1.1 ORGANIZATION NAME

BRAC Bank Limited (BBL)

1.2 LOCATION

Head office: Annex 1

House No-B/115, Block-B, Road-05

Shooting Club, Gulshan-1, Dhaka-1212

Swift: BRAKBDDH

Web: www.bracbank.com

1.3 HISTORICAL BACKGROUND

BRAC Bank is a scheduled commercial bank established under the Banking Companies Act, 1991 and incorporated as a public company limited by shares on 20 May, 1999 under the Companies Act, 1994 in Bangladesh. The primary objective of the Bank is to carry on all kinds of banking business. The Bank could not start its operation till 03 June, 2001 since the activity of the Bank was suspended by the High Court of Bangladesh. Subsequently, the judgment of the High Court was set aside and dismissed by the Appellate Division of Supreme Court on 04 June, 2001 and accordingly, the Bank has started operations from 04 July, 2001.

BRAC Bank has a unique institutional shareholding between BRAC, the largest DFO in the world, the International Finance Corporation (IFC), the commercial arm of the World Bank Group, and Shore Cap International, a concern of Shore Bank Corporation, America’s first and leading community development and environmental banking corporation. A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. Almost 40% of BRAC Bank’s clients had no prior experience with formal banking. The Bank has 313 regional marketing unit offices offering services in the heart of rural and urban communities and employs about 1,200 business loan officers – around 70% of total staff.

BRAC Bank Limited, a full service commercial bank with Local and International Institutional shareholding, is primarily driven by creating opportunities and pursuing market niches not traditionally met by conventional banks. BRAC Bank has been striving to provide “best-in-the-class” services to its diverse range of customers spread across the country under an on-line banking platform.

The reason BRAC Bank is in business is to build a profitable and socially responsible financial institution focused on markets and businesses with growth potential, thereby assisting BRAC and stakeholders to build a “just, enlightened, healthy, democratic and poverty free Bangladesh.” Which means to help make communities and economy of the country stronger and to help people achieve their dreams? We fulfill the purpose by reaching for high standards in everything we do: For our customers, our shareholders, our associates and our communities, upon which the future prosperity of our company rests. As such a career in the BRAC Bank Limited requires one to be versatile, to have genuine love and understanding towards others and to be able to take on different roles.

Remarkably, BRAC Bank, despite being one of the newest Banks in the country, has attained a reputation for being in the forefront of the industry. Our retail business and corporate business have gained new ground over the last two years and today BRAC BRAC Bank began it’s operations with a mind to provide formal banking services to all levels of people in the urban, semi-urban and rural spectrum, and through the nearly 300 unit offices across the country, the Bank has seen that goal a long way through – providing Bangladesh with a degree of service and professionalism that the traditionally underserved class could ever dream of.

The issue manager, in addition to the issuer company, shall ensure due compliance of the above mentioned conditions and shall submit compliance report thereon to the Commission within seven days of expiry of the aforesaid fifteen days time period allowed for refund of the subscription money.”

Since inception in July 2001, the Bank’s footprint has grown to 26 branches, 349 SME unit offices and 37 ATM sites across the country, and the customer base has expanded to 210,000 deposit and 55,000 borrowers through 2006. In the last four and half years of operation, the Bank has disbursed over BDT 2,100 crore in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

1.4 Achievements

- i. Fastest growing bank in the country for the last two years

- ii. Leader in SME financing through 350 offices

- iii. Biggest suit of personal banking & SME products

- iv. Large ATMs (Automated Teller Machine) & POS (Point of Sales) network

2.1 Names of the Founders

- Mr. Fazle Hasan Abed

- Mr. Syed Humayun Kabir

- Mr. Faruq A. Choudhury

- Mr.Md. Aminul Alam

- Mr. Quazi Md. Shariful Ala (Nominated by BRAC)

- Mr. Paul D. Christensen

2.2 characterstics of the Founders

I. The company shall go for Initial Public Offer (IPO) for 5,000,000 ordinary shares of Taka 170.00(one hundred seventy) per share worth Taka 850,000,000.00 (Eighty five crore) following the Securities and Exchange Commission (Public Issue) Rules, 2006, the Depository Act, 1999 and regulations issued hereunder.

II. The abridged version of the prospectus, as approved by the Commission, shall be published by the issuer in four national daily newspapers (in two Bengali and two English), within three working days of issuance of this letter. The issuer shall post the full prospectus vetted by the Securities and Exchange Commission in the issuer’s website and shall also put on the web sites of the Commission, stock exchanges, and the issue manager within working days from the date of issuance of this letter which shall remain posted till the closure of the subscription list. The issuer shall submit to SEC, the stock exchanges and the issue manager a diskette containing the text of the vetted Prospectus in ms-word format.

III. Sufficient copies of prospectus shall be made available by the issuer so that any person requesting a copy may receive one. A notice shall be placed on the front of the application form distributed in connection with the offering, informing that interested persons are entitled to a prospectus, if they so desire, and that copies of prospectus may be obtained from the issuer and the issue manager. The subscription application shall indicate in bold type that no sale of securities shall be made, nor shall any money be taken from any person, in connection with such sale until twenty five days after the prospectus has been published.

IV. The company shall submit forty copies of the printed prospectus to the Securities and Exchange Commission for official record within five working days from the date of publication of the abridged version of the prospectus in the newspaper.

V. The issuer company and the issue manager shall ensure transmission of the prospectus, abridged version of the prospectus and relevant application forms for non-resident Bangladeshis through e-mail, simultaneously with publication of the abridged version of the prospectus, to the Bangladesh Embassies and Missions abroad and shall also ensure sending of the printed copies of abridged version of the prospectus and application forms to the said Embassies and Missions within five working days of the publication date by express mail service of the postal department. A compliance report shall be submitted in this respect to the SEC jointly by the issuer and the issue manger within two working days from the date of said dispatch of the prospectus & the forms.

VI. The paper clipping of the published abridged version of the prospectus, as mentioned at condition two above, shall be submitted to the Commission within 24 hours of the publication thereof.

VII. The company shall maintain separate bank account(s) for collecting proceeds of the Initial Public Offering and shall also open FC account(s) to deposit the application money of the Non- Resident Bangladeshis for IPO purpose, and shall incorporate full particulars of said FC account(s) in the prospectus. The company shall open the abovementioned accounts for IPO purpose; and close these accounts after refund of over-subscription.

3.1 VISION

BRAC Bank vision is to build a profitable and socially responsible financial institution focused on Markets and Businesses with growth potential, thereby assisting its stakeholders build a just, enlightened, healthy, democratic and poverty free Bangladesh.

3.2 MISSION

BRAC Bank will adhere to professional and ethical business principles and internationally acceptable banking and accounting standards.

Every BRAC Bank employee will need a commitment to excellence in all that he/she does, a keen desire for success, a determination to excel and a drive to be the best. We will individually and jointly learn continuously from customers and colleagues around the globe to improve the way we do business, so that we are the best. We will walk that extra mile with enthusiasm and empathy to serve our customers and to solve problems together so that our customers succeed in their business and remain loyal to our Bank. We will set up goals for ourselves and then exceed the goals that we set up. We shall not accept failure.

