Introduction:

Financial Institutions have historically have been distinguished by the types of services they provide. In recent years Financial Institutions have diversified their services by creating new subsidiaries that perform additional services or by merging with other types of financial institutions. The result has been the creation of financial conglomerates, composed of various units offering specialized services. Diversification also offers benefits to financial institutions.

1.1 Objective of the study:

The objective of this study is to have a clear concept and some practical experience about Financial Statement Analysis Systems of an organization. However, we had some textbook knowledge but had little in real life, practice so ever.

This report is designed to know more about the financial performance of PUBALI BANK LTD. and analyze the ratio of this organization and identify the financial condition of this organization. In addition, the study seeks to achieve the following objectives:

- To know about the process of ratio analysis systems.

- To identify the financial condition of an organization.

1.2 Methodology of the study:

This report is prepared by two sources

- Primary Sources.

- Secondary Sources.

Primary Sources: Basically this type of Sources included interviews with the bankers of PUBALI BANK LTD.

Secondary Sources: Secondary data were collected in the following ways:

- Data gathered within the organization itself.

- Data gathered from Texts

- Internet sources.

- General reports

- Annual reports

- Official documents

- Credit manual and foreign exchange manual of the bank.

1.3 Limitations of the study:

In this report I have tried to use, as much as information possible but in some cases the information were not enough. Lacking of some essential footnotes hampered our work in some steps. The area of banking operating is very large. I had been working in this bank about three months. This time is not enough to understand all the banking functions of foreign exchange. Beside this, the employees were always busy under tremendous workload. So, they could not able to extend their cooperation properly. I faced some problems when I collect information about the organization because the information was strictly private and confidential.

1.4 Scope of the study:

In spite of limitation I also got some facility to complete my internship report. The employees whose held a responsible post in the entire department helped me lot. They gave me all essential data and conversation with me. My university internship supervisor also helped me a lot. He gave me a guidelines how to prepare my report more attractive and perfect. This bank has given me the opportunity to observe the banking environment for the first time indeed. I got an opportunity to gather experience by working in the different departments of the branch under the supervision of different departmental heads.

CHAPTER-TWO

Overview of the Bank

Background of The PUBALI BANK LTD. :

PUBALI BANK LIMITED is the largest Commercial Bank in Private Sector in Bangladesh. It provides mass banking services to the customers through its branch network all over the country. This Bank has been playing a vital role in socio-economic, industrial and agricultural development as well as in the overall economic development of the country since its inception through savings mobilization and investment of funds. During the last 5 years the growth rate of bank’s earnings is more than 25% on average.

2.1 Board of Directors:

The Board consists of 14 directors. Among them Md. Hafiz Ahmed Mazumder MP is the Chairman of the Board while Md.Muniruddin Ahmed And other 11 member are Directir. Mr. Helal Ahmed chowdhury holds the Managing director CEO. Mr. Sayeed Ahmed FCA is a Chief Financial Officer.Mr. Md. Sayeed Sikder is a Company Sectary The Board of Director held 33 meetings during the year 2009. Besides 07 committee meetings were also held during that period.

2.2 Management:

Mr. Helal Ahmed Chowdhury is the Managing Director and CEO of the Bank. He is a renowned and dynamic banker with more than three decades of banking experience to his Credit. Mr. Khurshid-ul-Alam, a prominent banker is the Deputy Managing Director of the Bank. Nineteen members are leading General Manager of the Bank. Twenty six members are Deputy General Manager of the Bank. One Hundred thirty two members are Assistant General Manager. The Management is well supported by an organized team of dedicated executives and officers.

2.3 Pubali Bank Limited at a glance:

(As on December 31, 2009)

|

(Sources: Annual Report 2009 on Pubali bank)

2.4 Vision:

To hold the position of best private commercial Bank in Bangladesh with adherence to meticulous compliance of rules and regulations and strong commitment to corporate social responsibility.

2.5 Mission:

To become most remarkable and admirable is private commercial bank in the country. To get recognition as a dynamic, innovative and customer service oriented Bank. To keep momentum of continuous and steady is growth with maximum transparency and to diversify products and resources. To expedite continuous up date of information and technology with all modern facilities to cope with demand challenges of the time.

2.6 Growth and development of the organization:

It has branches all over Bangladesh and carries out all banking activities through its branches in our country and through international correspondent outside the country. On December Total assets of the Bank stood at Tk. 107579.60(Million)

2.6.1: Corporate Governance:

Pubali bank is a 100% indigenously sponsored private commercial Bank .Meanwhile pubali Bank Ltd. has taken effective measures to implement corporate Governance is echoed with the good governance .Pubali Bank has ensured basic four columns of good governance i.e. accountability, transparency, predictability and Balancing the extreme through utilization of available resources and day to day decision making in conformity with instruction of regulatory bodies.

