EXECUTIVE SUMMARY

This report represents the working experience on private sector commercial bank operated in Bangladesh named “BRAC Bank Limited” (BBL) as internship report for BBA program .BRAC Bank intends to set standards as the Market leader in Bangladesh. It will demonstrate that a locally owned institution can provide efficient, friendly and Modern full- service banking on a profitable basis. The main objective of the study is to conduct an assessment of the implementation of Customer Service Quality and Product Promotional Strategy of BRAC Bank Limited. Besides, the objective of the study is to have a clear knowledge about the service delivery status of private commercial Bank and different types of service they provide to the customer. In these report different types of assessment tools is discussed that bank used for the assessment of their staff. Different type of promotional techniques that bank use for the promotion of their product promotion also is discussed basis on qualitative and quantitative strategy. Based on their promotional activities some recommendations will also suggest that will helpful to increase the product selling and quality of customer service .A survey research is also conducted for measuring the customer satisfaction and BRAC Bank position in the Market. After discussing the whole topic a general recommendation has also done on the basis of some problem that identified in the report. After conducting the survey research it can be said customer are more or less satisfied with the bank performance but many customer complaint about over charging price strategy of the Bank. Most of the customer are satisfied of their modernized an excellent idea of their customer service quality. BRAC BANK is a well established Bank in Bangladesh. It is providing maximum services to the customer then other Bank. Entering as a new bank in private banking scenario of Bangladesh, BRAC Bank is constantly try to cross the obstacles regarding typical business oriented ideas and come up with innovative curtailed to its Consumers need to harvest maximum benefit for them. BRAC Bank Limited is a third generation bank inaugurated on 4 July 2001 with a mission of providing best banking service in the country to enhance economic activity .BRAC Bank is maintaining its competitiveness by leveraging on its on line Banking Software and modern IT infrastructure. It is the pioneer amongst the local banks in introducing innovative products like SMS Banking, Phone Banking, and Internet Banking and so on.

OBJECTIVE OF THE STUDY

General Objective

The general objective of preparing this report is to fulfill the requirement of project work as well as completion the BBA Program through gaining the experience and view the application of Theoretical knowledge in the real life. Also find out the Operational Process of the Bank and it’s overall Performance.

Specific Objective

The objectives of this report are the followings:

- Get introduced with the idea of “Customer Service Quality” in BRAC Bank Ltd.

- Introduce with the Bank service quality assessment tools.

- Techniques to win a strong customer base.

- To know the expectations of customers of BRAC Bank.

- To know about the Retail Product and promotion techniques of BRAC Bank ltd.

- To Know the BRAC Bank position in the Market.

- To know the study’s and conditions of overall performance.

- To make some recommendations and conclusion to further the development of Retail products of BRAC Bank Ltd.

SCOPE OF REPORT

The report covers overall Retail banking (emphasis on deposit and loan product) activities and procedures of the BRAC Bank Limited. This report especially emphasizes on Customer Service Quality and Product Promotion Strategy.

METHODOLOGY

Sampling methodology

To make the report more meaningful and presentable, two sources of data and information were used widely. Both primary and secondary data sources were used to prepare this report. The nature of this report is descriptive with some survey or using sampling method. Most of the necessary information has been collected by random sample.

Data collection

Both the primary and secondary forms of data are used to make the report more rich and informative.

The details of these sources are gives below

Primary Sources

- Most of the information was acquired by questionnaire.

- Observation and work experience with different divisional in-charges and suggestions of many executives of the bank.

Secondary Sources

- Annual Report of the BRAC Bank Limited.

- Various books, articles, compilations etc.

- Websites of the Bank.

- Instruction circular of Head Office, brochures of different banks, newspapers and magazines regarding banking issues, seminar papers and so on.

Data analysis procedures

The report is based on information and it is also a descriptive research. After collecting all the relevant data, analysis has been done with the help of arithmetic and statistical operations. Software such as Microsoft Excel was used to calculate the data and present the results in graph. Based on all the possible results that have been found from the analysis I have tried to identify the reason behind the problem and draw the solution of the problem by formulating the conclusion and preparing the report.

Bank overview

About BRAC Bank Limited

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore cap International, has been the fastest growing Bank in for last two years. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh. A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last six years of operation, the Bank has disbursed over BDT 10,000 core in loans to nearly 2,00,0,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. In 2011, the Bank’s has 81 branches ,22 SME service center,46 SME/KRISHI Branches, 421 SME unit offices and 240 ATM sites across the country, and the customer base has expanded to 1400 core deposit and 1,87,000 advance accounts. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMs across the country.

BRAC Bank intends to set standards as the Market leader in Bangladesh. It will demonstrate that a locally owned institution can provide efficient, friendly and Modern full- service banking on a profitable basis. It will produce earnings and pay out dividends that can support the activities of BRAC, the Bank’s major shareholder. Development and poverty alleviation on a Country wide basis needs mass production, mass consumption and mass financing. BRAC Bank goal is to provide mass financing to enable mass production and mass consumption, and thereby contribute to the development of Bangladesh.

Shareholding Structure

The shareholding structure of BRAC Bank Limited consists of different group with institutional shareholdings by BRAC, International Finance Corporation (IFC), Shore cap International and general public is also included through IPO.

