Introduction

The competition policy is a body of laws, administrative rules and case law employed to

deter restrictive business practices in order to maintain fair competition. It also includes

rules and regulations that deal with mergers and acquisitions. The competition policy

includes measures that remove restrictions upon and barriers to competitive transactions

within a national market. Its target categories are cartels and other horizontal restraints,

dominant positions and mergers, vertical restraints, price discrimination and

multinational enterprises. The aim of competition policy is to create a competitive market

environment by adopting appropriate measures to deal with anticompetitive conduct of

business firms. The general goals of both trade policy and competition policy are to

increase the efficiency of resource allocation and welfare of consumers. However, their

strategies differ as trade policy emphasizes cooperation among the nations of the world

whereas competition policy wants to promote rivalry among the various firms of the

nations as well as across the nations.

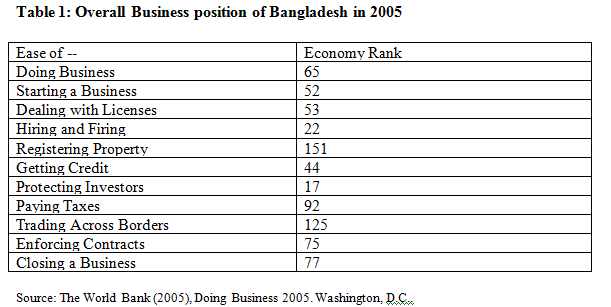

To date there is no in-depth and systematic analytical study to determine the nature,

magnitude and impact of restrictive business practices, monopoly and anti-competitive

elements (RMA) in the different sectors of Bangladesh economy. The World Bank has

carried out systematic surveys in a large number of countries including Bangladesh on

business environment and investment climate of recent years. The Bank’s Doing Business

Project initially covered 130 countries in 2003. The survey began with five areas of

business regulation and subsequently additional topics were added. It included business

regulation, insolvency, contract enforcement, hiring and firing workers and accessing

credit. Table 1 ranks the relative position of Bangladesh in various areas.

As seen in Table 1, Bangladesh fared poorly in all areas of the survey and its rank was

below the mean (65) in 5 out of the 11 areas including such critical areas as registering a

property, paying taxes, enforcing contracts and closing a business. The survey, however,

does not address regulatory and monopoly issues. There are also widespread feelings

among members of civil society and concerned citizens that because of favorable

government regulations regarding purchase of inputs, advertising and general trade

regulations, the major economic sectors of Bangladesh are dominated by a few big firms.

In order to address the concerns of the civil society, an attempt was made to determine

the nature and dimensions of RMA by asking questions to knowledgeable persons and

stake holders of the concerned sectors. The methodology was that of a purposive

sampling. Two survey instruments were designed and two types of questions were asked.

The first questionnaire was designed to collect information on RMA in the different

public and private sectors of Bangladesh economy in 2003. A second questionnaire, in

the form of an opinion survey, was administered to collect information based on the in-

depth interviews of the different constituencies of the society. This questionnaire was an

opinion survey regarding RMA and competition and regulation policies in Bangladesh.

The purpose of this paper is to analyze the overall business practices in major sectors of

Bangladesh economy with a view to evaluating the competition policies of the

government in each of these sectors.

A Brief Review of the Theory of Competition

The theory of a competitive firm is now well-founded in the literature of Economics. The

competitive market model is assumed to satisfy certain conditions. In this market there

would be a large number of buyers and sellers making transactions of a perfectly

homogeneous product at a predetermined market price over which no individual buyer or

seller will have any control. Obviously there would be perfect information of the product

to buyers and sellers, no advertisements, no transport costs, no barriers to entry or exit,

and perfect mobility of factors production. Any infringement of any of the conditions or

any deviation from this well-defined model would make the market imperfect. It does not

seem necessary to make an elaborate case against the seemingly unrealistic assumptions

of the perfectly competitive market model. These assumptions were severely criticized by

two well-known authors of modern economic theory, Joan Robinson and Edward

Chamberlin1. While the ideal competitive market model is based on highly simplifying

assumptions, the enforcement of a pragmatic competition policy by a government will

confront the complexity of real life. A large variety of administrative, international,

diplomatic and political issues are involved in the transaction of goods and services in the

modern world. The emerging literature highlights the issues from different perspectives.