3.3 GOALS & OBJECTIVES

BRAC Bank will be the absolute market leader in SME business through out Bangladesh. It will be a world – class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank across the globe.

3.4 STRATEGIES

Summed up in a single sentence, our long-term strategy is to go where the market is. The SME market in Bangladesh is large. The report produced by the Shore Bank team, (Ronald Grzywinsky- Chairman & Mary Houghton-President and Lynn Pikholz) and the independent consultant, Kaiser Zaman, indicates that the market size would be overhundreds of billions of Takas. We quote: “As a result of the achievements of the micro-credit providers, Bangladesh now has an hour glass shaped banking market in which credit and other limited financial services are valuable to both very large and very small businesses and very wealthy and very poor individuals. While there is well – known informal system that provides credit to businesses, virtually nothing is available from either banks or micro finance provider to the million the middle – businesses and individual- who are severely constrained in their ability to produce and save for lack of access to financial resources and services. Until modern, competitive financial services are readily available – including credit in amounts, terms and conditions that small can access, Bangladesh will not be able to create the large middle class that is a prerequisite to social stability.” (Ref: www.bracbank.com)

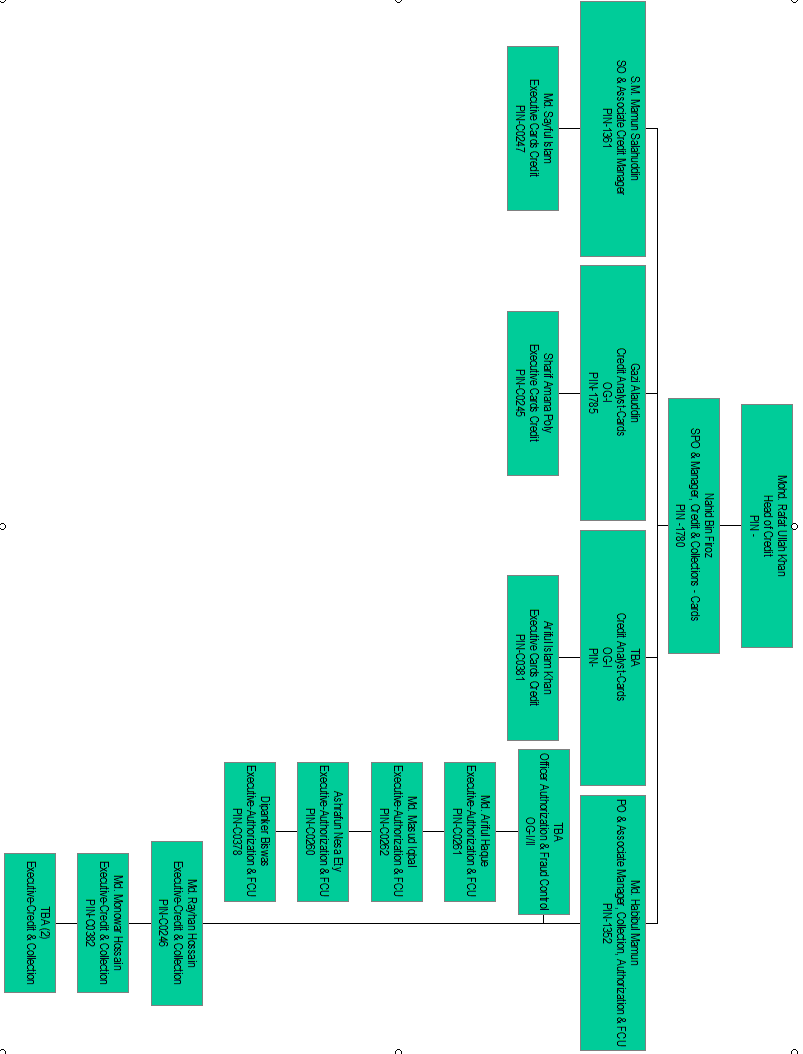

4.0 ORGANIZATIONAL STRUCTURE (ORGANOGRAM of Cards Division)

5.1 MAJOR FUNCTIONS OF BBL

BRAC Bank Limited is a scheduled commercial bank established under the Bank Companies Act 1991 and incorporated as a public company limited by shares on 20 May 1999 under the Companies Act 1994 in Bangladesh. The primary objective of the Bank is to carry on all kinds of banking businesses. The Bank could not start its operations till 3 June, 2001 since the activity of the Bank was suspended by the High Court of Bangladesh. Subsequently, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 4 June 2001 and accordingly, the Bank has started operations from 4 July 2001. At present the Bank has 18 (eighteen) branches, 65 zonal offices and 313 unit offices of SME.

5.1.1 Basis of accounts

The financial statements have been prepared on a going concern basis under the historical cost convention and in accordance with the first schedule (Sec 38) of the Bank Companies Act 1991, Bangladesh Accounting Standard (BAS-30), Companies Act-1994 and the forms of financial statements as prescribed by Bangladesh Bank vide BRPD circular No. 14 dated 25 June 2003.

5.1.2 Loans and advances Particulars

General provision on: Unclassified loans and advances 1%

Small enterprise 2%

Consumer finance for house building loan and loans for professional setup 2%

Consumer finance 5%

Special mention account 5%

Specific provision on: Substandard loans and advances 20%

Doubtful loans and advances 50%

Bad/ loss loans and advances 100%

Interest on loans and advances is calculated on daily product basis, but charged and accounted for monthly and quarterly on accrual basis.

Provision for loans and advances is made based on the period and review by the management and instruction contained in Bangladesh Bank BRPD Circulars No. 16 dated 6 December 1998, 09 dated 14 May 2001, 10 dated 20 August 2005, 19 and 20 dated 20 December 2005 and 8 dated 8 February 2006 respectively.

Interest is calculated on classified loans and advances as per BRPD Circulars No. 16 of 1998, 09 of 2001 and 10 of 2005 and recognized as income on realization.

5.1.3 Fixed assets and depreciation

- Fixed assets have been accounted for at cost less accumulated depreciation.

- Depreciation is charged on straight-line method rates varying from 10% to 33%. Depreciation on fixed assets has been charged in the following month of acquisition. Depreciation on fixed assets disposed off has not been charged in the month of disposal.

- Leasehold premises are written-off over the term of lease agreement and such amortization has been accounted for accordingly on half-yearly basis.

5.1.4 Foreign currency transactions

Assets and liabilities in foreign currencies are translated into Taka at mid rates prevailing on the balance sheet date, except bills for collection, stock of travelers cheque and import bills for which the buying rate is used on the date of the transaction. Gains or losses arising from normal fluctuation of exchange rate are charged to revenue.

5.1.5 Provident fund

Provident fund benefits are given to the staff of the bank in accordance with the registered provident fund rules. The Commissioner of Income Tax, Large Tax Payers Unit, Dhaka has approved the Provident Fund as a recognized provident fund within the

meaning of section 2(52) read with the provisions of part – B of the First Schedule of Income Tax Ordinance 1984. The recognition took effect from 1 January 2003. The fund is operated by a Board of Trustees consisting 11 (eleven) members of the bank. All confirmed employees of the bank are contributing 10% of their basic salary as subscription of the fund. The bank also contributes equal amount of the employees’ contribution to the fund. Interest earned from the investments is credited to the members’ account of half yearly basis. Members are eligible to get both the contribution after 3 years continuous service from the date of their membership.