BRAC

BRAC, a national, private organization, started as an almost entirely donor funded, small-scale relief and rehabilitation project initiated by Fazle Hasan Abed to help the country overcome the devastation and trauma of the Liberation War and focused on resettling refugees returning from India. Today, BRAC has emerged as an independent, virtually self-financed paradigm in sustainable human development. It is one of the largest Southern development organizations employing 97,192 people, with 61% women, and working with the twin objectives of poverty alleviation and empowerment of the poor.

International Finance Corporation

International Finance Corporation (IFC) is the commercial wing of World Bank. Using certain channels and overseas representatives, IFC it helps local financial institutions find profitable ways to target small and medium sized companies. Funding comes from the Asian Development Bank, Canada, the European Commission, the Netherlands, Norway, United Kingdom and IFC itself. IFC is a 19% shareholder in BRAC Bank. A new assistance program signed in August 2005 aims to double the bank’s number of small and medium enterprise clients in 18 months through campaigns to target women entrepreneurs and rural clients, introduce new products and train branch managers.

Shore Cap International

Shore Cap International Ltd. is an international private non-profit, equity company seeking to invest in small business banks and regulated micro finance institutions in countries with developing and transitional economies. Founded in mid 2003, Shore Cap has a current base of $28.3 million in capital commitments and seeks to support the growth of development finance institutions in Africa, Asia and Eastern Europe. The institution has made investments totaling $7 million in Bangladesh, India, Cambodia, Armenia, Mongolia and Kenya. Shore Bank is a 9% investor of Shore Cap and runs the management company, which oversees investment activities. Shore Cap typically invests between $500,000 and $2 million for an ownership position of 10- 25% of a company. As a minority shareholder, Shore Cap seeks financial institutions with a strong, experienced management team and a committed set of local development-minded investors. Shore Cap currently owns 18% of BRAC Bank Limited.

Corporate Values

BRAC Bank Limited’s strength emanates from their owner – BRAC. This means, we will hold the following values and will be guided by them as we do our jobs.

- Value the fact that we are a member of the BRAC family.

- Creating an honest, open and enabling environment.

- Have a strong customer focus and build relationships based on integrity, superior service and mutual benefit.

- Strive for profit & sound growth.

- Work as a team to serve the best interest of our owners.

- Relentless in pursuit of business innovation and improvement.

- Value and respect people and make decisions based on merit.

- Base recognition and reward on performance.

- Responsible, trustworthy and law-abiding in all that we do.

Performance of BRAC Bank Ltd. AT a Glance

- BRAC Bank wins the award for best retail banking in Bangladesh by Asian banker.

- BRAC Bank awarded prestigious FT sustainable bank of the year 2010.

- DHL-DAILY STAR Bangladesh business award 2008.

- BRAC Bank received ICAB National award.

- National award as the highest VAT payer for the financial year of 2007-2008.

- Fastest growing bank: BRAC Bank has been the fastest growing Bank in last two years. It is one of the local private commercial bank that set the standard of banking for the leader bank of Bangladesh banking industry

- Leader in SME financing through 421 SME unit offices: The idea of SME unit are become very popular to the BRAC bank customer. In the last six years of operation, the Bank has disbursed over BDT 10,000 corer in loans to nearly 2,00,0,000 small and medium entrepreneurs.

- Biggest suit of personal banking & SME products: BRAC Bank has variety of product for their customer in Branch and also in SME office.

- Large ATMs (Automated Teller Machine) & POS (Point of Sales) network: Now BRAC Bank has 240 ATM Machine all over the country.

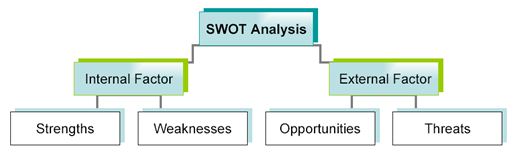

SWOT Analysis of BBL

SWOT Analysis

SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strengths

Company reputation

BRAC bank has already established a favorable reputation in the banking industry of the country particularly among the new comers. Within a period of 10 years, BBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have lead them to earn a reputation in the banking field.

NGO name (BRAC)

BRAC is one of the largest NGO of the world and it is operating its activities in Bangladesh. BRAC bank is not a NGO bank but many people of the country consider it as a NGO bank like Grameen Bank which is not correct.

Sponsors

BRAC Bank Limited has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to prominent resources persons of the country. The Board of Directors headed by its Chairman. Therefore, BBL has a strong financial strength and it built upon a strong foundation.

Top Management

The top management of the bank is also major strength for the BBL has contributed heavily towards the growth and development of the bank. The top management officials have all worked in reputed banks and their years of banking experience, skills, expertise will continue to contribute towards further expansion of the bank. At BBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Facilities and equipment

BRAC Bank Limited has adequate physical facilities and equipments to provide better services to the customers. The bank has computerized and online banking operations under the software called Finacle banking operations. Counting machines in the teller counters have been installed for speedy service ant the cash counters. Computerized statements for the customers as well as for the internal use of the banks are also available.

Impressive branches

This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. 81 branches of the bank are impressive and are compatible to foreign banks.

Interactive corporate culture

BRAK Bank Limited has an interactive corporate culture. Unlike other local organization, BBL’s work environment is very friendly, interactive and informal. There are no hidden barriers or boundaries while interacting among the superior or the subordinate. The environment is also lively and since the nature of the banking job itself is monotonous and routine, BBL’s likely work environment boosts up the spirit and motivation of the employees.

