The Performance of Shahajalal Islami Bank Limited:

Bank’s Performance:

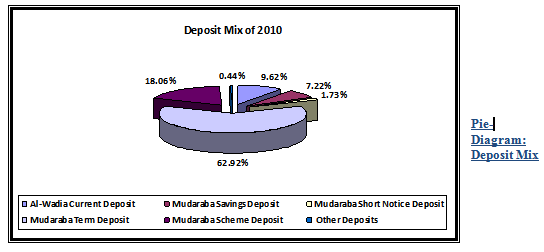

Sl.No. | Nature of Deposit | Taka in million | Percentage of Total Deposit |

| 1 | Al-Wadia Current Deposit | 5,236.44 | 9.62% |

| 2 | Mudaraba Savings Deposit | 3,928.15 | 7.22% |

| 3 | Mudaraba Short Notice Deposit | 965.11 | 1.73% |

| 4 | Mudaraba Term Deposit | 34,257.56 | 62.92% |

| 5 | Mudaraba Scheme Deposit | 9,826.65 | 18.06% |

| 6 | Other Deposits | 233.09 | 0.44% |

| Total | 54447.00 | 100% |

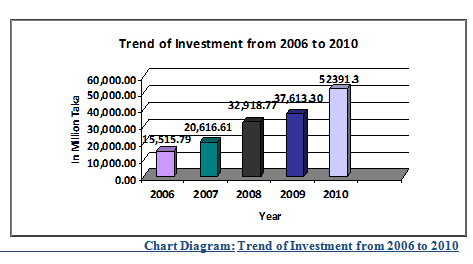

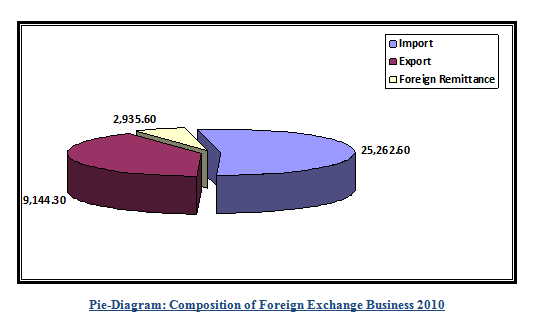

Despite changing macro-economic condition and volatile money market & foreign exchange market, Shahjalal Islami Bank Ltd. was successful in achieving much higher than national growth in deposit, Investment, export, import & remittance business. As on 30th September 2010 total deposit of the bank stood at Tk.54447.00 million showing growth rate of 28.76%, total amount of Investment of the bank stood at Tk. 52391.30 million with growth rate of 39.29%. During the year import volume stood at Tk. 25262.60 million with growth rate of 48.95% compared to that of the previous year. The growth rate of export business has significantly been increased by Tk. 5749.2 million, it stood at Tk. 19144.30 million as of 30th September 2010 against 13395.10 million of the previous year which indicate 42.92% growth over previous year. Foreign Remittance of the bank stood at Tk. 2935.6 million as of 30th September 2010 as against Tk. 33951.60 million of 2009 with significantly growth of -18.38% over previous year. The ratio of non-performing investment is within the acceptable range of 0.44%. The fact that non-performing investment ratio remained below 1% indicated that the strategy of equity growth by adhering to compliance in spheres of operations is working well.

Table: Deposit Mix of 2010

Pie-Diagram: Deposit Mix

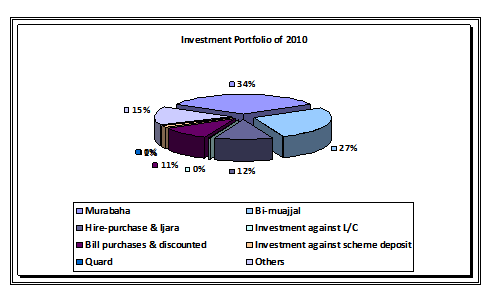

Investment Portfolio of 2010

| Sl. No. | Modes of Investment | Taka in Million | Percentage of total Investment |

