Executive Summary

The banking system plays a critical role in underpinning economic development of any country. On that view Southeast Bank Limited, Agargaon Branch was opened on December 29, 2002. Now they are one of the leading banks in Bangladesh. Actually the bank gets a good position in the market for their diversified services. Employees are the most valuable assets in the origination. Human Resource Department is responsible for the people dimension of the organization. The basic objective of this study should be analyzing the Human Resource Activities in Southeast Bank Limited.

All kinds of commercial banking services are provided by the Bank to the customers following the principals of Islamic Sari’ah, the provision of the Bank Act 1991 and Bangladesh Bank’s directives. Apart from the corporate culture, working environment, employee relationship and overall the mission and vision of the Bank demonstrates a highly conductive and praiseworthy.

Of course, there traced few limitations and shortcomings. With the increasing flow of customers the Bank needs to increase the number of service provider in the particular branch to gain a best customer satisfaction.

In brief I can say that the SEBL develops diversified Human Resource Activities and very short they have got good response from their customers. They actually have achieved tremendous success in the last few years. It has come forwarded with an ideology accompanied with modern and innovative banking services to attract new customers in the competitive market place.

Chapter One:

(Introduction)

Introduction:

The Internship program bears a significant for BBA students that are an opportunity for them to achieve practical experience in different field of business and commerce though learn by doing. Students under this program have the change to be familiar with the business world with challenging enterprising dimension. Internship is one of the beast ways to acclimatize the students with reality and the estimation e.g. comparison the theoretical learning and the reality expression.

Being a student of regular BBA of Northern University Bangladesh I was authorized to do internship under any Commercial Bank on the issue of Human Resource Management. I have chosen the South East Bank Ltd. with the help of relevant authority of Northern University Bangladesh. A complete duration of three month internship conducted under the Agargaon Branch of South East Bank Ltd, Dhaka Starting from 02/04/2011.

Purpose of the Report:

I have been introducing with different work sections and departments of the Branch from the very beginning of my internship. My objective was to achieve acquaintance, observance, understanding and doing by learning. Since, my area of internship study was Human Resource Management. I have tried to get idea, observe and understand the management aspect of Human Resource of the branch. Some times, I tried to interrogate Bank personnel to clarify myself on overall aspect my study with the bank was determined with some particular objectives which have been briefly note below:

a) To achieve the particular knowledge, understanding, and obtaining experience on the operational aspects of the Bank and HRM as well.

b) To get the knowledge on the procedural aspects of general banking and relevant operation.

c) To get the ideas about the human resource planning, process of recruitment, selection, training and development other compensation and benefit and facilities etc of the Bank.

Scope of the Report:

I think have done my internship study with Agargaon Branch of South East Bank Ltd. as a rare opportunity to enrich my learning. From the very beginning all the personnel of the Bank extended me their sincere assistance and cooperation. I had to ask question and clarification from personnel of different level of the Bank who, have subsequently helped me to understand.

Though it is the first time in the bank as an internee I never felt very uncomfortable with process of working environment of the bank.

Methodology of the Report:

This report has been prepared on the basis of experience gathered during the period of internship. In order to make the study more meaningful and presentable; two sources of data are used:

a. Collection of Data

This report is report on the basis of primary and secondary data and most of the data has been collected from the secondary sources.

Primary sources of information:

- Face to face conversation with the officers of the Branch of the Bank.

- Face to face conversation with the clients of the bank.

- Interviewing branch manager

- Observation method also used to collect data.

Secondary sources of information:

- Branch records

- Service Rule of Suotheast Bank Limited.

- Website of the bank.

Justification of the Report:

The justification or rational of the study can be elaborated such as, developing a simple guideline for the interested people in commercial banking operation. It can be useful to the banker and the investor who might be interesting and useful in general banking, process and procedure.

Different researcher, resource person in banking sector can also use to undertake research activities, using the training and workshop of banking operation.

In specifically the study focused as follows:

a) To identify the effectiveness operation aspects of South East Bank Limited.

b) To identify the process, procedure and other indicators of facilities in comparison with other banks.

c) To analysis and observation of the Human Resource Management process implementation.

Limitations of the Report:

This report is an overall view of Organizational Structure, foreign exchange business procedure and its contribution to profitability of SEBL and financial analysis. But there are some limitations for preparing this report.

Firstly, this bank is moderately new so they do not have enough data, that’s why I did not make vast compare this bank with other banks.

Secondly, when I was doing my internship, the bank was conversion others bank. That’s why I could not get all required data. With all of these limitations, I tried my best to make this report as best as possible. So readers are requested to consider these limitations while reading and justifying any part of my study.

Some restraint at the time of preparing the report are appended below

- The insufficiency of information is main constraint of the study. Moreover employees are not interested to provide all information due to security and other corporate obligation.

- The employees and clients are busy to provide me time for interview.

- Inexperience and time limitation were the constraints of the study.

- Lack of knowledge about HRD system.

- It is too much difficult to comment & suggest based on only the annual report and information supplied by the organization.

- Don’t give the data from their source document.

