1.INTRODUCTION

1.1BACKGROUND

Internship is a compulsory requirement for everybody pursuing a MBA degree at the Department of Finance, Southeast University. The Internship program includes organizational attachment period of 12 weeks. During the organizational attachment period interns work on a project, and write report on that project in the report writing period. I am working in the Credit Division & Foreign Exchange Division of The Premier Bank Limited. After consultation with my Placement Director Mrs. Khaleda Khatun and my supervisor in the host organization Mrs. Nausheen Rahman, I decided to work on the policies and practices of credit management system of the bank. After I started working as an intern, a steel manufacturing company applied for a loan facility to the Bank. The steel manufacturer was a new customer of the bank but it is one the largest Corrugated Iron/Galvanized Plain sheet (CI/GP) manufacturers and marketers in the country. I contacted with the Corporate Marketing Division and decided to work on the appraisal of this investment proposal and to prepare my internship report on the light of this project. I strongly believe that, this study will enrich my knowledge in the very crucial area of the banking business: Credit Management.

1.2 COMPANY OVERVIEW

The Premier Bank Limited started its operation from October, 1999 under the Banking Companies Act 1991. Since then, the Bank has emerged as a quality Financial Institution and making significant contribution to the national economy. The authorized capital of the Bank is BDT 2,000.00 million and the total capital funds as on 31.12.2006 is BDT 1690 with paid-up capital BDT 845.00 millon. Capital adequacy ratio is 9.47% as against required 9%. The Bank is a full service Commercial Bank and licensed by Bangladesh Bank. The Bank has a strong capital base, with no insider lending and low non-performing loans (4.88%).

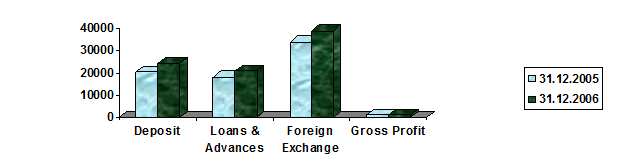

Comparative position of deposit, advance, foreign exchange business & profit of the bank is as follows:

Particulars | 31.12.2009 | 31.12.2008 | Growth Rate |

| Deposit | Tk. 24,199 million | Tk. 20,290 million | 19% |

| Loans & Advances | Tk. 20,678 million | Tk. 18,032 million | 15% |

| Foreign Exchange | Tk. 38,797 million | Tk. 33,850 million | 15% |

| Gross Profit | Tk. 942 million | Tk. 899 million | 5% |

Table 1.1: Summary of Deposit, Advance, foreign Exchange and Profit of PBL

Figure 1.1: Year –wise Total Deposits, Loans & Advances, Foreign Exchanges and Gross Profits of the Premier Bank Limited.

Like other Commercial Banks, the Premier Bank has invested money to earn profit. But the bank differs in the manner of operation. The Premier Bank is a customer-oriented bank and its motto is “Service First”. The philosophy of The Premier Bank is to be the most caring and customer friendly provider of financial services, creating opportunities for more people in more places. The Premier Bank is committed to ensure stability and sound growth while enhancing the value of shareholders investments. As a bank of the new millennium Premier Bank aggressively adopts technology at all levels of operation to improve efficiency and reduce cost per transaction. To ensure a high level of transparency and ethical standards in all business transactions it trains and equips fresh recruits to build a strong foundation and appoints skilled manpower to cope with its growing business needs. The bank provides congenial atmosphere, which attracts competent workforce. 14s a commercial bank, the main target of Primer Bank is to earn profit but Premier Bank not only gives emphasis on profit but also is socially responsible and strives to uplift the quality of life by making effective contribution to national development. The Premier Bank Limited is gradually coming up as a major bank in Bangladesh and making significant contribution to national economy. The last five years’ business performance of Premier Bank is remarkable. The result was largely due to confidence and loyalty of the customers. The Premier Bank Limited is now more encouraged and striving for excellence with the guidance of the valued shareholders and directors.

