1.1 Background of the report

The MBA internship program is a required course for the students who are post graduating from the Human resource management of ASA UniversityBangladesh. It is a 6 credit hour course with duration of 12 weeks. Students who have completed all the required courses are eligible for this course.

In the internship program, I was attached of my organization named ‘Agrani Bank Ltd.. During this time I learned and focused how my organization works with the help of the internal supervisor. As a result I have decided to make a report on “Human Resource Management Practices of Agrani Bank Ltd.”. Agrami Bank Ltd is the leading nationalized bank in this country. To maintain its leading position in the Bangladesh, Agrani Bank Ltd. is always keen to develop long-term beneficial relationship with trustworthy clients. To achieve this end, they have always upgraded their approaches to achieve profitability.

The report on “Human Resource Management Practices of Agrani Bank Ltd.”. was initiated as part of the Internship Program, which is a MBA Degree requirement of the Faculty of Business, ASA University Bangladesh (ASAUB). The report is being submitted to Dr. Abdul Awal Khan Dean, Faculty of Business ASA University Bangladesh. Since the MBA program is an integrated, practical and theoretical method of learning, the students of this program are required to have practical exposure in any kind of business organization as last term of this Program.

1.2 OBJECTIVE OF THE STUDY

As a partial fulfillment of the Master’s of Business Administration internship is a requirement at the end of the completion of all the credit courses. The main purpose is to be familiar with the real world situation and practical experience in a business firm. Commercial bank, especially Private Bank is one of the important business sectors in Bangladesh. Agrani Bank Limited is a scheduled commercial bank in the govt. sector, which is focused on the established and emerging markets of Bangladesh. The purpose of this study is to earn a real life practical experience on Banking System.

The study mainly conducted with the following objectives:

- To understand how important Commercial Banks are in the functioning of a modern economy and financial system

- To see how the commercial are regulated

- To be able to read and understand bank financial statements and grasp how banks create and destroy money

- To see how to generate the credit division along with general banking system.

Analysis Objective

Broad Objective

To analyze the present “HRM PRACTICE” of Agrani Bank Limited.

Specific objective

- To determine the steps involved with HRM.

- To determine the roles of HRM.

- To identify the type of system is in HRM.

- To forecast the effectiveness of HRM.

Hypothesis & Assumptions

- Political situation is more or less stable.

- All staffs are involved with HRM.

- There are certain rules and regulations for HRM.

- There is a great demand for Agrani Bank Limited.

Benefits of the Study

- It will help to find out the “HRM Practice” of Agrani Bank Limited.

- The study will help to develop models & apply them effectively in HRM system.

- The study will help us to identify the type of problems that the companies usually face & it will overcome the problems.

Sources of Data

The sources of data or information are divided into two parts that are; primary and secondary sources.

(I) Primary Data

In the primary source, data are collected directly from interviewing their employees and other related personnel. According to the oral communication to determine the responding factors that are extremely related with “HRM System”.

Primary Sources:

- Officials Records of Agrani Bank Ltd (ABL)

- Face-to-Face interview with the respective personnel

(II) Secondary Data

In the secondary source, different textbooks and journals relating to the theoretical frame work of the project was accessed to define and to determine “HRM Syatem”. Moreover, annual reports, company projects profile, related preserved data, financial statements, internet browse and brochure had been collected from the Agrani Bank Limited.

- Secondary Sources:

- Research, brochures, and various publications of Agrani Bank Ltd.

- Annual report, Official data book, Internet.

Study Period

18,March -17 Jun 2009

1.3 LIMITATIONS:

The objective of this study is to earn real life practical experience in Banking System. It requires long time to acquire to the real experience. Time limitation is the main constrain in this respect. The lack of available of data is another limitation. Maximum of banking activity are practical. . Just reading the manual is not enough. To earn such practical experience, it requires working with those events.

The main limitations are as:

- Time constrain

- Banking employees are very busy. Sometimes it seems hard to get their attention

- Lack of published relevant documents

- Some information is confidential-not open to public.

- Lack of website information to reach on any nice ending.

- Facing hassle also to make communication with employees of the organization.

- Within this limited period it is a bit tough to track all the facts accurately.

1.4 METHODOLOGY

The study methodology included observation of their work procedure, analysis of their information input forms and their output documents, face-to-face communication with the clients, interviews of relevant ABL officials.

HRM system is indeed a tough job to find out. Because several people are involved with this process and they differ from each other by their perception, experience, interest etc. With this process, there is another part; the part is known as “Management”, what is a healthy organization from employee’s point of view.

By preparing this paper we have to find out:

- The steps involved with HRM.

- Biasness towards the HRM.

- Types of System.

- Priority in Management.

- Importance in organization.

All types of related things would be revived this project paper to visualize the current phenomenon.

1.5 Ethics & Social Responsibilities:

An organization cannot move alone. Organization needs people to generate its activities & people needs organization to get some kind of services. Agrani Bank is an organization that is concerned to maximize its profit along with maintaining some kind of social responsibilities. It is fully devoted to fulfill the needs for its customer’s satisfaction as well as it is involved socio-economic development activities.

2.1 HISTORY OF BANKING SYSTEM AT BANGLADESH

The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi interests and three by foreigners other than West Pakistanis. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of Pakistan as the central bank and renamed it the Bangladesh Bank. The bank was responsible for regulating currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves.

The Bangladesh government initially nationalized the entire domestic banking system and proceeded to reorganize and rename the various banks. Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds. Cooperative credit systems and postal savings offices handled service to small individual and rural accounts. The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances.

The government’s encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between 1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent.

The transformation of finance priorities has brought with it problems in administration. No sound project-appraisal system was in place to identify viable borrowers and projects. Lending institutions did not have adequate autonomy to choose borrowers and projects and were often instructed by the political authorities. In addition, the incentive system for the banks stressed disbursements rather than recoveries, and the accounting and debt collection systems were inadequate to deal with the problems of loan recovery. It became more common for borrowers to default on loans than to repay them; the lending system was simply disbursing grant assistance to private individuals who qualified for loans more for political than for economic reasons. The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take firmer action to strengthen internal bank management and credit discipline. As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and Banking recommended broad structural changes in Bangladesh’s system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987.

2.2 Banking In Bangladesh

WHAT IS A BANK ?

A Bank is known by the functions it discharges. It may be defined only by stating what it performs.

Sir John Paget says, that no person or body, corporate or otherwise, can be a banker who does not (a) take deposit accounts (b) take current accounts, (c) issue and pay cheques and (d) collect cheques, crossed and uncrossed, for his customer.

Section 5 of the Bank Company Act, 1991 defines banking as the Accepting, for the purpose of lending or investment, of deposits of money from the public repayable on demand or otherwise and withdrawal by cheque, draft, order or, otherwise. The Act further provides that a banking company which transacts the business of banking must add the words Bank/Banking/Banker after its name.

What is Scheduled and Non-Scheduled Bank ? :

Banks may be divided into scheduled banks and non-scheduled banks. Banks having paid up capital and reserves of Tk.______ and whose names have been enlisted by the Bangladesh Bank in their approved list of banks are called Scheduled Banks. There are at present _____ scheduled banks in Bangladesh:

Commercial Banks:

Nationalised banks: 3

Sonali Bank, Agrani Bank, Janata Bank.

Foreign Banks: 7

ANZ Grindlays Bank, Standard Chartered Bank, American Express Bank, Habib Bank Ltd., State Bank of India, Banque Indosuez, National Bank of Pakistan, ..

b) Development Banks: 4

Bangladesh Shilpa Bank, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, Bank of Small Industries and Commerce (BD) Ltd.

c) Private Commercial Banks: 23

Bangladeshi ownership: 20

. Pubali Bank Ltd., Agrani Bank Ltd., Arab Bangladesh Bank Ltd., United Commercial Bank Ltd., The City Bank Ltd., IFIC Bank Ltd., National Bank Ltd., Eastern Bank Ltd., NCCBL.,., Dhaka Bank Ltd., Premier Bank Ltd., Prime Bank Ltd., Standard Bank Ltd., The Bank One Limited, EXIM Bank Ltd., Trust Bank Ltd., First Security Bank Ltd., The Bank of Asia Ltd.,

Jointly owned by foreigners and Bangladeshis: 3

Islamic Bank (Bangladesh) Ltd., Al-Baraka Bank (Bangladesh) Ltd., Agrani Bank Ltd.,

Besides there are a number of Co-operative banks which may be termed as non-scheduled banks. Other financial institutions:

e) Besides the aforesaid commercial banks and specialized banks we have got two other financial institutions which perform in fact development by industries in the country. These are: Bangladesh Shilpa Rin Sangstha (renamed as Development Bank Ltd.), Investment Corporation of Bangladesh(ICB).

