EXECUTIVE SUMMERY

This report is a pre-requisite of completion of the MBA Program. I conducted my internship program with the duration of 3months in Trust Bank Ltd, Mirpur Branch. In this phase of my education I received the practical knowledge related with my education. I achieved a commendable knowledge on general banking, particularly on the consumer banking. The report emphasize on the “Customer Satisfaction of Trust Bank Limited” highlights products and services offered by the bank to its customers, ranges of these services, their different features, quality of service. Trust Bank tries to introduce international standard products and services to attract the customers. And upgrade their satisfaction level. According to my observation and understanding, it is very difficult on my part to introduce the customer satisfaction procedure in our country in this short period of time. The TBL is trying to do so with their prescheduled programs and procedures to attract wide range of customers by providing them quality services in terms of their personal satisfaction and needs. They have various offers and programs to their customers with attractive packages. although they are doing a good job but according to my perception they need to focus more on the overall management system and consumer behavior which should be much cooperative with the main branches as well as with other branches for a smooth flow of work. I express my observation and personal experience towards the bank. I made necessary recommendations to be adjusted to maintain the organizations journey to the excellence according to my viewpoint. To summarize the whole situation, I would like to say that, this organization is trying their best and putting a lot of efforts to standardize the banking system in our country. And as per my understanding, this bank will definitely progress with the modernization of business environment.

In short, this report Mainly focuses on how to satisfy the customers by providing them various services and benefits from this bank and to upgrade their satisfaction level by providing better services and qualities in comparison to other banks. This reports also deals with customer needs and wants in terms of their personal views.

1.1 Introduction

Achievement of high economic growth is the basic principles of present economic policy. In achieving the objectives, the banking sector plays an important role. The banking sectors channel resources through deposit mobilization and providing credit for different business venture. The successful running of a bank business depends upon how effectively the credit management recovered the funds. Trust Bank Limited as new commercial banks in Bangladesh responsibility best upon it to ensure efficient and effective banking operation in a sound manner.

Trust Bank Limited is always ready to maintain the highest quality services by upgrading Banking technology prudence in manage and applying high standard of business ethics through its established commitment and heritage. Objectives of a private institution like TBL are to maximize profit through optimum utilization of resources by providing best customer’s service.

1.2 Objective of the report

1.2.1 General objective

- To gain practical job experiences and view the application of theoretical knowledge in the real life.

- To present an over view of Trust Bank Limited.

- To know Trust Bank’s customers’ different queries and query frequencies regarding deposit , loans and other facilities..

- To apprise major activities of Trust Bank Ltd

- To know Trust Bank’s customers view on bank’s current operation quality and standards.

- To identify problems of Trust Bank Ltd in handling customer.

- To suggest ways of improving the service standard that accommodates a rapidly growing customer volume.

1.2.2 Project objective

1.3 Scope of the report

As I was working in the Trust Bank, Mirpur Branch, I got the opportunity to learn different part of banking system. The supervisor divided the whole banking system in five parts, as a result I got the opportunity to work in all the five divisions (Account opening, Foreign remittance, FCAD, Credit Division& Cash Counter). My main concern was to identify the customer satisfaction level of overall general banking. From the survey I had the opportunity to gather information about-

a) Who and why people look for CCS?

b) The customers who mainly look for this scheme, their income level, occupation,

age group, habitants etc.

c) What are the benefits those customers look in CCS?

d) Habit and life style of the customer who takes the loan.

1.4 Methodology of the study

Although there were so many limitations, it was tried to use both the primary and secondary sources of collecting information to make the report presentable with as less abstraction as possible.

Sources of Information:

A. Secondary data

Data that were published before for some other reason can be collected using internal and external sources.

i) Internal Secondary data: To furnish the report properly some papers has been collected form the officials of Trust Bank Limited. Information from annual reports, journals, newspapers and other published documents have been used. Besides other published information about the organization, depth interview of the branch manager and Sub- manager have also taken. The information mainly about CCS was taken from the authorized officer who deals with this scheme.

ii) External Secondary Data: For better interpretation some data has been collected from Bangladesh Bank. Internet Browsing is also one source of external Secondary data.

B. Primary data

Primary data is always collected from the respondent. For this project personal Interview with the customer has been conducted. When it became impossible to conduct face to face interview I collected the primary data by using the Telephone Interview and also face to face.

1.5 Measurement Techniques

For collecting the information two types of measurement techniques have been used-

- A. Questionnaire: to make the report unquestionable or fair I conducted a questionnaire survey among 40 respondents.

- B. Observation: The direct examinations of behavior, the result of behavior, or psychological changes have been conducted.

1.6 Limitations

- Lack of comprehension of the respondents was the major problem that created many confusions regarding verification of conceptual question.

- Limitation of time was one of the most important factors that shortened the present study. Due to time limitation many aspects could not discussed in the present study.

- Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own secrecy that in not revealed to others. While collecting data on Trust Bank, personnel did not disclose enough information for the sake of confidentiality of the organization.

- Rush hours and business was another reason that acts as an obstacle while gathering data.

- The findings of the survey are based on customers’ response in Trust Bank credit card services located in Dhaka City only. The results may not reflect the same for other branches of Trust Bank outside Dhaka.

- Limitation of the Personal knowledge is another one. Since knowledge knows know bound, so this report is incapable to present all things with more depth.

