Introduction:

The telecommunication sector of Bangladesh, after its liberalization began with small steps in 1989 with the insurance to a private operator for the provision of Inter Alia Cellular Mobile Services to compete with the previous monopoly of telecommunication services the BTRC (Bangladesh Telecommunication Regulatory Commission), has since never looked back. Significant changes in the number of mobile services deployed in Bangladesh occurred in the late 1990’s and the number of the service in operation has subsequently grown exponentially in recent years.

The incentives from both public and private sector have helped to grow this sector and it now one of the biggest sectors of Bangladesh that is only generating huge amount of profit but also developing the social and economic conditions of the people. As a populous country, its huge market has attracted many foreign investors to invest in this sector and Airtel Bangladesh Ltd. is only the most recent one to step in to the market. The project was conceived from the idea to overlook the subscribers’ opinions (Customer Satisfaction Levels and Dissatisfaction Levels, if any) about the Value Added Services (VAS) of Airtel Bangladesh Ltd. Much of the work has been based on the first hand experiences and the customers’ feedbacks as collected in the survey are also looked and studied upon, with muchimportance.

Background of the Industry:

Bangladesh, with its burgeoning population, has an enormous need for telecommunications services. Such high population means that the telecommunications sector can really play a big role to boost and improve the economy and social level of people. This has been further brought to fore through the emergence of cellular phones, that has quite drastically changed the lives of businesses and individuals alike.

The rise in the number of village people changing their professions and occupations has meant that the importance of mobiles far supersede the requirements of only the affluent and the welloffs. Following the government’s decision of deregulating the telecommunications sector, the overall efficiency of businesses has increased tremendously- a feat that was previously missing since the sector functioned only as a state monopoly since 1980. The telecom industry, only one of those technical industries to have benefitted from the introduction growing business needs. This is one of those industries that has intense competition among the players in the market and the fact still remains that majority of the players in the market are multinational subsidiaries- with vast finances at their disposal. The Bangladeshi people’s plan and intent of carrying more than one subscription (in most cases, catering to

subscriptions from different service providers), coupled with the huge population (roughly around 200 million) have always given the service providers a strong base to provide for. While the early years saw the domination of Pacific Bangladesh Telecom Limited (Citycell), primarily because of the failure of Sheba Telecom to gain market share because of poor infrastructure, customers were denied of benefits as Citycell ran a monopoly market, with the sole intention of profit maximization. However, the introduction of Grameenphone and AKTEL into the scene meant that call rates experienced drastic falls- with Grameenphone acquiring a greater market share through improved coverage and better customer services. The introduction of Orascom (which bought off Sheba Telecom) followed soon after and the company was then renamed Banglalink- triggering a price war never seen before in the Bangladeshi telecom market. This resulted in a huge drop in registration and call rates. December 2004 saw the introduction of Government owned Teletalk BD Ltd. While its slogan to “Keep Your Money in your Country” created some buzz, it waned soon after. The company was the first to give BTTB (now BTCL) facility to its subscribers. Later, Airtel Bangladesh Ltd. (previously known as Warid Telecom), entered the market- the sixth entrant. A look at the competitors in the market will reveal the following companies-

• Airtel Bangladesh Ltd. Branded as Airtel,

• Grameenphone/Telenor Bangladesh Ltd. Branded as Grameenphone,

• Orascom Telecom Ltd. Branded as Banglalink,

• Pacific Bangladesh Telephone Ltd. Branded as Citycell,

• Axiata Bangladesh Ltd. Branded as Robi and

• Teletalk Bangladesh Ltd. Branded as Teletalk.

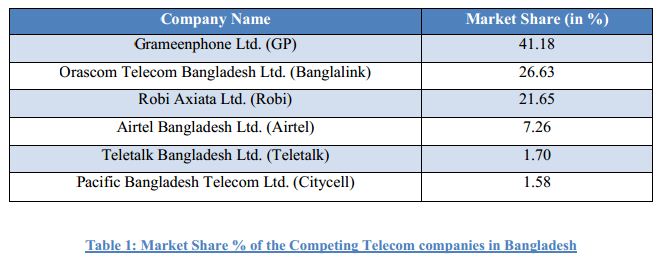

The total number of mobile phone subscribers in Bangladesh was 45.21 million as of February 2009, rising to 95.0 million at the end of July 2012, which has now grown to 99.87 million at the end of March 2013. In these few months the total number of mobile phone subscribers in this country has reached 113.784 million at the end of December 2013. In starting of the analysis of the companies in the telecommunication sector in Bangladesh a list of percentage of the companies is stated below. This list will represent the comparison as well the positions of the companies in the current market scenario of the telecom industry of Bangladesh.

