BRAC Bank is the fastest growing retail banking in Asia, 2011. BRAC Bank has made its place of reliability and trust in customer mind. It was an enormous opportunity to do three month internship at BBL (BRAC Bank Limited) where I got a taste of professional environment. general banking activities and process.

This internship report is a combination of personal experience with BBL and customer satisfaction of ATM card holder of BBL. This repost focus on satisfaction level of BRAC Bank ATM card holder, ATM card quality and developing other alternatives to boost up customer satisfaction along with a customer survey research.

This report is a descriptive research which is based on both qualitative and quantitative data. Exactly 50 participants have completed structured questioner and interviews. According the research problem research methodology was selected and after analyzing the data it is found that the customer are not dissatisfied with BRAC Bank although there is a number of objection among them. To increase the customer satisfaction BBL can take a number of initiatives like – taking initiative to eliminate wrong information about BBL ATM card, broadening internet banking and online shopping and most importantly increase the number of ATM booth.

BRAC Bank Ltd.

BRAC Bank Limited, a scheduled commercial Bank, commenced its business operation in Dhaka, Bangladesh on 4 July 2001. The Bank is mainly owned by the largest NGO in Bangladesh – BRAC. The Bank has positioned itself as a new generation Bank with a focus to meet diverse financial needs of a growing and developing economy. The Bank has embarked with an avowed policy to promote broad based participation in the Bangladesh economy through the provision of high quality banking service based on latest information technology. The Bank will ensure this by

increasing access to economic opportunities for all individuals and businesses in Bangladesh with a special focus on currently underserved enterprises and households across the rural-urban spectrum. We believe that increasing the ability of underserved individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladeshis.

About BRAC Bank Limited.

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore cap International, has been the fastest growing Bank in 2004 and 2007. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last six years of operation, the Bank has disbursed over BDT 7500 corer in loans to nearly 2,00,0,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 56

branches, 429 SME unit offices and 112 ATM sites across the country, and the customer base has expanded to 4,65,000 deposit and 1,87,000 advance accounts through 2008. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMs across the country.

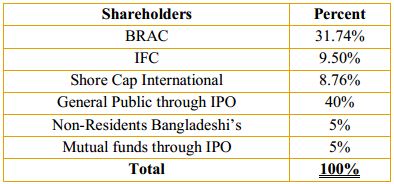

Shareholding Structure

The shareholding structure of BRAC Bank Limited consists of different group with institutional shareholdings by BRAC, International Finance Corporation (IFC), Shore cap International and general public is also included through IPO.

SWOT Analysis

SWOT analysis is an important tool for evaluating the company‟s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strength

- The term BRAC itself has a great brand value

- Only BRAC itself has 119,520 internal employee who are directly involved with BBL

- Invincible management system and skill which made BBL number 1 fastest growing bank in Asia in March 11,

- A good working environment

- A wide range of branches and wide banking services

Weakness

- The remuneration and compensation are significantly lower than other Bank

- Employee endure huge work load which is leading to employee dissatisfactions

Opportunity

- BBL can adopt green banking to minimize cost

- BBL can add technology in their product to be unique

- BRAC Bank can encourage its depositor to invest BRAC EPL

Threat

- Competition with international, contemporary and upcoming bank

- Online deception in e-banking

- Economic or Financial Crisis

Different Aspects of Job Performance

The whole internship period was interesting and exciting also. I have got a chance to meet a number of people within BRAC Bank and outside also. BRAC Bank Gulshan Branch is the center of every banking activity. More over Gulshan branch is the linking point of all BRAC staff. Therefore I have got a chance to visit BBL annual meeting “Town Hall” which was a great experience.

Finally the most important is that I have also visited the BRAC research lab and there other department as well. This internship has revealed the door to introduce with other large organizations.

Observation and Recommendation

BRAC Bank always forces to enhance better service quality. Besides, it is fact that most of the employee of BBL work harder than any other banker. I think the priority BBL giving to its own BRAC Staff is the main barrier behind efficient and effective service quality. Therefore if BBL appoint only one BSSO for BRAC Staff only then the service quality will jump up significantly.

More over BBL has a tradition that no employee is allowed to leave before 6.00am. What if the job is done before 6.00pm no one can move? Although this is a lesson of discipline but indirectly it has a drawback on service quality. This makes the service slower and employee is not encouraged to working fast. May be it has some other reasons which I am unable to discover.