Team work at mid level and lower level

At BEAC Bank Limited is mid level and lower level management, there are often team works. Many jobs are performed in groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

Weaknesses

Advertising and promotion of SME loan

This is a major setback for BBL and one of its weakest areas. BBL’s advertising and promotional activities are satisfactory but it SME loan is not advertised well. It does not expose its SME product to general public and are not in lime light. BBL does not have neon sign or any advertisement for SME loan in the city. As a result people are not aware of the existence of this bank.

Low remuneration package

The remuneration package for the entry and the mid level management is considerably low. The compensation package for BBL entry level positions is even lower than the contemporary banks. Under the existing low payment structure, it will be very difficult to attract and retain higher educated employees in BBL. Specially CRO’s are not satisfied with compensation package

Provided to them.

Opportunities

Diversification

BBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify in to leasing and insurance. By expanding their business portfolio, BBL can reduce their business risk.

Product line proliferation

In this competitive environment BBL must expand its product line to enhance its sustainable competitive advantage. As a part of its product line proliferation, BBL can introduce the following products.

ATM

This is the fastest growing modern banking concept. BBL should grab this opportunity and take preparation for launching ATM. Since BBL is a local bank, they can form an alliance with other contemporary banks in launching the ATM.

Threats

Multinational banks

The emergence of multinational banks and their rapid expansion poses a potential threat to the new growing private banks. Due to the booming energy sector, more foreign banks are expected to arrive in Bangladesh. Moreover, the already existing foreign banks such as Standard Chartered are now pursuing an aggressive branch expansion strategy. This bank is establishing more branches countrywide and already launched is SME operation. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks.

Upcoming banks

4.2The upcoming private local banks can also pose a threat to the existing private commercial banks like BBL. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against an on slaughter of foreign banks.

Contemporary banks

The contemporary banks of BBL such as Dhaka bank, prime bank and Dutch Bangla are its major rivals. Prime bank and other banks are carrying out aggressive campaign to attract lucrative clients as well as big time depositors.

12 Departments of BRAC Bank Ltd.

If the jobs are not organized considering their inter relationship and are not allocated in a particular department it would be very difficult to control the system effectively. If the departmentalization is not fitted for the particular works there would be haphazard situation and the performance of a particular department would not be measured. BRAC Bank Limited does these works very well. Departments are as follows—

- Human Resource Department

- Financial Administration department

- Asset Operations Department

- Credit Division

- SME divisions

- Inter Control and Compliance Department

- Impaired Asset Management

- Probashi Banking Operations

- Treasury Front

- Treasury Back

- General Infrastructure Services

- IT

- Customer Service Delivery

- Cards Division

- Phone Banking Cash Management

- Payment Service

- Loan Administration Department

Business Division of BRAC Ban k

BRAC Bank Limited consists of four major business divisions namely:

a) Corporate Banking Division

b) Retail Banking Division

c) Small and Medium Enterprise (SME)

d) Foreign Trade & Treasury

a) Corporate Banking Division

Corporate Division provides full range of commercial banking products and services to any potential corporate clients including multinationals, large or medium local corporate, NGOs, institutional bodies. The Corporate Banking Division has a centralized structure through on-line banking system. Any credit facility is processed at the Corporate Banking Division, Head office. After sanctioning of the facility, the limit is put on line and the customer can enjoy the facility from any of the BRAC Bank branches. Strict adherence to internal control guidelines and other legal and statutory compliance are followed. The Credit approval process involves separate Credit Division, the Managing Director and finally the Board. Credit Division, the Managing Director and finally the Board. Other departments like Foreign Trade, Treasury, and Credit Administration etc. play the support role for a comprehensive range of service to the Corporate Banking Division.

b) Retail Banking Division

Retail Division offers a wide array of lucrative and competitive banking products to the individual customers of the bank. Currently there are seven lending products and a number of other attractive new products will be launched shortly. It also offers different types of term deposit scheme and attractive STD & Savings deposit schemes giving interest on daily balance.

c) Small and Medium Enterprise (SME)

SME is an additional and specialized horizon of the bank which serves the bank’s special focus in promoting broad based participation by catering to the small and medium entrepreneur. The network of SME has already been established throughout Bangladesh. The SME market in Bangladesh is large. BRAC Bank is the absolute market leader in the number of loans given to small & medium enterprises throughout Bangladesh that has made more than 26500 dreams come true. The Bank disburses almost BDT 10,000 core of their loan to the SME unit. SME unit is dealing with small scale loan which is known as “ANONNO”.

Now SME banking introduced a new loan facility titled”APURBO” SME loan facility for small & medium entrepreneurs. This offer up to 50 lac as loan facility towards the SME entrepreneurs.

d) Foreign Trade & Treasury

Treasury Division is one of the major divisions of BRAC Bank. Treasury Division deals with money market. All treasury related products are processed in conformity with the Bank’s Operational, Trading, Money market, Overnight, Term placing, Deal settlement, Commercial position keeping, Treasury, Credit, Finance & other applicable policies. Treasury Operations calculates investment figure, prepares the auction application, forwards the application to Bangladesh Bank for Bid and Treasury Operations maintains and reconciles all accounts with foreign and local banks.

