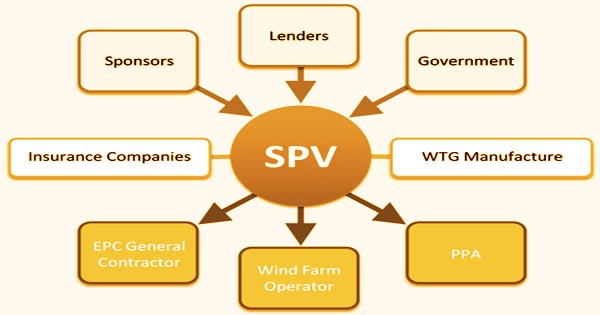

A special purpose vehicle (SPV), also known as a special purpose entity (SPE), is a legal entity formed by a corporation; it is a separate company with its own assets and liabilities, as well as its own legal status. Typically, an organization will move resources for the SPV for the executives or utilize the SPV to back a huge task along these lines accomplishing a tight arrangement of objectives without putting the whole firm in danger. Generally, they are made for a particular target, regularly to disengage monetary danger. Since it is a separate legal entity, the special purpose vehicle will continue to operate even though the parent company goes bankrupt.

The SPVs lawful status as a different organization makes its commitments secure regardless of whether the parent organization fails. Thus, a unique reason vehicle is some of the time called a liquidation distant element. SPVs are likewise normally utilized in complex financings to isolate various layers of value imbuement. SPVs, which are often established and registered in tax havens, allow tax avoidance strategies that are not available in the home district. Partnerships, limited partnerships, and joint ventures are the most common legal types of special purpose vehicles.

Besides, at times, it is necessitated that the SPV ought not be possessed by the organization for whose benefit the substance is made. On the off chance that bookkeeping escape clauses are misused, these vehicles can turn into a monetarily wrecking approach to conceal organization obligation, as seen in 2001 in the Enron embarrassment. A SPV may be used as a financing structure to pool all investors (or investors under a certain investment threshold) into a single entity for the purpose of raising money. Alternatively, the SPV may be used as a holding company for debt securitization.

Also, SPVs are regularly used to possess a solitary resource and related allows and agreement rights, (for example, a high rise or a force plant), to take into account simpler exchange of that resource. An SPV is created by a parent company to isolate or securitize assets in a separate company that is typically held off the balance sheet. It could be created to take on a high-risk project while shielding the parent company from the worst consequences of failure. A particular reason vehicle might be possessed by at least one different elements and certain purviews may require proprietorship by specific gatherings in explicit rates.

It is often critical that the SPV is not owned by the person on whose behalf the SPV is formed (the sponsor). In other situations, the SPV may be formed solely for the purpose of securitizing debt and providing investors with a guarantee of repayment. Along these lines, numerous SPVs are set up as ‘orphan’ organizations with their offers chose altruistic trust and with proficient chiefs given by an organization to guarantee that there is no association with the support. In either case, the SPV’s operations are restricted to the acquisition and funding of particular assets, with the separate company structure serving to isolate the risks associated with these activities.

The following are the most common reasons for creating SPVs:

- Risk sharing: A corporation’s initiative may be fraught with dangers. By forming an SPV, the company will legally separate the project’s risks and then share them with other investors.

- Securitization: Loans are often securitized using SPVs (or other receivables). A bank, for example, would choose to issue a mortgage-backed security with payments derived from a pool of loans. However, these loans must be legally segregated from the bank’s other commitments in order for the holders of mortgage-backed securities to have first priority in receiving payments on the loans. This is accomplished by setting up a special purpose vehicle (SPV) and then moving the loans from the bank to the SPV.

- Asset transfer: Certain properties can be difficult to pass. As a result, a company can establish an SPV to hold these assets. They will simply sell the SPV as part of a merger and acquisition (M&A) process when they wish to move the properties.

- Property sale: A business may create an SPV to own the properties for sale if the taxes on property sales are higher than the capital gain realized from the sale. Instead of paying land sales tax, it can sell the SPV instead of the assets and pay tax on the capital gain from the sale.

A SPV may fill in as a counterparty for trades and other credit-touchy subordinate instruments. Like an organization, a SPV should have a promoter(s) or sponsor(s). Generally, a supporting partnership hives off resources or exercises from the remainder of the organization into a SPV. This asset separation is critical for investors’ peace of mind. A business may create an SPV in a variety of ways, such as a limited partnership, a trust, a corporation, or a limited liability corporation. It could be designed for self-management, financing, and ownership.

Regardless, SPVs help organizations securitize resources, make joint endeavors, separate corporate resources, or perform other monetary exchanges. The resources or exercises are separated from the parent organization; henceforth the presentation of the new substance won’t be influenced by the good and bad times of the starting element. An SPV’s financials may not appear as equity or debt on the parent company’s balance sheet. Instead, it will keep track of its cash, liabilities, and equity on its own balance sheet. As a result, the SPV can obscure important information from investors, preventing them from having a complete picture of a company’s financial situation.

Investors need to dissect the accounting report of the parent organization and the SPV prior to concluding whether to put resources into a business. A decent SPV ought to have the option to remain on its feet, free of the supporting organization. Sadly, this doesn’t generally occur by and by. One of the reasons for the Enron SPV’s demise was that it became a tool for furthering the parent company’s goals in violation of corporate finance and accounting prudential standards. The corporation reported its financial statements on balance sheets for the company and special purpose funds by the end of the year. Its conflicts of interest were there for all to see.

Benefits and risks of Special Purpose Vehicles (SPV):

Benefits –

- Isolated financial risk

- Direct ownership of a specific asset

- Tax savings, if the vehicle is created in a tax haven such as the Cayman Islands

- Easy to create and set up the vehicle

Risks –

- Lower access to capital at the vehicle level (since it doesn’t have the same credit as the sponsor)

- When an asset is sold, mark-to-market accounting laws can be activated, having a direct effect on the sponsor’s balance sheet

- Regulatory changes could cause serious problems for companies using these vehicles

- The optics surrounding SPVs are sometimes negative

Few investors, on the other hand, delved deep enough into the numbers to realize the seriousness of the situation. Executives at Enron used special-purpose vehicles as one of their key instruments for concealing losses and fabricating profits, which resulted in the Enron scandal of 2001. Executives at Towers Financial Corporation, which declared bankruptcy in 1994, used them to cover losses and overstate earnings. Several business executives were found guilty of stock fraud and received jail terms as well as fines. When the value of Enron’s stock fell, so did the value of the special purpose vehicles, and the assurances were put into action.

Information Sources: