Executive Summary

This report is a pre-requirement for the competition of four years BBA course, to get knowledge of practical banking activities. This report focuses three month working experiences in National Bank Limited, Kawran Bazar Branch. This report has been developed basically by the secondary data of banking activities of National Bank Limited and primary data from day to day activities during my internship period.

National bank Ltd is the first and major private sector commercial bank in Bangladesh fully owned by the Bangladeshi Entrepreneurs. The Bank started its operation from 23rd March 1983.now with its 131 branches in all over the country NBL serving its valued customers through diversified banking activities. The whole banking process of NBL is divided into 3 sections. These are General Banking, Loan & Advance Division, and Foreign Exchange Division. Here first chapter basically discuss background of the report, objective and methodology used in preparation of the report and limitation faced in preparation. Next I have tried to concentrate on company profile and internship duties.

In this report I have tried to show different aspect of foreign remittance activities. In short time I try my level best to discussing foreign remittance activity. As an internee it is really difficult to give recommendation but I think it will be right I express them elaborately such as proper training, monitoring activities.

From 1983 to 2010 it has twenty seven long years of journey for NBL. They have made strong initiatives in banking sector. They can be one of the best private banks in Bangladesh, if they will match the expectation of their clients through their best banking service.

ORIGIN OF THE REPORT:

The report has been prepared as an academic requirement of achieving BBA degree through three month internship program by Sumana Sultana BBA student majoring in finance from the faculty of Business Administration’s joined National Bank Limited for the completion of my internship program and requested our honorable course teacher Mohammed Ruhul Amin to supervise me during my internship program. He kindly accepted my request and asked me to prepare a report on “Foreign Remittance activities of National Bank Limited” after my internship period thereon. The bank scheduled my place of posting at the Kawran Bazar Branch for three month. During this internship I worked different department especially in Foreign exchange division of Kawran Bazar Branch to come to know about the different functions of the bank. And at long last after getting practical knowledge I managed to prepare my report on “Foreign Remittance activities of National Bank Limited in Kawran Bazar Branch” and submitted my honorable supervisor.

SCPOE OF THE STUDY:

The National Bank Limited is one of the leading Banks in Bangladesh. The scope of the study is quiet wide as this report has covered the banking activities that Kawran Bazar Branch performs such as account opening, cash, clearing or transfer transaction, advance or loan, export and import and so on. . Moreover some emphasis is given is on foreign remittance activities of Kawran Bazar Branch. After getting knowledge about these activities an analysis is made on the findings.

OBJECTIVE OF THE STUDY:

Broad objective is the main issue of a report. The prime objective of this report is to achieve practical knowledge about foreign remittance activities of National Bank Limited Kawran Bazar Branch. Specific objective are as follows.

- To know the activities of Kawran Bazar branch in foreign remittance section.

- To know the inward and outward foreign remittance of NBL Kawran Bazar Branch.

- To know the contribution Kawran Bazar foreign remittance into the total foreign remittance in NBL.

- To know the last six month position in foreign remittance section in this branch like FBC, FBP, No of F/C account etc.

- To analyze the performance of foreign remittance activities of National Bank Limited, Kawran Bazar Branch.

- To evaluate the performance of the bank

- To get through all the department of the bank and observe the work done in National Bank Limited. Kawran Bazar Branch.

- To gain practical experience on different function on different departments like foreign remittance especially from the perspective of the NBL.

METHODOLOGY:

To make the report more meaningful and presentable, two sources of data and information have been used widely these are Primary Data and Secondary Data. Both primary and secondary data sources were used to generate the report. But Most of the information collected in secondary sources:

Secondary Sources: The secondary sources information are:

- Annual report of NBL.

- Materials and files of NBL, Kawran Bazar Branch.

- Website of NBL.

- Different articles.

- Unpublished data received from the branch.

Primary sources: The primary source information are as follows:

- Face-to-face conversation with the bank officers and staffs.

- Practical desk work

- Personal diary (that contains every day experience in bank while under going practical orientation).

RATIONALE OF THE STUDY:

The first and important reason of emphasizing in Foreign Remittance section is that I spend a lot of time in these sections during my internship period. In additional large volume of transaction occurs in these sections of Kawran Bazar Branch. Moreover foreign remittance transactions play an important role in the economy of Bangladesh and I hope getting proper knowledge of these sectors will assist me to develop my career better in future.

LIMITATIONS OF THE STUDY:

There were several constrains while preparing this report are:

- Difficulty in accessing data of its internal operations.

- Non Availability of some preceding year’s statistical data.

- Non-disclosure of some basic information.

- Like any other research, this reports limited to time and resource and only three months are not enough to cover such wide area of banking.

