As a commercial consideration, the banks used to concentrate their lending mainly on large customers having enough resources that could easily provide adequate coverage of the exposure through offering high value security. A substantial portion of bank’s lending was thus security oriented and that too to a few large and corporate clients. But experience with large customers was not that much pleasant as was thought to be. So changes in the concept of bank’s lending became necessary. Financing in Small & Medium Enterprises (SME) have become a major focus of the commercial banks as an effective means of stimulating economic activity for overall development of a country like Bangladesh. Dhaka Bank Limited is pretty aware of this lending concept and has already stepped into the field by extending finance to this sector. From the very beginning of its inception, DBL is endeavoring to encourage entrepreneurship within the country. This report is a small attempt to focus on that endeavor DBL has adopted to encourage entrepreneurship.

The report consists seven chapters. Chapter one talks about the origin, objective, scope, methodology and limitations of the report. In chapter two, the author has briefly discussed about Dhaka Bank Limited’s Historical Perspective, Mission & Vision, Goals of the Bank, Values, Objectives of the Bank, Management System, Correspondent Relationship, Departments of DBL, Current Performance, Policies and Strategies of the bank, Environment of Dhaka bank, Corporate Banking, Banking System and Financial Structure In Bangladesh, Commercial Banking in Bangladesh, SWOT Analysis of Dhaka Bank Limited, Credit rating report of Dhaka bank limited.

Chapter three consists of the working experience of the author in different departments. The whole SME financing, Product Program Guide under DBL SME Financing where the author discussed about the types of facilities under DBL SME and their features, eligibility criteria to enjoy the facilities, customer segments, purpose for DBL SME financing, restricted areas under SME Financing etc. SME loans and advances procedure has been discussed in chapter four. Each and every step from loan application receiving to loan disbursal and loan recovery has been

elaborately described in this chapter also DBL SME Financing Scenario in recent years.

Introduction

Background of the Study

Bangladesh economy has experienced a rapid growth since the ’90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessman of the country grouped together to respond to these needs and established Dhaka Bank Limited in the year 1995.

Research Objectives

My primary objective behind this report is to get acquainted with the different issues of SME. Without the specific objectives, any study cannot become the fruitful one. Before preparing the report, I would like to set up objective of my study as:

Primary Objective

• To get acquainted with the different issues of SME Financing.

Specific Objectives

• To understand the SME loan processing

• To understand the guidelines for SME financing in Dhaka Bank Limited.

• To understand the legal formalities required in SME financing

• To understand the importance of eligibility criteria for enjoying SMEF

• To understand the facilities of SME financing

• To understand the types of customers and purpose of SME financing

• To get to know about the loan approval process

• To learn the recent scenario of SME financing

Methodology of the Study

The study is performed based on the information extracted from the different sources collected by using a specific methodology. The details are given below:

Data Collection

The Primary sources are:

• Practical desk work

• Conversation with the officers

• Conversation with the clients

• Appropriate file study as provided by the concerned officer.

The Secondary sources are:

• Annual reports of Dhaka Bank Limited

• Different “Procedure Manual” published by the Dhaka Bank Limited

• Publications obtained from different libraries and from the internet.

Organization Overview

Historical Perspective of Dhaka Bank Limited

Dhaka Bank Limited (DBL) is the leading Private Sector Bank in Bangladesh offering full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. Dhaka Bank Limited is the preferred choice in Banking for Friendly and Personalized Services, cutting edge Technology, tailored solutions for Business needs, Global reach in Trade and Commerce and high yield on Investments, assuring Excellence in Banking Services.

DBL is a Scheduled Bank that was incorporated as a public limited company on April 06, 1995 under the Companies Act, 1994. The Bank started its commercial operation as a Private Sector Bank on July 05, 1995 with a target to play the vital role in the socioeconomic development of the country. Aiming at offering Commercial Banking Service to the Customers’ door around the country, the DBL established 74 branches up-to this year. This organization achieved Customers’ confidence immediately after its establishment.

Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. This is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution. The Bank was incorporated as a public limited company under the Companies Act. 1994. The

Bank started its commercial operation on July 05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at Tk. 4,668 million as on December 31, 2012. The total equity (capital and reserves) of the Bank as on December 31, 2012 stood at taka 9,786,311,177. The Bank has 74 Branches, 3 SME Service Centers, 8 CMS Units, 4 offshore Banking Unit across the country and a wide network of

correspondents all over the world. The Bank has plans to open more Branches in the current fiscal year to expand the network.

The Bank offers the full range of banking and investment services for personal and corporate customers, backed by the state–of–the-art technology and highly motivated Professionals. As an integral part of our commitment to Excellence in Banking, Dhaka Bank now offers the full range of real-time online banking services through its all Branches, ATMs and Internet Banking Channels.

Dhaka Bank Ltd. is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments.

