For a country like Bangladesh, pharmaceutical sector is a great success story. The market is growing in a spectacular rate. In just five years (from 2010 to 2014) the size of the market almost doubled. Competition is fierce in the market, but since growth potential is still there the pharmaceutical companies are exerting their best effort to gain more market share and be a part of the growth. Sanofi-Aventis Bangladesh Limited is no exception. Along with other strategies like bringing up their own research product to Bangladesh market, they are also trying to win greater share of the generic market. Launching dermatological product portfolio was a decision in congruence to their growth policy. This report was prepared as an internship report to fulfill the program completion requirement of the BBA Program at BRAC University and the training work was done in Sanofi-Aventis Bangladesh Limited. In the training program, firsthand experience was gained regarding pharmaceutical product launching by working in the derma portfolio launching project. The intention of the internship training was to obtain some real world experience by working in a practical environment. Pharmaceutical marketing is a delicate task, product launching is even more. It is such a complex task that, for every marketer in the pharmaceutical sector it’s a challenging experience. The Inter-departmental nature of the jobs makes it extremely interactive. The product manager has to manage so many stakeholders that he has to be very careful about maintaining the balance. Beginning from the initial market analysis

and profit-loss analysis, thorough subjective and objective decision making capabilities are required. Meeting the deadline is always important but it becomes more so in case of product launching.

An efficient communication line has to be maintained between the backward linkage stakeholders (supply chain & production) to the forward linkage stake holders (distribution & sales). Also the task of managing external stakeholders, like vendor management, is involved in many steps of launching. The task of launching a pharmaceutical product launching is critical in the sense that, for the company, it is a step forward to capitalize growth opportunities. Launching is also a critical experience for a product manager: it requires interaction with almost every department of a pharmaceutical company. This is probably the best way of getting an in-depth understanding of

the pharmaceutical marketing job. Being involved in the product launch procedure at SanofiAventis Bangladesh Limited was an enriching experience.

Introduction

Background

Pharmaceutical sector is one of the most thriving sectors in Bangladesh. The 1982 drug ordinance directed the whole industry in such a favorable direction that in the recent years Bangladesh is almost self sufficient in producing medicine. The local drug manufacturers flourished in the last three decades, displacing the multinational pharmaceutical companies form the leading position in the market. The multinational companies are fighting back with a better value proposition and continuing to offer new products. Even though the competition is fierce, the consumers are being benefitted by theses healthy competition among the local and global companies.

Being one of the leading multinational pharmaceutical companies operating in Bangladesh, Sanofi-Aventis Bangladesh Limited is exerting its best effort to become one of the top 5 companies in the country. The company is making new launching of originator products and also generic products to stay in line with the market dynamics.

This report is the study of an upcoming product of Sanofi-Aventis Bangladesh Limited. The new launch ‘Comol’ has been subjected to study to observe and analyze the launching procedure of a pharmaceutical product launching.

Objective of the report

The objective of this report was to find answers to the following questions:

· How new product feasibility study is done in a pharmaceutical company?

· How product launch plan is formulate?

· How the product launching plan is executed?

· What are the findings and analysis?

· What will be the recommendations?

The outcome of the thorough study done during the internship period has been represented and consolidated in this report to fulfill the objective of the report.

Methodology

The report has been prepared on the basis of primary data collected from the real life activity and secondary data collected from publications, and internet.

The collected data were analyzed and consolidated. The data analysis procedure endorsed by the company has been used to analyze data for the report.

Overview

Industry Overview

Pharmaceutical sector is technologically the most developed manufacturing industry in Bangladesh and the third largest industry in terms of contribution to government’s revenue. The industry contributes about 1% of the total GDP. There are about 250 licensed pharmaceutical manufacturers in the country; however, currently a little over 100 companies are in operation. It is highly concentrated as top 20 companies produce 85% of the revenue. According to IMS, a US-based market research firm, the retail market size is estimated to be around BDT 84 billion as on 2011. Two organizations, one government (Directorate of Drug Administration) and one semigovernment

(Pharmacy Council of Bangladesh), control pharmacy practice in Bangladesh. The Bangladesh Pharmaceutical Society is affiliated with international organizations International Pharmaceutical Federation and Commonwealth Pharmaceutical Association.

Bangladesh pharmaceutical companied focus primarily on branded generic final formulations, mostly using imported APIs (Active Pharmaceuticals Ingredient). Branded generics are a category of drugs, including prescription products, that are either novel dosage forms of offpatent products produced by a manufacturer that is not the originator of the molecule, or a molecule copy of an off-patent product with a trade name. About 85% of the drugs sold in Bangladesh are generics and 15% are patented drugs – the structure differs significantly from the

international market. Branded generic drugs represent about 25% on average of worldwide pharmaceuticals sales’; however, given the popularity in emerging markets like China, India and Latin America, branded generic drugs may well dominate the total sales within a decade.