Early academic works on the structure of competitive industry and control of monopoly

are pertinent in the context of modern competition policy2.

Defining unfair business practices and anticompetitive conducts is one set of problems. In

addition there are also formidable difficulties in formulating and enforcing a

comprehensive competition policy. Besides, the implementation of competition policy

has also other deep rooted implications for political and sociological dimension of the

society. One of the most influential works on this subject is due to Scherer3. This work

has been done within the broader framework of the Brookings Institution’s project on

Integrating National Economies. The cornerstone of this project is its emphasis on

international economic interdependence and the increasing sensitivity of national

economies to events and policies originating abroad.

Methodology

As discussed earlier, two surveys were conducted to evaluate the competition policies of

the government of Bangladesh in selected economic sectors. The methodology for

evaluating the competition policy was based on the common perception that major

companies dominate the production and distribution of telecommunication products,

pharmaceutical and medicine products, petroleum products, and food and soft drinks

products. Such perceptions were captured from the studies conducted by the World Bank

(reported in Table 1) as well as from the popular print and electronic media4. In order to

investigate the hypothesis (Ho: Major companies dominate production and distribution of

most goods and services in Bangladesh due to lack of competition policy), any study of

this nature must begin with a precise identification of the population from which the

sample will be selected. Secondly, once the population is identified, we decided to use

the purposive sampling method to accomplish the objective of this study. As Guilford

and Fruchter (1978) mention, a purposive sample “is one arbitrarily selected because

there is good evidence that it is very representative of the total population”

Two purposive samples were used to elicit responses from stake holders and from civil

society members. The first set of questions was designed to elicit responses on types of

RMA and their consequences. Answers to questions were sought from stake holders both

in their own sector as well as outside of their respective sectors. It was an investigation

with a structured questionnaire with in-depth interviews. Investigations were carried out

in the following four sectors5:

- Telecommunications

- Pharmaceutical and medicine products

- Petroleum products, and

- Food and soft drinks

The following sections contain a brief description of the government’s competition policy

in the four sectors noted above followed by an analysis of the responses collected through

interviews.

Telecommunications Sector

The telecommunication sector was until early 1989 the sole monopoly of the public

sector corporation known as Bangladesh Telegraph and Telephone Board (BTTB). It was

the only provider of telecommunication network services in the country. However, in

1989 the government for the first time issued a license to a private operator for provision

of cellular, paging and radio tracking services with exclusivity for five years.6 This small

beginning of a private sector provider in the telecommunication sector has now gone a

long way in enhancing the role of the private providers in the telecommunication of the

country. While it is true that the Public Switched Telephone Network (PSTN) market has

been dominated by BTTB and there has been no significant competition in the fixed-line

access market, the cellular market has recently featured more competitive elements than

in the past.

The Bangladesh Telecommunication Regulatory Commission (BTRC) has recently

divided the country into five zones. It has accordingly given 35 licenses to 19 operators to

provide PSTN services to the four regions, i.e. southwest, southeast, northwest and

northeast of the country. However, Dhaka multi-region area is considered the central

region where an investment of taka 30,000 million ($428 million) in the next five years is

expected from the private sector. This would bring about 2.5 million land line telephones

in the region. But for this project, large investment is needed by major investors. This

would mean reinvestment for the expansion of network and infrastructure. The existing

private sector PSTN operators are not in favor of open tender for this project because

they do not think they would qualify through the competitive process.7

The telecommunication market can be better understood by considering the current state

of affairs of the telecommunication operators of the country:

- BTTB provides fixed telephone, NLD and O/S services.