Product and Service of Retail Banking

Retail Division offers a wide array of lucrative and competitive banking products to the individual customers of the bank. Currently there are seven lending products and a number of other attractive new products will be launched shortly. It also offers different types of term deposit scheme and attractive STD & Savings deposit schemes giving interest on daily balance. Retail product is following bellow:

- Deposit product

- Loan product

- Card

- Non-stop banking

- ATM /Branch locator

- Locker service

- Foreign exchange & related service

Retail Banking (Deposit schemes and services)

An overview of Deposit Accounts:

One of the primary function of a banker as contained in the Banking Corporation act 1991 is to accept money from the public. Taking deposits from the customers and providing loan facility to borrower is one of the generic functions of consumer banking.

The deposits collected by bank may be broadly classified into:-

Demand Deposit

Demands on demand deposit accounts may be withdrawn on demand and thus no prior notice is needed. Deposit in

- currents Accounts

- Short term Deposit Accounts fall under this category.

Time Deposits

Deposits maintained in the Time Deposits or Term Deposit accounts are withdrawn on the expiry of a fixed period of time only.

- Savings Accounts

- Fixed Deposit Accounts

Current Deposit Accounts

A Current Deposit Account may be operated upon any number of times during the business hours of a working day. Current Deposit Account suits the requirement of Businessman, Joint Stock Companies, Institutions and Public Authorities etc. as they require numerous transactions on every working day. The banks do not pay interest on current deposits. Usually the loans and advances are disbursed through Current Accounts.

Savings Accounts

The savings accounts are usually opened and operated by individuals to meet their future contingencies and also to enjoy the convenience of easy accessibility of money kept in savings accounts. Savings accounts are designed for the investment of the personal savings. One of the objectives of such accounts is promotion the habit of thrift among people. The banks impose certain restriction on withdrawals from the savings accounts. The bankers usually on a special request may permit withdrawals exceeding these limits but then interest for that particular month in which withdrawals exceed these limits, is not paid. Interest on savings accounts is allowed on minimum balance. Interest is credited every six months (generally in June and December).

Fixed Deposit Accounts

Fixed Deposit Accounts are also called Time Liabilities of a banker. They are so called because the money is payable on the expiry of a fixed period of time only. The guest suiting his convenience chooses this time period. The rate of interest for different period is different but in case is usually higher than the arte offered on the Savings accounts. The reason is very obvious. The bank when knows the exact date of repayment, he can invest the money in long term projects bringing him a higher rate of return.

Deposit Products (Savings Accounts)

Savings Accounts

- A Savings Account is an account that gives interest on the deposits kept in it.

- This Account is for individuals and non-trading entities.

- One can put his money in this account and earn interest on the idle funds also use the fund when he needs it.

Savings Account is suitable for

- Individuals, clubs, associates, societies, trusts and others of similar stature.

- Particularly suited for individuals who have regular and fixed sources of income and fixed expenses. For example: housewives, salaried professionals, businessman and other self-employed professionals.

Savings Accounts of BRAC Bank Ltd.

a) Triple Benefit Savings Account (TBS)

b) Savings Classic Account

c) Aporajita Account.

d) Future Star Account.

Required Documents to open a Triple Benefits Savings Account

A completed personal account opening form. Completed personal account opening form means-

- Name, occupational details and nationality of the applicant mentioned.

- Applicant(s) Date-of-birth, father’s and mother’s name mentioned.

- Applicant(s) full mailing and permanent address mentioned.

- Name, photograph, Date-of-birth, relationship, address of nominee –all information are given.

- If the nominee is minor, then his/her thumb impression and one legal guardian is must.

- The nominee must sign at the back of his/her photo and the applicant must sign underneath, attesting that sign.

- Signature of the applicant in the appropriate boxes.

- The applicant will have to use the sign in all account related activities.

- This sign must also be the same as the one on the back of the nominees photograph.

- Name, account No., and sign of the introducer. Introducer must be an existing account holder of BBL with at least 6 month’s satisfactory relationship.

- The monthly income and the source of income of the applicant must be mentioned.

- The transaction profile must be filled in.

- The initial deposit should be filled up. If the initial deposit is in cheque, then the drawee bank name, cheque number must be mentioned.

- One bill copy of the communication address should be given; if it is not given then a verification of the address must be filled up and verified by the introducer.

- If the applicant wants to have other facilities (such as: sms banking, internet banking, fixed deposit, locker facility) then proper boxes should be filled in.

- A KYC form should be properly filled up by the account opening officer and attach with the form.

Facilities in the Triple Benefits Savings Account

- Account opening balance: BDT 50,000 only.

- Interest rate of up to 8% p.a., credited to the account every month.

- No Debit card Fee.

- No upfront Fee.

- No yearly/ half yearly Account maintenance Charges.

- First cheque book of 12 pages for free.

Interest rate on Triple Benefits Savings Account

Tax rate on the Interest & on the Triple Benefits Savings Account

There is a 10% tax on the interest earned in the savings account. This tax is deducted at source, meaning the bank deducts the tax before giving it to the customer. There is also Government Excise Duty on the deposit/ balance level of the account. The duty is calculated on the balance between January and December.

Triple Benefits Savings Account statements

Customer gets half yearly statements (every six months) in the TBS account. If the customer wishes any other frequency then they will have to mention it in the account opening form. They can also change the frequency of the statements as well. Statement is usually mailed to the customer’s mailing address. Customers can also collect the statements from any branch of BBL from anywhere in the country.

