Findings

SME service in our country became more attractive to all kind of business owners. All kind of banks are already started providing the SME services to the small and medium business owners. They are creating new facilities to make it more helpful for the business owners. They are trying to help poor people and family by providing this service to the women. The government of Bangladesh also paying attention in this service, so the small and medium business owners can get more benefits from the banks and others who provide this service to them.

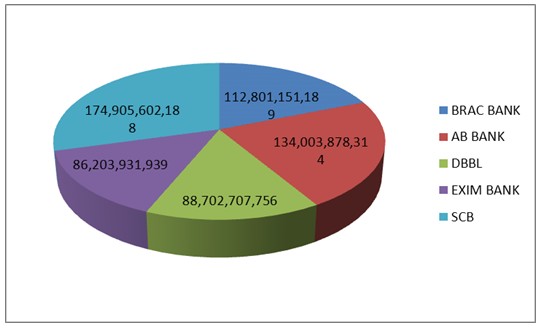

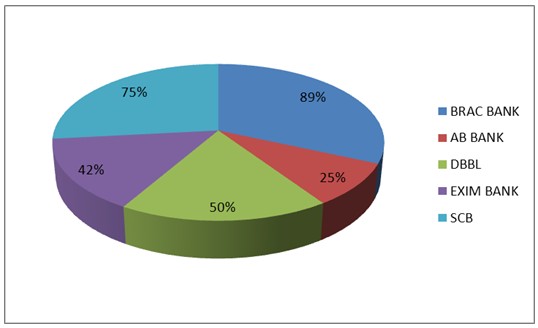

Ratio of Banks SME loan

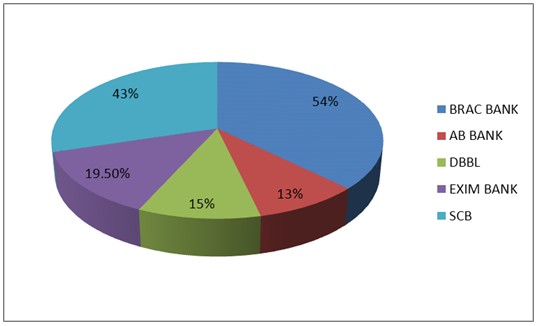

Return from SME

Total Asset

Recommendations

1. Seed Money, Leasing, Venture Capital and Investment Funding:

There is a need for improving different aspects of financial services of SMEs, such as seed money, leasing, venture capital and investment funding. There is a lack of long-term loans; interest rates are high, Guarantee/Security issues, exchange risks etc. All these limit the development of SMEs. Finance, both short and long term, should be provided at market cost of capital. Fund should be made available through encouragement for setting up ‘Venture Capital’ organization in Bangladesh. The concept of venture capital (VC) has successfully Operating in the USA, EU countries, and Canada.

2. Establishment of Small Business Investment and Lending Corporation (SBILC):

We should start with ‘something effective’ for industrial development in general and the SMEs sector in particular. Such a step, for example, could be the establishment of a separate corporate body. That means a separate financing institution could be developed, with joint ownership of the public and private sector. To make the proposed initiative effective in achieving its goals, government may set up a Small Business Investment and Lending Corporation (SBILC).

The SBILC can be formed under Small Business Investment and Lending Act passed through the Parliament. Under SBILC there may have external and Internal Financing policies. Taken from the different countries experiences the different types of financing policies and program that can be introduced through SBILC, is enumerated below:

- Low Doc Loan Program, which may allows small business to use a simple one-page application for loans up to Tk.50, 000; loans between Tk.50, 000 andTk.1, 00,000 may require the one-page application plus personal tax returns for three years and a personal financial statement from entrepreneur.

- Direct loans, this type of loan may be provided directly to the small business with public funds and no participation. The interest rate charged on direct loans depends on the cost of money to the government and it changes as general interest rates fluctuate. It can be limited to a fixed ceiling.

- Immediate participation loan can be made from a pool of public funds and private loans.

- Guaranteed loan. When private lenders extend loans to small businesses, SBILCin those cases can provide guarantee for repayment in case the borrower defaultson the loan, which may be given for a defined amount of loan and up to certain percentage e.g., 80% or 75% of loans.

- Seasonal line of credit programme, may be offered for short-term capital to growing companies needing to finance seasonal buildups of inventory or accounts receivable. The maturity period cannot be exceeding 12 months and the company must repay it form cash flow. Accounts receivables and inventory can be collateral for the loan.

- Contract loan programme, is another short-term loan guarantee, but it is designed to finance the cost of labour and materials needed to perform a contract. Maturity times are up to 18 months.

- Export working capital programme. Under this prgramme the SBILC may give guarantee 90 percent of bank credit line up to a certain limit. In such case Loan proceeds must be used to finance\e small business exports.

- Disaster Loans. As their name implies, disaster loans can be provided to small businesses devastated by some king of financial or physical losses (such as tremendous flood, earthquakes). Disaster loan may carry below-market interest rates.

- Greenline revolving line of credit programme. Greenline programme can be designed to increase small companies’ access to working capital by providing them with revolving lines of credit. It can be different than traditional loans, which may require fixed monthly payments; the Greenline programme may employ highly flexible revolving loans, in which cash-hungry small businesses able to draw on a credit line only when they need the money. This loan programme can be designed to provide short-term credit to allow small businesses to finance the sale of their products and services until they can collect payment for them.