Company Overview

History and Background

Airtel Bangladesh Limited originates from the Indian Bharti Airtel that started its telecom services business by launching mobile services in Delhi (India) in 1995. Founded in 1976, by Sunil Bharti Mittal, the company has grown from being a manufacturer of bicycle parts to one of the largest and most respected business groups in India. The company has emerged as one of the top five wireless operators in the world and since its inception, has always been on its way up the success meter. Bharti Group, its global telecom operations group has now presence in 21 countries in Asia, Africa and Europe- Sril Lanka, India, Bangladesh, Jersey, Guernsey, Seychelles, Burkina Faso, Chad, Congo Brazzaville, Democratic Republic of Congo, Gabon, Ghana, Kenya, Madagascar, Malawi, Niger, Nigeria, Sierra Leone, Tanzania, Uganda, and Zambia.

Airtel Bangladesh Ltd. formerly known as Warid Telecom is a GSM and 3G based cellular operator in Bangladesh. Airtel is the sixth mobile phone carrier to enter the Bangladesh market, and originally launched commercial operations under the brand name Warid on May 10, 2007.

In 2010, Bharti Airtel bought out the majority share of the company. This is Bharti Airtel’s second operation outside of India after launching its mobile services in Sri Lanka in January, 2009. Bharti Airtel has made a fresh investment of USD 300 million to rapidly expand the operations of Warid Telecom and have management and board control of the company in 2010. This is the largest investment in Bangladesh by an Indian company. The new funding is being

utilized for expansion for the network both for coverage, capacity and introduction of innovative products and services. As a result of this additional investment, the overall investment in the company has moved to USD 1 billion.

Currently Airtel Bangladesh has 7.97 million subscribers with 7.3% market share at the end of August, 2013. On September 8th 2013, Airtel Bangladesh received 5 MHz 3G spectrum with 1.25 million USD.

Functions and Departments:

There are total 13 departments that work together in Airtel Bangladesh Ltd. with their respective functions. The departments are:

• Customer Care,

• Supply Chain Management,

• Engineering,

• Operational Excellence,

• Human Resource and Administration,6

• Sales,

• Information Technology,

• Corporate Affairs,

• Finance,

• Marketing,

• Legal and Secretarial,

• CEO Office and

• Corporate Assurance Group

Combining all the above divisions the management team is built. Since I have worked under the Marketing Department therefore the discussion will be on this respective department throughout the report.

Department Overview:

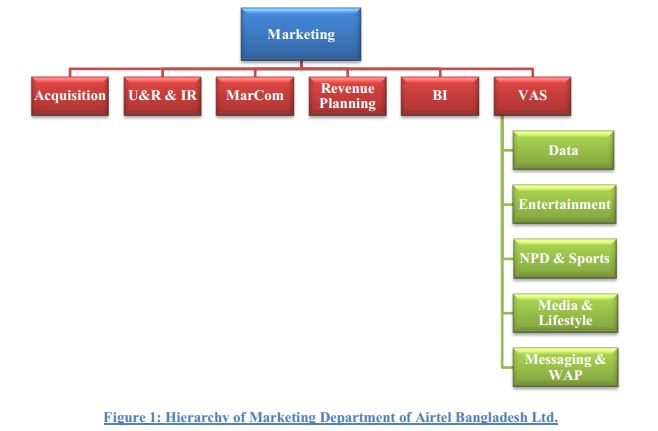

There are 6 units in the Department of Marketing of Airtel Bangladesh Ltd. They are as follows:

• Acquisition,

• Usage & Retention & International Roaming,

• Value Added Services (VAS),

• Marketing Communication (MarCom),

• Revenue Planning and

• Business Intelligence.