Chapter Two:

(Organizational Profile)

Profile of the bank:

Southeast Bank Limited was established in 1995 with a dream and a vision to become a pioneer banking institution of the country and contribute significantly to the growth of the national economy. The Bank was established by leading business personalities and eminent industrialists of the country with stakes in various segments of the national economy. The incumbent Chairman of the Bank is Mr. Alamgir Kabir, FCA, a professional Chartered Accountant. Mr. M. A. Kashem a member of the Board and Mr. Yussuf Abdullah Harun were past Presidents of the Federation of Bangladesh Chamber of Commerce and Industries (FBCCI)

Southeast Bank is run by a team of efficient professionals. They create and generate an environment of trust and discipline that encourages and motivates everyone in the Bank to work together for achieving the objectives of the Bank. The culture of maintaining congenial work – environment in the Bank has further enabled the staff to benchmark themselves better against management expectations. A commitment to quality and excellence in service is the hallmark of their identity.

Division-wise-Branches:

Southeast Bank Limited has 64 branches in the country. Divisional distribution are given below:

Division | Branches |

| Dhaka | 31 |

| Chittagong | 17 |

| Rajshahi | 4 |

| Sylhet | 8 |

| Khulna | 1 |

| Barishal | 1 |

| Rangpur | 2 |

Product and Services:

Since commencement of banking operation, Southeast Bank Limited has not yet only gained enormous popularity but also been successful in mobilizing deposit and loan products.

The bank has made significant progress within a very short time period due to its dynamic management and introduction of various consumer-friendly loan and deposit products. Those are given below:

- SME Banking

- Monthly Benefit Deposit

- Fixed Deposit

- Saving Deposit

- SND (Short Notice Deposit)

- CCS (Consumers’ Credit Scheme)

- Loan against Shares and Securities.

- House Building Finance Scheme

- Import Financing

- Export Financing

- Industrial Financing

- ATM Services

- SWIFT Service

- Remittance Business

- Locker Service

History and Background:

South East Bank Limited is a schedule commercial bank in the private sector established under the ambit of bank company Act 1991 and incorporated as a public limited company under company Act 1994 on March 12, 1995. The bank started commercial banking operations on May25, 1995. During this short span of time the bank has succeeded in positioning itself as a progressive and dynamic financial institution in the country. The bank has been widely acclaimed by the business community from small entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers for its forward-looking business out look and innovative financial solutions. Thus within this very short period of time it has been able to create an image and earn significant reputation in the country banking sectors as a bank with vision.

South East Bank Limited has been licensed by the Government of Bangladesh as a scheduled commercial bank in the private sector in pursuance of the policy of liberalization of banking and financial services and facilities in Bangladesh. In view of the above , the bank, within a period of 16 years of its operations, achieved remarkable success fully meeting capital adequacy requirement of Bangladesh Bank.

As evident from the financial statements for the last 12 years, it has been growing rapidly as one of the leaders of the new generation banks in the private sectors in terms of business and profitability.

Structural Management of South East Bank Ltd.

Chairmen

↓

Board of directors

↓

President and Managing Director (MD)

↓

Deputy Managing Director (DMD)

↓

Senior Executive Vice President

↓

Executive Vice President

↓

Senior Vice President

↓

Vice President

↓

Senior Assistant Vice President

↓

Assistant Vice President

↓

Senior Principal Officer

↓

Principal Officer

↓

Executive Officer

↓

Senior Officer

↓

Officer

↓

Junior Officer

↓

Assistant Officer

About Southeast Bank Limited , Agargaon Branch:

Agaegaon Branch opened on. 29 December 2002. The location of the branch is Plot# E-4/B (1st Floor), Agargaron Administrative Area, Shere-e-Bangla Nagar, P.S. Mohammedpur, Dhaka. The work load in this branch is always in high volume. The total manpower of the branch is 22. There are One Manager, One Manager Operation, Two Executive Officer, Two Senior Officer, One Probationary Officer, Two Officer, Five Junior Officer, Two Tainee Cash Officer, Two Messenger, Three Guard, One Tea Boy.

Mr. Md. Zakir Hossain is present manager of the branch. The function of the branch mainly divided into two wings. General Banking operation and Investment operation. General Banking operation done by various section such as Chase section, Bill and Remittance section, Clearing and Collection section, Account Opening section, Credit section, Fringe Exchange Transaction and Sundry section. The branch can open L/C. The branch provides on-line banking, ATM-cash service. Transaction hour is guarded by armed security guards.

The branch strives for a customer-oriented banking culture, with prudent, lending and attractive deposit schemes.

Corporate mission:

- High quality financial services with state of the art technology

- Fast customer service

- Sustainable growth strategy

- Follow ethical standards in business

- Steady return on shareholders’ equity

- Innovative banking at a competitive price

- Attract and retain quality human resource

- Commitment to Corporate Social Responsibility

Corporate Vision:

To be a premier banking institution in Bangladesh and contribute significantly to the national economy.

Objects of the Bank:

- To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

- To remain one of the best banks in Bangladesh in terms of profitability and quality.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To maintain a healthy growth of business with desire image.