CORPORATE INFORMATION:

- Address: 18, Dilkusa C/A, Dhaka-1000

- Incorporation of the bank: 15 March, 1983

- Licensed Issued by the Bangladesh Bank: 22 March, 1983

- Formal launching of the Bank: 23 March, 1983

- Listed with Dhaka Stock Exchange: 20 December, 1984

- Listed with Chittagong Stock Exchange: 06 November, 1984

- Registration Certificate as Stock Broker: 24 October, 2007

- Number of Employees: 2960

- Number of foreign corresponding : 415

HISTORICAL BACKGROUND OF NATIONAL BANK LIMITED:

The history of National Bank limited is a golden stair of the history of emergence of private banks in Bangladesh. National bank Ltd is the first and major private sector commercial bank in Bangladesh fully owned by the Bangladeshi Entrepreneurs. The Bank started its operation from 23rd March 1983. As a result of the collective effects of the some eminent bankers, of failure in playing due to role in mobilizing small savings of the teeming millions and providing improved clients services to them in our country, the Government gave right decision to allow establishing banks I private sector. National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of National Bank Limited to play a vital role in the national economy. They are determined to bring bank the long forgotten taste of banking services and flavors. NBL want to serve each one promptly and with a sense of dedication and dignity.

NBL has been the pioneer in promoting readymade garment industries and still is the single largest financier in this sector. In the early 80’s when garment industry in Bangladesh was experiencing a process of trial, the bank foresights the bright prospect of this sector and extend finance to the deserving and promising entrepreneurs. It provided them with financial support including market information and advice and today the garment sector constitutes about 66% of the total export of the country.

VISSION OF NBL:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national company and establishing ourselves firmly at home and abroad as a font ranking bank of the country are our cherished vision.

MISSION OF NBL:

Our mission is to continue our support for expansion of activities at home and abroad by adding new dimensions to our banking services which have been ongoing in an unabated manner. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service, as well as our commitment to serve the society through which we want to get closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

SLOGAN:

A Bank for Performance with Potential

CORE VALUE OF NBL:

NBL’s core value consists of 6 elements. These values bind its people together with an emphasis that they are essential to everything being done in the bank.

BRANCHES OF NBL:

To fulfill the commitment of serving the valuable customers at present. NBL has been carrying von business through its 131 branches all over the country. These branches can be categorized under five major regions.

ROLE OF NBL IN THE ECONOMY OF BANGLADESH:

The emergence of NBL is the private sector is an important event in the Banking arena of Bangladesh. During the decades of 1980 when there was severe recession in the economy, by allowing the private sector banks Govt. took the intuitive decision to revive the economy of the country. And several dynamic entrepreneurs came for establishing a bank with a motto to invigorate the economy of the country.

At present NBL has been carrying on the business through 119 branches spread all over the country. Besides, the bank has arrangement with 415 correspondents in 75 countries of the world as well as with 32 overseas Exchange companies.

Besides the profit oriented banking activities NBL is also ahead to serve the people as well a societal body at whole. With the commitment of serving the nation NBL is going on with its diversified banking activities. NBL introduced National bank Monthly Saving Scheme (NMS), Special Deposit Scheme, consumer’s credit Scheme and NBL housing loan, NBL Small Business Loan, Small House Loan Scheme, Festival Small Business Loan etc. to combine the people of lower and middle income group.

KAWRAN BAZAR BRANCH INFORMATION:

- Branch Name: Kawran Bazar

- Date of establishment:

- Address: 7-9 BTMC Bhaban, Kawran Bazar, Dhaka-1205

- Phone: 9660445

- Licensed Issued by Bangladesh Bank:

- Number of Employees: 52 (40 officers and 12 staff) till April 30.

BACKGROUND F KARWAN BAZAR BRANCH:

The history of Kawran Bazar branch is an integral part of the history of National Bank. As the branch of the bank from the day of establishment Kawran Bazar Branch plays a vital role in the efficient management of the bank. From the day it is working successfully as another branch for Dhaka Division.

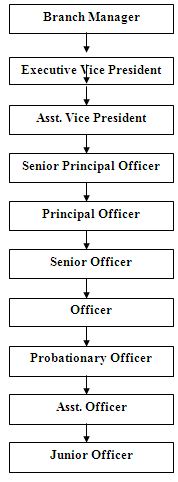

MANAGEMENT HIERARCHY OF KAWRAN BAZAR:

DEPARTMENT OF THE KAWRAN BAZAR BRANCH:

- Account Opening Branch

- Cash Department

- Account Department

- Investment Department

- Foreign Exchange Department

- Clearing Department

- Local Remittance Department

FOREIGN REMITTANCE:

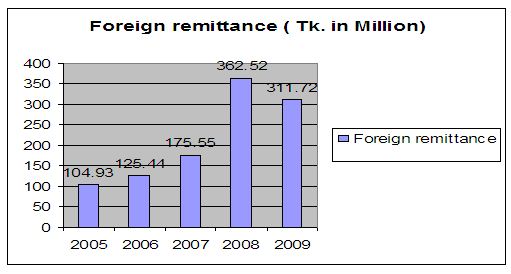

As a part of the foreign exchange operation, foreign remittance activities play a vital role in any commercial bank. Because both export and import’s finally job is to being ( Inward Remittance) or pay (Outward Remittance) foreign currency, which is one of the major functions of this department. In an essence the sale and purchase of foreign currencies. The last five year positions of the foreign remittance in this branch are given below

Table: 1 last five year positions of the foreign remittance

2005 | 2006 | 2007 | 2008 | 2009 |

104.93 | 125.44 | 175.55 | 362.52 | 311.72 |

ACHIEVEMENT OF NBL, KAWRAN BAZAR BRANCH:

Now a day it is pointless to declare that homebound foreign remittance is significantly contributing in building Foreign Exchange Reserve of the country. Realizing the prospects of the sector, NBL, Kawran Bazar Branch since its beginning is progressively establishing its network where concentration of Bangladesh expatriates is higher. At the time passes, NBL Kawran Bazar Branch achieved the confidence and trust of the Bangladesh wage earners and successfully handling a significant volume of remittances, which is increasing day by day. The milestones in the history of NBL Kawran Bazar Branch achievement are:

SWIFT:

SWIFT stands for “Society for Worldwide Inter-banking Financial Telecommunication. It regards the safe, quick and reliable media of financial transactions all over the world. The bank mains round the clock communication with the external world using the latest information technology services of SWIFT. In order to give improved and risk free banking services to the valuable clients, all arrangements for launching line banking are its final stage. This time bank established relationship management application in 73 countries besides 32 local places of test key arrangement.

WESTERN UNION MONEY TRANSFAR:

In Bangladesh NBL Kawran Bazar Branch introduced the remittance service of “Western Union” in 1998. NBL are able to reach with lighting speed the hard-earned foreign exchanges of non-resident Bangladeshis to their near and dear ones at home through the world renewed Western union. In the year 2000 the Bank managed to procure foreign remittance to the tune of US$ 8.44 million dollar equivalent to TK 4662.10 million compared to TK 3989.20 million in the previous year indicating a growth of 16.96 % Banking is not only a profit oriented commercial institution but it has based and social commitment admitting this true NBL Kawran Bazar Branch is going on with its diversified banking activities

FOREIGN REMITTANCE SECTION:

In the foreign remittance section I stayed for 4 week, like the local remittance section the purpose of foreign remittance section is to ease the flow funds between our country and abroad. When an international transaction is made the payment of the transaction is made trough foreign currencies. Here the foreign remittance department works as a media between the transactions of the two currencies. Foreign remittance can be categorized in the following ways:

Inward Remittance:

The Remittance of freely convertible foreign currencies which we receiving from abroad against which the authorized making payment in the local currency to the beneficiaries may be called as inward remittance. Inward remittance comprise remittances on account of exports, family maintenance, donation, indenting, commission, gift, export brokers, and private remittances on sundry items, purchase of traveler’s cheque, currency notes and coins. These remittances can be received y names, business firms or other general A/C like partnership, club society, Association, Trust, NGO etc.

There are no restriction on inward remittances by Bangladesh Ban other that the prescribed formalities to be complied with by the exporters and other recipients. The authorized dealer can freely purchase foreign currencies. Authorized dealer are required to maintain a proper record of all inward remittances and furnish such particulars as required on the prescribe returns to submitted to the Bangladesh Bank.

Cancellation of Inward Remittance:

In the event of any inward remittance which has already been reported to the Bangladesh Bank, being subsequently cancelled, either in full or in part, because of non-availability of beneficiary. Authorized dealers must report the cancellation of thr inward remittance as an outward remittance on form T/M. The return in which the reversal of the transaction as reported should by supported by a letter giving the detailed particulars of original amount of remittance, amount cancelled, reason for cancellation, name and address of the beneficiary, the date of the return in which the inward remittance was reported.

Outward Remittance:

The remittance in foreign currency which are being made on our country to abroad is known as foreign outward remittances. Outward remittance comprises remittance on account of import and private remittance on sundry items, sale of traverler’ chequq, currency notes and coins etc. As the country is in a perpetual state Bank scarcity of foreign currency and to seek and maintain favorable balance of payment before any outward remittances to be made to out Bangladesh Bank’s prior permission is requires as the foreign exchange business is restricted and controlled by the Bangladesh Bank.

Outward remittance can be occurred due to the following reasons:

- Payment of Import bills.

- Remittance of freight and passage.