Bangladesh manufactures about 450 generic drugs for 5,300 registered brands which have 8,300 different forms of dosages and strengths. These include a wide range of products from anti ulcerants, flouroquinolones, anti-rheumatic non-steroid drugs, non-narcotic analgesics, 5 antihistamines, and oralanti-diabetic drugs. Some larger firms have also started producing anticancer and anti-retroviral drugs.

Domestic manufacturers account for 97% of the drug sales in the local market while the remaining 3% are imported. This is a complete turnaround over from two/three decades back when imports used to dominate the market. The imported drugs include essential live saving drugs and other high quality drugs. The ratio will further increase in favor of the local production as some of the big players are poised to manufacture these high quality drugs in-house in the future.

As stated earlier, the size of the retail market reached BDT 84.0 billion as on 2011 based on IMS report. The report further stated that, retail sales in the domestic market achieved 23.6% growth in 2011 following 23.8% and 16.8% growth in 2010 and 2009 respectively. High growth in the last three years (78.8% cumulative and 21.4% CAGR) meant that the Bangladesh Pharmaceutical market doubled in just over four years. The retail market also crossed USD 1.0 billion in size in 2011. It is one of the fastest growing sectors in the country with an annual average growth rate of 17.2% over the last five years and 13.1% over the last decade.

However, considering that IMS does not include rural market in their survey, the actual size of the market will vary slightly (5%-10%). It is estimated that the retail market represent 90% of the total market; in that respect the total market size (including the rural market) is expected to be over BDT 90.0 billion at present.

Government spending proportion is much lower than that in other regions – it is one possible area where future growth may come from. Moreover, the total health expenditure to GDP ratio and health expenditure per capita of Bangladesh (both of which gradually increased from 2000) is very low in comparison to developed and developing countries. Since the base is still very low, we expect the recent growth in the local retail market to continue in the current decade. Some other factors that will also boost the industry growth include:

· Increase in number of modern hospitals

· Increase in level of service/treatment provided in the hospitals with improved/more modern diagnostic equipments

· General people are getting more health conscious

· Growing income level of the people

· Export of pharmaceutical product launching

Based on the IMS report for the fourth quarter 2011, Square Pharmaceuticals (DSE: SQURPHARMA) holds the top market share in the retail market – 18.7%, followed by Incepta Pharmaceuticals (INCEPTA) – 9.3%, Beximco Pharmaceuticals (DSE: BXPHARMA) – 8.8%, OpsoninPharma (OPSONIN) – 5.1% and Renata (DSE: RENATA) – 4.9%. The top five companies held 46.8% market share in 2011, slightly more than their 46.2% market holding in

2010 – indicating cumulative revenue growth in excess of the sector growth. Among the top five, three are listed in DSE – Square, Beximco and Renata.

Top 10 companies held 67.7% of the market in 2011 as shown in chart 1. Growth at par with the entire market meant that there cumulative holding did not change from 2010 level. However, the market share shifted among the top players. SQURPHARMA lost 0.5% market share in the last year (from 19.2% in 2010) while the next four companies gained 1.1% market share in the same period. Growth in local sales of these four companies – INCEPTA, BXPHARMA, OPSONIN and RENATA – was 28.5% in 2011, increasing their market share from 27.0% in 2010 to 28.1% in 2011.

Sanofi Worldwide

Sanofi, a leading global pharmaceutical company, discovers, develops and distributes therapeutic solutions. Sanofi is the one of world’s leading Pharmaceutical companies and the largest in Europe. Present in more than 100 countries, with around 11,000 scientists, Sanofi has around 100,000 employees working to improve health and wellbeing. The Global headquarters are in Paris, France.

Sanofi focuses its activities on 7 major therapeutic areas:

• Cardiovascular

• Thrombosis

• Oncology

• Central Nervous System

• Metabolic Disorders

• Internal Medicine

• Vaccines

With more than 25 research centers on three continents, Sanofi coordinates its Research and Development on a worldwide basis. The Sanofi annual R&D budget exceeds four billion Euros and ranks among the three largest budgets of global pharmaceutical industry. Sanofi currently possesses one of the richest and most innovative portfolios in the industry with more than 100 molecules and vaccines in development, half of which are in advanced stages (phases II and III).

The group dedicates its research in finding innovative, effective and safe medicines that provide new therapeutic solutions to patients.

Sanofi worldwide: timeline

Sanofi is the heir to a long history that includes some of the major scientific advances of the nineteenth and twentieth century. In 1718, Laboratories Midy was founded by a family of pharmacists. In 1980, the ClinMidy group was acquired by Sanofi. Laboratories Dausse was founded in 1834 and is Laboratories Robert & Carrière in 1901.