2.3 Establishment and status of the Bank:

Agrani Bank Limited has been incorporated as a Public Limited Company on May 17, 2007 vide Joint Stock Companies and Firms’ certificate of incorporation No. E-66888 (4280)/07. The bank has taken over the business alongside assets, liabilities, rights and obligations of the former Agrani Bank (emerged as a Nationalized ) Commercial Bank in 1972, pursuant to the Bangladesh Bank (Nationalization) order No. 1972 (P.O. No.-26 of 1972) on a going concern basis through a Vendors Agreement signed between the Ministry of Finance, Government of the People’s Republic of Bangladesh on behalf of the former Agrani Bank and the Board of Directors of the Bank on behalf of Agrani Bank Limited on November 15,2007 with retrospective effect from 10 july,2007.

The Bank’s entire shares are held by the Government of the People’s Republic of Bangladesh and 07 other shareholders nominated by the Government. The Bank has 866 branches as on 31, December, 2007 with no overseas branch. The Bank has, however, two wholly-owned subsidiary companies named Agrani Exchange House (pvt.) Limited in Singapore and Agrani Remittance House SDN, BHD in Kuala Lumpur, Malaysia.

A BRIEF OVERVIEW

Agrani Bank Limited, a leading commercial bank with 867 outlets strategically located in almost all the commercial areas throughout Bangladesh, overseas Exchange Houses and hundreds of overseas Correspondents, came into being in 1972 immediately after the emergence of Bangladesh as an independent state. It started functioning as nationalized commercial bank taking over assets and liabilities of the erst while Habib Bank ltd and commerce Bank ltd. functioning in the East Pakistan.

It has been corporatised on 15th November.2007 and emerged as Agrani Bank Limited (ABL) taking over assets, liabilityand goodwill of Agrani Bank.

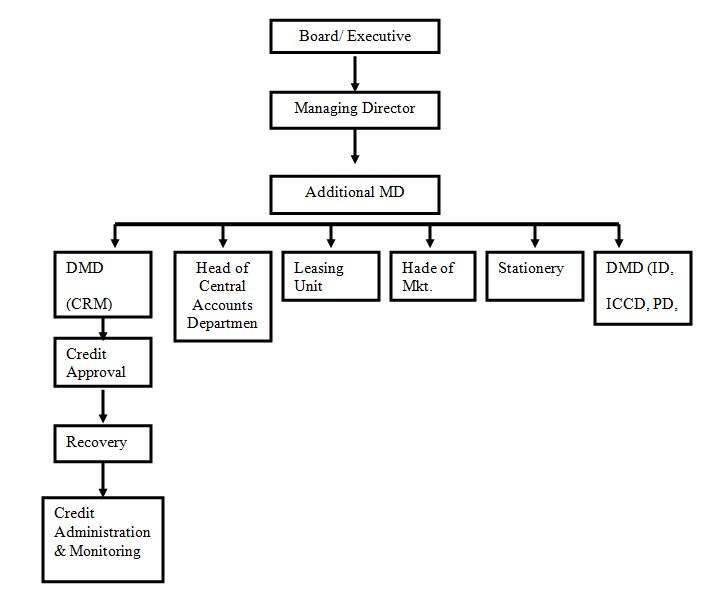

Agrani Bank Limited is governed by a Board of Directors consisting of 11(eleven) members headed by a chairman. The Bank is headed by the Managing director & Chief Executive Officer; Managing director is assisted by Deputy Managing Director and General Managers. The bank has 7 Circle offices, 30 Divisions in head office, 52 zonal offices and 867 branches including 10 corporate and 40 AD( authorized dealer) branches. The corporate and AD branches are authorized to deal in Foreign exchange business.

The authorized capital of the Bank is Tk. 800 crore.

2.4

Vision

To become a leading bank of Bangladesh operating at international levels of efficiency, quality and customer service.

Mission

We will go operating ethically and fairly within the stringent framework set by our regulators. We will go fusing ideas and lessons from best practice to explore newer ways to stay stronger and more efficient, nimble, and adaptable, and competitive as will. We will keep abreast of the advances of information and communication technology for the benefit of our customers and employees. We will invest to strengthen the future of the bank.

Motto

To adopt and adapt modern approaches so as to stand supreme in the banking arena of Bangladesh.

Credo

We believe in integrity, transparency and accountability, entwined with ingenuity that will provide high standard of service to all our customers and stakeholders.

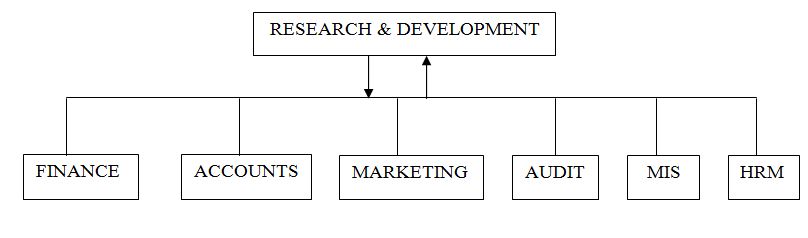

2.5 Organogram

Corporatisation has necessitated the Bank to restructure its Organogram in force. As such existing positions, portfolios and functional jurisdictions of GMs, DGMs and heads of zones will be re-framed or re-designated. In order to run the gamut of the Bank’s activities mire efficiently and effectively, some divisions under head office will be merged together and some new ones will also be established.

Proposed Organogram For Agrani Bank Limited

The organization have carried their business by using 7 Circle offices, 30 Divisions in head office, 52 zonal offices and 867 branches including 10 corporate and 40 AD (authorized dealer) branches. From the proposed ORGANOGRAM I have omitted the divisional practice.

ORGANOGRAM For Head Office

AGRANI BANK LIMITED

In the organogram the Head office works for basically works for planning through strategic view and making decision to match with mission, vision, motto and credo. For other offices to gather information and analyzing those according to various factor such as; demography, gender etc. toward subordinate offices. It can crate better practice a participative management. From Head offices planning the other offices follow that and try implement in the rural areas.

Organogram of Agrani Bank Limited:

2.6 Division of ABL.

Division Name |

| Agrani Bank Training Institute |

| Audit Implementation Division |

| Audit & Inspection Division |

| Board Division |

| Branch Control Division |

| Central Accounts Division |

| Common Services Division |

| Development & Co-ordination Division |

| Disciplinary Action Division |

| Engineering & Establishment Division |

| Foreign Currency Management Division |

| Fund Management Division |

| General Credit Division |

| Human Resources Division |

| Information Technology Division |

| Industrial Credit Division-1 |

| Industrial Credit Division-2 |

| International Trade Division |

| Law Division |

| Loan Classification Division |

| Loan Recovery Division |

| MD’s Squad |

| Personnel Division |

| Planning, Research & MIS Division |

| Printing & Stationery Division |

| Public Relation Division |

| Reconciliation Division |

| Remittance Management Division |

| Rural Credit Division |

| SME & Micro Credit Division |

3.1 Board of Directors

(As on 31. 12.2007)

Chairman :- Siddiqur Rahman Choudhury

Former Secretary

Ministry of Finance

Government of the People’s Republic of Bangladesh

Directors AKM Shamsuddin Former Secretary Ministry of Primary and Mass Education Govermment of the people’s Republic of Bangladesh

Nasiruddin Ahmed Member, Privatization Commixxion and Secretary to the

Ranjit Kumar Chakraborty Joint Secretary, Finance Division Ministry of finance and project Director Financial Management reform Programme (FMRP)

