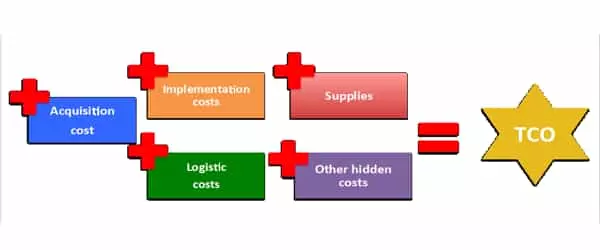

Total cost of ownership (TCO) is a financial estimate that buyers and owners can use to determine the direct and indirect costs of a product or service. It is the asset’s purchase price plus the operating costs. It is a management accounting concept that can be applied to full cost accounting or even ecological economics where social costs are included. Assessing the total cost of ownership entails taking a broader view of the product and its long-term value. It is the sum of an asset’s purchase price and operating costs over its lifetime.

The total cost of ownership is used to calculate the total cost of purchasing and operating a technology product or service over its useful life. It is important for evaluating technology costs that aren’t always reflected in upfront pricing.

When comparing TCO for manufacturing to doing business overseas, it goes beyond the initial manufacturing cycle time and cost to make parts. When making a purchasing decision, buyers should consider not only an item’s short-term price, known as its purchase price but also its long-term price, known as its total cost of ownership. TCO includes a variety of costs of doing business items, such as ship and re-ship, as well as opportunity costs, and it also takes into account incentives developed for an alternative approach. Tax credits, common language, expedited delivery, and customer-oriented supplier visits are examples of incentives and other variables.

The cost of owning a car is a simple example. You can buy a car, but you will still have to pay license fees and insurance premiums, and it must be serviced on a regular basis. You must also fill the tank with gas, and if something goes wrong, you must pay for repairs.

Use of concept

Companies and individuals consider the total cost of ownership when purchasing assets and investing in capital projects. When TCO is included in any financial benefit analysis, it provides a cost basis for calculating the total economic value of an investment. Return on investment, internal rate of return, economic value-added, return on information technology, and rapid economic justification are some examples.

Companies analyze business deals using the total cost of ownership over the long term as a framework. A TCO analysis considers the total cost of acquisition, operating costs, and costs associated with replacement or upgrades at the end of the life cycle. A TCO analysis is used to determine the feasibility of any capital investment. It could be used by a company as a tool for comparing products and processes. It is also used by credit markets and lending institutions. TCO directly relates to an enterprise’s total costs for assets and/or related systems across all projects and processes, providing a picture of profitability over time.

When evaluating a capital investment, businesses consider the total cost of ownership (TCO). They will want to know more than just the listed price if they want to buy this new machine or that software package. It stands to reason that they should. Just as a car can’t run without gas and can’t be driven without a license and insurance, an asset is worthless if the operating costs aren’t covered or if the benefits outweigh the cost.