Marketing Analysis

INTRODUCTION

Banking sector is expanding its hand in different financial events every day. At the same time the banking process s becoming faster, easier and the banking arena is becoming wider. As the demand for better service increases day by day. Generally by the word “Bank” we can easily understand that the financial institution deals with money. But there are different types of banks like; Central Bank, Commercial Bank, Savings Bank, Investment Bank, Industrial Bank, Co-operative Bank etc. Here I am going to discuss a bank which name is AB Bank, which is a commercial bank.

AB Bank Limited, the first private sector Bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.

Dubai Bank Limited (name subsequently changed to Union Bank of the Middle-east Limited) decided to off-load their investment in AB Bank Limited with a view to concentrate their activities in the UAE in early part of 1987 and in terms of Articles 23A and 23B of the Articles of Association of the Company and with the necessary approval of the relevant authorities, the shares held by them in the Bank were sold and transferred to Group “A” Shareholders, i.e. Bangladeshi Sponsor Shareholders.

OBJECTIVE OF THE STUDY

During my internship the area of study was the General Banking of AB Bank Ltd. Through achievement of the objectives outlined below, I would like to gather some practical knowledge about the General Banking activates.

The objectives of this internship report are as follows:

- marketing analysis of product of AB Bank Ltd;

- To undertake a comparative analysis of ABBL’s performance over the last four years of its operation;

- To identify the problems relating to general banking activities of ABBL and to make suitable suggestions to solve these problems.

METHODOLOGY OF THE REPORT

Research is a systematic inquiry whose objective is to provide information to solve a particular problem. Good research generates dependable data, being derived by practices that are conducted professionally and that can be used reliably for decision making about problem. Here I made my research on AB Bank Limited (ABBL), Dhanmondi Branch, which is the biggest branch of ABBL. I conducted that research to gather the information about the general banking activity of ABBL and which will help me to solve those problem which I was found during my research time.

Research Type

Research could be tow type they are:-

I. Quantitative: – When we work with the numerical data we defined it as the quantitative research.

II. Qualitative: – But when we work with the data those are not numerical but descriptive than it will known as the qualitative analysis.

Actually my research was based on the qualitative judgments of ABBL. But when I analyze the performance of the ABBL I made the quantitative judgment.

Sample Design

A sample is a part of the target population, carefully selected to represent that population. My target population was the every employees of the ABBL but it was not possible to work with them all, that’s why I chose the employee of the ABBL Dhanmondi Branch as a sample to conduct my research.

Survey Method

Basically I made my survey by the face to face interview with the in-charge of different department and also the responsible officer of those departments. And another most important and the primary source to collect necessary data was the observation method. Here I did different type of work by my own which help me to get a clear concept about the work here done. I also made a questioner, on the basis of which I asked question to the employee and answer of those question helped me to find out the problems in different department and the customer demand to the bank. The questioner is following

Q: – What are the problems you face in your department?

a) Infrastructural

b) Manpower

Q: – Are your customer satisfied with your service?

a) Yes

b) No

c) Complain sometime

Q: – How could you improve your service?

a) By recruiting new manpower

b) By arranging a training program for existing employee

Q: – Are you happy with salary and other benefit

a) Yes

b) No

c) Meet minimum level

d) No-comment

Q: – Are you satisfied with the work environment?

a) Co-operative

b) No

Q: – Are the client suggest for the online service?

a) Yes

b) No

Q: – Do you think online will improve work efficiency?

a) Yes

b) No

c) May Be

Q: – How could ABBL Attract Customer?

a) By launching new product

b) By improving service

c) By launching automation

d) By proper marketing

Q: – What is the main driving force of the ABBL?

a) Customer loyalty

b) Modern Banking System

c) Quick service

d) Proper marketing

Q: – Do you think bank should offer more interest on its deposit especially on FDR? If yes how much?

a) No

b) Yeas

- More than any existing bank

- Same to existing bank

Q: – What do you think about the customer loyalty to the bank, ABBL is in which position?

a) Less

b) Almost Same

c) Batter than any Bank

d) Same to leading banks

Scope and Limitation

There were so many problems I had to face to prepare this report. The main problem was the time limitation because I have to submit that report before the end of by internship period. I had to face problem about the information those I expect from AB Bank Limited, Dhanmondi Branch. Another problem I had to face that I had worked in local remittance for 2 months because of that I can’t spend enough time in another department.

BACKGROUND OF AB BANK LIMITED

AB Bank Limited, the first private sector Bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.

Dubai Bank Limited (name subsequently changed to Union Bank of the Middle-east Limited) decided to off-load their investment in AB Bank Limited with a view to concentrate their activities in the UAE in early part of 1987 and in terms of Articles 23A and 23B of the Articles of Association of the Company and with the necessary approval of the relevant authorities, the shares held by them in the Bank were sold and transferred to Group “A” Shareholders, i.e. Bangladeshi Sponsor Shareholders.