- To maintain adequate control systems and transparency in procedures.

- To develop and retain a quality work-force through an effective Human Resources Management System.

- To ensure optimum utilization of all available resources.

- To pursue an effective system of management by ensuring compliance to ethical norms, transparency, and accountability at all levels.

Corporate Slogan:

Bank with a Vision.

Values of the Bank:

- To have a strong customer focus and to build relationship based on integrity, superior service and mutual benefit.

- To work as a Team to serve the best interests of the organization.

- To work for continuous business improvement.

- To value and respect people and make decisions based on merit.

- To provide recognition and reward on performance.

Strategies:

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund.

- To strive for customer satisfaction through quality control and delivery of timely services.

- To identify customers’ credit and other banking needs and monitor their perceptions towards our performance in meeting those requirements.

- To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

- To train and develop all employees and provide them adequate resources so that customers’ need can be reasonably addressed.

- To promote organizational effectiveness by openly communicating company plan, policies, practice and procedures to employee in a timely fashion.

- To cultivate a working environment that factors positive motivation for improved performance.

Executive Committee:

All routine matters beyond the delegated power of the Management are decided upon by or routed through the Executive Committee, subject to ratification by the Board of Director.

Name | Designation |

| Mr. Alamgir Kabir (FCA) | Chairman |

| Mr. Mahabubul Alam | Managing Director |

| Mr. Ragib Ali | Member |

| Mr. M. A. Kashem | Member |

| Mr. Azim Uddin Ahmed | Member |

| Dr. Zaidi Sattar | Member |

| Mr. A.H. M. Moazzem Hossain | Member |

Audit Committee:

In line with the guidelines of Bangladesh Bank, 3 (three) members Audit Committee of the Board of Directors has been formed to assist the Board to Audit and Internal Control system of the Bank.

Name | Designation |

| Mr. Azim Uddin Ahmed | Chairman |

| Dr. Zaidi Sattar | Member |

| Mr. M. A. Kashem | Member |

Chapter Three:

(Internship Position Duties Learning)

Internship position, Duties and Learning points:

The Internship Program:

I have completed my internship program in Southeast Bank Limited. I was placed in Agargaon Branch. I joined my internship on January 1, 2011. During my internship period I had not any specific organization position. So I was got a chance to do work many desk of the Branch. Therefore I had lots of experience. I got the opportunity to work as an internee of the Bank in the General Banking Department.

Internship duties:

Basically I worked in account opening section of Southeast Bank Limited in Agargaon Branch But during my internship period I got a opportunity to do several tasks in varies department like FDR section, Accounts Sections, Foreign Exchange and Clearing section. I would like to discuss my internship duties on the basis of these departments.

Account Opening Section:

Account opening was one of the my tasks. The major duties of Account Opening department are to open various kind accounts and keep record of that accounts. In this department I gather lots of practice knowledge and this are-

- How to open various kinds of account?

- What are the prerequisites to open an account?

- The amount require for different types of account.

- How to keep record of various accounts?

- Verifying the account opening form

- Verifying other document regarding account opening

- Verifying the customer signature

- Issuing check and cash books.

FDR Section:

In FDR section I worked for a very few time. In this section I provided the information regarding the FDR. I helped the clients to fill the FDR form. Then I checked the documents that required. When the offers completed his posting I took the papers to the manager sir for his approval. At the end of the day I put entry of the FDR forms in an entry book according to the FDR numbers, names, opening date and matured date. After that I filed up all the forms.

Accounts Section:

This is a very much crucial department for each branch of a commercial bank. Records of all the transactions of every department are kept here as well as with other respective branches. Accounts section verifies all financial amounts and contents of transaction. If any discrepancy arises regarding any transaction this department report to the concern department.

Learning Points

- In account opening section I have also learned about the interest of different types of account.

- There are lots of DPS in the bank. I have learned about the requirement to open a DPS. I also know which DPS provides how much interest.

- I have learned about clearing section. In the clearing section, I have received the cheque also learned about the things that should be written in the cheque and the deposit receipt.

- I have a clear idea about recruitment process.

- I have an idea about leave policy.

- I have a clear idea about maternity policy.

- I have some idea about foreign exchange activities.

- I have clear idea about accounts section of the bank.

- I have idea about different promotional of the bank.

- I have idea about pay and allowance policy of the bank.

- I have idea about salary structure of the bank.

Chapter Four:

(HRM Activities)

HR Practices of South East Bank Ltd of Agargaon Branch.:

Job description:

Manager/ Branch incumbent:

1) To be responsible for smooth conduct, control, administration and supervision if the whole affairs of the Branch.

2) To ensure proper security measure of the desired working efficiency at the Branch.

3) To keep constant watch on the desk works of the officers and staff of the branch and also to ensure equitable distribution of works among them.

4) To be responsible for exercising the administrative, financial and business discretionary power in conduct of the affairs of the branch as delegated by Head office.

5) To ensure maintenance of proper books of Accounts, Ledgers and Registers, Computer Sheets, Security, Keys and test Keys of the branch including their periodical balancing and checking there of.

