This report aims at providing an overall analysis of the repayment behavior of the SME loan borrowers of BRAC Bank Limited. Before going to the analysis, it is mandatory to know something about the organization, its core products that it offers to its customers; about the SME loan, its classifications and the whole of its process starting from loan sanction to recovery and closing of the loan.

That’s why, first of all, I’ve made an overview of the organization, BRAC bank Limited, where I had completed my internship program. Here I tried to focus the bank’s history of origination, its mission and vision, major departments and business units and major products and services. Then, in the next part, I said something about the methodology of the report. How the data have been collected, how the study has been conducted. Next, comes the focal part of the report. The module of SME is the most vital part if this report, where I gave my concentration. Here I focused on SME products, the terms and conditions of giving SME loan, enterprise selection criteria and documentation. Then talked about the procedure of SME loan where I delineated the sanction, disbursement, repayment and closing of SME loan.

After talking about the whole process of SME loan, I made an attempt to analyze the repayment behavior of SME loan borrowers in the last part. For this end in view, I have collected information about 40 SME borrowers. Then I have chosen eight major variables which have an impact on the recovery rate of SME loan. That is, these are the variables which may change the repayment behavior of SME borrowers. I found some significant variable like age, experience and income of the entrepreneurs which might have an impact on repayment of the loan.

Historical Background

BRAC Bank is a scheduled commercial bank established under the Banking Companies Act, 1991 and incorporated as a public company limited by shares on 20 May, 1999 under the Companies Act, 1994 in Bangladesh. The primary objective of the Bank is to carry on all kinds of banking business. The Bank could not start its operation till 03 June, 2001 since the activity of the Bank was suspended by the High Court of Bangladesh. Subsequently, the judgment of the High Court was set aside and dismissed by the Appellate Division of Supreme Court on 04 June, 2001 and accordingly, the Bank has started operations from 04 July, 2001. A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. Almost 40% of BRAC Bank’s clients had no prior experience with formal banking. The Bank has 313 regional marketing unit offices offering services in the heart of rural and urban communities and employs about 1,200 business loan officers – around 70% of total staff.

The reason BRAC Bank is in business is to build a profitable and socially responsible financial institution focused on markets and businesses with growth potential, thereby assisting BRAC and stakeholders to build a “just, enlightened, healthy, democratic and poverty free Bangladesh.” Which means to help make communities and economy of the country stronger and to help people achieve their dreams? We fulfill the purpose by reaching for high standards in everything we do: For our customers, our shareholders, our associates and our communities, upon which the future prosperity of our company rests.

As such a career in the BRAC Bank Limited requires one to be versatile, to have genuine love and understanding towards others and to be able to take on different roles. Remarkably, BRAC Bank, despite being one of the newest Banks in the country, has attained a reputation for being in the forefront of the industry. Our retail business and corporate business have gained new ground over the last two years and today BRAC Bank can claim itself to be among the top financial service providers.

BRAC Bank began its operations with a mind to provide formal banking services to all levels of people in the urban, semi-urban and rural spectrum, and through the nearly 300 unit offices 2across the country, the Bank has seen that goal a long way through – providing Bangladesh with a degree of service and professionalism that the traditionally underserved class could ever dream of. Since inception in July 2001, the Bank’s footprint has grown to 26 branches, 349 SME unit offices and 37 ATM sites across the country, and the customer base has expanded to 210,000 deposit and 55,000 borrowers through 2006. In the last four and half years of operation, the Bank has disbursed over BDT 2,100 core in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

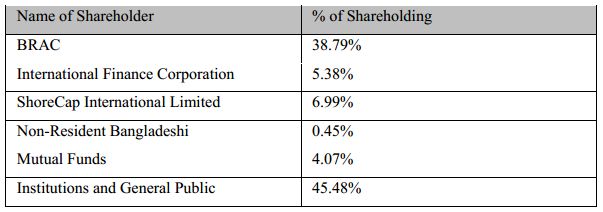

Shareholding Structure

Description of the repoort

This paper is entitled “The process of SME loan and repayment behavior of Customers: BRAC Bank Limited” originated from the fulfillment of the internship program.

