Porter’s Theory of Value Chain

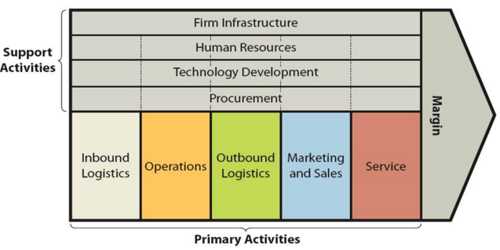

To better understand the activities through which a firm develops a competitive advantage and creates shareholder value, it is useful to separate the business system into a series of value-generating activities referred to as the value chain. In his 1985 book Competitive Advantage, Michael Porter introduced a generic value chain model that comprises a sequence of activities found to be common to a wide range of firms. Porter identified primary and support activities as shown in the following diagram:

Fig: Porter’s Generic Value Chain

The goal of these activities is to offer the customer a level of value that exceeds the cost of the activities, thereby resulting in a profit margin.

The primary value chain activities are:

- Inbound Logistics: the receiving and warehousing of raw materials, and their distribution to manufacturing, as they are required.

- Operations: the processes of transforming inputs into finished products and services.

- Outbound Logistics: the warehousing and distribution of finished goods.

- Marketing & Sales: the identification of customer needs and the generation of sales.

- Service: the support of customers after the products and services are sold to them.

These primary activities are supported by:

- The infrastructure of the firm: organizational structure, control systems, company culture, etc.

- Human resource management: employee recruiting, hiring, training, development, and compensation.

- Technology development: technologies to support value-creating activities.

- Procurement: purchasing inputs such as materials, supplies, and equipment.

The firm’s margin or profit then depends on its effectiveness in performing these activities efficiently, so that the amount that the customer is willing to pay for the products exceeds the cost of the activities in the value chain. It is in these activities that a firm has the opportunity to generate superior value. A competitive advantage may be achieved by reconfiguring the value chain to provide lower cost or better differentiation.

The value chain model is a useful analysis tool for defining a firm’s core competencies and the activities in which it can pursue a competitive advantage as follows:

- Cost advantage: by better understanding costs and squeezing them out of the value-adding activities.

- Differentiation: by focusing on those activities associated with core competencies and capabilities in order to perform them better than do competitors.

Cost Advantage and the Value Chain

A firm may create a cost advantage either by reducing the cost of individual value chain activities or by reconfiguring the value chain.

Once the value chain is defined, a cost analysis can be performed by assigning costs to the value chain activities. The costs obtained from the accounting report may need to be modified in order to allocate them properly to the value-creating activities.

Porter identified 10 cost drivers related to value chain activities:

- Economies of scale

- Learning

- Capacity utilization

- Linkages among activities

- Interrelationships among business units

- Degree of vertical integration

- Timing of market entry

- Firm’s policy of cost or differentiation

- Geographic location

- Institutional factors (regulation, union activity, taxes, etc.)

A firm develops a cost advantage by controlling these drivers better than do the competitors.

A cost advantage also can be pursued by reconfiguring the value chain. Reconfiguration means structural changes such a new production process, new distribution channels, or a different sales approach. For example, FedEx structurally redefined express freight service by acquiring its own planes and implementing a hub and spoke system

Differentiation and the Value Chain

A differentiation advantage can arise from any part of the value chain. For example, procurement of inputs that are unique and not widely available to competitors can create differentiation, as can distribution channels that offer high service levels.

Differentiation stems from uniqueness. A differentiation advantage may be achieved either by changing individual value chain activities to increase uniqueness in the final product or by reconfiguring the value chain.

Many of these also serve as cost drivers. Differentiation often results in greater costs, resulting in tradeoffs between cost and differentiation.

There are several ways in which a firm can reconfigure its value chain in order to create uniqueness. It can forward integrate in order to perform functions that once were performed by its customers. It can backward integrate in order to have more control over its inputs. It may implement new process technologies or utilize new distribution channels. Ultimately, the firm may need to be creative in order to develop a novel value chain configuration that increases product differentiation.

Technology and the Value Chain

Because technology is employed to some degree in every value creating activity, changes in technology can impact competitive advantage by incrementally changing the activities themselves or by making possible new configurations of the value chain.

Linkages between Value Chain Activities

Value chain activities are not isolated from one another. Rather, one value chain activity often affects the cost or performance of other ones. Linkages may exist between primary activities and also between primary and support activities.

Consider the case in which the design of a product is changed in order to reduce manufacturing costs. Suppose that inadvertently the new product design results in increased service costs; the cost reduction could be less than anticipated and even worse, there could be a net cost increase.

Sometimes, however, the firm may be able to reduce cost in one activity and consequently enjoy a cost reduction in another, such as when a design change simultaneously reduces manufacturing costs and improves reliability so that the service costs also are reduced. Through such improvements, the firm has the potential to develop a competitive advantage.