Analysis of Customer Satisfaction at the Premier Bank Limited

The Premier Bank Limited is one of the most well known private banks in our country. It undertakes all type of banking transactions to support the development of trade and commerce in the country. Above all of their service they go through their objectives such as earning and maintaining performing strong, establishing relationship banking, introducing fully automated systems, ensuring an adequate rate of return on investment, maintaining adequate liquidity to meet maturity obligations, pursuing an effective system of Management by transparency and accountability at all levels.

As a part of fulfilling their objectives through their customer PBL offers the following accounts such as Current Deposits, Savings Bank Deposits, Fixed Deposits, Short Term Notice Scheme Deposits, Monthly Savings Scheme, Education Scheme, Monthly Income Savings Scheme and other deposits as may be approved/ advised by Head Office. They give credit and loan to their valued customer where interest rate is charged according to the rate fixed by Bangladesh bank.

In General Banking, Clearing department receives cheques, pay order etc from depositors attached with a deposit slip.

The system of transactions of the bank is essentially double entry system of book keeping. In the bank, instead of recording transactions in a journal initially, these are directly recorded and posted in the ledger (computer) separating the debits and credits by slips or voucher system.

Foreign exchange is an important department of Premier Bank Limited, which deals with import, export and foreign remittances. It bridges between importers and exporters. This department is playing an important role in enhancing export earnings, which aids economic growth and in turn it helps for the economic development. On the other hand, it also helps to meet those goods and service, which are most demandable and not adequate in our country.

In The Premier Bank Limited, Kakrail Branch everyone has the tendency to give proper and better service to the customer. Here numbers of customer come in this branch everyday. When I have talked with some customer they told me about their experience. They are very much glad to be the customer of this bank and branch. They always get fast service from the employee and staff. They don’t have to wait in queue for collecting and depositing money. There are always five employees to serve the fast service to the customer.

First day when I was standing in front of door to ask them about the service of premier bank and to drop different type of emotion of their experience, they are very joyous to give the answer and to drop the smiling face which is excellent and good. So I found that the customer of Premier Bank Limited is happy by the banking service.

On the other hand, there are some problems which customers face and by that they are not satisfy with the service Such as debit card and credit card related problem and not to have available booth service and so on.

Finally The Premier Bank Limited is trying to develop their service and to give their customer best and fast service. So that they are bringing special and more benefit to market for the customer. By this they provide “Service First” as their slogan.

Introduction:

The Banks play an important role in the economy of the country. Early banking system served mainly as depositors for funds, while the more modern system has considered the supplying of credit their main purpose. Banks are financial institutions or financial intermediary that collect fund from people as deposit and lend this fund as loans and advances to the borrowers in different sectors of the economy against interest for a certain period.

Banks play a very important role in both National and International trade. Now a day, no country can survive without international trade. Moreover, banks provide some other non-traditional services like- factoring, issuing bank guarantees etc., which are very much supportive to modern business.

After liberation of our country all banks were nationalized accepts the foreign banks. These banks were merged and grouped into six commercial banks. Total six commercial banks along with Uttara and Pubali were transferred to private sector from 1985. The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central bank, 04 nationalized commercial banks (NCB), 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions are existing in our country at present.

Objective:

The intership program, designed to provide the student with an opportunity to obtain on the job trainning and it aims to bring the two facts of learning the theoritical and practical knowledge together.

Primery objective:

- To measure the level of customer satisfaction.

- To find out the way to improve customer satisfaction

Secondary objective:

- To give an overview of operations of PBL.

- To identify the problem and solution related with the service which is provided by the bank.

- To analyze the gap between expectation and perception of customers regarding the service provided by JBL.

- At last to relate theoretical knowledge with practical experience in several functions of bank.

Methodology:

The report has been prepared on the basis of the experience gained during the period of the internship. Here both quantities and qualitative data are included. However, this report is basically qualitative in nature. The important feature of the report is the use of both primary and secondary data. The data is collected from two sources:

Primary Source:

- Personal experience by MEET and GREET with the customer.

