In general sense we mean “Bank” as a financial institution that deals with money. There are different types of banks like Central bank, Commercial bank, saving bank, Investment bank, Merchant bank, Co operative bank etc. But when we use the term bank it generally means ‘commercial bank’ that collects the deposit from surplus unit of the society and then lends the deposits to the deficit units of the society.

The existence of banking sector is not a new matter, as its existence was long years ago. But the new thing is that how it operates and presenting its activities for the purpose of serving customer requirements to increase their well being in the sense of wealth. Banks also provide many services for clients to make easy their life in a busy environment. In this competitive environment in today’s world, the entire bank increases their facilities in favor of their customers to retain them and capture more share of the market to be leader. Interest is one of the main factors in attracting customers and also one of the significant factors in increasing extra income from providing loans besides other service income. So, it can be said that conventional banking systems are interest-based system.

Bangladesh is one of the largest Muslim countries of the world. The people of this country are deeply committed to Islamic way of Life as it is mentioned in the Quran and Sunnah. But it is not possible for the people to establish and design their economic lives in accordance with Shariah. The very objective of Shariah is to promote the welfare of the people that lies in safeguarding their faith, their life, their posterity and their wealth. In this regard to establish a banking world that run according to Shariah, the concept of Islamic Banking Arise. Its establishment in Bangladesh on 13th March 1983, named Islamic Bank Bangladesh Limited.

The definition of Islamic Bank, as approved by the General Secretariat of the OIC, is stated in the following manner.

“An Islamic Bank is a Financial Institution whose statutes, rules and procedures expressly state its commitment to the principles of Islamic Shariah and to the banning of the receipt and payment of interest on any of its operation.”

This paper is an attempt to evaluate the Different Modes Investment of Exim Bank Bangladesh Ltd. in terms of productivity and effectiveness.

Significance of the study:

Internship program is the completing of BBA program from Bangladesh University of Business and Technology (BUBT) is provides practical knowledge to the ongoing students as the going to participate in the management of different organizations.BBA degree reveals not only read but also realizes the subjects deeply and knowledge have no value. The practical experience also helps learners to grow new ideas and techniques. Though this report an individual can expect to have a good knowledge and understanding on the Training and Development Activities of EXIM bank limited. Internship is clearly justified as the crucial requirement of four year BBA completion from BUBT.

1.2. Scope of the Study:

This report has been prepared through extensive discussion with bank employees and with the clients. Prospectus provided by the bank also helps to prepare the report. At the time of preparing the report, I had a great opportunity to have an in depth knowledge of all the banking activities practiced by the EXIM Bank Limited

Objective of the Study:

The objectives of the study are as follows:

a. Broad Objective:

To know about the employee training and development process of the EXIM Bank Limited.

b. Specific Objectives:

Furthermore, the specific objectives of this report are

- To know the objective of the training and development of EXIM Bank Limited.

- To identify the training method of EXIM Bank Limited.

- To know the opinion of the employee regarding and development program of EXIM Bank Ltd.

- To identify the problems of training and development of EXIM Bank Ltd.

- To suggest some possible recommendations to overcome the problem relating to training and development of EXIM Bank Ltd.

Methodology of the study:

A. Research type:

It is a descriptive research, which briefly explains of the training and development activities of EXIM Bank Limited.

B. Sources of Data:

All the relevant data regarding this study are collected from two sources

1. Primary Sources:

- Interviewing with the Bank officials of EXIM Bank Ltd. Satmasjid Road Branch.

- Through questionnaire survey.

- Official records and observing practical work.

- Practical desk work

- Face to face conversation with the officer

- Direct observations

2. Secondary Sources:

- Annual report of EXIM Bank Ltd.

- Published Booklet of the Bank.

- Website of EXIM Bank Ltd.

- Various published documents.

C .Data collection procedure:

Primary data:

I have collected raw data through informal face to face conversation with the officers also through questionnaire survey. I have also collected data from practical deskwork.

Secondary data:

In order to collect the secondary data different related printed materials like EXIM annual report; its website etc has been used. Moreover Library sources also have been used as secondary source of collecting early mentioned data and information.

Data analysis and reporting:

Different types of computer software are used for analyzing the gathered information such as Microsoft word and Microsoft power point. Different tables and graphs were used to make the data meaningful and comparable.

Limitations of the Study:

The following limitations are apparent in the report:

- Time is the first limitation as the duration of the program is very few only.

- Another limitation of the report of Bank policy is not disclosing some data and information for obvious reason, which could be very much useful.

- It requires lot of assistance from all level officers and staff but as a bank the officer was busy in doing their works.

- It was very difficult to collect data, which is very essential.

- Every organization has their own secrecy that is not revealed to others.

Lack of sufficient well informed officials:

Many officials of the branch are not well informed about different systems of Exim Bank. They know but less. I had to face much difficulty to collect this information.

Insufficient data:

Some desired information could not be collected due to confidentially of business.

Background of the Company:

EXIM Bank came in to operation as scheduled commercial bank on 3rd August 1999 as per rules and regulations of Bangladesh Bank. It is established under the leadership of Late Mr. Shahjahan Kabir, founder chairman who had a long dream of floating a commercial bank which would contribute to the socio-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. In deed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder chairman. Of its very beginning EXIM Bank Bangladesh limited was known as BEXIM Bank Limited. But some legal constraints the bank renamed as EXIM Bank, which means Export Import Bank of Bangladesh Limited. At present the bank is performing its work all over the country by 55 branches.