Air cdre Syed Imtiaz Hussain,ndu, psc

Director, Training Armed Forces Division

Captain Jamilur Rahman Khan (Retd.) Former Joint Secretary

Muhammad Aftab Uddin Khin Former Additional Secretary Cabinet Division

Managing Director (additional charge ) Syed Abdul Hamid

Company Secretary

Md. Khalilur Rahaman Deputy General Manager

| Audit Committee (As on 31. 12. 2007) | Board of Trustees of Agrani Bank Ltd. Employees’ Provident Fund (As on 31. 12. 2007) |

| Nasiruddin Ahamed Director of the Board Chairman | Nasiruddin Ahamed Director of the Board Chairman |

| Ranjit Kumar Chakraborty Director of the Board Member | Syed Abdul Hamid Managing Director (additional charge ) Member |

| Air cdre Syed Imtiaz Hussain,ndu, psc Director of the Board Member | Md. Fayekuzzaman Deputy Managing Director Member |

| Md. Abdul Latif Sikdar Deputy General Manager Secretary | |

| Auditors | |

Chartered Accountants Gulshan Pink city Suit 1-3, Level 07 Plot No. 15, Road No. 103 Gulshan Avenue, Dhaka-1212 Tel: 8837285-7 | Zoha Zaman Kabir Rashid and Co. Chartered Accountants Dhaka Chamber Bhaban 65-66, Motijheel C/A Room No. 504, Dhaka-1000 Tel: 9564178-9, 9564755 |

| Legal Advisors | |

| Shamim Khaled Ahmed Bar at Law 2/8 Sir Syed Road Block-A Mohammadpur, Dhaka Tel: 9136501 | Syed Abdur Rahim Advocate 62/1 purana paltan, Dhaka Tel: 9557856 |

| Khursheeda Jahan Advocate 2/1-A, Road No. 2 Shamoly, Dhaka- 1207 Tel: 9112070 | Md. Ruhul Amin Bhuiyan Advocate Jheelkuthi Apartment: A-502/A 6 Kabi Jasimuddin Road Motijheel, Dhaka Tel: 8313228

|

| Nitai Roy Chowdhury Advocate 657Shaheenbagh, Tejgain, Dhaka Tel: 9132461 | A.K.M. Badrudduza Advocate Law Concept Room No. 802, 7Th Floor BaitulHussainBuilding 27 Dilkusha C/A, Dhaka-1000 Tel: 9552434 |

| Income Tax Advisor | |

M/s. L.R Bhuiyan and Associate 6 Bijoy Nagar (2nd Floor) Dhaka-1000 Tel: 9330736 | |

3.2 Hierarchy of Agrani Bank

3.3 Nature of business

The principal activities of the bank are providing all kinds of commercial banking services to its customers and the principal activities of its subsidiaries are to carry on the remittance business and to undertake and participate in any or all transactions, and operations commonly carried or undertaken by remittance and exchange houses.

3.4 Business Performance

Assets Quality

For improving the quality of our assets, the Bank Management has prioritized financing in trade and commerce by providing working capital. However, some pragmatic steps have been taken to reduce non-performing loans.

Import-Export Business

The Bank’s foreign trade related activities, carried out through 40 AD branches across the country, are well run by our skilled manpower to earn confidence of importers, exporters and Bangladeshi workforce working abroad.

In 2007, the Bank’s export dealing stood at Tk.48.92 billion and import at Tk.113.43 billion.

For smooth conduct of international trade, Agrani Bank Limited has as many as 416 foreign correspondents throughout the world. In addition, the Bank is maintaining 39 NOSTRO Accounts with the world’s leading banks.

Foreign Remittance Business

The Bank continues taka Draft/Electronics fund transfer arrangements with different overseas exchange companies/banks. In 2007, the bank extended such overseas network by adding 3 more exchange companies/bank, totaling 30 as against 27 of 2006 covering Middle East, the Gulf States, South-East Asia and Italy. A policy that has been devised during the period for online distribution of remittances to beneficiaries has greatly encouraged the expatriates to bank more on us.

Our of these 30 exchange companies/banks, we have two subsidiaries of our own through which expatriates are sending home their hard-earned money. The result was obvious. In 2007, the remittance inflows from abroad increased a record high of Tk.42.81 billion from Tk.39.30 billion of 2006. The increase was 8.93 per cent higher than that of last year.

Treasury Operation

As in 2005 and 2006, the fund management division also performed as a major market maker and market leader in 2007.

The good news for the year under review was that the Division achieved a remarkable success in providing a lion share to the Bank’s total income. Through prudent treasury operation, it became the Bank’s top profit centre.

SWIFT

Modern communication system Is essential for carrying out foreign exchange transactions. With a view to ensuring better services to the customers especially to the importers, exporters and remitters, Agrani Bank Limited has, in the meantime, set up 14 SWIFT stations in the near future.

The bank offers to its customers a cluster of instant services in matters of encashment of cheque, information of current balances, statements of accounts erc. Moreover, customers will soon be brought on- line to meet their banking needs through use of their computers and phones.

3.5 Agrani Bank Corporate Governance

Observing the spirit of good governance is a core value for the bank. This makes sense in business terms, and also conforms to the rules, regulations and guidelines issued from time to time by our regulators such as Government, Bangladesh Bank, Registrar of Joint Stock Companies and Firms, Securities and Exchange Commission and the like in matters of capital adequacy, statutory reserves, liquidity, pricing, budgeting, superior client service, product quality, disclosures, credit portfolios, their associated risk factors and their preventions, internal control and compliances etc.

We also carry out our activities strictly in accordance with the bank company Act, 1991 and the companies Act, 1994, in line with the voluntary guidelines of World Bank and international Finance Corporation; we also emphasize environmental and social impacts on the projects we finance.

The board sets the strategy and approves the annual operating plans presented by the management for achievement of the strategic objectives. The board meets regularly and receives information about the overall activities for smooth operation of the bank. As a result, all the Directors have full and timely access to all relevant information

Thus we remain within the regulatory framework to promote greater accountability and transparency in all our policies and practices.

3.6 Highlights on the overall activities of the Bank for the period from May 17, 2007 to December 31, 2007

| SL. No | Particulars | Taka |

| 1 | Paid up capital | 2,484,200,000 |

| 2 | Total capital/equity | 3,342,709,283 |

| 3 | Capital surplus/(deficit) | (3,257,100,000) |

| 4 | Total assets | 186,280,385,573 |

| 5 | Total deposits | 135,921,381,916 |

| 6 | Total loans and advances | 118,493,857,283 |

| 7 | Total contingent liabilities and commitments | 67,961,485,412 |

| 8 | Total classified loan to total loans (%) | 26.83% |

| 9 | Net classified loan to net loans | 8.82% |

| 10 | Amount of classified loans | 31,788,870,000 |

| 11 | Provisions kept against classified loans | 12,691,779,000 |

| 12 | Interest suspense against classified loans | 9,498,622,458 |

| 13 | Provision surplus ?(deficit) | – |

| 14 | Credit deposit ratio (%) | 87.18% |

| 15 | Profit after tax and provision | 858,509,283 |

| 16 | Cost of fund (%) | 6.68% |

| 17 | Average interest earning assets | 142,633,331,506 |

| 18 | Non-interest earning assets | 43,647,054,067 |

| 19 | Income from investments | 949,921,751 |

| 20 | Return on investment (ROI) | 8.67% |

| 21 | Return on assets (ROA) | 0.92% |

| 22 | Earnings per share | 34.56 |

3.7 Agrani Bank Limited

Business Target -2009

| No | Cercal/Corporate Bran’s Name | 01. Investment | 02. Loan & Advance | 03. Profit | |||

| Earn of 31/12/08 | Target of 2009 | Earn of 31/12/08 | Target of 2009 | Earn of 31/12/08 | Target of 2009 | ||

| 1 | Dhaka cercal -1 | 2487.10 | 2550.00 | 36.77 | 900.00 | 58.31 | 75.00 |

| 2 | Dhaka cercal -2 | 3246.85 | 3350.00 | 1298.82 | 1350.00 | 74.81 | 85.00 |

| 3 | Chittagong cercal | 2655.94 | 2800.00 | 697.12 | 800.00 | 62.73 | 80.00 |

| 4 | Sylhet cercal | 996.81 | 1200.00 | 99.33 | 300.00 | 20.63 | 35.00 |

| 5 | Rajshahi cercal | 1564.01 | 1700.00 | 922.61 | 950.00 | 25.50 | 30.00 |

| 6 | Khulna cercal | 1041.96 | 1100.00 | 623.12 | 650.00 | 14.89 | 20.00 |

| 7 | Borishal cercal | 469.62 | 500.00 | 242.58 | 250.00 | 5.06 | 6.00 |

| 8 | Principal Bran’s, Dhaka | 645.91 | 750.00 | 3855.00 | 4000.00 | 201.13 | 200.00 |

| 9 | Foreign exchange corporate, Dhaka | 145.37 | 150.00 | 268.98 | 280.00 | 16.45 | 20.00 |

| 10 | Amin coat corporate, Dhaka | 143.96 | 230.00 | 390.78 | 450.00 | 15.15 | 20.00 |

| 11 | Porana Palton corporate, Dhaka | 103.51 | 100.00 | 71.66 | 80.00 | 4.33 | 5.00 |

| 12 | Romna corporate Dhaka | 164.99 | 170.00 | 553.53 | 580.00 | 7.74 | 10.00 |