Departments of DBL

If the jobs are not organized considering their interrelationship and are not allocated in a particular Department it would be very difficult to control the system effectively. If the departments are not fitted for the particular works there would be haphazard situation and the performance of a particular department would not be measured. DBL has does this work very well. Different Departments of DBL are as follows:

• Human Resources Division

• Personal Banking Division

• Treasury Division

• Operations Division

• Computer and Information Technology Division

• Credit Division

• Finance & Accounts Division

• Financial Institution Division

• Audit & Risk Management Division

• Foreign Trade Division

Commercial Banking in Bangladesh

Commercial Banking may be retail or wholesale on the basis of amount of transitions and nature of clients. When banking services are provided to individuals and volumes of transactions are smaller, then it is called retail banking. On the other hand, when banking services are provided to corporate clients and volume of transactions are bigger, then it is called wholesale banking or Corporate Banking.

Functions of Commercial Bank:

1. Acceptance of money on deposit from the public

2. Grant of credit to all sectors of the economy ( loan and advances, discounting of bills, investments in open-market securities)

3. Collection of cheques, draft, bills and other instruments for their depositors

4. Issue of performance and financial guarantees

5. Provision of remittance facilities by issue of drafts.

6. Provision of facilities of safe custody of deeds securities and safe deposit volts

7. Purchase and sale of securities for their constituents

8. Granting consumers loans

9. Providing financial advisory services

10. Offering equipment leasing

11. Making venture capital loans

It should be noted that most banks offering a wide array of financial services today, the bankers’ service menu is growing rapidly. Now, commercial banks are considered as “Financial Super Markets”. There are different types of commercial banks. Dhaka Bank is under second generation Private commercial banks.

SWOT Analysis of Dhaka Bank Limited

Strength

The employees of the Dhaka Bank Limited think that Dhaka banks Strengths are

• Dynamic and vibrant Board of Directors

• Strong and resilient team of management professionals

• Forward looking strategies and management policies

• Cutting-edge tools and technologies to support real time on-line banking

• Well-diversified line of business

• A good risk management and compliance culture

• Deep focus on quality control

• And a dedicated line of human resources.

A good amount of salary is given to the employee of the Dhaka Bank Limited. For exampleManagement Trainee officer (MTO) of Dhaka Bank Limited get the highest salary (48,000 taka) from the other bank’s post of MTO.

• Dhaka Bank has lower amount of Bad debts

• To create sustainable shareholder DBL has solid business growth

• Employee turnover rate is very low

Weakness

• Junior employees get the less amount of concentration though their ideas are distinctive. It creates demoralization in them

• Technology used by the bank are not sufficient

• Dhaka Bank focuses on the small sectors like- SME loan, Microcredit. This might be the reason of loosing sufficient profit in the future.

Opportunity

• Now a day, SME is an emergent sector and government is giving priority to this sector. It would be a beneficial to DBL to be the focused in this sector.

• Strong compliance of the laws and regulations of the state and regularity bodies which will change the activity of this bank.

• Government favoring the private banks development.

Threat

• Private Banks are increasing day by day so, the deposits competition is also increasing.

• Dhaka Bank does not have diversified products

• Technological changes may become the threat for the bank.

• Dhaka bank has 71 branches all over the country but mainly in the urban areas .In rural area they have very few branches whereas other banks have created muscular network in the rural area like Dutch-Bangla Bank and BRAC bank.

SME Financing

SME Finance is the funding of small and medium sized enterprises and represents a major function of the general business finance market – in which capital for different types of firms is supplied, acquired and cost/priced.

Capital is supplied through the business finance market in the form of:

- Bank loans and overdrafts

- Leasing and hire-purchase arrangements

- Equity/ corporate bond issue

- Venture capital or private equity and

- Asset-based finance such as factoring and invoice discounting

However, it should be noted that not all business finance is commercially supplied through the market. Much finance is internally generated by business out of their own earnings and supplied informally as trade credit.

The economic and social importance of the small and medium enterprise (SME) sector is well recognized in academic and policy literature. It is also recognized that these actors in the economy may be underserved, especially in terms of finance. This has led to significant debate on the best methods to serve this sector.

There have been numerous schemes and programs in markedly different economic environments. However, there are a number of distinctive recurring approaches to SME finance.

• Collateral based lending offered by traditional banks and finance companies are usually made up of a combination of:

- Asset based finance

- Contribution based finance and

- Factoring based finance, using reliable debtors or contracts

• Information based lending usually incorporates financial statement lending, credit scoring and relationship lending.

• Viability based financing is especially associated with venture capital.

Prudential Guidelines for Small and Medium Enterprise Financing

There are 13 prudential guidelines for small and medium enterprise financing. These are:

1. Source, capacity of repayment and cash flow backed lending Banks are required to:

• Identify the sources of repayment and assess the repayment capacity of the borrower on the basis of assets conversion cycle and expected future cash flows.

• Assess conditions in the particular sector they are lending to and its future prospects.

• Document the rationale and parameters used to project the future cash flow and annex the same with the cash flow analysis undertaken by the Bank.

• Assist the borrowers in obtaining the required information future cash flows since a large number of SME’s will not be able to prepare the same due to lack of sophistication and financial expertise.

2. Personal Guarantees:

All facilities to SME’s shall be backed by:

• Personal guarantees of the owners

• Spouse guarantee

In case of limited companies, guarantees of all guarantors other than nominee directors shall be obtained.

3. Per party exposure limit

The minimum and maximum exposure of a bank on a single SME shall remain within Tk.

0.50 lac subject to following:

In case of WCF – Maximum up to 100% of the NRWC or 75% of the sum total of inventory and receivables is lower.