I have completed my internship in the unit of VAS, hence a discussion of the unit of VAS has been given bellow. Value Added Services are those particular services that make a telecom company different from its competitors. The basic function of all the telecom are same and that is to provide the consumers with the facility of talk time by using which they become able to talk to others. The VAS are the services that includes all the functions apart from the talk time facility. There are number of VAS services that all the telecommunication companies are providing to the consumers. These services are the ones that make company more appealing to the consumers there it can be definitely say they all the marketing activities are done in accordance with the Value Added Services. In Airtel Bangladesh Ltd. the unit of VAS is divided in to 5 more parts. They are:

• Data,

• Entertainment,

• New Product Development & Sports,

• Media & Lifestyle and

• Messaging & WAP.

A departmental hierarchy of Marketing Department of Airtel Bangladesh Ltd. is given below:

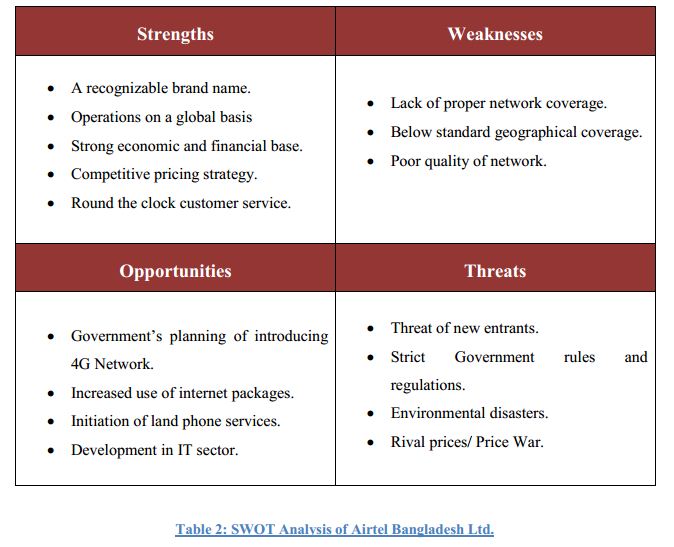

SWOT Analysis:

A SWOT analysis of Airtel Bangladesh Ltd. has been done for getting a clear idea about the ongoing working processes and areas where improvements can be introduced. This SWOT analysis represents many strong points that allow this company to grow in a little span of time in this telecom industry. There are the going and growing opportunities that will help the company to be more flourished. However there are some weaknesses and threats that are also needed to be improved.

The Job Description

As an intern of Airtel Bangladesh Ltd., I have worked in the Marketing Division of the company. Basically my maximum works was related to VAS (Value Added Services) under the Supervision of Ziaul Hoqur Shikder, Senior Manager and Head of VAS, however I have also helped the International Roaming unit with some important activities in guidance of Syed Fakhruzzaman, Manager of International Roaming. The works I have done during my internship period is sated elaborately below.

Value Added Services Functions:

VAS (Value Added Services) department basically functions to improve the customer satisfaction by constantly providing the subscribers with different sorts of Value Added Services. In Telecom Industry, every service other than the Voice call falls under VAS. So, the VAS department has to plan and execute for new Value added Services along with keep tracking to the existing ones. Most of the services are outsourced to different Content and Service providing organizations. To design the services, assuring the quality of the services and company’s and subscriber’s benefits out of it, closing the commercials with the vendor, initiating and preparing the agreements, configuring the new services with the system and network, testing and retesting the services and finally launching the services are the tasks that are done for the new services. For the existing services regular revenue tracking, analyzing, regular service checking, problems finding and resolving, complains resolving, health check of the regular services, required

additions making etc are the usual works done. For the promotions of the services, both ATL (Above the Line) and BTL (Below the Line) promotional activities are done. Even though the ATL tools such as print advertisements, Radio endorsements, Television Commercials etc are done by the marketing communication team, the VAS team has to ensure the language of the message in order to deliver the proper message to the target group of customers. And for the BTL promotions, the entire plan is done by the VAS team that includes the OBDs (outbound dialers), Bulk SMS, ECNs (end call notifications), USSD messages (unstructured supplementary service data) etc. To design and plan for the promotions is also a part of VAS’s responsibility.

In short, this team has to run all the necessary steps to provide the subscribers with the services that add value to their life and network experiences.