- Agency commission for handling vessels.

- Oeration expenses of Bangladesh Shipping Corporation and Bangladesh Biman.

- Charter of foreign ships and aircraft’s.

- Employment of overseas agents.

- Opening branches or subsidiary companies abroad etc.

Modes of Foreign Currencies Received & Paid:

Foreign currency can be received and paid in the following Modes:

- T.T= Telegraphic Transfer

- M.T= Mail Transfer.

- F.D= Foreign Drafts.

- P.O= Payment Order.

- T.C= Traveler’s Cheques.

- Foreign Currency Notes.

IMPORT SECTION:

As foreign activities import is one of the important functions of commercial banks. The major function is to import goods from aboard. In this section I stayed 4 weeks and observed the tit-bits of total import process. Some major activities of this section are preparing proposal, opening L/C, security of import bills, providing post import finance etc.

EXPORT SECTION:

Besides the import a large volume of profit is generated from export activities in Kawran Bazar Branch. The major function of this section is to assist our exporters to exporr their goods to aboard. In this section I stayed many times and observed different export related activities like opening BTB L/C, providing acceptance, scrutiny of import papers etc.

OPERATION OF FOREIGN REMITTANCE

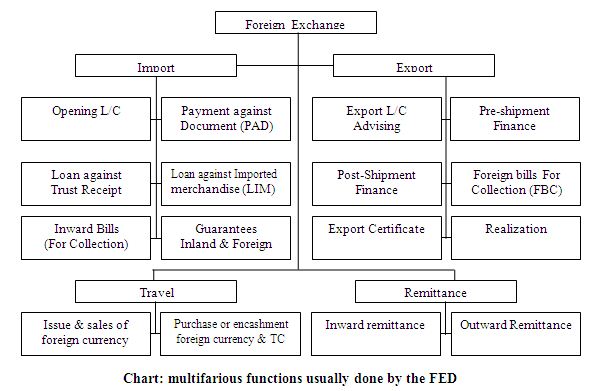

FOREIGN EXCHANGE:

Foreign Exchange Department is the international department of a bank. It deals globally. It facilities international trade through the various modes of services it possess. If the branch is an authorized dealer in foreign exchange market, it can remit foreign exchange from home country to foreign countries. The department mainly deals with foreign currencies. Hence it is called foreign exchange department. The department brides with the export, import and foreign remittance.

Following flow chart depicts the multifarious functions usually done by the FED.

FOREIGN REMITTENCE

The transfer of any funds across national boundaries. Foreign remittance means purchase and sale of freely convertible foreign currencies as admissible under Exchange Control Regulations of the country. Purchase of foreign currencies constitutes inward foreign remittance and sale of foreign currencies constitutes outward foreign remittance.

Types of Foreign Remittance:

There are two types of Foreign Remittance:

Foreign Inward Remittance

Foreign Outward Remittance

Foreign Inward Remittance

Purchase of foreign currencies constitutes inward foreign remittance. For different use bank can purchase foreign currency such as endorsements.

Foreign Outward Remittance

Sale of foreign currencies constitutes outward foreign remittance. When bank sale the foreign currency to its customer or clients then it called outward foreign remittance. Such as FDD, TT etc.

Activities in foreign remittance in:

The Foreign Remittance department of National Bank Limited Ka wran Bazar Branch is equipped with a number of foreign remittance facilities. Following are the types of foreign remittance facilities offered by National Bank Limited Kawran Bazar Branch.

- Issuance of Foreign Demand Draft (F.D.D)

- Issuance of travelers Cheques (T.C)

- Issuance of foreign T.T (Telegraphic Transfer)

- Disbursement of the cash of incoming F.T.T.

- Collection of F.D.D.

FOREIGN REMITTENCE ACTIVITIES NBL:

As a part of the foreign exchange operation, foreign remittance activities play a vital role in any commercial bank. Because both export and import’s finally job is to being ( Inward Remittance) or pay (Outward Remittance) foreign currency, which is one of the major functions of this department. In an essence the sale and purchase of foreign currencies. The sale involves exchange of foreign currency of home currency i.e, conversion of home currency into foreign currency and the purchase involves exchange of home currency of foreign currency i.e. conversion of foreign currency in to home currency.

Table-5 Last six Months Inward and Outward Remittance Flow in Kawran Bazar Branch:

| Nov | Dec | Jan | Feb | Mar. | Apr | |

| Inward | 49836.3 | 55983 | 587066 | 475328 | 432269 | 490191 |

| Outward | 106581 | 165287 | 135767 | 96311.5 | 82830.2 | 65577.1 |

From the above graph we can easily see that there are many up and downs in the Inward and outward curve. This is happened due to the world financial recession many wage earners become panicked and they send their savings to the country during November and arise in January and now the situation is quite steady. And in the December due to enough dollar endorsement and many students went to abroad for higher study which causes rise in the outward curve.

