Employee Job Satisfaction of Standard Bank

With the advent of the 21st century, globalization and association among the multinational and foreign companies are making their impact in the third world economies including that of Bangladesh. To address this ever increasing competition, Bangladesh financial institutions and other companies are working such a way in order to meet challenges both locally and as well as international markets.

Bank is an important and essential financial institution for the necessity of the use of money and protection of the money for the globalization and technological innovation, banking business has become competitive. To deal with this, bankers should have massive theoretical knowledge and proficient knowledge as well as technical basics.

Primary Objectives:

The primary objective of the study is to find out of employees Job satisfaction level in Standard Bank Branch at Principal Branch. It is most important to appraise the job satisfactory of these branch employees. The report will be prepared based on the information of employee‟s satisfaction against the job security, compensation and benefits from the organization, working atmosphere etc.

Secondary objectives:

The report helps to evaluate overall employees‟ job satisfaction in Of SBL of Hatirpul Branch. It identifies the relative importance of job satisfaction factors and the organizational benefits of SBL‟s employees. The report also gives a idea about working atmosphere at this branch Besides this to identify the interpersonal relationship between co-workers, the limitation of bank management to satisfy their employees is the objective of the report.

Methodology of the study

In general, Methodology is the efficient explanation of sequence of activates required. In this internship report, both the descriptive and exploratory method has been used. To get internship report elements and to implement the report I worked in some steps. Those steps are sampling methods, Questionnaire development, and data collection, data analysis.

Nature of the report:

Exploratory report. An exploratory research project is an attempt to lay the ground work that will lead to future studies, or to determine if what is being observed might be explained by a currently existing theory. Most often, exploratory research lays the initial ground work for future research.

Data Collection:

The questionnaire method has been used for data collection for the study. Information collected to deliver this report is both from primary and secondary sources.

Sample size: 10 people

Population size: 20 people

Primary Data:

The primary data are collected from several desk works in different departments of Standard Bank Ltd. I have done some face to face discussion with executive and officer from different division which is consider being another source of primary data. I also collected some interesting and important data through my observation during of my internship period. And my survey questionnaire was the best of the lot from other methods. It helps me to get specified data which is essential for my internship report.

Secondary Data:

The secondary data are collected from annual reports of the Standard Bank Ltd. the manual of export procedures of SBL is also another source of data. Procedure manual published by SBL, those kinds of sources can be considered as a secondary data. And data regarding the operations and analysis of financial statement were collected from secondary sources like annual report, Broachers and company website.

The Organization

Standard Bank Limited was incorporated as a public limited company on May 11, 1999 under the companies act, 1994 and the bank achieved satisfactory progress from its commercial operations on June 03, 1999. Until June 2013 SBL has 81 branches. In the year 2011, the bank registered an operating profit of 4% in comparison to the year 2010. The total assets of the bank have increased from taka 34210 million to taka 49001, resulting in a 43% annual increase.

The bank success in the import and export business area with a growth rate of 13.23% and 16.37% respectively in comparison to the year 2008.

SBL is also focusing on retail business and small and medium enterprise which was also recognized by Bangladesh bank as major driving factor in Bangladesh‟s economic development.

SBL has introduced several attractive products and services and extended loans and credits to different sectors if the economy. Besides, the bank has already introduced real time online banking. Through all this activities SBL has created a positive impact in the market.

Capital and capital adequacy ratio

Bank‟s authorized capital was enhanced from tk. 880 core to tk. 1500 core on November 2011. The paid up capital stood at tk. 487.36 core in 1012.

The Bank has earned an operating profit of TK. 1331 million during the year 2012 compared to Tk. 1297 million during year211, showing an increase of 19%. The Bank has earned substantial amount of profit during the last year compared to preceding year. The progress was possible due to the pragmatic and right direction of our board of directors as well as active support and co-operation of valued client‟s and shareholders.

Deposits

The deposit base of bank continues to register steady growth bad stood at tk. 76089 million as on December 31st 2012 as against tk. 63871 million as on December 31, 2011. It is an increase of 11%. The bank has by this time achieved a stable and sizable deposit base and has managed its deposit and inevitable fund efficiently for the purpose of both liquidity and profitability. In addition to the normal deposit schemes to bring un-tap resources to banking channel for benefit of the people.

Loans and Advances

Total loan and advances figure rose up to Tk. 61380 million as on December 31st 2012 in comparison to Tk. 55346.84 million as on December 31st , 2011 which indicates an increase by 37%.

