCBL has follow some rules & regulations by completing new forms such as: Application form, Application for investing, Collecting CIB report, Making investment proposal, Project appraisal, and Head Office approval. After fulfill the above documentation procedures loan is sanctioned. The percentage of loan able funds are Working Capital Financing is 45%, Industries 25%,Small Industries & various sect oral finance under Government 15%, Real estate & Civil construction 5%, Agro-based financing is 5%, Lease financing 3%, Consumer Financing is 2%. The trends of loan & advances are increasing at an increasing rate from Tk. 20533.13 to Tk. 50387.68 from 2005 to 2009. This figure shows that the loan & advances has increased. After all the profit margin of NCCBL is increasing at an increasing rate.

The NCCBL has strong risk management procedures. The risk management of the bank covers core risk areas of banking VIZ. credit risk, liquidity risk, arising from money laundering incidences. The prime objective of the risk management is that the bank evaluates & taken well calculative business risks & there by safeguarding the banks capitals, its financial resources & profitability from various business risks through its own measures & through implementing Bangladesh Bank guidelines & following some of the best practices.

During providing loan the NCCBL follow the credit risk grading score by giving score based on financial risk (50), business risk (18), management risk (12), and security risk (10), and relationship risk (10). When a company or individual shows (85+) then it consider goods & applicable for loan without any doubt. When it is (75 to 84) then it considered applicable, when it score (65to 74) then it consider marginal or watch list, when it obtain (55 to 64) then it consider special mention, when it score (44 to 54) then it consider to be substandard.

The loan recovery procedure of NCCB is very good then others. Though the bank has few weaknesses on online banking on ATM Card, Credit Card & other perspective, but the NCC bank has play an important role in developing the socioeconomic sector by providing loan in diversified area in the country . And play an important role in reducing unemployment problem by providing loan productive sector.

Since its inception NCC Bank Ltd. has acquired commendable reputation by providing sincere personalized service to its customers in a technology based environment. The Bank has set up a new standard in financing in the Industrial, Trade and Foreign exchange business. Its various deposit & credit products have also attracted the clients-both corporate and individuals who feel comfort in doing business with the Bank.

- All types of commercial banking activities including Money Market operations.

- Investment in Merchant Banking activities.

- Investment in Company activities.

- Financiers, Promoters, Capitalists etc.

- Financial Intermediary Services.

- Any related Financial Services.

Head Office operates the branches, SME service centers and brokerage house throughout the country.

2.2 Corporate Vision:

To become the Bank of Choice in serving the nation as a progressive and Socially Responsible financial institution by bringing credit & commerce together for profit and sustainable growth.

2.3 Corporate Mission:

To mobilize financial resources from within and abroad to contribute to Agriculture’s, Industry & Socio-economic development of the country and to play a catalytic role in the formation of capital market.

2.4 Corporate Information:

Registered address:

7-8, Motijheel Commercial Area

Dhaka-1000 Bangladesh

Cable: NATCREDIT DHAKA

Phone: PABX (02) 95610902-4, 95566283, 9563981-3

Telex: 642821NCL BJ

Fax: 880-2-9566290

Email:nccbl@bdmail.net

Web: nccbank.com.bd

Company Secretary:

Mr. Md. Tarikul Alam.

3.1 E-Banking:

The possible steps that are taken to introduce technology based banking products & services to the customers. At present 142 ATM booth are under E-Banking services.

The emphases on E-Banking are:

- Debit Card

- Credit Card

- Online Banking

- ATM

- Visa Card etc.

E-banking promises the followings in our services:

- Interest rate is 2% per month.

- Dedicated service at your door steps

- Sporty

- Faster service

- Security of cards

- Team work

- Patient at our services

- Transparency

- Quick decisions

Instant Cash Advance

You do not need to carry cash any more if you have a NCC Bank Credit Card. You can withdraw cash up to 50% of your credit limit from any ATM across the country that shows Visa logo.

Credit Facilities

NCC Bank Visa Credit Card offers you free Credit facility up to 45 days and minimum of 15 days without any interest (Purchase only).

Supplementary Card

NCC bank Visa Credit Card holder can also enjoy spouse Credit Card free of cost for lifetime and issue more Supplementary card.

Objective of Corporate Customers

- Fast and Accurate Services.

- Effective Communication.

- Attractive Pricing (Annual fee 50% discount on card fee) .

- Strong Communication.

- Smiling faces of the Bankers.

- Good Ambience in the Bank.

Our Corporate Offer

| Particular | Small (10-100) | Medium (101-500) | Large (500 above) |

| Card Fee | 50% | 50% | (Negotiable) |

| Rate of Interest | 2% | 2% | 2% |

| Cash Withdrawal | 2% | 2% | 2% |

| Purchase | 2% | 2% | 2% |

| Maximum period of interest free | 45 days | 45 days | 50 days |

| Replacement Card Fee | Charges | Charges | Free |

| Late Payment Charge | Charges | Charges | Free |

| Excess Over Limit Charges | Charges | Charges | Free |

Balance Transfer Facilities

If anyone holds other Bank Credit Card, then NCC Bank will issue a credit card with equivalent limit and will issue a pay order by debiting card A/C from balance transfer option for the equivalent amount of total outstanding in order to full settlement and cancellation of other Bank A/C.

More parts of this post–

SME Banking of NCC Bank Limited (part-1)

SME Banking of NCC Bank Limited (part-2)