F/C ACCONT OPENING AND MAINTANANCE:

In Kawran Bazar branch one of the major tasks of Foreign Remittance section is opening and deal with different foreign currency A/Cs foreign currency A/C can be following types:

F/C General A/C:

This F/C account can be opened only by Bangladeshi citizen (wage earner) who is working in aboard. He A/C holder may deposit currency notes, Traveler’s cheque, drafts etc. brought into Bangladesh. Both the A/C holder and nominee can operate the A/C. The nominee can withdraw every dollar from the A/C but he/she can not deposit foreign currency in this A/C. Foreign currency can be remitted to aboard from this A/C but no business deal can be done using this account.

Residential F/C deposit A/C (RFCD):

Only Bangladesh resident can be open this type of A/C with foreign currency brought in by the time of their return to Bangladesh from traveling a country. Any amount brought in with it with declaration to custom authorities on from “FMJ” can deposited in this A/C (amount below $5000 no need to declaration). But processed from export or any service from Bangladesh would not be deposited here. Foreign currencies of their foreign travels (i.e. cash endorsement in passport and ticket) up to $300 in the from of cash and reminders can be issued in the traveler’s cheque.

Non-Resident F/C deposit A/C (NFCD):

It is an interested term deposit A/C. This A/C can be opened for 1/3/6/12 months or more basis auto renewal term. All non –resident Bangladeshi nationals and persons of Bangladeshi origin including who have duel nationality and having nationality but working aboard can open this A/C at the time on their return to Bangladesh. This A/C can also be opened by debating the balance of exciting F/C (wage earner) A/C. The A/C holder can freely repatriate the principal amount and the interest.

D. F/C Exporter A/C (Retention Quota):

According to the Bangladesh Bank’s order firm or company who is engage in exporting goods to abroad can retain 7.5% of their exports proceeds to this A/C. This fund can be utilized to develop their business or to meet up the cost of their import to support the export.

Term Deposit Receipts (TDR):

This account is quite similar to our general GDR A/C. here the A/C need to open theA/C with foreign currency. This is also opened for a period of time like 1/3/6/12 months or more basis with auto renewal term.

Interest on F/C Account:

In previous time interest is provided to F/C account but recently NBL has stopped to provide interest in F/C account except NFDC and TDR because now Bangladesh Bank also do not provide any interest on the balance of F/C kept by the authorized dealer. The interest rate of NFCD and TDR (as on 30th June 2009) is given below:

Table: 6 interest rate of NFCD and TDR

CURRENCY | 1 MONTH | 3 MONTHS | 6 MONTHS | 1 YR/ ABOVE |

US$ | 0.05% | 0.05% | 0.48% | 1.00% |

GBP | 0.00% | 0.00% | 0.35% | 1.15% |

EURO | 0.00% | 0.03% | 0.52% | 0.77% |

Requirement to open F/C A/C:

The following supplementary papers are required to open F/c accounts:

- Application for opening F/C A/C.

- A/c opening form

- Declaration form.

- Letter of authority.

- Nominee declaration from with Photographs (F/C and RFCD)Cs:

- Proof of Income

- Photocopy of passport.

- KYC form.

- Job / Tax payee Certificate.

These entire documents should be attested by appropriate body or persons.

Table:7 F/C Account opened in the first four month of 2010 in Kawran Bazar Branch

A/c Month | Jan | Feb | Mar | Apr |

F/C Gen | 9 | 2 | 4 | 6 |

RFCD | 11 | 4 | 7 | 5 |

NFCD | – | – | – | – |

TDR | – | – | – | – |

During the first four month F/C general and RFCD A/C opened totally 21 and 27 respectively. This is because many people traveled in different countries during the last four months and bought dollars from aboard with which they opened RFCD A/C. On the other had many BD nationals who are working aboard send their earning and saving due to down turn in the global company. During the last four months on NFCD and TDR A/C is opened in Kawran Bazar Branch.

FOREIGN BILLS COLLCETION (FBC):

When a Clients presents a foreign cheque of FDD, first it is registered in the FBC register with a FBC no, date, beneficiary details with A/C no, and particulars of the instrument. Then the instrument is sent to the foreign collecting bank (Gen: NBL uses Standard Chartered Bank for collection) with a forward letter by endorsement seal o “pls pay to the Standard Chartered Bank, USA. When the bill is collected the collecting bank cr. NBL’s NOSTRO A/C maintained with them and sent an advice to NBL’s International Division (ID) about the collection. Then ID sends an advice to Kawran Bazar‘s F/C A/C and then the party’s A/C is credited and the debited the ID A/C.