1.3OBJECTIVES

- This report intends to meet the following objectives in the broad sense:

- To give a detailed description of the host organization (The Premier Bank Limited), its business, performance and organizational aspects.

- To perform comprehensive project analysis of a Corrugated Iron/Galvanized Plain Sheet Manufacturer and thereby take a thorough look at the policies and practices of credit management in The Premier Bank Limited.

This report intends to meet the following objectives in the specific sense:

- To describe the policies regarding credit management practices of Premier Bank.

- To evaluate the credit management practices of Premier Bank,

- To suggest ways to improve credit management practices of Premier Bank.

The above mentioned objectives will be achieved by performing the following:

By describing-

- Types of credit

- Types of credit facilities

- Credit guidelines

- Lending process

- Evaluation of credit proposals and safeguards Processing of loan proposals

- Required documents

- Credit analysis

- Lending risk analysis

- Financial spreadsheet analysis

- Thorough analysis of the project

- Different financial analysis of the project

- Financial projections

- Credit practices Credit policies

1.4 METHODOLOGY

This report has been prepared by following the steps below:

1.4.1 DEFINE THE PROBLEM AND REPORT OBJECTIVES

A.Problem: This report is on Policies and Practices of Credit Management in The Premier Bank Limited. This means that the report is asking the question: “What are the states of policies and practices of credit management in the Premier Bank Limited? Are these policies and practices good or there are some drawbacks? If there are any drawbacks, what are the ways to improve those?”

B.Objective: The followings are the objectives of this report:

a.What are the policies and procedures of credit management in Premier Bank?

b.What are the advantages or the drawbacks of credit management in Premier Bank?

c.What would be done to improve the credit management practices of Premier Bank?

1.4.2 DEVELOPING THE REPORT PLAN

A.Data Sources: The report plan calls for both secondary data and primary data.

Primary Sources:

Primary sources of information were thorough discussion with the concerned officers and executives of Corporate Marketing Division and Credit Division of the Bank.

Discussions with the customer were also used as a platform to understand the merits of the project.

Secondary Sources:

- Credit Manual

- Website

- Different documents, forms etc.

- Other books and publications regarding credit policy

Secondary information was mainly used in performing the analyses, which include information on the CR coil and CI/GP sheet industry of Bangladesh. For analyzing the information collected, both qualitative and quantitative techniques were used, In the macro environment analysis, the research is more qualitative than quantitative, while the analysis of the project itself is a quantitative one. Different tools as per the policies and procedures of the Bank as well as the instructions and requirements of the Central Bank were utilized to analyze the investment proposal.

B. Research Approach; Primary data was collected in the Survey Research approach.

C. Research Instruments: A questionnaire was used to collect primary data for the study. The questionnaire contained open-end questions.

D. Sampling plan; The sampling plan calls for the following decisions

a Sampling Unit: The intern chose some officers and some credit customers of The Premier Bank Limited.

b. Sample Size: The intern chose four officers from the Head Office Corporate Marketing Division, two officers from the Head Office Credit Division and four credit customers of the bank.

c. Sampling Procedure: The intern obtained non-probability samples from the population. And in non-probability sampling he chose convenience samples.

E.Contact Methods: The intern personally interviewed the interviewees. And here, convenience intercept interview was the method.

1.4.3 COLLECTION OF INFORMATION

In this step the intern approached to the interviewees. He interviewed the concerned officers who are engaged in different duties like marketing of loan products, credit appraisal, credit analysis, loan disbursement etc. Also customers who have taken credit from the bank were interviewed. Primarily some of them could not understand the purpose and importance of the study. But when they were convinced that the information were to be gathered only for academic purpose, they began to give information.

The intern also collected information from various secondary sources such as credit manual, website, different documents, forms etc.

1.4.4 ANALYZING THE INFORMATION

In the next-to-last step in this report preparation, the intern tried to extract potential findings from the collected data and information.

1.4.5 PRESENT THE FINDINGS

At the last step in this internship report, the intern presents his findings to the faculty instructor.