In case of FAP – Maximum up to 90% of the purchase price

4. Aggregate exposure of a bank on small and medium enterprise sector

The aggregate exposure of a bank on SME sector shall not exceed the limits as specified below:

• Below 5% 10 times of the equity

• Below 10% 6 times of the equity

• Below 15% 4 times of the equity

• Up to and above 15% up to the equity

5. Limit on clean facilities

For facilitating growth of smaller loans, banks are free to determine security requirements for loans less than Tk. 10.00 lac.

6. Securities

For loans from Tk. 0.50 to less than Tk. 10.00 lac

As a minimum, Banks must take charge over assets being financed.

For loans from Tk. 10.00 lac to 50.00 lac

• Hypothecation on inventory, receivables, advance payments, plant and machineries.

• Registered mortgage over immovable properties with registered power of attorney.

• Personal guarantees of spouse or parents or other family members

• One third party personal guarantee

• Post dated cheques for each installments

• One undated cheque for full amount including full interest

7. Loan documentation

For all facilities, Banks must obtain and not limiting to the following documents before disbursement of loan can be made:

• Loan application duly signed by the customer

• Acceptance of the terms and conditions of the sanction advice

• Trade license

In case of Partnership Firm

• Copy of registered partnership deed duly certified as true copy or a partnership deed on non-judicial stamp of Tk. 150.00 duly notarized.

In case of Private Limited Company

• Copy of MOA and AOA including COI duly certified by RJSC and attested by the MD accompanied by an up-to-date list of directors.

• Copy of board resolution for availing credit facilities and authorizing Managing Director or Chairman or Director for execution of documents and operation of accounts.

• An undertaking not to change the management and the MOA and the AOA of the company w/o prior permission of the bank.

• Copy of last 3 years audited financials.

• Personal Guarantees of all directors including the Chairman and the Managing Director.

• Certificate of registration of charges over the fixed and floating assets of the company duly issued by RJSC.

• Certificate of registration of amendment of charges over the fixed and floating assets of the company duly issued by RJSC in case of repeat loan or change in terms and conditions of sanction advice regarding loan amount, securities, etc.

• Demand Promissory note.

• Letter of Hypothecation of stocks and goods.

• Letter of Hypothecation of book debts and receivables.

• Letter of Hypothecation of plant and machinery.

• Charge (Deed of mortgage) on fixed assets.

• Personal Letter of Guarantee

• Whenever practical, insurance policy for 110% of the stock value covering all risks with Bank’s mortgage clause in joint name of the Bank and client.

8. Margin requirements

Banks shall adhere to minimum margin requirement as prescribed by Bangladesh Bank.

9. Credit information Bureau clearance While considering proposals for any exposure, Banks should give due weight to the credit report relating to the borrower and his group obtained from a Credit Information Bureau (CIB) of Bangladesh Bank.

10. Minimum conditions for taking exposure

• Except loans backed by 100% cash collateral, Banks shall, as a matter of rule , obtain a copy of financials duly audited by a practicing CA, relating to the business of the every borrower who is either a private limited company or where exposure of a bank exceeds Tk. 40.00 lac

• In case where enterprises like proprietorship and partnership concerns do not have proper books of accounts due to lack of sophistication and expertise, Banks shall assist the borrowers in obtaining or developing such books of accounts as per forms or formats prescribed by each bank.

• Each Bank shall develop their own loan application form and ‘Borrower’s Basic Fact Sheet’. Banks shall not approve and take any exposure until and unless the prescribed loan application form is accompanied by ‘Borrower’s Basic Fact Sheet’ under the seal and signature of the borrower.

Product Program Guide under DBL SME Financing

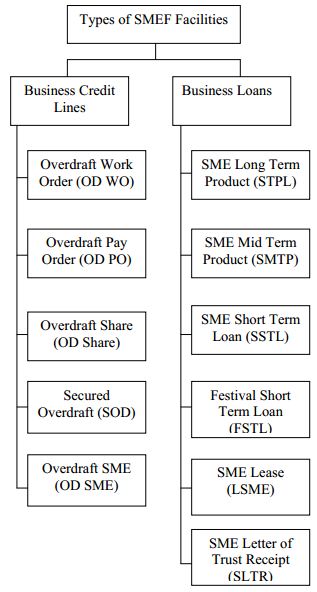

Types of Facilities under DBL SME Financing

Types of facilities under DBL SME Financing are classified into following criteria:

Details of the Business Credit Lines and Business Loans under DBL SMEF

1. Overdraft Work Order

DBL OD WO is a line of credit under assignment of receivables (under the awarded work) and lien/mortgage of collateral. It is for contractors/suppliers and can be availed on one off basis for financing the working capital requirement in business against specific work order or the same under a revolving line with renewal option.

Features:

- Credit max up to 35%-40% of net work order value

- Single facility limit max up to Tk. 50.00 Lac for small enterprise and Tk. 100.00 for medium enterprise

- Repayment through deduction up to 40%-45% from each running bill Interest charged only on the utilized amount

- Competitive interest rates

- Low Processing fee

- Validity max up to work completion date + 3 months for one off limit and max up to 1 year for revolving limit

Charges:

- Interest rate: Small- (Men- 13%-17%; Women- 10%); Medium- 13%

- Overdue interest: 3%

- Processing fee: 0.50% to 1.00%

- VAT: 15% of the processing fee

2. Overdraft Pay Order

DBL OD PO is also a revolving and renewable line of credit against lien/mortgage of collateral. It is for contractors/ suppliers as well and can be availed at a pre-determined margin to meet the obligation of pledging pay order(s) with the work order awarding authority as earnest money/security deposit.