5.1.6 Foreign exchange risk management

Foreign exchange risk is defined as the potential change in profit/loss due to change in market prices. Today’s financial institutions engage in activities starting from imports, exports and remittances involving basic foreign exchange and money market to complex structured products. Within the Bank, Treasury department is vested with the responsibility to measure and minimize the risk associated with bank’s assets and liabilities.

All treasury functions are clearly demarcated between treasury front office and back office. The front office is involved only in dealing activities and the back office is responsible for all related support and monitoring functions. Treasury front and back office personnel are guided as per BBL core risk management and their job description. They are barred from performing each other’s job. As mentioned in the previous section, ‘Treasury Front Office’ and ‘Treasury Back Offices’ has separate and independent reporting lines to ensure segregation of duties and accountability but also helps minimize the risk of compromise.

Dealing room is equipped with Reuter’s information, a voice screens recorder for recording deals taking place over phone. Counter party limit is set by the Credit Committee and monitored by Head of treasury. Trigger levels are set for the dealers, Chief Dealer and head of Treasury. Any increase to trigger limit of the head of Treasury requires approval from the MANCOM. Before entering into any deal with counter party, a dealer ensures about the counter party’s dealing style, product mix and assess whether the customer is dealing in an appropriate manner.

5.1.7 Prevention of Money Laundering

In recognition of the fact that financial institutions are particularly vulnerable to be used by money launderers. BRAC Bank has established Anti Money Laundering Policy. The purpose of the Anti Money Laundering Policy is to provide a guide line within which to comply with the laws and regulations regarding money laundering both at country and international levels and thereby to safeguard the bank from potential compliance, financial and reputation risk. KYC procedure has been set up with address verification. As apart of monitoring account transaction-the estimated transaction profile and high value transactions are being reviewed electronically. Training has been taken as a continuous process for creating/developing awareness among the officers.

5.1.8 Internal control and compliance

Internal Control is the mechanism in place on a permanent basis to control the activities in an organization, both at a central and at a departmental/divisional level. Management through Risk Management Department controls operational procedure of the bank. Internal Audit and Inspection team under Risk Management undertakes periodical and special audit of the branches, SME Unit Offices and Departments at Head Office for review of the operation and compliance of statutory requirement. In addition to the Internal Audit and Inspection team the Monitoring team conducts surprise inspection at the Branch, SME Unit and the Departments at Head Office as well. The Board Audit Committee reviews the reports of the Risk Management Department periodically.

5.1.9 Asset Liability Management

Changes in market liquidity and or interest rate exposes Bank’s business to the risk of loss, which may, in extreme cases, threaten the survival of the institution. As such emphasize has given so that the level of balance sheet risks are effectively managed, appropriate policies and procedures are established to control and limit these risks and proper resources are available for evaluating and controlling these risks. The Asset Liability Committee (ALCO) of the bank monitors Balance Sheet risk and liquidity risks of the Bank. Asset liability Committee (ALCO) reviews country’s over all economic position, Bank’s Liquidity position, ALM Ratios, Interest Rate Risk, Capital Adequacy, Deposit Advanced Growth, Cost of Deposit and yield on Advance, F.E. Gap, Market Interest Rate, Loan loss provision adequacy and deposit and lending pricing strategy.

5.1.10 Lease rental

Lease hold assets have been accounted for as operating lease and accordingly lease rentals have been charged to revenue in these interim financial statements for the period 1 January 2006 to 31 March 2006. Accounting of leased assets will, however, is done as per BAS-17 “Leases” considering the leases as finance lease in preparing year end financial statements.

5.2 DESCRIPTION OF BUSINESS

BRAC Bank is a scheduled commercial bank established under the Banking Companies Act, 1991 and incorporated as a public company limited by shares on 20 May, 1999 under the Companies Act, 1994 in Bangladesh. The primary objective of the Bank is to carry on all kinds of banking business. The Bank could not start its operation till 03 June, 2001 since the activity of the Bank was suspended by the High Court of Bangladesh. Subsequently, the judgment of the High Court was set aside and dismissed by the Appellate Division of Supreme Court on 04 June, 2001 and accordingly, the Bank has started operations from 04 July, 2001. BRAC Bank has a unique institutional shareholding between BRAC, the largest DFO in the world, the International Finance Corporation, the commercial arm of the World Bank Group, and Shore Cap International, a concern of Shore Bank Corporation, America’s first and leading community development and environmental banking corporation. A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. Almost 40% of BRAC Bank’s clients had no prior experience with formal banking. The Bank has 313 regional marketing unit offices offering services in the heart of rural and urban communities and employs about 1,200 business loan officers – around 70% of total staff. Since inception in July 2001, the Bank’s footprint has grown to 18 branches, 339 SME unit offices and 36 ATM sites across the country, and the customer base has expanded to 210,000 deposit and 50,000 borrowers through 2006. In the last four and half years of operation, the Bank has disbursed over BDT 2,100 crore in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

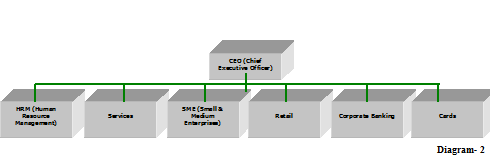

5.3 DESCRIPTION OF VERIOUS FUNCTIONAL DEPARTMENT

BBL activities are performed through functional departmentalization. So, the departments are separated according to the functions they perform (HR, Personal Banking, etc.). There are 6 major functional departments at BBL: Human Resources, Services, Small and Medium Enterprises (SME), Retail, Corporate Banking and Cards. Within these major departments there are some other subsidiary departments that allow smooth operation of their own major departmental function. A graphical presentation of all the departments is shown in the following page. A brief functional description of these departments is discussed below:

Functional Departments of BBL (BRAC Bank Limited)

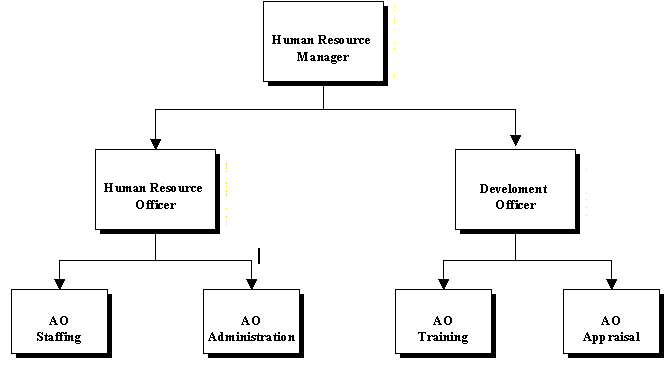

5.3.1 Human Resource Department

The Human resource Manager heads this department. The major functions of this department are Recruitment, Training and developments, Personnel Services and Security. The HR department is much concerned with the discipline that is set up by the BBL group. BBL group has got strict rules and regulations for each and every aspect of banking, even for non-banking purposes; i.e. The Dress Code. All these major personnel functions are integrated in the best possible way at BBL, which results in its higher productivity. The Human resource officer monitors the employee staffing and administration activities. The Training officer supervises Training, development & rotation activities. The structure of the HR department is shown below:

Structure of Human Resource Department

Recruitment, Training and Development

BBL Bangladesh limited follows a standard procedure for recruitment and selection. However there is no set time period when this recruitment and selection takes place. Each Departmental head places the requisition for recruitment to the Human resource officer, if any vacancy is created due to (1) Retirement, (2) Resignation (3) Death, or (4) Extra work load.