The bank has migrated all of its conventional banking operation into Shariah based Islamic banking since July/2004.

Major Activities of Branches:

a) Customer service:

- Account Opening and Closing

- Remittance

- Payment order issue

- Demand Draft issue and collection

- Endorsements

- Deposit

b) Accounts Department:

Clearing, Transfer, Cash.

Operations of Branch:

- Account opening Department.

- Cash Department.

- Remittance Department.

- Clearing Department.

- Investment Department.

- Foreign Exchange Department.

Objectives of EXIM Bank Limited:

- To have an overall idea about Islamic Banking System that is based on the Al-Quran and Sunnah.

- To know about the interest free Banking System and how it could be processed.

- To find out the difference between conventional banking system and shariah based banking system.

- Customer-driven focus.

Vision:

“TOGATHER, TOWARDS, TOMOMORROW”

EXIM as the name implies is not a new type of Bank in global but is the first in Bangladesh. It believes in togetherness with its customer in its march on the road to growth & progress with service. To achieve the desired goal, it has intention to pursuit of excellence at all stage with climate of continuous improvement. Because of it believes, the line of excellence is never ending. It also believes that its strategic plans & business networking will strength its competitive edge over in rapidly changing competitive environment. Its personalized quality service to customers with the trend of constant improvement might be cornerstone to achieve its operational success.

Mission:

The bank has chalked out the following corporate objective in order to ensure smooth achievement of its goal:

- To be the most caring and customer friendly and service oriented bank.

- To create a technology based most efficient banking environment for its customers.

- To ensure ethics and transparency at all levels.

- To ensure sustainable growth and establish full value to the honorable, stakeholders and

- Above all, to ad effective contribution to the national economy.

Eventually the bank also emphasizes on:

- Provide high quality financial service in export and import trade.

- Provide excellent quality customer service.

- Maintenance Corporate and business ethics.

- Being trusted repository of customers’ money and their financial adviser.

- Make their stock superior and rewarding to the customer.

- Display team spirit and professionalism.

- Sound Capital Base.

- Enhance Shareholders’ wealth.

- Fulfilling its social commitments by expanding its charitable and humanitarian activities.

Performance of EXIM Bank:

EXIM Bank Ltd. was incorporated as a public Limited company on the 2nd June 1999 under Company Act 1994. The Bank started commercial banking operations effective from 3rd August 1999. During this short span of time the Bank has been successful to position itself as a progressive and dynamic financial institution in the country.

The Bank widely acclaimed by the business community, from small business/entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers from forward-looking business outlook and innovative financing solutions.

Branch Expansion

During 2008 Bank has opened 09 (Nine) new branches at different commercially important location of the country and, thus, the total number of branches raised to 42(Forty Two). Out of total 44 branches, 44 are located at the prime business centre of urban areas and remaining 09 branches are at rural areas of the country. The following branches were opened during the calendar year 2008.

| Sl. No. | Name of the Branch | Opening Date |

| 01. | Corporate Branch, Gulshan-1 | 03.11.2008 |

| 02. | Pahartali | 29.01.2008 |

| 03. | Rajshahi | 19.08.2008 |

| 04. | Khulna | 05.01.2008 |

| 05. | Kushtia | 18.08.2008 |

| 06 | Golapgonj | 05.11.2008 |

| 07 | Muddaffargonj | 28.07.2008 |

| 08 | Chhagalnaiya | 17.12.2008 |

| 09 | Naria | 21.12.2008 |

DEPARTMENT AND DIVISION OF EXIM BANK

The following are the main divisions the structure and functions of each of these divisions are described below:

Internal Control & Compliance:

Internal control and compliance is considered as an eye of an organization the primary objective of internal control system in a bank is to keep the bank to perform better through the use of its resources through internal control system. Bank identifiers its weakness and takes appropriate measures to overcome the same. Internal control and compliance of the bank strictly follows the Bangladesh Bank’s guidelines. There is a well designed guideline of internal control and compliance division (ICCD) to run their operational smoothly. As per care, risk management policy of Bangladesh Bank. ICCD performs their duties with 03 departments named, Audit & Inspection, Compliance and Monitoring department. In 2008 ICCD was able to complete its audit & inspection on each branch as per schedule as well as to report in time to management and the Board Audit committee. As per guideline of care, risks management, MANCOM (Management Committee) conducts meeting regularly. The Committee reviews and supervise control system and inspection mechanism with policy and suggestion there of Internal Control and Compliance division of our Bank deserves the competency to introduce any effective control and compliance system and culture within the bank in case of any changed circumstance.

Financial Institute:

The bank achieved significant progress through continuous growth in all the areas of banking operations in the year under review. It has successfully mobilized TK. 57,586.99 million deposits from depositors and increased its investment (General) to Tk. 53,637.68 million as on 31st December 2008 through its 44 branches. The total income and expenditure of the bank were TK 8356.82 million and TK 5838.43 million respectively during period under review. It earns and operating profit of TK.2518.39 million with an annual growth rate 31.98% over that of the previous year. The return on Assets (ROA) after tax was 1.38%.

Shariah Council of the Bank:

A learned Shariah council consisting 12 members who are prominent Ulema, reputed banks and eminent economists of country has been formed to guide, monitor and supervise the banking activities complying shariah principle since inspection of its Islami banking branches and thereafter transformation of its from traditional to gully Shariah based Islami Banking System Professor Mawlana Mohammad Salahuddin in the Chairman of the Council.