They merged to create Synthélabo in 1970. In 1860 the pharmacist Etienne Poulenc created Wittmannet Poulenc Jeune. And in 1910 it was Rorer’s turn. The two companies eventually merged to form Rhône-Poulenc Rorer in 1990. In 1863, a group of chemists, sales people and workers embarked on the manufacture of dyes in a small factory to the west of the town of Höchst in Germany. This was the origin of the company Hoechst, which merged with Roussel (founded in 1911) to form Hoechst Marion Roussel. In 1887, Marcel Mérieux, a student of Louis Pasteur, founds the Mérieux Biological Institute which, in 2004 became Sanofi Pasteur, the Sanofi’s vaccine division.

The two young groups Sanofi and Synthélabo merged in May 1999 to create a major new pharmaceutical player. Sanofi dates back to 1973 and Synthélabo to 1970. In December 1999, Rhône-Poulenc and Hoechst Marion Roussel formalized their merger with the creation of the Franco-German group Aventis, one of the world’s largest pharmaceutical companies. In August 2004, Sanofi-Synthelabo acquired Aventis. The takeover was finalized on December 31 of that year, giving birth to Sanofi-Aventis. On May 6, 2011, Sanofi-Aventis simplified its name to Sanofi.

Company Overview: Sanofi-Aventis Bangladesh Ltd.

Sanofi-Aventis Bangladesh Limited is the local affiliate of Sanofi. Sanofi is one of the world’s leading pharmaceutical companies which is dedicated to the discovery, development, production and distribution of medicines and vaccines, for all people throughout the world. Sanofi-Aventis is the largest global pharmaceutical company in Bangladesh with a dedicated team of more than 1200 employees.

Sanofi-Aventis Bangladesh Limited is the entity that has been formed due to the amalgamation of three legal entities- Aventis Limited, Fisons (Bangladesh) Limited and Hoechst Marion Roussel Limited. The legal integration process has taken few years after the global merger between sanofi-synthalebo and Aventis in 15 September 2004 and finally the existing three legal entities have amalgamated as Sanofi-Aventis Bangladesh Limited on December 11, 2007.9 The head office of Sanofi-Aventis Bangladesh Limited is in Segun Bagicha, Dhaka. The local distribution of Sanofi-Aventis products are ensured by 12 sales and distribution offices nationwide.

Sanofi-Aventis Bangladesh Limited has a diverse pharmaceutical product launching includes prescription medicines, vaccines and non prescription medicines. Our prescription medicines range across therapeutic areas such as anti-bacterial, respiratory, dermatology, oncology, gastro- intestinal, cardiovascular and other diseases. The company is the market leader in most of the therapeutic categories in which it operates.

They offer a range of vaccines, for the prevention of hepatitis A, hepatitis B, invasive disease caused by H, influenzae, chickenpox, diphtheria, pertussis, tetanus and others. Locally, sanofi-aventis encompasses Sanofi Pasteur, a world leader in vaccines. In Bangladesh, vaccines like TetavaxTM, VerorabTM, Euvax BTM, AvaximTM, ACT-HIBTM,

TyphimViTMetc are included in the portfolio.

Product Overview

Product

One of the upcoming products of Sanofi-Aventis Bangladesh Ltd.: ‘Comol’, is the subject of interest of this report.

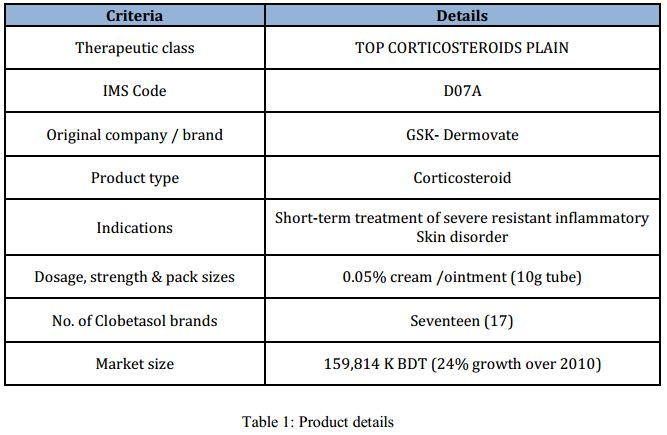

The product is scheduled to be launched on February 2014. Details of the brand are given bellow:

Competitors’ Products

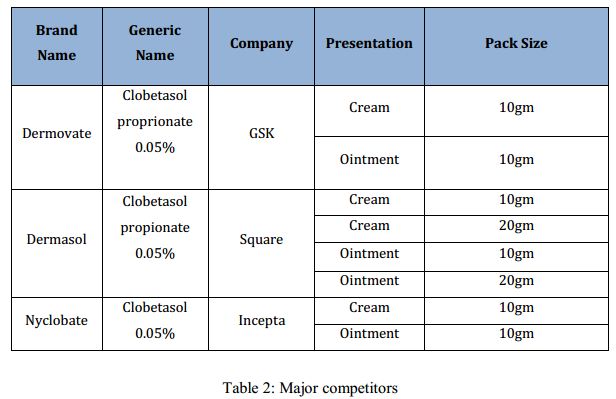

There are currently 17 other cobetasol brand present in the market, which are the direct competitors of the brand ‘Comol’. The major competitors are as follows:

Launch Planning

Launch Planning at Sanofi-Aventis

The initiation point of product launching at Sanofi-Aventis is the NPC (New Product Committee). This committee is headed by the Managing director and consists of the following members: Director Business Operations, Director Specialty Business, Director Business Excellence, Director Supply Chain, and Director Industrial Affairs. This committee continuously analyzes the market information and explores the potential of new products. Any proposal of new launch is initiated by a NPC member in its meeting. If any molecules seem significantly potential in the primary analysis then it is preceded for feasibility analysis.

Market analysis

Based on the available IMS data, market analysis has been done and projection has been done for ‘Comol’ up to year 2015:

This is a primary analysis and the forecast will be adjusted after launching in accordance with market dynamics, product performance and sales force size.

Profit and loss analysis

Based on Sanofi-Aventis internal standard, profit and loss analysis has been done. The analysis shows that product contribution will be positive from year two of launching. Before launching a product, profit and loss analysis is done using the internally standardized format. To assess the potential of a product, a factor called “Product contribution” is calculated.

This factor indicates how launching of a new product will affect the ongoing business. For the first one or two years if a newly launched product contributions with a negative product contribution value, it could be tolerated, given that in the long run (from year 2/3 and onwards) the product will contribute with a significant positive product contribution value. It is expected that in around 5th year of launching the product with contribute with a contribution value of around 50%. This analysis has been done for the brand ‘Comol’ and it has been found that in the first year of launch the product contribution will be negative and in the second year after launching the contribution will be significantly low. But then gradually it will increase to gain a value of around 50% in the fifth year. This analysis shows that the viable option to gain positive product contribution in the long run. The sample calculation presented in this report assumes an introductory sales line of 6 sales people and considering the initial R&D expense gives us an approximate idea of the profit and loss scenario of the newly launched product.

Go-No Go decision

The market analysis of the molecule clobetasol showed that it has a significant market volume in Bangladesh and has a strong growth prospect. Based on the profit and loss analysis it found out that the clobetasol brand will contribute positively to the business. This elaborate analysis enabled the NPC to decide ‘GO’ for a clobetasol brand and the launching responsibility was handed over to the marketing team PCB. The brand name was set to be ‘Comol’.15

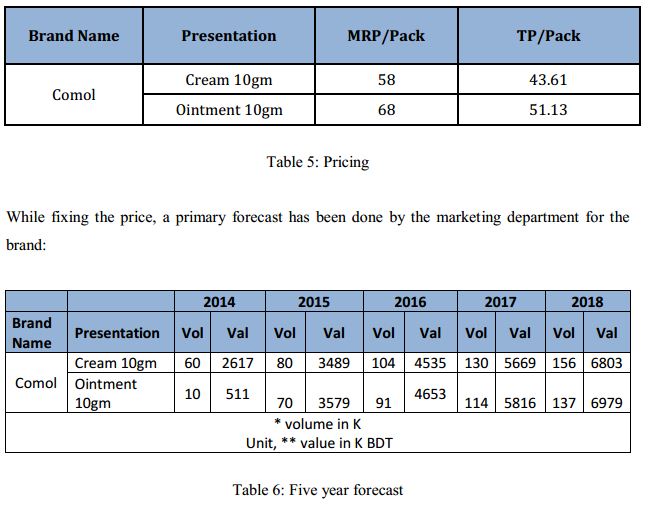

Pricing and Forecast

Pricing of the product is done considering two factors: Gross Profit and competitor’s price. Considering the competitors price, the price of a newly launched product is set in such a way that it would contribute at least 50% gross profit. Significantly higher or lower price than the competitors is highly uncommon in pharmaceutical industry. Only in case of some premium or originators products, price is set at a premium. Since ‘Comol’ is neither a premium product nor an originator’s product, the conventional pricing policy was utilized to set the brand’s price.

The two input factors: COGS and competitors price was he determining parameters here. The price while set equal to the competitors’ price showed to generate significant gross profit. Through elaborate calculation of differing price and yielding gross profit, it was finally decided that the price will not be varied from that of the competitors. The finally decided price of ‘Comol’ is as follows:

Budget allocation

The first step of allocating expense budget is to determine the sales budget of a product. Each year a sales budget is set to be achieved by the business unit. This sales budget acts as the target to be achieved and set by the product manager. This sales budget is then reviewed and finalized after feasibility assessment and the business operations head approves the final sales budget.