| 13 | B.B. Avenue corporate, Dhaka | 347.99 | 350.00 | 198.67 | 270.00 | 13.38 | 15.00 |

| 14 | Laldhagi porba corporate Chittagong | 115.65 | 150.00 | 229.53 | 240.00 | 9.23 | 10.00 |

| 15 | Agrabad Corporate Chittagong | 103.75 | 110.00 | 348.64 | 350.00 | 4.03 | 5.00 |

| 16 | Commercial Aria corporate Chittagong | 63.06 | 70.00 | 531.14 | 550.00 | 3.64 | 4.00 |

| 17 | Sir Eakbal road cor. Khulna | 34.17 | 40.00 | 193.84 | 200.00 | 2.16 | 3.00 |

| 18 | Head Office | 359.72 | 380.00 | 0.00 | 0.00 | 92.45 | 127.00 |

| Total= | 14690.37 | 15700.00 | 11354.12 | 12200.00 | 631.62 | 750.00 | |

| No | Cercal/Corporate Bran’s Name | 04.Emport | 05. Export | 06. Foreign Remittance | |||

| Earn of 31/12/08 | Target of 2009 | Earn of 31/12/08 | Target of 2009 | Earn of 31/12/08 | Target of 2009 | ||

| 1 | Dhaka cercal -1 | 192.85 | 200.00 | 331.99 | 350.00 | 313.52 | 560.00 |

| 2 | Dhaka cercal -2 | 538.44 | 550.00 | 690.28 | 750.00 | 437.18 | 800.00 |

| 3 | Chittagong cercal | 273.26 | 300.00 | 287.42 | 350.00 | 939.16 | 1650.00 |

| 4 | Sylhet cercal | 30.19 | 100.00 | 0.00 | 0.00 | 197.95 | 400.00 |

| 5 | Rajshahi cercal | 263.81 | 300.00 | 10.35 | 15.00 | 112.92 | 200.00 |

| 6 | Khulna cercal | 10.48 | 15.00 | 289.10 | 300.00 | 73.16 | 150.00 |

| 7 | Borishal cercal | 0.00 | 0.00 | 0.00 | 0.00 | 69.25 | 130.00 |

| 8 | Principal Bran’s, Dhaka | 7290.73 | 7170.00 | 1193.13 | 1225.00 | 43.00 | 760.00 |

| 9 | Foreign exchange corporate, Dhaka | 337.42 | 400.00 | 396.34 | 450.00 | 854.00 | 710.00 |

| 10 | Amin coat corporate, Dhaka | 401.18 | 500.00 | 477.39 | 550.00 | 59.95 | 20.00 |

| 11 | Porana Palton corporate, Dhaka | 114.48 | 100.00 | 90.08 | 100.00 | 72.18 | 70.00 |

| 12 | Romna corporate Dhaka | 107.39 | 250.00 | 204.62 | 300.00 | 316.38 | 20.00 |

| 13 | B.B. Avenue corporate, Dhaka | 242.67 | 200.00 | 230.65 | 250.00 | 155.64 | 10.00 |

| 14 | Laldhagi porba corporate Chittagong | 171.05 | 200.00 | 52.64 | 60.00 | 7.00 | 10.00 |

| 15 | Agrabad Corporate Chittagong | 340.55 | 300.00 | 240.14 | 300.00 | 3.29 | 5.00 |

| 16 | Commercial Aria corporate Chittagong | 526.39 | 400.00 | 134.79 | 150.00 | 2.01 | 2.00 |

| 17 | Sir Eakbal road cor. Khulna | 10.85 | 15.00 | 324.91 | 350.00 | 1.99 | 3.00 |

| 18 | Head Office | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total= | 10951.74 | 11000.00 | 4953.83 | 5500.00 | 5268.58 | 5500.00 | |

| No | Cercal/Corporate Bran’s Name | 07.Classificaton of Quantity Loan Earn | |||||

| Real earn 2008 | Target of 2009 loan earn | ||||||

| Cash | Total | ||||||

| 1 | Dhaka cercal -1 | 60.06 | 55.00 | 30.00 | 40.00 | 125.00 | |

| 2 | Dhaka cercal -2 | 288.99 | 60.00 | 60.00 | 130.00 | 250.00 | |

| 3 | Chittagong cercal | 29.02 | 25.00 | 35.00 | 25.00 | 85.00 | |

| 4 | Sylhet cercal | 7.62 | 4.00 | 9.00 | 2.00 | 15.00 | |

| 5 | Rajshahi cercal | 39.58 | 48.00 | 25.00 | 27.00 | 100.00 | |

| 6 | Khulna cercal | 132.73 | 30.00 | 25.00 | 20.00 | 75.00 | |

| 7 | Borishal cercal | 33.85 | 12.00 | 8.00 | 5.00 | 25.00 | |

| 8 | Principal Bran’s, Dhaka | 259.50 | 75.00 | 155.00 | 80.00 | 310.00 | |

| 9 | Foreign exchange corporate, Dhaka | 12.54 | 2.00 | 10.00 | 8.00 | 20.00 | |

| 10 | Amin coat corporate, Dhaka | 5.25 | 8.00 | 22.00 | 20.00 | 50.00 | |

| 11 | Porana Palton corporate, Dhaka | 26.29 | 2.00 | 5.00 | 3.00 | 10.00 | |

| 12 | Romna corporate Dhaka | 154.73 | 10.00 | 70.00 | 60.00 | 140.00 | |

| 13 | B.B. Avenue corporate, Dhaka | 104.40 | 2.00 | 10.00 | 18.00 | 30.00 | |

| 14 | Laldhagi porba corporate Chittagong | 181.34 | 4.00 | 25.00 | 31.00 | 60.00 | |

| 15 | Agrabad Corporate Chittagong | 14.99 | 2.00 | 25.00 | 33.00 | 60.00 | |

| 16 | Commercial Aria corporate Chittagong | 12.61 | 8.00 | 26.00 | 86.00 | 120.00 | |

| 17 | Sir Eakbal road cor. Khulna | 13.59 | 3.00 | 10.00 | 12.00 | 25.00 | |

| 18 | Head Office | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Total = | 1377.09 | 350.00 | 550.00 | 600.00 | 1500.00 | ||

3.8 Progress Achieved in 2007

I would first like to throw some light on the unique phenomenon that had taken place in our financial reporting, following Corporatisation , Since Agrani Bank Limited came into being in the middle of the financial year, we had to move away from the traditional way of preparing the final accounts by splitting its performance into two halves- the first half beginning from January 01,2007 to June 30,2007 and the second half from July 01,2007 to December 31,2007 (the former dealing with Agrani Bank’s pre-Corporatisation period and the later with that of Agrani Bank Limited). The task involved and the business carried out during the twin periods within the same accounting year appeared difficult but the Management addressed it successfully.

The Bank’s capital base is not adequate due largely to massive capital shortfall adjustment totaling Tk.3.25 billion. To improve this issue, the Management has devised a 3-year strategic plan, commencing from the year 2008.With the execution of the plan, the Bank would be able to maintain its required level of capital by adjusting its entire capital shortfall at the end of 2010.In 2006 total deposit declined, but in 2007, the situation was recouped and improved a great extent. Deposit was up by 5 per cent from Tk.118.92 billion to Tk.135.92 billon. Loans and advances also increased from Tk.105.87 billon to Tk. 118.49 billion with an increase of 12per cent. Operating profit also increased to Tk.5.26 billion as against Tk.3.58 billion of 2006 with an increase of 47 per cent over the previous year.

The unforeseen market forces at home and abroad impacted heavily on our foreign exchange business. However, our Management tried hard to improve the situation.