LAST SIX MONTH FBC OF THIS BRANCH:

Table: 8 In November 2009 to April 2010 Foreign Bills collection are given below:

Nov | Dec | Jan | Feb | Mar. | Apr |

13675 | 16653 | 18014 | 5876 | 12283 | 12652 |

FOREIGN BILL PURCHASE (FBP).

According to the party’s reputation Karwan Bazar purchase foreign cheque of clients then FBC becomes FBP. During FBP collection enough risk is involved because in FBP client gets the fund before collection of the instrument and the collecting Bank also credits the NOSTRO A/C before getting the processed. So, bank has to take measures to prevent frauds of receiving any collection item. During foreign bill purchase bank asks the following papers.

- Personal guarantee of client.

- Indemnity Bond from Third Party.

- C-from Declaration.

LAST SIX MONTH FBP OF THIS BRANCH

Table: 9 LAST SIX MONTH FBP OF THIS BRANCH

Nov | Dec | Jan | Feb | Mar. | Apr |

36238 | 33896 | 9965 | 7596 | 32835 | 15395 |

PROVIDING FOREIGN BANK GUARANTEE:

Providing foreign Bank Guarantee is another important job of foreign remittance section of Kawran branch. When an international party engages in any development activity of our country then they has to provide local bank guarantee as required by the local work provider. In this situation many foreign banks seeks local bank guarantee by NBL to support their clients. NBL earns a lot of commission from these services.

DOLLAR INVESTMENT THROUGH BOND:

Any F/C account holder can invest their dollar by purchasing premium Bond or US dollar Investment Bond. The interest rate in premium bond is 7.5% and US dollar investment bond is 6.5%. The requirement of purchasing these bonds is that bond may be issued only in the name of a holder of a holder a non resident account against remittance from abroad to the account.

SETTLEMENT OF FOREIGN BILLS UNDER INTERNATIONAL CARDS:

NBL offers International Credit Card for RFCD/ FC ge/ERQ A/C holders by which they can easily pay their international dues or payments and then again after getting dollar they can deposit the same to the account. The current interests on the loan by credit card are 16%.

OPENING STUDENT FILES:

Students who is about to go for higher education needs to transfer remittance to the foreign universities. But as they are not by Bangladesh Bank to carry the foreign currency directly with them so to remit the educational and accommodation fees they have to open a student file in NBL. The requirement to open a student file following papers is needed:

- Application in a plain paper.

- Original and photocopy of admission letter/ offer issued by the educational institute in the name of the student.

- Original and Photocopy of estimate relating to annual tuition fees, living expense, and incidental expenses.

- Attested copies of all educational certificates of the student.

- Valid passport and visa.

- Attested two passport size photographs.

- Application for purchasing foreign currency for studying purchase.

- To open a student file in NBL TK. 3000 is required. All of these student file should be reported to Bangladesh Bank with “TM” form in E3/P3 schedule.

ISSUANCE OF CERTIFICATES:

On the demand of clients sometimes various certificates are issued in favor of the clients from foreign remittance section. Some of these certificates are:

- Proceeds Realization Certificate: This certificate is issued in favor of the client to show how much proceeds is gained and the amount of Income tax realized from the clients which will be reported to the Bangladesh Bank.

- Encashment Certificate: This certificate is issued when some foreign currency from any F/C A/C is converted into TK. In favor of the client and should be reported in FCR-1 or FCP-6 in the related months.

- VAT Certificate: This certificate is issued in favor of the client to show how much fund has been realized from him as VAT, which should be reported to BB with a challan no, date, and amount deducted.

DOLLAR ENDORSEMENT:

When anybody wants to go aboard for traveler study purpose then they need to purchase dollar from banks by endorsement. A person can carry $500 by road and $1000 by Air for SAARC countries for a year. Other than SAARC countries she/he can carry $3000 for a year where $2000 by cash and $1000 by TC. All these endorsement must be reported to Bangladesh Bank with TM from in appropriate schedule.

Procedure of the Dollar Endorsement:

- Client who go to abroad he/ she seen his passport and then officer give a TM form.

- Client filled up TM from and gives the officer.

- Officer matches the signature of the passport and TM form signature.

- When signature was match then he took his passport and passport’s first five page photocopy and TM from.

- Then he gives the entry in the computer. Here he/ she record the name of the pass porter, passport no, dollar amount, location that client gone.

- Officer then give a money receipt in client that paid in the account department.

- When client paid the amount then officer gives the client passport, certificate and dollar. Here note that dollar are restricted in different countries such as for go to India a person can get at a time maximum 200 dollar and a year he/ she can five 1500 dollar.

- At the day ending it can recorded in the Bangladesh bank one schedule that name is E3/P3 schedule.

- And at the month ending it can sent in the Bangladesh Bank at a performance of the bank in this sector.