Project Part

Prologue

The competitive advantage of any firm depends on the quality of a firm’s products and services. Customer service plays a pivotal role in the development of quality and particularly if the company’s product is service. In banking, the competitive edge is almost exclusively derived from the quality of service.

Reichheld and Sasser (1990 as cited in Alhemoud, 2010) shows that “customer satisfaction is an evaluation by the customer after buying an industry’s goods and services”. Many industries along with banks are paying greater attention to customer service quality and customer satisfaction for reasons such as increased competition and deregulation. Figures of various surveys have shown that the costs of acquiring a new customer are more expensive than retaining accessible ones. Therefore customer satisfaction, customer relationships and service quality became a serious issue.

Therefore as a researcher, I would like to know how satisfied the ATM card holder of BRAC Bank? And what is the draw back and possible conclusion in future? This is what I have tried to find out in my research work.

Origin of the Report

This report is the upshot of three month internship at BRAC Bank, Gulshan Branch. According to the rule of BRAC University each student of BRAC Business School has to complete 4 credit internship program which will add grade to the final CGPA. As a part of the graduate course, I have got an opportunity to do internship at BRAC Bank Ltd. Later on my internship topic was selected by my supervisor Mr. Muhammad Intisar Alam, Lecturer, BRAC University and approved by Mr. Syeed M Parvez, BM, BRAC Bank Ltd.

Objectives of the report

General Objective

Measuring the satisfaction level of BRAC Bank ATM card holder

Specific Objective

Whether the customer is positive to BRAC Bank or not

ATM card quality and facility

Developing other alternatives to boost up customer satisfaction

Scope of Study

The advantage of doing this research work was –

- Implementation of theoretical knowledge to practical field

- This will give a brief idea about the satisfaction of ATM card holder

- This short research can be added to other research to get better out come

Methodology of the report

The research methodology has chosen according to research problem, design and questioners information. The research has done over 50 people in different location Dhaka city. Cluster of participant are given structured questioner and individual interview. Primary and secondary data both are used to conduct the research work.

Primary data: The raw data has gathered from individual interviews, discussion and structured questioner. The primary data has been processed with the software SPSS.

Secondary data: The information has also collected from indirect source and literature review to conduct the research. BRAC Research lab and library was the main source of information. A couple of relative case has also browsed in internet.

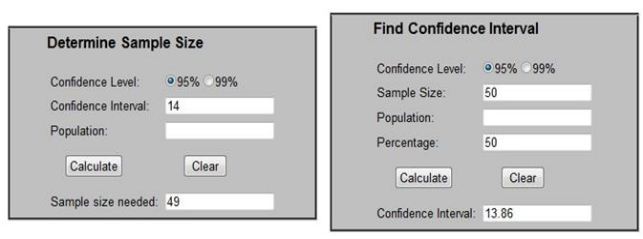

Sample Size Determination

Sample size is determined by automated software where confidence level has selected to 95%. It can be assumed that it is 95% certain that research outcome is correct. However the confidence interval is only 13.86 which measure the margin of errors.

Research Problem

Customer Satisfaction of BRAC Bank ATM Card Holder

Research Problem Analysis

ATM Card holder satisfaction = ƒ (ATM cad security & support, Bank charges, Use of ATM card) Here,

Dependent variable: ATM Card holder satisfaction

Independent Variable: ATM cad security & support, Bank charges, Use of ATM card

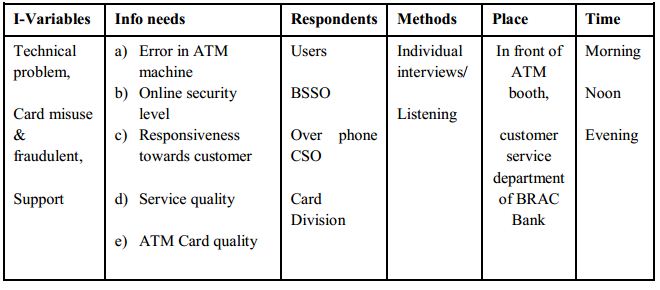

Research Design

ATM cad security & support

Based on the above research problem and frame work we have collected information from the relative respondents – users, BSSO, Over Phone CSO, CSM and Card division. The research has been conducted on 50 respondents of BRAC Bank, Gulshan Branch of Dhaka city. I have used both qualitative (descriptive, Individual interview, deductive) and quantitative method (Questionnaire)