International Roaming Functions:

The International Roaming Department deals with all the necessary activities to meet the roamers’ needs. The international roamers are divided into two broad categories. One is “The People” who come to Bangladesh from other countries (Inbound Roamers) and another is “The People” who go to other countries from Bangladesh (Outbound Roamers). The International Roaming Department has to ensure these roamers are getting all required facilities, both the Inbound and Outbound Roamers. In order to guarantee the subscribers benefit the department of

IR has to accomplish a number of tasks. Dealing with the operators across the national border, negotiating with them, configuring the system after the settlement, SIM cards management, system updating, regular service checking which is called Usage Acceptance Test (UAT), resolving all the problems, revenue calculations and analysis etc are the regular activities of international Roaming Department. I began my internship program on 24th September, 2013 with Airtel Bangladesh Ltd. The internship was for three (3) months with an extension of one more week and as a result my internship came to an end on 31st

Assigned Duties and Responsibilities:

• The Primary responsibility of my internship was to conduct continuous health check of the existing Value Added Services. This Health check is basically designed in the form of a campaign. Every week two students were brought to check a service. All the modalities of a particular service are checked every week. For that purpose, I had to prepare a questionnaire that had to include a detailed instruction of how the service worked and had to arrange the student as well. During the session, I had to be there with the respondents for instructing and helping them. And finally, after each lab session, I had to compile the reports and make a presentation analyzing it for the high level management. To assemble the problems found in 12 the Lab and initiate to resolve those was under my responsibility as well. I have arranged and conducted Five VAS Labs during my internship period.

• Besides this, I was assigned to prepare the service notes for new products and services and follow how the process of the services is carried out. I had to make the product concept note (PCN) every time a Value Added Service was to be launched. The Product concept notes include a comprehensive portrayal of the services, procedure of activation and deactivation, modality of access and usages and most importantly, the charging details. A projected business case is attached to every PCN and henceforth, the PCNs are for the internal use only and are highly confidential.

• Another important work that I had to conduct was preparing the Notes For Approval (NFA). NFAs’ are the documents that are prepared for doing every new work that is related to VAS. These works include planning of new service launch, going for new agreements, invoices, new USSD code launch etc. The NFAs alike PCN are only for internal use and very confidential.

• Checking on Invoices on regular basis was also a crucial part of my activities during my internship period. I had to check on the every new invoice that arrives, get them signed from the department head, make documentation, forward it to Chief Operating Officer (COO) when needed and make a proper list for future list. All these invoices comes from the vendors regularly stating the bills that need to be settled.

• In addition to this, I had to do the User Acceptance Tests (UAT) for the new or upcoming services. These tests include the tariff, time duration, service quality check and finding out the problems in the service. UATs are done again and again unless the services are perfectly ready to launch. Once all the aspects related to a service is Okay, the nodes get approval and the service is ready to be lived.

• For each of the new services under new short codes, the operator has to get BTRC approval. And to get a BTRC approval, a BTRC notification has to be prepared. A BTRC notification includes the charges, modalities and a bit of technical details of the service. To prepare the BTRC notification was one of my internship responsibilities.13

• Airtel Bangladesh Ltd. arranges many contest on every month based on different services, occasions, general knowledge etc. The winners of the contest were contacted, attended and rewarded by me and I had to do this work on every second week. After the contest winners are attended and rewarded properly the documentation is done properly and the list has to be sent to the Marketing Communication team for updating on the Social Networking Site (www.facebook.com/airtelbuzz).

• Below the Line (BTL) promotions are very crucial for any operator. Therefore, they have to make sure that the right message is receiving the right audience at the right time via the right media. For that purpose, a BTL plan is made at the beginning of every month. My regular task was to check the BTL plan whether they were being sent according to the plan or not in all the existing packages and correct the plan if any problem occurred.

• Additionally I had to conduct customer surveys on different issues related to both VAS and IR. I have conducted 3 surveys for VAS and 1 survey for IR. The first survey of VAS was on the Airtel Job Alert portal service, second survey was on the Matrimony service of Airtel. These two surveys were done for basically for knowing the customer usage and their acceptance. The third survey of VAS was done to know the consumer satisfaction on overall VAS of Airtel Bangladesh Ltd. This survey is also the topic of my project that I have prepared as my internship report. Besides these the survey I have done for IR was for knowing the effectiveness of the newly launched ISD campaign of Airtel Bangladesh Ltd. for the ISD subscribers. This survey was done to know their acceptance, usage and collecting

their feedbacks on improvements.

• Besides the customer surveys I had updated a file of the SIMs that were used for testing by the IR department. The updated SIM book is further used for the future records. Moreover I had to prepare NFA, PCN and new Agreement notes for IR as well.