At present the Authorized Capital and the Equity (Paid up Capital and Reserve) of the Bank are BDT. 800.00 million And BDT. 1105.32 million Respectively. The Sponsor-Shareholders hold 50% of the Share Capital; the General Public Shareholders hold 49.30% and the rest 0.70% Shares are held by the Government of the People’s Republic of Bangladesh. However, no individual sponsor share holder of AB Bank holds more then 10% of its total shares.

Since beginning, the Bank acquired confidence and trust of the public and business houses by rendering high quality services in different areas of banking operations, professional competence and employment of the state of art technology.

During the last 21 years, AB Bank Limited has opened 68 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India, two Representative Offices in London and Yangon, Myanmar respectively and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World.

AB Bank Limited, the premier sector Bank of the country is making headway with a mark of sustainable growth. The overall performance indicates mark of improvement with Deposit reaching BDT. 28,130.00 million, which is precisely 14% higher than the preceding year. On the Advance side, the Bank has been able to achieve 5% increase, thereby raising a total portfolio to BDT. 19,910.00 million, which places the Bank in the top tier of private sector commercial banks of the country. On account of Foreign Trade, the Bank made a significant headway in respect of import, export and inflow of foreign exchange remittances from abroad.

Arab Bangladesh Bank Ltd Should uses a communication solution or communication offered by the telecommunication company. That will increase their communication efficiency and it will reduce the cost of communication because the private telecommunication companies offer the cheapest price than they offer to the individual customer.

VISION STATEMENT

To be the trendsetter for innovative banking with excellence and perfection

MISSION STATEMENT

To be the best performing bank in the country and the

GOAL OF THE BANK

To exceed customer expectations through innovative financial products & services and establish a strong presence to recognize shareholders’ expectations and optimize their rewards through dedicated workforce.

LONG TERM GOAL

Keeping ahead of other competitors in productivity and profitability.

SHORT TERM GOAL

To attain budgetary targets fixed in each area of business

FUTURE PLAN

To exceed customer expectations, the management likes to turn this bank into a world-class bank so that all banking related services could be provided efficiently and effectively. Automation will play a vital role. All the branches will come under one network so that customers will enjoy the banking services. Corporate clients will be provided banking services at their doorsteps. Mobile ATM services will be introduced so that customers can be served in any corner of the cities. This service will help to ease the tension of carrying large quantity of money during the salary period. Phone banking and internet banking will allow the customers to withdraw and transfer money at any time. More specifically the bank will provide the following:

Electronic Fund transfer

Electronic L/Cs

Mobile ATM service

Utility bill payment through ATM cards

One stop service

Corporate banking

Real time banking

Profitability

Operating Profit of the Bank more than doubled during the year 2005 and taka 755.04 million which was the combined effect of 35% growth in Net Interest income and appropriate expenditure control measures among others. Bank excelled in its margin management in a fiercely competitive market. Bottom line was further bolstered by 11%increase in Non-funded income for the year although investment income reduced by 22% compared to 2004. Profit before tax also doubled at Taka 407.47 million. Earning per share (EPS) stood at taka 31.26 while return on equity (ROE) and Return on assets (ROA) were 10.64 and 0.50% respectively.

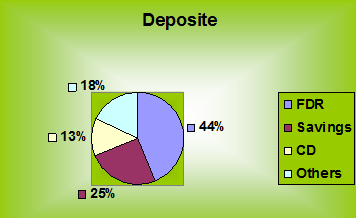

Deposits

Total deposits at the end of the year 2005 stood at 27361.43 million showing slight reduction compared to 2004. Bank continued to maintain its low coast deposit mix while feeding the growing funding needs related to increase in loans and advances at the same time.

Loans and Advances

Loans and Advances registered a significant growth of 25.73% over last year and stood at taka 21384.63 million. Bank’s portfolio remained well diversified with presence in Cement, Food & Beverages, Ship Breaking, Textile and Garment, Power etc. During the year, all the sectors to its operation registered growth and among them the industrial sector credit grew by 84% while infrastructure sector credit registered growth of 45% respectively.

International Trade

International trade business of the ABBL registered all-round growth in them year 2005. Bank maintained the growth through strengthening of trade finance spectrum by providing various services like issuance of Document Credit, Advising of Export L/C’s, purchase and negotiation of export bills, Documentary Collection, Pre-Shipment Finance, Remittance Disbursement Activities etc. Export growth was 24.70% as the volume rose to taka 12595 million in year 2005. Major contributors were Garment and Frozen fish sectors.

Import in the year 2005 was taka 23151 million marking an increase of 20.16% over the previous year. Major imports were in the category f capital machinery, industrial raw material, milk powder, scrap vessels etc.

ABBL remittance business reached a high note in 2005 as we crossed US $ 100 million and ended with the figure of US $ 115.41 million registering an overall growth of 38.27 %. Providing fast and efficient service and our coverage to reach the doorsteps remained the corner stone of our business. Bank is looking forward to expand its network and catchments capacity dedicated to the service of expatriate Bangladesh.

Merchant Banking Wing

Ever since its launch in 2003 this particular business wing registered tremendous growth both in terms income and profitability. MBW offers various schmes like Portfolio Management, Issue Management, Corporate Advisory and Underwriting. During the year 2005 MBW achieved Net Profit worth taka 137.83 million registering a growth of 64% over the last year.