| 1 | Murabaha | 17,449.51 | 33.31% |

| 2 | Bi-muajjal | 14,224.94 | 27.14% |

| 3 | Hire-purchase & Ijara | 6,463.44 | 12.34% |

| 4 | Investment against L/C | 106.13 | 0.20% |

| 5 | Bill purchases & discounted | 5,596.61 | 10.68% |

| 6 | Investment against scheme deposit | 657.61 | 1.26% |

| 7 | Quard | 168.33 | 0.32% |

| 8 | Others | 7724.73 | 14.75% |

| Total | 52391.30 | 100.00% |

Pie-Diagram: Investment Portfolio 2010

Chart Diagram: Trend of Investment from 2006 to 2010

Composition of Foreign Exchange Business of 2010

Particulars | Amount in Million Taka | Percentage of Total |

Import | 25262.60 | 54.28% |

Export | 19144.30 | 33.61% |

Foreign Remittance | 2935.6 | 12.11% |

Total | 47342.50 | 100.00% |

Pie-Diagram: Composition of Foreign Exchange Business 2010

Capital Structure:

At the very inspection, SIJBL started with an authorized capital of Tk. 800 million. While it’s initial Paid-up Capital was tk. 205 million subscribed by the sponsors in the year 2001. The Capital and reserve of the bank as on 30th September 2010 stood at Tk. 6000 million including paid-up capital of Tk. 3425.10 million. The Capital Adequacy Ratio (CAR) as on 30th June 2010 stood at 13.73% that was well above minimum requirement of 10% by Bangladesh Bank

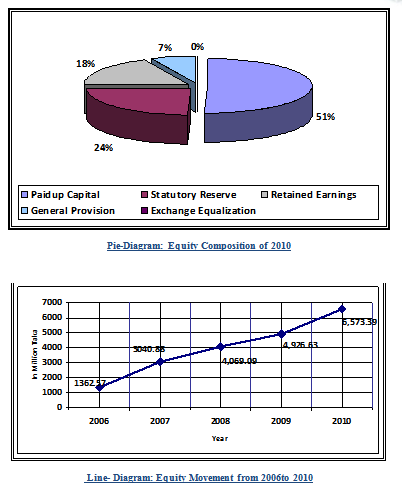

Equity of SJIBL

The Bank’s Equity is divided into two parts i.e. Tier-I and Tier-II capital. Tier-I includes paid-up capital, reserve and retained earnings and Tier-II includes general provision on unclassified investment and exchange equalization account. The authorized capital of the bank is Tk. 6,000 million and paid-up capital of the bank is Tk. 3425.10 million as on30th June 2010. Total equity was Tk.6573.39 million as on30th June 2010.

Pie-Diagram: Equity Composition of 2010

Pie-Diagram: Equity Composition of 2010

Line- Diagram: Equity Movement from 2006to 2010

Credit Rating Report by CRISL:

Credit rating of the bank was performed by Credit Rating and Information Services Limited (CRISL). In their report Highlights Of Performance 30th September 2010, they rated the bank as AA- (double A minus) for long term and ST-2 for short term. The gradation in long term rating has been done in consideration of its good capital adequacy, appropriate asset quality, increased non-funded business and sound liquidity position. The short term rating indicates high certainty of timely repayments of financial obligations. Risk factors are very small. The long term rating is valid for only one year and the short term rating is for six months. CRISL also viewed the bank with ‗Stable Outlook‘ in consideration of its overall performance, improvement in asset quality, growth in investment and deposits. The capital adequacy of SJIBL stood at 13.73% at the end of FY 2010 against regulatory requirement of 10%. The asset quality of the bank has improved and at the end of FY2010 non-performing asset stood at only 0.44%. During FY 2010, the deposit mobilization had significant growth of 28.76% and stood at BDT 54447.00 million. This augmented investment growth by 39.29% as well as asset growth by 59.51% in FY 2010. The equity growth during FY 2010 was 29.33%, supported by after-tax profit growth of 89.42%. The financial performance of the bank was good and almost stable in FY 2010 compared to previous year‘s performance. During FY 2010, the bank has shown outstanding growth in non-funded business; doing better in all area of export, import and inward remittance. SJIBL has been maintaining satisfactory liquidity and its short term and long term liabilities (up to five years) are also backed by adequate volume of assets. The bank maintained a surplus amount of provisions against its non-performing investment (NPI), to cover risk in future. The NPI coverage ratio stood at 325.06% at the end of FY 2010.