Credit:

The credit risk management department is assisted by the credit division which is mainly concern with the post approval function of the division. Duties and responsibilities of credit division are too focused on documentation, sitting the limit of system, monitoring and credit products. Credit Division ensures that no transaction is booked under expired limits online of credit accounts where security documentation or collateral have not been perfected.

Human Resources Division:

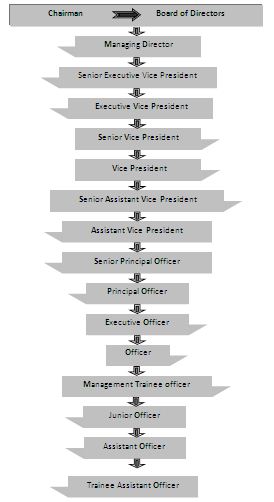

Amongst all the factors that combine to contribute towards the success of an organization, none counts as much as people, EXIM Bank believe it in letter and spirit. As such in order to select right type of people the bank is maintaining a very transparent & neutral modus operandi as regards recruitments. Recruitments are usually done through open invitation of applications by advertisement in the national dailies. As on 31 December, 2009. The manpower position of this bank was as follows:

| Sl.No. | Designation Category | No. of Employees (2009) |

| 01. | Executive | 86 |

| 02. | Officer | 1045 |

| 03. | Sub Staff (Casual) | 309 |

| Total | 1,440 | |

Exim Human Resources Division is in constant pursuit of providing for the optimum benefits and career support to its personnel through scores of mechanisms it has fashioned Exim Bank recreation a welfare center, Exim Bank foundation, and the library at the Training Institute, best performance Awards and so on

The Correspondent and Merchant Banking

Correspondent banks are the trade partners of international trade. Exim Bank has already achieved tremendous success in foreign exchange business. The Bank has established correspondent relationship with 246 banks covering 117 countries across the world. Having been licensed by the Securities and Exchange Commission, the bank is going ahead to expand its product horizon by offering Merchant Banking service to the customer. The Bank has come out with a diverse range of portfolio investment products, suiting customer investment need and providing prompt advice and solution to capital market business problems. The whole process is meant for the customer benefit mostly simultaneously this will accelerate the business growth in the country’s capital market and boost up the profitability of the bank.

Product & Service of the Bank

Finance / Investment

Corporate Finance.

Industrial Finance.

Lease Finance.

Hire Purchase Finance.

Commercial Investment.

Real Estate Finance.

Mode of Investment:

- Murabaha.

- Bai Muazzal.

- Izara Bill Baia.

- Wazirat Bil Wakale

- Local Documentary Bill purchased(LDBP)

- Foreign Documentary Bill purchased(FDBP)

Saving Scheme:

- Monthly Saving Scheme (Money Grower)

- Monthly Saving Scheme (Money Grower)

- Monthly The Deposit in years (SSS)

E- Cash/ ATM Service: The Bank is currently providing Credit Card Service (master card) to the Privileged Mars of the bank in collaboration with Prime Bank, Floating VISA Card it & credit card Service is under Process.

SME Banking: SME Sector Can Play a vital role in National Economy and Social Development Through Creation of New Entry Prize and poverty alleviation , Exim Bank Started its operation by opening two SME Service Centre at Board Bazar, Gazipur and Sitakunda Chittagong.

- EXIM Uddyog

- EXIM Abalamban

- Agricultural Banking

In line with Mandatory Provision of Bangladesh Bank for Agricultural Investment, Exim Bank has already introduced an agriculture product named as Exim Buniyad, It is short term Rural investment program under agriculture investment scheme.

Operation Area of the Exim Bank Ltd.

Export and Import Trade handling & Financing, as a commercial Bank, bank’s do all traditional Banking business including the wide of saving and credit scheme products, retail banking and ancillary services mobile the support of modern technology and professional Excellency. But our main focus is for obvious reason, on export and import trade handling and development patronization of private sectors.

Social Commitment of the Exim Bank Ltd.

The bank has established a foundation named Exim Bank foundation. This is a charitable organization, solely dedicated to the welfare of the helpless and down trodden people of the society. A certain position of the operating profit of the bank is usually provided in the foundation. The bank has actively participated in social, humanitarian activities well being of distress people at home and abroad through their foundation. The welfare activities of Exim Bank foundation are as follows:

- Income Generating Programs.

- Education.

- Health & Medicare Programs.

- Humanitarian Help Programs.

- Assistance for Natural Calamities Affected People and

- Zakat.

Human Resource Management

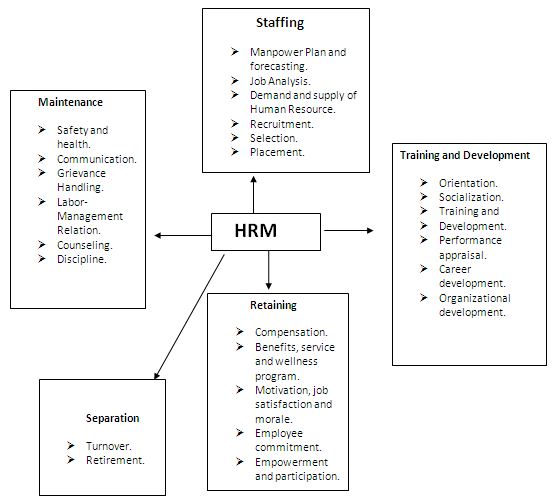

Human Resource Management (HRM) is the function within an organization that focuses on recruitment of, management of, and providing direction for the people who work in the organization. It is the process of procuring, developing, maintaining and compensating a given workforce.