Objective of the Report

Broad Objective

The prime objective is to gain practical experience by working in an office of an organization and thus relate theoretical knowledge with reality.

Specific Objectives

• To know the SME loan activities in BRAC Bank

• To find out basic appraisal of SME loan

• To know the enterprise selection criteria to provide SME loan

• To know the terms and conditions of SME loans

• To know the internal strength of SME related services of BRAC Bank Ltd.

• To know the disbursement and recovery procedures of SME loans

• To analysis SME loan repayment Behavior

Methodology

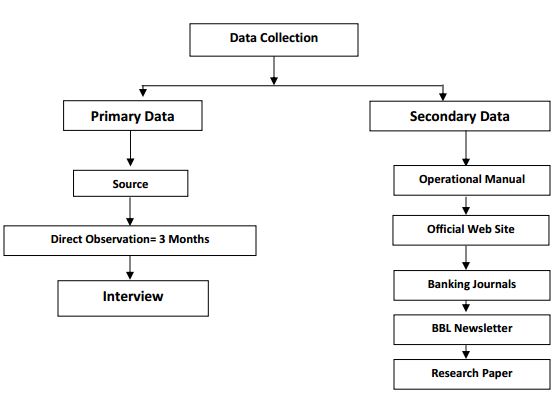

The study uses both primary data and secondary data. The report is divided into two parts. One is the Organization Part and the other is the Project Part. The parts are virtually separate from one another.

The information for the Organization part of the report was collected from secondary sources like books, published reports and web site of the BRAC Bank Limited (www.bracbank.com). For general concept development about the bank short interviews and discussion session were taken as primary source.

The information for the Project” Analysis of SME loan in BRAC Bank Limited” both were collected from primary and secondary sources. For gathering concept of SME loan, the Product Program Guideline (PPG) thoroughly analyzed. Beside this observation, discussion with the employee of the SME department and loan administration division they said bank was also conducted. To identify the implementation, supervision, monitoring and repayment practiceinterview with the employee and extensive study of the existing file was and practical case observation was done.

Data requirements

In fact, my aim was to collect as much information as it can be possible for me to make an overview of the bank, its mission and vision, its departments and its functions. Of course I had to collect enough information so that I can make an analysis of SME loan and the specific behavior of its borrowers. I have collected around forty customers’ information so that I could know something about their age, education, experience, loan repayment behavior and so on. The data collected allowed me to make an analysis regarding SME loan, its process starting from sanction of loan to closing of loan and especially regarding SME loan borrowers behaviors that is whether they are paying dully or lately or they have any default tendency.

Sources of data

For collecting the required data, I have used different sources or methods like the following:

Primary data sources:

• Interviews of Customer relationship officers(CROs)

• Focus group meetings

• Direct observation

Secondary data sources:

• Operational manual

• Official Website

• Banking journals

• BBL newsletters

• Research paper

We can show it in a data flow diagram:

The process of SME Loan

Financial and development assistance designed especially for small and medium enterprises in Bangladesh is a new and upcoming trend. After the surge of micro-finance in the last two decades, small and medium enterprises have come to the limelight in the financial sector on account of their contribution to economy and yet limited access to finance. Both micro-finance institutions and banks are beginning to realize the potential of this market and designing new financial products for it. BRAC Bank started providing credit to small and medium enterprises in 2002 in recognition of their special needs. With this end in view-BRAC Bank was opened to serve these small but hard working entrepreneurs with double bottom line vision. As a socially responsible bank, BRAC Bank wants to see the discharge of grass-roots level to their economic height and also to make profit by serving the interest of missing middle groups. BRAC Bank is the market leader in giving loans to Small and Medium Entrepreneurs and they have been doing it for the last Eight years since 2002. BRAC Bank’s SME Unit is the first of its kind to provide financial services on a national scale to small and medium sized entrepreneurs. After 18 months of operation, BRAC Bank approached BRAC RED to undertake an exploratory study on the effect of BRAC Bank’s SME Unit lending on.