LAST SIX MONTH ENDORSEMENT OF THIS BRANCH

Table: 10 LAST SIX MONTH ENDORSEMENT OF THIS BRANCH:

| Nov | Dec | Jan | Feb | Mar. | Apr |

102838 | 98600 | 74264 | 81050 | 96000 | 79150 |

REPORTING TO BANGLADESH BANK:

According to the Bangladesh Bank’s order all authorized on the last working day of each month shall report to the Bangladesh Bank particulars of all foreign exchange transactions, i.e. all outward and inward remittances effected, whether through their account in foreign currencies or through the Taka accounts of non-resident banks. For this purpose, Authorizes dealers must submit to the Bangladesh Bank monthly summarized statements of their transactions in each currency in which a position is maintained by them and also monthly summary statement of transaction effected on the taka accounts of non-resident banks the branches should submit the original copies of statements schedules directly to the statistics departments Bangladesh Bank Head office, Dhaka the duplicate copies along with the relevant forms should be endorse to the concerned area office of Bangladesh Bank. The monthly statements / schedules from the Head Office/ principle office should be dispatched so that these statements reach to the statistics departments at head office and concerned area office of Bangladesh Bank by the 12th of the following month. Some of these schedules/ statement are:

- Schedule E3/P3 for invisible payment.

- Schedule J1/O3 for invisible receipts ( incoming remittance for above $2000)

- Schedule IRV for invisible receipts (incoming remittance for below $2000)

- Statement S-6 for cash dollar transaction.

- Statements FCS-7 for F//C Gen. A/C (Wage earner) (including FCR-1, FCR-3, FCR-6, FCP-6), FCP-9 etc).

- Statement EFCS-7 for F/C Exporters Retention Quota (including EFCR-1, EFCP-1, EFCP-2 etc.)

- Statement of Convertible TK. A/C.

- Statement of Foreign Direct Investment.

- Statement of RFCD/ NFCD/ TDR/ NGO.

- Statement of SBS-2 for foreign currency A/C.

FINDINGS:

Proper Foreign exchange department is most important function of any bank. But foreign exchange department activities especially foreign remittance section suffer from some kinds of problem which are learnt from discussion with officers and clients and also problems identified from the job observation. The problems are as follows:

- NBL Kawran Bazar Branch has SWIFT facilities. Very few bank in our country offer this. By using this modem technology Kawran Bazar Branch, provide faster service.

- Change in policies, due to change in the foreign exchange policy as well as monetary and fiscal long term financing suffer a lot.

- Exchange rate movements.

- Multilateral, bilateral and unilateral taxes or restriction on trade.

- Government rules and regulation often make problem for import and export market in Bangladesh.

- Sometime importer brings some illegal and unusual things for that bank itself fall in problem.

- More innovative product must be offered, lack of customer confidence.

- Existing bad legal system and alarming factor recovering loan from defaulter. In reality it is very difficult, lengthy, and expensive to have a verdict in favor of the bank.

- High cost for maintaining account. The account malignance cost for NBL is comparatively high. In the long run this might turn out be a negative issue for NBL.

ANALYSIS:

Total Inward Remittance of NBL KB Branch (Dec-2009 to Apr-2010):

Month | Total inward | Change % |

Nov | 498336.3 | |

Dec | 559823 | 12.33 |

Jan | 587066 | 4.866 |

Feb | 475328 | -19.03 |

Mar. | 432269 | -9.06 |

Apr | 490191 | 13.4 |

Source: semi annually balance sheet of NBL foreign exchange, KB Branch

Table 12 : Total Inward Remittance

Total Outward Remittance of NBL KB Branch (Dec-2009 to Apr-2010):

Month | Total Outward | Change % |

Nov | 106581 | |

Dec | 165287 | 55.08 |

Jan | 135767 | -17.86 |

Feb | 96311.5 | -29.06 |

Mar. | 82830.2 | -13.98 |

Apr | 65577.1 | -20.83 |

Source: semi annually balance sheet of NBL foreign exchange, KB Branch

Table 13: Total Outward Remittance

Total Inward & Outward Remittance of NBL KB Branch (Dec-2009 to Apr-2010):

Nov | Dec | Jan | Feb | Mar. | Apr | |

Inward | 498336.3 | 559823 | 587066 | 475328 | 432269 | 490191 |

Outward | 106581 | 165287 | 135767 | 96311.5 | 82830.2 | 65577.1 |

Total | 604917.3 | 725110 | 722833 | 571639.5 | 515099.2 | 555768.1 |

Change % | 0.198693 | -0.00314 | -0.20917 | -0.09891 | 0.078954 |

Source: semi annually balance sheet of NBLforeign exchange, KB Branch

Table 14 : Total Inward & Outward Remittance

Total FBC of NBL KB Branch (Dec-2009 to Apr-2010):