Findings and Analysis

The questionnaire that was designed for identifying the Customer Satisfaction on the Value Added services contains 21 different questions. The first few questions and their analysis give an idea about the demographical information about the sample population. The second part of the questionnaire elaborates the information that is related to the customers’ opinion about the quality of the VAS and their perception towards the services. Last but not the least the third part of the questionnaire describes along with the second part about the consumer satisfaction. Upon

elaboration of the findings the satisfaction level of the customers will be clearer. All the findings are discussed in tabulation, percentage and graphical analysis and their interpretation.

The first five findings of the questions give answers and an overview of the demographical condition of the sample population. Interpretation and graphical representation of each finding along with a total demographical analysis has been discussed elaborately below for a better understanding.

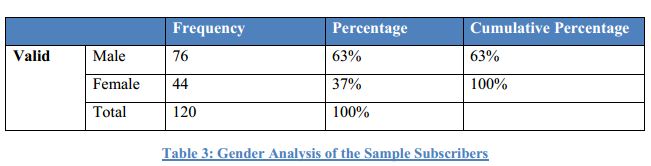

Finding 1 (Gender):

Interpretation: The above table shows the statistics of the sample’s gender. Here, among all the 120 respondents 76 are male and rest of the 44 respondents are female which clearly states that 63% of the sample population is male and 37% is female. Both the genders have been considered here to assess their satisfaction about the Value Added Services of Airtel Bangladesh Ltd.

Interpretation: From the above table, it is seen that among the 120 respondents 23% are below the age of 21, 28% of them have their age between 21-25, there are 13% respondents between the age limit of 20-30. 24% of the respondents belong to the age group of 31-35 and the rest of the 12% are 36 years old or have their ages more than 36. From the above statistics, if we give a look to the cumulative percentage then it can be said that, most of the respondents that is 75% from 100% belong to the age group of 21-30. It can be easily inferred that the young generation prefer Airtel more than the middle-aged one. A graphical representation has also given below for

better understanding.

Interpretation: In the above mentioned table there are 5 categories that were considered as the professions of the sample subscribers. The categories are as we can see Students, Business, Service, Teacher and Others. From the statistics it can be concluded that majority of the sample subscribers are students that is 56%. 13% of the respondents are businessman and 20% are involved in different services. The rest of the 8% and 4% respondents have their professions as teacher or other activities such as doctors and lawyers.

Interpretation: The above table shows the monthly income or the economic demography of the subscribers. From the table it can be seen that the largest group that is 49% of the subscribers has the monthly income of BDT 0-10,000, 15% have their income between BDT 11,000-20,000. 18% of the respondents are from the income group of BDT 21,000-30,000 and 12% are from the income group of 31,000-40,000. The rest of the 6% fall in the group in which they have their earning more than BDT 41,000. The table gives us an obvious support that Airtel has subscribers of all walks and types in Bangladesh.

Interpretation: There are five categories in the section of monthly expenditure on mobile phone to identify with usage pattern of the telephone services. The results in this section show that only 24% of the total respondents spend up to BDT 500 for mobile phone usage every month. Amazingly, 12% of the total sample population spends more than BDT 2,000 on their mobile phone every month. So from the table it can be supposed that the mobile phone expenses exceed BDT 500 in the case of most of the Airtel Subscribers. The Highest usage rate is in the range of BDT 500-1,000. And to get 12% respondents using above BDT 2,000 on the mobile connection is quite unlikely, but the probable reason behind it is the regular user retention follow-ups and the campaigns among the corporate to ensure a standard usage and also the wide range of services offered by the operator that boosts up the usages of the subscribers.

Total Demographic Analysis:

Demographic factors not only represent a population’s different aspects but also possess an impact on how the population will behave towards a specific thing. So for this reason in this research having an idea on the demographic conditions of the sample population is important. Among many demographic factors five have been given preferences in this research and those are Gender, Age, Profession, Monthly Income and Monthly expenditure

on mobile phone usage. From the analysis of the finding we can say that all of these factors have some influence over using a mobile company’s VAS to a certain extent. From 120 people 63% are male and female population is less than that. It represents that more male users are responsive and use mobile phone connection. Mostly the people who are students use Airtel as their mobile connections rather than the people of other professions. Additionally people belong to less or mid-income range use Airtel as they find Airtel more convenient and most of them tend to use BDT 500-1,000 per month behind mobile usage. However a sample does not give an accurate result about the whole population, so in this case a sample of 120 people does not give correct result rather an idea about the scenario of using Airtel as their mobile phone connection. From this section the analysis of the second part of the questionnaire will be carrying on. The next few questions will focus on the perception and satisfaction level of the sample population. These findings are also elaborated with tabulation, percentage analysis, graphical representation and interpretation of individual and overall quality of the VAS of Airtel Bangladesh Ltd.