Brief Descriptions of SME Product

Anonno Rin

“Anonno Rin” is a business loan designed to finance small scale trading, manufacturing and service ventures, especially to help small and medium entrepreneurs to meet their short-term cash flow shortages and bridge the fund-flow gaps.

Apurbo Rin

Apurbo is a loan facility for Small & Medium Entrepreneurs. APURBO is a combination of term loan and overdraft facility for the entrepreneurs involved in trading, manufacturing, service, agriculture, non-farm activities, agro-based industries etc.

Aroggo Rin

Aroggo is a term loan for small & medium size private Health Services Provider Like private clinics, diagnostics centers and doctors’ chambers. The product offers fixed assets purchase financing under equated Monthly Installments.

Digoon Rin

This is a double loan on your deposit. Now you do not need to put in your savings rather you can take double amount of loan on your deposit for your business expansion.

Prothoma Rin

“PROTHOMA RIN” is a loan facility for small and medium sized business, which are operated by women entrepreneur. The product offers terminating loan facilities for the purpose of working capital finance and/or fixed assets purchase.

Durjoy

Durjoy is a banking facility (combination of term loan and overdraft without any tangible security for working capital purpose and/or fixed asset purchase) targeted to SME customers.

Trade Plus

Trade plus is a composite facility for small & medium sized import-oriented businesses to meet their trade finance requirements.

Business Equity Loan

Business loan is a commercial loan in which borrower can borrow loan from bank with mortgage of their home or business.

Proshar

“Proshar” is a loan facility for small & medium sized manufacturing business. The product offers loan facilities for working capital finance and/or fixed assets purchase.

Supplier Finance

Supplier Finance is a loan facility for the enlisted Suppliers of various large retailers, marketing companies, distributors, exporters etc. This product’s main objective is to help various Suppliers to meet their short-term cash flow shortages or bridge the fund-flow gaps.

Terms and Conditions of SME Loan

The SME department of BRAC Bank will provide small loans to potential borrower under the following terms and condition:

• The potential borrowers and enterprises have to fulfill the selection criteria

• The loan amount is between Tk. 2 lacks to 3.5 crore.

• Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter ends residual on maturity

• Loan may have various validates, such as, 3 months, 3 months, 6 months, 9 months, 12 months, 15 months, 18 months, 23 months, 30 months and 36 months.

• The borrower must open a bank account with the same bank and branch where the SME has its account

• Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

• The loan will be realized by 1st every month, starting from the very next month’s whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C. With Bank’s named and branches name

• The borrower has to issue an account payable blank cheque in favor of BRAC Bank Limited before any loan disbursement along with all other security.

• The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by “BRAC Bank Limited”.

• The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

• SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

Procedure of BRAC Bank SME Loan

Loan Sanction activities:

• Select potential enterprise: For SME loan, in this step the CRO conduct a survey and identify potential enterprise. Then they communicate with entrepreneurs and discuss the SME program.

• Loan Presentation: The function of CRO is to prepare loan presentation based on the information collected and provided by the entrepreneur about their

• business, land property (Where mortgage is necessary)

• Collect confidential information: Another important function of a CRO is to collect confidential information about the client from various sources. The sources of information are suppliers regarding the client’s payment, customers regarding the delivery of goods of services according to order, various banks where the client has account, which shows the banks transactions nature of the client.

• Open clients accounts in the respective bank: When the CRO decided to provide loan to the client then he/she help the client to open an bank account where BRAC bank has a STD a/c. BRAC bank will disburse the loan through this account. On the other hand the client will repay by this account. Although there is some exception occur by the special permission of the authority to repay by a different bank account.

• Fill up CIB form: CRO give a CIB (Credit Information Burue) form to the client and the client fill and sign in it. In some case if the client is illiterate then the CRO fill the form on behalf of the client. Then CRO send the filled and signed form to the SME, head office.

• Sending CIB to Bangladesh Bank: The SME, head office collects all information and sends the CIB form to Bangladesh Bank for clearance. Bangladesh Bank return this CIB form within 10-12 days with reference no.