Depending on the targeted sales budget, AnP budget (Advertising and Promotion budget) is allotted for a product. The brand ‘Comol’ is not a budgeted product in 2014, meaning it does not have any targeted sales budget which is to be achieved in 2014. So the expense budget cannot be allocated based on sales budget. Since it’s a new launch, special approval expense budget has been allocated for the brand to start promotion in 2014. Form year 2015 and onwards, ‘Comol’ will be a budgeted product (i.e. will have a sales budget, which will have to be achieved by the

business unit) and will have expense budget allocated on the basis of that sales budget.

Pre-launch Activities

Marketing Strategy

A marketing strategy framework was developed for the product ‘Comol’. Listed below are the steps of the marketing strategy framework:

Step 1: Background studies

Through background studies were done to access the necessity of dermatological product of topical corticosteroid therapeutic class

Step 2: Situation Analysis (SWOT)

SWOT analysis helps to identify the opportunities and challenges in the derma market.17

Step 3: Target Audiences

Target audience is identified to consolidate the customer base and develop the proper marketing policies.

Step 4: Marketing Goals

Based on the background analysis, situation analysis and target audience analysis, marketing goals were set.

Step 5: STP (Segmentation-Targeting-Positioning)

Segmentation and targeting was done with through data analysis. Proper positioning was done keeping the target market and consumers in mind.

Step 6: Development of promotional plan

After executing STP exercise, a through promotional plan was developed to convey the positioning statement to the mind of the targeted customers.

Analyzing customer base

Pharmaceutical product launching are different from other products (like FMCG products) in several ways. Among other aspects, customer base is one of the major differentiating factors. In pharmaceutical industry the buyers of the products are not the target-customers of the pharmaceutical companies, the prescribers are. After diagnosing the disease the Physicians prescribes the drug to the patients. In Bangladesh, physicians are free to prescribe any brand of a drug molecule appropriate to the patient’s pathological condition. If a patient is diagnosed with fever, a doctor can prescribe any brand of metronidazole (i.e. Flazyl or Flamid) to that particular patient, as long as he thinks that molecule is the appropriate medicine for the patient. The patient then goes to the chemist shop/pharmacy with the prescription and the pharmacist/chemist fills the prescription with the brand of the drug prescribed by the physician. From this scenario it is evident that the physician directly influences the sales of the brand but the actual purchase is done by the patient. In most of the cases the patient or the pharmacist does not change the brand of the medicine while the actual sale occurs. Exception is observed only in case of some OTC (over the counter) drugs, brand substitution may occur there.

This dynamics must be kept in mind while doing the customer base analysis for any pharmaceutical brand. The brand of interest of this report, ‘Comol’ is a prescription medicine and its’ highly unlikely that prescription substitution will occur in its prescribing-selling process.

That is why; analyzing the prescriber base of the molecule of ‘Comol’ was considered as the appropriate way of getting a clear idea of the Brands customer base.

To analyze the customer base, prescription data obtained from a pharmaceutical market research firm: 4P marketing consultancy was used. 4P marketing consultancy provides weekly prescription survey data to its clients. Sanofi-Aventis is a client of 4P marketing consultancy and gets prescription survey data from them on a periodic basis. The market research wing of the business excellence department of Sanofi analyzes the data in accordance with the need of the business units and disseminates the report to all the BUs.

The derma project also gets the prescription survey data on all existing brands of clobetasol in a weekly basis. This database was utilized to generate target customer analysis report. A one year time period (april 2013 to march 2014) was chosen to be the time frame. The report consisted of around 17000 instances of prescription generation of the relevant brands. From there, 5000 unique doctors were identified and most potential 500 doctors were arranged in a pool to be targeted. This primary report was circulated to the existing sales line of the Sanofi primary care business to verify the details and address of the target physicians. The Regional Sales Managers were allowed to add or subtract name and details of the potential physicians not mentioned in the report, provided that the number of the addition or subtraction will not exceed 10% of the list provide. After receiving the revised list from the regional sales managers, the segmented data base was consolidated to finalize the target doctors.

Segmentation

The most potential prescribers of the molecule, clobetasol (the active pharmaceutical ingredient of the brand ‘Comol’) were analyzed for doctor specialty distribution. The data was analyzed to find out the number of doctors in each specialty segment for the 500 baseline prescribers. From among them the most and the least potential segments were identified. It was observed that the skin and the pediatrics specialty are the most potential segments and the cardio and surgery segments are lest potential segments.

Targeting

From among the segments, the most potential ones were targeted and the least potentials were excluded. To sustain the 500 baseline prescribers, more doctors for the targeted segments were added from the database. The targeting scheme makes the orientation more focused and it will make it easier to position the products in the targeted segments. The targeted doctors segments of ‘Comol’ are the skin specialists and the child specialists.