6) To ensure rectification/regulation of any audit/inspection irregular/ lapses guarding against recurrence of similar lapses.

7) To attend the reported problems and complaints from any corner and take appropriate step as considered necessary to dispose of such cases and appraise Head Office.

8) To responsible for achievement of business targets fixed by Head Office.

9) To attend Branch Managers Conference when arranged by Head Office.

10) To keep conduct with the investment clients and ensure timely recovery of the investments.

11) To proper annual confidential report of all the employees under his control impartially and exactly.

12) To arrange job rotation of the employees for enabling them to get oriented in all areas of operations of the branch.

Manager Operation:

1) He will act as second officer and joint custodian of the branch and overall in charge of the branch. He will also perform the duties and responsibilities as noted here under:

2) He will sign all the debit vouchers of investment and Forigne Exchange Department.

3) Proposal of investment and Forigne Exchange Department will be rotated through him.

4) Public relation and personalized customer service.

5) He will hold safe Keys all duplicate Keys, including main gate and Key register, to hold Keys of volt and Iron safe and security papers Almirah.

6) Ensuring safe custody of all ledgers, related with general banking department etc.

7) To check of general of general Ledger, Income, and Expenditure ledger, Transfer.

8) He will cancel/ sign/counter sign of all cheques above Tk 50000 to Tk 100000.

9) Transfer cheque/ voucher up to Tk 200000 jointly with any other authorized officer.

10) He will ensure remittance of excess cash or bring cash as and when required to and from.

11) He will be the supervising officer of the daily voucher and will sign in the voucher register after register being written.

12) Supervision of leave record register.

13) Ensure close supervision for DD. paid without advice A/C, Sundry Deposit A/C.

14) Suspense A/C, Pay Order payable A/C, Demand Draft payable A/C, such to keep the outstanding balance reduced in the A/C.

15) To hand over a chack list of the assigned job to the relieving officer/staff in case of granting level.

16) To take care of any missing circular and as soon as it is noticed, special arrangement to be made to collect the same from Head Office.

17) To ensure documentation formalities before any disbursement.

18) Ensure safe custody of all documents related to investment and ensure that the same have been entered in the documents registered.

19) To communicated any transfer to the concerned official prepare all the relevant papers/ orders and arrange to brief the incoming officer about his job assignment.

20) To ensure the compliance of annual closing.

21) To ensure all kind of account opening smoothly including ledger posting and balancing. Delivery of statement to the deserving clients etc.

Senior Officer Remittance:

a) To hold the branch mobile by his own responsibilities at the office hour and to receive and dispatch of TT`s by telephone/ telex/courien or specia/ messenger daily without fail.

b) To hold the maintenance the test Keys apparatus for TT, DD, advice etc. incase of absence engaged in other important activities like physical inspection of establishment of collateral of investment clients and correspondence workers of officers.

c) Payment and maintenance of TT payable register and issue reminder against outstanding TT which confirmatory not yet received.

d) Writing of voucher of TT incoming and counter signing there against.

e) Counter signing of cheques/ voucher/ DD/ PO advice of IBCA, IBDA etc.

f) Writing of DD and balancing of DD issue register and daily balance posting to be written at the back side of the last DD issued counter foil.

g) Submission of monthly Fraud, Forgery statement to Head Office.

h) Writing of day book of respective vouchers as mentioned and to help clean cash workers.

i) Any other works assigned to him by the management from time to time.

Officer Account Opening:

The duties and responsibilities to be performed by you meticulously are enumerated below:

a) To open all of new Accounts that is Savings Account, Current Account, Short Note Deposits, Forign Account.

b) Maintenance of Know Your Customer from for various Accounts.

c) Confirming issuance of Cheque of new account holder who did not received letter of thanks.

d) Preservation of all kinds of deposits slips and provides the same to the clients with confirming branch affixed seal and showing the writing procedures to the new clients.

e) Any other works assigned to him by the management from time to time.

Officer Clearing:

The duties and responsibilities to be performed by you meticulously are enumerated below:

a) Maintenance/ Preparation of clearing/Transfer delivery (In ward and Outward) and bills/ remittance etc.

b) Receipt of Cheques, Drafts, and others documents for collection and maintenance of regiater.

c) To keep the clients informed about any return/disorder of the cheque(s), Instrument(s), as soon as it learnt over the phone/ issuing letter.

d) To put marking of the register soon as the cheaque/ instrument is returned and keeping the instrument properly.

e) Serving the customers with regared to OBC/ IBC in that.

f) Collection, payment and records of OBC/IBC.

g) To maintain register to ecord receipt cheque, bolls etc. deposits for credit to clients accounts regarding OBC/IBC.

h) To keep the clients informed about any return/ dishonor of cheque(s), Instrument(s), as soon as it is learnt.

i) To put marking of the register a soon as the cheque/ Instrument is returned and keeping the instrument properly.

j) To take special care of the receiving proceeds over their IBC number and our OBC number.

k) Keeping the branch incumbent informed constantly of any development of abnormality relation to day to day banking affairs.

l) Writing of day Book of respective vouchers as mentioned and to help clean cash works.

m) Any other works assigned to him by the management from time to time.