HRM is the set of organizational activities directed at attracting, developing, maintaining an effective workforce to achieve the organizational objective effectively and efficiently.

Human Resource Planning

Human resource planning has traditionally been used by organizations to ensure that the right person is in the right job at the right time. Under past conditions of relative environmental certainty and stability, human resource planning focused on the short term and was dictated largely by line management concerns. As human resource planners involve themselves in more programs to serve the needs of the business, and even influence the direction of the business, they face new and increased responsibilities and challenges.

Human Resource Function

The role of human resource management is to plan, develop, and administer policies and programs designed to make expeditious use of an organization’s human resources. It is that part of management which is concerned with the people at work and with their relationship within an enterprise. Its objectives are:

- the effective utilization of human resources;

- desirable working relationships among all members of the organization; and

- Maximum individual development.

The major functional areas in human resource management are:

Training and Development:

Training

It is the learning process that involves the acquisition of knowledge, sharpening of skill, concept rules or changing of attitudes and behaviors to enhance to performance of employees Training is activity leading to skilled behavior.

- It’s not what you want in life, but it’s knowing how to reach it.

- It’s not where you want to go, but it’s knowing how to gate there.

- It’s not how high you want to rise, but it’s knowing how to take off.

- It may not be quite the outcome you were aiming for, but it will be an outcome.

- It’s not what you dream of doing bat it’s having the knowledge to do it.

- It’s not a sat of goals, but it’s more like a vision.

Training is about knowing where you sand ( no matter how good or bad the current situation looks) at present and where you will be after some point of time, training is about acquisition of knowledge, skill and abilities (KSA) through professional development.

Learning:

Learning has been described as a relatively permanent change in behavior that occurs as a result of practice or experience. It may be simply a sustain (unlearning a bad habit) or it may be a modification (adjusting new knowledge to old). What is learning is gradually change. The learning behavior differs from one another that is selective.

There are some principles of learning can be found which are:

- Learning is individual

- Motivation is the key

- Relevance of learning experience should be clear to the learner

- “Feedback” to learner is important.

Employee Orientation:

New employee orientation is the process that is used for welcoming a new employee into an organization. New employee orientation, often spearheaded by a meeting with the Human Resources department, generally contains information about safety, the work environment, the new job description, benefits and eligibility, company culture, company history, the organization chart and anything else relevant to working in the new company.

Employee Socialization:

Organizational socialization is the process through which organizational culture is perpetuated; by which newcomers learn the appropriate roles and behaviors to become effective and participating members.

Traditional and Modern Approaches of Training and Development:

- Traditional Approach – In the past, most of the organizations never used to believe in training. They were holding the traditional view that managers are born and not made. There were also some views that training is a very costly program and it doesn’t bring any benefit which is worthless. Organizations used to believe more in executives pinching. But now the scenario seems to be changing.

- The Modern approach- The modern approach of training and development is that Bangladeshi Organizations have realized the importance of corporate training. Training is now considered as more of retention tool than a cost. The training system has been changed to create a smarter workforce and yield the best results

Role of training

- Development of skills of employees – Training and Development helps in increasing the job knowledge and skills of employees at each level. It helps to expand the horizons of human intellect and an overall personality of the employees.

- Optimum Utilization of Human Resources – Training and Development helps in optimizing the utilization of human resource that further helps the employee to achieve the organizational goals as well as their individual goals.

- Development of Human Resources – Training and Development helps to provide an opportunity and broad structure for the development of human resources’ technical and behavioral skills in an organization. It also helps the employees in attaining personal growth.

- Productivity – Training and Development helps in increasing the productivity of the employees that helps the organization further to achieve its long-term goal.

- Team spirit – Training and Development helps in inculcating the sense of team work, team spirit, and inter-team collaborations. It helps in inculcating the zeal to learn within the employees

- Organization Culture – Training and Development helps to develop and improve the organizational health culture and effectiveness. It helps in creating the learning culture within the organization.

- Organization Climate – Training and Development helps building the positive perception and feeling about the organization. The employees get these feelings from leaders, subordinates, and peers.

- Obsolescence Prevention- “Training and development programmers foster the initiative and creativity of employees and help to prevent manpower obsolescence, which may be due to age, temperament or motivation, or the inability of a person to adapt him to technological changes

- Quality – Training and Development helps in improving upon the quality of work and work-life.

- Healthy work-environment – Training and Development helps in creating the healthy working environment. It helps to build good employee, relationship so that individual goals aligns with organizational goal.

Other Roles

- For an employers’ organization to raise awareness among employers of the need for increased investment in the development of human capital as an essential condition for achieving competiveness.

- In the training of personnel or human resource managers, given the fact that their role still tends to be downgraded relative to other management functions such as finance, marketing and production. This role could also be undertaken through training support given to professional bodies like an institute of personnel management.

- An employers’ organization should be able to influence the provision of training incentives to be offered to employers, through the tax system or training levies. Numerous examples in countries abound which can provide useful ideas to employers’ organizations.