• CIB report from Bangladesh Bank: In the CIB report Bangladesh Bank use any of the following reference no:

• NIL: if the client has no loan facility in any bank or any financial institution then BB (Bangladesh Bank) use ‘NIL’ in the report

• UC (Unclassified): if the client has any loan facility in any bank or financial institution and if the installment due 0 to 5.99 then BB use UC in the report

• SS (Substandard): if the client has any loan facility in any bank or financial institution and if the installment due 6 to 11.99 then BB use SS in the report

• DF (Doubtful): if the client has any loan facility in any bank or financial institution and if the installment due 12 to 17.99 then BB use DF in the report

• BL (Bad lose): if the client has any loan facility in any bank or financial institution and if the installment due 18 or above then BB uses BL in the report. This report indicates that the client is defaulter and the bank should not provide loan the client.

• Loan decision considering CIB report: Considering CIB report, BRAC bank decide whether it will provide loan the client or not. If the bank decides to provide loan then the SME of head office keep all information and send all papers to the respective unit office to apply with all necessary charge documents.

Loan Sanction

The respective unit office sanctions loan to the client if it is 2 to 5 lacs, and then sends the sanction letter including all necessary charge documents to the loan administration division for disbursing the loan. If the amount is higher than 5 lacs then the respective unit office sends the proposal to SME, head office for sanction. The head of SME sanctions the loan and sends the sanction letter including all documents to the loan administration division for disbursement and inform the respective unit office regarding sanction of the loan.

Disbursement of SME loan

i. Pre Disbursement Manual Activities

• Prepare loan file: Receiving all documents, Loan Administration Division prepare a loan file with all documents received from the unit office.

• Charge documents checking: The loan administration division checks all charge documents. Following charge documents are checked:

• Money receipt (Risk fund).

• Sanction letter.

• Demand promising note (With stamp of Tk 20/=)

• Letter of arrangement (With stamp of Tk 150/=)

• General loan agreement (With stamp of Tk 150/=)

• Letter of undertaken (With stamp of Tk 150/=)

• Letter of stocks and goods (With stamp of Tk 150/=)

• Letter of hypothecation book debt and receivable (With stamp of Tk 150/=)

• Letter of disbursement

• Photocopy of trade license (attested by CRO)

• Insurance (Original copy)

• Blank claque with signature (one cheque for full amount and others same as no of installment on Favor of BRAC bank, no date, no amount)

• Two guarantors (one must be Spouse/parents)

• If the loan provide for purchase of fixed assets or machineries and if the loan amount is over Tk 50,000/= then the stamp of a certain amount is require)

• Documents deficiency and problem resolving: If there is any error found then it informed to the respective CRO. If the application form is not filled properly then the file send to the CRO to fill the application properly. If any document error found then the loan administration division asked the CRO to send the require documents and the file stored to the loan administration division.

• Prepare disbursement list: The loan administration division lists all new sanctioned clients’ details and send a request to the treasury through internal mail.

• Disbursement of the amount: Sending the list to the treasury of BRAC bank for disburse the amount, the treasury disburse the amount to the client through the mother account of the clients bank. BRAC bank disburse amount through any of the following banks corporate branch nearer the BRAC bank head office and the corporate branch of the respective bank send the amount to the client account in the respective branch. These banks are:

• BRAC Bank Limited

• The City Bank Limited

• Janata Bank

• Bangladesh Krishi Bank

• Pubali Bank

• Agrani Bank

ii. Message sent to the unit office: Completing the disbursement, loan administration division sent a SMS to the respective CRO informing the disbursement of the sectioned loan. MBS (Millennium Banking System) entries for

loan disbursement:

• Initial ID generation: After sending the list to the treasury, the loan administration division generates an initial ID against the borrower. Entering required information, the banking software MBS automatically provide a ID no for the borrower.

• Loan account opening: According to the ID, the loan administration division opens a loan account in MBS against the borrower. Entering all required information, the MBS automatically give an account no. For the borrower.