Features:

- Credit max up to 90% of the amount of pay order Single facility limit max up to Tk. 50.00 Lac for small enterprise and Tk. 100.00 for medium enterprise

- Interest charged only on the utilized amount

- Competitive interest rates

- Low Processing fee

- Validity max up to 1 year

Charges:

- Interest rate: Small- (Men- 13%-17%; Women- 10%); Medium- 13%

- Overdue interest: 3%

- Processing fee: 0.50% to 1.00%

- VAT: 15% of the processing fee

- Documentation: At actual

3. Overdraft Share

DBL OD Share is a readily liquiditable revolving line of credit against pledge of stocks/bonds of reputed public limited companies enlisted with and traded on the country’s two authorized bourses viz. DSE and CSE. It is renewable and can be availed on a continuous basis to support the day-to-day operations and/or sudden escalation of financial requirement in a business.

Features:

- Credit max up to 50% of the lat 6 months‟ average market price of the stocks/bonds.

- Single facility limit max up to Tk. 35.00 Lac for institutional investors (including SE members) under Small enterprise and Tk. 100.00 Lac for SE members only under Medium enterprise.

- Interest charged only on the utilized amount

- Competitive interest rates

- Low Processing fee

- Validity max up to 1 year

Charges:

- Interest rate: Small- (Men- 13%-17%; Women- 10%); Medium- 13%

- Overdue interest: 3%

- Processing fee: 0.50% to 1.00%

- VAT: 15% of the processing fee

- Documentation: At actual

5. Overdraft SME

DBL OD SME is a revolving line of credit against hypothecation of stocks insured (covering all risks) under bank’s mortgage clause and lien/mortgage of collateral. It is renewable and can be availed on a continuous basis to support the day-to-day operations and finance growth of a business.

Features:

- Credit max up to 100% of net working capital or 75% of the sum total of inventory and receivable whichever is lower

- Single facility limit max up to Tk. 50.00 Lac for Small enterprise and Tk. 100.00 Lac for medium enterprise

- Interest charged only on the utilized amount

- Competitive interest rates

- Low Processing fee

- Validity max up to 1 year

Charges

- Interest rate: Small- (Men- 13%-17%; Women- 10%); Medium- 13%

- Overdue interest: 3%

- Processing fee: 0.50% to 1.00%

- VAT: 15% of the processing fee

- Documentation: At actual

6. SME Long Term Product

DBL SLTP is a long-term facility which can be avail to finance the cost of acquiring/erecting factory land, building and long lasting capital machinery & equipment for production of goods or rendering of services.

Features:

- Non-revolving and non-renewable

- Credit max up to 70% of the purchase price for land and building and 75% of the purchase price for plant, machinery & equipment

- Single facility limit max up to Tk. 50.00 Lac for Small enterprise and Tk. 100.00 Lac for medium enterprise

Competitive interest rates - Low Processing fee

Validity max up to 7 years

Charges:

- Interest rate: Small- (Men- 13%-17%; Women- 10%); Medium- 13%

- Overdue interest: 3%

- Processing fee: 0.50% to 1.00%

- VAT: 15% of the processing fee

- Documentation: At actual

Customer Type

An eligible customer for DBL SMEF could be of any of the following except a Public Limited Company:

• Proprietorship Firm having valid trade license issued by any City Corporation/Municipal Corporation/Regional Office of City or Municipal Corporation/Upozilla Parishad/Union Parishad.

• Partnership firms formed under the Partnership Act- 1932 and registered with the Registrar of Firms or notarized with the Notary Public.

• Private Limited Companies formed under the Companies Act- 1913/1994 and registered with the RJSC.

Purpose for SMEF

Generally DBL SMEF facilities are granted for the following purposes:

• Acquisition of capital goods (including second hand fixed assets, vehicles and plant & machinery), purchase of land, construction of building etc.

• Purchase of raw materials, components, stores, spares and maintenance of these items at minimum level and stock-in-progress and finished goods.

• Financing against receivables including received challans/invoices.

• Meeting marketing expenses where the units have to incur large-scale expenditure towards marketing of their products.

• Hiring capital machinery, commercial/industrial vehicle etc.

• Retirement of import documents.

• Clearing of imported consignment.

• Execution of work/supply orders.

• Performance, advance payment, security deposit against tender, guarantees for getting orders, procurement of raw materials etc.