- An employers’ organization could develop training material to be used by enterprises for in-house training

Inputs of Training and Development

Any training and development program must contain inputs, which enable the participants to gain skills, learn theoretical concepts and help acquire vision to look into distant future. In addition to these there is a need to impart ethical orientation, emphasis on attitudinal changes and stress upon decision making and problem solving capabilities.

- Skills-

Training is imparting skills to employees. A worker needs skills to use machine and other equipment with least damage or scrap; this is basic without which a worker is not able to work on machines. Same way employees like supervisors, executives needs interpersonal skills, popularly known as people skills. Interpersonal skills are necessary to understand oneself and others too and act accordingly.

- Education-

The purpose of education is to teach theoretical concept and to develop a sense of reasoning and judgment. HR specialists understand the importance of education in any training and development program. Many times organizations encourage employees to do course on a part time basis.

- Development-

Another component of a training and development, which is less skill oriented but stressed on knowledge. Knowledge about business environment, management principles and techniques, human relations, specific industry analysis and the like is useful for better management of the company.

- Ethics-

There is a need for imparting ethical orientation to a training and development program. There is on denial of the fact that ethics are largely ignored in business. Unethical practices abound in marketing, finance and production function in an organization. This does not mean that the HR manager is absolved of the responsibility. If the production, finance or marketing personnel indulge in unethical practices the fault rests on the HR manager. It is his/her duty to enlighten all the employees in the organization about the need for the ethical behavior.

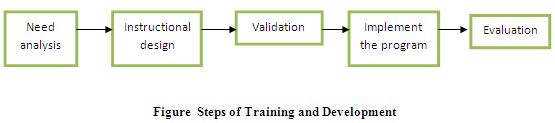

The Five steps of Training and Development process:

- Needs Analysis-

Needs analysis is the first step of the training process. It identifies the specific job performance skills needed, assesses the prospective trainee’s skills and develops specific measurable knowledge and performance objectives based on any deficiencies.

- Instructional Design—

In the second step instruction design individuals decide on compile and produce the training program content including work books exercises.

- Validation—

Validation is the third step in which the bugs are socked out of the training program by presentation it to a small representative audience.

- Implement the program—

The Fourth step’s to implement the program by actually training the targeted employee group.

- Evaluation—

Fifth is an evaluation step in which management assesses the programs successes or failures.

Training Methods:

Various methods of training which are given below:

Lectures, Demonstrations, Discussions, Computer based Training (CBT). Intelligent tutorial system (ITS).Program Instruction (PI) virtual Reality. Behavioral approach is: Games and simulations, behavior modeling, business games, case studies, equipment stimulators, in basket technique, role play.

Development:

Development is the process of increasing efficiency and changing behavioral pattern or mentality toward particular issues for the achievement of organizational objectives. That is, any attempt to improve current or future management performance by imparting knowledge, changing attitude or increasing skills is called development. Development involves in attaining the long-term efficiency in the workplace, that is getting the benefit in future rather than the present improvement in certain skill.

Difference between Training and Development:

Training is concerned with the immediate improvement of specific skill of the employee, that is the ways to make the employee more effective in his current role whereas development is a process to make the employee efficient enough to handle critical situations in the future, that is how well he can equip himself for the future demands. The basic difference is, training focuses on the current job skill (Short term process) whereby the development focuses on the future job skill and efficiency (Long term process).

Career Development:

Career development involves managing career either within or between organizations. It also includes learning new skills, and making improvements to help in career. Career development is an ongoing, lifelong process to learn and achieve more in career. Whether anyone looking at making a career change, or moving up within a company, planning his/her career development will succeed. By creating a personal career development plan; one can set goals and objectives for personal career growth.

Performance Evaluation:

The method of evaluating an employee’s performance which involves tracking, evaluating and giving feedback on actual performance based on key behaviors/competencies established in the goals that support the achievement of the overall organizational mission.

Training and Development

The training and development of all employees is critical to the Company’s success. It improves the performance of the company, teams and individuals and makes an important contribution to the retention of staff and the development of future talent.

EXIM Bank is committed to providing an environment which enables continuous learning, growth and personal achievement of all employees. The achievement of this commitment by the Company is also reliant on employee commitment and their willingness to learn, develop, take on new roles and responsibilities and seek opportunities for self-development.

Training and development plans are based on the future business strategy and through the output of regular individual appraisals. These plans identify where individual performance may be enhanced through development initiatives including training courses, coaching, job experience, formal studies, etc.

The Company is committed to the effective induction of all employees and in supporting all employees to realize their full potential. Training and development opportunities are offered on a fair basis to all employees. The Company ensures that no employee receives less favorable treatment or consideration.

Training and Development Objective:

- To help the employees perform more effectively in their jobs.

- To prepare the employees for future growth and advancement by providing supervisory and other management programs.

- To building effective work teams through developing staff communications and interpersonal skills.

- To inculcate a sense of dedication to highest quality.

To keep an employee up-to-date with changes those affect the business environment.