Part-2

2.1 Historical Background

Trust Bank Ltd. (TBL) is a Private Commercial Bank that started its operation 10 years ago. They gained success from the very beginning of their operation and were capable enough to hold the success year after year. It gained success very early because of its very strong financial backup of the Army Welfare Trust. This bank is very much popular within the army community because all the financial activities of the army done by this bank. In recent days TBL is also gaining popularity in the general people and also in the business community.

TBL is the scheduled commercial bank, which conducts its operation as per the rules and regulations of Bangladesh Bank. The bank obtained license from Bangladesh bank on 15th July, 1999 and started its operation from November, 1999. The Army Welfare Trust (AWT) is the main sponsor of the Bank, and it has already floated public shares in the capital market for its conversion into a public limited company. The Board is headed by the chief of army staff, Bangladesh Army as Chairman. Besides, there are eight other in-service senior army officers of Army Head Quarters acting as the members of the Board. The Managing Director is also the member of the Board. In the year 2007 its Authorized Capital was Tk.200.00 Crore and Paid-up Capital was Tk. 116.67 crore only. At present the bank has 39 branches across the country and has plans to open more branches very soon. TBL aims at optimizing profit with a view to allowing good returns on the investor’s money. Within nine years of its operations the Bank has strengthened its capital base by increasing reserve and retained earnings.

The Bank’s work force is composed of personnel having rich academic background with vast experience in banking. The Human Resources Division (HRD) means to create an environment by dynamic, enthusiastic and vigorous participation of all individuals. To make their personnel knowledgeable and truly professional they arrange training for them at Head office TrainingAcademy of the Bank, BIBM and other institutions.

The present image of the TBL is very important to the management and to its owners for their awareness in taking various decisions regarding the future action plans for its growth. The Management of the Bank are always change oriented as is evidenced by introduction of Trust Islamic Banking and ATM Cards. Since majority of the clients are religious minded and absence of Islamic banking system compel them to do traditional banking, therefore the very recent introduction of Islamic banking system has enhanced the image of the bank and at the same time can attract the new clients and will increase the customer volume which is important for bank’s profitability. With respect to ATM Cards and other technology-enabled services like Phone, Internet and SMS Banking services, TBL has been able to cater the banking requirement of today’s digital people where speed and accuracy are the important deciding factors. These have tremendous impact on the image and also on the profitability.

2.2 PHILOSOPHY OF THE TBL

At present the bank has as many as 39 branches across the country and it is committed tobecome equal service providers compatible with the norms of commercial schedule bank.It renders all types of personal, commercial and corporate banking services to its customers within the preview of the Bank Companies Act, 1999 and in line with the directives and policy guidelines laid down by Bangladesh bank. The main philosophy of the Trust Bank is – “Serves with Trust.”

2.3 Objective of TBL.

The Trust Bank Limited has been established with the objective of providing efficient and innovative banking services to the people of all sections of our society. One of the notable strengths of this bank is that it is backed by the disciplined and strongest Institution of Bangladesh i.e. Bangladesh Army and there is a synergy of welfare and profits in the dynamics of this institution.

The objectives for which the bank is established are as follows:

i) To carry on, transact, undertake and conduct the business of banking in all branches.

ii) To receive, borrow or to raise money on deposit, loan or otherwise upon such terms as the company may approve.

iii) To carry on the business of discounting and dealing in exchange of specie and securities and all kinds of mercantile banking.

iv) To provide for safe-deposit vaults and the safe custody of valuables of all kinds.

v) To carry on business as financiers, promoters, capitalists, financial and monitory agents, concessionaires and brokers.

vi) To act as agents for sale and purchase of any stock, shares or securities or for any other momentary or mercantile transaction.

vii) To ensure customized Qualitative and hassle free services in our banking operations along with the focus to Broaden the clientele base.

viii) To committed to contribute possible within its limitations for the economic growth and for ensuring value of its available resources.

2.4 Operations of TBL.

TRUST BANK’S VALUE

Trustworthy.

Dependable.

Reliable.

Professional.

Dynamic.

Fair.

The importance of the mobilization of savings for the economic development of our country can hardly be over emphasized. The bank considers savings and deposits as lifeblood of the bank. More the deposit greater is the strength of the Bank. So they intend to launch various new savings schemes with prospect of higher return duly supported by a well orchestrated system of customer services. Technologies such as computer, ATM, Tele‑communication etc all would be harmonized and adapted to the system in order to provide round-the-clock and any branch services to the clients. Travelers’ cheque credits cards and other ancillary services including payment of different bills from one counter will also be introduced to achieve the ultimate goal of ONE‑STOP service to the valued customers.

2.5 Vision & Mission Statement

The Trust Bank aim to provide financial services to meet customer expectations so that customers feel that they are always there when they need Banking service, and can refer them to their friends with confidence. They want to be a preferred bank of choice with a distinctive identity.

So we may able to highlight them as follows-

- To become a preferred bank of choice with a distinctive identity.

- To provide financial services to meet customer expectations so that customers feel TBL is always there when they need, and can refer to their friends with confidence.

- To build a sustainable and respectable financial institution.

- To be a leading Commercial Bank, with a social focus, assisting in the economic development of the country.

- A Bank with difference. Profit used for the Socio-economic development of the members of the Bangladesh Army and thereby the nation as a whole.

The mission of the Trust Bank is as follows-

- To make banking easy for customers by implementing one-stop service concept and provide innovative and attractive products & services through technology and qualified human resources.

