Background of the study

We studied our courses on business studies from theoretical aspects. There was no scope to earn practical knowledge about business and its environment, theory and practice are inter-related and are equally important. Knowledge is not fruitful one unless it is a combination of both theory and practical. Under the department of Business Administration, BBA Program allows its student to study and analysis a selected organization in order to get a practical knowledge which also facilitates use of theoretical knowledge, students have already gathered. As a part of requirement of BBA Program, I was also assigned to prepare report titled: “Overall banking system of Dhaka Bank Ltd. Special Focus on “Credit Division”

Rationale of the study

The purpose of this study is to find and analyze the Credit facilities (its outstanding, recovery, classified loans etc), approval and monitoring process of Dhaka Bank Limited, Local office. It will also include the performance of credit facilities in recent years. Find out different credit facilities that Dhaka Bank is providing for their customers. Also to give an idea about the securities behind the loan facilities and issuing different bank guarantees.

Objectives of the Report

The objectives of this report are:

- To identify the credit approval, their securities and monitoring process of Dhaka Bank Limited.

- To identify the different sectors that have or had been provided the different credit facilities and also to identify sectors got the highest and lowest credit facility and why. Reasons for those.

- Identifying the amount of outstanding credits of different sectors in the past four years and comparison of them.

- To identify the recovery rates of the loans in different sectors in last 4 years and have a comparison among them.

- Identifying the classified loans of different sectors in the last several years and analyzing the changes that had been occurred to them.

Scope Of The Report:

The report is based on the theoretical and practical analysis. However, the scope of the report is confined within the Bhulta Branch.

The report will focus on the following areas

- The kinds of products and services provided by Dhaka Bank Ltd.

- General procedures for getting different kinds of banking services.

- Different policies by which the Bank is governed.

The report may help to determine the efficiency of the Dhaka Bank Ltd operations, especially operations of Bhulta branch.

Limitations Of The Study

There are some limitations I had to face while preparing this report. It is very difficult to collect some of the important data and information. There are some information very secret and the Bank didn’t want to provide these information. But these information may help to build a good report. Another limitation is availability of the data. The bank doesn’t have the interest amount they collect from different loans. For this there is no specific profit calculation of the credit department. The credit department also doesn’t have the entire provision amount they collected from the classified loans. They started to keep it as document from the year 2008. So, I have only two years (2007 and 2008 up-to 1st December) provision amount. So, These kinds of limitations I faced while preparing the report.

Methodology

There are two main sources of collecting data. They are-Primary source and Secondary source. Primary source of data contains group interview, face to face interview, questionnaire survey etc and secondary source of data means collecting information through books, reports, journals etc. For this report almost all the data are collected through secondary sources. For getting the information I had to see the annual reports, books, quarterly report which they prepare to submit in the head office and also in Bangladesh Bank. There are some data collected from the primary source (face to face interview).

Overview of Dhaka Bank Limited

DHAKA BANK LIMITED was incorporated as a public limited Company on 6th April 1995 under the company act. 1994 and started it’s commercial operation on June 05, 1995 as a private sector bank. The bank started its journey with an authorized capital of Tk. 1,000.00 million and paid up capital of Tk. 100.00 million.

To facilitate the daily clientele requirements, DHAKA BANK LTD. has started its business with all the features of a corporate bank and the products of both corporate and retail banking system. Among all of its products Credit is one of the most important financial-tool in modern banking sector. Though DHAKA BANK is always trying to improve their services in this field, but in today’s competitive business world, banks need to offer additional concentration to the clients’ requirement in order stay at the top.

The strength of a bank depends on its management team. The Employer in Dhaka Bank is proud to have a team of highly motivated, well-educated and experienced executives who have been contributing substantially in the continued progress of the bank. The management is ably supported and assisted by well-motivated and experienced officers to run the day-to-day affairs of the bank smoothly. The bank is proud to have a dedicated band of people to whom the commitment to provide Excellence in banking is imbued in the way of their life.

The marketing activities at the Dhaka Bank LTD. are very implicit and vast comparing to that of other bank in the country today. The Philosophy of the bank is “EXCELENCE IN BANKING”. This is the bank’s commitment and guiding principle. In the General Banking sector marketing seems to be the most important sector. To influencing the clients the bank uses a few apparatus or tactics. The main objective of the bank is to persuade the clients to open an account in the bank, because a bank is an institute where the service is more or less intangible.

As the product of the bank is service oriented. Therefore, in most cases the bank has to pursue the customers through their wit and intelligence. Besides, there are a number of banks in the country both national and international therefore, the competition is immense. There are some very strict rules and specially maintained regulations and the operations of the bank, which are regulated by Bangladesh Bank.

Another important task of the bank is to maintain the reputation through their customer service oriented facilities. And Dhaka Bank is always willing to offer new product features to the client. Besides the applications of these products or services are prepared in a very modern way so that the service can be provided in least time required.

The Credit facilities approved by Dhaka Bank is increasing day by day because of its well-organized and trained management and also well-equipped facilities. The Bank didn’t stick with it’s in only one field rather it has diversified it’s credit facilities. In recent time banking sector becomes very competitive and without giving good and attractive facilities and service no bank can survive in this time. Dhaka Bank is also trying to provide good service to keep going with this competition.

Mission, Vision, Strategy Statement:

To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personal to deliver Excellence in Banking.

At Dhaka Bank, we draw our inspiration from the distant. Our is to assure a standard that makes every banking transaction a pleasurable experience. Our endeavor is to offer you supreme service through accuracy, reliability, timely delivery, cutting edge technology and tailored solution for business needs, global reach in trade and commerce and high yield on your investment.

Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinct foresight. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision –Excellence in Banking.

Capital and reserves:

Bangladesh economy has been experiencing a rapid growth since the ’90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to responded to this need and established Dhaka Bank Limited in the year 1995.

The Bank was incorporated as a public limited company under the Companies Act. 1994. The Bank started its commercial operation on July 05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at Tk 2,659,597,763 as on March 31, 2010. The total equity (capital and reserves) of the Bank as on March 31, 2010 stood at Tk 6,036,368,754.

The Bank has 54 Branches, 4 SME Service Centers, 5 CMS Units, 2 offshore Banking Unit across the country and a wide network of correspondents all over the world. The Bank has plans to open more Branches in the current fiscal year to expand the network.

Dhaka Bank Launches Own ATM Network-

On June 16, 2010 Dhaka Bank went live with its own ATM switching and debit card management software IRIS which is full-integrated with Flexcube and the existing Cashlink network. Having its own ATM switch enables the Bank to connect with all ATM networks in the country for better service to its valued customers. As part of this initiative, the Bank has launched 4(four) of its own ATMs at Mirpur, Narayangonj, Zindabazar and Halishahar with 6(six) other ATM locations soon to follow. This has been the result of strong teamwork between the IT, Retail, Operations and respective Branch teams with support from other Divisions.

Bangladesh walks a historic Digital Path mobile Remittance launched for the first time in the country-

April 13, 2010 a historic milestone for Bangladesh as international remittance took a turn towards the future today with the launch of Mobile remittance, a first ever for Bangladesh as well as South Asia. Dhaka Bank Ltd (DBL) and country’s 2nd largest mobile operator Banglalink jointly launched the service at a city hotel. Bangladesh Bank Governor Dr. Atiur Rahman formally inaugurated the service.

A Project Inauguration Ceremony of 11 MW Power Plant at Mohipal, Feni-

A Project Inauguration Ceremony of 11 MW Power Plant implemented by Doreen Power House and Technologies Ltd. was held on August 10, 2009 at project site of Mohipal, Feni. Mr. Khondker Fazle Rashid, Managing Director of Dhaka Bank Limited inaugurated the power plant. The Project started its commercial operation on April 25, 2009 and has been supplying electricity to the Rural Electrification Board (REB).

Risk management:

The evaluation process is carried out based on ‘Lending Guideline’ described in this Policy and the clauses and documents checklist as per the PPG. The detailed credit risk assessment should be conducted prior to the approving of any loans. Bank shall formulate a separate risk-grading matrix customized for SME financing on the basis of expert opinion taking into consideration the experience of the Bank in lending the SMEs for last few years.3.14 Reporting to business unit monthly summary of all new loans approved, renewed, enhanced, and a list of proposals declined stating reasons thereof shall be reported by Credit Team to the Business Head.

District-wise Branch distribution:

Dhaka Bank has opened new branches in different Cities, Places and areas over the years. This shows the banks commitment to provide services to the valued their customers through an extensive branch network at all commercially important places across the country. The bank has already 57 branches in different places in Dhaka and also in Chittagong, Sylhet, Rajshahi, Khulna, Barisal, Rangpur. They also have planned to open more branches in the sort coming year. These branches are well decorated and well secured with the new technologies.

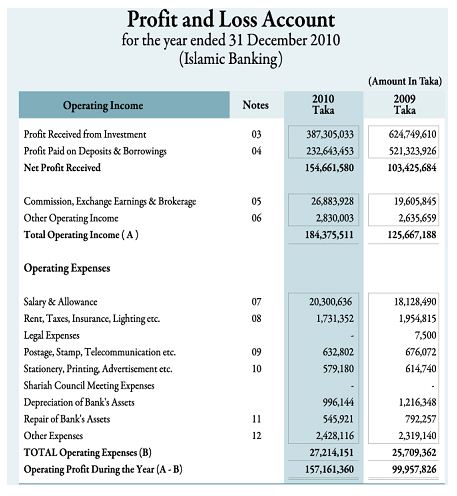

Profit And Loss Account:

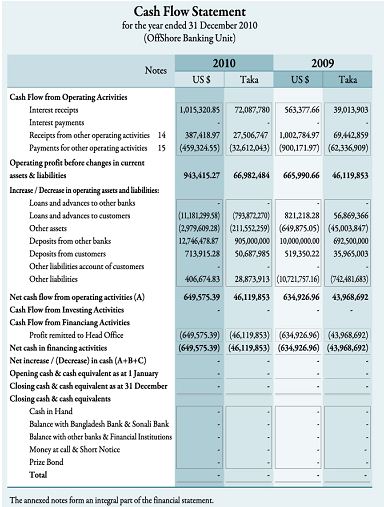

Cash Flow Statement

General Banking:

Bank is a financial intermediary that offers the widest range of financial services- especially credits, savings, and payment services-and performs the widest range of financial functions of any business firm in the economy. This multiplicity of bank services and functions has led to banks being labeled “financial department stores”.

Worldwide, banks grant more installments loans to consumers than any other financial institution. Banks are among the most important source of short-term working capital for businesses and have become increasingly active in recent years in making long-term business loans for new plant and equipment.

Accounts Opening Section:

The relationship between banker and customer begins with the opening of an account by the customer. Opening an account binds the banker and customer into contractual Deposit Account relationship. In fact, all kinds of fraud and forgery start by opening an account. So the bank should take extreme caution in section customers.

Different Types of Account:-

a) Current Deposit Account

b) Saving Deposit Account

c) Short term Deposit Account

d) Fixed Deposit Account

e) Monthly Saving Deposit Account.

Documents For Opening Some Special Account:

Current Account:

A current deposit account may be operated in several times during a working day. There is no restriction on the number and the amount of withdraws from a current account and the banker does not allow any interest on the current account.

As the banker is under an obligation to repay these deposits on demand, they called demand liabilities of a bank. To meet such liability the banker keeps sufficient cash reserves against such deposit. There are two facilities for the people who open a current account. They are:-

Over draft facility

Collection of check transfer of money rendering agency, general utility service. A person can open a current a/c or any entity. The entity can be a partnership firm, limited company, proprietorship firm, association, clubs etc. For opening a current account of the above, the requirements and steps, which are followed by this branch, are like: –

a) Individual Account opening:

There is an individual application form for opening personal current a/c. The person, who wants to open this type of a/c, is said to fulfill the following requirement:

a) Name/ Father’s Name/ Husband’s Name

b) Present and Permanent Address

c) Occupation

d) Mandate in Writing

e) Declaration of Nominee

f) Letter of Introduction

g) Specimen Signature

h) Two copies of passport size photograph

i) Initial deposit of Tk.10000.

b) Join Stock Companies, Association, Clubs etc. Account opening:

In case of opening a current a/c of joint stock companies, association, clubs etc. the following requirements are said to fulfill:

True copies of certificate of incorporation or registration (in case of companies and registered bodies)

True copies of certificate of commencement of business (in case of limited company)

True copies of memorandum and articles of association (in case of limited company). The rules of regulation by laws (in case of associations, clubs etc.)

True copy of resolution of the Board of Directors of Managing Committee/ Governing Body, regarding conduct of account.

Certificate list containing names and signature of the Board of Directors/ Officer Bearers.

c) Partnership / Proprietorship Company Account Opening:

To open a current a/c on the name of any partnership or proprietorship company, the following document are required:

Filled up application form stating about the name and address of the firm.

Partnership deed.

Trade License.

Two copies of photographs.

Endorsement of an a/c holder of the same branch. (for partnership companies).

Undertaking / declaration about the partnership is taken by the bank in a white paper (for proprietorship firm.

Private & Public Limited Company Account opening:

The document are required by the bank to open a current a/c be:

Copy of the certificate of incorporation or registration.

Copy of the certificate of business.

True copy of memorandum of association and articles of association abide by laws.

True copy of resolution of the Board of Directors/ Managing Committee/ Governing Body regarding conduct of the account.

Certificate list containing the names and signature of the Board of Directors/Officer Bearers. In order to open an account, the customer is first of all asked to fill up the application form given from the bank. The bank requires few documents of the client due to the producers, such as proposal for opening an a/c, name and full address (both present and permanent).

Savings Account individual or joint:

Saving Account / (SB)

A saving a/c is meant for the person of the lower and middle classes who wishes to save a part of their income to meet their future needs and intend to earn an income from their saving.

All the feature are like CD a/c except some restrictions imposed by the bank.

The bank offers a reasonable rate of interest.

The number of withdrawals over period of times is limited. Only two withdrawals are permitted per week. But more than that no interest will be paid on rest of the amount for that month.

The total amount of one or more withdrawals on any date should not exceed 25% of the balance in the a/c unless 7 days advance notice is given.

Cash Section:

Dishonored Cheques:

A dishonored cheque cannot be redeemed for its value and is worthless; they are also known as an RDI (returned deposit item), or NSF (non-sufficient funds) cheque. Cheques are usually dishonored because the drawer’s account has been frozen or limited, or because there are insufficient funds in the drawer’s account when the cheque was redeemed. A cheque drawn on an account with insufficient funds is said to have bounced and may be called a rubber cheque. Banks will typically charge customers for issuing a dishonored cheque, and in some jurisdictions such an act is a criminal action. A drawer may also issue a stop on a cheque, instructing the financial institution not to honor a particular cheque.

In England and Wales, they are typically returned marked “Refer to Drawer” – an instruction to contact the person issuing the cheque for an explanation as to why the cheque was not honored. This wording was brought in after a bank was successfully sued for libel after returning a cheque with the phrase “Insufficient Funds” after making an error – the court ruled that as there were sufficient funds the statement was demonstrably false and damaging to the reputation of the person issuing the cheque. Despite the use of this revised phrase, successful libel lawsuits brought against banks by individuals remained for similar errors.

However, in Scotland, a cheque acts as an assignment of the amount of money to the payee. As such, if a cheque is dishonored in Scotland, what funds are present in the bank account are “attached” and frozen, until either sufficient funds are credited to the account to pay the cheque, the drawer recovers the cheque and hands it into the bank, or the drawer obtains a letter from the payee that he has no further interest in the cheque.

A cheque may also be dishonored because it is stale or not cashed within a “void after date.” Many cheques have an explicit notice printed on the cheque that it is void after some period of days. In the United States, banks are not required by the Uniform Commercial Code to honor a stale dated-cheque, which is a cheque presented six months after it is dated.

Deposit Section

The deposit base of the bank registered a growth of the reporting year over the last year 2008 BDT Tk. 56,98,59,24,645 and this year 2009 at BDT Tk. 60,91,83,74,023. Expansion of branch network, competitive interest rate and deposit products contributed to the growth. The customers of the bank were individuals, corporations, financial institutions, government and autonomous bodies etc.

Credit and Risk Management:

The bank has established effective risk management for steady and growth of the bank in accordance with the guideline of Bangladesh bank. The risk management of the bank covers following five core risk areas of banking:

- Ø Credit risk

- Ø Marker risk

- Ø Liquidity risk/assets liability management

- Ø Reputation risk arising from inadequate prevention of money laundering

- Ø Internal control and compliance risk

- Ø Information technology risk

The prime objective of the risk management is that the bank takes credit and business risks while safeguarding bank’s interest from the losses, financial or otherwise. The banks risk management ensures internal control and compliance committee (MANCOM), asset liability committee (ALCO) cost containment committee and credit risk management committee for assessment of credit risk foreign exchange risk market risk money laundering risk reduction of operation cost etc. at office level on regular basis. Above that the executive committee and audit committee comprising of members the board of directors the risk assessment at board level.

Foreign Exchange:

Foreign Exchange in Bangladesh is still dominated by imports resulting

in adverse balance of trade. Export has registered a significant volume of

growth over the past years and the export import gap is reducing every

years. In early seventies the export of Bangladesh was dominated by jute

items only. In fact 90% of the export earnings at that time was from Jute

section and the test 10% from Leather and Tea sector. The situation,

however stared changing with the introduction of non – traditional items

like shrimps, fish, readymade garments, finished leather, newsprint,

handicrafts etc.

Foreign Exchange Market in Bangladesh:

Foreign Exchange Market allows currencies to be exchanged to facilitate international trade and financial transactions. Evolution of the market in Bangladesh is closely linked with the exchange rate regime of the country. It had virtually no foreign exchange market up to 1993. Bangladesh bank, as agent of the government, was the sole purveyor of foreign currency among users. It tried to equilibrate the demand for and supply of foreign exchange at an officially determined exchange rate, which, however, ceased to exist with introduction of current account convertibility. Immediately after liberation, the Bangladesh currency taka was pegged with pound sterling but was brought at par with the Indian rupee. Within a short time, the value of taka experienced a rapid decline against foreign currencies and in May 1975, it was substantially devalued. In 1976, Bangladesh adopted a regime of managed float, which continued up to August 1979, when a currency-weighted basket method of exchange rate was introduced. The exchange rate management policy was again replaced in 1983 by the trade-weighted basket method and US the dollar was chosen as intervention currency. By this time a secondary exchange market (SEM) was allowed to grow parallel to the official exchange rate. This gave rise to a curb market.

At present, the system of exchange rate management in Bangladesh is to monitor the movement of the exchange rate of taka against a basket of currencies through a mechanism of real effective exchange rate (RFER) intended to be kept close to the equilibrium rate. The players in the foreign exchange market of Bangladesh are the Bangladesh Bank, authorized dealers, and customers. The Bangladesh Bank is empowered by the Foreign Exchange Regulation Act of 1947 to regulate the foreign exchange regime. It, however, does not operate directly and instead, regularly watches activities in the market and intervenes, if necessary, through commercial banks. From time to time it issues guidelines for market participants in the light of the country’s monetary policy stance, foreign exchange reserve position, balance of payments, and overall macro-economic situation. Guidelines are issued through a regularly updated Exchange Control Manual published by the Bangladesh Bank.

The authorized dealers are the only resident entities in the foreign exchange market to transact and hold foreign exchange both at home and abroad. Bangladesh Bank issues licenses of authorized dealership in foreign currencies only to scheduled banks. The amount of foreign exchange holdings by the authorized dealers are subject to open position limits prescribed by Bangladesh Bank, which itself purchases and sells dollars from and to the dealers on spot basis. The size of each such transaction with Bangladesh Bank is required to be in multiples of $10,000, subject to a minimum of $50,000. In addition to authorized dealers, there are registered moneychangers to buy foreign currencies from tourists and sell them to outgoing Bangladeshi travelers as per entitlement. Their excess holdings beyond the permitted balance are required to be retained with authorized dealers. Some service institutions like hotels and shops have also obtained limited money changing licenses to accept foreign currencies the foreign tourists, but those are to be sold to authorized dealers. Transactions by customers take place mainly to satisfy customer demand for individual needs and to facilitate export, import, and remittances.

The foreign exchange market of the country is confined to the city of Dhaka. The 32 scheduled banks operating as authorized dealers in the inter-bank foreign exchange market are not permitted to run a position beyond certain limits. In the event of speculation on an appreciation of the value, an authorized dealer may buy more foreign currencies than it needs, but at the end of the day it must maintain its limit by selling excess currencies either in the inter-bank market or to customers. Authorized dealers maintain clearing accounts with the Bangladesh Bank in dollar, pound sterling, mark and yen to settle their mutual claims. If there any excess foreign exchange holdings exist after these transactions, it is obligatory for them to sell it to the Bangladesh Bank. In case of shortfall of the limit, authorized dealers have to cover it either through purchase from the market or from the Bangladesh Bank.

Before deregulation of foreign exchange market the volume of inter-bank transaction was low. The assured access to funds from Bangladesh Bank at known cost as well as the assured buy-sell margins and transaction fees contained in the pre-determined exchange rate provided little inducement for authorized dealers to engage in inter-bank transactions. However, the situation has been changing and the reliance of authorized dealers on the Bangladesh Bank is gradually declining.

The average monthly transactions of foreign exchange in the inter-bank market accounted for $23.46 million in 1991-92 and crossed the $1 billion mark in 1998-99. The average monthly turnover for the six months between July and December 2000 was $1.5 billion. The phenomenal growth of inter-bank transactions was due mainly to relaxation of exchange control regulations and expansion of the activities of the Bangladesh Foreign Exchange Dealers Association (BAFEDA) formed on 12 August 1993.

The-inter bank foreign exchange market of Bangladesh is still at its rudimentary stage. The market is an oligopolistic one and is dominated by a few relatively large banks, which have remained only as dealers instead of developing themselves into buyers or sellers. The most widely used practice is spot transaction; this covers 95% of the total transactions. Only forward transactions offer protection against foreign exchange risks. Deals in foreign exchange market are usually confirmed over telephone, followed by a written advice. Confirmed deals may be cancelled on payment of necessary costs.

There also exists a curb market, where currency racketeers transact foreign currencies through a chain of middlemen. This market emerged in the restricted regime of foreign exchange transaction but continues to be active. This market operates in the alleys or lanes and by-lanes of Dhaka city around the foreign exchange branches of authorized banks. Dealers of hundi also form part of this market. A sizeable amount of foreign currencies is channeled through this market every year.

12History of Exchange Rate In Bangladesh:

Up to 1990, multiple exchange rates were allowed under different names of export benefit schemes such as, Export Bonus Scheme, XPL, XPB, EFAS, IECS, and Home Remittances Scheme. This led to a wide divergence between the official rate and the SEM rate. The situation also gradually gave rise to a number of conflicting regulations, poor risk management, and various types of implicit or explicit government guarantees to the users of foreign exchange. This resulted in a number of macro-economic imbalances prompting the government to adjust the official rate in phases and to liquidate its difference with the rate at SEM. The two rates were finally unified in January 1992. The first step towards currency convertibility was taken on 17 July 1993 and this marked the beginning of a relatively open foreign exchange market in the country. Until then the Bangladesh Bank used to declare mid-rate along with the buying and selling rates for dollar applicable to authorized dealers. Initially the spread was BDT 0.10, which was gradually widened to BDT 0.30.

At present, the system of exchange rate management in Bangladesh is to monitor the movement of the exchange rate of taka against a basket of currencies through a mechanism of real effective exchange rate (RFER) intended to be kept close to the equilibrium rate. The players in the foreign exchange market of Bangladesh are the Bangladesh Bank, authorized dealers, and customers. The Bangladesh Bank is empowered by the Foreign Exchange Regulation Act of 1947 to regulate the foreign exchange regime. It, however, does not operate directly and instead, regularly watches activities in the market and intervenes, if necessary, through commercial banks. From time to time it issues guidelines for market participants in the light of the country’s monetary policy stance, foreign exchange reserve position, balance of payments, and overall macro-economic situation. Guidelines are issued through a regularly updated Exchange Control Manual published by the Bangladesh Bank.

3.13 Inter Bank Transaction In Foreign Exchange:

The inter bank market is the top-level foreign exchange market where banks exchange different currencies.[1] The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Brokering Services (EBS) and Reuters Dealing 3000 Matching are the two competitors in the electronic brokering platform business and together connect over 1000 banks. The currencies of most developed countries have floating exchange rates. These currencies do not have fixed values but, rather, values that fluctuate relative to other currencies.

The interbank market is an important segment of the foreign exchange market. It is a wholesale market through which most currency transactions are channeled. It is mainly used for trading among bankers. The three main constituents of the interbank market are

- Ø the spot market

- Ø the forward market

- Ø SWIFT (Society for World-Wide Interbank Financial Telecommunications)

The interbank market is unregulated and decentralized. There is no specific location or exchange where these currency transactions take place. However, foreign currency options are regulated in the United States and trade on the Philadelphia Stock Exchange. Further, in the U.S., the Federal Reserve Bank publishes closing spot prices on a daily basis.

Foreign Exchange Department:

Dhaka Bank Limited gives opportunity to maintain foreign currency account through it’s Authorized Dealer Branches. All non – resident Bangladeshi nationals and persons of Bangladesh origin including those having dual nationality and ordinarily residing abroad may maintain interest bearing NFCD Account. Benefits (Condition Apply):

- Ø NFCD Account can be opened for One month, Three months, Six months and One Year through US Dollar, Pound Starling, Japanese Yen and Euro.

- Ø The initial minimum amount of $1000 or 500 Pound Starling or equivalent other designated currency.

- Ø Interest is paid on the balance maintain in the Account. This interest is tax free in Bangladesh.

Findings And Analysis:

4.2.1 Different Sectors and Outstanding in that Sectors in Different Years

Dhaka Bank Limited has diversified its credit facilities in different sectors. Again each sector has some categories. The Bank provides loans based on these sectors and categories. The major sectors and their categories are given below.

Agricultural Sector: These sectors contain fishery, poultry, firming loans and loans for the farmers to buy seeds and cultivate crops.

Large Loans: These sectors contain the large industrial loans and loans in the normal industrial sides. All of these loans are of long-term. So, it is basically long-term industrial loans.

Working Capital: Some cases Bank gives loans to the companies for their every day expenses for buying raw materials, and other things is called working capital loan. Cash credit (C.C) is also a part of working capital loans.

Export: Loans provide in this sector by opening L/C, this also includes loan against trust receipt.

Import: Loan facility for importing different goods from the foreign countries for business and other purposes.

Small & Cottage Industry: Dhaka Bank did not provide any credit facilities in this sector and still now they are not providing loans in this side.

Others: This includes the credit facilities like transport loans, secured overdraft, staff loans, house-building loans, short-term loans etc.

Among these the bank provides credit facility in the good and profitable sectors and from where the bank will get the highest return.

From the analysis below we can get a clear view about the distribution of loans in different sectors.

Table: Outstanding Rate of the year 2005

Amounts in lac

Sector | Outstanding | Percent |

Agricultural loans | 0 | 0% |

Large loans | 1605 | 10% |

Working Capital | 2326 | 15% |

Export | 1460.27 | 9% |

Import | 2043.27 | 13% |

Small and Cottage | 0 | 0% |

Others | 8024.56 | 53% |

15459.1 |

|

Analysis:

The year 2005 was the almost intermediate stage of Dhaka Bank. At that time they just started to become stable in the loan and advance side. The above table shows that the outstanding in different sectors is not that large. The Bank allows the highest amount of loan, which is 53% in others sector which includes Bank Guarantee, Transport loans, Bid bonds, House building loans, Secured Overdraft, staff loans etc. The bank gives 15% of total loans in the working capital sector. 13% of total outstanding in year 2005 was given to the business sectors. 10% and 9% of the outstanding issued to export and large industrial loan side. The bank has also options of giving loan in the Agricultural and Small & Cottage industry sector. But the bank didn’t give any credit facility to those sectors.

Table: Outstanding Rate of the year 2006

Amounts in lac

Sector | Outstanding | Percent |

Agricultural loans | 0 | 0% |

Large loans | 3161.45 | 14% |

Working Capital | 2088.6 | 9% |

Export | 1588.81 | 7% |

Import | 5206.27 | 23% |

Small and Cottage | 0 | 0% |

Others | 10898.51 | 47% |

Analysis:

In the year 2006 the amount of the outstanding of different sectors changes in a small amount. The bank still emphasizes on the others sector in which they gave 47% of the total loans given. Then again the business sector got the second priority and 23% of the whole loan amount was issued to this sector. After that the rest of the sectors including large loan, working capital loan was facilitate with the credit and they had been given 14%, 9% and 7% of the total credit approved in the year 2006. Again the agricultural and small & cottage side was out of any credit facilities. The total amount of loans in this year increased a little than then the previous year.

4 Outstanding Rate of the year 2007

Amounts in lac

Sector | Outstanding | Percent |

Agricultural loans | 9.88 | 0% |

Large loans | 5599.99 | 12% |

Working Capital | 3402.17 | 8% |

Export | 2058.1 | 5% |

Import | 14743.07 | 33% |

Small and Cottage | 0 | 0% |

Others | 19536.13 | 42% |

45349.34 |

|

Analysis:

In the year 2007 the credit facility in different sector increased in a large amount because the bank as that time started to become stable in the credit sector and also in other sides. In this year the bank started to give loan in the agricultural sectors but a very small amount. Credit facility in the business sector increased a lot in this period and stood at 33% of the total loans. But they emphasize on the transport loans, bank guarantees, bid bonds, secured overdrafts, staff loans etc. So, others sector got 42% loan of the total credit facility. The rest of the sectors are almost same to the previous years. The bank allowed 12%, 8% & 5% in large loan, working capital and export sector consecutively. In this year the amount of total outstanding in different sectors increased significantly and almost become doubled than the previous year. So, it shows that the credit performance is improving gradually and this process started from the very beginning.

Table: Amounts in lac

Sector | Outstanding | Percent |

| Agricultural loans | 0 | 0% |

Large loans | 4888.21 | 12% |

Working Capital | 3720.62 | 9% |

Export | 722.11 | 2% |

Import | 11525.29 | 27% |

Small and Cottage | 0 | 0% |

Others | 21667.09 | 50% |

| 42523.32 |

|

Analysis:

In the year 2008 (up to 31st September), the credit facilities in different sectors decrease some amount because world economy was in a very bad shape and passed a very difficult stage. So from the information above the economic condition is clearly visible. Credit facility decreases or almost same comparing to the previous years. But the bank avoids providing the loan facility in the agricultural sector though they gave some amount in this sector previous year. Small & Cottage industry sector is still out the credit facility. Credit facility in Business sector decreases in 27%, which was 33% in the previous year. In the Others sector loan facility increases very good amount of 50% and which was 42% in previous year. Large loan and working capital sector got only 9% & 12% of the total outstanding. This year the total outstanding of the credit approved decreases a small amount because of the worldwide recession in the economy. Its impact causes almost all the developed and developing countries.

Although the above analysis gives a clear idea about the credit sanctioned in different sectors, which was defined, the bank. The overall outstanding of the loans increases gradually despite the year 2008. The bank gives a large amount of loan in overdrafts, cash credits, transport loans etc. The bank also prefers the business sector and other sectors got the less priority.

Findings:

From the above information it is visible that the Banks credit facility in different sector is increase very rapidly. They do not want to provide any loans in the agricultural sector. The reasons behind this kind of decision are that still the agriculture in Bangladesh depends on the weather and other natural conditions. So, it creates an uncertainty whether the production of crops will be good or not. One rain can damage the paddy when it is the time to cut. So, the Bank thinks that financing in this sector may be very risky and return from the loan may not be good. Another reason is Dhaka Bank is operating its activities in the urban society and they still didn’t spread their activities to the rural areas. Still, they provided credit facility in a fishery firm for developing fish cultivation. On the other hand, the Bank provided the highest credit facilities in short-term loans, transport loans house building loans, secured overdraft etc. Because these sectors proves to be very profitable and less risky. The Bank also gives loan long-term loans but in a very limited amount because this facility is sanctioned for a long period. The above analysis gives a clear idea about the credit sanctioned in different sectors, which were defined, by the bank. The overall outstanding of the loans increases gradually in the past few years without the year 2008. So, the overall outstanding or amount of loan provided is quite good.

Recovery of the Total Outstanding in Different Sectors

Recovery means the amount paid back by the client or return back from the credit approved to a particular sector or loan category. Good recovery in a sector indicates that the performance of that sector is good enough to provide more credit facility in the future. All recovery amounts given below are adjusted with the previous years’ recovery. Some times the recovery rate may become higher than the amount of loan given. The recovery position for the last four years are given below-

Table: Recovery Rate of the year 2005

Amounts in lac

Sector | Outstanding | Recovery | Percent |

Agricultural loans | 0 | 0 | 0% |

Large loans | 1605 | 664 | 1% |

Working Capital | 2326 | 11079 | 21% |

Export | 1460.27 | 13509.48 | 26% |

Import | 2043.27 | 18633.39 | 35% |

Small & Cottage | 0 | 0 | 0% |

Others | 8024.56 | 8952 | 17% |

15459.1 | 52837.87 |

Analysis

As stated earlier, in 2005 Dhaka Bank’s credit facilities started to become in a position to make people interested to take the credit facility. So, the total loan amount is not high. In this year the highest recovery came from the business sector, which was 35% of the total amount, recovered. 26% of the recovery came from the export sector. 21% and 17% of the total recovery came from the working capital and others side and only 1% recovered from the large sectors. The table shows that the total amount disbursed in this year is much lesser than the amount recovered from the total loans.

Table: 4.2.8 Recovery Rate of the year 2006:

Amounts in lac

Sector | Outstanding | Recovery | Percent |

Agricultural loans | 0 | 0 | 0% |

Large loans | 3161.45 | 362.95 | 0% |

Working Capital | 2088.6 | 9051.82 | 12% |

Export | 1588.81 | 12382.74 | 17% |

Import | 5206.27 | 35656.24 | 48% |

Small & Cottage | 0 | 0 | 0% |

Others | 10898.51 | 16773.63 | 23% |

22943.64 | 74227.38 |

|

Analysis:

In the year 2006 the loan disbursement started to increase gradually. In this year we can again find that the total loan amount is lower than the recovery. But highest amount recovered from the Business sector, which was 48% of the total recovery. 23% was recovered form the others sector (staff loan, secured overdrafts, transport loan etc.). 12% & 17% recovered from the Working Capital and Export sector. But the recovery amount from the large loan sector is very bad. In the tear 2006 the recovery rate is almost 0% of the total amount recovered. It is almost same as the previous year. Agricultural sector has no recovery because this has got no credit facilities in this year.

4.2.9 Recovery Rate of the year 2006:

Amounts in lac

Sector | Outstanding | Recovery | Percent |

Agricultural loans | 9.88 | 10.55 | 0% |

Large Loan | 5599.99 | 994.7 | 1% |

Working Capital | 3402.17 | 994.77 | 1% |

Export | 2058.1 | 24163.62 | 17% |

Import | 14743.07 | 55719.66 | 39% |

Small & Cottage | 0 | 0 | 0% |

Others | 19536.13 | 59682.44 | 42% |

45349.34 | 141565.74 |

See appendix for the Chart no. 2 (C)

Analysis:

In the year 2007, total recovery amounts from different sector increases in a very high rate. 42% of the total recovery again came from the others sector (staff loan, secured overdrafts, transport loan etc.). Second highest amount recovered from the business sector which 39%. This sector proves to be very regular for adjusting their loan amount. So, the recovery in this sector is always high also very stable. In this year the Bank provides very few amount of loan in the agricultural sector which almost 0% of the total recovery earned

Table: 4.2.10 Recovery Rate of the year 2008

(Up-to 31st, September)

Amount in lac

Sector | Outstanding | Recovery | Percent |

Agricultural loans | 0 | 10.15 | 0% |

Large Loans | 4888.21 | 1589.48 | 2% |

Working Capital | 3720.62 | 682.3 | 1% |

Export | 722.11 | 12817.14 | 17% |

Import | 11525.29 | 54818.54 | 71% |

Small & Cottage | 0 | 0 | 0% |

Others | 21667.09 | 6644.98 | 9% |

42523.32 | 76562.59 |

Analysis:

In the year 2008, the total outstanding and the total recovery both decreases in a very high rate. But there is some amount of recovery earned which comes from the previous year. This rate is almost 0% of the total recovery earned in this year. Recovery from the others sectors decrease in a very alarming rate and stand at only 9%, which was 42% in the previous year. In the business sector the recovery is very good as usual which 71%. In the rest of the sector recovery rate decreased with the downward outstanding amount.

Findings:

So, from the above recovery status it is clearly found that the overall recovery in different sectors increases in different years. But the highest recovery came in past few years from Import sector and others, which includes transport loan, staff loan, secured overdraft, loan against trust receipt etc. Because most of these loans are of small amount and short-term. But the in the large loans and working capital side recovery from the outstanding is not good enough. Loan amounts in these two sectors are also less than the other sectors. From the above information, one interesting finding is that sometimes the recovery amount became higher than the outstanding amount. Though it looks quite odd but it has some reasons. Suppose in a year a sector got some amount of loans (say 1 corer) and waiting for the recovery. Again the bank provide loan facility to a company in the same sector (say 5 corer), but this time the full amount is recovered in a very short period and the first one is still not recovered. For this, here the calculation showed the outstanding remains 1 corer but the recovery amount became 5crore. So, in this case the recovery amount exceeds the outstanding amount.

Table: Classified Loans of the Year 2005

Amount in lac

Sector | Classified Loans | Percent |

Agricultural loans | 0 | 0% |

Large Loans | 5.93 | 3% |

Working Capital | 167.95 | 76% |

Export | 0 | 0% |

Import | 16.37 | 8% |

Small & Cottage | 0 | 0% |

Others | 27.98 | 13% |

218.23 |

|

Analysis:

In the year 2005, the bank only started to become stable in the credit sector. So, in this year the amounts of classified loans are very small. The highest amount of loan classified in the working capital sector that was 76% of the total amount classified. Second highest loans classified in the transport loan, overdraft, short-term loans etc categories. In other sectors the amount of classified loans are not very high.

Table: 4.2.13 Classified Loans of the Year 2006

Amount in lac

Sector | Classified Loans | Percent |

Agricultural loans | 0 | 0% |

Large Loans | 0 | 0% |

Working Capital | 82.31 | 70% |

Export | 0 | 0% |

Import | 14.77 | 12% |

Small & Cottage | 0 | 0% |

Others | 21.68 | 18% |

118.76 |

|

Analysis:

In the year 2006 amount of classified loans were very small. The highest amount of loan classified in the working capital sector and which was 70% of the total amount of loan classified. No big changes occurred in the rest of the sectors. The main thing is that the total amount of classified loan decreases to One Crore Eighteen Lac and Seventy Six Thousand from the amount of previous year. So, this is a very good sign for the Bank

Table: 4.2.14 Classified Loans of the Year 2007

Amount in lac

Sector | Classified Loans | Percent |

Agricultural loans | 0 | 0% |

Large Loans | 5.13 | 4% |

Working Capital | 31.28 | 25% |

Export | 0 | 0% |

Import | 3.92 | 3% |

Small & Cottage | 0 | 0% |

Others | 85.01 | 68% |

125.34 |

|

See appendix for the Chart no. 3 (C)

Analysis:

In the year 2007some changes had been occurred in the classified loans. Above table shows that the classified loans in working capital sector decreased a lot and stood at 25% of the total classified loan amount. But on the other hand in others (transport loan, HBL, staff loan etc) sector the amount of classified loan increased alarmingly and was 68% of the total loans classified. Rest of the sectors again had no great change in the classified loan amount. The total amount of classified loan is still very low and within very much control.

Table: 4.2.15 Classified Loans of the Year 2008

(Up-to 31st, December)

Amount in lac

Sector | Classified Loans | Percent |

Agricultural loans | 0 | 0% |

Large Loans | 5.37 | 2.44% |

Working Capital | 49.21 | 22.43% |

Export | 52.27 | 23.82% |

Import | 15.23 | 6.94% |

Small & Cottage | 0 | 0% |

Others | 97.27 | 44.34% |

219.35 |

|

Analysis:

In this year 2008 others sector containing transport loan, HBL, staff loan etc has the highest amount of classified loans and it is 44.34% of the total loans classified. In the rest of the sectors some changes had been takes place. 23.82% of the total amount classified in the Import sector and working capital sector had as usual a big amount of classified loans and it is 22.43%. The total amount of the classified loans increased a very small amount and still under control.

Again we can compare the classified loan with the outstanding to find out the difference between them. This difference can help to see whether the classified amount is very big or not. It will also reflect the bank’s credit performance and about their clients.

Table: 4.2.16 Difference between Outstanding &Classified

Loans of the Year 2005

Amount in lac

Sector | Outstanding | Classified Loan | Percent |

Agricultural loans | 0 | 0 | 0% |

Large Loans | 1605 | 5.93 | 0.36% |

Working Capital | 2326 | 167.95 | 7.22% |

Export | 1460.27 | 0 | 0% |

Import | 2043.27 | 16.37 | 0.80% |

Small & Cottage | 0 | 0 | 0% |

Others | 8024.56 | 27.98 | 0.34% |

15459.1 | 218.23 |

Analysis:

From the above table, the difference between outstanding and classified loan can be measured easily. In the year 2005, the difference between the outstanding and classified loans in different sectors is very big. It is found that only two crore eighteen lac and twenty-three lac taka became classified from a huge amount of outstanding. Only 7.22% of the total outstanding became classified in the working capital sector and this is the highest amount classified in the year. It shows a positive sign for the credit department.

Table: 4.2.17 Difference between Outstanding &Classified

Loans of the Year 2006

Sector | Outstanding | Classified Loans | Percent |

Agricultural loans | 0 | 0 | 0% |

Large Loans | 3161.45 | 0 | 0% |

Working Capital | 2088.6 | 82.31 | 3.94% |

Export | 1588.81 | 0 | 0% |

Import | 5206.27 | 14.77 | 0.28% |

Small & Cottage | 0 | 0 | 0% |

Others | 10898.51 | 21.68 | 0.19% |

22943.64 | 118.76 |

Analysis:

In the year 2006, again the difference between the outstanding and the classified loans are very big. The highest amount of loan classified in the working capital sector and which was 3.94% of the total outstanding. In the large loan and export sector nothing classified against the outstanding. This is very good for the bank’s performance and will help for providing credit facilities in those sectors in future.

Table: 4.2.18 Difference between Outstanding & Classified Amount in lac

Sector | Outstanding | Classified Loans | Percent |

Agricultural loans | 9.88 | 0 | 0% |

Large Loans | 5599.99 | 5.13 | 0.09% |

Working Capital | 3402.17 | 31.28 | 0.91% |

Export | 2058.1 | 0 | 0% |

Import | 14743.07 | 3.92 | 0.02% |

Small & Cottage | 0 | 0 | 0% |

Others | 19536.13 | 85.01 | 0.43% |

45349.34 | 125.34 |

Analysis:

In the year 2007, rise a little and the amount is very small and there is nothing to compare with the outstanding amount. Because the outstanding is very high and almost nothing classified. So, in this year there is nothing special to talk about. Though the classified amount increased a little but on the other hand amount classified is distributed among different sectors and the ratio comparing with the outstanding decreases.

Table: 4.2.19 Difference between Outstanding & Classifie

Amount in lac

Sector | Outstanding | Classified Loans | Percent |

Agricultural loans | 0 | 0 | 0% |

Large Loans | 4888.21 | 5.37 | 0.10% |

Working Capital | 3720.62 | 49.21 | 1.32% |

Export | 722.11 | 52.27 | 7.23% |

Import | 11525.29 | 15.23 | 0.13% |

Small & Cottage | 0 | 0 | 0% |

Others | 21667.09 | 97.27 | 0.44% |

42523.32 | 219.35 |

Analysis:

In this year 2008 comparing with the outstanding the highest amount of loan classified in the export sector which 7.23% of the total outstanding. The total amount of classified loan decreased again and also the outstanding amount also decreased in this year. But again comparing with the outstanding amount the amount classified is very small. So, it shows that the credit policy and selection of clients are very good. For this, the amounts of problem loans or classified loans are very small.

Findings:

From the above information of the classified loans and findings from that information it is clearly found that the bank’s classified loan amount is very little and the bank handles very strongly with these kinds of loans. The main reason for this success of restricting the classified loan is that the bank mainly provides loans in the trading business. In this kind of business there is no chance of loss. In this business, the company buys or imports a product in a defined rate and will definitely sell the product more than that price and will not sell in loss. So, the cash flow is well under control. For this, the company can adjust the loan account without any problem. Another reason is that almost all of the clients of Dhaka Bank are corporate clients. They have very good reputations in the business society and doing business in their respective sectors for a very long time and their background in handling credit facilities is very good. So, there is lesser chance of becoming the loans classified. Despite all the factors, it should be mentioned that the client selection of Dhaka Bank is also appreciable and they do this job very seriously so that the chance becomes very small for the classified loans.

Summary of findings

Prior and Neglected Sectors: From the above findings of the credit facilities in different sectors, it seems that the bank provided most of the credit facilities in the large loans basically for long terms and also gave some personal loans too. Their main focus on these sectors because of high profitability and security. But if one of the clients fails to repay the loan then the bank will be in serious trouble. On the other hand, the bank just avoided the agricultural sectors showing reason that the sector is very risky because still our agriculture depends much on weather and also the technology is not of high quality. According to the bank, Recovery from this sector is also not very good.

Recovery Status: Above findings shows that the bank’s overall recoveries in different sectors are very en-couragable. But recovery from the import sector and from transport loans, staff loans, and secured overdrafts etc. sector is much higher than the large loan and other sectors. Because most of them are short-term loans.

Problem Loan Condition: Amounts of loans classified in different sectors are very low and under control. But among these most of the amount classified in working capital sector but it is not that big. The main reason behind this is that Dhaka Bank has limited clients and all of them have good reputation in the business society and also highly experienced in handling loan facilities. The client selection of Dhaka Bank is also very good. Again most of the loans are given in trading business in which chance of loss is almost nil. So, repayment is very good and very few become classified.

Conclusion

Credit policy is a very convenient banking tool for the business world. The value of this service is immense. It has gathered such a position in the banking sector that people at developed and also developing counties are very much depended on this service. In Bangladesh credit facilities or loans started to become very attractive in recent periods. But still lots improvements in services and facilities have to be made in this department.

The study of the report refers to the fact that people are aware of loan facilities in our country but they are not fully aware of the services or features of the loan process and its rules and regulations especially in case of individual or consumer loans. From the study it seems that Dhaka Bank focuses on the corporate sectors for the credit facility. But in case of consumer loans there are lots of restrictions created by the bank.

Credit Division of Dhaka Bank, Local Office has a very qualified and dedicated group of officers and staffs who are always trying to provide the best service to the clients. They always monitor the credit in different sectors and their position. Before providing the loan they analyze whether the loan will be profitable and whether the client is good enough to repay the loan within the given period of time.

Credit department diversified their loans in different sectors classified by them. Among the sectors they don’t provide any loans in the agricultural side. The reason they showed is that this sector is very risky and depends on natural climate and they still didn’t expand their service in the rural side. They also didn’t provide any loan in the small & cottage industry. The reason is that the return from this sector is not very good and also the sector is very uncertain. They provide most of the credit facility in term loan mainly in long-term loans. Return from short-term loan is very good and also proves to be very safe to finance.

So, from the report and also from my short experience it seems that the credit management and performance of Dhaka Bank is quit good and acceptable though it is a second generation bank and established in 1995. Their credit approval and monitoring process and its performance increased very rapidly and still trying their best to improve more and more. So, within a very short period they earned the respect and acceptance from the customers and now it is one of the leading private commercial bank of the country.

Recommendation

Recommendations of these report has been made on the basis of the research findings of the credit facilities of Dhaka Bank Limited, Local Office. It is very difficult to recommend about this topic because of research restrictions and unavailability of data. Despite these problems there are something that the credit department of Dhaka Bank, local office should look at.

- To create better client the bank should increase the amount of consumer loans in a short-term basis.

- The bank can provide a loan, which may be student loan. Though in other countries many bank provide this facility. This may encourage the students to come forward do something for the economy.

- Most of Dhaka Bank’s loans are in the large sector. If the performance of that sector crash then the bank will fail to continue though the profit is very high. So, the bank should provide more loans of small scale in different sectors though it will decrease the profit a little. But it will be very safe.

- In some case rural area is profitable. So, the bank should provide loans in the rural areas.

- Again maximum numbers of the loan are provided in the long-term industrial loans. Bank’s clients are also limited. So, they can’t serve the economy of the country that much. So, they should diversify their loans more in agriculture, new industries etc for better economic growth of the country.

- On one hand the bank says that they want serve the economy of the country. On the other hand they are avoiding the agricultural sector and our economies still depend a lot upon the agriculture. So, they should keep similarity among their words and their works and provide loans in agricultural sectors.

- In the bank there is a credit risk analysis division. But their activities are rarely seen. This division has to work more and have to point out which sectors are profitable and which sectors are risky.