Introduction about Ratio Analysis:

Analysis of time-series trends in financial ratios is another technique used in financial statement analysis. In some case, this analysis is relatively heuristic. It is analysis the Total Assets Turnover Ratio, Net Profit Margin Ratio, Return on Equity (ROE), Earnings per Share, Cash Reserve Ratio, Statutory Liquidity Ratio, Capital Adequacy Ratio, Investment Deposit Ratio, Return on Investment in Securities (ROI), Return on Asset (ROA), Price Earning Ratio, Investment Ratio etc.

Calculation of Different Ratios:

Return on Asset (ROA) =Net Income/ Average Total Assets

Return on Equity (ROE) =Net Income/ Average Stockholders’ Equity

Asset Turnover (ATO) = Interest Income/ Average Total Assets

Retained Earnings to Total Assets (RETA) =Retained Earnings / Average Total Assets

Profit Margin (PM) =Net Income/ Operating Income

Investment Ratio (IR) =Average Total Investment / Average Total Assets

Retained Earnings to Total Assets =Retained Earnings / Average Total Assets

Cash to Assets Ratio =Cash / Average Total Assets

Table: Capital Adequacy Ratio of SJIBL

| Particulars | Year 2010 | Year 2009 |

| Capital Maintained (Req. 5%) | Capital Maintained (Req. 5%) | |

| Core Capital | 12.24% | 15.05% |

| Supplementary Capital | 1.57% | 1.37% |

| Total | 13.73% | 16.42% |

Table: Calculation of Different Ratios of SJIBL

Table: Calculation of Different Ratios of SJIBL

| Particulars | Year 2010 | Year 2009 |

| Earnings Per Share (EPS) | 26.11 | 10.55 |

| Return on Asset (ROA) | 2.02% | 1.61% |

| Return on Investment in Securities (ROI) | 16.84% | 11.41% |

| Investment Deposit Ratio | 96.22% | 88.95% |

| Return on Equity (ROE) | 21.80% | 19.00% |

| Total Asset Turnover Ratio | 0.43% | 0.35% |

| Retained Earnings to Total Assets (RETA) | 1.66% | 0.82% |

| Profit Margin (PM) | 41.97% | 47.48% |

| Investment Ratio (IR) | 77.57% | 71.39% |

| Retained Earnings to Total Assets | 1.75% | 0.95% |

| Cash to Assets Ratio | 7.13% | 6.71% |

Analyze of Ratios:

Earning Per Share has been calculated in accordance with BAS-33.previous year’s Earning Per Share of Tk. 26.11 has been adjusted to Tk. 28.81 due to issuance of 37,43,300 bonus shares during the year. The SJIBL’s Capital Adequacy Ratio position is good but its lower than previous year. Return on Asset ratio is 2.02% of the year 2010. Return on Investment in Securities also 16.84%, this is higher than previous year. Bank’s Return on Equity is 21.80%, its lower than previous year. To analyze this ratio SJIBL’s profitability ratio performance is good and bank’s capital adequacy ratio is in good position. Total asset turnover, Cash reserve and Cash to asset ratio shown better liquidity performance.

SJIBL’s Profit Margin is 41.97% it is outstanding for this bank. And SJIBL’s Investment Ratio is outstanding and Investment deposit ratio is shown good position.

By analyze those ratio’s SJIBL’s Profitability, Efficiency, Liquidity and Asset-quality position is very good. This ratio also shown the bank’s overall performance is outstanding.

Conclusion:

From the practical implementation of customer dealing producers during the whole period of my practical orientation in Shahjalal Islami Bank Limited, I have reached a firm and concrete conclusion in a very confident way. I believe that my realization will be in harmony with most of the banking thinkers. It is quite evident that to build up an effective and efficient considered as soon as possible. Besides, every bank has to survive amidst of a large number of banks including local and foreign. That’s why to keep with expected profit margin of the time being and for the future every bank should try heart and soul to please the customers in a smart and trusty way. But quit regretful to mention that most of our bank face decreasing profit trend due to switch over of their present customers to those foreign with higher customer service facilities. So, timely decision for introducing sophisticated banking instruments should be taken as early as possible. After taking effective and time defeating measures regarding efficient employees and instruments will help the local office of Shahjalai Islami Bank Limited to reach the pinnacle of success with high profit and productivity. A new- bank they should be in financial side because there is too much competition and new banks are growing up. If Shahjalal Islami Bank adopts professionalism within the framework of Shariah, they will be able to earn handsome “Halal” profit and pay higher return to the depositors and share holders. Ultimately, public will get more confidence on this type of banking.