Positioning

Positioning means the perception build in the mind of the customer about the product. For the product ‘Comol’, the task of positioning was a tricky one. Since there is a very well established brand: Dermovate, is dominating the market, it was necessary to give a simple and precise message to the targeted customer base to develop perception about the brand. It was decided to do the positioning as follows:

“Effective and safe option for psoriasis management”

The specific disease class was targeted and ‘Comol’ was positioned as the effective and safe option to manage psoriasis.

Planning and Developing Promotional Material

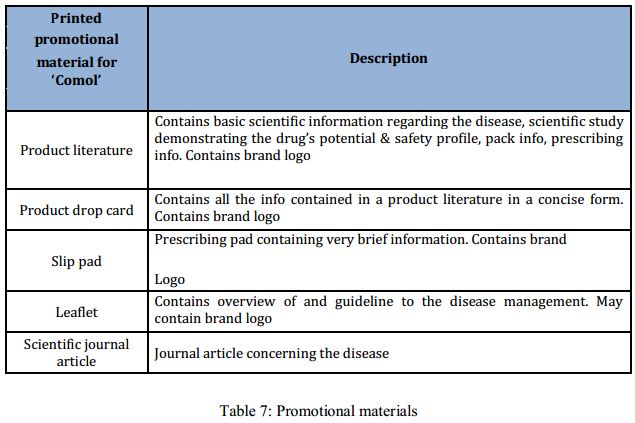

Planning and developing promotional material is a very critical step in pharmaceutical marketing. In case of a launching product, the importance is further stretched since the launching promotional materials are supposed to create the buzz among the target customers, who are habituated to prescribe other brands. For the upcoming brand ‘Comol’, printed promotional materials have been developed for the launching month. Printed promotional materials include literature, drop card, slip pad, leaflet and scientific journal article.

Each and every promotional material has to go through two different scrutiny processes. Internally the Medical and regulatory affairs department of sanofi-aventis accesses the rationale and appropriateness of the promotional material. Then each one has to be approved by the national regulatory body: the Drug Administration.

All the promotional materials prepare for ‘Comol’ has undergone this process and all of them are finally approved to be circulated among the target doctors.

Field Force Deployment

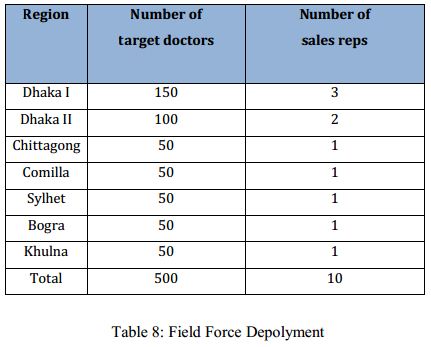

Field force deployment planning was done in accordance with geographic distribution of the target customers. The sales line which will execute the sales activity of the brand ‘Comol’ is the derma sales line. This will be the sales line dedicated to all dermatological brands among which ‘Comol’ is the flagship brand.

In 2013, the derma sales line representatives will be appropriated from and existing sales line of Sanofi-Aventis: the Primary care sales line. This sales line is divided in 7 regions country wide, having a regional sales manager for each region.

The newly appointed sales reps will be reporting to the respective PC-national regional sales manager of his respective region. The Derma business unit will not directly supervise the sales activity. The number of target doctors is not equally distributed among all the regions, in highly potential regions like Dhaka-1 and Dhaka-2 the number of target doctors is more than the other regions.

A single sales representative will be appointed to cover 50 target doctors. According to this policy, Dhaka-I will have 3 reps, Dhaka-II will have 2 reps and all other regions will have a single rep to cover the target doctors. In total, 10 reps will constitute the derma sales line in the launching year (2014). Potential sales reps among the existing regions are being interviewed to be deployed to the derma sales line. The vacancies created by the transfer of reps from the

existing sales line will be filled up by new recruits. Since, derma sales line will promote a whole new portfolio, the experienced sales reps are being transferred from other sales line rather than appointing new recruits.

Developing Training Material

Before launching of any new product, a very important step is to train the sales force properly. If a new product is similar to any existing product (i.e. of the same therapeutic class) it’s easier to execute the training task since the reps are acquainted with the details of the therapeutic class and associated diseases. Thus training procedure of a newly launched antibiotic will be much easier since there are many existing antibiotic products being actively promoted. But the task becomes harder if a pharmaceutical product launching is of a novel therapeutic class.