3. Periodical Professional Training Courses for SMEs & for Entrepreneurship Development:

Periodical professional training courses should be arranged for technical staff of SMEs. Moreover training in management of small enterprises and efficient marketing can also provide. Islamic Chamber regularly organizes training workshops on management, marketing, procurement of technologies, quality control system and financing of SMEs, for the benefit of representatives of private enterprises and staff of member chambers indifferent regions of the

Islamic World. Training programme / workshop should be organized for the development of SMEs capabilities to acquire enhanced knowledge and skills about how to choose, use and improve technology. At present, no such institution exists except a project of the BSCIC called ‘SCITI (Small and Cottage Industries Training Institute). Training on different aspects of SMEs activities for entrepreneurs is crucial for the development of an entrepreneurial.

4. Establishment of R&D Institute for Enterprise and Entrepreneurship Development, Training and Research Institute:

In a country like Bangladesh, where entrepreneurial initiative is rare and shy, a separate institute for enterprise and entrepreneurship development, training and research should be developed. To make it a ‘center of excellence’ in SMEs development, it should be designed, involving educational institutions, business associations, relevant government bodies, private research agencies, and individual consultants having experience in SMEs development.

5. Establishment of a separate bank for women entrepreneurs:

Establishment of a separate bank for women entrepreneurs will accelerate the development of women SME through their increased access to formal financial institutions.

6. Minimum quota for women entrepreneurs:

Maintaining a minimum quota for loan disbursement to women entrepreneurs and proactively seek out female clients.

7. Training program for women entrepreneurs:

Increase the capacity of women entrepreneurs through training and awareness raising activities on financial management, business procedures and other regulatory process such as trade license, tax and VAT, etc. At the same time, initiatives should be undertaken to sensitize the people working with respective regulatory institutions so that women SME can easily arrange necessary documents for loan application and other procedures.

8. Implementation and Monitoring of Policy Measures for SMEs:

Only policy prescription is not the end, if it is not implemented through different measures timely and properly. How far policy measures are implemented, along with, what effect – desired or not – such policy measures has had on the development of SMEs should also be monitored from time to time. This monitoring will provide feedback for taking corrective actions, if necessary, to ensure desired effect of the policy adopted.

Conclusions

As the experiences of SME finance in Bangladesh suggest, there is critical need for putting in place a credit delivery system that evaluates the credit worthiness of borrowers, on a basis other than fixed asset ownership. The evaluation may require examining transaction records of the borrowers, assessing the value of movable assets etc. There will also be the need for enhanced post disbursement monitoring. An effective SME finance policy will have to cover such enhanced cost of credit administration. In addition to credit guarantee or refinancing facility there will have to be adequate rediscount facility for the primary lender to accommodate these costs. The financing scheme should also include special provisions for women entrepreneurs. Indeed, the Implementation of appropriate policies and strategies is a prerequisite to harness sustainable competitiveness of SMEs around the country. Suggestive remarks have been stipulated in this write up. With that paradigm, proactive policy is essential to enact them. The first step this regard is to make firm’s filly aware of the competitive challenges they have to face. The next step is to help SMEs prepare to meet the challenge by understanding their strengths and weaknesses and providing the inputs they need to help them upgrade. The main inputs are finance, market information, training, infrastructure development, R&D, management tools, technology, skills and links with institutions for support services. SMEs are considered to be the seedbed for the development of entrepreneurial skills and innovation. Small capital requirement makes easy entry and exit possible and private sector entrepreneurial activities have many important spillover and positive externality effects. However, liberalization of the economy along with rapid globalization has posed severe challenges to SMEs not only in international markets but also in the domestic economy. Since SMEs are based on relatively small investment, their survival depends on readily available markets with easy access. In today’s world, market development is a much more challenging task, which requires coordinated efforts by individual business enterprises and the Government. Bangladesh has failed to maximize the benefits derived from the SME sector, which promises and needs to play a pivotal role in promoting and sustaining the industrial as well as overall economic growth. The failure can be attributed to various reforms and trade liberalization measures that have squeezed the sphere of Government’s activity in business. Consequently, the private sector has to lead the economy in a dynamic growth path. The role of SMEs in providing productive employment and earning opportunities has emerged as an important concern among policy makers, donor agencies and researchers. Regardless of the correct magnitude, SMEs undoubtedly play a very important role in the economy of Bangladesh in terms of output, employment, and private sector activities. They are quite predominant in the industrial structure of Bangladesh comprising over 90% of all industrial units. Together, the various categories of SMEs are reported to contribute between 80-85% of industrial employment and 23% of total civilian employment (SEDF, 2003). However, serious controversies surround their relative contribution to Bangladesh’s industrial output due to paucity of reliable information and different methods used to estimate the magnitude. The most commonly quoted figure by different sources (ADB, World Bank, Planning Commission and BIDS) relating to value-added contributions of the SMEs is seen to vary between 45-50% of the total manufacturing value added.

More parts of this post-

SME Banking Scope In Bangladesh.(Part-1)

SME Banking Scope In Bangladesh.(Part-2)

SME Banking Scope In Bangladesh (Part-3)

SME Banking Scope In Bangladesh (Part-4)

SME Banking Scope In Bangladesh (Part-5)

SME Banking Scope In Bangladesh (Part-6)

SME Banking Scope In Bangladesh (Part-7)