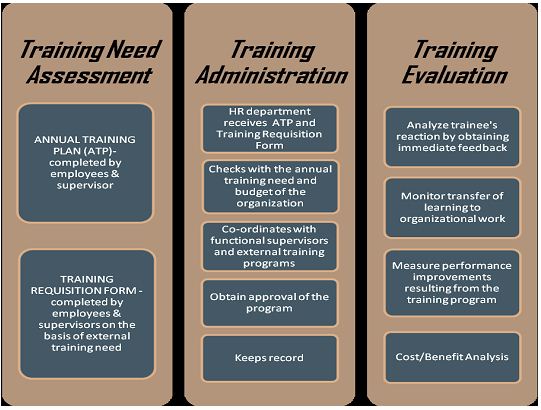

Training Needs Assessment:

Need assessment is the first step in the training and development process and it focuses of detecting and solving performance problem. The purpose is to identify if there is a need for training and the nature of the content of the training program. This phase determines the relevance of particular trainings to employee’s jobs and how it will improve the performance. It also addresses the organizational problems and then distinguishes the training needs with an objective to identify an appropriate training need which will link to improved job performance with EXIM Bank’s goals and bottom line.

Training Administration:

Objectives of a training program cannot be met unless there is a role-playing of the Human Resource Department. This Department carries out all the administration tasks of the training in co-ordination with the departmental supervisors, employees and at the same time with the trainer who will be or is in charge of providing the training program. As such, the HR department works as an intermediary between the employees, their supervisors and the training program. This is done to prevent any form of miscommunication and to ensure that the employees are receiving the right training pertaining to their needs, which will lead to improved performance of the company.

Training Evaluation:

Each and every training program is carried out with a view to achieving some pre-determined objectives and to analyze whether those objectives are fulfilled, training evaluation is a must. EXIM Bank believes in continuous development. Therefore, performances of the trainees are important to evaluate to know the effectiveness of the currently practiced programs. This will also help to rectify any loopholes in the process, which can be addressed during the evaluation process. The overall phase of Training Evaluation will focus on:

- Employees’ reaction towards the training program

- Analysis of the knowledge and skills that the employees have learned from the training programs

- Application of the knowledge and skills that were taught in the training

- Results of the new inputs made by the trainees.

Steps in Training and Development Process

Training needs assessment:

In this step of Training Needs Assessment, individual employees and line supervisors have essential and inexcusable role playing. EXIM Bank recognizes that employees are an integral part of organization and that they themselves have the potential to judge what kind of training will improve their performance at work. Therefore, they have the privilege to analyze their own abilities in line with their job responsibilities and can discuss these with their line supervisors.

On the contrary, it is one of the key responsibilities of the supervisors to keep their subordinates performance on constant check. They have to support their employees’ learning and development by scrutinizing and finding out the training needs. This is done in discussion with the employees. The supervisors have to gives priorities according to importance and availability of resources and then in prepare Annual Training Plan and External Training Recommendation which are forwarded to the Human Resource Department, upon completion.

Training Administration:

Administration of Training and Development is mainly done by the Human Resources Department. After receiving Annual Training Plan and External Training Recommendation from the line supervisors, it the responsibility of the HR Department to assess whether there is an actual necessity of the training which will be viable for the improved performance of the employees to achieve organizational objectives. Once this is done, HR searches through a number of resources and channels to find out about the related training availability and the associated costs with it. An approval from the Managing Director is then required prior to registering an employee with a training program. Employees and supervisors are also informed about the training details before registration. Hereafter, registration of the training program is done with proper documentation and the employees are able to attend the training. Finally, a record of training programs attended by each employee is maintained.

Training Evaluation:

Employees and line supervisors again have a major role playing in this segment of Training and Development of EXIM Bank. It is believed that active co-operation of all the parties will generate an accurate final output. Training Evaluation consists of four segments including Reaction, Learning, Transfer of learning and improvement in organizational work, and finally a cost-benefit analysis of the training program.

Employees who attend the training programs are expected to apply the newly learnt skills and knowledge at work and evaluate how it has helped to perform a task compared to the ability the incumbent possessed preceding training. They have to identify the differences and report their findings along with other views and suggestions to their line supervisors. This information flow can also include important notes on the first three segments of Training Evaluation, i.e. Reaction, Learning and Transfer of learning and improvement in organizational work.

Line supervisors, on the other hand, have to carry out multiple tasks. First and foremost, they have to prepare questionnaires and conduct survey of the trainees about their reaction towards the training program. This will then be followed by an interview of the trainees regarding what they have learned from the program. Information are all accumulated and kept for future references and comparison with previous performances of the employees. Problems identified in the training programs are recorded in order to be addressed to in future. In the mean time, supervisors have to perform activities for the third segment of Training Evaluation. They have to create work samples or allow and observe employees transfer their knowledge at work and at the same time evaluate how it improves the jobs. Occasional discussions are carried out to identify problems.

Finally, supervisors prepare a report consisting of records of all the evaluation of trainees and send it to the HR Department.

HR Department, after receiving the reports from the line supervisors, makes a thorough analysis and determines whether the training programs are actually effective. This is then finally followed by the fourth segment of Training Evaluation, i.e. Cost-Benefit Analysis. This is done by determining the Return on Investment of the Training Program and compare it with the cost of training.

Training methods followed by EXIM Bank:

Several methods can be used to satisfy on organization training needs and accomplish its objectives. The EXIM Bank classified their training by two categories:

Non-Supervisory Training: Non-Supervisory Training is the training for worker and operators of the company. Permanent and casual workers are included for these.

Vestibule Training:

In vestibule training, procedure and equipment similar to those used for the actual job are set in a special working area (called vestibule).

The main advantage of this method is that the trainer or worker can emphasize theory and use the proper techniques rather than output.