- To look out to the local community through supporting entrepreneurship, social responsibility and economic development of the country.

- Achieving sound and profitable growth in Assets & Liabilities, with focus to maintain non-performing assets at acceptable levels.

- To build long-lasting, credible and mutually dependable relationships with customers.

- Efficiently managing interest and operating costs.

- To be the preferred employer among Banks in Bangladesh.

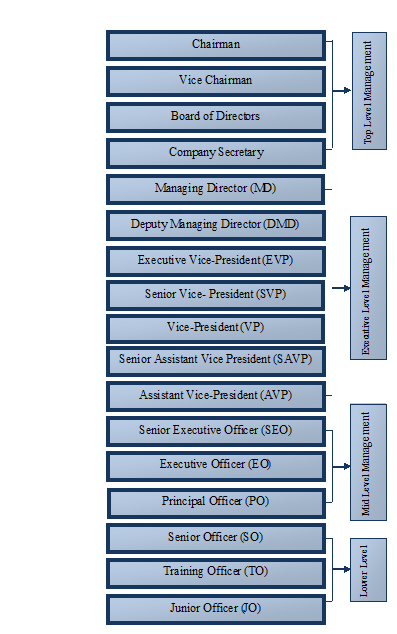

2.4 Management Hierarchy

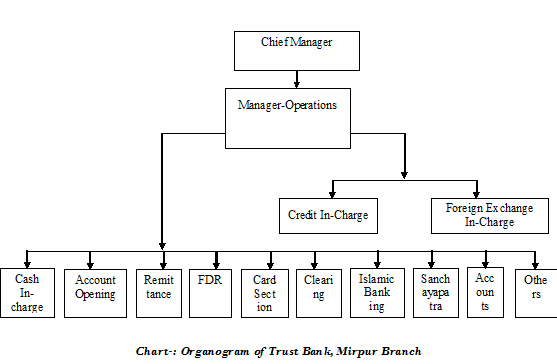

2.5 Trust Bank Limited (Mirpur Branch) Hierarchy

Mirpur branch is located at Mirpur 11, Pallabi, Dhaka. It is the 28th branch of Trust Bank and started its banking operation in the year 2007.

2.6 Activities of Trust Bank Limited

Bank activities can be divided into three categories. These are as follow:-

- General Banking activities.

- Credit or Loan advance activities

- Foreign Exchange activities

General Banking Activities:

- To maintain types of deposit account

- To operate cash transaction

- To operate clearing house activities

- To collect &discounts bill and check

- To maintains safety deposit lockers

- To operate customers standing instructions

Credit & Loan Advance Activities:

- Provides various types of loans in various sectors

Foreign Exchange Activities:

- Trust Bank open letter of credit for imports industrial and commercial goods and equipment’s against commission.

- Trust Bank participates in export business and earns commission and service charges.

2.6.1 General Banking

A bank starts its function providing service to the customers by its general banking activity. The efficiency of the general banking activity that provided by each branch reflects the whole service given by that bank. With the increasing competition customers are mostly impressed by the efficiency of this department. The whole general banking activity is consisted of receiving deposit, remitting fund and meeting the different need of the customers. It is one of the busiest departments. TBL Mirpur Branch has the full-fledged set up for general banking facilities.

In fact, a bank operates with the people’s money. And this process starts with the ‘General Banking Department’. The activity of the General Banking Department of PBL, Elephant Road Branch is mainly divided into categories:

- Account Opening Section

- Savings Schemes And Sanchaypatra Section

- Local Remittance Section

- Clearing and Collection Section

- Cash Section

Account Opening

The relationship between banker and customer begins with the opening of an account by the customer. Opening of an account binds the Banker and customer into contractual relationship under the legal framework of the “Contract Act–1872”. But selection of customer for opening an account is very crucial for a Bank. In fact, fraud and forgery of all kinds start by opening account. So, the Trust Bank Ltd. takes highest caution in this regard.

Trust Bank Ltd. opens the following accounts for its customers:

► Savings Accounts

► Current Accounts

► Fixed Deposit Receipt (FDR) Accounts

► Short Term Deposit (STD) Accounts

► Term Deposit Accounts.

Transfer of an Account

► When an account is transferred from one branch to another, the account opening form etc. signed at the time of opening account and any forms or documents signed subsequently which are necessary for its proper conduct at the time of transfer, must be forwarded under cover of form, to the branch to which the account is transferred. Specimen signature card and standing instruction if any must also be transferred. No charge is taken on such transfer.

► The necessary information regarding the character, means and standing of the account holder and must be given to the receiving branch.

Closing of an Account

A banker can close the account of his/her customer. The stoppage of the operation of the Account can be under following circumstances :

► Notice given by the customer himself.

► Death of customer.

► Customer’s insanity and insolvency.

► Order of the court / Injunction of the court.

► Garnishee Order.

An application to close the account from customer Is received. Signature must be verified by the respective officer. The following activities are the part and parcel of account closing:

► Draw amount form the A/C keeping Tk. 500 for saving and Tk. 900 for current A/C as closing charge.

► Cheque book or outstanding cheque leaf (if any) is destroyed.

Remittance

Cash handling from one place to another is risky. So, bank remits funds on behalf of the customers to save them from any mishaps through the network of their branches. There are four modes of remitting money from one place to another. These are–

► Pay Order (PO)

► Demand Draft (DD)

Pay Order (PO)

Process of Issuing Pay-order

○ Customer is supplied with PO form.