Findings

After taking structured individual interview and discussion with 50 respondents of BRAC Bank, Gulshan Branch, it is found that 46% of their customer is doing transaction between 2 or 3 Years. It is only 18% customer who is doing transaction with BRAC Bank for last one year. However other than the geographical location 54% customer moved to another bank and 16% never move to another Bank. 19.04% customer moved to another bank due to slow customer

service and 9.52% customer think BRAC Bank customer service is poor. But 41.42% of the customer moved to another Bank for other reasons like – safety, higher FD interest rate and for other Business purposes. It is noted that an individual is doing transaction in more than one bank.

ATM cad security & support

According to the survey 14% of the customer of BRAC Bank is using ATM card for more than 5 years, 36% are using for 3 to 5 years, 14% for last two years and 18% is in last year. While using BRAC Bank ATM card 36% people faced technical problem for less than 10 times in a year and 12% faced technical problem between 10 to 20 times. According to the interview with 50 participant majority people has a doubt about ATM card quality. 20% people are agree that BRAC Bank ATM card has good quality where 44% is opposing. On the other hand in terms of

BSSO responsiveness, 52% people are agree on that BSSO response quick for any technical problem, ie. Online fraud, fake note from ATM machine and so on. Whereas 22% people are disagree about this. Similarly in terms excellent customer service, 14% are strongly agree and 42% agree, 34% disagree and 10 percent strongly disagree. According to research customer has identify some limitation of BRAC Bank ATM card, like – wait for a long time in queue, deposit in ATM machine took 48 hours to update.

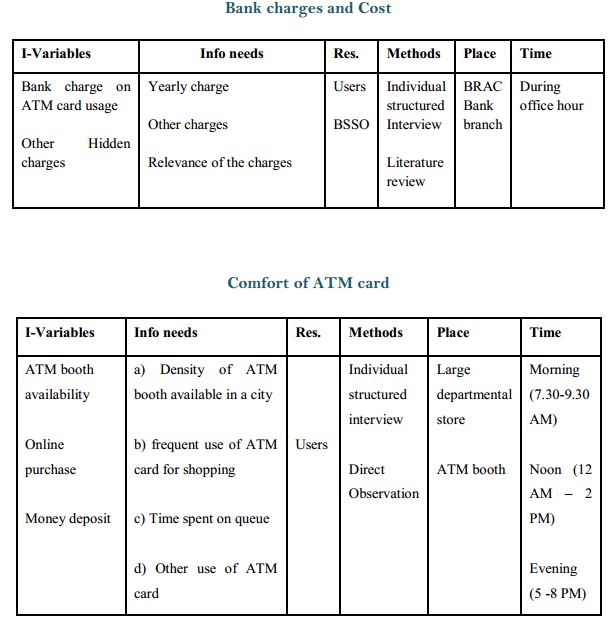

Bank charges and Cost

Around 32% people agree that BRAC Bank charges a competitive price for ATM card where 60% people disagree. On the other hand in terms of hidden charge (The charge which is not said or cleared by BSSO but written in terms and condition paper) 10% people strongly agree and 44% agree that they have not faced any hidden charges but again 30% people disagree on this issue.

Comfort and use of ATM card

Comfort of ATM card depends on flexibility, booth availability and wait in queue. Research found that 40% people have 10 to 20 min distance from his work place or residence to nearest ATM booth and 28% people have to cover 5 to 10 min distance. It is only 14% people who has to cover less than 5 min distance where as 18% people has nearest ATM booth for more than 20 min. distance. More over 68% of the customer has to wait in the queue for more than 5 min where as only 12% has to wait in queue for less than 5 min. It is also noted that while using BRAC Bank ATM card internationally there is a number of restriction. 18% customer of BRAC bank thinks they can‟t use this card abroad.

Interpretation of Data

BRAC Bank ATM cad satisfaction highly depends on ATM card security, Customer Service, Support, flexibility and lower bank charge. ATM card holder satisfaction also depends on the relationship between bank and the customer and other facilities. Most of the ATM card holder of BRAC Bank is satisfied with customer service and their responsiveness. Although in recent years they has experienced many online fraud, technical problem and fake note issue but BRAC Bank customer care was able to take control by solving the issue quickly. Besides the customer has experienced the weakness of BRAC Bank in poor ATM card quality, alarming internet security.