2.6.2:(a)Board structure:

The board of directors consists of 13 members mainly directs on policy formulation and monitoring of its guidelines. The board has following supporting committees:

(i) Executive committee: The executive committee is comprised of 5 board members and they take decision on emergency matters as and when required relating to bank’s business etc. subject to ratification by the full board. In 2009 the committee conducted 4 meetings.

(ii) Audit committee: the audit committee is formed with 3 members of the board of directors. The audit committee peruses and evaluates all the audit reports of all branches of the Bank. The committee assists the Board of directors in ensuring that the financial statements reflect true fair view of the state of affairs of the company and ensuring a congenial working method in the bank as per guidelines of the regulators. In 2009 the committee conducted 9 meetings.

(B): Financial management:

The annual budget and the statutory financial statement are prepared with the approval of the Board. The board regularly monitors and reviews bank’s liquidity, income, expenditure, non-performing loans, loss provisions and steps taken for recovery of defaulted loans including legal means.

(C): Management structure:

The management headed by managing director and CEO is assisted by 19 General Managers along with 2 consultants to run the Business. The workflows are carried out by the relevant divisions/departments/branches of the bank. The following committee’s also assistant management:

(i) Management committee (MANCOM): The MANCOM is comprised of senior management members, meets monthly to discuss relevant agenda and take appropriate actions for running the bank smoothly.

(ii) Asset liability management committee (ALCO): Asset liability management committee headed by managing director and CEO is responsible for balance sheet risk management .The results of balance sheet analysis along with recommendation are placed in ALCO meeting where important decisions are made to minimize risk and to maximize returns.

iii) Credit committee: Headed by the senior general manager, the credit committee evaluates credit proposals and recommends for approval and otherwise.

(iv)Task Force for recovery of classified loans: A task force for recovery of classified loans is constituted in the Head office of the bank with the chairmanship of managing director and CEO. The other members are general managers and deputy general manager of credit administration, monitoring and recovery division, CLS division, lease financing division and law division.

2.7 Statutory other reserve:

At the close of 2009 the statutory reserve and other reserves of the bank stood at TK 5687.25 million out of which statutory reserve was TK 3152.72 million .Other reserves was TK 2534.53 million. Total reserve was TK 4606.82 million at end of 2008.

2.8 Deposits:

The deposit trend was positive in 2009 .At the end of 2008 total deposit was TK. 73,016.51 million that came to TK. 88,466.46 million At the end of 2009 showing 21.16% increase. Out of the total deposits .Time deposits and Demand deposits were TK. 27,432.48 million and TK.61,033.98 million i.e. 31.01%and 68.99% respectively

2.9 Borrowing from other banks:

In 2009 the bank borrowed TK. 427.45 million for business purpose compared to borrowings of TK.393.07 million during the previous year.

2. 10 Advances:

Total advances of the bank as on 31 December 2009 stood at TK. 74203.33 million showing an increase of TK 12415.18 million @ 20.29% growth.

In line with national economic development, the Bank made advances mainly as commercial loan, import & export business, and term loan to large medium scale industries, house building loan, working capital loan, consumers’ credit loan and syndication loans etc.

2.11 Investment:

Total investment of the bank was TK.12168.65 million during 2009.In comparison to previous year total investment was increased by TK. 3793.06 million @ 45.29% growth. The bank mainly invested in government bonds, treasure bills, approved debentures of private institutions.

2.12 Foreign exchange business:

Bank largely depends in its foreign exchange business to ensure profitability. The Bank’s foreign exchange business is designed to assist development of trade, commerce and industry in the country in consonance with the guidelines of Bangladesh Bank. There are three categories in the below:

a) Import business: During the year the bank handled import business worth TK. 60,490 million. During the previous year the amount was TK. 58,010 million. The amount if import business handles by the bank increased by TK.2,480 million during the year which was 4.28 % higher than the previous year.

b) Export business: The bank handled export business worth TK.24, 740 million during the year as against TK.24, 790 million in the previous year.

c) Inward foreign Remittance: Non resident Bangladeshis sent foreign exchange equivalent to TK. 35,250 million through the bank during 2009 whereas the amount was TK. 28,190 million in 2008.The increase shows a growth of 25.04% which is a proof of confidence on the bank from the NRBs.