Triple Benefits Savings Account cheque book and Visa debit card

Customers will get cheque book and Visa debit card for the TBS account. TBS accounts in the name of the person, individuals or joint, will also get Visa debit card. Joint account holders will get Visa debit card for each person/ for any one person if the mode of operation is operating singly or either or survivor respectively.

Withdraw system of ATM

There is a cap of maximum TK. 20,000 from the ATM booth and TK. 100000 from the POS machine from any branch that can be withdrawn from one account in a single day. If anyone wants to extent his limit he can do this by calling to the phone banking.

Triple Benefits Savings Account Fund Transfer

There are no restrictions in fund transferring for Triple Benefits Savings Account. In fact,

- Customers can deposit cash and cheque at any branch in Bangladesh and have their account credited.

- Customers can also withdraw cash from any branch or ATM booth machine in Bangladesh.

- Funds can be transferred between two accounts of the same branch or different branches.

- Customers get cheque clearing facility for local cheque and collection facility for outstation cheque.

Procedures to operating account in absence of account holder

Customers can let another person to operate the account in his/ her absence by:

- Delegation of authority

Customers can delegate the authority to operate their account signing a form for “Delegation of authority”. The a/c holder must also attest the photograph of the procurator. The person to whom the authority is delegated is called Procurator. The form designed in such a way that the customer can choose which rights they will delegate and which they will not. Customers can cross out the powers they do not wish to delegate.

- Power of Attorney

By power of attorney we mean general Power Of Attorney here. Delegation of Authority covered special Powers of Attorney. Branch personnel must be absolutely sure of the Attorney’s identity and the document’s, which gives the power, is completely valid. If they feel that the Power was gained through duress they can refer it to the BSSM/CSM. Finally, the power of attorney must include clauses that relate to banking. If the documents don’t say anything about banking transactions, then the Bank is not obliged to recognize the Power of Attorney.

- Signature

Signature to operate the account can be change for both organizational and individual customers.

- For individuals

Customers can fill in an account services form, where they can change their Signature. The customer will have to give both the existing signature and the new signature in that form.

- For organizations

Signatories for the organizations account can change and they do change. In that case a new Board Resolution or extract of the Board Resolution is required. The resolution will state that the new signatories, whom they are replacing, are and if any special instructions are applicable for their signing authority.

- Closing of Triple Benefits Savings Account

- Customers can close a savings account by filling in an account closing form. Customers can withdraw all the amount end leave the funds to meet the account closing charges.

- Close the account the customer must return the cheque book and Visa debit Card. The employee will destroy the card and the cheque book in front of the customer.

b) Savings Classic Account

Savings Classic Account offers interest rate of 5.5% p.a. The minimum account opening balance Requirement is BDT 15,000. Any balance greater than zero will be eligible for interest. The account maintenance fee is BDT 300 + VAT for every half year. Annual Debit Card Fee is BDT 600 + VAT. The account offers free cheque book facility provided the minimum balance is maintained.

NB: Required Documents to open a Savings Classic Account is same as the individuals Triple Benefits Savings Account.

Facilities in the Savings Classic Account

- Account opening balance: BDT 15,000 only.

- Interest rate of up to 5.5% p.a., credited to the account every month.

- Half Yearly Account Maintenance Fee Tk. 300 Half-Yearly.

- Cheque book Issue Fee Free.

- Second Cheque book Issue Fee Tk. 100 for 12 pages, if balance is below Tk. 15,000. Free if last month’s average balance is Tk. 15,000 & above.

- Visa Debit Card fee (annual) Tk. 600 (yearly).

Savings Classic Account cheque book and Visa debit card

Customers will get cheque book and Visa debit card for the Savings Classic Account. Savings Classic Account in the name of the person, individuals or joint, will also get Visa debit card. Joint account holders will get Visa debit card for each person/ for any one person if the mode of operation is operating singly or either or survivor respectively.

NB:

- Savings Classic Account Fund Transfer is same as the individuals Triple Benefits Savings Account.

- Procedures to operating account in absence of account holder is same as the individuals Triple Benefits Savings Account.

- Closing of classic saving account is same as the individuals Triple Benefits Savings Account.

Future Star Account is a savings account for minor that offers an opportunity to save for your child’s future. The account is available for the children below 18 years of age. However, legal guardian of the child will operate the account on behalf of the minor. Future Star Account offers a high interest rate of up to 8% p.a. Interest is accrued on monthly average balance and applied to the guest account yearly. The minimum account opening balance requirement is BDT 2,000.Fund cannot be withdrawn until the child reaches 18 years of age. However, on emergency case, fund can be withdrawn by closing the account. In this case, if the account is closed before one year, interest amount shall be forfeited. Only self-deposited amount will be paid to the account holder.

Required Documents to open a Future Star Account

A completed personal account opening form. Completed personal account opening form means-

- Name, occupational details and nationality of the applicant mentioned.

- Applicant(s) Date-of-birth, father’s and mother’s name mentioned.

- Applicant(s) full mailing and permanent address mentioned.

- Name, photograph, Date-of-birth, relationship, address of nominee–all information are given.

- Birth certificate should be given.

- The nominee is minor, then his/her thumb impression and one legal guardian is must.

- The nominee must sign at the back of his/her photo and the applicant must sign underneath, attesting that sign.

- Signature of the applicant in the appropriate boxes.

- The applicant will have to use the sign in all account related activities.

- This sign must also be the same as the one on the back of the nominees photograph.