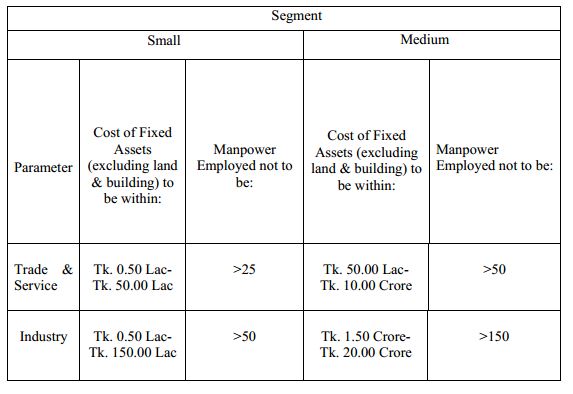

Customer Segment

The customer segment for DBL SMEF comprises of each small and each medium enterprise that has the ability to satisfy all/any of the following criteria:

Eligibility Criteria for Enjoying DBL SME Financing Facilities

• To enjoy DBL SMEF facilities, a client needs to meet the following eligibility criteria:

• Must be an affiliate of any valid cluster under any broad sectors of Trade, Service and Industry.

• Must be a firm (like, proprietorship and partnership) or a private limited company incorporated in Bangladesh.

• Must meet the criteria of either Small or Medium Enterprise.

• Sponsor‟s age has to be within 21-60 (for female) and 23-65 (for male).

• Sponsor‟s experience in the present line of business has to be 2 years (for female) or 3 years (for male).

• Must have a minimum average monthly income of BDT 35,000.

• Must have a TIN

• Must be able to provide last 3 years‟ financial report (audited/unaudited), i.e. Income Statement, Balance Sheet, Cash Flow Statement etc.

• Must have adequate A/C turnover during the last 2 or 3 years.

• Must be able to provide fresh/offer existing lien or mortgage of first/third party collateral (in the form of quasi cash/duly demarcated non-agricultural high land/land & building/most, if not all) against the credit facility.

Target Clusters and Sectors under Clusters

Target clusters for SME Financing by DBL are-

- Trade

- Service

- Industry

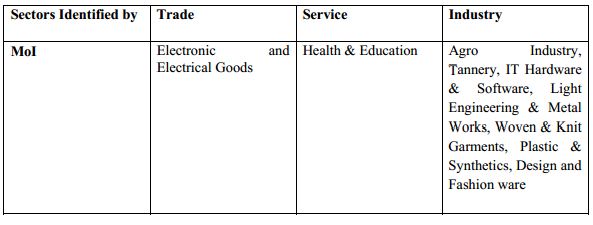

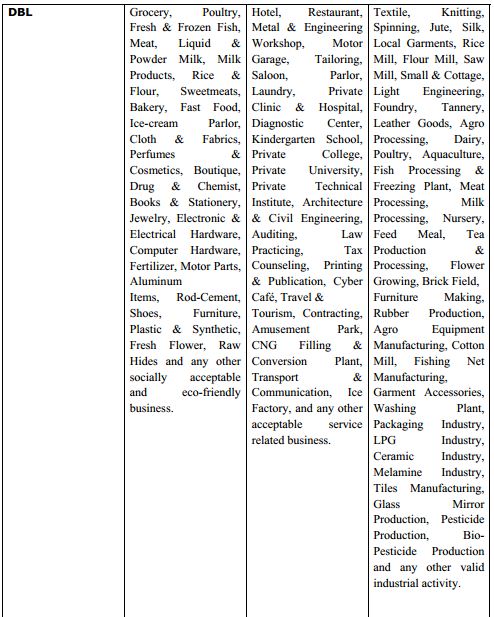

Ministry of Industries (MoI) has identified some booster sectors for SMEF. These as well as some other sectors Identified by DBL are furnished as follows:

Restricted Areas

• Any prospective client engaged in any of the following activities cannot be selected for SME lending under Loan Portfolio Guarantee:

• Production, processing or marketing of sugar, palm oil, cotton or citrus for export

• Purchase, manufacture, importation, distribution or application of pesticides

• Production, processing or marketing of luxury goods including such items as gambling equipment, alcoholic beverages, jewelry and furs

• Activities related to abortion or involuntary sterilization

• Police, other law enforcement or military activities

• Production, processing or marketing of materials for explosives, surveillance equipment or weather modification equipment

• Any activity which would result in any significant loss of tropical forests or involve the extraction of commercial timber in primary tropical forests

• Purchase of goods or services which are shipped from or produced in Brazil, Cuba, Iraq, Iran, Liberia, Libya, Nigeria, Serbia, Somalia, Sudan, The Gambia, and North Korea or are produced by corporations or other entities that are more than fifty percent (50%) owned by nationals or permanent residents or Governmental Authorities of those

countries

• Any activity the purpose of which is the establishment or development of any export processing zone or designated area where the labor, environmental, tax, tariff and safety laws of the country would not apply

• Purchase or lease of motor vehicles manufactured outside the United States

• Moreover, Branches should ensure that the borrower is not engaged in any activity which is not permitted under the regulation of Bangladesh Government & Bangladesh Bank.