2.13 Information and technology and Automation:

As the 386 branches have been computerized out of which 286 branches have been running successfully with the in-house developed software, PIBS(Pubali integrated banking system).Pubali bank Ltd. has implemented centralized online Banking system in the year 2009 through its in- house developed software. In the mean time 50 branches in Dhaka, Chittagong and sylhet have been brought under online Banking system. The remaining branches will be brought under online banking sys tem gradually The bank has introduce one banking and mobile phone banking phase wise shortly. The bank has developed Islamic banking software and 2 Islamic banking wings will be opened in Dhaka and sylhet shortly. The bank has entered into the internet world through its website www.pubalibangla.com and has also has been operating ATM and POS services to meet the demand of the time.

2.14 Man-power and training:

Skilled work force is an essential pre-requisite for development of any service-oriented organization. PUBALI BANK LTD. Puts all out emphasis for the development of professional work force to meet the challenge of modern banking.

In the year 2009 the bank had 5,115 employees. Both the board and management stress on developing human resources. Thirty five courses covering different subjects were organized at the bank’s training institute where 1,168 official of different levels participated. Besides these, The Bank utilized the training services rendered by other training institution like BIBM, BBTA and other national institutes.

2.15 Dividend:

The board of directors has recommended 30% stock dividend i.e. 3 shares for every 10 shares and 5% cash dividend for all shareholder of the Bank out of profit on the basis of audited accounts for the year 31st December 2009 subject to approval in the annual meeting.

2.16 Future plan of this bank:

The bank stressed on the targets laid down in the annual budget 2010.The budget 2010 is a challenging one with growth of 33.43% in operating profit from that previous year. Deposit and loan are projected to increase by 29.37% and 28.03% respectively and import, export and remittance business is expected to rise by32.24% 61.68% and 70.21% respectively.

2.17 Overview of the Branch:

| Division | Number of Branches |

| Dhaka | 73 |

| Chittagong | 54 |

| Sylhet | 46 |

| Rajshahi | 24 |

| Khulna | 23 |

| Noakhali | 19 |

| Narayangonj | 18 |

| Moulvi Bazar | 31 |

| Comilla | 28 |

| Mymensingh | 24 |

| Rajshahi | 24 |

| Rangpur | 18 |

| Barisal | 27 |

Date of establishment of the bank: 1959

Head Office, Pubali Bank Bhaban

26, Dilkush Commercial Area

Dhaka-1000 Bangladesh, Post Box no. 853

Fax: +88-02-9564009

PABX: +88-02-9551614

E-mail: mailbox@pubalibankbd.com Web: www.pubalibangla.com

2.18 Functions of the PUBALI BANK LTD. :

- Establishing Banker Customer relationship,

- Remitting customer’s money from one place to another,

- Collecting bills for customers,

- Taking deposit and honoring Cheque drawn over Local Office.

2.19 Pubali Bank Ltd. Products & Services:

q One Stop Service

q Time Deposit Scheme

q Monthly Savings Scheme

q Deposit Insurance Scheme

q Inward & Outward Remittances

q Traveler’s Cheques

q Import Finance

q Export Finance

q Working Capital Finance

q Loan Syndication

q Underwriting and Bridge Financing

q Trade Finance

q Industrial Finance

q Foreign Currency Deposit A/C

q NFCA (Non Resident Foreign Currency Deposit Account)

q Consumer Cr. Scheme

q Locker Service

q RFCA (Resident Foreign currency deposit Account)

q ERQ (Export retention quota Account)

2.20 Network:

PUBALI BANK LTD. is always considers client service the most vital factor to face ever-increasing competition and challenge in the Banking sector and as such places on it utmost importance. With that end in view the Bank continued its personalized approach with speed, precision and accuracy. Presently the number of the branches stood at 386 covering almost al the important places of the country. Moreover worldwide international correspondent’s network of the Bank has been continuously expanding covering the important countries in all the countries of the world. Besides the Bank has arrangement with a number of Exchange Houses at Bahrain, Italy, KSA, Malaysia, UK, USA, Global (Western Union) Singapore, U.A.E., Oman, Qatar, and Kuwait to facilitate remittances from expatriate Bangladeshis. To cope with modern banking requirement all the branches are being computerized. To develop expertise on computer operation, regular training program of computer for the officers are continuing. The bank has been introduced new computer programs (ON-LINE BANKING) with fifty one branches for improving customer service and has finalized arrangements with other private commercial banks to introduce ATM. SWIFT (Society for worldwide inter-bank financial telecommunication) has already been introduced to speed up international transactions and passing of L/Cs at HEAD OFFICE. SWIFT will soon be introduced at all the A.D branches of the Bank.

CHAPTER-THREE

Financial performance of the Bank

Despite volatile economic atmosphere of the country, the Bank performed well in respect of deposit mobilization and profit earning during the year under review. The Bank was able to harvest the result of its efforts to enhancing quality of assets and recovery of dues from default borrowers. At the end of the year 2009 Banks operating profit stood at Tk. 10,663.81 million as against Tk. 9,009.25 million of the year 2008.

