EXECUTIVE SUMMARY

This internship report is written on “General Banking & Foreign Exchange Activities of Bank Asia Limited-A study on Motijheel Branch” I tried to divide this report into different like, in organization part-1 discussed about Bank Asia business activities, their products and services and about their financial position, SWOT analysis of BAL shows its strong position among different Commercial Bank’s of Bangladesh. In case of foreign international trade in BAL. Part-1 mainly focuses on the banking activities, procedures and precaution take to conduct export & import and general banking activities. On the other hand I tried to focus on the performance of BAL General Banking & Foreign Exchange Business Between these three months of my internship program I have also find out some matters, like; Bank Asia Ltd follows the rule and regulations of import-export policy and Bangladesh Bank Exchange Control regulation Act. And as per instruction of Bangladesh bank, BAL has to maintain some rules. So I have recommended here that, BAL should concentrate on collection information for the customers and creating new information for the customer of the foreign exchange transaction and general banking process. I have recommendation that, BAL can increase their investment in different non conventional or diversified items of export to increase foreign exchange earning. In this branch there is another problem that I have find out that is, some employees are careless about their task but they are efficient. As a result some time clients need more time to do their transaction rather than other bank. But in overall condition the employees are so much friendly with their clients. In BAL the employees are always in pressure for their duties. And some time pressure becomes burden for the employees also. And for this reason, Bank Asia Ltd should recruit minimum 15 employees more in this branch for the customer and also foe the employees. As the final point it could summarized that, if Bank Asia authority could fine-turn its functioning through some changes in overall banking performance, changes in providing other facilities with adaptation of modern business practices through upgrading and expansion of the range of dealing in the banking sector and simultaneously take advantages of modern technological breakthroughs in area such as electronic communication, proper online services etc.

1.1 Introduction:

The word ‘Bank” refers to the financial institution that deals with money transaction. Banks collect deposit at lowest possible cost and provide loans and advances at highest Cost. The spread between the two is the profit for the bank. There are two different types of banking. One is commercial banking and investment banking. The commercial bank is types of bank which is engaged in banking activities, like; deposit and making loans and other fee based services. It also byes corporate markets activities. In today’s world, technological and financial advancement is influencing every human activity. Commercial banks have been playing a vital role in the world economy. Bank is not only a financial institution, but also a helping hand for the common people, different organization and also foe the government country’s prospect and future economic conditions largely depends on the commercial banks. In today’s business world, few financial organizations have made a strong place in the market and “Bank Asia” is one of those names.

1.2 Origin of the report:

This report on “General Banking & Foreign Exchange Activities Of Bank Asia Ltd (Motijheel Branch)” was initiated as part of the internship program which is a BBA Degree requirement of the Department of Business Administration, Northern University Bangladesh. A three (3) months internship at Bank Asia Ltd, Motijheel Branch, Dhaka, preceded the preparation of the report. During the internship a student has to undertake as area of investigation of any organization for in depth study.

1.3 Objectives of the Report:

The objective of this report can be summarized as follows:

Specific:

• To fulfill the academic requirement.

• To gain practical Knowledge in banking.

• To focus on the brief description of foreign trade.

• To examine bank’s performance in foreign exchange risk.

• Give a functional overview in general banking sectors of Prime Bank.

• To identify major strength and weakness of BAL in respect of other Bank.

1.4 Methodology:

1.4.1 Sources of information:

This Report has been prepared on the basis of experience gathered during the period of internship. I also acquired information from the Annual report and website of the Bank Asia Ltd. I have presented my experience and findings with the help of different diagrams and tables in the analysis part. To make the report more meaningful and presentable, two sources of data and information has been used-

(a) Primary sources

• Practical desk work

(b) Secondary sources

• Files and Folders

• Websites

• Annual Report of Bank Asia

1.5 Limitations:

There were some problems while I have undergone the internship program. An unconditional effort was applied to conduct the internship program and to bring a reliable and prolific result.

• Sufficient record, publications were not available as per my requirement.

• All types of previous information are not processed through computer.

• Large-scale research was not possible due to constraint and restriction posed by the organization.

• Some of the relevant papers and documents were strictly prohibited.

• Time constraint

• Three months are very short time to prepare this.

1.6 Rationale of the Study

The word “bank” refers to the financial institution that deals with money transaction. Commercial banks are the primary contributors of the economy of this country. On one hand they are borrowing money from the locals and on the other hand lending the same to the locals as loans and advances. So the people and the government are very much dependent on banks. Moreover, banks are profit earning concerns, as they collect deposits at the lowest possible cost and provide loans and advances at higher rate. The difference between two is the profit for the bank.

This report basically deals with the General Banking & Foreign Exchange Activities of Bank Asia covering the areas like General Banking, Loan and Advance, Foreign Exchange, Remittance, Financial Performance, Online Banking, etc.

CHAPTER-02

ORGANIZATIONAL PROFILE & STRUCTURE

OF BANK ASIA LIMITED

2.1 Background of the Organization

The economy of Bangladesh has been experiencing a rapid growth since the 90’s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprise ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives. A group of highly acclaimed businessmen of the country grouped together to respond to this need and established Bank Asia Limited in the year 1999.

The Bank Asia incorporated as a public limited company under the Companies Act. 1994. The bank started its commercial operation on November 1999 with an authorized capital of Tk.800 million and paid up capital of Tk.218 million. The paid up capital of the bank stood at Tk.1116 million as on 31st December 2006.

Within a short span of time Bank Asia has established itself as one of the fast growing local private banks. It has at present a network of 26 branches serving many of the leading corporate houses and is gradually moving towards retail banking. Its other significant delivery channel is the shared ATM Network. Bank Asia has 25 ATMs as a member of ETN along with eleven other banks. Since its humble beginning in 1999, it set milestone by acquiring the business operations of the Bank of Nova Scotia in Dhaka, first in the banking history of Bangladesh. It again repeated the performance by acquiring the Bangladesh operations of Muslim Commercial Bank Ltd. (MCB), a Pakistani bank. Last year the Bank again came to the limelight with over subscription of the Initial Public Offering of the shares of the Bank, which was a record (55 times) in our capital market’s history and its shares commands respectable premium.