Apprenticeship Training:

Apprenticeship training is frequently used to train personnel in skilled trades such as electricians, mechanics. This type of training period generally lasts from 6-4 years. During the training the trainee or worker under the guidance of a skilled licensed worker, but receives lower wages than the licensed worker.

Classroom Training:

Classroom training is conducted off the job and is probably the most familiar training method. This training is an effective means of imparting information quickly or large groups with limited, or no knowledge of the subject being presented. This training is more frequently used for technical, professional and managerial employee.

Demonstrations and Simulation:

Demonstration and simulation are the important training methods of EXIM Bank. Demonstration may be carried out on the job or in a classroom. A demonstration in which the instructor actually shows the trainees how to do something has wide application.

A simulator is any kind of equipment of technique that duplicates as nearly as possible the actual condition encountered on the job. On the job training, Vestibule training and Apprenticeship training are usually for the non-supervisory training. Class room training and Demonstrations & Simulation are for the supervisory training.

Management Development of Exim Bank

On the Job Development:

- Coaching.

- Under Study.

- Committee Assignment.

- Job Rotation.

Off the Job Development:

- Sensitivity Training.

- Transactional Analysis.

- Training within the company.

- Training outside the company.

- Lecture Courses.

- Simulation Exercise.

Workers Development:

- Coaching.

- Under Study.

- Committee Assignment.

- Group Assignment

Area covered under the Training and Development in EXIM Bank:

- Orientation Course on Banking:

General Banking, Structure/organ gram of EXIM Bank Ltd, Ethics in Banking Business, General Discipline, Etiquettes, Manners, Communication, Bookkeeping, Accounting.

- Refreshers:

General Banking, Foreign Exchange, Credit, Ethics, Money Laundering, SME.

- Basic Course:

Meaning, Definition, Importance of accounting, Single entry, double entry, Golden rules of accounting, Financial and ratio analysis.

- Financing of Foreign Trade:

International trade, concept of Letter of credit, Kinds of Letter of credit, Foreign Exchange and Remittance.

- Documents:

Familiarize the trainee with various types of loan, Charge documents, Mortgage, Signing, Witness, Registration, Valuation, Certificate, legal opinion, Preservation.

- Workshop on Anti money laundering:

To combat money laundering activities, Anti money laundering Act-2009 etc.

- Credit Management and Project Appraisal:

Credit Appraisal, Credit worthiness, 5C (Character, Capital, Capacity, Capability, Collateral, Human Capacity etc).

Rationale behind the Focuses on Training and Development in EXIM Bank:

EXIM Bank always tries to focus on training and Development in order to-

- Creating a pool of readily available and adequate replacements for personnel who may leave or move up in the organization.

- Enhancing the company’s ability to adopt and use advance technology

- Building a more efficient, effective and highly motivated team, which enhances the company’s competitive position and improves employee morale.

- Ensuring adequate human resources for expansion into new programs.

A well-conceived training program can help a firm to succeed. EXIM Bank tries to make a program, which is structured with the company’s strategy and objectives and has a high probability of improving productivity and other goals that are set in the training mission.

Formulating a training strategy requires addressing a series of questions which is identified by them-

- Who are the customers?

- Who are the competitors? How do they serve the market? What competitive advantages does EXIM Bank enjoy? What parts of the market have EXIM Bank ignored?

- What strengths does the company have? What weaknesses exist?

- What social changes are emerging that will affect the firm?

- How to face the threats?

By identifying the answers of this questions EXIM Bank develop a training program for their employees (Executives, Operatives and Fresher) in order to get the desired output that make them more adroit in the banking sector at the same time help to reach their desired goal.

Techniques of Evaluation:

For evaluating the effectiveness of training program the performance based evaluation measure are used by EXIM Bank like:

- Pre-post training performance method: Here the main concern is how an employee performs his/her duties before and after the training. That is, before joining the training program the performances of the employees are measured and after getting the training the performance are also measured and compare it with the previous one. This method is the most used method for evaluating the effectiveness of the training method.

But the EXIMBTI does not always follow this method. This method mostly used in EXIM Bank for the executives but not for the operatives and fresher. This method is very much useful for both the executives and operatives/fresher.

- Post training performance method: In this method the performances of the trainee are identified by EXIMBTI after conducting the training program. The main concerning areas are- how the employees perform their duties, does the training enhances their efficiencies in their respective work field and their behavior, way of conducting the task. This method is not always used by EXIMBTI because of the reluctance in measuring the performance.

The methods of training evaluation of EXIM Bank are:

- Observation: After completing the training program the evaluator of EXIM Bank make the evaluation by observing the trainee’s activities in the workplace. Here the direct observation is conducted. Most of the time this observation is done for the Executives trainees.

- Test: In EXIM Bank mostly used technique of evaluation is taking the test. Here a paper is given to the trainee whereby the question is affixed with the paper. The trainee is asked to answer the question within the same paper, which is taught in the training program.

- Reaction: This technique is used for identifying the effectiveness of the training program after conducting the training program. Here a question paper is given to the trainee and asked to give their comment regarding the overall training program.

- Costs and result analysis: Here the costs of the training program and the results are identified. The results are compared with the cost because training is one types of investment and if this investment doesn’t able to bring the desired result then it will be considered as loss.