3.1 Capital and Reserves:

During the year 2009 authorized capital of the Bank was Tk.5000 million. The paid-up capital stood at Tk. 3,822 million and reserve fund stood at Tk. 5,687.25 million on December 31, 2009

3.2 Deposits:

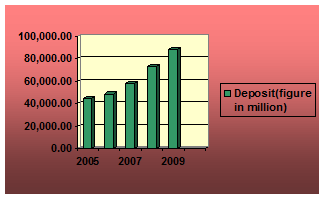

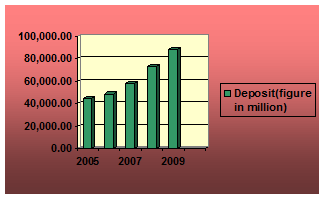

Deposit of the Bank increased in the year 2009 than in the year 2008. On December 2009 total deposit of the Bank stood at Tk. 88,466.46 million as against Tk. 73,016.51 million in 2008. The deposit of the bank registered an increase of 21.16% in the year 2009. The following

3.3 Credit:

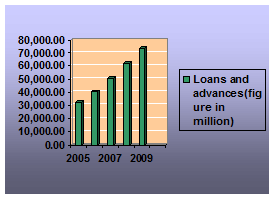

Credit program of the Bank continued to expand satisfactorily during the year 2009

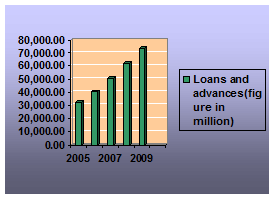

On December 31st 2009 net Credit of the Bank rose to Tk. 74,203.33 million as against Tk. 61,788.15 million in 2008.

The following graph shows loans and advances of PUBALI BANK LTD (2008-2009).

3.4 Investment:

Investment figure of the bank On December 31st 2009 stood at Tk. 12,168.65 million as against Tk. 8,375.59 million 45.29% in 2008.

3.5 Total Profit:

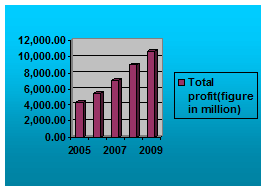

The total profit of the bank during 2009 was Tk. 10663.81 million as against Tk. 9009.25 million in 2008, rate of growth being 18.37%. Bank made more profit in the year 2009 than in the year 2008. On December 31st 2009 Total Profit of the Bank was Tk. 366, 94, 71,753.00.

3.6 Net Profit (Pre Tax):

The following graph shows net profit (pre tax) of PUBALI BANK LTD. (2005-2009)

3.7 Position of PUBALI BANK LTD (2005-2009):

The following table shows last five year’s position at a glance:

Last Five Years Position at a Glance | ||||||

Taka in Million | ||||||

| Year | 2005 | 2006 | 2007 | 2008 | 2009 | |

| 1. | Authorized Capital | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 |

| 2. | Paid-up Capital | 400.00 | 1,200.00 | 2,100.00 | 2,940.00 | 3,822.00 |

| 3. | Reserve Fund | 2,481.21 | 3,327.50 | 3,832.09 | 4,606.82 | 5,687.25 |

| 4. | Total Deposits | 44,503.33 | 48,675.93 | 57,996.82 | 73,016.51 | 88,466.46 |

| 5. | Total Advances | 32,639.68 | 40,386.65 | 50,549.17 | 61,788.15 | 74,203.33 |

| 6. | Total Investments | 5,536.84 | 4,982.10 | 5,556.58 | 8,375.59 | 12,168.65 |

| 7. | Total Income | 4,435.90 | 5,494.49 | 7,087.63 | 9,009.25 | 10,663.81 |

| 8. | Total expenditure | 3,063.27 | 3,684.43 | 4,145.67 | 5,563.39 | 6,824.34 |

| 9. | Net Profit (Pre-tax) | 1,042.63 | 1,810.06 | 2,491.97 | 3,445.86 | 3,839.47 |

| 10. | Net Profit | 573.45 | 845.53 | 1,353.51 | 1,515.23 | 2,092.23 |

| 11. | Import Business | 26,033.80 | 37,316.50 | 48,345.41 | 58,009.10 | 60,493.85 |

| 12. | Export Business | 15,721.10 | 17,701.80 | 19,907.50 | 24,795.65 | 24,739.65 |

| 13. | Bridge Finance | 7.29 | 7.14 | 6.89 | 6.89 | 6.89 |

| 14. | Total Assets | 52,671.44 | 58,401.14 | 71,560.66 | 89,884.70 | 1,07,579.60 |

| 15. | Fixed Assets | 546.48 | 1,369.07 | 1,367.23 | 1,383.36 | 1,443.50 |

| 16. | Number of Employees | 5,088 | 5,141 | 5,270 | 5,321 | 5,375 |

| 17. | Number of Shareholder | 7,591 | 11,697 | 19,009 | 24,153 | 30,899 |

| 18. | Number of Branches | 350 | 356 | 361 | 371 | 386 |

| 19. | Earning per ordinary (Tk.) | 143.36 | 70.46 | 64.45 | 51.54 | 54.74 |

Source: Annual Report of Pubali Bank Ltd.