• Cost center assign: The loan administration division enter the following information in MBS:

• Security details set-up

• Guarantor details set-up

• Loan other details set-up

• Risk fund collection: The loan administration division opens a different account risk fund of the client. This is known as loan processing fees. Receiving the risk fund, the loan administration division prints voucher and posting the voucher in the MBS. The amount of risk fund is not refundable.

• Activision of the loan: Loan administration division do the following tasks to activate the loan

• Loan sanction details set-up

• Repayment schedule set-up and printing

• Loan activation

• Disbursement and CC wise voucher print

• Disbursement voucher posting

Post Disbursement Manual Activities

• Repayment schedule sent to unit office: Completing the disbursement of the sanctioned amount the loan administration division prepare a repayment schedule in MBS and send it to the unit office. CRO from the unit office collect it and reached to the respective client. The client repays the loan according to this schedule.

• Loan details MBS entry: The loan administration division enters details information regarding the loan in MBS. Each officer has an ID no in MBS and if there is any error found then the respective officer would be responsible for it. So everybody remain alert at the time of MBS entry.

• Document stamp cancellation: The loan administration division cancels all document stamps. In future if any client found defaulter and the bank file sued against him then stamps of these document help to get the judgment favor of the bank. But If these stamps are not canceled then the judgment may not on favor the bank.

• Send the loan file to archive: completing all activities, loan administration division sends the loan file to the archive for future requirement. In future if any document of the loan account requires then the bank can collect the file from archive and get the necessary document. If the clients take repeat loan then it is not require applying all documents because his all documents stored to the bank.

Analysis of SME Loan Repayment Behavior

SME loan in fact, a small loan ranging from 2 lacks to 30 lacks given to small or medium enterprises not for initiating the business but for the purpose of working capital management or for purchasing any long term asset. Any sound organization after one year of their starting of business can apply for this loan. It almost a rare case for BRAC Bank that an SME borrower will default to repay the loan he/she has taken even the loan is given without taking any collateral. There are several reasons for which the SME loan borrowers hardly default. These reasons may

like:

- The loan amount is not as large as it would be difficult to repay it.

- Mediocre entrepreneurs hardly default to repay loans. They are very conscious about their reputation in the market.

- As the loan is taken for meeting up of working capital, it can be easy to repay after the sales revenue is collected from respective customers.

However, from the observation of 40 SME loan borrowers’ personal and repayment information we find the following results:

- Average age of SME borrowers is 39

- Average education of most of the SME borrowers is Class IX or X.

- Average Experience (As a promoter of the business) is 11 years (along with some extreme values.

- Average Experience(As an employee of the same business) is 8 years

- Monthly income and expenditure of the Entrepreneur is around TK. 30000 and TK. 23000 respectively.

- Average personal and family assets are around TK. 150000 and TK. 240000 respectively

- Almost all of the borrowers are 55% retailer and 45% whole seller

- Average number of employees they have is 3

- Average Amount of loan taken by them is around TK. 379729.7

- Average time period of loan they take to repay is 26 months

- Average amount of loan suppose to be paid is 275314.47

- Average amount of loan currently repaid is TK. 286847.62 per person.

- Average amount of loan due for recovery is TK. 6679.62 per person.

We have gathered 8 variables to analyze the relationship of each variable with recovery rate. These variables are:

- Age of the borrowers

- Education of the borrowers

- Experience of the borrowers related to their business.

- Amount of loan taken by the borrowers

- Term of loan

- Income of the borrowers

- Personal Asset of the borrowers

- Nature of business

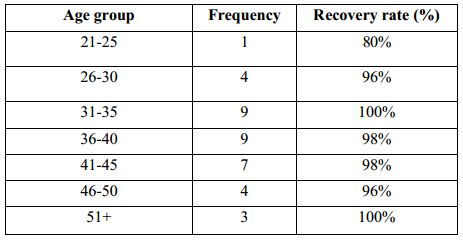

Relationship of recovery rate with age of the borrowers:

We can analyze the relationship sequentially:

The relationship of recovery rate with the age of the customers can be described from the following charts:

From the above chart we can see that recovery rate increases as the age of the borrowers increases. Here the recovery rate is lowest at the age group of 21-25 for the lacking of experience and knowledge in the related business. They can’t make the proper use of funds. And that’s why their business fails. At the age of 31-35 recovery rate is 100%. At that age group people like to behave professionally and control everything with strict discipline. They are highly concerned about their career which brings success to their business. So at that time recovery rate is the highest. Again at the age of 50 and above recovery rate is also 100% because of their huge experience and success in business.