- Personal experience gained by visiting different desks.

- Personal investigation with bankers.

Secondary Source:

- Different “Procedure Manual” published by The Premier Bank Ltd.

- Publications of Journal

- Internet

- Annual Report

The Organization:

The Premier Bank Limited (PBL) is the leading private bank in Bangladesh. It is a scheduled bank, which is incorporated in Bangladesh as banking company on June 10, 1999 under Companies Act.1994. It has created a new way of its own banking area of Bangladesh in terms of providing service to customer and value addition to its stakeholders. Bangladesh Bank, the central bank of Bangladesh, issued banking license on June 17, 1999 under Banking Companies Act.1991. The Head Office of the Premier Bank Limited is located at Banani. Within short period of time, the bank has been successful in positioning itself as progressive and dynamic financial institution in our country. The bank is now widely operated by the business community from small entrepreneurs to big merchant and multinational because of modern and innovative ideas and financial solution. Now it has opened 65 branches in different areas of the country.

Company overview:

The Premier Bank Limited is managed by a group of dynamic Board of Directors drawn from different disciplines. They hold very respectable positions in the society and are from highly successful group of Businesses and Industries in Bangladesh. The Bank has a very competent Management Team who have long experience in domestic and international Banking. The Bank upholds and strictly abides by good corporate governance practices and is subject to the regulatory supervision of Bangladesh Bank.

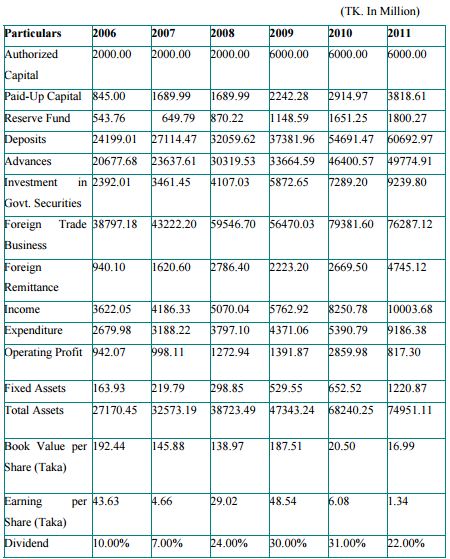

Authorised Capital: BDT 6000.00 Million

Paid up Capital: BDT 3818.61 Million

Performance of the bank at a glance:

Project Description:

Customer is the most important part of any organization and customer satisfaction is the only thing to get more customers, to make more profit. Bank is a service organization, here it is mandatory to satisfy its customers. The Premier Bank Limited always tried to provide better service to its customer. But it is not possible to any one or any organization to satisfy the entire customer. If PBL provide best service to its customer, there will be some people who will be not satisfied at all. Not only that, customer satisfaction level might be changed day by day. In my intern period, I observe that one customers choice, his/her opinion, feelings about PBL products, behaviors are different from other customers, and satisfaction level is also vary from others. To run business successfully, every organization must measured its customer’s satisfaction level. In PBL, I have to meet many customers in a day. Some of them are happy with PBL but some of them are totally disappointed with PBL. To understand this situation more clear I choice this customer’s satisfaction level as my intern project. To measure this satisfaction level, I asked some fixed question to 50 different customers who visited PBL, Kakrail Branch frequently. (Questioner is attaching in appendix). I divided my questioner in some criteria, like PBL product, Employees behavior, Charges, Loan facilities, Interest rate etc.

Two types of customers are visiting PBL most. One for transaction and another for account service. I choose randomly my samples for my survey. In my target customers, some of them are businessman, some people are service holder, some of them are house wife or student etc. After completing my survey, I analyzed those data by using graph and have found a result.