Messenger:

All message oriented works more over the following works shall be done by him.

a) Stoking of cheques/voucher properly every day.

b) Stitching of Taka in the cash section and when requires.

c) Move to one branch to another branch when require.

d) Miscellaneous works.

Security Guard:

Maintenance of full security for men and money in the office. Moreover the following works shall be done by him.

a) Carrying of money from and to the branch

b) Full watch and ward duty round the clock

c) Miscellaneous works.

Background of the personnel of the Agargaon brcnch of South East Bank Ltd.

SI NO | Name & designation | Educational Qualification | Experience | No of Training & Duration |

| 1. | Mr. Md.Zakir Hossain(vice President & HOB) | MBA | 14 Years | 1.Foundation training two months2. Investment Management three days.3. Managerial function ten days. 4. Investment Risk Management eight days. 5. Project Appraisal &Financing fifteen days. 6. Foreign Remittance thee days. 7. Schedule Bank statement three days. 8. IT training three days. 9. Money Laundering two days. |

| 2. | Mr. Md. Nazmul Haque(AVP& Manager Operation) | MBA | 14 |

|

| 3. | Mr. Aminul Islam(Executive Officer) | M.A. | 13 Years | 1. Foundation training two months.2. Investment Risk Grading five days.3. Human Resource Management three days. 4. Foreign Exchange Management three days. 5. Development & Marketing three days. 6. Money Laundering two days. 7. Banking Laws and Practices seven days. |

| 4. | Ms. Farjana Parveen.(Executive Officer) | M.A. | 13 Years | 1. Foundation training two months.2. Investment Risk Grading five days.3. Human Resource Management three days. 4. Foreign Exchange Management three days. 5. Development & Marketing three days. |

| 6. Money Laundering two days.7. Banking Laws and Practices seven days. | ||||

| 5. | Mr. Abdul Kader.(Senior Officer) | MBA | 4 years | 1. Foundation training two months.2. Investment Risk Grading 5 days.3. Development & Marketing three days. 4. Money Laundering two days. 5. Banking Laws & Practices seven days.

|

| 6. | Ms. Kulsuma Begum.(Seniour Officer) | MBA | 8 years | 1. Foundation Training two months.2. Investment Risk Grading five days.3. Money Laundering two days. 4. Computer training 15 days.

|

| 7. | Mr. Mohammad Saaif-Al-Islam.(Probitionary Officer) | BBA | 2 Years | 1. Foundation training two months.2. Rules & Regulation 15 days.3. Banking Laws & Practices 6 days. 4. Money Laundering two days. 5. Computer training 15 days. |

| 8. | Mr. Md. Ahmed zunaid.(Officer) | M.A. | 10 Years | 1. Foundation

training two months. 2. Investment Risk Grading five days. 3. Human Resource Management three days. 4. Money Laundering three days. 5. Banking Laws & Practices seven days. 6. Computer training 15 days. |

| 9. | Mr. Md. Jalalul Bari(Officer) | M.A. | 8 years | 1. Foundation training two months.2. Human Resource Management three days.3. Money Laundering three days. 4. Banking Laws & Practices seven days. 5. Computer training 15 days.

|

| 10. | Ms. Songita Basak.(Junior Officer) | M.A. | 3 years | 1. Foundation training two months.2. Rules & Regulation 15 days.3. Money Laundering two days. 4. Computer training fifteen days. |

| 11. | Sultana Begum(Junior Officer) | M.A. | 8 Years | 1. Foundation training two months.2. Investment Risk Grading fine days.3. Money Laundering two days. 4. Computer training fifteen days. |

| 12. | Sultana Akter(Junior Officer) | M.A. | 8 Years | 1. Foundation training two months2. Investment Risk Grading five days.3. Money Laundering two days. 4. Computer training fifteen days. |

| 13. | Ms. Dilara Zaman (Tainee Officer) | M.A. | 2 Years | 1. Foundation training two months.2. Money Laundering two days. |

Pay, Allowance, Grades & other Financial benefits:

The scale of pay, allowances, other financial benefits and grades shall be decided by the Board from time to time. The Board may incorporate new grades, designations(s), scales of pay, allowances and other financial benefits as its discretion as and when necessary.

Increment:

Southeast Bank Limited is a service industry. Its operations are regulated on the guiding principle of professionalism and result orientation. It’s human resource is the main engine for the operational success of the Bank.

The quality of the people working in an organization is not same. Their character, capacity, level of performance, intelligence, output and commitment are not equal and identical. Obviously, the performance of the people working in the Bank is needed to be periodically evaluated and quantified. In the process, the fittest will survive and come up in the management hierarchy while the non performers will fall behind in race or may ultimately be eliminated in the natural process.