- The cellular service is provided by mobile companies like Grameen Phone, TMI

(brand name Aktel), Sheba (brand name Banglalink), PBTL (brand name City

Cell), and Teletalk (new mobile of BTTB). Whereas City Cell uses the code

division multiple access (CDMA) technology, other companies including BTTB

use global system for mobile (GSM) technology. The CDMA is more efficient in

radio frequency utilization than GSM but its equipments are more complex and

expensive.

- As many as fifteen companies have been given licenses in 2004-05 for PSTN or

fixed telephone (wire line and wireless) to operate in four geographical zones of

the country. About 170 have been given licenses for providing internet services

but only 50 are functional.

- The rural telephone service is provided by Bangladesh Rural Telecommunication

Authority (BRTA) and Integrated Service Limited (ISL). The BRTA provides

about 45000 lines in northern zone and ISL provides about 3000 lines in southern

zone. The BRTA has been divided into two companies that are further converted

into two fixed telephone operator companies.

Radio tracking and radio paging are done by Bangladesh Telecom Ltd. (BTL).

It has been pointed out that the primary constraint to the expansion of telecommunication

service has been the distorted telecommunications market controlled by a monopolistic

government provider (BTTB) not willing to increase its capacity to connect mobile

systems to the fixed telephone infrastructure. The GP and other mobile companies have

been unable to add additional phones to the national switched network and instead have

had to offer primarily mobile-to-mobile phone services.

In addition to the above mentioned products, the GP also provides short message service

(SMS), voice message service (VMS), wireless application protocol (WAP) and

international roaming.

GP has the widest network and it plans to cover the whole country by 2005. The price

and output decisions of the GP are taken by its management board. It distributes products

to its customers through sales agents. GP has agreements with established agencies like

Butterfly, Flora and Rangs that also distribute its products. Currently the number of

distributors in the whole country is over 250.

In order to appreciate the nature of the telephone mobile market, it is necessary to look

into the behavior of other players that are GP’s competitors. Among the existing

competitors, City Cell and Aktel are planning to develop countrywide network. The

recently introduced Teletalk by BTTB will ultimately have nationwide coverage. These

potential developments will have considerable impact on the market share of GP. Global

companies like AT&T and BPL are operating in India. If these companies decide to (as

speculations are there) to enter the telecommunication market of Bangladesh with higher

capital and cheaper technology, it will have significant impact on the market share of the

existing market operators.

Since GP is a joint venture of some telephone companies, it is a case of horizontal

integration. Whether it would be able to exert any significant influence on market share

or not would depend on market developments now and in the future. Whether joint

venture should be allowed to work or it should be divided /broken into four companies

would remain an important policy decision for the government of Bangladesh. However,

a crucial factor in the policy decision would be to consider whether GP is involved in any

anti-competitive practices or not. The economies of scale and or scope appear to have an

important role to play in the present context of telecommunication market.

This, however, needs a careful analysis of mobile telecommunication industry in

Bangladesh. In the first half of 1990s City Cell was the only mobile company in the

country. The company targeted only the upper class of the society and during that time

the price of mobile telephone was more than Taka fifty thousand (more than $1,000).

The government of Bangladesh issued licenses to other operators thereby increasing the

competition in the market. However, the market share of the GP is still the highest being

around 70%. Until the introduction of Teletalk, the market shares of Aktel, City cell and

Sheba have been 13%, 12% and 4% respectively. GP has the advantage of large

investment by its shareholders, sanctioned loan from the World Bank, cheap rate of

packages and countrywide network. In addition, GP has a contract of 25 years with

Bangladesh Railway to use its optical fiber network that has enabled to set up a cheap

network nationwide.