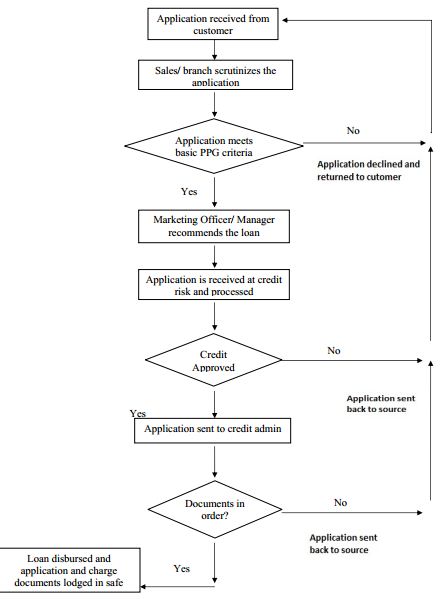

Loan approval process

Credit approval authority is delegated in writing from the In-charge of SME unit, acknowledged by the recipients and records of all delegations retained. The credit approval function is separate from the sales & marketing function. Approvals are evidenced in writing or by electronic signature. Approval records are kept on file with the credit applications.

Credit approval is centralized within the credit function. Regional credit centers may be established, however, all large loans (as defined in the PPG) gets approved by the Head of Credit or delegated Head Office credit executive. Any credit proposal that does not comply with Lending Guidelines, regardless of amount, is referred to Head Office for approval. Any breaches of lending authority are reported to the MD, Head of ICC and HOC.

It is essential that executives assigned to approve loans get relevant training and experience to carry out their responsibilities effectively. As a minimum, approving executives must have:

• At least 5-year experience in Branch or Sales Team as RM or account executive

• Training and experience in financial statement, cash flow and risk analysis

• A good working knowledge of accounting

• A good understanding of the local market

A monthly summary of all newly approved, renewed and enhanced facilities, and a list of declined proposals stating the reasons gets reported by the Credit Team to the Head of Business Banking.

De Duplication Check

All approved applications must be checked against bank’s database to identify whether the firm or company is enjoying any other loan in another account apart from the declared loans. Executives take help form CIB in this regard.

Risk Management

1. Credit Risk

Credit risk is managed by the Credit Risk Unit which is completely segregated from business and sales. Following elements contribute to the management of credit risks:

• Loans and advances are given only after proper verification of customer’s static data and proper assessment and confirmation of income related documents which will objectively ascertain customer’s repayment capacity.

• Proposals are assessed by Credit Risk Unit.

• Every loan and advance is secured by hypothecation over the asset(s) financed and customer’s authority, i.e. IGPA taken for re-possession of the asset(s) in case of loan loss.

• The CA system is made parameter driven, (i.e. it will use a Credit Scoring Matrix to pick up desired customers) as much as possible which subsequently eliminates the subjective part of the assessment procedure.

• There is a dedicated collection force that will ensure time monitoring and follow up of loans and advances.

• The Credit & Collection activities are managed centrally and credit approval authorities are controlled centrally where the branch managers or sales people will have no involvement.

2. Contact Point Verification

Contact point Verification is done by branches and/or third party CPV agencies whichever is convenient for the applicants. The external CPV may inter alia include residence, office and telephone verifications. All verifications are done to seek/verify/confirmed the declared/undeclared information of the applicant.

3. Third Party Risk

In case of third party deposits/security instruments, the SME Unit/branches verify third party’s signature against the specimen attached to the original instrument. They also send the instrument to the issuing office (Branch in case of a bank) as well as the Head Office for their verification and written confirmation and reconfirmation (in case of Head Office) on lien marking and encashment of the instrument. Therefore, any inherent risk emanating from

accepting third party deposits/security instruments is minimal.

Fraud Risk

There is an inherent fraud risk in any lending business. The most common fraud risks are as follows:

Application Fraud

The applicant’s signature may not be verified for authenticity. However, the applicant’s identity is confirmed by way of scrutiny of identification and other documentation. A CPV agency gets in place to verify inter alia applicant’s residence, office and contact phone numbers etc.

There always remains the possibility of application fraud by way of producing fraud documents. Considering the current market practices and operational constraints, it may not always be feasible to validate the authenticity of all documentation. However, DBL SME Unit is aware of this threat and considers validating the bank statement (the most important and commonly provided income document) through Branch(s)/CPV agencies.

5. Liquidity and Funding Risk

This risk is managed and the position monitored by the Asset-Liability Committee headed by the MD of the bank.

6. Political and Economic Risk

Political and economic environment of a country play a pivotal role behind the success of a business. DBL SME Unit always keeps a close watch in these areas so that is able to position itself in the backdrop of any changes in country’s political and economic scenario.

7. Operational Risk

Like consumer credit (where the activities of front line sales and behind-the-scene maintenance and support are clearly segregated), separate Credit Risk, Collections and Credit Administration units have been formed. These units report to different Heads of Divisions and manage the following aspects of the product:

• Inputs and approvals

• Monitoring and collections

• Operational jobs (disbursal in the system including raising debit standing orders and the lodgment and maintenance of securities and customer file maintenance)

Since all of the above three aspects are handled by separate units, therefore, the risk of compromising loan/security documentation is minimal. It will ensure uncompromising checking, quick service delivery, uncompromising management of credit risks and effective collections & recovery activities.