3.9 Glimpses of Last Five Year’s Financial

(Taka in Billion)

Agrani Bank | Agrani Bank Limited 2007 (01 July to Dec.) | Total (01 Jan.2007 to31 Dec. 2007 | |||||

2003 | 2004 | 2005 | 2006 | 2007 (01 Jan .to 30 June | |||

| Paid-up Capital | 2.48 | 2.48 | 2.48 | 2.48 | 2.48 | 2.48 | 2.48 |

| Reserve Fund | 0.34 | 0.34 | 0.34 | 0.29 | – | 0.16 | 0.16 |

| Retained Profit(Loss) | – | (21.72) | (20.08) | (18.10) | – | 0.70 | 0.70 |

| Total Equity | 2.82 | (18.90) | (17.26) | (15.33) | 2.48 | 3.34 | 3.34 |

| Total Deposits | 117.43 | 125.39 | 130.84 | 128.92 | 136.06 | 135.92 | 135.92 |

| Total Loans and Advances | 89.31 | 95.92 | 99.40 | 105.87 | 104.56 | 118.49 | 118.49 |

| Net Loans and Advances | 79.67 | 71.32 | 75.41 | 83.58 | 83.63 | 95.09 | 95.09 |

| Investments | 31.50 | 26.85 | 24.33 | 22.31 | 27.46 | 21.90 | 21.90 |

| Foreign Business | |||||||

| 1. Import | 28.97 | 35.91 | 51.19 | 105.92 | 63.05 | 50.38 | 113.43 |

| 2. Export | 35.75 | 41.97 | 41.71 | 51.71 | 24.93 | 23.99 | 48.92 |

| 3. Remittances: | 27.43 | 36.48 | 34.57 | 39.30 | 20.22 | 22.59 | 42.81 |

| Total | 92.14 | 114.72 | 127.47 | 206.93 | 108.20 | 96.96 | 205.16 |

| Guarantee Business | 1.38 | 1.21 | 1.18 | 1.08 | 1.03 | 1.05 | 1.05 |

| Total Income | 9.40 | 9.02 | 10.60 | 12.33 | 6.60 | 7.08 | 13.68 |

| Total Expenditure | 9.13 | 9.77 | 8.46 | 8.75 | 4.12 | 4.30 | 8.42 |

| Provision | 0.26 | 20.97 | 3.74 | 0.29 | 0.24 | 1.98 | 2.22 |

| Interests Suspense | 8.50 | 11.24 | 9.59 | 8.92 | 7.98 | 9.50 | 9.50 |

| Fixed Assets | 0.48 | 0.48 | 0.44 | 0.41 | 0.39 | 2.48 | 2.48 |

| Total Assets | 141.44 | 151.38 | 155.53 | 154.08 | 160.49 | 186.28 | 186.28 |

| Operating Profit | 0.26 | (0.75) | 2.14 | 3.58 | 2.48 | 2.78 | 5.26 |

| Net Profit(Loss) after provision and tax | 0.0014 | (21.72) | 1.63 | 1.94 | 2.30 | 0.86 | 0.86 |

| Cost of Fund | 7.51% | 8.51% | 6.95% | 6.48% | 6.52% | 6.68% | 6.68% |

| Number of Branches | 872 | 870 | 864 | 866 | 866 | 866 | 866 |

| Number of Employees | 12514 | 12208 | 11938 | 117963 | 11568 | 11345 | 11345 |

| Number of Correspondent Bank with NOSTRO A/c | 37 | 41 | 41 | 38 | 38 | 39 | 39 |

| Number of Foreign Correspondents | 391 | 399 | 410 | 416 | 416 | 416 | 416 |

| Return on Equity | 7.78% | – | – | – | – | 29.55% | 29.55% |

| Return on Assets | 0.19% | (0.50%) | 1.05% | 1.26% | 1.43% | 0.92% | 0.92% |

| Net Interest Margin | 0.89% | (0.45%) | 1.73% | 2.96% | 3.56% | 3.69% | 3.69% |

| Average Yield on Loan | 9.93% | 7.59% | 7.49% | 9.53% | 10.68% | 10.35% | 10.35% |

| Loans as percentage of Deposit(A. D. Ratio) | 76.06% | 76.50% | 75.98% | 82.12% | 76.85% | 87.18% | 87.18% |

| Gross classified Loans to Total loans | 29.57% | 28.07% | 28.31% | 26.27% | 26.94% | 26.83% | 26.83% |

| Net Classified loans to Net loans | 21.05% | 3.25% | 5.51% | 6.61% | 8.23% | 8.82% | 8.82% |

* Total net profit after tax of the former Agrani Bank and the Agrani Bank Limited for the year 2007 stood at Tk. (2.30+0.86) =3.16 billion. However, net profit of Agrani Bank up to 30 June 2007 amounting to Tk.2.30 billion has been squared off against valuation adjustment

3.10 Financial Results:

Total income

The bank’s total income after corporation was Tk. 7.08 billion while total income earned in 2007 stood at Tk. 13.68 billion as against total income of Tk.12.33 billion in 2006, registering an increase of Tk. 1.35 billion which was 10.95 per cent higher over the last year.

Total Expenditure

After corporation, total expenditure stood at Tk. 4.30 billion whereas during 2007 total expenditure was Tk.8.75 billion. In 2006, total expenditure was Tk. 8.75 billion.

Net Profit

After corporation, the bank’s after-tax income stood at Tk. 0.86 billion. However, during 2007, the bank’s total net profit stood at Tk. 3.16 billion as against Tk.1.94 billion of 2006, showing an increase of 62.88 per cent over the net profit of 2006.

Shareholder’s Equity

As per vendors agreement dated 15 November, 2007 the Agrani Bank Limited has paid Tk. 2.48 billion by issuing shares to the Government. The equity of the bank stood at Tk.3.34 billion on 31 December, 2007 along with reserve and undistributed profit of Tk. 0.86 billion.

It is worth mentioning that the management of the Bank has devised a 3-year broad-based business development plan which will come into effect from the year 2008. on its completion, the bank would be able to maintain more than the required level of capital at the end of 2010.

Appropriation of Profit

Out of the net profit of Tk. 0.86 billion (after tax) earned after corporation, the board of directors proposed to transfer an amount of Tk. 0.16 billion to Statutory Reserve Account and the rest balance amount of Tk. 0.70 billion to Retained Surplus Account. No dividend for the year 2007 has been recommended by the Board.

4.1 INTRODUCTION

Today’s business market is very complicated, due to diversified business world. Also importance of total quality management put emphasis on competition market. As a result the essence of HRM is introduced in today’s organization and we know that. HRM sets up the job by virtue of job evaluation; job analysis & job design and also ensures the HR laws and keeps in organization’s mind about government rules and regulations.

The HR department of today’s organizations deals with total systems of the organization. HR officer’s job is to make the HRM system pretty much accurate, in order to ensure that, all other factors related to organization are handled quite effectively.

Therefore, HR officer has to concern about dealing with HRM system as well as performance management due to the importance of cost. Further more, he has to make the image of the company more attractive, nice working condition, good benefit & compensation. Because, these are the part of HRM system.

Some of the constraints have to be follow in the real world while setting up HRM system. We are trying to mention this in the following way:

- If the organization needs active employee, than the salary should be high to attract the candidate.

- If the organization has a better working condition, good applicant will be attracted.

- Compensation and benefit should be standardized.

- Technically sound people.

- Government rules and regulations should be in consideration.

- Motivation is always working for the employees.

- Economic condition of the overall economy should be in mind of HR officer.

These are the prime constraint or consideration be kept in mind or HR officer while dealing with HRM practice.

4.2 HRM: Bangladesh Scenario

Bangladesh economy experienced a trend rate of growth of 4.8 percent during 1990s as against 4.4 percent during the previous decade. The rate of growth of per capita GDP has also been impressive during the 1990s. In addition to the higher growth rate of overall GDP, this was facilitated by a sharp fall in the rate of growth of population. During the 1980s, population grew at an annual compound rate of 2.2 percent, and the rate of growth of per capita GDP was recorded at 1.7 percent per annum. In contrast, population growth rate came down to 1.7 percent during the 1990s. Per capita GDP grew at an annual compound rate of 3.3 percent during the 1990s. However, in terms of the absolute level of per capita income, Bangladesh continues to remain at the lower end of the income scale. Per capita income of US $370 compares unfavorably against the low-income country average of US $ 410.The main stream of skilled human resources development and the management of the same is the possible option to impart a favorable GDP rate.

During 1990s, Bangladesh’s total exports in current US$ value grew at an annual compound rate of 14.4 percent. In fact, Bangladesh experienced double digit export growth in most of the years during the 1990s. Imports, on the other hand, grew at an annual compound rate of 10.9 percent during 1990s. The gap between export and import widened from –US $1792 million in 1990/91 to -$2814 million in 1999/00, although the share of export earnings in import payments steadily rose from 31 percent in 1980/81 to 67 percent in 1999/00. The openness of the economy as measured by total external trade as a proportion of GDP went up from around 22 percent in 1990/91 to nearly 30 percent in 1999/00 with the share of export in GDP rising from 7 percent to 12 percent during the same period.