- Name, account No., and sign of the introducer. Introducer must be an existing account holder of BBL with at least 6 month’s satisfactory relationship.

- The monthly income and the source of income of the applicant must be mentioned.

- The transaction profile must be filled in.

- The initial deposit should be filled up. If the initial deposit is in cheque, then the drawee bank name, cheque number must be mentioned.

- One bill copy of the communication address should be given; if it is not given then a verification of the address must be filled up and verified by the introducer.

- If the applicant wants to have other facilities (such as: sms banking, internet banking, fixed deposit, locker facility) then proper boxes should be filled in.

- A KYC form should be properly filled up by the account opening officer and attach with the form.

Facilities in the Future Star Account

- Account opening balance: BDT 2,000 only

- Interest rate of up to 8% p.a., credited to the account yearly

- Free colorful passbook

- Free privilege card.

- No relationship or account maintenance fee.

Interest Rate on Future Star Account

Monthly Average Balance | Rate |

Below Tk. 50,000 | 4% |

Tk. 50,000 to less than Tk. 1 lac | 6% |

Tk. 1 lac & above | 8% |

Facilities in the Current Classic Account

- Account opening balance: BDT 15,000 only.

- yearly/ half yearly Account maintenance Charges Tk. 500 Half-Yearly

- Chequebook Issue Fee Free

- Second Chequebook Issue Fee Tk. 100 for 12 pages, if balance is below Tk. 15,000

- Visa Debit Card fee (annual) Tk. 600 (yearly).

Closing of Current Classic Account

- Customers can close a savings account by filling in an account closing form. Customers can withdraw all the amount end leave the funds to meet the account closing charges.

- To close the account the customer must return the cheque book and Visa debit Card. The employee will destroy the card and the cheque book in front of the customer.

- Customer can also transfer the money left to another BBL account by fund transfer option.

d) Salary Account

Salary Account is a non-cheque book individual account for employees of different Corporate Houses, offered to facilitate the disbursements of their monthly salaries. Employees of MNC/LLC/MID CORP/NGO/Large proprietorship/Partnership firm, other than foreign nationals are eligible to open this account. Interest rate for Salary Account is 4% p.a. Any balance greater than zero will be eligible for interest. Interest calculation will be based on Daily Balance and Interest payment will be made half yearly. There is no Annual Account Maintenance Fee in Salary Account. Annual Debit Card Fees is BDT 300 + VAT. Cheque Book facility is also available for this account.

Eligibility for opening a Salary Account

The organization needs to have a minimum of 10 employees & a payout of Tk. 1 lac per month and an average salary per employee of Tk. 10,000 per month

Required Documents to open a Salary Account

A completed personal account opening form same as the individuals Current Account including Copy of the office ID. If ID is not available appointment letter signed by the authority. Here National ID card/passport is also mandatory.

Minimum Deposit required to open a Salary Account

The minimum deposit required to open a Salary Account. is TK.0.

Facilities in the Salary Account

- 4% interest on any deposit amount (*on daily balance).

- No Account Maintenance Fees.

- Partial waiver on VISA Debit Card.

- Cheque book facility (Free for Aarong and BRAC staffs).

- Loan facility at preferential rates (Personal loan, Home loan, Auto loan).

Salary Account cheque book and Visa debit card

Customers will get cheque book and Visa debit card for the Salary Account. Salary Account in the name of the person, individuals or joint, will also get Visa debit card. Joint account holders will get Visa debit card for each person/ for any one person if the mode of operation is operating singly or either or survivor respectively.

Literature Review of Customer Satisfaction

Customer satisfaction

Customer satisfaction, a term frequently used in marketing, is a measure of how products and services supplied by a company meet or surpass customer expectation. Customer satisfaction is defined as “the number of customers, or percentage of total customers, whose reported experience with a firm, its products, or its services (ratings) exceeds specified satisfaction goals.” Satisfaction is an emotional or feeling reaction. It is the result of a complex process that requires understanding the psychology of customers. The range of emotion is wide with, for example, contentment, surprise, pleasure, or relief. Satisfaction is influenced, in the end, by expectations and the gap between perceived quality and expected quality, called “expectancy disconfirmation”.

3.2 Customer satisfaction process

The figure below shows the predominant linkage of this process:

3 Level of customer satisfaction

Customer satisfaction, however, is when the customer is satisfied with a Product/service that meets the customer’s needs, wants, and expectations. To further understand customer satisfaction, we must take a deeper look at the levels of specific satisfaction. We must also recognize that there are levels of customer satisfaction that, in a sense, define the basic ingredients of quality. There are at least three levels of customer expectations about quality:

Level 1. Expectations are very simple and take the form of assumptions, must have, or take it for granted.

Level 2. Expectations are a step higher than that of level 1 and they require some form of satisfaction through meeting the requirements and/or specifications.

Level 3. Expectations are much higher than for levels 1 and 2. Level 3 requires some kind of delightfulness or a service that is so good.

Measurement of customer satisfaction

The strategy issue is also a very important element of customer satisfaction, primarily because it sets the tone for the appropriate training, behavior, and delivery of the specific service. There are four items that the strategy for service quality ought to address:

- Customer service attributes

The delivery of the service must be timely, accurate, with concern, and with courtesy. One may ask why are these elements important the answer is that all services are intangible and are a function of perception. As such, they depend on interpretation. In addition and perhaps more importantly, service by definition is perishable and if left unattended, it can spoil on the organization.