Pharmaceutical Sector

The pharmaceutical sector of Bangladesh exhibits characteristics of an oligopolistic

structure except the lack of advertising. There are a large number of firms in this sector

producing drugs, cosmetics, toiletries and food items. While price and output decisions

are in principle taken by the management boards, the drug prices are significantly

influenced by the pricing policy of the government of Bangladesh. Some pharmaceutical

firms collude or cooperate among themselves in respect of production of certain products

and their pricing. There are restrictions on the use of imported raw materials in the

pharmaceutical industry of Bangladesh. The firms are forced to use locally available raw

materials of low quality. They are required to follow the listed price of the product and

there is no scope for advertisement.

The large pharmaceutical companies play dominant roles especially in the urban markets.

The markets are segmented and the prices of some widely used products (such as the

widely used aspirin-based pain killer Paracitamol) vary from firm to firm. In most cases,

products are differentiated only through packaging – a common feature of imperfectly

competitive firms. The drugs are easily available without prescription. A number of

pharmaceutical products made in Bangladesh are exported to the neighboring countries of

the region.

As an example of an oligopolistic firm, Glaxo Smithkline, a horizontally integrated

multinational company holds major market share in products like vaccine and horlicks

although in principle it competes with some smaller firms. The government requirement

to buy raw materials locally adversely affects the firm’s variable costs. In general, there

are many formal and informal restrictive business practices in the pharmaceutical market

of Bangladesh. The requirement of hygiene and health conditions for certification of a

new product often works as a deterrent to market entry. Interestingly enough, many drugs

of cheaper quality are available in the market at lower prices due to smuggling across the

India-Bangladesh border.

Petroleum Products

The petroleum sector of Bangladesh is oligopolistic in nature. A few companies like

Singer, Titas Gas, Bashundhara and Summit Surma Petroleum Company Limited

(SSPCL) are engaged in producing LP gas in Bangladesh. Some of these companies are

agglomerations of several companies doing diverse businesses. For example, SSPCL is

one such company that works under Summit group.

The distribution of LP gas to the customers is done through dealers.

The pricing of LP gas mainly revolves around the international market. The company sets

up a price structure on the basis of international market price and overall costs of

production. The company first sells the gas to its contracted distributors at a trade price

that is set up at cost and freight basis

This price is fixed on the basis of global cost of per unit LP gas. The distributors then

supply to the local dealers at different points. The sales price at this particular exchange is

formed by the previous trade price plus the distributor’s expenditure including its margin.

The dealers after procuring the gas from the distributors sell gas to the consumers at retail

price. The major incentive to this price is the dealer’s own price of the gas which they fix

with a good profit margin. Thus the final consumers purchase the gas at a price that is

largely determined by the dealers which in turn is dependent on the price that they pay to

the distributors.

The main target customer area of LP gas is the region of Bangladesh where natural gas

provided by the government is not available. Compared to natural gas the price of LP gas

is higher. On the other hand illegal gas distribution from natural gas line, gas stealing and

illegal pricing in some areas have adversely affected the use of LP gas. SSPCL plays a

dominant role in production and distribution of LP gas. It has a market share of 30%.

The targeted market area is expected to cover a part of Bangladesh that has no access to

natural gas facilities. However, the non-availability of gas burning stoves has limited the

use of LP gas in the rural areas. People in the rural areas burn trees for cooking than

using LP gas.

The petroleum companies discriminate between commercial and household customers.

For example, SSPCL segmented its market in two major areas. Household customers are

people of income of about taka 7000. They use it for domestic purposes like cooking,

central heating, space heating, hot water, and air conditioning. The commercial use is for

the major and medium hotels and industries for boilers.

Unlike the pharmaceutical companies, petroleum companies use newspapers, signboards,

banners, leaflets, calendars and seminars to promote their products, capture market and

make profit; however, no plant in Bangladesh can manufacture LP gas containing

cylinders; these are imported from India.

Food and Beverage Products

Bangladesh produces a large number of food products and the market is oligopolistic.