Total Perceived Value Analysis:

The second part of the questionnaire is analyzed to find how much value does the sample population puts on the Value Added Services of Airtel. From the 6th to 18th findings the perception on different aspects of the VAS are analyzed in tabulation and also in graphical representations. At first we can see that the majority of the respondents use Airtel connection as secondary one. The main reason for using it on secondary purpose is that the company is new to the industry and it has been only a few years to enter the market. Moreover the competitors have been growing their consumers for many years as a result their consumer loyalty increased with time. However in a short course of time Airtel has become second preference to many of the subscribers and they are finding the connection useful. The sample was also asked why they use Airtel connection and majority replied that the trariff rate of the company is comparatively less than the other competing companies. The call rate is less and the other rates of the services are also fewer. Another prime portion said that the packages that Airtel offers are attractive and

comfortable. Airtel is the first company that has introduced highest F & F’s in this industry which has attracted the customers especially the young generation. Moreover the Brand itself made the customers purchase the SIM as this is one of the largest telecom service providers in the world. However the Value Added Services was not the reason for which people are using Airtel. When the respondents asked whether they use Airtel for wide range of VAS the majority responded negatively. The sample people were also asked whether they would like to switch the current service provider they are using where maximum remained neutral. We all know that the telecommunication industry is one of the most competitive industries in Bangladesh and Airtel in a few time made its mark. While the survey was done people remained liberal despite of having many problems in using Airtel connection. To know the psychology of the sample a question regarding the factor that influenced them to purchase Airtel SIM was asked. Maximum people said that they have bought the SIM cards on their own will, some of them said that family, friends and both influenced them to buy the Airtel connection. The sample population was also asked about their perception on about the quality of the VAS they are using currently and the prime portion remained neutral in this case as well. According to them the quality of the VAS is not bad but a little bit of improvement would be better. Most of the respondents use 3 to 5 Value Added Services and majority use the caller tune, missed call alert, F & F service and mobile backup service. There are also other services that are also broadly used such as news alert, job portal, matrimony service, health tips etc. Among the respondents there only a few people who said that they have never used of rarely use VAS which means maximum people use the Value Added Services of Airtel broadly. The additions in the current Value Added Services also attract the consumers to use more services and remain stick with brand. The pricing of the VAS are also satisfying to the consumers as maximum of them think that they are paying the worthy amount for the services they are using. The contents of the VAS are also relevant to the subscribers however there are a few who face problems in the services. Sometimes the connectivity remains missing and sometimes the price is over charged.

Despite of these problems the respondents with the majority response feel positive about the relevance of the services. Additionally the activation and deactivation process of the services are also normal according to the sample respondents. Here some of the people faced problems had to complain almost on daily basis for being charged even after deactivation however the number is pretty few.

Lastly the innovativeness of the VAS is perceived neutrally by the sample subscribers. They feel that Airtel is providing the same services that the companies are providing. Though among them few are not satisfied with the services they are being using, majority find the VAS as innovative as the other competitors in the industry. So after analyzing the questions and observing the statistics it can be concluded that the subscribers are not totally 40 satisfied or dissatisfied with Value Added Services provided by Airtel as majority of them were neutral in each aspect of the questions.

Finding (How Well Informed the Promotions are):

Interpretation: Customer Solutions are to facilitate the subscribers with all the necessary information of all the services and to resolve any problems while using any service or to activate or deactivate the service. Therefore, the frequency of seeking help to the customer care can give us the view of customer’s ease and thus the satisfaction of the VAS. Here, as we can see that, only 3% of the total sample has to complain daily regarding any service; 10% has to complain once in a week; 16% of them complain in monthly and 62% of the total respondents has to call to the customer care sometimes for variety of query regarding the services which is the largest group of all. And 10% of the respondents never had to complain about any of the Value Added Services to the CS.