1.5 SCOPE

This report examines whether The Premier Bank Limited should invest in the proposed project or not The making of the actual decision is a task of the Senior Management and the Board of Directors of the Bank, and hence, is out of the scope of this undertaking.

1.6 LIMITATIONS

+ The report deals with the project appraisal done by the Head Office Corporate Marketing Division and Credit Division. It does not cover the credit disbursement process that is practiced by the branches.

The entire process of lending facility to the Project and also the Project itself is a confidential documentation of The Premier Bank Limited. Hence, for the sake of confidentiality, anonymity is maintained and for this, the name of the company, its management and accounting figures have been altered.

+ Premier Bank has not yet prepared its own Credit Manual. Preparation of the credit manual of the bank is under way. Right now the bank follows standard credit operation principles practiced by all other banks to perform its credit manage’ practices. So, this report is based on standard credit management principles.

Recent data on the CR coil and CI/GP sheet industry (production, price, local/overseas market condition, performance of the major players, etc.) are not easily available. This makes understanding the present trends and forecasting the future very difficult.

2. THE PREMIER BANK LIMITED AT A GLANCE

The Premier Bank Limited started its operation from October, 1999 under the Banking Companies Act 1991. Since then, the Bank has emerged as a quality Financial Institution and making significant contribution to the national economy. The authorized capital of the Bank is BDT 2,000.00 million and the total capital funds as on 31.12.2009 is BDT 1690 with paid-up capital BDT 845.00 millon. Capital adequacy ratio is 9.47% as against required 9%. The Bank is a full service Commercial Bank and licensed by Bangladesh Bank. The Bank has a strong capital base, with no insider lending and low non-performing loans (4.88%).

2.1 MISSION OF THE BANK

The Bank has a clear vision towards its ultimate destiny- to be the best amongst the top financial institutions. The mission of the Bank is –

To be the most caring and customer friendly provider of financial services, creating opportunities for more people in more places.

To ensure stability and sound growth whilst enhancing the value of shareholders investments.

To aggressively adopt technology at all levels of operations and to improve efficiency and reduce cost per transaction.

To ensure a high level of transparency and ethical standards in all businesses transacted by the Bank.

To provide congenial atmosphere which will attract competent work force who will be proud and eager to work for the Bank.

To be socially responsible and strive to uplift the quality of life by making effective contribution to national development.

2.2 CORPORATE INFORMATION

As on DECEMBER 31, 2009

| v Date of Incorporationv Inauguration of 1st Branch (Gulshan Branch, Dhaka) | :: | June 10, 1999October 26, 1999

| |

| v Ownership | Dr. H. B. M. IqbalMr. B. H. Haroon Dr. Arifur Rahman Mr. Nurul Amin Mr. Kutubuddin Ahmed Mr. Abdus Salam Murshedy Mr. Shafiqur Rahman Al-haj Abul Kashem Mr. Mohammed Mazharul Islam Mr. Yeh Cheng Min Mrs. Shaila Shelly Khan Ms. Nawrin Iqbal Mrs. Faiza Rahman | 5.41%9.01% 9.01% 9.01 % 9.01% 9.0 1% 4.50 °k 4.50 °k 9.01 % 9.01 % 9.01% 4.50 % 9.01 % | |

| v Authorized Capitalv Paid-up Capital v Deposit v Advances v Foreign Trade Business v Number of Branches v Number of Foreign Correspondents v Manpower | :: : : : :

: :

| Tk. 1,000.00 millionTk. 408.91 million Tk. 10,030.52 million Tk. 8,095.57 million Tk. 20,934.30 million 17

238 435 |

Comparative position of corporate information from 2005 to 2008 is given below:

Table: 2.1: 5 Years Corporation Information of The Premier Bank Limited

(Taka in Million)

Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| Authorized Capital | 1,000.00 | 1,000.00 | 1,000.00 | 1,000.00 | 2,000.00 |

| Paid Up Capital | 222.00 | 222.00 | 222.00 | 239.76 | 845.00 |

| Reserve Fund | 0.00 | 2.86 | 25.30 | 98.24 | 130.00 |

| Deposits | 1,424.24 | 1,856.13 | 2,206.39 | 5,373.75 | 10,030.52 |

| Advances | 11.21 | 1,089.22 | 2,057.96 | 4,280.73 | 8,095.57 |

| Investments in Govt. Securities | 60.00 | 140.15 | 270.13 | 680.09 | 1,330.20 |

| Foreign Trade Business | 54.27 | 2,348.20 | 6,158.43 | 11,782.80 | 20,934.30 |

| Foreign Remittance | – | 24.62 | 57.51 | 54.80 | 364.50 |

| Income | 20.68 | 224.36 | 415.41 | 576.78 | 1,251.76 |

| Expenditure | 31.43 | 199.18 | 291.27 | 380.54 | 851.03 |

| Operating Profit | -10.75 | 25.18 | 124.14 | 196.24 | 400.73 |

| Fixed Assets | 6.71 | 46.79 | 48.59 | 73.29 | 107.90 |

| Total Assets | 1,852.02 | 2,832.25 | 3,448.94 | 6,036.92 | 11,096.30 |

| Book value per Share (Taka) | 100.00 | 100.00 | 121.68 | 140.97 | 168.12 |

| Earning per Share (Taka) | 0.00 | 3.85 | 26.09 | 28.30 | 67.02 |

| Dividend | – | – | 13.50% | 13.70% | 36.35% |

| Loan as a % total Deposits | 0.79% | 58.68% | 93.27% | 79.66% | 80.71% |

| Non Performing Loan as % of total Loan | – | – | 0.64% | 1.16% | 0.36% |

| Capital Adequacy Ratio | – | 17.13% | 12.47% | 9.27% | 11.76% |

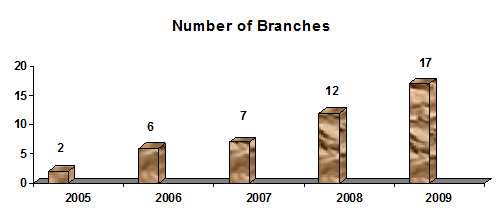

| number of Branches | 2 | 6 | 7 | 12 | 17 |

| No. of Foreign Correspondents | 72 | 103 | 131 | 156 | 238 |

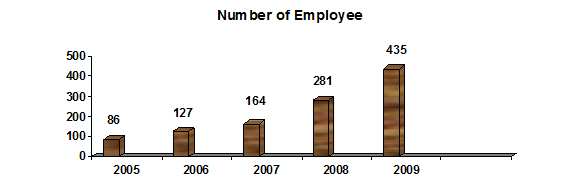

| Number of Employees | 86 | 127 | 164 | 281 | 435 |

Figure 2.1: Year –wise Number of Employees of the Premier Bank Limited.

2.4 PRODUCTS & SERVICES

Premier Bank is always conscious of the changing needs of the customers and strives to develop new and improved services for its valued customers. The bank offers the following deposits and lending & services to meet all kinds of financial needs of our customers:

Figure 2.2: Year –wise Number of Branches of the Premier Bank Limited.

2.4.1 DEPOSIT PRODUCTS

Monthly Savings Scheme (MSS)

Monthly Income Scheme (MIS)

Education Savings Scheme (ESS)

Special Deposit Scheme (SDS)

Fixed Deposit (FD)

Saving Account (SB)

Current Account (CD)

2.4.2 LENDING PRODUCTS

Consumer Credit Scheme

Rural Credit Scheme

Lease Finance

SME Finance

2.4.3 CREDIT CARD

Premier Bank holds the principle member License from VISA International to issue & acquire the world’s most widely used Credit Card. Premier Bank is the first local private bank to offer VISA International credit card in the country. The Bank is offering both local and international cards.

2.4.4 SERVICES

Real Time Online Banking ensures reliable any branch banking for customer.

SWIFT facility ensures effective communication between our bank & other local foreign banks.

More parts of this post-

Credit Management Of Premier Bank (Part-1)

Credit Management Of Premier Bank (Part-2)