3.8 Present Situation:

The following table shows the balance sheet as on December 31st 2009

PUBALI BANK LTD.

BALANCE SHEET

As at 31st December 2009

PROPERTY & ASSETS |

December31, 2009 |

| Cash | 895,73,92,045.00 |

| Cash in Hand (including foreign currency) | 194,94,00,007.00 |

| Balance with Bangladesh Bank & its agent bank (including Foreign currency) | 700,79,92,038.00 |

| Balance with Other Bank and Other Financial Institution | 168,25,97,097.00 |

| In Bangladesh | 131,26,96,347.00 |

| Outside Bangladesh | 36,99,00,750.00 |

| Money at Call and Short Notice | 126,96,86,667.00 |

| Investments | 1,216,86,52,910.00 |

| Government | 934,43,94,912.00 |

| Others | 282,42,57,998.00 |

| Loans & Advances | 7,420,33,31,304.00 |

| Loans, Cash Credit, Over Draft etc. | 7,362,26,70,849.00 |

| Bills Discounted & Purchased | 58,06,60,455.00 |

| Premises & Fixed Assets (Less Depreciation) | 144,34,98,551.00 |

| Other Assets | 785,40,67,065.00 |

| Total Assets | 10,757,96,00,885.00 |

Source: Annual Report of Pubali Bank Ltd.

LIABILITIES AND CAPITAL | 2009 TAKA |

| Liabilities | |

| Borrowing from Other Banks, Financial Institutions and agents | 427,50,81,400.00 |

| Deposits and other accounts: | |

| Current deposits and other accounts | 1,282,35,33,865.00 |

| Bill payable | 259,55,49,837.00 |

| Savings Bank Deposits | 3,066,23,11,042.00 |

| Fixed Deposits | 306,31,73,364.00 |

| Term Deposits | 3,932,18,91,678.00 |

| Other liabilities | 917,64,39,394.00 |

| TOTAL LIABILITIES | 9,807,03,49,994.00 |

| Shareholders’ Equity Share Capital | |

| Paid up capital | 382,20,00,000.00 |

| Statutory Reserve | 315,27,22,217.00 |

| Retained surplus(General reserve) | 136,94,68,957.00 |

| Other reserve-Assets revaluation Reserve | 116,50,59,717.00 |

| Profit and loss account-retained Earning | ———— |

| TOTAL SHAREHOLDERS’ EQUITY | 950,92,50,891.00 |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 10,757,96,00,885.00 |

Source: Annual Report of Pubali Bank Ltd.

PROFIT AND LOSS ACCOUNT

For the year ended 31 December 2009

| income and expenditure | 2009 TAKA |

| Interest income | 805,66,37,551.00 |

| Less: interest paid on deposits and borrowings | 376,55,42,303.00 |

| Net interest income | 429,10,95,248.00 |

| Income from investments | 110,94,67,712.00 |

| Commission, exchange and brokerage | 118,85,28,522.00 |

| Other operating income | 30,91,79,520.00 |

| Total Operating Income | 689,82,71,002.00 |

| Salary and allowances | 176,34,26,398.00 |

| Rent, taxes, insurance, electricity etc. | 18,32,59,632.00 |

| Legal expenses | 10,62,875.00 |

| Postage, stamp, telecommunication etc. | 5,28,43,449.00 |

| Stationery, printing, advertisement etc. | 814,97,617.00 |

| Managing Directors salary and allowances | 61,00,000.00 |

| Director’s fees | 49,76,715.00 |

| Audit fees | 4,50,000.00 |

| Depreciation and Repair of Bank’s assets | 11,90,62,609.00 |

| Other expenses | 3,482,54,93,573.00 |

| Total operating expense | 30,58,799,249.00 |

| Profit before provisions and taxation | 383,94,71,753.00 |

| Provision for loans and advances | 5,00,00,000.00 |

| Provision for diminution in value of investment | 7,00,00,000.00 |

| Provision for exposure of off balance sheet items | 5,00,00,000.00 |

| Total provision | 17,00,00,000.00 |

| Profit before tax | 366,94,71,753.00 |

| Provision for current tax | 157,43,87,628.00 |

| Provision for deferred tax | 28,49,849.00 |

| Total provision for taxes | 157,72,37,477.00 |

| Net profit after taxes | 209,22,34,276.00 |

| Appropriations | ————– |

| Statutory reserve | 73,38,94,351.00 |

| Retained surplus | 135,83,39,925.00 |

| Earning per ordinary share (EPS) | 54.74 |

Source: Annual Report of Pubali Bank Ltd.