Bringing an idea into life and benefiting the community, as a whole is what progress, development, and prosperity are all about. We here at AB Bank, believe that the spirit of the entrepreneur is what drives the wheel of progress and development. We know that the key to national development is the growth of your financial assets in the capital market. As your savings grow, so does the nation. We here at AB Bank, the nation’s first private bank with more than 20 years of know- how, have been working relentlessly at the forefront of wealth-creation through our commercial banking operations.

Islamic Banking

The Islamic Banking of ABBL was launched at the end of the year 2004. Throughout the year 2005, considerable efforts were put-in to complete the platform for launching the business in a meaningful way. Sharia Council of the Bank was formed comprising of Ulemas, Faqih, Islamic Banker and also nominees from the ABBL board. The Bye-Laws for the Sharia Council has also been finalized. Sharia Council also approved different products for the business.

Meantime, we have started operating tough collection of Deposit and extending credits in limited way. Till the end of the year, Deposit worth taka 56.8 million was collected through Al-Wadiah (current account) and Mudaraba (savings and term deposit scheme). Besides, advances worth taka 15.1 million where extended to different clients.

Card Division

ABBL is the first domestic commercial bank in Bangladesh to introduce Visa Electron and Visa Credit Card ant the same time. ABBL also the only Bank in Bangladesh to introduce Visa ATM Acquirer along with POS Acquirer, which opened the opportunity for all the Visa Cardholder (domestic and international) to use our ATMs. Recently ABBL have opened an ATM booth in Cox’s Bazar thereby further extending network of ATMs, POS< and Q-Cash ATMs outlets which extended ABBL reach to as far as Munshiganj, Sirajganj, Khulna and Bogra.

Business Automation

“Misys” the core banking solution are being implemented gradually. During the year 2005, seven Branches of the Dhaka Region were upgraded with the new Misys solution there heralding the era of new phase of automation in your Bank. ABBL are now into the Second Phase of Misys implementation whereby six more branches of the Chittagong region is came under the coverage from beginning of the June 2006. By the end of 2006, all the Branches will be hooked to this core system along with the implementation of a whole range of banking solutions. We have embarked on massive project of migration, connectivity and standardization of processes and hardwires throughout the Bank. A CORE TEAM would drive this Project to its destined objective.

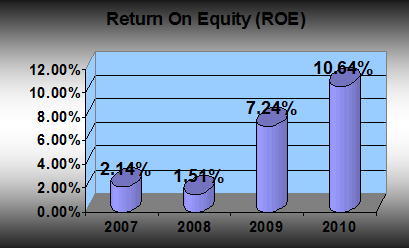

Return on Equity (ROE)

Return on Equity (ROE) is the ratio of a bank’s net after-tax income divided by its total equity capital. Return on Equity (ROE) is a measure of the rate of return flowing to the bank’s shareholders. It approximates the net benefit that the stockholders have received from investing their capital in the bank that means placing their funds at risk in the hope of earning a suitable profit.

In the above graph we see that in year 2004 and 2005 the Return On Equity increased by 4 and 5 times respectively than the year 2003 which indicate that AB use more debt than equity. Which raise the return to the shareholder but it also raise risk for the bank.

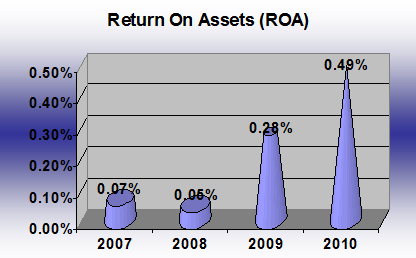

Return on Assets (ROA)

Return on Assets is the ratio of a Bank’s net after-tax income divided by its total assets. Thus ROA is primarily an indicator of managerial efficiency; it indicates how capably the management of the bank has been converting the institution’s assets into net earnings.

Here In above graph we see that the ROA is also increase almost as same as the ROE it’s happen because of the efficiency of the management level. They are become so efficient in year 2004 and 2005 as we see in the above graph the ROA is increase by almost 6 and 10 times respectively.

Net Interest Margin

The Net Interest Margin is efficiency measures as well as profitability measures, including how well management and staff have been able to keep the growth of revenues (which come primarily from the bank’s loans, investments, and service fees) ahead of rising costs (principally the interest on deposits and money market borrowings and employee salaries and benefits). The net interest margin measures how large a spread between interest revenues and interest costs management has been able to achieve by close control over the bank’s earnings asses and the pursuit of the cheapest sources of funding.

In the above graph we see that the net interest margin is increasing year by year which indicate the efficiency and the competitiveness of the management and the staff of the ABBL. It also indicates that the spread between the income and the cost of ABBL is increasing day by day. It may happen because of bank’s efficiency to provide the loan to its client at a highest but reasonable rate of interest which is competitive but not higher than the other bank and the financial institution which are operate in our country.

Some more parts-

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-1)

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-2)

Report On Marketing Analysis Of Product Of AB Bank Limited (Part-3)