The structure of export has changed significantly over the past two decades. Bangladesh seems to have made the transition from resource-based to process-based exports using its several resources, specially using the proper management of existing human resource. In 1980/81, primary commodity constituted nearly 29 percent of total exports. In 1990/91, this share came down to 17.8 percent and further down to 8.2 percent in 1999/00. There has been a shift from jute-centric to garments-centric export. In 1980-81, raw jute and jute goods together constituted 68 percent of total exports. Between 1980/81 and 1999/00, export of both raw jute and jute products declined in absolute terms and their total share came down to only 6 percent in 1999/00. In contrast, woven and knit garments together accounted for less than 1 percent of exports in 1980/81. Their combined share in exports rose to nearly 76 percent in 1999/00.

A change in the composition of output and employment away from the agricultural sector in the direction of manufacturing and service sectors is often used as a measure of development. In Bangladesh, the share of agriculture in GDP declined from 29.2 percent in 1990-91 to 25.5 percent in 1999-00 – a decline of 3.7 percent. The fall was compensated by an increase in the share of manufacturing and construction. Despite declining share of agriculture in GDP, the increase in food production has been quite satisfactory moving the country from a state of chronic food deficit to near self-sufficiency level.

Manufacturing industry in Bangladesh achieved respectable growth during 1990s. The contribution of manufacturing to GDP increased from 12.9 percent in 1990-91 to 15.4 percent in 1999-00. However, the sector’s current share in GDP appears rather modest for it to spearhead sustained high growth of the economy. Thus, for example, in Thailand the share of manufacturing in overall GDP was 22 percent in 1980 and it rose to 32 percent by 1998. The growth of Bangladesh’s manufacturing sector has also been rather narrowly based with readymade garments accounting for nearly a quarter of the sectored growth. Other important export industries contributing to sectored growth are Fish & seafood, and Leather tanning. Major import substituting industries experiencing significant growth during this period include Pharmaceutical, Indigenous cigarettes (bidi), Job printing and Re-rolling mills.

Other success stories of Bangladesh include maintenance of low level of inflation, rapid spread of micro credit program largely at the initiative of NGOs, and significant improvements in the social sector. However, in spite of such successes, the structure of production and exports has remained extremely narrow in Bangladesh. Bangladesh has also failed to attract adequate amount of FDI into the country. While the opening up of gas, electricity and telecommunication sub-sectors to private investment has resulted in the inflow of considerable foreign direct investments (FDI) in these sectors, the overall inflow of FDI has remained sluggish. The narrow export base has rendered Bangladesh’s external sector extremely dependent on global trading environment and preferential treatment by its main trading partners. The recent poor performance of exports in the face of global economic slowdown has confirmed this vulnerability of the Bangladesh’s external sector. Other weaknesses of Bangladesh economy include a dysfunctional banking system overburdened with classified loans, persistent loss of the state owned enterprises, poor infrastructure, deficient tax efforts, political disturbances and unsatisfactory law and order situation.

The concluding scenario is that like all other developed countries, Bangladesh still yet not setup human resource management department in every sector as much as that level .In spite if that in it’s standard private entrepreneurs, almost 80% are well equipped with human resource management setup and in public sector, almost all institution’s human resource management functions are performed by its respective administration section. And in fact that, most of them are conducted by traditional and combined of traditional and contemporary method. Even though, above statistics shows that Bangladesh has been triggered its economic development by synchronizing with other developed countries and making a harmony with world economy.

4.3 DEPARTMENTAL HUMAN RESOURCE MANAGEMENT PLANS

This diagram shows that the HRM plan must have the combination with strategic view and also match with all factors of the organization. Human Resource Management will be organized and managed in the department. Due to the importance of the subject, an officer at the directorate level should normally be assigned the responsibility for Human Resource Management in the department. An officer at this level should have the broad understanding of the department’s mission, values and objectives. It needs to be considered what the relationship should be between managers and administration staff, and/or officers charged with specific human resource management responsibilities, e.g. training officers.

The plan needs only be as detailed as the department determines is appropriate, and may not necessarily show specific activities in all areas of Human Resource Management. However, the component areas are:

Manpower Planning

Manpower planning enables a department to project its short to long term needs on the basis of its departmental plans so that it can adjust its manpower requirements to meet changing priorities. The more changing the environment the department is in, the more the department needs manpower planning to show:

- The number of recruits required in a specified timeframe and the availability of talent.

- Early indications of potential recruitment or retention difficulties.

- Surpluses or deficiencies in certain ranks or grades.

- Availability of suitable qualified and experienced successors.

Recruitment

Before a department takes steps to employ staff, it should work out the type of staff it needs in terms of grade and rank, and the time scale in which the staff are required. The general principles underpinning recruitment within the civil service are that recruitment should:

- Use procedures which are clearly understood by candidates and which are open to public scrutiny.

- Be fair, giving candidates who meet the stipulated minimum requirements equal opportunity for selection.

- Select candidates on the basis of merit and ability.

.Performance Management

Performance management is a very important Human Resource Management function. Its objective is to improve overall productivity and effectiveness by maximizing individual performance and potential. Performance management is concerned with:

- Improving individual and collective performance.

- Communicating management’s expectations to supervisors and staff.

- Improving communication between senior management, supervisors and staff.

- Assisting staff to enhance their career prospects through recognizing and rewarding effective performance.

- Identifying and resolving cases of underperformance.

- Providing important links to other Human Resource Management functions, such as training.

Training and Development

The objective of training and development is to enable civil servants to acquire the knowledge, skills, abilities and attitudes necessary to enable them to improve their performance. Staff training and development should focus on the department’s objectives and goals and staff’s competencies in achieving them. A strategic approach has the following characteristics:

- Commitment to training and developing people.

- Regular analysis of operational requirements and staff competencies.

- Linking training and development to departmental goals and objectives.

- Skilled training personnel.

- Regular evaluation.

- A continuous learning culture.

- Joint responsibility between managers and staff for identifying and meeting training needs.

- A variety of training and development methods for different circumstances and learning styles.

Staff Relations

The purpose of staff relations is to ensure effective communication between management and staffs, to secure maximum cooperation from staff, and to motivate staff to give their best by ensuring that they feel fairly treated, understand the overall direction and values of the Civil Service and those of their departments, and how decisions that affect them have been reached. The principles that govern staff relations are that, where possible:

- Management should communicate regularly and openly with staff.

- Staff should be consulted on matters that affect them.

- Problems and disputes should be resolved through discussion and consultation.

- The Government should uphold the resolutions of the International Labor Organization conventions.

- Management should devise and encourage activities that contribute to staff’s well being.

Management Information Systems

An effective management information system enables various levels of information to be systematically collected about human resource matters so that departments, policy branches and Civil Service Branch can monitor and predict the effectiveness of Human Resource Management practices. Accurate management information enables forward looking Human Resource Management by providing the means to:

- Monitor and improve on-going Human Resource Management performance.

- Provide up-to-date information on which to base policy development.

- Verify and demonstrate departmental effectiveness in Human Resource Management.

- Create service-wide checks and balances to safeguard delegation and provide true accountability for Human Resource Management

If the Agrani Bank Limited practices this model, the organization can get easily competitiveness advantage from the HRM view. It is cost effective for the organization and also the knowledge each every employees through management information system.

4.4 A conceptual and theoretical analysis

Human resource management is the policies and practices involved in carrying out the ’people’ or human resource aspects of a management position, including recruiting, screening, training, rewarding, appraising and compensating employees, and attending to their labor relations, health and safety, and fairness concern. It provides with the concepts and technique which we need to carry out the ‘people’ or personal aspects of any management job. Those includes

- Conduction job analysis

- Planning labor needs and recruiting job candidates

- Selecting job candidates

- Orienting and training new employees

- Managing wages and salaries

- Providing incentives and benefits

- Appraising performance

- Communicating (interviewing, counseling, disciplining)

- Training and developing managers

- Building employee commitments

Most writers agree that there are certain basic functions all mangers perform. Those are planning, organizing, staffing, leading and controlling. In fact, the mangers perform the management process. Those are in details:

Planning. Establishing goals and standards; developing rules and procedures; developing plans and forecasting.

Organizing. Giving each subordinate a specific task; establishing departments; delegating authority to subordinates; establishing channels of authority and communication; coordinating work of subordinates.

Staffing. determining what type of people should be hired; recruiting prospective employees; selecting employees; setting performance standards; compensating employees; evaluating performance; counseling employees; training and developing employees.

Leading. Getting others to get the job done; maintaining moral; motivating subordinates.

Controlling. Setting standards such as sales quotas; quality standards, or production levels; checking to see how actual performance compares with these standards; taking corrective action as needed.