The asset and liability growth has been remarkable. By December 2006 the total asset of the Bank grew to Tk. 30,478 million, increase of almost 30% comparing to 2005. As of December 2006 deposits increased to Tk. 25,289 million, an increase of 37% over that of 2005, and Loans & Advances reached Tk. 22,255 million, an increase of 25% over that of the year 2005.

Bank Asia has been actively participating in the local money market as well as foreign currency market without exposing the Bank to vulnerable positions. The Bank’s investment in Treasury Bills and other securities went up noticeably opening up opportunities for enhancing income in the context of a regime of gradual interest rate decline.

Bank Asia is maintaining its competitiveness by leveraging on its Online Banking Software and modern IT infrastructure. It is the pioneer amongst the local banks in introducing innovative products like SMS banking, and under the ATM Network the Stellar Online Banking software enables direct linking of a client’s account, without the requirement for a separate account.

Bank Asia has successfully established a transparent process of recruitment seeking the best talent. In its efforts towards continuous development of the human resources of the Bank, it arranges training programs throughout the year.

2.2 Vision

Bank Asia’s vision is to have a poverty free Bangladesh in course of a generation in the new millennium, reflecting the national dream. Our vision is to build a society where human dignity and human rights receive the highest consideration along with reduction of poverty.

2.3 Mission

To assist in bringing high quality service to our customers and to participate in the growth and expansion of our national economy. To set high standards of integrity and bring total satisfaction to our clients, shareholders and employees. To become the most sought after bank in the country, rendering technology driven innovative services by our dedicated team of professionals.

2.4 Corporate Governance:

The Bank tries to achieve balance between increasing value of the shareholders’ investments and maintaining high standards of ethics as a socially responsible corporate entity, within the framework of regulatory norms. Continued improvement in the quality of service to the depositors and borrowers remains the link between these objectives.

A successful business is defined by its relationship with its shareholders, customers, employees, business partners and the community in which it operates. BAL aims to tap into the synergy of these relationships and create a collectively beneficial business environment. Its responsibilities are as follows:

• Shareholders “To safeguard shareholders’ investment and to create and add economic value.”

• Customers “To satisfy the unique needs of our customers by offering safety to their trust, provide innovation and flexibility in delivered service, that creates value for their business thereby enhancing their commercial success and, in turn, ours. To take due care and diligence in ensuring that regulatory norms are not breached in extending service to customers and other constituents.”

• Employees: “To recognize that employees are our greatest asset and to ensure that they have a safe and conducive working environment with equitable and competitive terms and conditions of service. The Bank promotes a culture of trust, and the development and best of human talent and resource.”

• Business partners: “To cultivate meaningful, mutually beneficial and successful long-term relationship with our partners, suppliers and contractors based on trust and understanding.”

• Community: “To be a responsible corporate citizen and conduct business in a manner that promotes sustainable development for both BAL and the community it serves. This involves full compliance with local laws and regulatory authorities, and giving due consideration to cultural, social and environmental impact in all commercial decision

2.5 Performance of the bank at a glance 🙁 Amount in Tk)

| YEARS | 2008 | 2007 | 2006 | 2005 | 2004 |

| Authorized Capital | 4450** mill | 1200 mill | 1200 mill | 1200 mill | 800 mill |

| Paid up Capital | 1116 mill | 930 mill | 744 mill | 600 mill | 235 mill |

| Total Asset | 30478 mill | 23380 mill | 17811 mill | 12600 mill | 8458 mill |

| Total Deposit | 25289 mill | 18501 mill | 13471 mill | 10432 mill | 7009 mill |

| Total Loans & Advances | 22255 mill | 17870 mill | 11862 mill | 8190 mill | 2000 mill |

| Operating Profit | 1071 mill | 801 mill | 659 mill | 420 mill | 230 mill |

| Profit before Tax | 967 mill | 604 mill | 461 mill | 381 mill | 207 mill |

| Classified Loans to Total Loans & Advances | 2.27% | 2.77% | 3.30% | 1.75% | 1.50% |

| Return on Investment | 7.45% | 9.15% | 6.26% | 5.19% | 3.78% |

| Return on Assets | 3.17% | 2.58% | 2.58% | 3.32% | 2.71% |

| Earning per Share (TK) | 42.63 | 41.24 | 39.48 | 35.97 | 48.51 |

| Return on Equity | 24.40% | 24.47% | 24.82% | 24.26% | 30.44% |

| Price Earning Ratio | 10.04% | 11.82 | 18.53 | – | – |

| Administrative Cost | 2.18% | 2.26% | 2.68% | 2.71% | 3.15% |

2.6 Management Practices in Bank Asia:

HR & Company Secretary:

In the evolving banking arena innovation and specialization will be the key to maintaining competitive edge. A transparent process to recruit the best talent is successfully established through the Human Resource Department. The human resource department conveys a number of training and development programs throughout in an effort towards continuous development of the Human product of the bank. Both internal and external trainers conduct in-house training programs and these programs are continuously updated to reflect the latest development in the banking as well as information technology sector. By the end of 2005 increases the manpower strength increased to 397 from 331 at the end of the previous year.

Marketing

The Marketing Department is responsible for the coordination of all marketing activities of the Bank; ensures marketing activities are in compliance with state and federal regulations; develops various marketing concepts, objectives, materials, advertisements, programs, press releases, and other special events approved by senior management and the Board of Directors. The department provides guidance and coordinates implementation efforts with respect to the installation of new or existing products and services. The Marketing Department is also responsible for being the primary contact of public relations and media contacts, advertising, and certain business development activities that promote the spirit, philosophy, dedication, and general direction of the Bank.

International Division

International Division develops and service comprehensive personal financial relationships within affluent International target market through a professional sales effort and identifies qualified International potential clients. The department initiate contacts assess need; present an array of products and services, and close sales. This department is responsible for the management and total servicing of the international client relationship, and for the growth and profitability of the largest, most complex and profitable relationships in the unit.