The process for the recruitment of personnel for managerial and non-managerial level differs slightly but the basic steps are same in both the cases. The steps are-

- Initial Screening

- Screening by Departmental Heads

- Filling of the BBL Job Application Form

- Screening on the basis of SAF

- Initial Interview

- Selection for written test

- Written test

- Evaluation of test papers

- Selection of Final interviewees

- Final interview

- Documentation Check

- Medical Examination

- Probationary Appointment

- Confirmation

In order to enhance the efficiency of the employees, BBL gives emphasis on the both theoretical and practical training for its personnel. All the training and development programs are aimed at two basic reasons – (1) skill development (2) motivation through counseling and persuasion to change value system. For the top management or senior Managers there is provision for overseeing training arranged by BBL group. For the mid-level manager or other managerial level there is provision for regional training courses. Besides, for non-management level there are training programs arranged in different institution and also with in the organization. For the operatives, various on the job-training program are conducted within the company. Finally, BBL follows a performance based promotion system for all levels of its employees.

Performance Appraisal

The company follows both rating and descriptive systems for the performance appraisal. Although the appraisal system is non-participative but the employees are annually assessed with a joint consultation with their immediate supervisor and departmental head.

Rating is mainly done on the following factors-

- Knowledge of work

- Accuracy and Reliability

- Speed

- General intelligence

- Sense of responsibility and duty

- Diligence

- Initiative and self confidence

- Readiness to work for and with others.

Welfare Activities

BBL has many well-structured welfare policies for its employees. These include well-structured wage & salary policy, medical facility, sports & cultural facilities, provision for loans at a minimal rate, free uniform etc. These welfare policies aim at strengthening the relationship of the employees to the organizations and make them more responsible in their respective positions.

5.3.2 Services Department

This is an integral and vital part of the bank. The services department ensures smooth operation and functioning within and between all the departments of BBL. It also provides continuous support to the core banking activities of BBL. The Manager of Services heads this department who formulates and manages various critical issues of the services function of BBL. He is followed by a group of executives who are the heads of various subsidiary divisions that operate within the services department. The services department is considered as the backbone of all other departments. The various subsidiary divisions within this department are Administration, IT, Internal Control (IC), Network Services Center (NSC), and HUB.

ADMINISTRATION

Like that of any other organizations, the Admin department of BBL makes sure that the organizations moves on with all its departments and staffs operating according to all the rules and regulations of the company. It also prevents any bottlenecks within the work process and ensures smooth functioning. The admin department has two divisions – general administration and Business support services.

The general admin division is pretty much similar to the admin departments of other companies that ensure discipline and regulatory concerns. The business support services provide supports to the departments during employee leaves and sudden terminations so that the department can function without problems.

IT

This department gives the software and hardware supports to different departments of the bank. As BBL is engaged in online banking, the role of IT is very crucial for the bank. This department is the most active department of BBL where employees always stand by to solve any problems in the system. The managers and executives of IT division work continuously to develop the total IT system of BBL so that it can be operated with ease, accuracy and speed.

INTERNAL CONTROL

BBL has internal auditors who visit on regular basis and submit the report to the higher authority for audit purposes. This gives different departments the chance to know their mistakes and take necessary corrective actions. Again, the Bank annually administers a company wide audit program to evaluate the overall performance of the bank in Bangladesh.

NETWORK SERVICES CENTRE (NSC)

This department can be described as the ‘Power House of BBL Bangladesh. NSC does the back office job for the bank. The main four jobs that are performed by NSC are Clearing, Scanning of signature cards, issuing checkbooks and sending & receiving Remittances. NSC looks after the clearing process of BBL and makes necessary contact with the central bank for maintaining account flows. All the customer signatures are scanned in this department and are entered into the system. NSC also issues checkbook for new and old accounts based on requisition from various branches. ‘Remittance’ is a banking term, which means ‘Transfer of funds through banks’. When a bank remits on behalf of its customers, it is termed as outward remittance. On the other hand, when the bank receives the remittance on behalf of the bank, it is inward remittance. The following are the methods that NSC used to remit money for customers: Telegraphic Transfer (TT), Demand Draft (DD) & Cashier’s Order.

5.3.3 Small & medium enterprises (sme)

BBL has established strong infrastructure for SME financing all over the country. Data as on 31st March 2006 show total number of zonal and unit offices stood at 51 and 285 respectively. There are 652 customer relationship managers and 7 territory Managers. BBL is the market leader in SME financing. Total number of staff in SME stood at 686 as on 31st March 2006. Disbursement in SME financing has been increasing significantly. SME five years Business Plan provides the road map of maintaining the leadership position of BBL. At present, Government and Non-Government supports for promoting SME in Bangladesh encouraged different banks for participating more in SME financing. The experience in SME financing provided BBL strategic strength to maintain its growth of assets by extending its network in untapped areas in the country.

The most valuable natural resource of Bangladesh is its people. As a nation we struggled for our independence and now the attainment of economic uplift is the main goal. Micro lenders are working here in the financial field, providing very small amount and on the other hand regular commercial banks have been providing bigger amount of loans to larger industries and trading organizations. But the small and medium entrepreneurs were overlooked. This missing middle group is the small but striving entrepreneurs, who because of lack of fund cannot pursue their financial uplift, as they have no property to provide as equity to the commercial banks. With this end in view-BRAC Bank was opened to serve these small but hard working entrepreneurs with double bottom line vision. As a socially responsible bank, BRAC Bank wants to see the emancipation of grass-roots level to their economic height and also to make profit by serving the interest of missing middle groups. 50% of our total portfolio usually collected from urban areas, are channeled to support these entrepreneurs who in future will become the potential strength of our economy. We are the market leaders in giving loans to Small and Medium Entrepreneurs. We have been doing it for the last five years.