Bank’s Annual Increment and efficiency Assessment Policy is an instrument not only to identify and reward good performers but also to take reformative actions against non-performers and those who resort to go-slow. For the purpose, the following rules are enjoined:

01) The salary structure of the Bank for the employees provide for annual increment. The annul increment to a confirmed employee shall accrue on the basis of his/her performance as on the 31’th day of December every year, unless stopped as a measure of penalty, provided that an employee has completed minimum 180 days confirmed service in the bank. This condition may be relaxed by the managing Director for maximum 15 days. Annual increment shall not, however, be claimed as a matter of right. The annul increments shall be sanctioned with effect from 1’th July of the year. The management may on special consideration, allow more than one increment to a deserving employee basing on his performance upon approval of the Board.

02) Employees on probation shall not be entitled to annual increment.

03) In case of promotion of an employee effective from first January i. e. if increment is due on the date of promotion then an employee will first get his normal annual increment in the existing scale and thereafter his/her new basic pay in the grade and scale he/she has been promoted will be fixed at the nearest higher slab if there is no exact slab for the amount.

04) Employees who slow marked weakness in the performance Appraisal shall be cautioned for improvement of performance. In case of no improvement, appropriate, administrative action shall be taken.

The table shows the pay and Allowance of the Personnel of Agargaon Branch.

SI NO | Designation | Basic Pay House Rent | House Rent | Convey | Medical | Total |

| 1 | VP & HBO | 42500 | 21250@50% of Basic | 2500 | 5000 | 71250 |

| 2 | AVP & MO | 32500 | 16250@50% of Basic | 2500 | 5000 | 56250 |

| 3 | Executive Officer | 21500 | 10750@50% of Basic | 2000 | 3500 | 37750 |

| 4 | Senior Officer | 19500 | 9750@50% of | 2000 | 3500 | 34750 |

| 5 | Junior Officer | 13500 | 6750@50% of Basic | 1500 | 3000 | 24750 |

| 6 | Tainee Officer | 9000 | 4500@50% of Basic | 1000 | 2500 | 17000 |

| 7 | Messenger | 5700 | 2850@50% of Basic | 680 | 695 | 9925 |

| 8 | Tea Boy | 4800 | 2400@50% of Basic | 650 | 650 | 8500 |

| 9 | Guard | 3650 | 1825@50% of Basic | 675 | 580 | 6730 |

Promotion/ Cadre Change Policy:

- Promotion may be considered for the highly deserving employees having satisfactory performance and service record.

- Promotion is not a matter of right. It has to be earned by merit and performance.

- Employees having adverse ratings in performance appraisal form/ACR or under disciplinary action may not be considered for promotion / cadre change.

- Promotion/ change of cadre usually may take place once in a year to be effective from 1’st January of each year.

- Promotion may take place subject to availability of sanctioned post in the higher grades.

- Individuals may be promoted on the basis of following consideration:

- The eligible employees will be evaluated on the basis of standard performance Appraisal Form.

- Individuals evaluated as outstanding or very Good may only be considered for promotion.

- For consideration of promotion minimum qualification require is Graduation.

- Bank may consider accelerated Promotion / cadre change of any employee irrespective of fulfillment of promotion / cadre change criteria but having outstanding performance / service records and making significant contribution to the causes of the Bank.

- Individuals evaluated as outstanding but could not be considered for promotion / cadre change because of non-fulfillment of promotion / cadre change policy / criteria may be allowed one or more than one performance increment provided the employee fulfills the criteria for annul increment (normal increment) in a particular financial year.

- Initial Pay

a) Initial pay on promotion:

The initial of an employee promoted to a higher post shall be fixed at the minimum of the scale of the higher post: Provided that if his pay in the lower post is equal to or higher than the minimum in the scale of the higher post to which he is promoted, his pay in the higher post shall be fixed at a next stage above his pay in the lower post.

b) Initial pay on cadre Change:

The initial pay of an employee Cadre Change to a particular post shall be fixed at the minimum of the scale of the new post: Provided that if his pay in the present post is equal to or higher than the minimum in the scale of the new post to which he is Cadre Changed, his pay in the new post shall be fixed at a next stage above his pay in the existing post.

Leave Rules:

Leave application: All applications for leave shall be addressed to the Head of branch / Relevant Department / Divisional Head which must contain his full address during the period of leave applied for and in the case of leave on the ground of illness or maternity leave must be supported by medical certificates indicating the period of leave recommended.

Grant if Leave:

Leave cannot be claimed as a matter of right. When exigency of service so required the competent authority may at it’s discretion decline leave of any kind also require an employee to resume duties before expiry of the leave already sanctioned to him. Casual leave will be approved by the Head of branch. All other forms of leave will be sanctioned by the Head office. However, casual leave applications from Head of branches as well as Operation Managers shall be approved by the Head office.

Absenting from Duty without Leave:

An employee shall not absent himself from duty or leave his place of posting on any ground whatever without obtaining prior leave sanctioned by the competent authority. An employee shall not also absent himself from duty on the ground of illness without applying for leave and submitting a medical certificate in support thereof.

Resumption of Duties:

All employee shall resume duties on the expire of leave as initially granted or as subsequently curtailed or extended. Over stay of leave without authority may warrant for disciplinary action not excluding dismissal from service. An employee shall not accept any employment or office of profit during leave period.