Interpretation: Based on the survey conducted over the phone, 18% of the sampled Airtel subscribers prefers Airtel as the best service provider in the country, the biggest portion of the subscribers which is more than the half (57%) still prefers Grameenphone as the most preferred service provider; 14% goes with Banglalink and 8% with Robi as the most preferable service provider of Bangladesh. 2% of the total sample prefers Citycell and only 1% prefers Teletalk the most.

Analysis of the Customer Loyalty and Satisfaction:

The first and the second part of the questionnaire described the demographical analysis and thecustomers’ perception on the Value Added Services of Airtel. The third part of the questionnaire along with the second part discusses about the overall satisfaction on the VAS of Airtel. Though the biggest support goes to the major market share holder of the country Grameenphone in terms of providing the best service in the country, surprisingly the second preference goes to Airtel despite of being the 4th market share holder in the industry. There are several reasons for which customers prefer Airtel and some of them are observed here such as Relevance of VAS, Quality,

Ease of Activation/ Deactivation, Providing highest VAS services, Innovative Services, Well Informed Promotions etc. In addition if we see the likeliness of switching the current service provider and the complains that are made to the Customer Care, we can see that people are less likely to switch Airtel and majority of the sample needs to complaint rarely which is basically related to network problem or call drop problem. While doing the calls it was observed that the complaints that were made to the CS were rarely about Value Added Services. So after the

discussions on findings and analysis, tabulations, graphs, calculations, statistics and interpretations, the conclusion can be made that the consumers are neither fully satisfied nor dissatisfied on the Value Added Services provided by Airtel as majority of the sample subscribers remained neutral on maximum answers.

Recommendation

The report has been analyzed to get to know about the satisfaction level of the subscribers about the Value Added Services of Airtel. As we go through the tables, graphs and analysis we can say that the sample subscribers are neither unhappy of extremely happy with the VAS that Airtel provides rather they have neutral opinions. However after talking with the consumers and analysis of the report a list of recommendations is enlisted below. The recommendations are basically given in light of every finding yet some general suggestions are also stated.

• As it is mentioned early that the first few questions were asked to know the demographic conditions of the sample subscriber we can see that majority of the respondent are young people, students by profession, have their income up to BDT 10,000 and spend up to BDT 1,000 on mobile phones. So it is clear that the target consumers of Airtel have always been the young people while the largest portion of the population is middle aged. So Airtel should

expand their market base covering all the generations as the competitors have already created their marks in that.

• While the respondents were asked about using Airtel, majority of them said that they use Airtel as secondary mobile connection. This implies that Airtel is still lacking the ability to be one of the chosen brands for the consumers. It is hence necessary for Airtel to promote more useful and friendly VAS rather than the wide range of unimportant services.

• The network problem has always been the big issue while it comes to Airtel’s preference as primary mobile connection. The network improvement of Airtel is important as it is one of the major reasons of purchasing a SIM card and using it.

• There were only a few respondents who agreed that they use Airtel for wide range of VAS. They only prefer using the brand because of the cheaper call rate and packages. It is not profitable for any company if it remains the low cost provider for a long period of time. So it is high time for Airtel to become more innovation and provide proper network and useful services.

• The quality of the VAS of Airtel was moderate according to the sample subscribers. However there were some people who were not satisfied with the quality. They suffered from activation/deactivation problem, connectivity problem, unknown subscription problems etc. so to remove this type of hassle with the services Airtel’s research and data team should more concerned so that the number of unhappy consumers do not increase.

• The telecommunication industry in Bangladesh is one of the most competitive ones. To remain in the competition and also to grow Airtel should provide unique services. The services that Airtel is providing are common among other competitors. New, unique and more useful services should be provided to the consumers for getting the first mover’s advantage.

• The pricing of the services in this competitive industry is very tough and risky as the consumers are more price-sensitive nowadays. While doing the survey it was noticed that majority of the people remained neutral about the pricing though they suggested reducing the price. Additionally there were people who were dissatisfied with this particular issue. For example, the caller tune users suggested that the monthly charge should be decreased from

31.5 Tk. to 10 Tk.-14 Tk. So here we can see that the pricing for some services should be reduced to retain the consumers.

• For being one of the most preferable brands among the users providing more relevant services is necessary. While asking the sample subscribers about the relevance of the VAS the dissatisfied consumers said the services are less relevant. Some of the consumers said that the news services such as breaking news, stock news, business news, evening news etc. are not relevant at all. Some of them suggested not providing such services that cannot be

delivered in time. So the relevance and contents of the services should be more specific.