Credit

The Credit Division is responsible for gathering and analyzing credit information on current and potential borrowers; determines the advisability of granting credit for diversified types of loans Duties also include assisting loan officers in writing loan requests; promoting business for the Bank by maintaining good customer relations and referring customers to appropriate staff for new services.

Audit & Internal Control

The Audit & Internal Control Department is responsible for developing, implementing and communicating Treasury Bank Audit’s vision, mission, goals and strategies. To ensure that critical business and regulatory processes are in place and working, this department develops and maintains an effective relationship with business partner management, helps business partners balance their business strategy with appropriate risk management controls and encourages business unit management to self-assess its business environment and develop action plans around ‘gaps’ that could impact sound risk management or success in meeting business plans. The division also ensures that staff understands and is appropriately aligned to the company’s objectives/values, and stay abreast to tactics employed by Audit and the business units they review. Other duties include assuring that adequate resources and training are provided to staff, sufficient to ensure full compliance with all regulatory requirements.

Financial Control

This department of BAL is responsible for the all of the Bank’s fiscal operating results, such as cost accounting, budgets, regulatory agency and government reports ensuring the safeguard of Bank assets. The Financial Control Department also counsels senior management on fiscal control and profitability; prepares, presents and interprets financial reports to senior management; adheres to tax laws and regulatory compliance to properly reflect the financial position of the Bank.

Information & Communication Tech

The Information & Communication Department is responsible for the Bank’s electronic and cash management-based products and services, including the development, deployment and maintenance of Bank’s Internet web site; assists account and business development officers in the sales of related products and services. The department also performs direct supervisory duties of department staff; coordinates staff for coverage in all related areas of the department; ensures various department activities or projects run smoothly and efficiently.

Correspondence Banking: Bank Asia also engaged with Bilateral Key Exchange (BKE) with other international banks.

Working Environment:

Adequate priority is accorded to the health and safety of our employees, primarily through providing safeguards to branches with appropriate security arrangements, i.e. employment of both physical premises are under regulatory requirement to conduct periodic drills for a systematic approach both to prevent any security breaches and to promote a cultural security and safety awareness. This involves managing health and safety as any other critical business activity with periodic reporting, appraisals and improvements made. For more specific details, consult the Health and Safety Guidelines in bank’s Human Resource Department.

Environment

While conducting due diligences on credit facilities request, BAL will strive to ensure environmental issues are appraised with the same regard as any other business factors. To the extent deemed practical, BAL will raise and recommend compliance with local environmental laws to all its borrowing relationships. We firmly believe in long-term sustainable development and investment decisions will only be made when the bank is convinced, taking into account all relevant feedback, that any environmental impact will be minimal and that will not be more than what is necessary to achieve the ends.

Teamwork

Teamwork and cooperation is an important aspect of the work ethics in BAL. BAL leverages on the dynamics of their collective skills, knowledge and experience to achieve the best for their customers. BAL views its employees as its greatest asset and recognizes the pivotal role that meritocracy plays in setting rewards and penalties to safeguarding the interests of its employees. It respects the incidence of conflicts arising in the workplace and seeks the amicable resolution of continuous issues in a manner that is constructive, open, and honest and ultimate beneficial to al parties involved.

Diversity:

BAL respects employees as unique individuals with fundamental human rights and supports the cultural and ethnic diversity of its workforce. It is our belief that creating a work environment that enables us to attract, retain and fully engage diverse talents leads to enhanced innovation and creativity in their service. BAL takes all allegations of harassment seriously, including sexual, communal, etc and prohibits all forms of discrimination.

Handling Information:

Clear, honest and open communication is maintained in BAL to ensure full accountability, subject to business confidentiality. Any information not released to the public by Corporate Office communications is considered confidential and sensitive information and is handled on a “need-to-know basis that the job involved so requires in the organization.

Administration:

All employees are responsible for fully understanding and complying with BAL’s Code of Business Conduct. Violation of the Code is not tolerated and violators are subject to local laws where relevant, and may also face disciplinary action and dismissal. Additionally, Branch Managers and Executives at appropriate Department Head levels are required to record their acknowledgement and duly raising awareness of their reports, the values and principles of the Code of Conduct periodically.

CHAPTER-03

INTERNSHIP ROLE

&

LEARNING PART

3.1 Internship Role & Responsibilities

As an internee person I have some duties and responsibilities in Bank Asia which I had to do during the internee period.

3.1.1 General Banking (Front desk):

Check book issue.

Saving account/DPS from fill up

Register book of DPS, FDR, and LDS.

Account opening in the bank system (on line).

Pay-order issue and entry in register book

Cash:

Collection of shares from customers and put the serial number about seal return to the customer’s copy to them.

Cash register book maintain.

Clearing

Collection of cheques on behalf of its customer is one of the basic functions of a commercial bank.

Clearing stands mutual settlement of claims made in between member banks at an agreed time and place in respect of instruments drawn on each other

Responsibilities

Receiving and scrutinizing the cheque

Affixing the stamp

Scrutiny and receipt by the authorized officer

Returning the counter foil to the depositor

Scrutiny the deposit slip and cheque:

Date of cheque-( stale or post dated)

Crossing- general or special

Cheque no. amount

Drawee bank name( same or outward clearing station)

Amount in word and figure

3.1.2 Foreign Exchange:

New back-to-back L/C opening and register book maintaining.

Voucher making or issuing.

Amendment of L/C and register maintaining.

Acceptance of bill while bill received and maintaining register liabilities and voucher issuing.

Bill purchase and register maintaining.

Performance registers of export and import L/C maintaining.

Letter of Credit (L/C):

The duties, which I have done in foreign exchange, are as follows

New back-to-back L/C opening and register book maintaining.

Vouchers creating

Amendment of L/C and register maintaining.

Acceptance of bill while received and maintaining register liabilities and voucher issuing.

Bill purchase and register and voucher.

Liability registers maintaining.

Opening of Back-to-Back L/C:

Papers required at the time of opening an L/C

• Importer registration certificate.

• Trade license.

• IMP form

• Letter of credit authorization (LCA form).

• Pro-forma invoice indent/contract/purchase order.

• Credit report of the importer.

• Credit report of the seller should be collected form the correspondent bank.