Report on Return from Leave:

An employee on leave shall unless otherwise instructed report to his place of posting at which he was stationed before proceeding on leave.

Certificate of Fitness:

An employee who was granted leave on medical ground shall not return to duty without first producing a certificate of fitness from an acceptable medical authority provided that no such certificate shall be necessary if the leave was for 7 (seven) days or less.

Types of Leave:

Subject to fulfilling the necessary conditions the following types of leave may be available to an employee:

1) Casual leave

2) Privilege leave

3) Sick leave

4) Maternity leave

Casual leave:

Casual leave means a leave of absence for a very short period granted to an employee who may be unable to attend duty during such period due to certain illness or urgent private affairs.

Casual leave for not more than 10 (ten) days in a calendar year may be granted to an employee provided that:

a) Not more than 3 (three) days leave is taken at a time.

b) Casual leave can be combined with holidays either suffixed or prefixed but not with both.

Any unutilized casual leave during a calendar year will not be carried forward to next year.

Privilege Leave:

Every employee shall earn privilege leave on full pay after completion of one year service @1/13th of the period spent on duty i, e, 1 (one) day for every thirteen days of duty and the leave shall be credited to his leave account on first day of joining and the maximum that can be accumulated shall be 90 days.

Sick Leave:

An employee shall be entitled to sick leave on medical ground up to a maximum of 14 (fourteen) days in a calendar year with full pay. Maximum 28 (twenty eight) days sick leave may be accumulated. Following issues relating to sick leave should be taken into consideration while sanctioning such leave:

a) Such leave can be availed only on medical grounds and on production of medical certificate from a registered and recognized medical practitioner acceptable to the bank.

b) Sick leave shall be credited to the employees leave account on the first day of each calendar year.

c) Sick leave may be taken in continuation of and in combination with holidays. In case where any weekly holiday intervenes sick leave, the entire period (including holidays) shall be treated as sick leave.

d) Sick leave may be taken in combination with any other leave excepting casual leave.

Maternity Leave:

Maternity Leave to female employees may be granted for a period of 6 (six) weeks at a time. Maternity leave shall be granted only thrice during the entire period of services of a female employee with the bank. The interval between the first and last maternity leave if the request for its grant be supported by medical certificates acceptable to the bank.

Recruitment Policy:

Preamble:

Human Resource Management is of paramount importance for Bank Management. Bank’s physical resources, human resources and technology are to be combined into a productive system to achieve organizational goals.

Human Resource Recruitment involves evolving an appropriate planning process to move the bank from its particular human resource position to desired human resource position and placement of right of people at the right place at the right time.

Recruitment Principle:

All appointment / recruitment in the bank will be made by direct recruitment as per prescribed criteria or by promotion as per promotion policy approved and / or amended / updated / by the competent authority from time to time.

Requirement for Recruitment:

No person shall be appointed in the service of the bank unless:

1) The applicant is a citizen of Bangladesh. Provided, however, that this may not be applicable in case of recruits abroad or in case where relaxation has been approved by the Board on consideration of special circumstances.

2) A qualified medical practitioner acceptable to the bank certifies that the applicant is physically and mentally fit for service in the bank.

3) The applicant has not been dismissed / terminate from the service or his service has been dispensed with for any specific reason with his / her former employer for financial irregularity or act of dishonesty / fraud / forgery. Those lateral entrants who have been dismissed / terminated from the service of their former employers after submission of their registrations with the intent to join Southeast Bank Limited shall, however, remain outside the purview of this sub-rules.

4) The age limit of the applicant for fresh entry in the Bank should be within the age bracket of 18-30 years. For lateral entry, the maximum age limit will be 50 years. It will not, however, be applicable in case of contractual employment.

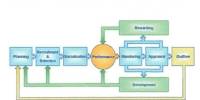

General Flow Chart of Selection process:

Advertisement / submission of CVs at HRD, Head Office

↓

Sorting out of application

↓

Preparation of preliminary list

↓

Calling the selected applicants for the written test

↓

Holding written test

↓

Selection of eligible candidates for the Interview (VIVA-VOCE)

↓

Calling the selected candidates for the Interview

↓

Conducted Interview

↓

Investigation of applicant details

↓

Preparation of desirable candidates’ list

↓

Final approval by the competent authority

↓

Physical fitness for employment

↓

Appointment and Placement

Mark Distribution:

The making system to be followed by competent authority or selection committee is as follows:

1) Education 12 marks

2) Interview Performance 20 marks

Total: 32 marks

Points for academic record:

The distribution of the educational achievement on the point basis is as follows:

| Examination Division / Class | SSC | HSC | Graduation / Honors | BBA | Masters | MBA/ MBM/Higher Professional Degrees (CA,ICMA) |

| 1st | 3 | 3 | 3 | 3 (CGPA 3.00 or above) | 3 | 3 (CGPA 3.00 or above) |

| 2nd | 2 | 2 | 2 | 2 (CGPA 2.75 or above but less than 3.00) | 2 | 2 (CGPA 2.75 or above but less than 3.00) |

| 3rd | 1 | 1 | 1 | 1 (CGPA 2.50 or above but less than 2.75) | 1 | 1 ( CGPA 2.50 or above but less than 2.75) |