• When a customer uses a service s/he wants accurate activation and deactivation. There were many respondents who faced problems in activation/deactivation in many of the VAS service especially the caller tunes, missed call alert, news alerts, call block, mobile back up services etc. Some of the subscribers activated single caller tune while multi caller tunes got activated, some tried to deactivate missed call alert but could not do it even after following proper steps of deactivation, some of them wanted to activate mobile back up and call block services but 46

could not activate it even after trying for several times and contacting with the customer care. So the problem of activation and deactivation is prominent and this problem should be taken in to account and solved as soon as possible.

• Another problem that was faced by the consumers was the connectivity problem of the VAS. There were many services that were not connected properly after activation. in case of caller tunes the tune did not play most of the time, the news alert were activated but one day’s news was generated the next day, the missed call alerts were not received in time as well. So there were problems regarding proper connectivity. Some of the services remained activated even after deactivation. So these problems should be solved by conducting more VAS Labs or

health checks of the Value Added Services.

• The Value Added Services should be promoted more clearly and new innovative as well as useful services should be launched to penetrate the market. The users of the services should be reinforced in a timely manner in order to boost up their usage volume, thus the revenue system. If more innovative services are not introduced, current services are not promoted well then the retaining consumers will be a tough job for Airtel.

• The promotions, especially the Below The Line (BTL) ones should be more target segment oriented. Many consumers had complaints that the promotional messages they get are not relevant and irritating. The language and usage of grammar in the messages should be more accurate because irrelevant promotions can lead to consumer dissatisfaction.

• Some of the consumers said that the website of the company is not updated and while they visit the website for having some information, many of them failed to fulfill their purpose. So the company website should be more updated and the new, innovative and important Value Added Services should be kept in notice of the subscribers.

• While the sample subscribers were asked about the number of times they needed to complain to the customer care, majority of them said that they had to seek help of customer care sometimes. However that complains was not vastly regarding the Value Added Services. Many of them said that the customer service center were not that much effective enough to solve the problem rather they took longer time to work out on the stated issues. So the 47 customer care as well the backend problem solvers should be more effective and spontaneous at times.

• Airtel is famous for its inexpensive nature. It’s known that low cost providing cannot be a permanent solution for any company rather they should go for providing innovative services. However providing innovative Value Added Services may increase the cost to some extent, but if the company tries to impose the expense on the consumers then it will lose the target market. So Airtel should stick on providing services at low, increase the number of

innovative and useful services and reducing the unimportant or less useful ones. Because if the ineffective services can be reduced then providing innovative services at a less cost will be possible and it will not only retain the current consumers but also help to expand the target subscriber base.

Conclusion

Regular market survey and analysis is a fundamental part of the Marketing department of any organization. Especially in the telecom industry it is really important to analyze the problems and expectations of the current subscribers. These studies also facilitate the operator with the planning of new subscribers’ acquisition. As a part of the regular market survey, I carried out this study in order to assess the satisfaction level of the consumers on Value Added Services, where the developments are needed and how the problems can be solved to retain and acquire new customers. In the study, a number of notable findings were got. For instance, compared to the female subscribers, the male subscribers use more Value Added Services and the churning tendency is also higher in the male subscribers. Another remarkable finding is that, even though Airtel came to the telecom industry of Bangladesh after all the other operators, Airtel is the fourth best preferred operator of the subscribers which is quite an achievement for a new entrant like Airtel.

The principal topic of this project was to find out the satisfaction level of the consumers’ on the VAS of Airtel and how their loyalty towards Airtel is related to VAS. With the tabulation and analysis through graphs it has been shown that despite being satisfied with the quality of the VAS, 10% respondents are very likely to switch the operator and despite being highly dissatisfied, 6% respondents are indifferent about migrating to other operator. So, evidently,

Value Added Services are not the only determinants of the retention or loyalty of the subscribers. However, though Value Added Services are not the only determinants of the customer satisfaction and retention, they have influences on these and if proper services cannot be provided then it will tough for the company to be in the competition. So, it can be said that, Value Added Services have influence over the loyalty of the subscribers and therefore, the

company has to be more considerate about the VAS in order to facilitate them with extra privileges and benefits than the other network providers.