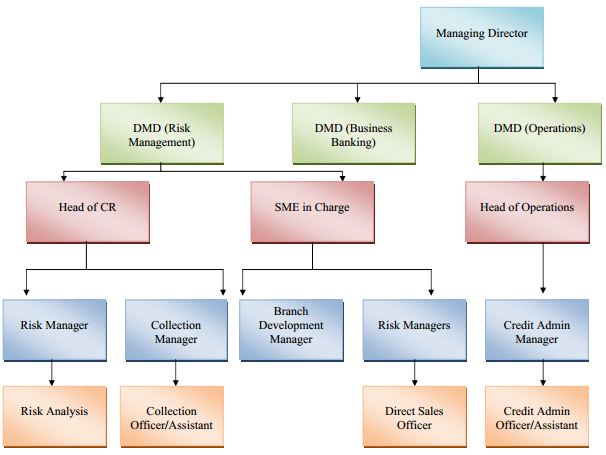

Management Structure for SME Financing

An appropriate structure for credit must be in place to ensure the segregation of the sales & marketing function from approval/risk management where administration functions will be under Operations umbrella. Credit approval is centralized within the Credit Risk Unit or regional credit centers where reporting is central. The concerned level(s) of SME Credit Committee or the EC must approve all applications. The following chart represents the preferred management structure for SME Financing:

Successful Entrepreneurial Growth with the Help of DBL SME Financing

The long expecting dream came true in the year of 2006 when Ms. Yeasmin Morshed Chowdhury opened the first outlet “Muhua Naksha” at Nasirabad in Chittagong. Being trained on crafting diverse handicraft items, Ms. Yeasmin could not start her own venture in the early nineties because of inadequate finance. Nevertheless, nothing would prove to hold her back. Shrugging off all the drawbacks, the 40 year old women entrepreneur from Chittagong focused on training aspiring women on handicrafts since 1998. About thousand novices have successfully completed their trainings from her training centers. In this way Ms. Yeasmin saved some money & looked for bank finance to set up a fashion house. Considering the management skill & future prospect of the business, DBL financed the client for the first time in 2006, which got the dice rolling and the concern started to rise. Besides her all out effort, DBL has provided continuous support to fly the business all the way. Now Ms. Yeasmin has four showrooms in Chittagong, employing 15 people directly and several hundred indirectly. She also runs a factory to supply goods to the outlets. Ms. Yeasmin designs saris, salwar kameezes,fatuas, and panjabis and also takes orders to make these items. Yeasmin had participated in a number of training programmes on fashion designing, handicrafts, embroidery and other related areas.

The business is already standing on a sound foundation; even still, she spends plenty of time providing training on

stitching, handicrafts and making boutique items to other women entrepreneurs. As a member of BWCCI, Ms.Yeasmin has been playing an active part in encouraging others and creating awareness on different women entrepreneurship issues. She won the, “BWCCI-EBL Progressive Award” for her contribution to entrepreneur development.Ms. Yeasmin, a BA degree-holder, also eyes to build a training institute and a display center where the other women entrepreneurs, who are unable to set up their own outlet, will be able to display their items. She believes that it may take time but would not be impossible if Banks extend their support in time.

Findings and analysis of the study

Data analysis

From the data regarding SME Financing by DBL in 2010 and 2011, we can clearly see the amount of loan disbursement under SME has significantly increased in 2011. The percentage of disbursed amount in Service, Trading and Manufacturing sectors in 2011 compared to the amount disbursed in 2010 are as follows:

- Service- 197.61%

- Trading- 142.97%

- Manufacturing- 107.29%

From the data regarding SME Financing by DBL in 2011 and 2012, we can clearly see the amount of loan disbursement under SME has significantly increased in 2012. The percentage of disbursed amount in Service, Trading and Manufacturing sectors in 2012 compared to the amount disbursed in 2011 are as follows:

- Service- 74.4%

- Trading- 102.24%

- Manufacturing- 123.44%

Findings

From the above analysis, we see the Service sector is the most blooming sector among these three sectors because the percentage change in the amount disbursed in this sector is higher than the two other sectors in case of 2011 but in terms of 2012 most blooming sector is manufacturing sector as it is higher than the other two sectors. From the above analysis we can see that the bank achieved the targeted loan disbursement and as we know service sector includes hotels, restaurants, automobile servicing, architecture and civil engineering etc. on which DBL focused more in 2011. But in 2012 bank’s focused shifted from manufacturing to service more. Now the question arises why it shifted from manufacturing to service. Because of the unstable political situation and more prospective sectors like textile, knitting spinning, rice mill, flour mill, tannery, agro processing, dairy were more focused by the bank as it was ensured that hotel, restaurants, automobile servicing sectors will not be a blooming sector for the political

instability. Basically bank focused more in manufacturing sector in 2012 like textile, knitting spinning, rice mill, flour mill, tannery, agro processing, dairy due to rapid growth of this industry and for huge economic potentialities. As these sectors are the core business sectors of our country. For this reason export was increased in 2012 than 2011. As Bank invested more in core export oriented industry like leather, textile, garments, knitting, weaving etc. DBL has always endeavored to encourage entrepreneurship within the country and as a result, we have seen the success story of Ms. Yeasmin Morshed earlier. This is just one single case of success among numerous others backed by Dhaka Bank Limited.

SWOT Analysis of DBL SME Financing

Strengths

Dhaka Bank offers a wide variety of loans for the SMEs to meet specific needs of the customers. The products include Overdraft, Term Loan, Work Order Finance, Lease Finance, Trade Finance, etc. The Bank is flexible in terms of security against the facilities. They also offer bundle of products at lower interest rate and this becomes possible because interest rate is very low. Dhaka Bank experienced SME management team which not only sanction loan but also provide operational advice to the clients. This becomes possible because the value of nonperforming loan is very low and that leads a small amount for provisioning.