• In case of F.O.B, C&F, insurance cover note.

• In case of quota item, quota allocation paper.

Then,

• Bank serves its L/C application form-affixing stamp, which acts as the contract between the importer and the opening bank.

• Importer submits the L/C application form along with pro-forma invoice/indent IMP, LCA, form duty signed.

• Bank realizes necessary margin and other charges from the importer at the time of opening of L/C.

• Necessary charge documents to be obtained from the imported duty signed.

3.2 Major Learning:

The students who are completing their internship at Bank Asia have no particular place to work. As a result of this all internee’s has to work new task everyday. At I worked in the foreign exchange department and then I worked in clearing section under the general banking department. Each and every time I had to ask for works to the officers. So I can say that most of the work I performed in the bank with my own initiatives. Although few works are specific for the internee’s as well.

CHAPTER-04

GENERAL BANKING &

FOREIGN EXCHANGE ACTIVITIES OF BANK ASIA LIMITED

(MOTIJHEEL BRANCH)

4.1.1 General Banking Activities

The function of general banking is directly related to client’s service. The banking service starts from here. To be a customer, a person has to go there. The general banking department performs mainly following tasks.

1. Cash Management

2. Customer Service

3. Clearing

4. Accounts Department

4.1.2 Cash Management

Bank’s one of the main function is the collection of deposit from public. Bank’s goodwill to the mass people heavily depends on quick and prompt service of this department.

4.1.3 Cash Department and its Structure

Strong Room /Vault- Under dual Controlled

Cash keeping safe vault that is under dual Controlled

well protected safe area

Cash in charge

Teller

Cash department normally in a separate enclosure where there is no free access of the staff of other department and outsiders. This department is directly dealing with clients.

4.1.4 Register and records of cash department

Daily cash balance book

Vault key register

Cash transit register

Teller’s cash proof

4.1.5 Functions of cash department

Following points have to take into consideration for receiving cash

1. Deposit slip is properly filled in

2. Denomination of cash to be mentioned in the deposit slip

3. The of the account and account number is correct

4. Words and figure is correct

5. Both the copy of deposit slip is in order

6. Depositor signature is in the slip

7. Depositor slip must be signed by the teller and counter signed by the cash in charge

8. Receive seal in the slip

Following points have to take into consideration for payment of a cheque

1. Date (stale or post dated)

2. Words and figure of the cheque is identical

3. Crossed or open cheque and bearer or order cheque

4. Genuineness of signature is verified

5. Balance of the account is available

6. Cheque leaf is genuine

7. Legal bar e.g. notice of death, Garnishee order

8. Stop payment

9. Account is debited and payment has to be made in good faith and without negligence

10. Denomination is mentioned in the reverse side of the cheque

4.1.6 Others functions of cash department

Receiving the Grameen Phone, Citycell, Rangstel bill

Change of mutilated notes as per guide line of the Bangladesh Bank

Receiving admission fee of different universities as per arrangement

It is mentionable that there is a vault limit in each and every branch. Excess amount have to send to the principal branch. Vault limit amount as well as counter limit amount must be insured policy.

4.1.7 Customer service Department:

This department is comparatively a new department in the contemporary banks. An efficient CRD can give a bank or a branch an extra edge against the competitor banks. The main reason to set up Customer service department is to maintain interaction with the existing and potential customers. Customer service determines the level of long-term success in business. It helps a company in maintaining current customers, as well as gaining new customers. I have worked in customer service department of Motijheel Branch. Form this department I have learnt – To retain good relation with the customer a banker should careful about the following things

Customers are the reason for the work

Warm and friendly responses

Customer wants to feel important

Listen the customer requirements

Apologize to him for doing any mistake

Say “No” positively

Keeping cool when customer gets hot

Although bank is always customer focused and try to gain new prospective customers, one more thing should be kept in mind, which is the Money Laundering Case. As a result of money laundering activities in Bangladesh, the government is annually losing a huge sum of revenue. At the same time the laundering activity is distorting the market mechanism & competitive economy in the country. In order to curb down money laundering activities, Bangladesh bank now a day enforces some additional rules in case of opening new account.

As a responsible scheduled Bank Asia’s officials also tactfully investigate any possible presence of money laundering case while dealing customers in the CRD department. Officials have been trained to trace out money laundering cases. Anyway, during my training I could trace the following key functions that are done in CRD.-

Key Functions:

Before creating a customer relationship a primary level screening should be accomplished

Opening of new account or close of account

Transfer of account

Selling newly introduced bank products to the existing client or new client

Counseling

Up to date existing customer information

Issue ATM card

Issue Pay order, DD or TT

The Customer Service Department is responsible to promote the following products and services (presented here with current offer rates) of the bank –

4.1.8 Products & Services:

Bank Asia is a new entrant in the private banking sector of Bangladesh. It is committed to provide flexible services to its customers for their maximum benefit & higher satisfaction. Gradually Bank Asia increases its product list for our valuable customers we are offering some products & schemes mentioned below-

Savings account Foreign Currency account

DPS- Deposit Pension Scheme Current account

MB+ FDR

STD- short term deposit DB+

Since establish, its product list is healthy and includes most features. Whenever, the bank launches a product, it looks deeply in its technical issue & acceptance to the general public

Features of the Products & Schemes:

4.1.8.1 Savings Account:

Interest bearing account

Provide reasonable interest. Rate is now- 8 %

Customer can Deposit any amount & no. of deposit is not restricted

No. of withdrawal is restricted

Deposit below tk15000.00 charges tk100.00 on half yearly basis

Better for the small income group

4.1.8.2 Current Account:

Non interest bearing account

Running account

No. of withdrawal or deposit is not restricted

Operated any no. of times during a working day

Generally run by different business organization

4.1.8.3 FDR (Fixed Deposit Receipt):

Provide high interest

Premature encashment provides only savings rate

It is renewable before the date of maturity.