Small & Medium Enterprise (SME) Product Details

Ananya

This business loan is offered for the expansion of small- and medium-sized trading, Manufacturing, Service, Agriculture, Non–farm activities, Agro-based industries etc. with a valid trade license and in operation for at least 1 year. The size of the loan amount is between Tk. 3 lac to Tk. 8 lac. ( Ref: www.bracbank.com)

Apurbo

This business loan is offered for the expansion of small- and medium-sized trading, Manufacturing, Service, Agriculture, Non–farm activities, Agro-based industries etc. with a valid trade license and in operation for at least 3 years. The size of the loan amount is between Tk. 8 lac to Tk. 30 lac. ( Ref: www.bracbank.com)

Educational institution (Pathshala)

The loan is offered to educational institutes (School/College/University) that has been in operation for at least 3 years, for loans upto Tk. 5 lac, or at least 5 years, for loan in excess of Tk. 5 lac. The loan is provided for the purchase of any fixed assets, infrastructure development, or shifting to a new address for any government recognized educational institution. The size of the loan amount is between Tk. 3 lac to Tk. 30 lac. ( Ref: www.bracbank.com)

Health service provider (Aroggo)

This loan will be provided for health service providers i.e. clinics; diagnostic centers located around the unit offices towards the purchase of relevant medical equipment. The medical centre should have permission to operate and be in operation for at least 2 years. Doctors with at least five years of experience in the profession may also apply for this loan. The size of the loan amount is Tk. 3 lac to Tk. 30 lac, of which Tk. 9.5 lac in loans may be disbursed collateral-free. ( Ref: www.bracbank.com)

Digoon Rin

Digoon Rin is a loan facility for Small and Medium enterprises. Entrepreneurs with 2 (two) year’s experience in Small and Medium sized trading, manufacturing, service, agriculture, non-farm activities, agro-based industries etc. located surrounding the branches of BRAC Bank in Dhaka, Chittagong, Sylhet, Narayangong, Dhaka EPZ and Sonagazi (Feni) can avail this loan facility. To get the benefit of ‘Digoon Rin’ facility the enterprise has to provide 50% cash security (BRAC Bank FDR) of the loan amount. One can get the loan from Tk. 5 lac to Tk. 30 lac. The product offers terminating loan facilities for working finance and fixed asset purchase under equated monthly installment and/ or a single installment based repayment plan. ( Ref: www.bracbank.com)

Prothoma Rin

“PROTHOMA RIN” is a loan facility for small and medium sized trading, manufacturing, service, agriculture, non-farm activities, and agro-based industries etc. which are operated by women entrepreneur. The product offers terminating loan facilities for the purpose of working capital finance and/or fixed assets purchase. Eligibility –

Entrepreneurs aged between 18 to 55 years, Entrepreneurs with minimum 2 years experience in the same line of business, Minimum 1(One) year of continuous from minimum BDT 3 lac up to maximum of BDT10 lac. ( Ref: www.bracbank.com)

5.3.4 retail

Retail is the most flourishing department of BBL Bangladesh. This department basically deals with the management of products and services offered to the in individual consumers. Within a span of only seven years, BBL Retail has grown tremendously and is still growing with its innovative products and service offerings. Manager of retail is the person behind the astounding growth of Retail department in BBL Bangladesh. Chief of Retail manages and supervises the Personal Banking activities of the branch network of BBL Bangladesh.

LOAN PRODUCTS:

Car Loan

BRAC Bank offers easy, customer-friendly car loans for customers who wish to purchase either a brand new car or a reconditioned one. All BRAC Bank account holders aged between 21 and 65 are eligible to apply. The loan can be repaid over a maximum of 4 years through equal monthly installments (EMI).

- No down payment.

- BBL offers the highest loan amount in the market, going up to Tk. 2,000,000 in some cases.

- There is a low processing fee.

Teachers Loan

The Teachers Loan is an “any-purpose” loan offered to a teacher permanently employed at an educational institute for at least three years. The customer is eligible for a loan up to 10 times his or her current monthly salary without a requirement for security.

Repayment can be made in equal monthly installments for 1 to 4 years.

NOW Loan

The Lifestyle loan is provided for the purchase of consumer durable items such as electronic goods, furniture, computers, music systems, communication machine and other household items. All BRAC Bank account holders aged from 21 to 65 and people from all income groups, whether salaried employees or self-employed business persons, are eligible to apply. NOW Loan amounts vary from Tk. 15,000 to Tk 5 lac and are repayable through equal monthly installments (EMI) for 1 to 4 years.

Secured Loan/OD

Special schemes are offered by the Bank that allows customers to avail cash at nominal interest rates. The security is kept untouched in Bank’s custody and the value grows. All BRAC Bank account holders aged from 21 to 65, people from all income groups – salaried employees and self-employed business-persons – with security in their possession are eligible to avail these facilities.

The maximum amount can go up to Tk. 5 crore, and customers may avail the facilities in single or in joint names. BBL allows loans for up to 100% of the value of the securities (conditions, however, apply). In case it is an overdraft, the customers repay only interest at quarterly intervals. In case it is a Loan, the customer is allowed to choose between the quarterly repayment option and the monthly installment option.

Unsecured Personal Loan

This is a package specially designed for salaried employees; eligible customers are offered this “any-purpose” loan without any security. Employees of multinational companies or local corporate bodies; also employees of midrange companies, govt. officials and self-employed business-persons are eligible to apply. Customers may apply for up to 8 times gross salary or 5 times gross monthly income (maximum Tk. 5 lacs) as loan repayable through equal monthly installments (EMI) for 1 to 4 years.

Credit Card Loan

Customers holding a credit card from any financial institution, for at least 1 year, may apply for this loan. Customers with a minimum credit limit of Tk. 40,000 on their credit cardare being eligible for the loan. The Credit Card Loan offers loan up to 5 times the credit card limit on the card.

Salary Loan

Salary loan is offered to facilitate salaried individual working in Bangladesh. Any individual earning a gross monthly salary of Tk. 10,000 may avail the Salary Loan. The Salary Loan requires no security and the customer may receive up to 15 times of his/her gross monthly salary for a maximum of Tk. 15 lac. The Salary Loan is due in convenient Equal Monthly Installments (EMIs) over a period of 12 months to 60 months.

5.3.5 Corporate Banking

This division of BBL provides financial services to organizational clients. Whether it is locally or around the nation, BBL offers a comprehensive range of services that can be tailored to the individual needs of the company. Two offices of BBL offers corporate banking services to corporate clients. These are the Dhaka Head Office and Chittagong office. Corporate Banking of BBL includes Corporate Institutional Banking (CIB). These sub-divisions are discussed briefly in the following sections:

Corporate Institutional Banking (CIB)

Operating through the major centers and in close liaison with BBL Investment Bank, Corporate and Institutional Banking provides the full range of the Group’s capabilities at nationwide, with a particular focus on payments and cash management, trade and securities custody. BBL also offers local financial institutions and banks access to wide range of financial services available on countrywide. The services are tailored to suit the needs of the companies. CIB has a separate wing: Relationship management department. This is discussed below:

Relationship Management Department

The RM department consists of various relationship managers who are assigned to different corporate client to better satisfy their needs. These RM’s communicate with the clients and are solely responsible for the companies they deal in. Any information regarding a corporate client must be communicated through the respective RM assigned to that corporate client. A relationship manager may be assigned more than one company and this decision depends on the Head of Corporate Banking.

5.3.6 cards

This department just started it journey officially at February 6th 2007 in Bangladesh. This department has different wings – sales, customer services, credit, operations, acquiring and portfolio management. BBL Cards division is mainly operated by the senior manger and first assistant president, Mamun Rashid. Some other mangers working under him are as follows who are in charge of different wings; sales-Imran Habib, acquiring-Khandaker Bappy, customer services-Sazzad Hossain, operations-kabir Ahmed, credit-Nahid Bin Zafar, portfolio management-Masuma Yesmin. Under sales there are MIS (management information system), TELE Sales, Direct sales, retention unit.