- Approach for service quality improvement

The basic question one must be able to answer is why bother with service quality? The answer is in a three prong approach. The first is cost, the second is time to implement the program, and the third is the customer service impact. Together, they present a nucleus for understanding and implementing the system that Customer Service and Satisfaction is responsive to both customers and organization for optimum satisfaction.

- Develop feedback systems for customer service quality

The feedback system one chooses will make or break the organization. Make sure not to mix the focus of customer satisfaction and marketing. They are not the same. The focus of customer service and satisfaction is to build loyalty, and the focus of marketing is to meet the needs of the customer profitably. Another way of saying it is that marketing’s function is to generate customer value profitably, whereas the purpose of customer service and satisfaction is to generate repeatability, recognition, and overall satisfaction of the transaction. The concern here is to make sure that a goal exists (a reporting system for measurement is appropriate and useful for the particular service) and to reach the reward of service quality. The question then becomes how to develop a system that is responsive to the customer’s needs, wants, and expectations. To answer these concerns, look to the customer for answers. The value of the information must be focused in at least the following areas:

• To know what customers are thinking about company, company service, and company’s competitors.

• To measure and improve company’s performance

• To turn strongest areas into market differentiators

• To turn weaknesses into developmental opportunities—before someone else does

• To develop internal communications tools to let everyone know how they are doing

• To demonstrate your commitment to quality and your customers In essence your measurement for the feedback must be of two distinct kinds:

1. Customer satisfaction, which is dependent upon the transaction

2. Service quality, which is dependent upon the actual relationship

- Implementation

Perhaps the most important strategy is that of implementation. As part of the implementation process, management must define the scope of the service quality as well as the level of customer service as part of the organization’s policy. Furthermore, they must also define the plan of implementation. The plan should include the time schedule, task assignment, and reporting cycle.

Customer loyalty

Customer loyalty is not always easy to construe and many definitions have been proposed. Let’s first settle what customer loyalty is not (Prus & Randall, 1995): Customer loyalty is not customer satisfaction. Satisfaction is a necessary but not sufficient criterion. We know that “very satisfied” to “satisfied” customers sometimes switch to competitors. Customer loyalty is not a response to trial offers or incentives. Customers who react to incentives are often highly disloyal and they often leave as fast as they came. They are very much inclined to respond to a competitor’s incentive. Customer loyalty is not a strong market share. High level of market share can also be influenced by other factors such as poor performance by competitors or price issues. Customer loyalty is not repeat buying or habitual buying. Some of your consumers choose your products because of convenience or habits and they can be tempted to defect for any reason .Prus & Randall then describe customer loyalty as follows: “Customer loyalty is a composite of a number of qualities. It is driven by customer satisfaction, yet it also involves a commitment on the part of the customer to make a sustained investment in an ongoing relationship with a brand or company. Finally, customer loyalty is reflected by a combination of attitudes (intention to buy again and/or buy additional products or services from the same company, willingness to recommend the company to others, commitment to the company demonstrated by a resistance to switching to a competitor) and behaviors (repeat purchasing, purchasing more and different products or services from the same company, recommending

Satisfaction-Loyalty link

High-quality products and associated services designed to meet customer needs will create customer satisfaction. This high level of satisfaction will produce increased customer loyalty. According to conventional wisdom, we would be tempted to believe that the link between satisfaction and loyalty is a simple, linear relation. But reality proves us wrong: it is neither linear nor simple (see figure “The effect of satisfaction” below). The relation reacts differently according to time and circumstances. Unless they are totally satisfied, there is always a chance you will see customers be lured away (Jones & Sasser Jr., 1995). Source: Rust, Zahorik, Keiningham, 1996

Customer Service Quality

Let’s see what business Guru’s thinks:

“Customer Service is an organization’s ability to supply their customers’ wants and needs”

“Customer Service is any contact between a customer & a company, that cause a +ve /-ve perception by a customer”

At first BRAC Bank introduce the concept of customer service quality at banking sector in Bangladesh. BRAC Bank is always careful to provide their customer the best service and always try to make them happy. That’s why in every branch has a customer service department that consisting two level of employee:

BSSO (Branch sales and service officer)

They give all the service to the customer except cash transaction.

- Seek information about products /service

- Get more Clarity on something

- Solving Problems

- Lodge complaint & seek Solution

- Multiple affaires: FDR Receipt order and delivery, PO etc.

BSSO are responsible to solve this problem of customer.

2 Importance of Good Customer Service

Good customer service always has to play some rule. BRAC Bank customer service is always tried to provide certain service to their customer. Those are:

Customer Satisfaction

Customer satisfaction is the main purpose of customer service. All the branch staff is always try to give the best service to their customer.

Building Relationship

BRAC Bank treat customer as their guest. That’s why floor supervisor always cordially invited the customer when they enter into the branch and serve them until they leave the branch. That’s help customer to make loyal to the Bank.

Customer Expectation

As a service organization BRAC Bank always try to provide the best service that expected by its customer.

Higher Service Charge

Expectation of better Service

Positive & Negative Word of Mouth

BRAC Bank is always following the motto ‘Customer is always right’ and also behaves softly with the customer.

Customer Loyalty

BSSO and CSM always show sympathy in the any sad news of the customer or share a Share a happy moment with their existing customer. ex: Send Eid card, Calendar, Inform about new facility.