Tenor | 2 months | 3 months | 6 months | 1 year |

Rate | 9.5% | 9.5% | 9.5% | 8.5% |

4.1.8.4 Deposit Pension Scheme (DPS):

- To get the scheme client have to maintain an account with the bank

- Deposit monthly installment and on maturity receive a handsome amount

Monthly Installment | Tk. 500.00 | Tk. 1000.00 | Tk.3000.00 | Tk. 5000.00 |

Tenor | Amount Payable on Maturity | |||

3 years 5 years 10 years | 21000.00 37500.00 92500.00 | 42000.00 75000.00 185000.00 | 126000.00 225000.00 555000.00 | 210000.00 375000.00 925000.00 |

4.1.8.5 Double Benefit plus (DB+):

It is a 7 years scheme and client’s deposit will be double in 7 years

- Its not necessary to maintain an account with the bank

- Minimum initial deposit is Tk.100000.00

- If client go for the premature encashment then the applicable interest will be savings interest rate

- If premature encashment will be less than 6 months the client will not get any interest

4.1.8.6 Monthly Benefit plus (MB+):

- It is a deposit scheme, which provides a monthly benefit to its customer.

- To get the benefit Client has to maintain an account with the bank

- It has 5 years tenor

- Client can open more than one account for different size at any branch of the bank

- If client go for the premature encashment then the applicable interest will be savings interest rate

- If premature encashment will be less than 6 months the client will not get any interest.

- Monthly interest is transferred automatically to the savings account.

Deposit Amount(in Tk) | Monthly Interest Amount (in Tk.) |

100,000.00 200,000.00 300,000.00 400,000.00 & above | 850.00 1,700.00 2,550.00 3,400.00 & onward |

4.1.9 Foreign Currency Account:

Two types of account:

- RFCD- Any resident who is going abroad for traveling can be able to open this account. If the deposit amount is above $5000 then he or she has to show the source of the income.

- NFCD- Any non resident can open this account. Here he can authorize anyone to operate the account in the country. Before opening this type of account he has to submit the employer’s certificate or driving license as a proven of work permission of that country where he is living in addition to the other documents required for savings account. Any amount of fund can be deposited here.

4.1.10 Necessary Information for Opening of Deposit Account:

4.1.10.1 Account for an Individual or in Joint name

In this regard following documents are required-

Account Opening Form and Specimen Signature Card – it should be properly filled in & signed by the applicant and the authorized person of the bank

Two copies of Passport size photographs attested by the introducer

Photocopy of Passport ( attested) or certificate issued by ward commissioner or letter of introduction by the employer

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

4.1.10.2 Account for Sole Proprietorship concern

For opening this sort of account bank requires following

Account Opening Form and Specimen Signature Card – it should be properly filled in & signed by the applicant and the authorized person of the bank

Two copies of Passport size photographs attested by the introducer

Photocopy of Passport (attested) or certificate issued by ward commissioner or certificate issued by the Chairman of Union Parishad

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

Valid Trade License

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

Valid Trade License

4.1.10.3 Account for Partnership Firm

Account Opening Form and Specimen Signature Card – it should be properly filled in & signed by the applicant and the authorized person of the bank

Two copies of Passport size photographs of each of the partners of the partnership firm attested by the introducer

Photocopy of Passport (attested) of the partners or certificate issued by ward commissioner or certificate issued by the Chairman of Union Parishad

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

Valid Trade License

Partnership deed

4.1.10.4 Account for Limited Companies

Account Opening Form and Specimen Signature Card – it should be properly filled in & signed by the applicant and the authorized person of the bank

Two copies of Passport size photographs of each of the signatories of the account attested by the introducer

Photocopy of Passport (attested) of the signatories

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

Valid Trade License

Certified copy of Memorandum and Article of Association

Certified copy of incorporation

Certified copy of commencement of business (in case of Public ltd. Co.)

Resolution of the Board of Directors authorizing for opening an account with the bank

Resolution of the Board authorizing specific signature of signatories to operate the account

List of Directors of the co.

Latest Audited B/S

4.1.10.5 Account for Co-operative society / Club

Account Opening Form and Specimen Signature Card – it should be properly filled in & signed by the applicant and the authorized person of the bank

Two copies of Passport size photographs attested by the introducer

Photocopy of Passport (attested) or certificate issued by ward commissioner or letter of introduction by the employer

TIN certificate

Customer Transaction Profile Form

KYC profile form properly filled in and signed

Certified by laws by the Cooperative Officer

Certificate of registration

Resolution for opening account

Resolution of the committee authorizing specific signatories to operate the account

List and particulars of office bearers.

In all above cases Applicant should be introduced by an Account holder of bank or by a respectable person accepted to the bank..

4.1.11 Clearing

Collection of cheques on behalf of its customer is one of the basic functions of a commercial bank. Clearing stands mutual settlement of claims made in between member banks at an agreed time and place in respect of instruments drawn on each other

4.1.11.1 Types of clearing

Outward clearing: When a particular branch receives instrument drawn on the other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch.

Inward clearing: When a particular branch receives instrument whice drawn on them and sent by other member bank for collection are treated as Inward clearing.

4.1.11.2 The Clearing house

Clearing house is where bank receivable and obligations are settled. A particular house under supervision of central bank where representative of all bank meet together for settlement of their banks receivable and payables.

Common procedure for all kind of instrument

Receiving and scrutinizing the cheque

Affixing the stamp

Scrutiny and receipt by the authorized officer

Returning the counter foil to the depositor

Scrutiny the deposit slip and cheque:

Date of cheque-( stale or post dated)

crossing- general or special

cheque no. amount

drawee bank name( same or outward clearing station)

amount in word and figure

Process flow chart for in ward clearing

Receipt the instrument from messenger

Scrutiny the instrument and tallying the amount of the schedule and that of the instrument

Sending the instrument to respective department

Preparation of reason memo if any dishonor cheque

Sent the dishonor cheque to principal branch

Filling the statement in the respective file

Posting the IBCA

Process flow chart for in ward clearing

Receipt the instrument with the paying in slip

Scrutiny of the instrument and paying in slip & affixing received seal

Affixing special crossing endorsement and clearing seal

Return of the counterfoil to the depositor with seal and signature

Separation of the instrument from the paying in slip

Posting in the nikash software

Classification of the instrument first bank wise and then branch wise

Check the total amount in validation sheet

Sending the instrument to principal branch

4.1.12 Accounts Department

Basic duties and responsibilities:

Internal Control.