In these are the major departments of BBL Bangladesh. Except the branches all other departments are situated at BBL Bangladesh head offices located at Annex Building 1, Shooting Club, Gulshan 1. Most of BBL’s operation and activities are operated centrally from the head office. But to deal with customers more completely, the branches are given considerable authority and they operate in a more decentralized manner but subject to verification of the respective departments.

6.1 INDUSTRY ANALYSIS

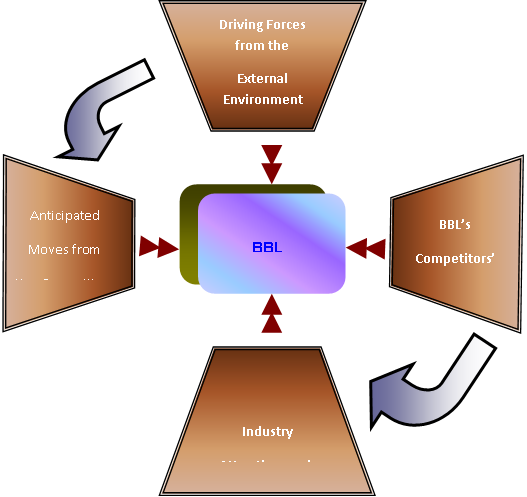

Industry analysis builds on customer & competitor analyses to make more strategic judgment about a market & its dynamics. Porter’s approach can be applied to an industry, but it can also be applied to a market or sub-market within the industry. The basic idea is that the attractiveness of an industry or market as measured by the long-term return investment of the average firm depends largely on five factors.

Micro Environment of BRAC Bank Limited

Rivalry among existing competitors

The rivalry among the competitors and the growth in the industry depends upon the intensity of competition. A high amount of competition is observed in the banking sector of Bangladesh. There are more than 50 commercial banks in Bangladesh that fight for there own share of the market. The national banks have the highest banking network in Bangladesh. They compete against the banks with their low cost of operation and government support. Again, Standard Chartered bank is the largest multinational banking network in Bangladesh that has its network in many metropolitans of Bangladesh. There are other international banks that also take part in the competition and are aggressive in nature. This HIGH INTENSITY of competition makes companies difficult to sustain in the long run.

Threat of new entrants

The next force highlights the possibility of new competitors entering the market. Existing firms may try to discourage new competition by aggressive expansion & other types of entry barriers. The banking sector of Bangladesh seriously faces the threat of new entrants. However the threat comes from two DIRECTIONS. The first threat comes with the arrival of the multinational banks and her branch expansion particularly due to the booming energy sector. Secondly, the continuous entry of local banks with lower cost structure also POSES a severe threat to this industry.

In the context of BBL the various new & upcoming Banks pose a significant threat, being new entrants in the banking sector of Bangladesh. But BBL is aware of these potential competitors and is trying to expand countrywide to make the sector unattractive & to create entry barrier.

Threat of substitute products

This force considers the potential impact of substitutes. New products that satisfy the same customer needs are important sources of competition including alternative products in the definition of product market structure identify substitute forms of competition.

BBL continuously faces the threat of various substitute products launched by its strong competitors in the market place. For example, the launch of premiere banking by SCB poses a strong threat on BBL’s premium customer group and BBL is at a condition where it should launch an even better product. More over the various consumer credit schemes offered by various local banks with lower interest rates and cost also pose a strong threat on the BBL personal banking products. Again the lower service charges at national banks also discourage a wide group of customers to hold account in BBL. These are some of the threats posed by substitute products in the market place.

Bargaining power of suppliers

The fourth force is the power of suppliers that may have impact on the producers in an industry. Companies may pursue vertical integration strategies to reduce the bargaining power of suppliers.

In the context of BBL, suppliers are those customers and organizations that provide financing to the firm via depository schemes. If the cost of financing rises, then BBL will have to increase the interest rate that it charges to its customer in order to remain in the business. This may result in severe customer dissatisfaction & as a result poor profitability. BBL is aware of this devastating situation.

Bargaining power of buyers

Finally, buyers may use their purchasing power to influence the producers or service providers. Understanding which organizations have power & influence in the distribution channel provides important insight into the structure of competition.

In the banking sector of Bangladesh, customers have a strong bargaining power since there a large number of commercial banks providing similar services. Customers have a wide range of options in deciding where to bank. They can either go for the Multinationals or turn to new local banks for getting quality service. Others may also consider the national banks for large credit facilities. Therefore banks have to pursue the customers with attractive interest rates and provide them with tailor made customized services in order to attract the customer or hunt depositors.

In the context of BBL, the firm is more or less free from the cope of the bargaining power of the buyers. BBL has its own policies to carry out its operations & employees follow those rules to deal with the customers. But too much rigidity of the prevailing policies when to deal with the clients may under cut its client base as well as profitability. To overcome this worst scenario – a positive & personalized approach to the needs of customer – has become BBL’S motto.

6.1.2 swot aNALYSIS OF BBL

strengths

| Strong Corporate Iidentity | BBL is the leading provider of financial services nationwide. With its strong corporate image and identity it can better position in the minds of customers. This image has helped BBL grab the personal banking sector of Bangladesh very rapidly.

|

| Distinct Operating Procedures | BBL in known nationwide for its distinct operating procedure. The company’s Managing for Value strategy better satisfy customers needs and also keeps the firm profitable. |

Efficient Performance | The selection & recruitment of BBL emphasizes on having the skilled graduates & postgraduates who have little or no previous work experience. The logic behind is that BBL wants to avoid the problem of ‘garbage in & garbage out’. & This type young & fresh workforce stimulates the whole working environment of BBL.

|

| Young Enthusiastic Workforce | The human resource of BBL is extremely well thought & perfectly managed. As from the very first, the top management believed in empowered employees, where they refused to put their finger in every part of the pie. This empowered environment makes BBL a better place for the employees. The employees are not suffocated with authority but areable to grow as the organization matures.

|

Companionable Environment | All office walls in BBL are only shoulder high partitions & there is no executive dining room. Any of the executives is likely to plop down at a table in its cafeteria & join in a lunch chat with whoever is there. One of the employees has said, “IT’S exciting to know you maysee & talk to the top management at any time. You feel a part of things”.

|

| No Communication Barriers | BBL has tried hard to avoid communication barriers & structural bureaucracies. The little existence of authoritative barriers among the different level of management stimulates a feeling of importance as their workget priority over the position.

|

MBO | BBL also has Management by Objectives (MBO) everywhere. Each person has multiple objectives. All the employees must have to get the approval of their bosses on what they are going to do. Later they review as how well they have performed their job with their management as well as the peer group.

|

| Modern Equipment & Technology | BBL owns the best banking and information technology equipments in Bangladesh. It ultra modern banking systems starting from terminal pc’s to HUB’s are based on the international banking standards and are the latest. |