Since, Sanofi-Aventis is currently not doing active promotion of any dermatological products, sales reps are not acquainted with this type of products. This makes the training process is of much importance for the derma sales line. There are two standard training materials which are developed for each and every launching product. These are as follows:

- Training manual and presentation

- Brand book

Training manual:

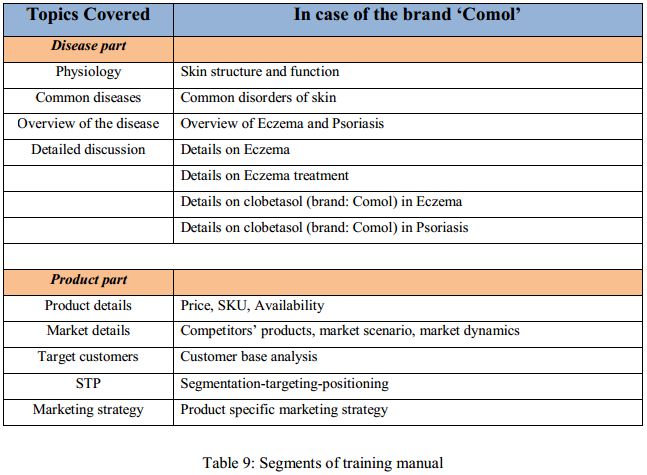

The training manual is a comprehensive guideline to the sales representative. This manual covers a vast array of topics, ranging from basic physiological facts to market details. The manual usually consists of two parts: the disease part and the product part. For the product ‘Comol’ the details of the training manual is as follows:

Based on the training manual a training presentation is prepared which is used in the training sessions of the sales reps.

Brand book:

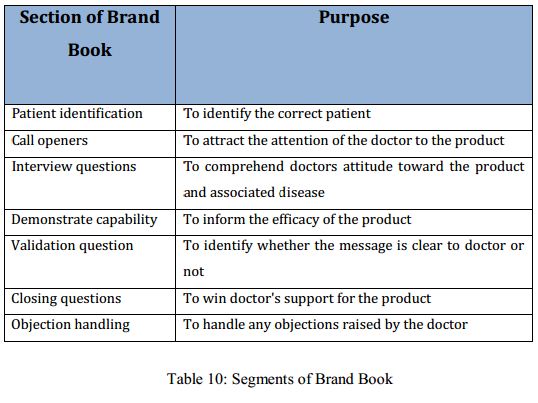

Another important training material is the brand book. The brand book is based on the printed promotional materials. A brand book has been developed for the launching product ‘Comol’. In the printed promotional material the scientific information is presented in a concise manner with aiding visual. In the brand book content of the printed promotional materials are elaborated. The sales reps make call to the doctors to promote the product and the brand books contains instruction covering every aspect of a call. It instructs how to approach the doctor, how to detail the printed promotional material and how to engage the doctor. Probable objections by the doctors are also discussed in the brand book. The common aspects covered in the brand book are:

Launching

When price is approved by the drug administration, factory is ready to manufacture and all the promotional material are finalized then the actual launching operation is initiated. For the brand ‘Comol’, this launching operation will be initiated in the second week of August 2014. There are several steps in the launching operation. These steps are discussed here:

Training program for the sales forces

For every sales line, monthly meeting is held in the beginning of each month. For the derma sales line the first such meeting will be held on the beginning of the launching month (tentative date: August 1, 2014). In this meeting the training of the sales forces will be conducted. Based on the training manual developed, the marketing department will provide training on the following modules:

– Product overview

– Market overview

– Scientific details of the product

– Marketing and sales strategies

In collaboration with the marketing department, the ‘Sales force training department’ will provide training on sales techniques.

Pipeline filling

After the factory produces the first batch of the product, the product manager of the marketing department finalizes the allocation of product to the 13 depots of Sanofi-Aventis all around the country. The allocation is based on the geographic distribution of the target customers. The sales representatives then approach the chemist shops/pharmacies with a launching letter and inform them about the product launching. Then according to the demand from the chemists/pharmacists, supply is initiated. For Comol this pipeline filling action plan has been finalized. Whenever the factory will supply the product, it will be instantly allocated to all the depots and sales personnel will start to approach the chemists/pharmacist.

Initial Communication with target customers

Immediately after executing the pipeline filling task, the first encounter with the target customers (the target doctors) takes place. An informative letter is prepared to be delivered to the doctor by 27 the sales reps in person. The doctors’ letter contains the basic information about the launching product, the diseases in which it is effective and some other briefings about the product. For Comol, the doctors’ letter has been prepared and is scheduled to be distributed to each and every one of the 500 target doctor.

In this first meeting the sales representatives will inform the target doctors about the very essential information about the product: its molecule, indication, relevant patients and price. They will assure the target doctors that the product has been made available in the chemist shops/pharmacies and the product will be available to the patients if it’s prescribed.