○ After filling the form the customer pays the money in cash or by cheque.

○ The concerned officer than issues PO on its specific block.

○ The officer then writes down the number of the PO block on the PO form.

○ Two authorized officers sign the block.

○ At the end customer is provided with the two parts of the block after signing on the black of the Bank’s part.

Demand Draft:

Demand Draft is purchased when one person wants to pay money somebody who is living out of this area and bearing an account with another branch in this bank. For instance, a person is living in Dhaka. He wants to give some money another person of Chittagang who is bearing an account with the TBL. at Chittagang. But he does not want to pay in cash. In this case he may purchase a DD (A/C payee only) in favor of him.

2.6.2 Credit Department

One of the two primary functions of a commercial bank is to extend credit to the deficit economic unit that comprises borrowers of all types. Bank credit is a catalyst of economic development. Without adequate finance, there can be no growth in the economy. Bank lending is important for the economy in the sense that it can simultaneously finance all of the sub-sectors of financial arena, which comprises agricultural, commercial and industrial activities of a nation. Therefore, a bank is supposed to distribute its loan able fund among economic agent-in-deficit in a manner that it will generate sufficient income for it and at the same time benefit the borrower to overcome his/her deficit.

The granting of credit is one of the most important functions of a bank and the test of bank strength depends considerably on the quality of its credit and proportion they bear to the total deposit. Although receive from exchange, commission and banks charges contribute a fair amount of the profits or commercial bank, its earnings are chiefly derived from interest charged on loans and discounts.

Traditionally banks have been following three cardinal principles of lending they are:

- i. safety

- ii. liquidity and

- iii. Profitability.

Credit may be made either of the personal security of the borrower or on the security of some tangible assets. The former is called unsecured or clean or personal credit and the latter is called secured credit. Confidence in the borrower is the basis of unsecured credit. The confidence is judged by three considerations: character, capacity and capital. Secured credit means loans and made on the security of tangible assets like land, building, machinery, goods and documents of title goods. Such loans provide absolute safety to a banker by creation of charge on the assets in favor of him.

MODE OF CHARGING SECURITIES:

The important methods of charging a security are the following:

- i. LIEN

Lien is the right of a creditor to retain the properties belonging to the debtor until the debt due to him is repaid. Lien gives a person only a right to retain the possession of the goods and not the power to sell the goods. A banker’s lien is a general lien which tantamount to an implied pledge.

- PLEDGE

The usual method of obtaining a title to goods offered as security is by way of pledge. Under section 172 of Contract Act 1872, pledge is defined as ‘a bailment of goods as security of payment of a debt or performance of a promise’ that is in case of pledge the possession of the goods‑ is delivered to the creditor i.e. the banker. It is therefore, regarded as the most secured type of advance.

- MORTGAGE

A mortgage is a method of creating charge on immovable properties like land and building. Section 58 of the Transfer of Property Act 1882, defines a mortgage as ‘the transfer of an interest in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by way of loan, an existing or future debt, or the performance of an engagement which may give rise to pecuniary liability’. A mortgage can be affected only on immovable property.

- iv. HYPOTHECATION

The mortgage of movable property for securing loan is called Hypothecation. In other words, in case of hypothecation, a charge over movable properties like goods, raw materials, and goods in progress is created. Hypothecation is only an extended idea of a pledge, the creditor permitting the debtor to retain the possession either on behalf of or in a trust for him.

- v. SET OFF:

Set-off means the total or partial merging of a claim of one person against another in a counter claim by the latter against the former. It is in fact the combining of accounts between a debtor and a creditor so as to arrive at the net balance payable to one or the other. It is a right that accrues to the banker as result of the banker-customer relationship.

CREDIT IN TRUST BANK LTD:

TBL Offers the following types of credit:

- Funded Facilities:

Funded facilities can also be divided into the following categories:

1. Term Loans:

The term of loan is determined on the basis of gestation period of a project generation of income by the use of the loan. Such loans are provided for Farm Machinery, Dairy, Poultry, etc. It is categorized in three segments:

| Types of Term Loan | Time (Period) |

| Short Term | 1 to 3 years |

| Medium Term | 3 to 5 tears |

| Long Term | Above 5 years |

2. Over Draft (OD):

OD is some kind of advance. In this case, the customer can over draw from his/her current account. There is a limit of overdraw, which is set by the bank. A customer can with draw that much amount of money from their account. For this there is a interest charge on the over draw amount. This facility does not provide for every one, the bank will provide only those who will fulfill the requirement. It means that only real customer can get this kind of facility.

3. Cash Credit (Hypo):

It allows to individuals or firm for trading as well as whole-sale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is a continuous credit. It allowed under two categories:

- Commercial Lending

- Working Capital

4. Cash Credit (Pledge):

Financial accommodation to individual/firm for trading as well as whole sale purpose or to industries as working capital against pledge of goods primary security falls under this head of advance. It also a continuous credit and like the above allowed under the categories:

- Commercial Lending.

- Working Capital.

5. SOD (General):

Advance allowed to individual/firm against financial obligation (i.e. lien of FDR/PS/BSP etc.) and against assignment of work order for execution of contract works fall under this head. This advance is generally allowed for allowed for definite period and specific purpose. It is not a continuous credit.

6. SOD (Imports):

Advances allowed for purchasing foreign currency for opening L/C for imports of goods fall under this type of leading. This is also an advance for a temporary period, which is known as preemptor finance and falls under the category ‘Commercial Lending’.