WEAKNESSES

Absence of Strong Marketing Activities | BBL currently don’t have any strong marketing activities through mass media e.g. Television. TV ads play a vital role in awareness building. BBL has no such TV ad campaign.

|

Lack of Customer Confidence | AS BBL is fairly new to the banking industry of Bangladesh average customers lack the confidence in BBL and judge the bank as an average new bank.

|

Too Many Contract Workers | BBL has contract workers who lack the commitment with superior quality service and also are pretty dissatisfied as being a contract worker. This hampers the bank’s service quality as a whole.

|

OPPORTINITIES

High Demand of Housing Loans | Since housing is one of the basic needs of people, there is a high demand of housing loans. BBL personal banking division can focus on this category of products and grab these segments of customers.

|

Distinct Operating Procedures | BBL is noted for its distinct operating procedures. Repayment capacity as assessed by BBL of individual client helps to decide how much one can borrow. As the whole lending process is based on a client’s repayment capacity, the recovery rate of BBL is close to 100%. This provides BBL financial stability & gears up BBL to be remaining in the business for the long run.

|

Countrywide Network | The ultimate goal of BBL is to expand its operations to whole Bangladesh. Nurturing this type of vision & mission & to act as required, will not only increase BBL’s profitability but also will secure its existence in the log run.

|

More Experienced & Managerial Know-how | The top management team of BBL is expert in banking activities. The operating policies established by them are unique & unified. They equally contributed to BBL’s superior leadership, by carrying out their unique roles. They worked well together, respecting each other’s abilities, & arguing openly & without any rancor when they disagree.

|

THREATS

Upcoming Banks | The upcoming private local & multinational banks posses a serious threat to the existing banking network of BBL. it is expected that in the next few years more commercial banks will emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against and win the battle of banks.

|

Lose of Customers | Absence of various products such AS HOUSING loans are causing various customers to detract from BBL. This is a serious threat for BBL Bangladesh.

|

Moderate Levels of Customer Satisfaction | BBL should continuously improve its customer service strategies and the overall service quality needs to win the customer satisfaction undoubtedly.

|

Default Culture | As BBL is a very new organization, the problem of non-performing loans or default loans is very minimum or insignificant. However, as the bank becomes older this problem will arise enormously and the bank may find itself in a more threatening environment. Thus BBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

|

7.1.1 STRATEGIC ISSUES

Definition of the Product

The card division of BBL offers three types of cards:

- i. MasterCardGold

- ii. MasterCardSilver

- iii. Visa Silver

And it is also very good news for all of us that this bank is going to be issuing the International US$ card from coming February. It was experimentally approved and the system is functioning.

Based on income criteria (TK. 10,000 at least) all three types of cards are given to the people. In order to have the Visa or the MasterCard one should have at least TK.10, 000 monthly incomes and the highest limit of these cards are below 1 lac. The Gold card’s range starts with minimum of TK. 1 lac.

A secured credit card called Fast Card is issued against lien over on – bank deposit account (Savings, FDR, Current, and STD) or govt. approved savings certificates.

Credit card holder payments are accepted at all the 15 branches across the country. Manual payment toward the card account can be made through cash, cheque and debit instruction. Manual payment is automatically posted in to the card account if the auto debit is availed.

OFFENSIVE strategy to gain market share

BBL uses various approaches or strategies to gain more and more market share (capturing new market, taking over the customers of their competitors).

defensive strategy to prodect market share

BBL uses various approaches or strategies to hold on to their existing customers which is taken care by the retention unit.

increase asset with the increase of customer account

BBL is increasing its asset through Savings, FDR, Current, and STD which they are getting through more and more new customer accounts.

know the customer need and fullfill it

BBL trying to figure out the need if its’ customers and fulfilling it through introducing different new products and VAS (value added services).

come up with new product line or new product

In some cases BBL is coming up with completely new products and product lines which is another strategy to grab more and more customers.

cross-sell opportunity

BBL providing their credit cards to two different types of customers; one – who are their existing customers (already have a hank accounts or FDR, savings) another one – completely new, which usually BBL pick up through references. The existing customers are known by the name Pre-Approved customers and the new ones are known by the name Fresh customers. In the case of Pre-Approved customers since they are getting the Cards due to their pre attachment with BBL it is where BBL is using the cross-sell strategy. BBL has got another type of customers name Bundle products where these customers are those who has taken loan from BBL.

7.1.2 OPERATIONAL ISSUES

Operational issue is a showing of something—such as a variable, term, or object—in terms of the specific process or set of validation tests used to determine its presence and quantity. Properties described in this manner must be publicly accessible so that persons

Other than the definer can independently measure or test for them at will. Operational definitions are also used to define system states in terms of a specific, publicly accessible process of preparation or validation testing, which is repeatable at will. For example, 100 degrees Celsius may be crudely defined by describing the process of heating water until it is observed to boil. An item like a brick, or even a photograph of a brick, may be defined in terms of how it can be made. Likewise, iron may be defined in terms of the results of testing or measuring it in particular ways.

Organizational structure

Responsibilities, authorities and relations organized in such a way as to enable the organization to perform its functions. Organizational structure is use of a new organizational form. Organizational structure is an overall way to identify many examples of organizational structures. Organizational structure is lines of authority and responsibility. Organizational structure is the division of authority, responsibility, and duties among members of an organization. Organizational structure is the way in which the interrelated groups of an organization are constructed. The main concerns are effective communication and coordination. BBL has managed to cope up with the organizational structure as per the global standard which has been leading them to the path to success.

process flow

Process flow is the passing of execution of a process from one process step to the next. It may include the passing of information or materials from the first step to the second. Process flow a set of process steps and order for performing the process steps to produce a desired result. Process flow is process modeling, and is designed to capture the temporal and logical aspects of “how you do it”. BBL has managed to cope up with the process flow as per the global standard which has been leading them to the path to success.

Delegation of authority & accountibility

Accountability for the management of financial resources is delegated by the Chancellor to the organizational heads (Department heads) of functional units on campus, e.g., administrative and service departments such as accounting, purchasing, personnel, and storehouse, or the heads of academic departments. Accordingly, the Department heads are responsible for safeguarding University resources by establishing and maintaining sound business controls that are designed to deter and detect any potential misuse of resources. To ensure that proper controls are in place, responsibility for departmental transactions must be divided among at least two individuals in a department, the preparer of the transaction and a reviewer (the Department head or a designee). If a department is too small to have adequate separation of duties, a larger administrative unit should be involved to provide the required separation.

Delegations of authority are made by Department heads to authorize specified individuals in their departments to initiate, process, and review business transactions. Some type of paper or electronic signature authorization form is customarily used for this purpose. The following qualifications are recommended for individuals who are delegated signature authority:

- Active involvement with the activity being conducted;

- A working knowledge of the banks budget process.

- The technical skills required to use the administrative application systems involved in conducting the activity;

- Familiarity with the policies, rules, laws, regulations, and other restrictions on the use of funds sufficient either to ascertain compliance or to seek additional assistance when required; and

- Authority to disallow a transaction without being countermanded or subject to disciplinary action.