Bread, biscuits and soft drinks are the dominant food products of Bangladesh. Al Amin

Bread and Biscuits Limited, Nabisco Biscuits Limited and Haque Biscuits Limited are

the major food producing company of Bangladesh with a limited export market. The

market shares of Al Amin, Nabisco and Haque are 20%, 20%, and 15% respectively. All

major companies advertise their products in television, radio and the print media with Al

Amin being the most aggressive advertiser. Like biscuits the market for soft drinks is also

dominated by a few large firms. Coca cola, Pepsi, RC Cola, Virgin, Uro Cola and Pran

Cola are the major producers of soft drinks in Bangladesh.

The market shares of Coca Cola, Virgin, Pepsi and RC Cola are 40%, 25%, 20% and

10% respectively.

Another important food item is the dairy products. The dairy industry of Bangladesh is

still in its early stage of development. The major dairy firms operating in Banglaesh are

Milk Vita, Arong, Aftab, MO Milk and Shilaydaha. Milk Vita is the dominant firm in the

dairy industry of Bangladesh. It supplies 60% of the total products marketed in the

country. The market share of Arong is 25%. Thus, the dairy industry exhibits

characteristics of an oligopolistic market.

The market of dairy products of Bangladesh is vulnerable to price fluctuations of powder

milk in the international market. The industry is a capital-intensive one but higher

productivity technology is not available in the country. One of the weaknesses of the

industry is that it has not given adequate attention to value added products. The interests

of farmers, consumers and dairy farms are not protected as there is no dairy board to

regulate them.

Overall Business Practices in Bangladesh: Perceptions of the Civil

Society

As a second phase of this study, an opinion survey was conducted among civil servants,

politicians, journalists, business men, academics and bankers to elicit their perceptions

about competition policy issues. The adverse consequences of RMA are generally

recognized by the civil society. They identify telecommunications, power and energy,

television and radio, transport and communications, banking and finance and

pharmaceutical sectors to be most affected by RMA. They are of the opinion that

effective measures should be taken against RMA to protect the interests of consumers in

Bangladesh. Some of them are of the view that the chambers of commerce and industries

should set up a code of conduct for the businessmen and measures should be taken

against producers violating consumer’s rights. The competition policy can safeguard the

rights and interests of the consumers in Bangladesh by enforcing competitive pricing,

disseminating market information and undertaking measures against restrictive business

practices.

The civil society believes that a competition policy would not only protect consumer’s

rights but also increase productive efficiency of the economy. However, there should be

differential treatment between private and public sectors. A national competition

authority in Bangladesh would face some confrontation from the bureaucracy and the

government in dealing with public sector monopoly. Generally it is recognized by all that

public sector monopoly has a special role to play in the economy of Bangladesh

particularly in promoting public interest.

The different constituencies of the society have expressed the view that private sector

business in Bangladesh has some unholy alliance/collusion with the government

bureaucracy. They are involved in financing political parties and national elections

through corrupt practices. The private sector is in alliance with the bureaucracy to exploit

government sanctions, permits and exemptions. The bureaucracy has been held

responsible for the growth of monopoly and restrictive business practices in the country.

The role of bureaucracy in implementing industrial and trade policies, control of public

utility and management of state owned enterprises has contributed to the growth of anti-

competitive elements in the economy. The restrictive business practices in the capital

market influence the restrictive business practices in the manufacturing and other sectors

of Bangladesh economy. The dominant firms significantly influence the flow of funds.

Summary and Conclusions

The competition policy of the government of Bangladesh in four economic sectors was

examined in this paper. An analysis of the government’s policies in telecommunications,

pharmaceutical and medicine products, petroleum products, and food and soft drinks was

examined in this paper. All of the sectors exhibited an oligopolistic market structure with

the dominance of one major firm in each industry; however, the government’s

competition policy did not specifically address remedies for reducing or eliminating the

dominance or enhancing competition in these sectors. The perceptions of the civil

society members regarding restrictive business practices, monopoly and anti-competitive

elements will play a crucial role in the formulation and implementation of a national

competition policy in Bangladesh. Inevitably it would require establishment of a national

competition authority and its performance would depend, among other things, elimination

of collusion of the bureaucrats and the management of large firms.