Customer Satisfaction:

The customer satisfaction level of Premier Bank we should know what is customer satisfaction? What are the factors those are influencing the customer satisfaction and why it is needed? Customer satisfaction is really hard to define as many factors have a great influence on it. The generally accepted the definition of customer satisfaction is “The extent to which a product perceived performance matches a buyer’s expectation. If the product’s performance falls short of expectations, the buyer is dissatisfied. If performance matches or exceeds expectation, the buyer is satisfied or delighted”.

- So, Customer satisfaction = Perceived Performance – Actual Performance

- When Customers are Satisfied?

- Dissatisfaction: It occurs when the actual performances fail to met its expectation.

- Satisfaction : It occurs when the performance meets the expectation.

- Delight : It occurs when the performance level exceed it expectation.

This service quality has some dimensions that are presented in the above diagram. Quality of service is one of the important factors that influence customer satisfaction. Researchers and managers of service firms concur that service quality involves a comparison of expectations with performance. So, by this diagram the author tried to show the 7 dimensions of service quality and the reliability, responsiveness, assurance, empathy, tangibles, access and lastly courtesy. These seven dimensions are discussed here below:

Reliability:

- Providing service as promised

- Dependability in handling customers’ service problems

- Providing services right the first time.

- Providing services at the promised time.

- Maintaining all of free records accurately.

Empathy:

- Giving customers individual attention

- Employees who deal with customers’ in a caring fashion (recognizing regular customer)Having the customer’s best interest at heart.

- Employees who understand the need of their customers

- Convenient business hours.

Responsiveness:

- Keeping customers’ informed as to when services will be performed

- Prompt service to customers (sending bill)

- Willingness to help customers (calling back)

- Readiness to respond to customers’ requests

Tangibles:

- Modern equipment

- Visually appealing facilities (plastic credit card)

- Employees who have a real, professional appearance

- Visually appealing materials associated with the service.

Assurance:

- Employees who have confidence in customers

- Making customers feel safe in their transactions

- Employees who are consistently courteous.

- Employees who have the knowledge to answer customer questions.

- Physical Safety

Accessibility:

- The service is easily accessible by telephone (lines are not busy and don’t put you on hold)

- Waiting time to receive service is not expensive

- Convenient time of operation

- Convenient location of service facility

Courtesy:

- Politeness, respect, consideration and friendliness

- Clean and neat appearance of public contact personnel.

- Consideration for the consumer’s property.

Customer satisfaction factor:

Banking is a service oriented business. They are providing service to attract the customer. They are the key element of business. So Banks are mostly emphasizing on providing better and quality service to the customer. They should more concern about what type of service they are providing. Now in the market there are tough competitions among banks. Customer satisfaction depends on several factor of bank. Herewith we can measure the level of customer satisfaction by analyzing different satisfaction factor. Customer satisfaction factor are given bellow.

- Advanced product and service

- Account opening procedure

- Time taken to issuance cheque book and debit card

- Interest rate of different deposit scheme

- Loan and credit facility of PBL

- Interest rate charged by PBL for different loan

- Online banking system of PBL

- Service charge

- Behavior of employee

- Internal environment

- Employee interaction

- ATM Booth Service

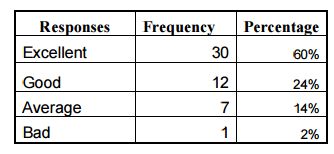

Here we have taken information from the general customer of the bank who has taken service from the bank at different times. So we have taken the information from 50 general people who have divided bank’s service quality into some criteria such as Excellent, Good, Average and Bad. To collect the information, we have used customer evaluation box in the bank. And daily we have recorded the information in our logbook.

Data Analysis and Interpretation

After collection of all necessary data, those are analyzed in the following two ways:

- Subjective Analysis: Qualitative data are analyzed critically using judgment and knowledge.

- Statistical Analysis: Appropriate statistical tools are used to analyze the gathered data. All these analysis will be done with Microsoft Excel statistical analytical software.