Expenditure control.

Establishment.

Reconciliation of accounts.

Checking and balancing.

Day to day activities:

Day begin and end: At the beginning of every day, day must be opened in the Stelar banking system. If it is not done no transactions of the day cannot

Reporting (external and internal).

Expenditure control and budgeting.

4.2 Foreign Exchange Activities

4.2.1 Letter of Credit

Letter of Credit is a guarantee or undertaking or commitment to the beneficiary/exporter for making payment issued by the issuing bank on behalf of the importer upon fulfillment of some conditions. As distance involved in international trade, buyers and sellers do not know each other. It is difficult for both the buyers and seller to appreciate each others’ integrity and credit worthiness. By opening a Letter of Credit on behalf of buyer in favor of seller, commercial banks like BAL undertake to make payments to a seller subject to submission of documents drawn on in strictly compliance with Letter of Credit terms giving title of goods to the buyer. It is a conditional guarantee. The Letter of Credit thus constitutes one of the most important methods of financing foreign trade.

In the Import Policy Order 2003-2006 Letter of Credit denoted as – ‘“Letter of Credit” means a letter of credit opened for the purpose of import under this Order’

4.2.2 Types of letter of Credit

Revocable and Irrevocable:

The revocable credit is one which can be revoked without the concurrence of the beneficiary. The irrevocable credit is one which cannot be revoked amended, or modified by the issuing bank without the concurrence of the beneficiary or any other interested party including the confirming bank.

Confirmed and unconfirmed credit:

In the case of confirmed credit, the beneficiary receives a credit confirmed by a bank in his own country. The confirmation constitutes a definite and legal undertaking that confirming bank will honor the payment or acceptance on presentation of stipulated document. In the case of unconfirmed credit the advising bank just advises the credit stating in the forwarding letter that it is not confirming the credit.

Back To Back Credit:

It is a secondary credit opened by a bank on behalf of the beneficiary of an original credit. The amount of back to back credit must not exceed the amount of original

Deferred payment L/C :

The issuing bank undertakes to make payment against such type of L/C at a future date e.g. 60/90/180days after receipt of order document.

4.2.3 The Letter of Credit (L/C) Process

The various steps involved in the operation of a letter of credit are described as follows. Please refer to Figure below for an elaborate illustration.

The importer and exporter have made a contract before a letter of credit has been issued.

The importer applies for a letter of credit from his banker known as the issuing bank. He may have to use his credit lines.

The issuing bank opens the letter of credit that is channeled through its overseas correspondent bank, known as the advising bank.

The advising bank informs the exporter (the beneficiary) of the arrival of the letter of credit.

Exporter ships the goods to the importer or other designated place as stipulated in the letter of credit.

Meanwhile, the exporter also prepares his own documents and collects transport documents or other documents from relevant parties. All these documents will be sent to his banker, which is acting as the negotiating bank.

Negotiation of export bills happens when the banker agrees to provide him with finance. In such case, he obtains payment immediately upon presentation of documents. If not, the documents will be sent to the issuing bank for payment or on an approval basis as in the next step.

Documents are sent to the issuing bank (or reimbursing bank, which is a bank nominated by the issuing bank to honor reimbursement from negotiating bank) for reimbursement or payment.

Issuing bank honors its undertaking to pay the negotiating bank on condition that the documents comply with the letter of credit terms and conditions.

Issuing bank releases documents to the importer when the latter makes payment to the former or against the latter’s trust receipt facility.

The importer takes delivery of goods upon presentation of the transport (usually shipping) documents.

4.2.4 Parties Involved in Letter Of Credit (L/C)

The Applicant: The applicant is the party who approaches a bank in order to issue the letter of credit. Generally, the applicant is an importer who reaches an agreement with the exporter before approaching the bank to issue the letter of credit. The applicant is also normally obligated to reimburse the issuing bank for any payments made under the letter of credit.

The Issuing Bank: The bank issuing the letter of credit is known as the issuing bank and it is usually the bank with which the importer maintains an account. The issuing bank undertakes an absolute obligation to pay upon presentation of documents drawn in strict conformity with the terms and conditions of the letter of credit.

The Advising Bank: The correspondent bank in the beneficiary’s country to which the issuing bank sends the letter of credit is commonly referred to as the advising bank. The advising bank simply advises the letter of credit without any obligation on its part. However, the advising bank shall take reasonable care to check the apparent authenticity of the credit that it advises.

The Beneficiary: The beneficiary or exporter is the party entitled to draw payment under the letter of credit. The beneficiary will have to present the required documents to avail payment under the letter of credit.

The Confirming Bank: The confirming bank confirms that the issuing bank has issued a letter of credit. The confirming bank becomes directly obligated on the credit to the extent of its confirmation and by confirming, it acquires the rights and obligations of an issuer. Letter of credit confirmation is usually done by the advising bank or a third bank in the beneficiary’s locate

The Negotiating Bank: The bank that agrees to examine the documents under the letter of credit and pay the beneficiary is called the negotiating bank. Typically, the advising bank is nominated as the negotiating bank.

Reimbursing Bank: The bank nominated by the issuing bank to provide reimbursement to the negotiating bank or the payee bank is referred to as the reimbursing bank.

4.2.5 Documents against Letter of Credit:

Import document usually consists of………..

Bill of Lading

Bill of lading is the cardinal document against an import LC. It is a document of title to goods evidencing its dispatch from the exporting to the importing country. The B/L issued by the shipping company facilitates negotiation of documents. Through it the exporter ensures:

It is clean

It evidence that the consignment is on board and that bears the date of shipment not after the stipulated date.

It must state the position with regard to how and who has paid or would pay the freight

It must indicate the port of loading and the name of the port of destination.

It must not indicate transshipment unless the terms authorizes to do so

It must bear the description of goods, marks, numbers, gross and net- weights. LC number should also be correctly mentioned

It must not be stale

The name of the beneficiary should appear below the name of the shipper with prefix account

Bill of exchange:

A bill of exchange is an instruction by the exporter (drawer) to the importer or the importer’s bank to make payment of the amount mentioned in it.