Written test (In case of fresh recruits):

a) An external authority to be determinate by the bank shall hold written test for recruitment of Management Trainee (MT) and Probationary Officer.

b) According to the Grading / marking policy, each fresh candidate has to sit for a written test.

c) The subject matter to the test may be General Aptitude, General Knowledge, Arithmetic, English, Bengali or as will be determinate be the external Authority.

d) Code numbers may be used to “ensure secrecy” and to avoid “undue persuasion”.

e) Qualification marks for viva-voce will be determinate by the Bank Management.

f) The total marks, of the written test will be determinate by the external authority.

Interview Performance:

The following marking system for interview shall be followed:

1) Dress, Physical Appearance, Personality, Confidence & Capability 5

2) Knowledge in Related Field/Subject 5

3) General Knowledge 5

4) Analytical Ability, Communication Skill & Potentiality 5

Total: 20

General Rules for Recruitment:

1) A panel of successful candidates will be prepared in order of merit for recruitment in the Bank and appointment letter will be issued from the panel after the approval of the competent authority serially from the beginning based on final evaluation on the basis of requirement of the bank.

2) A candied selected for appointment must be medically fit. Any physical or mental disorder will result in cancellation of his recruitment/ appointment.

3) Each candied shall have to mention two well placed / respectable persons as reference in his / her resume. The confidential opinion of the referees about the character antecedent of the candidate shall be obtained. Besides the management shall also try to gather information from other sources about the character and past records of the candidate. If any adverse report is thereby received, the appointment of the candidate, if done, shall be cancelled and he / she may be terminated without assigning any reason whatsoever.

Findings:

The analysis of banking activities normally to as under:

Particulars | Description |

| The working environment of the branch | Employees are satisfied with the branch environment of per group cohesiveness, air condition room, separate desk, pc and telephone facilities etc. |

| Salary structure | The salary package of SEBL is not as the market demand, so the turnover of manpower is increasing day by day. |

| The branch work load | Banking activities are average. The work load is moderate. |

| The bank remuneration system | SEBL is good package by occasionally. |

| Consumer behavior | Consumer behavior is also good quality. Every Sunday and Thursday is so pressure from the coustomer but employees are taking easily. |

| Computer facilities | The number of computers and other supporting facility is sufficient in Bank. |

| The bank promotion system | Branch Employees are get promotion to be following SEBL. Promotion policy and they are satisfied. |

| The employees of the branch are co-operative | Every employee is maintaining good relationship each to other. |

Chapter Five:

(Conclusion & Recommendations)

Conclusion:

Southeast Bank Limited. Achieved stable growth and continuous as one of leading private sector Banks of the country. Since after its inception the Bank is satisfactorily contributing to the growth of GDP of the country through stimulation trade and commerce, acceleration the pace of industrialization, boosting up export, creating employment opportunity for the unemployed youths, poverty alleviation, raising standard of living of limited income group and overall sustainable socioeconomic development of the country. From the evaluation and analysis of the facts and information collected during the period of my involvement as an internee, it is clear that, Southeast Bank Limited is performing satisfactory over the last years and growing rapidly preserving a unique position in the banking sector of the country. The profitability of the Bank is showing increasing trend as a consequence of a dynamic investment management policy and farsighted efficient direction. The Bank has all the possibility of becoming maintain this trend of improvement and I think SEBL will be able to do so.

Recommendations:

- The Bank should consider the issue of better customer service more sincerely, and in this regard it may introduce various customer-oriented services, should automated operation.

- Every employee should have individual computer to work faster and give better quality services to the customers.

- The way of entrance of the branch is combined with other organization, for that Bank needs a separate entrance.

- In this branch for the investment clients to give them clear idea about some formalities with the bank before sanctioning of investment facility particularly to the new investment clients.

- It is necessary to increase the working capacity of all bankers in this Branch.

- More training, professional development is required for more often. Officers should be sent for training for betterment of service.

- For the employees of the Branch they do not have any canteen. Canteen facilities should be provided to the Branch.

- Only higher salary package cannot satisfy a self-motivated and exposed employee in high level. The employee wants recognition and reward for their self-actualization. There are few reward and recognition options is available in SEBL should be review for deals with employee turnover.

- HR development activities as individual, career and organizational by the HR department for enhancing the employee’s growth as well as achieve organizational hierarchy.

- The recruitment process of the bank is very lengthy and expensive. The bank should select the employee by reducing the lengthy process.

- One of the business strategies is promotion. Successful business depends how they can promote their products of services to the customer. In this connection to improve the business bank should introduce more promotional programs.

References:

Books:

- Decenzo, David A and Robbins, Stephen P; “Human Resource Management”, John Wiley & Sons, New York, 2002.

- Deslarer, Gray, 2003, Human Resource Management-Ninth Edition, New Delhi.

Internet:

http://www.southeastbank.com.bd