7. PAD:

Payment made by the bank against lodgment of shipping documents of goods imported through L/C falls under this type head. It is an interim type of advance connected with import and is generally liquidated shortly against payments usually made by the party for retirements of documents for release of import goods from the customer authority. It falls under the category ‘ Commercial Lending’.

8. LTR:

Advances allowed for retirement of shipping documents and release of goods imported through L/C without effective control over the goods delivered to the customer fall under this head. The goods are handed over the importer under trust with arrangement that sales proceed should be deposited to liquidate the advances within a given period. This is also temporary advance connected with import that is known post-import finance under category ‘Commercial lending’.

9. IBP:

Payment made through purchase of inlands bill to meet urgent requirements of customer fall under this type of credit facility. This temporary advance is adjusted from the proceeds of bills purchased for collection. It falls under the category ‘Commercial Lending’.

10. Bank Guarantee:

The exporters pay of the imported goods on behalf of the importer through bank guarantee. If the exporter fails to make the fulfill payment at the moment the bank will take the liability and pay to the exporter. This type of guarantee is also needed to attend in any tender.

11. Micro Credit:

Loan has given only to the Army Person for the purpose of Repairing and Reconstruction of dwelling Houses.

12. CDS:

A credit facility is available for Armed Forces officials (Major and above or equivalent Ranks and Status with minimum length 12 years of services). Car loan and Marriage loan are also included as CDS.

13.HBL:

A credit facility is available for the retired Armed Forces officials.

- Non Funded Facilities:

Non funded facilities are divided into the following categories:

1.Guarantee:

A credit facility in contingent liabilities from extended by the banks to their clients for participation in development work, like supplies goods and services.

2. Letter of Credit:

A credit facility in contingent liabilities from provided to the clients by the banks for import/procurement of goods and services.

C Another Common Purpose Loans:

- 1. Household Durables Loan:

Trust bank provide household durables loan to meet finance requirement to build home and industrial buildings.

Eligibility to get Household durables loan Employees Of:

- Government/Semi Government/Autonomous Bodies.

- Sector Corporation.

- Non-Government Organizations.

- Multi-national Companies.

- Banks/ Financial Institutions.

- Educational Institutions.

- Doctors’ Loan:

Eligibility: General Practitioner, FCPS & MBBS Doctors/Dentists or Specialist Doctors having FCPS or a Post-graduate degree and specialization in a particular area of treatment such as Medicine Specialist, Eye Specialist, ENT Specialist, Cardiac Surgeon/Specialist etc. having 5 years experience as specialist.

- 3. Educational Loan:

A substantial amount of finance is required to give child the best education or to get a higher degree either at home or abroad.

Eligibility:

- Employees of confirmed Service holders, Businessman, Professionals

- Adequate cash flow to repay the loan

- 4. Travel Loan:

When you plan to travel local or global exotic location, financing is the key issue. Don’t be worried; TBL Travel loan is ready to provide instant financial support.

Eligibility:

- Employees of confirmed Service holders, Businessman, Professionals

- Adequate cash flow to repay the loan

- 5. Hospitalization Loan:

Crises come at anytime and well being comes at a prices. When the urgency comes for medical treatment of your family, there can never be any compromise. At any urgency, please remember us to provide financial support through our “Hospitalization Loan” scheme.

Eligibility:

- Employees of confirmed Service holders, Businessman, Professionals.

- Supportive cash flow to repay the loan.

- 6. Any Purpose Loan:

We have so many needs, some are attainable with our means & standing and some are unattainable. The unattainable needs can be met by TBL “Any Purpose Loan”.

Eligibility:

- Confirmed employees of the Govt. Organizations/Semi Govt. Organizations /Autonomous Bodies/ Multinational Companies/ Banks/ Insurance Company/Financial Institutions/ Educational Institutions/Corporate Bodies.

- Supportive cash flow to repay the loan.

- 7. Apon Nibash Loan (House Finance):

TBL offers Apon Nibash Loan (House Finance) to you with easy repayment schedule matching your affordability. You have unlimited options of choosing your home with limited means and standing. Here, TBL Apon Nibash helps you to match your long cherished dream.

Eligibility:

Salaried People

- Confirmed employees of Govt./Autonomous body.

- Confirmed employees of Financial Institutions.

- Confirmed employees of different Public Limited Company/Private Limited Company having Corporate Structure.

- Teachers of any School/College/University.

- Supportive cash flow to repay the loan.

Professionals

- Doctor/Medical Professionals.

- Engineers.

- Accountants.

- IT Professionals.

- Management Consultants.

Self-Employed

- Businessmen (in business at least for five years).

- CNG Conversion Loan:

Driving a car is no longer a burden as our TBL Conversion Loan makes it easily affordable.

Eligibility:

- Employees of confirmed Service holders, Businessman, Professionals (Owner of the vehicle or user of the vehicle) & Corporate Clients (for more than one Car).

- Any other persons who have adequate cash flow to repay the loan installment.

- 9. Marriage Loan:

Tying the marital knot is an event of a life time and memories should last forever. TBL “Marriage Loan” will help you to arrange celebrate the marriage in style.

Eligibility:

- Employees of confirmed Service holders, Businessman, Professionals.

- This Loan is applicable for first marriage.

- This Loan may be availed by the guardian and/or applicant as the case may be.