Increasing market Competition

BRAC Bank introduces new strategy day by day to make their potential client as their loyal customer.

A Survey of Customer Satisfaction

Research Approach

I have conducted a survey on the people of different occupation. Today the demand of Deposit and loan is rapidly increasing. At the preliminary stage, only rich people were interested to take service from BRAC Bank. Now middle class segments are also interested to this sector. So I have surveyed on both high and middle class people. So I have tried my best to go through most of the places.

Contact Method

I have contacted to the persons individually with a questionnaires. Then I gave them both close ended questions and open-ended questions. Most of the person gave answer of my entire question. Some did not because of their busyness and lacking of knowledge about loan procedure.

Sample Design

Sample design consists of three parts-

- Sample size

- Sampling frame

- Sample technique

a. Sample size

For this research (the survey on customer satisfaction) the determined sample size is 15.

b. Sampling frame

Opening an account is depending on the occupation of the family. He may be a company owner of related to any other type of business and he may be service holder. So the survey is conducted on these persons – businessmen & service holders.

c. Sampling technique

For this research the researcher follow the convenience sampling. As here the main objective was to gather knowledge about the customer satisfaction.

Research Instrument

My research instrument was a printed questionnaire to which I gave both close-ended questions and open-ended questions. It is because to make an explanatory research and to easily interpret and tabulate our research work.

Findings

By analyzing Consumer Banking system of BBL I have find out following issues-

Positive Findings

- BBL always tries to satisfy their customers through quality services.

- BBL tries to provide quick services to the customers and try to solve problems of the customers as soon as possible.

- All the employees of the customer service have excellent interpersonal and communicational skills.

- Customers of the bank pursue a great attitude about the bank.

- BBL provides excellent banking environment for both the customer and the bankers.

Negative Findings

- BBL customer service charges are much higher than other commercial banks in Bangladesh. This charges system should be changed. Otherwise it can be threat for the bank in future.

- The remuneration package dissatisfies the bankers because it is very poor for their hard work.

- Phone banking system found busy in many time.

- Absence of Islamic Banking System.

- There are some hidden costs in products or services which cause the customer sometimes in difficulty and sometimes the officers are not telling it to the customers properly which in the long run can hamper their business. Officers should clear every paisa about the costing to the customer clearly.

- CSO dealing with retail products have to perform dual duties- Service to customers and fund collection. So that they can’t concentrate on customer service properly. As a result sometimes there service hampered as they always think how they can fulfill the target.

Recommendations and conclusion

Recommendations

However the satisfaction level of BRAC Bank is good enough. But some customers have expressed their dissatisfaction about the BRAC bank in various aspects. It has a profound effect on the overall satisfaction level of the bank. I have to make some recommendations based on the findings that I have got from my research. I hope the recommendation will help the bank to take necessary steps in order to increase the satisfaction level of customers of BRAC Bank. The following are some recommendations for the company:

- Bank has to satisfy its customer at any cost. Even if the customer is wrong in that case also, even then the officers should not make any rough behave to the customer. Because customers are everything for a bank. The employee of BBL should show a sincere interest in solving the customer’s problem.

- For maintaining the relationship with the customer, employees have to give all types of support to the customers.

- Officials should be more cooperative with the clients.

- Officials should be faster during transaction.

- There are a lot of banks now in Bangladesh and customers now have lots of options. So a bank should do everything possible for them to do to retain its customer.

- Bank should be more innovative and diversified in its services.

- Some customers said that the service charges of BRAC bank are comparatively higher than other bank so it should be reduced if possible. Otherwise it can be a threat for the bank in future.

- Facilities of equipment like PC system should be improved so that every employee could work properly in time.

- The code of conduct for the officials should be strictly maintained.

- Token system/Queue system should be introduced in the customer service to minimize the rush and for easy service giving by the officer.

- Mobile phone use of the customers should not be allowed inside the Bank like some other multinational Banks.

- Sometime it is seen that some people are sitting in the waiting bench for hours without any cause. So security system should be more strict in the Bank.

Conclusion

Today banking business becomes more competitive than before. Now customers are more aware and become smart to compare between the banks. And then choose the most convenient bank for them for dealing with their hard earned cash and business finance. Considering the fast moving and altering business era in the world each and every business organizations need to upgrade their ways of business to keep pace in the changing situation. It is very true that the most of the customers do not hesitate to term BRAC Bank better than other banks. But it should also be considered that the customers have very few choices of banks with which they can actually compare the Consumer Banking services of BRAC Bank. The bank has successfully made a positive contribution to the economy of Bangladesh with in very short period of time. Its profit is gradually increasing. The local banks have recently focused their attention to customer service, satisfaction regarding deposit-banking services. Moreover there are a good number of private banks that are into the competition. Therefore it is better for BRAC Bank not to let the situation be worst and should emphasize on serving customers effectively and efficiently to ensure better services. By the grace of Almighty ALLAH, My study finally ended up with considerable degree of success. I consider it to be a success, because I carried out a lot of invaluable experiences. It helped me to identify the best way of applying the theoretical knowledge to practical field, to make adjustments, alteration in order to be in line with practice. As per working experience concern; it cannot be spelled out within few words. It really gave me tremendous experience of working in a congenial atmosphere. Experience with BRAC Bank Ltd. proves that putting corporate interest before individual interest and a sense of responsibility can lead an organization to its desired goal.