| cASH FLOWS FROM OPERATING ACTIVITES | 2009 TAKA |

| Interest received in cash | 901,44,80,608.00 |

| Interest paid by cash | (376,55,42,303.00) |

| Dividend received | 15,16,24,655.00 |

| Fees & Commission received in cash | 77,15,41,031.00 |

| Recoveries of loans previously written of | 11,298.00 |

| Cash paid to employees | (176,95,26,398.00) |

| Cash paid to supplies | (14,54,14,941.00 |

| Income taxes paid | 16,02,16,562.00 |

| Received from other operating activities | 72,61,55,713.00 |

| Paid for other operating activities | (105,71,56,743.00) |

| Operating profit before changes in operating assets and liabilities increase/Decrease) in Operating Assets & Liabilities | 408,63,89,482.00 |

| Statutory Deposits | (157,66,29,631.00) |

| Purchase-sale of trading securities | (221,90,26,494.00) |

| Loans and advances to customers (Other than Banks) | (1,241,51,78,719.00) |

| Other assets | (61,97,82,300.00) |

| Deposits from other Banks | 3,43,84,869.00 |

| Deposits from customers (other than banks) | 1,544,99,51,226.00 |

| Other liabilities account of customers | (149,33,27,689.00) |

| Other liabilities | (57,75,312.00) |

| Increase or decrease in operating assets and liabilities | (284,53,84,050.00) |

| Net Cash received from operating activities | 124,10,05,432.00 |

| B) Cash flows from investing activities | |

| Purchase of property, plant and equipment | (14,68,37,054.00) |

| Net cash used in investing activities | (14,68,37,054.00) |

| C) Cash flows from financing activities | |

| Payment for redemption of loan capital and debt securities | (12,98,01,764.00) |

| Net cash received from financing activities | (12,98,01,764.00) |

| D) Net (decrease) / increase in cash (A+B+C) | 96,43,66,614.00 |

| E) Opening cash and cash-equivalents | 1,096,58,28,196.00 |

| F) Closing cash and cash-equivalents (D+E) | 119,30,19,4810.00 |

Cash Flow Statement

For The year ended 31 December 2009

Source: Annual Report of Pubali Bank Ltd.

PART-II

RATIO ANALYSIS

Ratio Analysis:

Ratio analysis is a powerful tool of financial analysis. A ratio is defined as “the indicated quotient of two mathematical expressions” and as “the relationship between two or more things”. In financial analysis, a ratio is used as a benchmark for evaluating the financial position and performance of a bank. Ratios help to summarize large quantities of financial data and to make qualitative judgment about the bank’s financial performance.

4.1 Liquidity Ratios:

This ratio measures the ability to meet current obligation. It is extremely essential for a bank to be able to meet obligation as they become due.

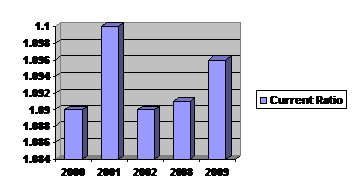

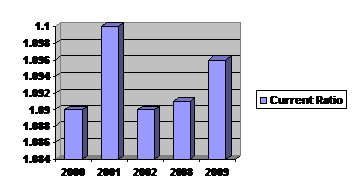

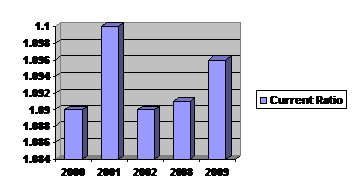

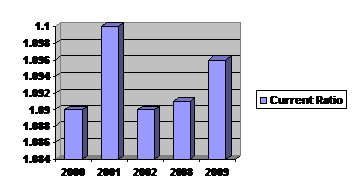

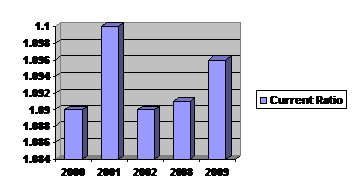

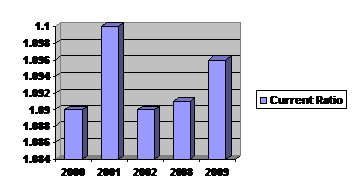

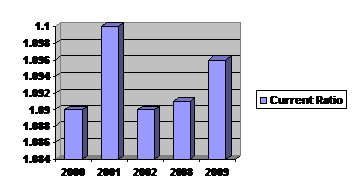

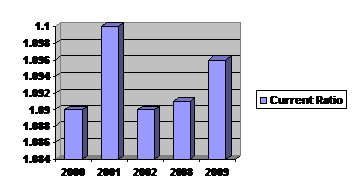

4.1.1Current ratio:

Current ratio is the traditional measure of liquidity. We compute it by dividing current assets by current liabilities. As we already mention that current ratio is a ratio to measure the ability to meet current obligation when it comes due.