- Supportive cash flow to repay the loan.

- 10. Advance Against Salary:

Life is continuously facing unforeseen events. For which sudden financial support is essential. We are at your side to meet up your urgency at any moment through our “Advance Against Salary”.

Eligibility:

- Salaried person in Govt. Organizations/Semi Govt. Organizations /Autonomous Bodies/ Multinational Companies/ Banks/ Insurance Com./Financial Institutions/ Educational Institutions.

- Confirmed Employees having 3 Years service ahead.

3.1 What is Customer Service?

Customer service is the set of behaviors that a business undertakes during its interaction with its customers. It can also refer to a specific person or desk which is set up to provide general assistance to customers.

CRM is system with which to identify and track customers needs. Four basic steps will help to ensure a greater effectiveness in your CRM system:

- Establish clear and specific objectives regarding the CRM needs you wish to fulfill

- Plan a realistic strategy to accomplish the set objectives

- Identify a CRM software that matches up with set goals

- Evaluate on a regular basis to train and adapt your strategy to your progressive experience

3.2 what is Customer Satisfaction?

It refers to the satisfaction of customers in terms of how are they satisfied with the politeness, knowledge and promptness of employees in handling busy customers. It also takes into consideration the perception of the customers as to whether the product or service is worth what they are paying for it.

Customers of Trust Bank Limited have a good perception about the quality of service provided by them. From our survey we found that customers are satisfied with the overall service of TBL . All the offers provided by TBL are very beneficial for the customers. But in case of service benefit is not the alone factor that determines the level of satisfaction. There are many other things that take control over the overall satisfaction. For instance, service having attractive offers may fail only because of rude behavior or carelessness of the provider. So it is very important to ensure other factors that are related with the success of the service.

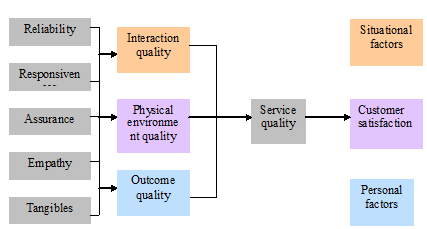

3.3 The five Factors to customer Satisfaction

There are five major factors identified by the experts that are essential to assure the quality of better service that will lift the level of satisfaction. They are reliability, responsiveness, assurance, empathy and tangibles. These five factors determines the quality of interaction between customer and provider, the quality of Physical environment quality and out come quality of the service which leads the overall service to the position of excellence of quality. From our survey we found that how these factors affect their satisfaction level.

Reliability:

It means ability to perform the promised service accurately. In case of banking reliability is very important. Because if the client pretends that the company is not able to continue its service proper in the future they will not interested to banking with PBL . From our survey we see that most of the customers chose PBL because they think it is reliable compare to others in case of providing various unique features (Bangladesh international). On the whole customers have a perception that PBL is capable to provide all the services they offered.

Responsiveness:

It is another vital factor that controls customers’ perception about quality of service. It means willingness of the employees to help the customers. According to the perception of customers responsiveness is very important to increase the quality of the service. Even the customers ranked the importance of responsiveness in banking 7 out of 9. If employees do not response immediately to the need of the customers, valuable time of the customers will be spent unnecessarily. Even the customer may become frustrated whether he will get the service or not. The customers of PBL replied that PBL responses promptly.

Assurance:

It means the knowledge and ability of the employees to develop trust in the mind of the clients about the completion of the task properly and on time. Customers have a great perception about PBL that they perform according to their promise. Assurance has a great impact on the quality of the service because if promises are not kept customers may switch to other bank.

Empathy

To ensure better service it is very important for the employees to have empathy. Empathy means giving individual attention and taking extra care of the customer. PBL has young and energetic employs that interact with customers nicely and they continuously ask about their satisfaction and dissatisfaction of every individual.

Tangibles

Tangibles are very important factor because it directs the customer mind about the quality of the service. Tangibles are physical facilities, equipment etc used in the context of service company. Interior decoration, sitting arrangements, temperature of the room, cleanness odor everything controls the perception of customers about the quality of the service. PBL has confirmed well interior decoration in all there branches and they try keep the standard of there services cape same all over the world. They use all the elements Used in there company like chairs, carpet etc imported from Hong Kong and all of them are same for all branches.

3.4 Factors that determine service quality and customer satisfaction

Fig: Factors that determine service quality and customer satisfaction

Comparison between the fine Product and service of TBL ,

3.5 Deposit scheme offered by Trust bank are categorized into 6 section

| Deposit scheme | Objective | Mode | Benefits |

| 1 DBDS (Double benefits deposit Scheme) | 1 Give maximum benefit. 2 Help in meeting specific needs like education, marriage

| Deposit a fixed amount of money for 06(Seven) years.

| double of the amount deposited after 6 years. Minimum deposit shall be Tk.10,000.00 or its multiple.

|

| 2 STD (Short term deposit) | Being Organization, Public Institute , Corporate bodies | Below Tk. 1 crore 5% loan, above 1 crore 6% | Senior citizens will get 0.5% more benefit

|

| 3 LDS (Lakhopati Savings Scheme) | For all | Deposit monthly 500 Taka for 5 years | Tk. 1,00,000/- |

| 4 FMD | Help the retired persons for investing their retirement benefits. Create investment opportunities for Non-Resident Bangladeshi. Explore investment opportunities for school, college, university etc. Give investment opportunities for Trust; Foundation etc. | Deposit a fixed amount of money for 05 (Five) years | A fixed amount of money in every month for 05(Five) years Minimum amount of required deposit is TK.75,000.00 or its multiple

|

| 5 FRD (Fined deposit Scheme) | Help the retired persons for investing their retirement benefits.