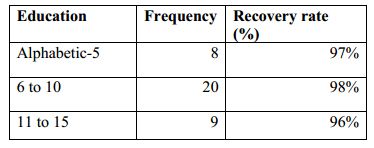

Relationship of recovery rate with education of the borrowers:

From the above chart we can see that Small and medium businesses are not highly affected with the educational background of the borrowers. That’s why recovery rate also is not much affected with the education of the borrower. There should be some other variables affecting it as well.

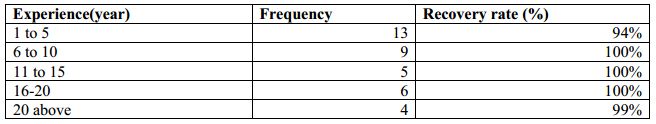

Relationship of recovery rate with experience of the borrower:

From the above table we see that recovery rate is highly affected with the experience of the borrowers in the business he is engaged with. In fact, it is all out true that a business and its success is greatly affected by the experience the entrepreneur have on the same line of business. At the initial periods of the business lack of experience can cause the business to fail which ultimately results in the default of loan repayments. So BRAC Bank is always concerned about the related experience of the entrepreneur. They don’t give SME loan to anybody having no experience or for initiating any business. And here also we see that recovery rate is lowest at the experience of 1 to 5 years.

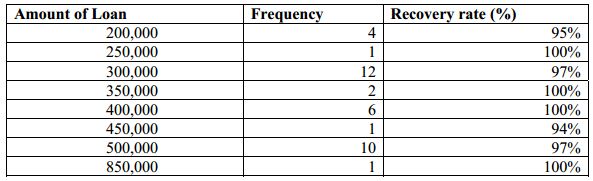

Relationship of recovery rate with Amount of loan taken:

From the above chart we see that it’s tough to make a relationship with both the recovery rate amount of loan taken by the borrowers. But still it can be said that loan amount ranging from 250000 to 400000 have a good recovery rate on an average. That’s why maximum amount or size of SME loan the authority like to disburse is 300000.

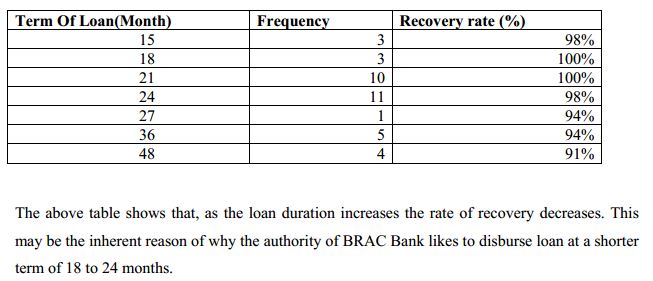

Relationship of recovery rate with term of loan:

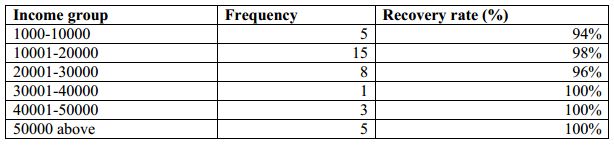

Relationship of Recovery Rate with Income of the Borrowers:

In fact, income of a borrower can be a vital factor to repay his loan. And the above graph is a replica of this truth. Here we see that people with higher income group like 30000 to 50000 or above have the highest recovery rate. Entrepreneurs having a good skill, knowledge and experience in business can make success in their business which ultimately increases their income as well. So their recovery rate is good than those group of people who have lower

income.