So, higher the ratio indicates high capacity to repay the obligation and lower ratio indicates less capacity to repay that obligation and bank always prefer high ratio. We estimate the Current ratio by using the following formula:

| Year | Current Ratio |

| 2009 | 1.096 |

| 2008 | 1.091 |

CurrentRatio=(CurrentAsset

The current ratio represents a margin of safety for Creditors. The higher than the current ratio the greater the marginal of safety. In PUBALI BANK LTD. the current ratio is 1.091 in 2008 and 1.096 in 2009. So say that PUBALI BANK LTD. does have the greater margin of safety. Because Current Ratio is increases in 2009.( Appendix-1)

4.2 Leverage Ratio and Solvency Ratio:

To judge the long-term financial position of the firm, financial leverage or capital structure ratios are calculated. These ratios indicate mix of funds provided by the owners and lenders.

4.2.1 Debt Ratio:

Debt ratio indicates how borrowing has financed much of the firm’s assets. Higher ratio implies more contribution of lenders over the assets than shareholder and then if the cost of debt is higher than the firm’s overall rate of return, the earnings of shareholder will be reduced. Other hand lower ratio implies more contribution of shareholder and then shareholder fall in risk if company cannot earn as much as they expected. To determine the debt ratio the following formula is used:

Debt Ratio= (Total Liabilities/Total Assets)*100

| Year | Debt ratio |

| 2009 | 91.16% |

| 2008 | 91.60% |

In PUBALI BANK LTD. the debt ratio is 91.60% in 2008 and is 91.16 % in 2009 implies that the lenders have financed more in the year 2008. (Appendix-2)

1.2.2 Debt to Equity:

This ratio measures the relationship between lender contributions for each taka of owner’s contribution through debt-equity ratio. The following formula is used:

Debt-Equity Ratio= (Debt/Equity)*100 borrowing from other bank / total shareholder equity

| Year | Debt- Equity ratio |

| 2009 | 75.79% |

| 2008 | 7.29% |

In PUBALI BANK LTD. the debt-equity ratio is 75.79% in 2008 and 7.29% in 2009 which implies that lender contribution is 75.79% in 2008 for each TK of owner’s contribution, which is higher than2006. (Appendix-3)

4.3 Profitability Ratio:

The profitability ratio is very much important because it indicates the overall result of the firm. It is the outcome of all kinds of efficiency of the firm. It starts with different measurements that give result of profit.

4.3.1 Return on Equity

The return on equity implies the return that a firm generates against its common equity. So it is very important to increase return on equity. Because high return on equity increase net worth of the firm, value of the share, reputation of the firm, less risky for investment. So firm always try to increase its return on equity. The following formula is used to calculate return on equity:

Return on Equity= (Net Income/Total shareholder equity)*100

| Year | Return on Equity |

| 2009 | 21.24% |

| 2008 | 22.00% |

Here return on equity is higher in 2009 than 2008 so, in the year 2009 PUBALI BANK LTD. is less risky for investment and increase net worth of the bank, value of the share and reputation than 2008. (Appendix-4)

4.3.2 Return on Assets:

This is also another measure of profitability. Here the relationship is shown between profit and assets i.e. the efficiency of assets to produce profit. A higher return is desirable by the firm. So, profit is taken as a percentage of total assets. The following formula is used to calculate return on assets:

Return on Assets= (Net Income/Total Asset)*100

| Year | Return on Asset |

| 2009 | 1.35 % |

| 2008 | 1.47% |

This ratio is commonly used to evaluate the management of bank and how they are performing. By comparing the ratio I see that PUBALI BANK LTD. has good performance of the management in 2009. Appendix-5)

4.4 Profit Margin:

It measures the relation between sales and profit. It is calculated by dividing net income by the operating revenues of the bank. Normally if return on equity and return on assets are higher the profit margin will also be higher. The following formula is used to calculate profit margin:

Profit Margin= (Net Income/Operating Income)*100

| Year | Profit Margin |

| 2009 | 23.98% |

| 2008 | 25.68% |

A high profit margin ratio is a sign of goods management. Here I see that PUBALI BANK LTD. has an increasing profit margin in 2009. (Appendix-6)