Difference between Academic Learning and in Practice of Training and Development:

There is a gap between the academic learning and the practice of training and development in EXIM Bank. The theoretical knowledge when applied in the practical field, the dissimilarities found between the two different aspects. These dissimilarities are identified here:

a. Identification and analysis of training needs:

- In the academic learning, there are certain rules and regulation, method or analysis exists; those are needed to identify the employees, who need to be trained.

- But in EXIM Bank, most of the time they select the employees without making the assessment. That often creates some problems by avoiding the employees who need to be trained.

b. Training method:

- For the implementation of the training program there are varieties of traditional method and also technical techniques are available in the theoretical or academic. Learning. Where by the technical techniques are most appreciable for making the training more effective.

- EXIM Bank often follows the traditional method rather than the technical one. But if they use the CD-ROM and interactive media, Distance learning, Web-based instruction, Intelligent tutorial system, Virtual reality training then they will be more self sufficient with their skill workforce. Though these techniques are costly to develop but provide cost savings in terms of time to complete the course.

c. Obligatory training program:

- In academic learning there are certain obligatory training program suggested to use specially for the operative and fresher.

- But in EXIM Bank, the obligatory training programs are not used for the trainee. Which may create the employees less effective in certain work field.

d. Principles of training program:

- In academic learning certain principles of training are found. These principles are identified through the researches that are needed to enhance the skill and to change the attitude of the employees.

- But in the practice, these principles are not broadly practiced in developing or implementing the training plan in EXIM Bank

e. Evaluating the effectiveness of training program:

- For evaluating the effectiveness of training program, Duecento and Robbins suggested to use performance based evaluation measure, which consists of Post-training performance method, Pre-post-training performance method, and Post-training performance with control group method.

- In EXIM Bank, Post-training performance method and Pre-post-training performance method are used, but do not use on a regular basis. This method is very much helpful for measuring the effectiveness of the training program.

Management Development Program (MDP) of EXIM Bank:

In most of the company’s 37% of the training budgets go to Management Development and learning program. But in EXIM Bank the budget is not sufficient compared to other company. Though the existing development programs are satisfactory but if they invest more in this regard, they will be more financially solvent to make effective executives. Because the MDP often need to:

- To develop efficiency

- Remove managerial obsolescence

- Overcome technological obsolescence

- Conservation of resources

- Gain competitive advantage

- Make effective decision making

- Reserve Human Resources

The MDP is any attempt to improve current or future management performance by imparting knowledge, changing attitude or increasing skill. So, to keep pace with the changing environment there is no option for EXIM Bank other than MDP. So, they need to make proper concentration on it.

Major Findings

- EXIM Bank Ltd is now using training and development as an incentive to retain and motivate their employees and executives. EXIM Bank Ltd arranges the necessary training for enhancing the skills and knowledge to keep pace with the technological change and customer service.

- The approaches of training need assessment are not scientific.

- There is no particular process routinely followed by EXIM Bank Ltd for identifying the deficiencies in performance level and skill before providing the training program.

- In EXIM Bank Ltd the budget of Management Development Program (MDP) is not adequate.

- Training method are not enough clarified and structured.

- In EXIM Bank Ltd, the Notification of training is not given to the nominated employees by the HR manager. For this the trainee does not able to get proper idea about the training.

- EXIM Bank Ltd doesn’t provide proper concentration on before and after training assessment.

- In EXIM Bank Ltd, the employees and executives are very much satisfied with the trainers of different training program.

- The training environment of EXIM Bank Ltd is quite satisfactory that most of the executives satisfied with their existing environment.

- EXIM Bank Ltd is much conscious about allocating the budget in employee training and development program.

Conclusion

Lots of new commercial banks have been established in last few years and these banks have made this sector very competitive. EXIM Bank Ltd setting new standards in the Banking sector in the time of turbulent economic conditions. From the very inception it plays a vital role in the national economy. To keep pace with the motto, they provide proper attention on every department including the Human Resources Department and an important function of this HR Department is Training and Development. Banking sectors no more depends on a traditional method of banking. In this competitive world, this sector has trenched its wings wide enough to cover any kind of financial service anywhere in this world.

This report has tried to present the HR practices in EXIM Bank ltd. in comparison to its closest competitor in the same industry. From the analysis I found the Training and Development system is a very satisfactory one. In the time of my internship, I got the support as per my demand for attaining this knowledge and to get proper information about my topic that is Training and Development program of EXIM Bank Ltd.

From the phase of need assessment to evaluation of training, EXIM Bank Ltd tries to provide proper attention to enrich their employee’s skill for reaching in their desired goal. With the help of training and development programs, organization can improve its productivity and efficiency level to an utmost position.

Despite few of problems in training and development section in EXIM Bank Ltd. it improving its employee and executive skill to reach the summit.

Recommendations

- The Human Resource Division of EXIM Bank Ltd needs to be more rigid in conducting the need assessment and has to make it obligatory.

- Training method should be more clarified and structured. Different types of training method may be introduced. Such as- vestibule school, special courses.

- EXIM Bank Ltd has to provide proper concentration on before and after training assessment by an effective use of pre-post training performance method.

- For developing executive different types of development program may be introduces.

- The evaluation of training program should also be scientific.

- The trainer may be qualified with various types of training method and techniques.

- The trainers of EXIM Bank Ltd must provide expert advice to HRD, usually about the importance of the training program and how to make the training program more effective.

- Time schedule of the training and development program may be arranged properly.