It can assume that the customer of BRAC Bank is there or thereabouts satisfied with the charge. There is no significant difference in ATM card cost in compare to other bank and customer are used to it.

Finally after analyzing the data it is found that the comfort and flexibility of BRAC Bank ATM card is significantly low. First of all the density of ATM booth is lower than needed. More over many people have to wait for a long time in a queue. Then it is also difficult to use ATM card abroad and online. At the same time most of the customer doesn‟t know the details use of ATM card in online. Finally although customer welcome to the facility of deposit money in ATM booth but still it took 48 hours to update. Although a number of issues made customer despondent, After all the facility and service they are having from BRAC Bank is worthy in cost and relatively better in compare to many other bank.

Recommendation

First of all BRAC Bank can develop online banking activities through expanding online shopping. As an example now BRAC Bank ATM card holder can do shopping online in Bangladesh. But the number of shop is only 11 which should be increased. More over it is often found that customer has a lots of wrong information about BRAC Bank internet banking and ATM card usage. Therefore BRAC Bank can launch a new campaign to establish internet banking where they can demonstrate the process of e-banking.

BRAC Bank should also give attention to on their employee specially those who are skilled and loyal, because BRAC Bank has the highest employee turnover rate. After all employee satisfaction ensures the customer satisfaction. Most importantly BRAC Bank must need to increase the number of ATM booth for its growing customer.

Finally but not least, it looks odd that customer of BRAC Bank is standing in a long queue for deposit or withdraw money for a long time with very poor air cooling system. At least BRAC Bank has enough economic strength to maintain Air cooling system, After all this gives a good impression to the customer.

Conclusion

Finally in conclusion it can say that the existing customer of BRAC Bank is more or less satisfied with BRAC Bank but there remain some wrong information among the customer which causes a little harassment. BRAC Bank is always taking new initiatives to improve the satisfaction of ATM card holders. As a result BRAC Bank is awarded as the fastest growing Bank in Asia in March, 11.

Questionnaire for Interview

PART 1: GENERAL CUSTOMER INFORMATION

1. Which of the following is your current bank?

A) Standard Chartered Bank

B) Eastern Bank

C) BRAC Bank

D) Other Bank

2. How long have you been a customer of BRAC Bank?

A) More than 5 years B) 3 – 5 years C) 1 – 2 years D) Less than 1 year.

3. In the past 5 years, other than for geographical relocation, how many times have you switched to a different bank?

A) Over 5 times B) 3 to 5 times C) 1 to 2 times D) Never switched

4. What was the main reason for switching Bank?

A) Poor Customer Service

B) Slow service

C) Other

BANK CUSTOMER SATISFACTION SURVEY

5. How long you are using BRAC Bank ATM Card?

A) More than 5 years B) 3 – 5 years C) 1 – 2 years D) Less than 1 year.

6. How many times you have faced technical problem in ATM Machine in a year?22 | P a g e

A) Over 40 times B) 20 to 40 times C) 10 to 20 times D) Less than 10 times

7. BRAC Bank ATM card lasts as long as it has expire dates.

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

8. BRAC Bank customer care response in fever of customer in terms of any technical problem?

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

9. BRAC Bank always offer an excellent customer service.

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

10. Is there any limitation of BRAC Bank ATM card?

11. BRAC Bank offers a competitive charge for ATM Card holders.

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

12. BRAC Bank never has any hidden charges.

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

13. How far you have to travel to reach the nearest ATM booth?

A) Less than 5 min B) 5 – 10 min C) 10 – 20 min D) More than 20 min

14. Shopping and cash withdrall, Deposit and e-payment is easier with BRAC Bank ATM card.

A) Strongly Agree B) Agree C) Disagree D) Strongly Disagree

15. Face any difficulty while using internationally?

16. How long you have to wait in a queue while using ATM booth.

A) Less than 5 Min B) 5 to 10 Min C) More than 10 Min

17. What are the things BRAC Bank can add up to increase ATM card holder‟s satisfaction?

![Internship Report on Customer Service of IFIC Bank [ Part-1 ]](https://assignmentpoint.com/wp-content/uploads/2013/04/ific-bank-limited-200x100.jpg)