In the past years bank has concentrated to explore new and diversified avenues for investment with the objective of developing and maintaining a sound portfolio ensuring profitability and risk mitigation. In recent time bank has given emphasis on service sector like telecommunication and agriculture sector and allocated fund towards contributing into poverty alleviation and post SIDR economic rehabilitation. Bank‟s combined and continuous effort has resulted in a very negligible percentage of classified loans at the end of December 31st, 2012.

Retail Banking

Standard bank limited has established a retail banking division with launching of consumer financing and small enterprise financing in 2006 aiming to explore the rapidly increasing opportunities in the fast expanding SME sector.

Government on Bangladesh have attached due important in SME sector development, acknowledging the importance and implications of SME‟s in economic development. The government and its related agencies have already undertaken various initiatives to support the growth of SME sector. They are, therefore, encouraging financial institutions to find ways and means to make loans available to SME‟s.

To realize the present market needs and to have a better understanding of the local SME market, we have organized practical and comprehensive guidelines in accordance with credit norms. We anticipate that if designing a marketing program with probability and safe lending can be undertaken in this sector the impact of profitability will be reflected if post disbursement monitoring and portfolio management be effective.

Investment

The investment has always and inverse relationship with capital adequacy ratio although it contributes to the desired bottom figure. The size of the investment portfolio in the year 2012 rose at Tk. 1443.02 million including government Treasury bill and the other security bonds against Tk. 739.85 million in the year 2011 showing and increase of 95.04%.

International Trade

Foreign exchange operation of the bank played a significant role in the overall business of the bank. During the year of 2012, the bank has contributed in the country‟s national economy after successfully handing of foreign exchange with a 30.63% higher than the previous year.

International Banking Division

The objective of SBL is to increase its foreign exchange business and for that end in view we are concentrating our efforts to establish relationship with all major banks of the world. The bank‟s correspondent business expanded using the year with 643 correspondents across the world enabling for cross border trade and payment business. We are at present maintaining 21 Nostro A/C in different currencies. Out of which we have 5 USD Nostro A/C in the USA, 2 GBP Bostro A/C in the U.K., 2 Euro Nostro A/C in Germany, 1 JPY Nostro A/C in Japan, 1 AUD Nostro A/C in Australia, 5ACUD Nostro A/C in India. 2 ACUD Nostro A/C in Pakistan, 1 ACUD Nostro A/C in Nepal and 1 ACUD A/C in Bhutan.

Exchange House: Standard Bank Limited has drawing arrangements with three exchange houses in U.K., USA and UAE for inward foreign currency remittance. This has provided opportunity for the Bangladeshi‟s in U.K., USA, Canada and UAE to remit their foreign remittance to their families here in though banking channel of our bank. These Exchange houses are remitting funds through our bank.

Moreover we are scheduled to sign drawing arrangement with money gram payment system, INC, USA by June 2008. The operation will start within a month and we are expecting to receive a handsome amount of foreign remittance on regular basis. Drawing arrangement with 5 reputed exchange houses of the world will be established very soon.

Treasury

SBL treasury is a core-banking unit and it is one of the best warning sources of the bank. The bank is well equipped with skilled human resources for efficient dealing. Our every business revolves around participation in foreign exchange market and local money market in a substantial volume. During the year 2012 total income from treasury of the bank is Tk. 118.59 crore.

Risk Management

Commercial operation in bank is very much inherent to risks especially credit risk is inevitable to be managed to reduce the possibility of loss and maximize the profit. In recent time various types of tools have been evolved by Bangladesh bank like credit risk regarding, GAP analysis to deal with the liquidity risk, Foreign exchange risk and Interest rate risk etc. the bank is arranging training on the aforementioned issues and en-lighting its human resources with the objectives to enabling the bank to proactively manage loan portfolio in order to minimize losses and earn an acceptable level of return on Investment.

The management is striving effort to proper securitization of all proposals in accordance with the prudential guidelines provided by Bangladesh Bank for bringing harmony in banking operation and to protect interest of the bank. The management stressed the need for maintaining good asset quality and strengthening monitoring and follow-up. The bank management is very much careful regarding 6 (SIX) core risk guidelines of Bangladesh Bank. Asset- Liability of the bank is managed effectively through ALCO (Asset Liability Management Committee) to address Liquidity Risk, Profit rate risk, operational risk and other risks like risks related to balance sheet.