Findings

BRAC Bank, as we know, is one of the fastest growing banks in Bangladesh. SME banking which has made the performance of this bank so enlightened is its core product to offer to the small and mediocre business entrepreneurs. In fact no businessman could think ever before that they could take loan so easily, without any collateral and without going to bank. But BRAC Bank has made this improbable process so successfully through SME banking. However from the analysis of SME loan repayment behavior I can make the following findings:

Age have a significant impact on the recovery of SME loan. Young entrepreneurs have a lower rate of recovery. On the other hand as middle aged and experienced entrepreneurs are very loyal with their loan repayment they can make proper and timely repayment of their loans. And that’s why most of the SME loan borrowers age rages from 30 to 40. Education does not have any direct relationship with the recovery rate. In fact, Most of the entrepreneurs of retail and whole business (small or medium in size) are not highly educated.

Most of them studied up to class 9 or 10. Sometimes there are some entrepreneurs who have only alphabetic knowledge or who can give their signature only. But still they are running their business so well for many years. In this case experience makes them successful in their business.

So, education does have much impact on these small and medium enterprises and also on the recovery rate of SME loans. Experience is the most significant variable which has a great impact on any kind of business and recovery rate as well. Experienced entrepreneurs run their business so tactfully, identify the exact time what is their pick time of sales and when they need fund. They take the loan in the pick season when they have excess demand but short of capital. Then they ensures the best use of the loan and finally they reach to success and make the dully installments. So their recovery rate is good and that’s why BRAC Bank looks always for experienced entrepreneurs. Number of installments (term of loan) and amount of loan taken do affect recovery rate slightly. But trends show that BRAC bank prefers to disburse loan of an amount of 300000 and at a term of 18 to 24 months.

Another variable affecting recovery rate very much is the income of the borrowers. The higher the existing income of the borrowers, the lower the rate of default. Higher income groups make the best use of the loan they have taken and get success. On the other hand lower income group may misuse the loan and ultimately may default in paying installments. Personal or family asset might have some impact while sanctioning the loan as well as when recovering the loan installments. Suppose if a borrower fails to pay one of his installments, bank can find his personal assets as back up for the recovery of the installments.

Retail business and whole sale business both types of businesses get loans from BRAC Bank but whole sellers have a higher recovery rate as their business transactions occur at lot size and their collection is much quick. Finally we can say that SME loan is a loan given especially to entrepreneurs who are experienced small or medium businessmen, more or less middle aged, at least moderate income generated and who have reasonable personal or family asset. That’s why their recovery rate is so high that is 97%. And their default rate is so small compared to other loan categories. Sometimes borrowers go for early settlements of their loans.

Conclusion

BRAC Bank Limited is proving itself as the fastest growing bank with establishing its 36th branch only in 10 year of its journey and showing remarkable progress of its financial position with the mission of being countries leading bank providing world class services in a cost effective manner. This bank first introduced the SME loan in commercial banking sector which help the people of poor society both in rural and urban area. SME loan is one of such quality product through which they offer the small and mediocre entrepreneurs a quality banking services and earn the maximum profit as well. The recovery rate of this loan is 97% which is extremely good in comparison to any other bank’s recovery rate. BRAC Bank has made it possible as the loan is given to experienced, small and mediocre entrepreneurs most of whom are middle aged, slightly educated and having moderate income and this class of people is very loyal. But they can serve this class of customers with more commitment and loyalty and they can turn the recovery rate to 100%. For this they can make the following policy implications:

- Redefine mission/vision towards achievement of “Double Bottom-line”

- Commit resources specifically for growth of SME business.

- Implement strict and continuous monitoring system of the whole recovery process.

- Train the Customer Relationship officers more comprehensively and realistically so that customers may not face any trouble while getting and repaying the loan.

- Analyze customers’ behavior that what type of customer makes default and stop giving them SME loan.

- Risk Management department’s audit report should be more strict and reliable so that possible defaulter may not get the loan.

Whether the borrowers are utilizing the loan on the right purpose should be ensured.