| Deposit a fixed amount of money 1 month 3 month, 6 month and name than 1 yearly and more than 1 year | A family can have a maximum of 02 (Two) PFSD account in names of persons (his/her) in his/her family

Minimum amount of required deposit is TK.25,000.00 or its multiple.

|

| PMS (Prime Millennium Scheme) | Help the retired persons for investingating their retirement benefits. Technical and Maturity shall be 10 lac | Deposit a fixed amount of money 5 years or 7 years on monthly 10 installments of various sizes | A family can have a maximum of 02 (Two) PFSD account in names of persons (his/her) in his/her family.

Minimum amount of required deposit is Tk. 5000.00 or its multiple or 2500 or its multiple.

|

4.6 Credit scheme offered by Prime bank are categorized into 6 section

| Credit scheme | Objective | Terms and Conditions | Benefits/Special Features |

| 1 Consumers Credit Scheme | Help fixed-income people for buying house hold durable. For the amount up to Tk. 1,00,000 the period is two years. Interest rate will be charged quarterly rest.

| Interest Rate 13.00% Risk Fund 1.00% SSupervision Charge (per year on outstanding balances) 0.25% Application Fee BDT 100.00

| The loan amount is directly credited to the customer’s account. |

| 2 CAR LOAN Scheme | Help fixed-income people for buying car For the amount up to Tk. 25,00,000 the period is five years that is 60 monthly installments Interest rate will be charged quarterly rest.

| Interest Rate 13.00% Risk Fund 1.00% SSupervision Charge (per year on outstanding balances) 0.25% Application Fee BDT 250.00

| BDT 7.50 Lac for reconditioned Car/Jeeps/SUVs and BDT 25.00 Lac for new Cars/Jeeps/SUVs.

|

| 3 Doctors’ Credit Scheme | Interest Rate 13.00% Risk Fund 1.00%

| For new doctor 5.00 Lac and for experienced doctor 15 Lac

For Hospital, Clinic and Diagnostic Center 50.00 Lac

Application Fee BDT 250.00 | |

| 4 Rural Development Scheme | Raise the standard of living of rural people. Initiative to break the vicious cycle of poverty. Enhance the purchasing power of rural people.

| Credit limit are as follows Interest Rate 11.50%. Risk Fund 1.00. Service Charge 0.25% per year on outstanding balances. Repayment period 1 years.

| Security: Group guarantee, no collateral

30 person in a group |

| 5 Lease Financing | Assist and encourage entrepreneurs for acquiring capital machinery, medical equipment, automobiles etc.. | Lease period 3 to 7 years Lease rent @ 13.00% Risk Fund 1.00% Service Charge 0.25% per year on outstanding balances.

| Primary: Ownership of fixed items. Collateral: Landed property, Bank Guarantee, ICB Unit Certificate etc

|

| Credit scheme | Objective | Terms and Conditions | Benefits/Special Features |

| 6 Personal Loan Scheme | Help fixed-income people for buying house hold Durable For the amount up to Tk. 3,00,000 the period is 03 (Three) years. Interest rate will be charged quarterly res

| Interest Rate 13.00% Risk Fund 1.00% Supervision Charge Application Fee BDT 100.00

| The loan amount is directly credited to the customer’s account. Loan limit BDT 3.00 Lac or 8 times of monthly evidenced income, whichever is lower. Repayment period Maximum 3 years, that is 36 monthly installments.

|

| 7 Small Loan | Extend credit facility to small shopkeepers. Give collateral-free credit

| Maximum amount of loan Tk. 2,00,000. Interest Rate 13.00% Risk Fund 1.00% Service Charge 0.25% per year on outstanding balances Application Fee BDT 250.00 Loan Limit BDT 2.50 Lac

| Repayment period 3 years Interest rate will be charged at quarterly rest

|

Part-4

QUESTIONNAIRE FOR THE REPORT ON CUSTOMER SATISFACTION

QUESTIONNAIRE FOR THE BANK CUSTOMER

(Service qualities of banks are facing high competition. So it becomes very important to know why people choose Trust Bank LTD, Mirpur Branch, that is why I have developed a questionnaire to collect information from the customers about the service quality of different departments of TBL. For these, we need your opinion about the service of your bank.

Your active participation will be carried as fully confidential, in this regard)

1. In which bank you have account? ………………………………………………

2. How did you come to know about this bank? ………………………………

3. Was this your first preference: Yes No

4. In order of preference name three banks you were considering:

(a) ……………

(b) ……………

(c) ……………

5. Why did you choose this bank?

(a) Reputation

(b) Better interest rates

(c) Good facilities

(d) Nice environment

(e) Known personnel

(f) If more than one, please those.