Advanced product and service:

The main customer satisfaction factor is the various types of product and services. Advanced product and service helps the customer to define which their satisfaction level and to find out which bank provides them best services. So here is aimed at finding out how much customer is satisfied with the advanced product and service of Premier Bank Limited, Kakrail branch, at present.

The above figure shows 60% of the total customer are said Premier Banks Limited’s Advanced product and service are excellent that is they are fully satisfied regarding the product and service of Premier Bank Limited, 24% are said good. Therefore, in general it can be said that customers are satisfied regarding product and service of Premier Bank Limited.

Account opening procedure:

Account opening procedure is also an important satisfaction factor of customer. Most of the time, customers make compare with other bank about fast service. So here our aim is to measure the level of customer satisfaction against account opening procedure.

Majority of the client about 61% expressed that A/C opening procedure excellent where as 29% Said Good Service 4% said average service. Therefore, in general it can be said that customer are satisfied A/C opening procedure of Premier Bank LTD.

Time taken to issuance cheque book and debit card:

Time is one of the most important elements of customer. They don’t want to compromise with the time. They want best service within short period of time. In that case, to issue cheque and debit card, they want fast service. So by the analysis, our aim objective is to find out the level of customer satisfaction about Time taken to issuance cheque book and debit card.

The above figure shows 75% of the total customer are said PBL’s Cheque Book Issuance procedure are excellent that is they are fully satisfied regarding the Cheque Book issuing procedure of Premier Bank Limited, 20% are said good and 16% Said Average. Therefore, in general it can be said that customers are satisfied regarding Cheque Book Issuance procedure of Premier Bank Limited.

Interest rate of different deposit scheme:

Interest rate of different deposit scheme is also an important factor of level of customer satisfaction. Customers always want best benefit. In that case, the always expect high interest rate against their deposit money. So they can get high profit of their deposit money at the end of maturity. But it is rarely varied from other bank because interest rate is getting fixed from Bangladesh bank, itself. But as a satisfaction factor of customer, our aim is to find out their satisfaction level.

The above figure shows 50% of the total customer are said PBL’s interest rate provided for different deposit scheme are excellent that is they are fully satisfied regarding the interest rate provided for different deposit scheme of Premier Bank Limited, 26% are said good and 22% said Average.

Loan and credit facility of PBL:

The Premier Bank Limited (PBL) gives loan and credit facility to customer. In kalrail Branch, there are some customers who take loan in a regular basis. They are satisfied with the service of the Premier Bank Limited Kakrail branch. So here we will follow how much customer is satisfy with the Advanced Loan and credit facility of premier bank, Kakrail branch, at present.

The above figure shows 68% of the total customer are said Bank ’s loan issuing procedure are excellent that is they are fully satisfied regarding the loan issuing procedure of Premier Bank Limited, 26% are said good on their loan issuing procedure.

Therefore, in general it can be said that the credit customers are satisfied regarding loan issuing procedure of Premier Bank Limited.

Behavior of employee:

Employee’s behavior is also important factor of customer satisfaction. Some times customer came back to the bank because of friendly behavior by employee. On the other hand if they are disturbed for one time, they don’t come for second time. That’s why, this is important factor. Now our objective is to find out customer satisfaction level case of behavior of employee of PBL, Kakrail Branch.

The above figure shows that 72. % are agreed with the opinion ‘Employee behavior is perfect’ in Premier Bank limited. 24% are agreed with good. So in general it can be said that Employee interaction is perfect in Premier Bank Limited.

Employee interaction:

Our objective is to find out customer satisfaction level case of behavior of employee of PBL, Kakrail Branch. Sometime customer may become de-motivated to do transaction with us because of miss interaction of the employee.

The above figure shows that 40% are agreed with the opinion ‘Employee interaction is perfect’ in Premier Bank limited. 44% are agreed as good. So in general it can be said that Employee interaction is perfect in Premier Bank Limited.

ATM Booth Service:

Here our main objective is to find out customer satisfaction level in case of ATM booth service.