4.5 Assets Utilization:

This ratio represents the ability of the management to generate revenues by using assets. Higher ratio indicates greater efficiency of the management to use the firm’s assets. The formula of calculating asset utilization can be shown as follows:

Asset Utilization= (Operating Income/Total Asset)*100

| Year | Asset Utilization |

| 2009 | 5.62% |

| 2008 | 5.72% |

In PUBALI BANK LTD. asset utilization is 5.62% in 2008 and 5.72% in 2009.. This ratio shows that PUBALI BANK LTD. has greater efficiency of management to use the bank’s assets in 2009. (Appendix—7)

4.6 Risk Ratio:

4.6.1 Equity Multiplier:

This ratio is an indicator of the firm’s degree of leverage and ultimately the risk. If the bank has opportunity to use the funds well and it does not have enough capital it can go for debt. And it may generate profit for the firm. It also reflects a choice of funds between debt and equity.

Equity Multiplier= (Total Asset/Total Equity)

| Year | Equity multiplier |

| 2009 | 15.75X |

| 2008 | 15.28X |

In this ratio PUBALI BANK LTD. has 15.75 X equity portion in total assets in the year 2008 and 15.28X in the year 2009 but which is ultimately lower than 2008. (Appendix-8)

4.7 Loan Ratio:

The loan ratio indicated the extent to which assets are devoted to loans as opposed to other assets including cash, securities, and equipment and so on. This is taken as a percentage of total assets.

Loan Ratio= (Net Loans/Total assets)*100

| Year | Loan Ratio |

| 2009 | 4.81% |

| 2008 | 0.48% |

Loan ratio is decreasing over the period and we also found that there is a decreasing trend of the profit in the year 2009 because higher loan ratio implies higher profit. (Appendix-9)

4.8 Loan to Deposit Ratio:

The bank is not required to take all the funds in its hands to meet obligation of the depositors. It always comes up with permanent level of fund that can either be invested or extended as loan to the borrowers to earn profit thereon.

Loan to Deposit Ratio= (Net Loans/Total Deposits)*100

| Year | Loan to Deposit Ratio |

| 2009 | 5.94% |

| 2008 | 5.60% |

In the year 2009 loan to deposit ratio is 5.94 % and 5.60 % in the year 2008 which indicate that the PUBALI BANK LTD. granted more loan to the borrowers as a percentage of total deposit. (Appendix-10)

CHAPTER: FIVE

Findings & Recommendation & Conclusion

5.1 Findings: The success of a bank depends on improved service delivery to its customers. Now so many banks in the country have emerged to cater to the needs of customers. But most of the banks in Bangladesh are used conventional banking system. The PUBALI BANK LTD. local office is not exception to these trends.

From the overall discussion of this report I found out that the overall banking of PUBALI BANK LTD. satisfactory. Here I measure performance of PUBALI BANK LTD. through ratio analysis for two years.

From this analysis I can say that PUBALI BANK LTD. did not have the greater margin of safety which indicates the lower liquidity in 2009 than 2008.The lenders finance ability decrease in 2009 than 2008.PUBALI BANK LTD. was less risky for investment and increase its net worth, its value of share and reputation has also increased in 2009.PUBALI BANK LTD. has done good performance of the management in 2009.Profit margin was higher which indicate good management for the year.

Assets Utilization implies the greater efficiency of management to the banks assets in 2009.Loan paid decrease in 2009 that is the cause of lower profit. Loan to deposit ratio decrease in 2009 than 2008 which indicate that the PUBALI BANK LTD. granted more loans to the borrowers as a percentage of total deposit in 2008.

5.2 Recommendation:

5.2.1: It is seen in the study that the liquidity ratio of P.B.L during 2008 & 2009. The liquidity of the bank should be reds by improving current & quick ratio.

5.2.2: It is further seen that the loan to deposit ratio of the bank was lower during 2008 & 2009. Therefore the loan to deposit ratio must be improve by increasing need loan.

5.2.3: Assets utilization ratio was also lower in 2008 & 2009. In case P.B.L. This ratio should also be increased by increasing operating income.

5.2.4 Finally, at the end of the year we can see that although there have some difficulties but we can overcome those difficulties by removing all the weaknesses to develop the product effectively and grab more opportunity hidden in the banking industry and the bank should also increase the strength with their solid brand image, experience and skills of the employees. With their strengths PUBALI BANK LTD. can also reduce the threats existing in the market.

Conclusion

The days are gone for banks to keep their functions confined with in the periphery of accepting deposit and lending money as well as making a profit. To cope up with the new millennium’s electronic banking, bank should reinvent and redesign itself for customer satisfaction. Some recommendations may be put forward in this regard.

The bank should launch some new products as automatic teller machine, money link, Tele bank for better customer service.