6. What type of account you maintain with Trust?

(a) Current account

(b) Savings account

(c) Fixed account

(d) Business account

(e) Others

7. Where do you transact the most?

(a) Govt. Bank

(b) Foreign Bank

(c) Other private local Bank

8. Relationship with the Mirpur branch of TBL / Prime bank.

(a) Less than one year

(b) 1-2 years

(c) More than 2 years

9. Do you think the saving scheme of Trust Bank is reliable (your suggestion)?

(a) Not quite good

(b) Good

(c) Perfect

10. Which saving scheme would you prefer the most?

(a) Trust Smart Savers Scheme (TSSS)

(b) Lakhopati Savings Scheme (LSS)

(c) Trust money Double Scheme (TMDS)

(d) Trust Double Deposit Scheme (TDDS)

(e) Monthly Benefit Deposit Scheme (MBDS)

(f) Interest First Fixed Deposit Scheme (IFFDS)

11. If you need to choose credit scheme then what type of scheme would you prefer the most?

a) Household Durables Loan

b) Car Loan Scheme

c) Doctors’ Loan:

d) Educational Loan:

e) Travel Loan:

f) Hospitalization Loan:

g) Any Purpose Loan:

h) Apon Nibash Loan (House Finance):

i) CNG Conversion Loan:

j) Marriage Loan:

12. Do you have to face any problem during the account opening process?

(a) Employees sometimes get busy in other activities

(b) Lengthy processes

(c) Bad tempers of the employees

(d) Need to go through various formalities

13. Do you think the amount that is required to open an account is satisfactory?

(a) Satisfactory

(b) Should be more flexible amount options

(c) Not always possible

14. Problems according to your judgment can one face in opening an account?

(a) Time

(b) Introducer

(c) Strict rules

(d) Others

15. How do you find the Bank employee at the customer service desk?

(a) Rude

(b) Worthless

(c) Helpful

(d) Efficient

(e) Very much comparative

16. What do you think could be the reason behind the gap between you and the services?

(a) Inefficiency of employees

(b) Short of staff

(c) Complications

(d) Lengthy processes

17. Finally, to ensure that we have all types opinions represented in our survey, we would like you to answer the following questions.

Sex: Male Female

Your age: …..………………..

Your district of origin ……………………

Your occupation : …………………..………………….

Your Monthly family income:

ÿ Below – Tk. 10,000 ÿ Tk. 10,000 – Tk. 30,000 ÿ Tk. 30,000 – Tk. 50,000Tk.

ÿ Tk. 50,000 – Tk. 80,000 ÿ Tk. 50,000 – Above

Your name:

Contact address:

Contact number:

Part-5

Recommendation & Suggestion

Although the Trust Bank Ltd is performing very well in our country, but as per my observation and understanding, I think they need a little modification in their procedures to be the number one organization. Such as-

v They need to maintain an upgraded guideline for the employees to avoid any kind of confusion.

v According to my observation, there is a lack of communication between the customers and the organization which they need to reduce for the betterment and they can easily do that by instructing the employees about how to communicate in a proper way.

v Although they are giving the world-class services and products, yet their charges are comparatively high then others and that is very much de-motivating for the customers. So they should consider this fact and can try to reduce it within their capacity.

v The interest rates for loans are also very high in TBL .but to sale more they should reduce this rate and thus they can make a higher profit. And in deposit sector their interest rate is poor always customer say that your rate is too poor than other bank.

v Though they have many classified savings , they introduce customer only two, so they should enhance their savings facilities by introducing many other saving schemes, because customers really look for various savings programs.

v To open any account in this bank, like savings, access or current account, the minimum amount which a customer must maintain is really high which does not match with the economic level of our country. So they must reduce this rate.

v They should specify some basic training course in some specified sector to make clear understanding about each employee’s job and for promotion of employees.

v There is a need to establish specific increment category for each level.

v Special increment should be given to middle and junior level managers and executives also to increase their motivation level.

v While ranking job or evaluate them to specify the range of comensation, they should consider the employee’s overall performance, rather than his designation, to make a better understanding on the evaluation process.

v There should be a scope for participate in decision making process of the organization within a fixed range. because according to my understanding it is one of the best way to encourage the employees to perform in a better way as they feel themselves as a permanent part or body of the organization.

v They need to increase the range of non-financial incentives like-secretarial assistance for senior level officers, option for casual dress up for clerical level once in a week, etc.

v They can motivate their employees with some special incentives like-children’s education facility, loan facility, compensation for short time disability, company products at subsidized price, paternity leave, etc.

Part-6

Conclusion

TBL has started its banking activities much earlier comparing to the other banks and due to that it has gained a lot of banking experience which has been proved very worthy for them. But that is a part of their job because our countries economic condition is yet to progress a lot. Time to time they are offering different attractive packages of program like various loan packages for particular economic group as doctors loan, businessman loan, household loan,etc.from the given charts and tables we can see the various range of their loans and other offers which remains on changing time to time. They also have adequate planning for compensation in various sectors like-they have a wide range of bonus- branch bonus, sales bonus as the percentage of individual performance, etc. they also have some special incentives for specified performance which is really encouraging for the employees. But at the same time they have some drawbacks like- they do focus mainly on financial incentives and benefits and not on non-financial ones. But it is not wise on their part. So they need to consider the non-financial incentives a little bit seriously for the customers as well as for the employees also. They also need to increase the range of attractive offers with the increasing business. Another thing is, according to my perception, they require a much prompt guideline to operate their activities.

To summarize the whole situation, I would like to say that, this organization is giving a wonderful service to the people in general and of course for Army person of our country and at the same time they are also trying to educate our people about the world class banking procedures which is, according to my concept, a very worthy step and we should cooperate with them in this matter for our own benefit. The Trust Bank Ltd to manage the overall banking activities program and they will definitely progress with the modernization of business environment.