Here the percentage shows that 50% customer has mentioned about the service of ATM booth is average. So comparing to the other segment we can say that customer didn’t find proper service from it. So here their satisfaction level is quite low.

Recommendation

In the fast evolving world, it is very necessary for each and every organization to build a strong presence in the market by maximizing profit margin by satisfying their customers as much possible. As a bank, the manager has to identify the strategies that align, fit or match the banks’ resources and capabilities to the demands of the environment in order to exploit opportunities and counter threat and to correct company weakness building on the strength. It is like a process containing corporate planning, performance analysis, program or service delivery, and evaluation and review.

After completing my internship program with PBL, Kakrail Branch, I think the following recommendations will help them to improve the level of customer satisfaction.

Deposit book:

Deposit book should be provided to the regular account holder such as current account and MSS account holder. Some customers want a full book of deposit slip. By discussing with them it comes to know that they are the current account holder and MSS account holder. They have to come the bank daily or monthly. So it becomes tough to them to come in the bank to put the signature on deposit slip. If they get that slip as book, it will be helpful for them as they can send bearer to deposit the money.

Debit card

Debit card should be given to the new account holder with in short period of time and it should be activated as early as possible. Sometime customers open bank account for their early and fast service in the case of carrying debit card but it is reached on customers hand after 15 or 20 days later. So they claimed that the service of premier bank is not excellent. So it takes more time to issue debit card and activation of it.

ATM Booth Service:

ATM Booth service is very poor in PBL Comparing to the other bank. So it should be developed as early as possible. Number of booth should be improved to fill up customer demand as we know that at present it has only for Booth throughout the country. so it should be reachable and available to the customer.

Locker service:

Premier bank Limited have the facilty of locker service for the customer. But it has only in head office. But it should be improved at PBL, Kakrail Branch. There are many customer have come to take that service at their nearer branch.

Number of Branches:

PBL should create business opportunities for themselves. Nowadays there is a intense competition between the banks. All the banks are expanding with aggressive approach. so Premier bank needs to open more branches to capture the market and it should be nearer to the customer address. So they can do banking easily with PBL.

Number of Trained employee:

There are some employees untrained which decreases the efficiency of the bank branch. Number of trained employee should be improved to give proper and better service to the customer. As we know that PBL of Kakrail branch faces employee shortage.

Cheque authorization Process:

Cheque authorization Process should be developed to save the time of customer. Here customers have to wait for long time to take the authorization of cheque from other branch.

Marketing Effort:

Premier Bank limited should give more emphasize on their marketing effort and try to increase their sales force. Model Banks like Citibank, HSBC Bank, Standard Chartered Bank are using media very effectively to increase the business of banks. So PBL should need to use electronic media for its business developments.

Incraese Loan Facility:

Premier Bank should pay attention to consumers’ need and want. It should increase the facility of consumer loan products, small loan products like car loan, personal loan, and student loan, House Building loan etc.

House-Building loan facility

There are House-Building loan facilities available in Premier Bank Ltd, Which is only offered to Staffs of the bank. This loan facility should be opened for every people.

Job rotation:

Most of the bank employees are sticking to one seat only, with the result that they become master of one particular job and lose their grip on other banking operation. In my opinion each employee should have regular job change.

Conclusion

Success in the banking business largely depends on effective lending. Less the amount of loan losses, the more the income will be from lending operations. The more the income from lending operations the more will be the profit of the bank

Overall of my investigation I can say that Products and services are satisfactory and continuously meet the challenges of developing new products and services to match the specific requirements of customers.

Over the years Premier Bank Ltd. had shown commendable improvement. But as discussed earlier, the world will not compromise for PBL, for that matter, neither local competitors nor the multinational ones. In this era, when only the fittest survives, PBL wrap a long yard behind from that fitness. This is the crucial time for PBL to consolidate the success they have achieved, and go on with its mission. Otherwise ‘A Bank with Vision’ will only be an illusion to them.