Weaknesses

There is no fixed sales force in the Bank for the marketing of SME finance. Many people who are now working in SME financing in the branch level have lack of in-depth knowledge in this line. At Dhaka most of the branches are corporate customer oriented and there is no sufficient number of SME booths in the city. So marketing and expanding the SME loan products in the city area has become very difficult.

Opportunities

Dhaka bank has many rural and semi urban branches where there are many business communities which are yet to be penetrated by the formal financial institutions. So there is a huge scope for expanding the business in these areas. It has good relation with various multinational organizations like South-Asia Enterprise Development Facility (SEDF), USAID, World Bank, etc. that can provide assistance for developing and expanding this sector. It can open KIOSKs (small booths) around its branches in the areas like Islampur, Bangshal, Gulshan, Karwanbazar, etc. for the marketing and processing of SME loans. As the bank already has its presence in these areas it will enjoy some advantages as a known and reputed financial institution.

Threats

Other commercial banks like BRAC Bank Limited, Eastern Bank Limited and foreign Bank like Standard Chartered Bank are aggressively marketing the SME financing products and services. Nationalized banks very often offer the loans at lower cost in the form of corporate loan without properly distinguishing the loan type and business aspect. Most of the SMEs are proprietorship concerns and in many cases they lack in ready successors. So in the case of the death of the proprietor the recovery of the loan will be in jeopardy. Sometimes these business firms borrow excessively without properly analyzing the business scenario and need. For this reason the highly leveraged firms may collapse at any time.

Recommendation

Considering the findings of this report and present market scenario the following methods can be recommended to catalyze the expansion of SME finance in Dhaka Bank Limited: Considering the risk involvement and net profit aspects in terms of input and output ratio from a single unit the SME loan is really feasible and attractive for the small, semi-urban and rural branches. So the Bank should expand more SME finance through these branches in order to make them profitable for the Bank. To reduce the high cost and time of processing, the unit should do the following:

- Develop various delivery channels and thus decentralizing the delivery channels, so that branches can process and deliver SME loans by themselves.

- Use multiple channels to collect necessary information of the client before the processing of loan.

- Develop KIOSKs (small booths) and establish more SME Centers to process and deliver SME loan facilities, especially in the rural and semi rural areas of the country. It can reach the customers in the rural and semi-urban areas through SME booths. In the big city like Dhaka and Chittagong where the Branches are focused to the corporate clients, the Bank can service the SME loans by setting up the booths. Places like Islampur, Bangshal, Aminbazar have huge unexploited demand for SME loan that can be met easily by establishing booths in these areas.

- Setting up alternative channels of distribution like booths are therefore essential to market penetration and as a competitive advantage over other institutions. It may be mentioned that the Booths will not be worked as branch and will be operated with minimum investment and operational cost. As the loan size is small it does not require assigning higher ranked officials for marketing and operating the Loan. The officers to Principal Officer level officials are good enough for this purpose so the administrative cost will also be low for this product.

- Marketing effort (sales force) should be increased. Aggressive marketing strategies should be developed to compete with other banks or financial institutions that provide SME financing facilities. DBL is lagging behind in aggressive marketing strategy. The bank should assign fixed sales force for marketing and hunting SME loan application for the SME finance. Private Banks like BRAC, Eastern Bank Limited and other foreign Banks have already established their sales force in this regard. The sales force could be contractual in nature that will lessen the administrative cost.

- The Bank has already this type of sales force for marketing and expanding the personal loan, Home Loan and Car Loan products. The Bank should also assign specific officers in the branches for monitoring and maintaining the SME finance. In other way the concept for Relationship Officer for the SME loan to be built up who will not only look after the portfolio but also mix closely with the SME business community to understand their need and make them aware of the benefit of SME loan in the Bank.

Conclusion

The SMEs play dominantly important role in the national economy of Bangladesh by making up over 90 per cent of industrial enterprises, providing employment to 4 out of 5 industrial workers and contributing to over one-third of industrial value-added to GDP. The relative SME share in manufacturing value-added is much higher and estimated to vary between 45 to 50 per cent of total value-added generated by the manufacturing industries sector. Further as important sources of new business creation and developing new entrepreneurial talents, these industries provide the

much needed dynamism and vitality to the national economy. However, as is well known, the SMEs because of their scale barriers and liquidity problems suffer from various operational constraints of which technological backwardness, low technical efficiency, low labor productivity and limited market access are most serious. These in turn impede their competitive strength and sustainable growth. These problems are likely to be further aggravated by the competitive challenges globalization and the freer trading regime which throw the SMEs in the midst of risks and uncertainty of the fiercely competitive national and global markets. It is thus imperative that these industries achieve a reasonable level of technological standards and competitive strength to withstand challenges of the global market and survive and grow in a much more uncertain and unstable business environment both at home and abroad. Dhaka Bank Limited is pretty aware of this responsibility and has already stepped in to the field by extending finance to this sector. The SME unit has to run through various limitations. But the Bank is keen to expand this product and like to improve it gradually in a short period.