For many years it has been said that capital is the bottleneck for a developing industry. But many of the economists do not belief, this may longer holds true. They say the workforce and the company’s inability to recruit and maintain a good workforce that does constitute the bottleneck for production. They don’t know of any major project backed by good ideas, vigor, and enthusiasm that has been stopped by a shortage of cash. They don’t know of industries whose growth has been partly stopped or hampered because they can’t maintain an efficient and enthusiastic labor fore, and this will hold true even more in the future.

There are some common concepts and techniques those are very important for all managers. Perhaps it is easier to find those by listing some of those personal mistakes we don’t want to make while managing. Say for example, we don’t want to:

- Hire wrong person for the job

- Experience high turnover

- Find the existing people not doing their best

- Waste time with useless interviews

- Have the company taken to court because of discriminatory actions

- Have the company cited under national occupational safety laws for unsafe practice.

- Have some employees think their salaries are unfair and inequitable relative to others in the organization

- Allow a lack of training to undermine your department’s effectiveness

- Commit any unfair labor practices

In fact, a manager can everything else as a manager-lay brilliant plans, draw clear organization charts, set up modern assembly lines, and use sophisticated accounting controls but still fail as a manager by hiring the wrong people or by not motivating subordinates, On the other hand, many managers-presidents, generals, governors, supervisors—have been successful even with in adequate plans, organization, or controls. They were successful because they had the knack of hiring the right people for the right jobs and motivating, appraising, and developing them.

5.1 Human resource management:

Human resource management involves all management decisions and practices that directly affect or influence the people, or human resources, who work for the organization. In recent years, increased attention has been devoted to how organizations manage Human Resources. This increased attention comes from the realization that an organization’s employees enable an organization to achieve its goals and the management of these human resources is critical to an organization’s success.

5.2 Functions of HRM:

Planning for Organization, Jobs and People

Strategic Human Resources

Human Resources Planning

Job Analysis

Acquiring Human Resources

EEO (Equal Employment Opportunity)

Recruiting

Selection

Building performance

Human Resources Development

Human Resources Approaches to improving Competitiveness

Rewarding employees

Performance Appraisal

Compensation and Benefits

Maintaining Human Resources

Safety and Health

Labor Relation

Employment Transitions

Managing Multinational HRM

5.3 Importance of HRM:

Today, professionals in the human resources area are important elements in the success of any organization. There jobs require a new level of sophistication that is unprecedented in human resources management. Not surprisingly, their status in the organization has also been elevated. Even the name has changed. Although the terms personal and human resources management are frequently used interchangeably, it is important to note that the two connote quite different aspects. Once a single individual heading the personal function, today the human resource department head may be a vice president sitting on executive boards, and participating in the development of the overall organizational strategy.

5.4 Philosophy:

Human Resource works with the employees in the organization. Its main views are to put the right people in the right places and also make them an asset for an organization.

5.5 Objective:

Human Resource Management refers to the practices and policies one need to carry out the people or personnel aspects of one’s management job. These include:

Conducting job analysis (determining the nature of each employee’s job)

Planning labor needs and recruiting job candidate.

Selecting job candidates

Orienting and training new employees

Managing wages and salaries (determining how to compensate employees)

Providing incentives and benefits

Appraising performance

Communicating (interviewing, counseling, disciplining)

Training and development

Building employee commitment.

5.6 Human Resource Management and Development

We treat our human resource as an instrument for development. Our workforce is the prime factor of our success. Following Corporatisation , the Bank’s key strategy is to set a new standard towards the full range of exploration and development of our human resources, in 2007 , we concentrated more on quality, efficiency, creativity and professionalism in our human resources .

The promotion criteria were revised in 2007 and as many as 1248 employees from different grades were promoted. Of them, 34 became DGMs, 77 AGMs, 163 SPOs and the remaining 974 in other grades.

6.1 Human Resource Planning:

Have collected Human resource planning is concerned with the flow of people into, through, and out of an organization. HR planning involves anticipating the need for labor and the supply of labor and then planning the programs necessary to ensure that the organization will have the right mix of employees and skills when and where they are needed.

6.2 Manpower planning and Career Development

Headcount at the end of 2007 was 11345, comprising 6358 officers and 4987 staff members. Rationalization of manpower continues as part of the employee productivity enhancement programmed. Under the World Bank Enterprise Growth and Bank Modernization Project, immediate appointments of consultants with the rank and status of General Manager for credit, Audit, Information Technology and Accounting are now under active consideration.123 security guards from 4 companies were appointed to Head Office and different zones. The policy of out-sourcing for non-core activities will continue in 2008 as and when required.

Major changes have been made in the criteria for promotion, especially for promotion to the rank of Assistant General Manager and Deputy General Manager. Although recognition of seniority continued an increased weight age was given to proven professionalism and the candidate’s future potential.

6.3 Human Resource Demand:

Once HR planners have collected information from both internal and external sources, they forecast the demand for labor. How many and what type of people will be needed to carry out the organization’s plans in the future? These forecasts are grounded in information about the past and present and in assumptions about the future. Different methods of forecasting the demand for labor require different assumptions. Some of the more common assumptions are that past trends and relationships among variables will hold up in the future; that the productivity ratio is constant (or follows a known pattern) as the number of units produced increases; and that the business plans of the organization, sales forecasts, and so on are reasonably descriptive of what will actually happen. In a highly volatile business, these assumptions may not be valid. It is always wish to explicitly list one’s assumptions in forecasting and to put on more faith in the forecast than in the assumption on which it was based.

Demand forecasting method can be divided into two categories. They are Judgmental and Mathematical. In practice, most organizations use some combination of the two methods. In our country most of the financial institutions use the judgmental method.

Judgmental Methods:

Judgmental methods make use of knowledgeable people to forecast the future. Judgmental methods do consider quantitative data but also allow for intuition and expertise to be factored in. these methods may be used by small organization or by those new to HR forecasting that do not yet have the database or expertise to use some of the more complex mathematical models. Judgmental methods also may be preferred when an organization or environment is in a state of transition or turmoil; at such times, past trends and correlations cannot be used to make accurate predictions about the future.

Supply of labor:

Once the demand for labor is predicted, it is necessary to forecast the supply of labor that the organization will already have available to meet the demand. It is basically of two types:

- Internal supply of labor

- External supply of labor

Gap Analysis:

In an organization there might be two type of gap exists:

- Shortage:

When demand is more and supply of human resource is less in a particular area this called shortage.

- Surplus:

When supply is more and demand of human resource is less in a particular area this called surplus.

6.4 Job Analysis:

The procedure for determining the duties and skill requirements of a job and the kind of person who should be hired for it.

The process of job analysis is of two types:

- Job Description

- Job Specification

A. Job Description:

A list of a job’s duties, responsibilities, reporting relationship, working conditions, and supervisory responsibilities- one product of a job analysis.

B. Job Specification:

A list of a job’s “human requirement”, that is, requisite education, skills, personality, and so on – another product of a job analysis.

Job Analysis:

The procedure for determining the duties and skill requirements of a job and the kind of person who should be hired for it.

The process of job analysis is of two types:

- Job Description

- Job Specification

A. Job Description:

A list of a job’s duties, responsibilities, reporting relationship, working conditions, and supervisory responsibilities- one product of a job analysis.

B. Job Specification:

A list of a job’s “human requirement”, that is, requisite education, skills, personality, and so on – another product of a job analysis.

6.5 Organizational Practices:

Organizational Practices is not properly followed by Agrani Bank Limited. Job description and specification exists in the organization but in the case of demand and supply of their human resource in different department and branches they usually not assess the demand and supply gap properly, as a result employee surplus and shortage have been found in their several department and branches as well. In this case what they did, if there is shortage of employee they have tried to find out the area and then search employees from other areas and by giving proper training they sent them and if there is any surplus employees exists the branch manager or divisional head usually not informed Human Resource Department.

7.1 Recruitment:

When a vacancy occurs and the recruiters receive authorization to fill it, the next step is a careful examination of the job and an enumeration of the skills, abilities, and experience needed to perform the job successfully.

7.2 Recruitment process:

In the recruitment process there are couple of steps are to be followed:

- Written test: The recruitment test is combined of both elaborative and MC.Q. type. Usually Agrani Bank Ltd assigned this to some organization. The particular organization does all the thing. In the written test a person has to obtain a certain marks to pass the exam.

- VIVA: The candidate after qualifying written test has to face VIVA test. VIVA usually taken by the top management of the bank. Only short listed candidate are selected finally for the job.