7.1.3 LEGAL ISSUES

nationality

BBL account holder or credit card holders’ nationality has to be Bangladeshi (by passport).

kyc (Know Your Customer) policy

Customer acceptance criterion- Interview the customer by bank official and review of customer background, documents required for individual /corporate Account Open -for identification the customer, address verification-supporting documents or physical verification, transaction Profile etc.-Based on customer source of income and customer rejection criterion- interview the customer by bank official and review of customers background.

bangladesh bank guideline

BBL strictly follows the guideline provided by the central bank of Bangladesh, Bangladesh Bank.

Anti Money Laundering Policy

The policy reflects the Board of Directors commitment to comply with the Money laundering Prevention Act 2002, Bangladesh Bank Instructions and other related local and international regulations. It spells out our senior management’s responsibility in Anti Money Laundering Compliance and develops awareness at all levels of the bank regarding the importance of the Bank’s Anti Money Laundering Strategy.

trade licence

All the account or card holder of BBL has to provide the genuine trade license which has to be at least 1 year business operation time according to the PPG (product program guide).

legal documents

All the account or card holder of BBL has to provide the genuine legal documents asked by the bank.

7.2 sTRATEGIES or tactics TO COPE UP WITH THE STRATEGIC, OPERATIONAL & LEGAL ISSUES

Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a just, enlightened, healthy, democratic and poverty free Bangladesh.

Value the fact that we are a member of the BRAC family creating an honest, open and enabling environment Have a strong customer focus and build relationships based on integrity, superior service and mutual benefit Strive for profit & sound growth, work as a

team to serve the best interest of our owners Relentless in pursuit of business innovation and improvement, value and respect people and make decisions based on merit, base recognition and reward on performance Responsible.

Sustained growth in ‘small & Medium Enterprise’ sector, Continuous low cost deposit growth with controlled growth in Retained Assets, Corporate Assets to be funded through self-liability mobilization, Growth in Assets through Syndications and Investment in faster growing sectors, Continuous endeavor to increase fee based income, Keep our Debt Charges at 2% to maintain a steady profitable growth, Achieve efficient synergies between the bank’s Branches, SME Unit Offices and BRAC field offices for delivery of Remittance and Bank’s other products and services, Manage various lines of business in a fully controlled environment with no compromise on service quality, Keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality.

The policy reflects the Board of Directors commitment to comply with the Money laundering Prevention Act 2002, Bangladesh Bank Instructions and other related local and international regulations. It spells out senior management’s responsibility in Anti

Money Laundering Compliance and develops awareness at all levels of the Bank regarding the importance of the Bank’s Anti Money Laundering Strategy. The policy includes the development of –

- KYC policy /procedures before opening new accounts

- Monitoring existing accounts for unusual or suspicious activities

- Information flows

- Risk classification

- Reporting suspicious transactions

- Hiring and training employees

It includes a description of the roles of the Anti Money Laundering Compliance Officers. It also emphasizes the responsibility of every employee to protect the Bank from exploitation by money launderers and describing the consequence of non-compliance

With the applicable laws and the Bank’s policy, including the criminal, civil and disciplinary penalties and reputation harm that could ensue from any association with money laundering activity.

- Customer Acceptance criterion- Interview the customer by Bank Official and review of customer background, profession etc.

- Customer Rejection Criterion- Interview the customer by Bank Official and review of customer background, profession etc.

- Documents required for Individual /Corporate Account Open -for identification the customer

- Address Verification-supporting documents or physical verification

- Transaction Profile etc.-Based on customer source of income

For monitoring the customer transaction and reporting to the concerned department designated officials are assigned as follows:

- Branch Anti Money Laundering Compliance Officer (BAMLCO): at branch for reporting head office

- Chief Anti Money Laundering Compliance Officer (CAMLCO): at Head Office for reporting to Bangladesh Bank

The Monitoring Systems:

- Cash transaction amounting BDT 3.00 lac and above (System generated report) is reviewed by BAMLCO daily.

- Transaction amount exceeding Estimated Transaction Profile (System generated report) is reviewed by BAMLCO monthly.

Reporting System:

- If any transaction/customer activity is detected as suspicious or unusual the detecting officer reports it to BAMLCO with reason for suspicion.

- BAMLCO will review the suspicious report and put his/her comment. If s/he (BAMLCO) deems it as a suspicious s/he will forward to CAMLCO with his/her comment.

- CAMLCO will review the report forwarded by BAMLCO and put his/her comment. If s/he (CAMLCO) deems it as a suspicious s/he will forward to Bangladesh Bank

In addition to the immediate report of suspicious transactions, the following returns are to be submitted to Bangladesh Bank.

Periodical Return:

- Monthly: Cash Transaction Report (CTR) amounting BDT 5.00 lac or more in a day Suspicious Transaction Report (STR) from CTR

- Bi monthly: Transaction Amount BDT 1.00 crore or above in Non Resident Account in a period of 6 months.

8.0 AN aSEESMENT OF THE COMPANY’S CURRENT STATE OF OPERATIONS AND FUTURE DIRECTIONS

This research on customer satisfaction of BBL was designed across the some dimensions of service quality. Such dimensions were responsible for influencing the overall service quality and customer satisfaction of BBL. Reliability, Responsiveness, Assurance, Care & empathy, Tangibles, Location & Features of Products & services were the seven dimensions used in this survey to assess the overall customer satisfaction. Various attributes of BBL services were grouped within these seven category and the respondents were asked to express their views.

The results showed that the most important dimension of service quality was reliability of the service– which is ability to perform the promised service dependably and accurately.

BBL customers expressed average satisfaction along this dimension of service quality, which implies that BBL needs to improve more along this direction of services.

The second most important dimension pointed out was the Assurance dimension of service quality – which consists of employees’ knowledge, courtesy and ability to inspire trust and confidence. The results showed that customers were satisfied with this dimension of BBL services. Friendliness of employees and safety with BBL are some of the most satisfied attributes of this dimension. This indicates that BBL should build on this dimension of service quality.

The conveniences of the Locations were another of the important dimension mentioned by the customers. But the satisfaction with this dimension falls short of expectation and most of the customers are on the above average side. Thus to improve customer satisfaction BBL should improve its location facilities according to customer needs and wants. Most of the dissatisfaction came due to the inconveniency of the branches.

The most satisfied dimension of BBL came out to be the tangibles – which include appearance of facilities, equipment, personnel, etc. The importance given to this attribute was average. This implies that BBL has the best premises, equipment and facilities that should be promoted more aptly to customers.

The most dissatisfied dimension found out in the survey was Care & Empathy – which is Caring & giving individual attention to customers. This dimension was moderately important to customers but the significance of dissatisfaction along this attribute was severe. To improve the overall satisfaction BBL should improve its service concepts and envisage care & empathy into the overall customer services.

Lastly, the products & services dimension, which included features of the products, was somewhat important to customers in deciding service effectiveness. Average satisfaction was observed in this category. Investment services & rates on Savings were the two most dissatisfied aspects of this dimension. To score high on satisfaction, BBL should consider these two features and redesign them according to customer needs. Fees and service charges, savings services, cash & remittance & Phone banking were some of the most satisfied aspects of this dimension and represent the strengths of BBL.