A bill of exchange is a negotiable instrument and is governed by the Negotiable Instruments Act.

Its date must not be prior to the date of shipment or subsequent to the date of presentation.

Its value must correspond to the value of the invoice and must not exceed the L/C amount.

It must be drawn to the order of a bank.

Invoices

Various types of invoices are required in L/C. Brief descriptions of those invoices are given below:

Commercial Invoice

A commercial invoice is a statement containing full details of the goods sipped. The general contents of a commercial invoice used in foreign trade are:

Names and addresses of the seller and buyer;

Details of goods shipped-quantity, quality, description and value;

Packing details and packing marks;

Price and amount payable by the buyer;

Terms of trade-FOB, CFR OR CIF, etc;

Details of freight charges, insurance premia and other chargers;

Reference to the sale contract in fulfillment of which the shipment is made;

Name of the vessel in which the goods are shipped; and

Reference to the license number under which the import is made.

Proforma Invoice

A proforma invoice contains all the particulars in a commercial invoice. It is distinguished from the commercial invoice by the words ‘proforma invoice’ appearing on it. It does not evidence a sale. The proforma invoice may be required in the following cases:

It may be the basis of which the contract of sale is concluded later.

When the goods are sent on consignment basis, a proforma invoice may be used since the goods are only sent to an agent of the seller; it serves as a guide as to the price at which the agent should sell the goods.

Certificate of Origin

A certificate of origin declares the place of actual manufacture or the growth of the goods. A country may place restrictions on imports from certain countries. Or, preferential treatment may be accorded in tariff for imports from certain countries. For both these purposes, certificate of origin becomes necessary. Usually such certificates are issued by the chambers of commerce or trade associations in the exporting countries.

Packing List

This document contains full particular of consignment viz- number of bales, price or packages, net and gross weight of each unit, Shipping mark eyc.which enables the buyer and the shipping company to readily identify and collect the goods.

4.2.6 Issuing the Letter of Credit for Imports

In this stage, the issuing banks have to fills the bank-specified-form for issuing Letter of Credit. A Letter of Credit should contain the following information and terms and conditions:

Charges (Minimum 15% Margin)

Insurance documents, cover note, policy no.

Country of origin of goods

Currency and amount

Date and place of the expiry of the Documentary Credits ;

Description of goods and quantity ;

Documents required for negotiation;

Instruction for negotiating bank;

Last date of shipment;

Letter of Credit Authorization (LCA) number, IRC (Import Registration Certificate) number and Harmonized System (HS) code;

Mode of Carrying –Air/Ship/Truck;

Name and address of beneficiary ;

Name and address of the advising bank;

Name and address of the applicant;

Name of the issuing Bank and Branch;

Negotiating bank preferably freely negotiable in any bank;

Number of Letter of Credit and date of opening ;

Payment Term-Sight

Period of Negotiation

Period of presentation

Port of Loading and port of Discharge;

Reimbursing Bank and payment mode;

Terms and conditions regarding Transshipment and Partial Shipment

CHAPTER-05

ANALYSIS & FINDINGS

5.1 Analysis of the Bank’s Branch performance [Motijheel Branch] from 1st April 2009 to 1st July 2009

As I was an internee of that Branch, I tried to analysis the performance of the Branch of those 03 Months. By collecting their data of those three months, According to my view point in that time the Branch performance was better efficient and effectively than another months of the year. The records are shown here as follows

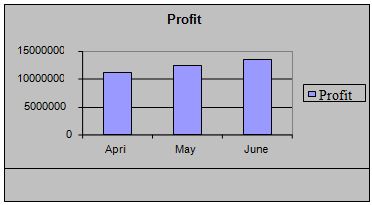

Profit

Month | Amount |

April | 11245789 |

May | 12545678 |

June | 13525423 |

Total | 37316890 |

The Profit of the Bank in the month of April, May, and June is increasing month by month which is well to do for the Branch. According on this information the graphical presentation is as follows

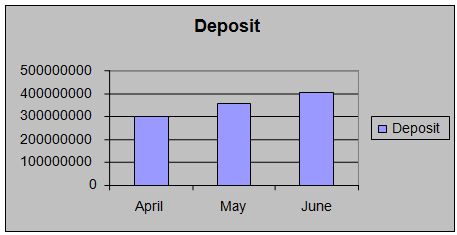

Deposit

Month | Amount |

April | 300326456 |

May | 353556987 |

June | 404065789 |

Total | 1057949232 |

If the Branch has more deposit, it will get more benefited to apply its performance. The last three month its deposited amount was increasing gradually. According on this information the graphical presentation is as follows

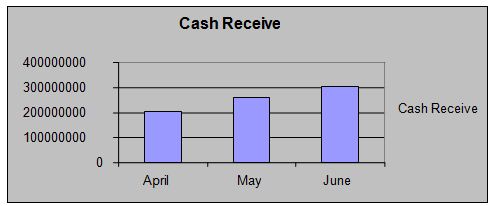

Cash Receive

Month | Amount |

April | 200106745 |

May | 261078123 |

June | 304565258 |

Total | 765750126 |

Because of having more customers the Branch’s cash receive was too much high per month. According on this information the graphical presentation is as follows

Cash Payment

Month | Amount |

April | 351425456 |

May | 404578159 |

June | 456545753 |

Total | 1212549368 |

The Branch always ready to pay money to their customer as it did well last three months. The amount of cash payment was moderate and efficient. According on this information the graphical presentation is as follows

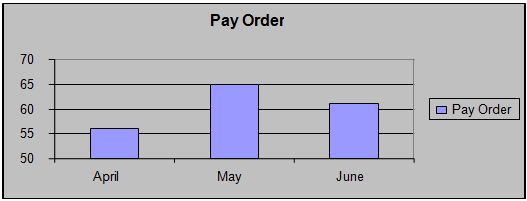

Pay Order

Month | Number |

April | 56 |

May | 65 |

June | 61 |

Total | 182 |

In every pay order Bank charge an amount so more number of pay orders is very essential for achieving profit to the Branch.