Starting the promotional activity

Pipeline filling and initial communication with the target customers will create the ground to formally initiate the promotional activity. The promotional activity of ‘Comol’, like all other pharmaceutical product launching, will be done following a monthly plan, called cycle plan. The cycle plan clearly defines which promotional activity should be carried out when in a specific month. The cycle plan for the launching month of ‘Comol’ has already been developed. To execute the cycle plan, target doctors are arranged in three categories according to their prescribing potential:

- Category ‘A’ doctors: Most potential

- Category ‘B’ doctors: Medium potential

- Category ‘C’ doctors: Average potential

It has been planned that the category ‘A’ doctors will be visited by the sales representatives eight times a month (twice a week). Category ‘B’ and Category ‘C’ doctors will be visited six and four times a month respectively. Each visit will deliver at-least a printed promotional material or a gift. Each visit will generate a strike to the mind of the doctor about the brand. There is also a rough outline of cycle plan developed for the remaining months of 2014. It is expected that the promotional activity of the launching month will create awareness of the brand among the

doctors and analyzing the result the promotional plan of the coming months will be adjusted.29

Post-launching

The post launching activities are out of scope of the report. Only the major activities planned to be performed after launching are listed here:

– Performance monitoring in a monthly basis

– Reviewing the profit loss scenario

– Sales force right sizing

– Reviewing the budget acceding to product performance

Findings and Analysis

During my 3 month long internship program, I have observed that Sanofi-Aventis faces some problems in terms of launching a new product in the market. From my findings, Sanofi faces some obstacles when a new product is to be launched as well as some post launching complicacy. They are as follows:

1) First of all, when a pharmaceutical company produces various medicines, they need the raw materials to produce these. The main ingredients of these medicines can be produced in Bangladesh, but other ingredients which are called ‘Excipient’ such as diluents, disintegrating agents, binding agents, flavoring agents, sugar etc are needed to be

imported from USA or France (Mother Company of Sanofi-Aventis). As it takes time, the entire launching plans delay. Other local pharmaceutical companies import these ingredients from India and China at a lower cost. But multi-national companies like Sanofi are bound to obey the rules.

2) Another problem from my perspective is that Sanofi and other multi-national companies, especially pharmaceutical companies, after producing a medicine they put that product in a quality control process. After producing any medicine, it will be tested via ‘Shelf Life’ process where the medicine will be kept in the shelf for 6 months to check its quality.

After every three months the quality will be checked. After everything is okay, the 30 product will be ready for launching. The whole process is very time consuming. Most of the local companies do not follow these processes.

3) When a new product will be launched, pharmaceutical companies especially multi – national companies need government and many other authorized approvals. These processes are slow as well as time consuming in our country.

4) Pharmaceutical companies often give promotional materials considered as gift items to the doctors and chemists. Now some local companies sometimes offer gifts which would be considered as unethical. As a matter of fact, some doctors become satisfied with the gift despite knowing it is unethical. Multi-national companies like Sanofi have no

permission to do so which puts them at an unfair disadvantage.

5) Another minor problem for Sanofi is when a new drug is being produced; drug stores refuse to take the new drug until the doctors generate prescriptions. On the other hand doctors also become reluctant to prescribe the new drug until it is available in the store. So it becomes almost impossible to motivate both of them simultaneously.

Recommendations

There are some ways to avoid the complicacies which happens when a new product is being launched. As I have done a 3 month long internship program at Sanofi and observed their launching activities, my recommendations for Sanofi would be:

1. Sanofi’s product launching often delays because of having difficulties in maintaining some formalities and multi-national companies have some other criterion. So they should make their product launching program well planned through prior negotiation and discussion so that the launching program could not be delayed.

2. The government should make rules and laws in providing gift materials to the doctors from the pharmaceutical companies. There will be some certain rules about what types of gifts are allowed and what are not allowed for pharmaceutical companies.

Conclusion

Bangladesh pharmaceutical market is growing in a spectacular rate. In just five years (from 2010 to 2014) the size of the market almost doubled. Competition is fierce in the market, but since growth potential is still there the pharmaceutical companies are exerting their best effort to gain more market share and be a part of the growth. Sanofi-Aventis Bangladesh Limited is no exception. Along with other strategies like bringing up their own research product to Bangladesh market, they are also trying to win greater share of the generic market. Deciding to launch the

derma portfolio is one big step in gaining a greater foothold in the generic medicine market. Pharmaceutical marketing is a delicate task, product launching is even more. It is such complex a task that, for every marketer in the pharmaceutical sector it’s a challenging experience. The interdepartmental nature of the jobs makes it extremely interactive. The product manager has to manage so many stake holders that he has to be very careful about maintaining the balance.

Beginning from the initial market analysis and profit-loss analysis, thorough subjective and objective decision making capabilities are required. Meeting the deadline is always important but it becomes more so in case of product launching. An efficient communication line has to be maintained between the backward linkage stakeholders (supply chain & production) to the forward linkage stake holders (distribution & sales). Also the task of managing external

stakeholders, like vendor management, is involved in many steps of launching.

The task of launching a pharmaceutical product launching is critical in the sense that, for the company, it is a step forward to capitalize growth opportunities. Launching is also a critical experience for a product manager: it requires interaction with almost every department of a pharmaceutical company. This is probably the best way of getting an in-depth understanding of the pharmaceutical marketing job. Being involved in the product launch procedure at Sanofi-Aventis Bangladesh Limited was an enriching experience.