Department overview:

1.branch banking

2.corporate banking

3.SME

4.marchant banking

5.remittance service

6.islami banking

Findings and analysis

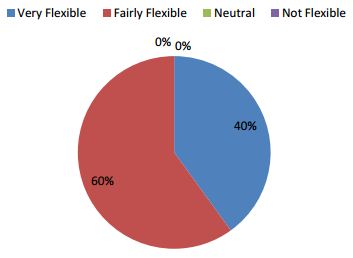

Flexibility to the degree of family responsibilities

The above illustration that 10 respondent constituting hundred percent (100%) of the employee is satisfied with the flexibility with respect to their family responsibilities. The main reason is the manager as well as 2nd manager and all employees are very much co-operative to each other. Employees can take leave or can leave the office earlier in any family emergency. There is no issue regarding this matters. As a result 100% employees are satisfied with respect to their family responsibilities.

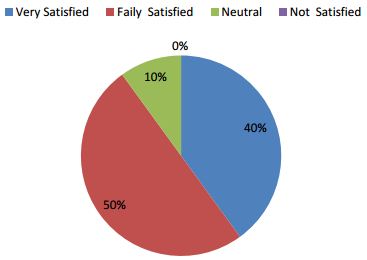

Pay Structure and Promotions

The above illustration resulted in this way because the difference in the Pay division among the Hierarchy is fair enough. Which is why from the 10 respondent constituting fifty percent of the employees are fairly satisfied forty percent are very satisfied and ten percent are neutral with the pay structure and promotions. None of them are dissatisfied.

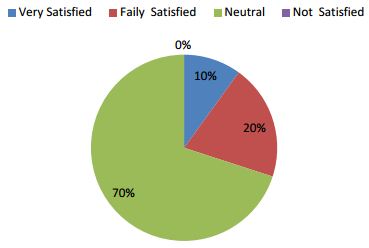

Management looks to the employs for suggestion and leadership

Some interesting response came from this illustration. The above illustration from the figure shows that 10 respondent constituting fifty percent of the employees are strongly satisfied, thirty percent are fairly satisfied with the Managers behavior. Here twenty percent were dissatisfied because they think that senior level staffs overlook to take their views in real life and their active participation in any project is not recognized as well in SBL branch in Hatirpul branch.

Recommendation

Based on the results from the study and conclusions drawn from it, the following recommendations are spelt out:

As the lower level employees are not included in the decision making process, they might not feel important to this bank. Their involvement in the decision making process will motivate them and will make them feel more challenged with what they are doing. From this they will also learn more about the bank. On the contrary some might think it is too soon to involve new employees in this decision making process but just attending in this kind of meeting will make them more motivated.

From this research that took place, it is recommended that the Standard Bank should improve the working environment by providing a lounge, different prayer room for male and female, coffee maker, etc as most of the employees are not satisfied with it.

Every bank has certain rules and procedure to operate which is followed by the employees. Although some of the customers can alter the procedure under the influence of the higher officer. Some employees are skeptical with this alter in the procedure. As this practice sometimes effects negatively to the employees, the management should change this practice for the better of both employees and banks reputation.

The bank should also provide more tools and resources as it is a busy place. Employees can rush through many works in hand but the deficiency of printer, wifi, telephone, etc slows their works. So, by providing adequate tools and resources this bank can improve the speed of the employees work and thus the employees will have more satisfaction with their provided tools and resources.

Due to the generally inadequate image the bank has, it needs to embark on an intensive awareness programs such as event sponsorship, which is also a good public relations tool. Through this the bank will become more involved with the public. This will enhance the Bank‟s reputation and also intensify employee‟s attachment toward this Bank.

For every organization good and friendly relation between co-workers is a needed. But here in this branch relationship need to change a little. There need to bring a little formal relation which is support the office environment more effectively.

Conclusion

From the abovementioned report it can be apprehended that Standard Bank is one of the leading banks with its developed reputation among the users. As a the branch has to deal with commercial and noncommercial clients. Therefore, the branch has all level of employees of the bank. Since my internship program was directed to understand the level of job satisfaction, I had to gain the practical area of responsibilities and of accountabilities of the employee so that I could interact with them to assess their views about and relations with the organization. I tried best to ask the staffs directly and indirectly to gather my information. However, I had a good access to the bank‟s publications. My task was designed to understand the level of job satisfaction of the employee of the Standard Bank Ltd. Hatirpul Branch. For preparing this report I used primary and secondary data. The objectives of the report were understood level of job satisfaction of the employees of the Standard Bank Ltd, Hatirpul Branch. So, the research was designed to achieve it. The previous studies on this issue practically and empirically learnt that job satisfaction largely depends on the number of interrelated components such as workplace, salary, training, lack of gender discrimination, neutral promotion policies. Despite differences in opinions made by the employees of the organization on what the study was conducted, what the study finds is that they are highly satisfied in their job.