Month Number

April 58

May 69

June 76

Total 203

The number of current account leads the total number of customers of the Bank and last three month the amount of opening account was sufficient. According on this information the graphical presentation is as follows

Saving Account

Month Number

April 65

May 71

June 81

Total 217

The number of savings account also leads the total number of customers of the Bank and last three month the amount of opening saving account was sufficient. According on this information the graphical presentation is as follows

Fixed Deposit

Month Number

April 25

May 39

June 31

Total 96

The last three months the number of fixed deposit is more effective then any other month of the year and it make easy for Branch to lend money to the customers

Short term Deposit

Month Number

April 26

May 21

June 35

Total 82

The number of Short term deposit increase the total amount of deposit of the Bank and last three month the amount of opening STD was sufficient. According on this information the graphical presentation is as follows

Special Saving Scheme

Month Number

April 35

May 60

June 52

Total 147

The number of Special Saving Scheme increase the total amount of deposit of the Bank and last three month the amount of opening SSS was sufficient. According on this information the graphical presentation is as follows

Cheque Book Issue

Month Number

April 78

May 105

June 123

Total 306

There are so many customer in the Branch so they always need to issue the cheque book and the Branch did very well for the last month by increasing gradually. According on this information the graphical presentation is as follows

L/C opining

Month Number

April 34

May 39

June 36

Total 109

Bank gets a lot of profit by charging the L/C opening so the number of L/C open was so much handsome in the last three months. According on this information the graphical presentation is as follows

All the information has collected from the Motijheel Branch Manager of Bank Asia

5.2 SWOT Analysis of Bank Asia (Motijheel Branch):

I have done my internship program at Motijheel branch of Bank Asia. As every organization has its strength. Weakness, opportunity & threats like this if we think Motijheel Branch individually as a particular organization it also has its own strength, weakness, opportunity & threats. At the period of working in this branch I have find out the SWOT analysis of Motijheel Branch, which is as follows.

STRENGHT:

• As it is a commercial area various shopping centers, different types of organization are grown up here. All the business people come here to get quick banking service for their daily transaction

• The management of Motijheel branch is a big strength. The rule of the branch is very strict. There is also good and clean relationship with the manager and employees.

• The employees are the big and important part of the bank. The employees always ready to work in pressure. They always try to make their clients happy by giving quick and right service.

• The performance of Motijheel branch is also a matter of remarkable. Every year Motijheel branch can make profit up to their given target.

WEAKNESS:

• The place and the scope of the branch are very conservative. There is not sufficient space that the employees can work freely. The employees cannot even get that much space that they needed.

• Most of the employees are efficient but some of them do not work efficiently as the other one and some time they crash on clients which are not good sign of a good employee.

• There is not any parking place to park the car of the clients.

OPPORTUNITY:

• Motijheel is comparatively busy place. It is a business area, many new shopping malls, supper market are growing up here day by day and they needed the banking facilities every day for their daily transaction. This is a great opportunity for Bank Asia Ltd. (Motijheel Branch) if it can provide good service to the customer.

THREAT:

• In the same place there is another all private bank which competition of Bank Asia Ltd, may become a threat for it

• Dutch Bangla Bank has large amount of ATM booth, as a result customer get much better facilities rather then Bank Asia. So to compete with the DBBL, the management should make proper decision increase the ATM both to ensure the better customer service.

CHAPTER-06

CONCLUSION

&

RECOMMENDATIONS

6.1 Conclusion:

Over the last decade, the foreign Exchange Market has become more diverse as well as much larger. In addition, the size of the foreign exchange market has grown as the economy has continued to globalize. This report is an empirical study on Foreign Exchange and General banking at Bank Asia Limited. It is well position to meet the challenges of 2008 and will continue to strive to innovative and capture opportunity for growth and value creation. In the present situation world surviving a commercial age

Banks are working as a medium to help people doing business. On the other hand no country is self sufficient. One country can’t produce all the things they need for consumption. They have to depend upon other countries to meet these requirements. They import goods which they can’t produce and export those, which are in abundance in their country. Most of the cases the exporter and importer don’t know each other. Then they need someone who will be undertaking the responsibility for the payment of these transactions. Commercial Bank then come ahead to help them in this situation by issuing the L/C (letter of Credit) for the importers

It seemed to me that the bank have a large amount of deposit but not encouraging the large scale producers that much for long term industrial loan to accelerate the economy as well as to help the economy to solve unemployment problem. Bank Asia Ltd started with a vision to be the most efficient financial intermediary in the country and it believes that the say is not far off when it will reach its desired goal. Bank Asia Ltd. looks forward to a new horizon with a distinctive mission to become a highly competitive modern and transparent institution compellable to any of its kind at home an abroad.

This report is an empirical study on General Banking & Foreign Exchange activities of Bank Asia. Though they have some lacking but it is well position to meet the challenges of 2009 and will continue to strive to innovative and capture opportunity for growth and value creation. The last Bank Asia audit gives them positive result in spite of having some gaps and discrepancy in between the loyal customer and employees of the bank. Bank gives more facilities to their loyal customer by ignoring some rules but this is not yet good for bank so they should try to avoid it They explain it as a practice of banking policy. They do it for better customer service through a little considering.

Otherwise the performance of the branch is very efficient and effective

6.2 Recommendation:

After a complete analysis and realization of the BAL, performance appraisal, some facts and recommendation can be taken into account for a relatively meaningful and precise application of the BAL performance development

• The bank should encourage and provide the large scale producers a significant amount of long term industrial loans to accelerate the economy as well as to help the economy to solve unemployment problem.

• Bank Aisa Limited should consider not only increasing the number of corporate loans but also thinks about swelling both SEM and consumer loans. Among the three categories of loans, SEM loan could be given most preference, as this is a booming sector now a day.

• Division of the labor, job rotation and job specification should be combined rationally to achieve the standard level of performance of the personnel to reduce the customer waiting time for the desired service.

• Top management of Bank Asia Limited should conduct comprehensive study or survey on the branch performance, its management and their motivation as well. The marking department also should be enthusiastic with their new idea and strategies.

• As a department private bank, Bank Asia should have the scope of customized services for their clients or customers.