Month | Total FBC | Change % |

Nov | 13675 | |

Dec | 16653 | 21.77 |

Jan | 18014 | 8.17 |

Feb | 5876 | -16.38 |

Mar. | 12283 | 10.9 |

Apr | 12652 | 3.42 |

Source: semi annually balance sheet of NBL foreign exchange, KB Branch

Table 15 : Total FBC

Total FBP of NBL KB Branch (Dec-2009 to Apr-2010):

Month | Total FBP | Change % |

Nov | 36238 | |

Dec | 33896 | -6.46 |

Jan | 9965 | -17.61 |

Feb | 7596 | -23.77 |

Mar. | 32835 | 33.22 |

Apr | 15395 | -15.11 |

Source: semi annually balance sheet of NBL foreign exchange, KB Branch

Table 16 : Total FBP

Total Dollar endorsement of NBL KB Branch (Dec-2009 to Apr-2010):

Month | Total endorse | Change % |

Nov | 102838 | |

Dec | 98600 | -4.12 |

Jan | 74264 | -24.68 |

Feb | 81050 | 9.18 |

Mar. | 96000 | 18.45 |

Apr | 79150 | -17.55 |

Source: semi annually balance sheet of NBL foreign exchange, KB Branch

Table 17 : Total Dollar endorsement

Comparing NBL Total Foreign remittance into KB Branch:

2005 | 2006 | 2007 | 2008 | 2009 | |

| Total NBL | 13618.2 | 21353.9 | 27560.8 | 35877.8 | 41381.5 |

| KB Branch | 104.93 | 125.44 | 175.55 | 362.52 | 311.72 |

Table 18: NBL Total Foreign remittance into KB Branch

CONCLUSION:

Through Bangladesh is a small country in nature but its import and export activities in the world is considerable. Every year Bangladesh exports a large volume of jute, tea, woven Garments, Knitwear, Frozen fish, Leather etc and import raw materials for readymade garments, manure, accessories and different apparels.

In Bangladesh many banks are providing foreign exchange services in terms of letter of credit and foreign remittance and among them National Bank is one of the successful bank. Even in last year 2008 the whole world sank in the global commercial recession but the foreign exchange activities of NBL was quite steady through the year.

In 2008, National Bank limited forwarded total number of 21210 LCs amounting to US$ 1130.96 Million in import trade with a growth of 25% over the previous year. The main commodities were scrap vessels, rice, wheat petroleum products etc. and In export trade it handled total 16234 export LCs amounting to US$ 531.03 million which was 14% over the previous year’s records.

Besides the above activities NBL is showing its interest in foreign operation. NBL has own exchange house in Oman, Singapore, Malaysia, Myanmar and arrangement with different world leading exchange houses. Through which the foreign exchange operation and transfer of remittance have becomes ease. In the last four month the total inflow of foreign remittance is US$ 806096.92 Lac which shows an envious performance of National Bank among its competitors.

Now a day’s National bank Ltd. has established goodwill through innovative products and services. It has many problems but is followed very sincerely the rules, regulations and advice of Bangladesh bank during the last ten years. Technological development has opened up a new dimension in the development creative products, efficient services and customer satisfaction. National Bank Ltd. must cope with this technological advancement to retain its present status. Many new generation private commercial banks have already introduced On-line banking. But National Bank Ltd. Could not established it till now. The bank must take initiative to established on-line banking.

RECOMMENDATIONS:

- As the numbers of employees in Kawran Bazar branch are less than it requires, it should increases its employee to provide faster services to its customers.

- Of the year 2009, foreign remittance decreased -50.8%. So the branch should take proper step to increase their remittance.

- Of the month Feb to April. 2010, foreign outward remittance decreased, So they need to take proper step in this sector.

- Of the month February and April FBC and FBP was up and down so the branch need to proper step to remove their situation.

- Kawran Bazar Branch should develop its server so that many officers can use different software at a time for reducing service delay.

- To increase its customer Kawran Bazar should implement different online services to the clients.

- Through most of the employee are well educated and learner but few of them have lack in computer proficiency. So, they should be provided more computer operating training to increase their skills in computer.

- To running the business efficiently they need to improve their L/C procedure.

- By improving the L/C procedure they can acquire customer satisfaction and it will help to increase the clients as export Import business. As a result economic condition gets developed.

- Provide proper modern technology to given efficient service to the customer basically foreign exchange service.

- Long term training very much required for the foreign exchange official.

- Allocate the employee on the basis of skill and experience to run the Business efficiently.

- Attractive incentive package should be provided to the exporter which will help to export business.

- The branch Manager should monitor the activities of officers so that the clients get efficient service.