The Recruitment Process of the Organization:

Organization |

Vacant or new position occur |

Perform job analysis and plan recruiting effort |

Generate applicant pool via internal or external recruitment methods |

Evaluate applicants via selection process |

Impress applicants |

Make offer |

7.3 Method of recruitment:

There are two method of recruitment:

- Internal recruitment

- External recruitment

Internal recruitment:

Most companies fill vacancies internally whenever possible. A number of internal recruitment methods are use for different level of jobs. Lower-level jobs such as manual and clerical jobs are often called nonexempt jobs because their incumbents are not exempt from the minimum wage and overtime provisions of the Fair Labor Standards Act. These people typically are paid an hourly wage. In contrast, higher-level administrative, managerial, and professional employees are paid on a salary basis and are exempt from the overtime provisions of the Fair standard Labor Act.

External recruitment:

In addition to looking internally for candidates, it is customary for organizations to open up recruiting efforts to the external community. Through the recruiting process, the hiring manager should stay in close touch with the recruiter. The hiring manager should examine resumes or application that have passed initial screening by the recruiter and should also review some of the application that the recruiter rejected during the first steps. Such involvement on the part of the hiring manager allows feedback as to whether or not the recruiter’s decisions are consistent with the hiring manager’s preferences.

External recruitment methods are often grouped into two classes: 1. Informal and 2. Formal.

Informal Method:

Informal recruiting methods tap a narrower labor market than formal method. Informal method includes rehiring former employees or former cooperative education students, hiring people referred by present employees, and hiring from among those who have applied without being solicited (such applicants are called walk-ins or gate hires).

Employee’s referral, also known as word-of-mouth advertising, is quick, effective, and usually inexpensive. Because employees who refer their friends and acquaintance as candidates have their own credibility on the line, they tend to refer people who are well qualified and well motivated and then to mentor these individuals once they are hired.

Formal Methods:

Formal method of external recruiting entail searching the labor market for candidates who have no previous connection to the firm. These methods traditionally have included newspaper advertising, use of employment agencies and executive search firms, and campus recruiting. Posting jobs ads on the Internet, either on the company’s own site or a commercial job board, has also become extremely popular in the last few years. Historically, newspaper advertising has been the most commonly used method of recruiting.

Formal method includes:

- Recruitment Advertising

- Internet Recruiting

- Employment Agencies

- Public Job Service Agencies

- Private, For-profit Agencies

- Unions

- Additional Recruiting Methods

- Campus Recruiting

- Executive Search Firms etc.

7.4 Selection:

Selection the right employees are important for an organization. First own performance always depends in part on subordinates. Employees with the right skills and attributes will do a better job for the company. Employees without these skills wont perform effectively and as a result the firm will suffer.

7.5 Process of selection:

Selection activities typically follow a standard pattern, beginning with an initial screening interview and concluding with the final employment decision. The selection process typically consists of eight steps:

- Initial screening interview

- Completing the application form

- Employment test

- Comprehensive interview

- Background investigation

- A Conditional job offer

- Medical or physical examination

- The permanent job offer.

Initial Screening:

As a culmination of our recruiting efforts, organization should be prepared to initiate a preliminary review of potential acceptable candidates. This initial screening is, in effect, a two steps procedure: (1) the screening of inquiries and (2) the provision of screening interviews.

Completion of the Application Form:

Once the in initial screening has been complicated, applicants are asked to complicate the organization’s application form. The amount of information required may be only the applicant’s name, address, telephone number and other information.

Employment tests:

Organization historically relied to a considerable extent on intelligence, aptitude, ability and interest tests to provide major input to the selection process.

The comprehensive interview:

The applicant may be interviewed by HRM interviewers, senior manager within the organization, a potential supervisor, potential colleagues or some or all of these.

Background investigation:

The next steps in the process are to undertake a background investigation of those applicants who appear to offer potential as employees. This can include contacting former employers to confirm the candidate’s work record and to obtain their appraisal of his or her performance, contacting other job- related and personal references, verifying the educational accomplishments shown on the application, checking credit reference and criminal records, and even using third party investigation, to do the background check.

Method of selection:

There are two statistical methods of selection- correlation and regression. Correlation is use to assess the strength and direction of a relationship between variables, whereas regression makes use of the relationship to predict scores on one variable from scores on one or more other variables.

Physical/ Medical Examination:

Physical exams can only be used as a selection device to screen out those individuals who are unable to physically comply with the requirements of a job.

7.6 Conditional job offer:

If a job applicant “passed” each steps of the selection process so far, it is typically customary for a conditional job offer to be made. Conditional job offers usually are made by an HRM representative. In essence, what the conditional job offer implies is that if everything checks out “okay- passing a certain medical, physical or substance abuse test” the conditional nature of the job offer will be removed and the offer will be permanent.

Job offer:

Those individual who perform successfully in the preceding steps are now considered to be eligible to receive the employment offer.

7.7 Organizational practice:

Agrani Bank Ltd recruit employees both formal and informal ways. Formal recruitment usually dose through newspaper advertisement, where entry-level employees has been recruited. In the advertisement, criteria are mentioned specially for recruitment. But some times they also recruited experienced people in med level and top level.

Informal method is also true for this bank. In this case they consider the educational level for entry level i.e. cash officers, junior officers etc. They also recruit mid level people those who are experienced and good track record. Top level people recruitment also been done on contract basis.

8.1 Training:

The process of teaching new employees the basic skills they need to perform their jobs.

Training refers to the methods used to give new or present employees the skills they need to perform their jobs. Training might thus mean showing a machinist how to operate his or her new machine, a new salesperson how to sell his or her firm’s product, or a new supervisor how to interview and appraise employees. Training basically provide to the entry-level employees.

On the job training: It means learning by doing. It means employees training completed while he works. It is basically a practical oriented training program.

Off the job training: It means training provided to the employees out of the office in a training institute for a particular period of time i.e. for 15 to 20 days. During this time the employee does not have to go to office.

8.2 Development:

Development basically provide to the management level. Management development is any attempt to improve managerial performance by imparting knowledge, changing attitudes, or increasing skills. The ultimate aim of such development programs is, of course, to enhance the future performance of the organization itself. For this reason, the general management development process consists:

(1) Assessing the company’s needs (for instance, to fill future executive openings, or to boost competitiveness),

(2) Appraising the managers’ performance, and then

(3) Developing the managers (and future managers) themselves.

8.3 Development and Training

Training is a proven instrument for Human Resource Development, in this age of accelerated technological improvements, training plays a key role in developing knowledge and skills and change of attitude.

Agrani Bank Training Institute (ABTI) was established on the 24th December 1976. ABTI is entrusted with the responsibility of formulating and designing course curricula, reading materials, course contents for imparting training (both theoretical and practical ) to the officers/staff members. ABTI imparts training on different banking issues for the purpose of enhancing professional and administrative efficiency of all officers and managers. ABTI also conducts workshops, seminars, conferences, symposia, etc. on important issues for top executives. To cope with the changes and introduction of new tools and techniques for implementation of guidelines of Government and regulatory bodies and also for the purpose of implementation of various reform programs, ABTI stresses on actual need based training.

Agrani Bank training institute has already covered a total number of 46880 officers and staffs under different banner of training through 1460 courses/workshop from its inception. In 2007, ABTI maintained its momentum in the training arena covering a total of 2069 officers and staff through 67 courses/ workshops.

In 2007, ABTI undertook comprehensive training programs. The following courses/workshops are worth mentioning: Documentary Credit, Branch Management, Banking Foundation Course, Human Relations and Communication Development, Basic Accounting and Agrani Bank Accounting Procedures, Audit, Inspection and Implementation, Money Laundering Prevention, Credit Risk Grading, Internal Control and Compliance, UCPDC-600, Foreign Remittance Management, Management of non-performing Loan and techniques of profitability, Accounts Manual and Chart of Accounts, New Capital Accord (BASEL-ll). Communicative English in Banks, Human Resource Management, Management Development Programme , Procedure of Suit Filing and Techniques of Suit Settlement, Maintaining Records of Fixed Assets , Government Receipt System and Reporting Process, Computer : PC –MS Office, Computer : Application and Operation of Branch Banking Software, Computer: Its use in Agrani Bank, Branch Banking Software : Bexi Bank-4000 etc.

Apart from the training courses being offered by the ABTI,298 executives/officers were nominated for undergoing various training courses at BIBM, BPATC, BBTA, ICCB, ICICI, BAFEDA, Academy for planning and Development, etc.

In 2007, on invitation from many foreign organizations, 19 executives/officers were sent abroad to attend various training courses, workshops, seminars, conferences and symposia to acquire updated knowledge and techniques of banking.

8.4 Method of Training and Development:

There are some training and development methods which is given as under:

Training | Development |

the internet |

5. In HouseDevelopmentCenter |

8.5 Organizational practice: