Introduction to the Report

1.1 Problem Statement

BIS Shrapnel, leading industry analyst and forecaster, in its Bangladesh Mobile Telecommunication 2005 report, predicted that mobile phone subscribers will reach a whopping 18 million in our country during the Year 2007 . However, by the end of 2006, mobile phone subscribers in Bangladesh had already surpassed this forecast to sum up to 21 million and, with the launch of mobile communication operator Warid Telecom Ltd., by July this year, subscribers reached 32.37 millions to count, increasing the mobile phone tele-density to 23.23% . With such promising tendency for growth in this market, it only becomes appropriate that complimentary markets such as for mobile phone handsets should also grow, and that handset manufacturers should take a keener interest towards this nation in the nook of Asian subcontinent.

From the very beginning, Sony Ericsson (SE) Mobile Communications International has channeled its efforts to building its image as a premium brand, focusing on its products’ outlooks and features most to give it an exclusive profile rather than blending in with the trends of the industry. Such attitude has made it possible for the company to become a pioneer to many milestones of the industry such as introducing the first handset to have a built-in camera. The idea has been, rather than growing as a company that “sells in quantity” like many major brands, Sony Ericsson products will “sell in quality”. It is this consistency that has built its brand awareness amongst 96% of the Asia Pacific market, while generating a purchase consideration amongst 36% of this same populace, totaling its Brand Health Index to 57 and delivering it as the No. 2 Brand of Year 2006, with Nokia heading as the No. 1 Brand .

Growing as an entity, both geographically and productively, the company’s latest expansion has been directed towards Bangladesh, one of the E-8 (emerging 8) countries of mobile phone subscriber penetration . Opening a branch office in our country in December 2006, the company has immediately launched a full-fledged marketing program to build awareness, association, and allegiance amongst the huge customer potential that have been discovered here. Keeping to its exclusive branding style, it began its history here with the launching of the W200i Walkman™, but to better cater to the price sensitive tendency of the local market, the company went as far as developing a series of four Entry Level Phones that featured functions such as FM Radio and Camera at a very low price. Clearly, Sony Ericsson plans to follow the Napoleonic rule of “We Came, We Saw, and We Conquered” here in Bangladesh.

The company’s main objective right now is to generate activities that will position it positively in the local consumers’ minds and increase its purchase consideration and loyalty level amongst them. The company here in Bangladesh has already launched a full-fledged marketing campaign. However, to ensure that no stones are left unturned and that the company is not liable for any loophole, proper grasp of the current market situation in the mobile phone community is required, from both the buyers’ perspective as well as that of the sellers’. Therefore, the rationale of this study has been to determine where Sony Ericsson is positioned currently in mobile phone market in Bangladesh as well as to identify opportunities that may be ventured into, which can be both cost effective and pro company policy. To generate feasible solutions to this problem, a thorough market research had to be conducted before any effective and efficient recommendations could be made.

1.2 Objective of the Study

1.2.1 Broad Objective

Broadly, the Study was aimed at determining the Current Situation of the Mobile Phone Market and identifying Cost Effective Marketing Opportunities for Sony Ericsson, Bangladesh to increase and maintain a Desirable Market Attitude and Purchase Trend without being in contradiction to the company’s product policy.

1.2.2 Specific Objectives:

To come up with opportunity ventures that are actually feasible, proper market analysis had to be conducted. The specific objectives of this study then were as follows:

• Developing a comparative database of mobile phones available in the local market to determine the competitive advantages SE’s key models.

• Discovering the local trade practices being pursued by competitors as opposed to those being followed by Sony Ericsson.

• Identifying the current industry trends and strengths that Sony Ericsson may take advantage of.

• Suggesting strategies that may help overcome their weaknesses to avoid possible threats and enhance strengths to take advantage of opportunities.

1.3 Scope of the Research

Although any suggestions made in this report was generated for the marketing purposes in the whole of Bangladesh, the findings here were drawn by taking the Dhaka market as representative of the national potential. The term “Market” here extends to Retailers and Consumers, and of course, Competitors. It should be noted here that this is a study on the mobile phone handsets available in Bangladesh, and therefore, takes into consideration only the vendor market and not mobile phone operators or BTTB/PSTN connectivity.

1.4 The Research Methodology

1.4.1 Data Collection Techniques

This research made use of both secondary and primary sources. The secondary data were collected via newspaper articles, trade literature, online archives, company website, as well as prior company research findings. The purpose of such documentations served to draw the premises and boundaries for certain industrial facts and figures, as well as the concerned organization’s profile. The primary data were collected via face-to-face interviews/surveys and Focus Group Discussions with local retailers, customers, and company employees and partners, as well as through industry observations. The in-depth interviews and FGDs all consisted of unstructured (though following a guideline), open-ended questions while the surveys followed a structured questionnaire to ensure respondent comfort, where some were disguised and others undisguised to ensure the most accurate responses from the correspondents.

1.4.2 Sampling

Population

As the desired result of this report was to be able to recommend solutions that will raise the popularity for Sony Ericsson as a brand in the local market, the primary sample population were the competing brands to assess SE’s market position regarding certain in-focus products at the moment. The secondary population in this instance was representatives of these brand organizations in the local/regional market. In order to decide which brands are these key competitors, local retailers and consumers along with local SE supervisors were taken as another set of sample population. This done, the expertise of company employees and partners were sought to build the overview of the current market possibilities in lieu of the current situation of the local telecommunications industry.

Sampling Units

The samples for the initial stage of the research were taken purposively. Here, mobile phone models from key competitive brands such as Nokia, Motorola, Samsung, BenQ-Siemens, etc. and certain “non-brand” models were taken that match the price and feature range of the Sony Ericsson models, as available in the local market. This data was collected following a random selection of stores in Eastern Plaza, Boshundhara City, and Rifles Square, another set of primary sampling unit. During this session, face-to-face interviews with retailers and customer were also underway, which are the secondary sampling unit of the previous body (stores). The stage-2 samples, that is, the company employees and partners, were gathered in a strictly judgmental way, based on their levels of industry expertise.

Sampling Extent and Frame

All samples were taken from within Dhaka City, where most of the firms – or their headquarters – related to this sector are congregated. Confining the study to the immediate region also convened the ability to conduct a field study with more depth and accuracy then it would have if the samples were select from a broader region.

Sampling Design

The sampling design essentially followed a non-probability method of research, concentrating on purposive sampling approach when choosing the brand of handsets. This was because much had to be dependant on the instructions of supervisors at Sony Ericsson, Bangladesh to decide which particular handsets of the concerned company needed to be benchmarked against their competitors. The samples for the interviews with the retailers, consumers, as well as the industry experts were selected based on convenience and judgmental sampling method, as time was limited.

Sampling Size

While developing the database to benchmark the specified handsets of Sony Ericsson currently in focus in the company’s marketing campaign, the sampling size of the retail stores to be pursued extended to 100% of the stores available in Eastern Plaza, 50% of the stores in Rifles Square, and a selection of stores as convenient in Bashundhara City. The competitive models of other brands against specified Sony Ericsson models extended to as many as retailers judged them, ranging from 2-6 competitors. While running through the stores sampled, questionnaires were also dealt out, and of the correspondents in these stores thus available to answer the queries:

Samples for the FGDs were of course arranged under two headings: By age and by monthly income. Two age groups to include non-working mobile phone users and four ranges of salary groups among the working population were selected, and the respondent population of 58 was thus fragmented:

Samples of company employees, partners, and competing organizations were usually handpicked to singular entities as according to their industry expertise.

Sampling Plan

All of the sampling activities, interviews and surveys were conducted by me, while my supervisor at Sony Ericsson drew the boundaries on to what extent they should be performed and delivered as suiting the needs of the organization.

1.4.3 Data Interpretation

Once the data were collected, regarding the interviews, my supervisor at Sony Ericsson was consulted to review which materials were relevant to the study and what actual analysis can be derived from the gathered information. Tallying methods was used mostly in order to process the data gathered through the questionnaire surveys. The tallies were then converted to percentage-wise statistics, whereby a finalized analysis of the survey data put together.

1.5 Limitations

As much of the research was sample-based, there is the possibility that the representation of the universal population is slightly skewed. Also, the manner in which the interview subjects answered the questions was not always totally unbiased; personal analytical abilities were put forth, then, to best interpret the data around such negative possibilities. The retailers were slightly haphazard towards the survey and not always forthcoming, given their busy schedule keeping shop, placing the study under the risk of facing respondent errors, which ranged from anywhere between item non-response to distorted answers. In which case, conducted FGDs with consumers followed the surveys to gain their opinion in various matters. Also not enough documents were found to always answer all the relevant questions pertaining to the scheme of the study, and much had to be relied on the words of industrial experts instead.

Chapter Two

Sony Ericsson Mobile Communications International AB:

Organizational Overview

2.1 Background of the Organization

Sony Ericsson Mobile Communications AB

Type Private Company

Founded 2001

Headquarters Head Office: London, England

Incorporated: Sweden

Key people Miles Flint (President),

Anders Runevad (EVP)

Industry Communications

Products Mobile phones

Revenue €10,959 million (2006)

Net income €997 million (2006)

Employees ~8,500

Parent Sony Corporation (50%)

Ericsson AB (50%)

Website www.sonyericsson.com

Sony Ericsson Mobile Communications International AB is a global provider of mobile multimedia devices, including feature-rich phones, accessories and PC cards. The products combine powerful technology with innovative applications for mobile imaging, music, communications and entertainment. The net result is that Sony Ericsson is an enticing brand that creates compelling business opportunities for mobile operators and desirable, fun products for end users.

2.1.1 History of Sony Corporation

With revenue of $70.303 billion (as of 2007), Sony Corporation is a Japanese multinational conglomerate corporation and is noted as one of the world’s largest media conglomerates, its base being in Minato, Tokyo. Sony is one of the leading manufacturers of electronics, video, communications, video games and information technology products for the consumer and professional markets. Sony Corporation is the electronics business unit and the parent company of the Sony Group, which is engaged in business through its five operating segments — electronics, games, entertainment (motion pictures and music), financial services and other. These make Sony one of the most comprehensive entertainment companies in the world and true to its slogan: Sony. Like no other.

In 1946, Sony was founded by Masaru Ibuka and Akio Morita, originating from a small radio repairing shop situated in a war-demolished building in Tokyo. It was originally named Tokyo Tsushin Kogyo, which translates in English to Tokyo Telecommunications Engineering Corporation. Although the post-WWII Japanese economy was flailing, Masaru Ibuka and Akio Morita’s vision of global expansion was far from being disrupted. In its initial year, the company built Japan’s first tape recorder called the Type-G. Then in the early 1950s, during a visit to the United States, Ibuka convinced Alexander Bell to license the transistor technology invented in his Bell Labs to his Japanese company. While most American companies were researching the transistor for its military applications, Ibuka looked to apply it to communications and made the first commercially successful transistor radios. They expanded to the US and later Europe. By the mid 1950s, American teens had begun buying portable transistor radios, “SONY boy”, in huge numbers, helping to propel the fledgling industry from an estimated 100,000 units in 1955 to 5,000,000 units by the end of 1968.

The name, Sony, itself has much to do with Kogyo’s strive to climb as an international entity. When Kogyo was looking for a Romanized name to use to market their selves, they strongly considered using their initials, TTK However, TTK was being used by another company so to achieve company originality they initially used the acronym “Totsuko” in Japan. Yet this posed its own problem: Americans had trouble pronouncing that name. The name was finally switched to Sony in 1958 for the brand as a mix of the Latin word sony, which is the root of sonic and sound, and from the word sony-sony which is Japanese slang for “whiz kids”.. From this point Sony grew and grew to become one of the most popular brands of electrics, producing Televisions, computer, audio equipment and much more.

2.1.2 History of Ericsson AB

Ericsson (Telefonaktiebolaget L. M. Ericsson) (NASDAQ: ERIC, OMX: ERIC B) is a leading Swedish-based provider of telecommunication and data communication systems, and related services covering a range of technologies, including handset technology platforms. Founded in 1876 as a telegraph equipment repair shop by Lars Magnus Ericsson, it was incorporated on August 18, 1918. Headquartered in Kista, Stockholm Municipality, since 2003, LM Ericsson is considered to be part of the so-called “Wireless Valley”. Since the mid 1990s, Ericsson’s extensive presence in Stockholm helped transform the capital into one of Europe’s hubs of information technology (IT) research.

The beginning of Ericsson’s journey coincided with Alexander Graham Bell inventing the telephone in the US and Bell’s telephones started on sale in Sweden the following year. Ericsson started to repair telephone equipment and in 1885, the company produced it first handsets and still does so today. However, in 1900, Managing Director and founder Lars Magnus Ericsson resigned from his post, and in 1903, LM Ericsson resigned from the board altogether. By then, Ericsson was active in Scandinavia, UK, USA, Germany, The Netherlands, Russia, Spain, Egypt, Ethiopia, South Africa, China, Asia, and Oceania. In the early 20th century, Ericsson dominated the world market for manual telephone exchanges but was late to introduce automatic equipment. The world’s largest ever manual telephone exchange, serving 60,000 lines, was installed by Ericsson in Moscow in 1916.

In spite of their successes elsewhere, Ericsson never made significant sales into the United States. The Bell Group and local companies like Kellogg and Automatic Electric had this market tied up. Ericsson eventually sold off their US assets. In contrast, sales in Mexico were good. In a curious oversight, Ericsson had ignored the growth of automatic telephony in the US. They concentrated instead on squeezing the most sales out of manual exchange designs. By 1910 this weakness was becoming seriously apparent, and the company spent the years up to 1920 correcting the situation. Their first dial phone was produced in 1921, although sales of their early automatic switching systems were slow until the equipment had proved itself on the world’s markets. Phones of this period were characterized by a simpler design and finish, and many of the early automatic desk phones in Ericsson’s catalogues were simply the proven magneto styles with a dial stuck on the front and appropriate changes to the electronics. A concession to style was in the elaborate decals (transfers) that decorated the cases. These phones have been also highly collectable and attractive.

In 1928 LM Ericsson began its long tradition of “A” and “B” shares, where an “A” share comes with 1000 votes against a “B” share, so the chairman was actually only controlling a few of “A” shares, giving him control of the company whilst not actually controlling a majority of the shares. By issuing a lot of “B” shares, much more money was fed to the company, while maintaining the status quo of power distribution. Ericsson thus grew and advanced through both World Wars and increasingly gained influence in the US up to 1987, when the company produced the first mobile phone for the NMT Network. The year also marked the not yet released network, GSM, to be chosen for the first European mobile network. In 1992, the GSM network was launched in Europe, and Ericsson began to make more and more mobile phones to keep up with the demand. By 1998, Symbian was established in joint venture between Ericsson, Nokia, Motorola, Panasonic and Psion.

However, Ericsson, which had been on the forefront of cellular phone innovation for decades, decided to divest its mobile phone business in 2001 following huge losses. Ericsson had decided to source chips for its phones from a single source, a Phillips facility in New Mexico. In March 2000, a fire at the Philips factory contaminated the sterile facility. Philips assured Ericsson and Nokia (the other major customer of the facility) that production would be delayed by less than a week. Nokia began buying available chips from alternate sources and when it became clear that production at the Philips factory would be compromised for months, Ericsson was faced with a serious shortage. This compromised Ericsson’s ability to compete by preventing the launch of new handsets and production of current models. And thus, Sony Ericsson came to be.

2.1.3 The Formation of Sony Ericsson and Its Journey

On October 1st 2001, the companies, Sony and Ericsson, formed a 50-50 share joint venture to unify their individual fortes into what is today recognized as Sony Ericsson Mobile Communications International AB. Its main objective was to become the most “attractive and innovative” mobile phone company on the globe. Whereas Sony’s contribution to the union was its AV Technology, Product Planning and Design, and a knack for Consumer Marketing and Branding, Ericsson had its Mobile Communication Technology and Operator Relationships to offer. The company is announced its first joint products in March 2002. Sony Ericsson products are different in the key areas of imaging, music, design and applications, and the company has launched products that make best use of the major mobile communications technologies, such as the 2G and 3G platforms, while enhancing its offerings to entry level markets.

The years have been good to Sony Ericsson in terms of progress and expansion. Believing in meeting a wide variant of customer needs and total product solutions, from a mere handful of phones in its initial year, the company has built its portfolio to 57 handsets and over 100 accessories, including trademark features such as Walkman and Cyber-shot that it shares with Sony Corporation to keep things exclusive. In its short six years of existence, the company has taken some long successful steps that have made it easily possible to acknowledge the company as the most pioneering of mobile phone companies on the map. It was the first company to introduce the “camera phone” (2003), and went on to winning the GSM Association’s Best 3GSM Mobile Handset Award for sequential years in 2004, 2005, and 2006. With a 43% annual growth rate, the company became the fastest-growing mobile vendor in Q3 2006 leaving Motorola with a rate of 39%.Today, Sony Ericsson is the second-most profitable phone maker after Nokia and has achieved this status because of its growth in high end handset market.

The geographical entity of the company itself has seen much expansion. While its corporate headquarters and global management is based in London, it has landscaped its manufacturing facilities in 6 countries, R&D in 7, and sales and marketing efforts from 7 more regions, all around the world. Other brands of the industry may generate most of their efforts from one particular region, but Sony Ericsson is very proud of this unique system that enables it to distribute its application to customizing its products to meeting local needs everywhere while keeping its product standard international. Now, over 8,000 employees contribute to the development, design, marketing, sales, distribution and servicing of a full portfolio of products, accessories and applications, hailing from over 40 countries and employed across the map, its people inspired by the cultures that surround them.

2.2 Organizational Policies and Practices

2.2.1 Mission

To establish Sony Ericsson as the most “attractive and innovative” global brand in the mobile handset industry.

2.2.2 Vision

Creating sparks

Sony Ericsson believes that mobile communication and entertainment inspire people – a philosophy that drives it forward, from concept to creation.

Building connections

Joining forces with partners, teaming up with colleagues, gathering resources – a collaborative work ethic that results in new advances. From making a true camera out of a mobile phone, to adding music to a long commute, to doing two things at once by pushing a simple button.

Inspiring beauty

A Sony Ericsson product is beautiful as well as functional. It complements groundbreaking engineering with original designs that add bold colors, incorporate lightweight materials and turn screens into windows. And that makes Its products fulfilling – from the inside out.

2.2.3 Social Responsibility Code

Since its launch in 2001, Sony Ericsson has operated under a corporate Social Responsibility Code. This code helps its employees take ethical decisions during all activities of its operations — from human resource management to product design, from supplier requirements to community outreach programs.

Fair Treatment of Its Workforce

Sony Ericsson believes that its strength is through innovation, not just in product development, but in all aspects of how it operates. It encourages its people to be creative, curious and constructive while being efficient and aware of costs, by offering first-class training, an international environment and an innovative culture where employees can grow to their full potential and their ideas can fly. Sony Ericsson leads the way in mobile communications, film and imaging, music and games – a lead it can only keep by hiring the best people and giving them the best opportunities to succeed – personally, socially and occupationally. Pleasing customers is the key to success. For Sony Ericsson it’s all about delivering and keeping promises, and exceeding customer’s expectations. It, therefore listens, and acts fast, responding as well as it can to customers and colleagues alike. After all, in its world, everyone is a customer. Sony Ericsson is passionate about being the best in everything it does and having the confidence to do what it think is right by making the employees committed, taking ownership of their tasks and inspiring others by the way they work.

Supplier Social Responsibility Code

The importance of social responsibility is not limited to activities within the Sony Ericsson organization, but extends through the supply chain to all manufacturers of Sony Ericsson products. Its ethics policy extends throughout Sony Ericsson and to its suppliers, ensuring that all its operations are conducted in a socially responsible manner. The newly adopted Supplier Social Responsibility Code places expectations on suppliers to provide a safe workplace for employees, respect basic human rights, and apply proper ethics standards in all business dealings. Sony Ericsson inspects all first level suppliers to ensure the requirements are realized on a practical level.

Protecting Customer Well-being: Health and Safety

As a leading manufacturer of mobile phones, Sony Ericsson is committed to high safety standards in the design of its products. All of its phone models are carefully designed and rigorously tested to comply with international safety standards and government health and safety regulations. These standards employ wide safety margins to give greatest protection to the public. Extensive research over many years has not established any conclusive evidence linking adverse health effects with the use of mobile phones meeting those standards and regulations. The radio wave exposure guidelines employ a unit of measurement known as the Specific Absorption Rate, or SAR. Tests for SAR are conducted using standardized methods with the phone transmitting at its highest certified power level in all used frequency bands. The differences in SAR values between phone models do not reflect a difference in safety.

Environment

Sony Ericsson is committed to the continuous improvement of the environmental quality of our products and operations worldwide. It considers sustainable development and production to be one of the most important challenges for the future and one that demands immediate action from responsible manufacturers. The company has implemented a life cycle approach to product development that takes into account design, manufacturing, product use (operation), and End of Life treatment of all its handsets and accessories. The objective is to develop and deliver solutions that help to reduce global resource consumption and emissions to air, land and water.

No matter in which market its devices are sold, all Sony Ericsson products meet the same stringent environmental requirements. Sony Ericsson strives to produce the best products from environmental point of view and to lead the way in phasing out unwanted substances. It therefore constantly monitors and reports new evidence on chemical substances that might be harmful for human health and the environment. It endeavors substitution of potentially harmful chemicals with safer alternatives and that is why its starting point is the precautionary principle. The precautionary principle was defined in the UN Rio declaration as “Where there are threats of serious or irreversible damage, lack of full scientific certainty shall not be used as a reason for postponing cost-effective measures to prevent environmental degradation.” Through its environmental declarations it invites any interested party to get factual information known as the Environmental Product Declarations. This is a service that Sony Ericsson launched several years ago and it gives information on the most relevant environmental aspects of each product such as material content, energy consumption, batteries, packaging and recycling.

During the use of a mobile phone the environmental impact of the product comes from energy use. Most of the energy used for many consumer electronic products comes from products in Idle mode and not when the product is used. The reason for this is that all the small chargers and power converters are connected to many grids, draining small amounts of power. However, when connected small drain from many sources lead to substantial amount of energy wasted. This is the reason why Sony Ericsson focuses on the phone and accessory charger to minimize this energy waste. Sony Ericsson also recognizes the importance of product take-back and recycling. The idea of taking responsibility for its products is a concept it believes in – for itself as well as in partnership with its industry. Above all, the collection and recycling systems used must be efficient and effective. Therefore, Sony Ericsson participates in both voluntary and required collection and recycling schemes in many countries around the world.

2.3 Organizational Structure

2.3.1 Global Distribution of Its Operations

Sony Ericsson employs approximately 5,000 employees worldwide. It undertakes product research, design and development, marketing, sales, distribution and customer services. Global management is in London, and R&D is in Sweden, Japan, China, the US and UK. The management team includes President Miles Flint, a former senior executive of Sony Europe and one of the key players in the development of Sony in Europe in the 1990’s; and Corporate Executive Vice-President Jan Wäreby, a veteran of Ericsson and part of the team that shaped Sony Ericsson in 2001. Its manufacturing facilities are located in Japan, US, Mexico, India, and Indonesia.

Marketing Distribution Down to Bangladesh

2.3.2 Scenario in Bangladesh

Sony Ericsson prides itself as being a truly global corporation, having expanded its network and distribution system to seven strategic regions of the world. And as recently as December 2006, the company opened a branch office here in Bangladesh to gain a stronger hold on its local marketing and sales activities. Keeping to its premium branding style, it began its history here with the launching of the W200i Walkman phone, but to better cater to the price sensitive tendency of the local market, the company went as far as developing a series of four Entry Level Phones that featured functions such as FM Radio and Camera at very low prices. All the financing and strategic decisions, however, are made by the Sony Ericsson Singapore office. The Market Unit in Bangladesh works directly under the Singapore Office.

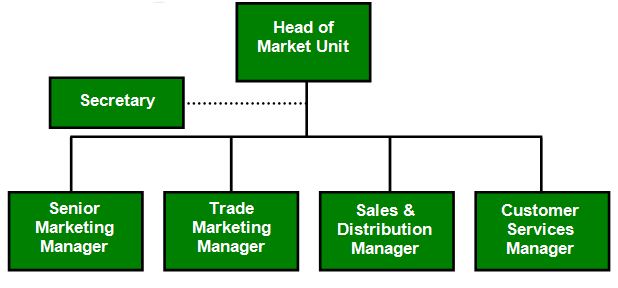

Sony Ericsson Market Unit in Bangladesh

Head of Market Unit (Country Manager)

The position is that of top level managers, or senior supervisors, whereby it requires the employee to oversee all the general activities and outcomes designated to the country/marketing unit, and ensure that all desired goals are duly met in any given Fiscal Year.

Senior Marketing Manager

The job describes the responsibility to analyze all gathered information regarding the immediate market or complementing markets and opportunities to develop marketing plans, implement and control them, and monitor and evaluating their performances before taking any corrective measures should the need arise, with a motive to best promote the brand within the budget set for the given period.

Trade Marketing Manager

The Trade Marketing Manager has to commit to relationship marketing whereby he/she has to maintain a constant understanding and means of motivation among corporate clients as well as wholesalers and retailers. It is part of the Trade Marketing Manager to persuade retailers to carry the brand, give it shelf space, promote it in advertising, and push it to customers.

Sales & Distribution Manager

It is the job of the Sales & Distribution Manager to ensure the sales goals are met during each Fiscal Quarter Year, and eventually Fiscal Year, by ensuring that the company’s products are distributed to the right people at the right time. The Sales & Distribution Manager also maintains that inventory are regulated among the official distributors in each region and that sales force controlled to uphold proper sales attitude towards not only increasing sales but also brand loyalty among consumers. In case of Sony Ericsson – Bangladesh, there are three official distributors, Global Cellular, Mobile Zone, and Gold Kist, to deal with.

Customer Services Manager

The Customer Services Manager is responsible for building and maintaining profitable customer relationship by delivering superior customer value and satisfaction. He/she is to ensure that any customer queries and complaints regarding product services and qualities are responded to efficiently and effectively to so as to retain customers and increase their lifetime value.

2.4 Product and Services Portfolio

Sony Ericsson products have universal appeal and are tangibly different in the key areas of imaging, design and applications. The company has consistently launched products that make best use of the major mobile communications technologies, such as the 2G and 3G platforms, while enhancing its offerings to entry level markets. Sony and Ericsson joined their businesses in March 2002 and they now have a full product portfolio covering all target groups under the ‘Sony Ericsson’ umbrella. The Global Advertising Agency for Sony Ericsson is Saatchi & Saatchi.

2.4.1 Product Lines

Sony Ericsson categorizes its phones as Talk and Text phones, Camera phones, Music phones, and Business (Internet and office application) phones. Japan is the only country where Sony Ericsson also operates in CDMA segment. Each segment has its own significant color representation to differentiate its models from those of other categories:

Sony Ericsson introduced the Walkman-branded W series music phones in 2005. The Sony Ericsson W-series music phones are notable for being the first music-centric series mobile phones, prompting a whole new market for portable music that was developing at the time. Sony Ericsson’s Walkman phones was originally endorsed by Pop star Christina Aguilera across Europe. This caters to the need of the music fanatics, mainly the youngsters. Consumers, who are more interested in listening to music in their phones, are the main target group of this segment. Music phone has been the best selling category for Sony Ericsson over years. They have earned a huge competitive advantage in this category.

Sony Ericsson’s influence from Sony increased when the Cyber-Shot branded line of phones was introduced starting in 2005. Sony Ericsson kicked off its global marketing campaign for Cyber-shot phone with the launch of ‘Never Miss a Shot’. The campaign featured top female tennis players Ana Ivanović and Daniela Hantuchova. The Cyber Shot technology of Sony has been a revolution for the industry. After incorporating that technology in Sony Ericsson Mobile Sets, it has set a new standard for many Mobile Set Manufacturers in the world, winning the GSM Association’s Best 3GSM Mobile Handset for two consecutive years for its models K750 (2005) and K800 (2006). The main target group of this category has been any one and every one who is passionate about talking picture and capturing exciting and important moments in life.

Sony Ericsson’s Lifestyle category has also been a big hit in many markets, being as it caters to so many different segments according to their economic structure, concentrating on the basic functions of mobile communication in its most qualitative delivery. But many feel there is still scope for creativity and innovation in this demanding category which is targeting a diversified socio-group/segment.

The Business Segment of Sony Ericsson has been very popular to the corporate personnel around the world. Its P990 series has sold like hot cakes in the market, and now its latest breed of Business Category P1 is showing a lot of promise with its affordable pricing.

2.4.2 Phone Series and Their Descriptions

Series Details

D series Low-mid range mobile phones. T-Mobile network operator exclusive. (“Deutsche Telekom”: D750)

F series Low-mid range mobile phones. Vodafone and Vodafone partner network operator exclusive. (“Vodafone”: F500)

J series Low end Bar mobile phones. Do not feature cameras but may feature FM Radio application. (“Junior”: J110)

K series Low to high end Bar mobile phones. Feature cameras with Dual Front design. Certain models are branded under the CyberShot name. (“Kamera”: K800)

M series Mid range Symbian OS Smartphones. Notable for their Touchscreens, QWERTY keypads (on most models), and use of the UIQ interface Platform from Symbian OS. (“Messaging”: M600)

P series High end Symbian OS Smartphones. Notable for their Touchscreens, QWERTY keypads (on most models), and use of the UIQ interface Platform from Symbian OS. (“PDA”: P1)

S series High-mid end swivel and slider mobile phones. (“Swivel”/”Slider”: S500)

T series Low to high-mid end Bar type mobile phones and a carryover from the former Ericsson line of mobile phones (“Fashion”: T650)

V series Mid to high end mobile phones. Vodafone and Vodafone partner network operator exclusive. (“Vodafone”: V800)

W series Mid to high end mobile phones branded under the Walkman name. (“Walkman”: W960)

Z series Low to high-mid end clamshell mobile phones (Fashion). (“Clamshell”: Z530)

Sony Ericsson’s third area of interest, after Walkman and Cyber-shot handsets, is Blackberry-enabled models for the business and corporate market. Sony Ericsson is currently working on a Bravia Branded Television phone to be released in Japan as well as a Playstation branded phone due out in Christmas 2007.

2.5 Marketing Strategies for Bangladesh

Sony Ericsson’s strategy is to introduce the right product, at the right time, at the right price, meeting end consumer needs appropriately. It wants be careful not to put an over-priced tag on its products nor does it want to under price its products, which could reduce its profits. It wants to be careful about what products they want to market in Bangladesh; not every product will be suitable for Bangladeshi customers, who are mostly of a price-sensitive mix. Careful research study and thinking is necessary to bring out the right products for this market.

It wants to have world class customer service centers in Bangladesh. It believes that, the customer service centers will play a vital role on customers’ perception toward Sony Ericsson’s Services. If there are more service centers, the consumers will be more willing to buy Sony Ericsson Mobile Phones, mainly the original ones with warranty, because they can gather a perception that if any thing is amiss, they can always get it repaired free of charge.

Sony Ericsson Bangladesh mainly runs through the muscle power of its Agencies and they wish to continue doing so. Getting the right agency to facilitating its business is absolutely crucial. Currently, Talking Point (the sister concern of Asiatic Marketing Communications Ltd, an advertisement giant in Bangladesh) are taking care of Sony Ericsson’s Above the Line Consumer (ATL) activities, such as production and implementation of television, radio, press, billboard advertisements etc. Mainly the promotional ATL activities are taken care by this Agency. Whereas, the Below the Line trade marketing activities of Sony Ericsson, such as shop designing, shop opening, event activations, putting up POS materials, market research and survey works, maintaining all trade marketing personnel who are responsible for Sony Ericsson activities are taken care of by Media 8 Agency.

2.5.1 ATL Marketing Activities

The Marketing Department supervises to see that all its ATL activities are carried out properly via its agency designations. The responsibility of its agency is to present the Senior Marketing Manager, Mr. Afzal Hasan, with plans after getting briefings them him on the specific goals of the company. The plans include the budget and detailed activities that will be performed and their schedule of the execution. However, every activity, creative and in production, is done under the detailed guidelines of Sony Ericsson Global.

Sony Ericsson – Bangladesh’s all ATL activities (and some BTL) are taken care by Talking Point from production to implementation. Until now, its main focus has primarily been the “Youth & Hip” segment of the population. It mainly concentrated on the following media vehicles:

Television

Much of the Television commercials in Bangladesh are borrowed from its Indian market with successful results. For example, TVCs of Hritik Rowshan’s W200i in all channels have generated a lot of sales. Another advertisement of Hritik Rowshan’s K-220i “Waking Up” Campaign also aired during the first week of September. Though some local TVCs have been produced, Sony Ericsson – Bangladesh is relying on its neighboring country’s commercials, mainly because of the Indian satellite influence in Bangladesh. It is, thereby, cutting much necessary cost in the regional development of its market. Much of its advertising is of subliminal format whereby it strategically features its handsets in the commercials of mobile operators.

TV show sponsorship also plays a significant part in Sony Ericsson’s ATL strategies. It initially conducted feature appearances of its products in a bidding show called “Fate and Fortune” in RTV, hosted by the famous local model, Azra. It has also been the official sponsor for the much acclaimed talent search program Drockstar, in keeping with its youth target market.

Radio

With the newly rebirth of the Radio appreciation trend of the nation, Sony Ericsson – Bangladesh is paying much attention to featuring its products via radio channels. It is expected that within the early next year, FM Radio will reach all the 6 districts of the country, its popularity having rocketed like a missile with just few months, courtesy of commuting listeners.

Currently Sony Ericsson has bombarded the radio channels with RDCs (Radio Commercials) of W200i Campaigns. Sony Ericsson’s “Play Time” at Radio Foorti is running right now every day at 7.30 p.m., with another Musical Program is coming soon in Radio Today soon. It also plans to have an interactive session in Radio Today very soon.

Billboards

14 Billboards are placed with W-200i campaign around the prime locations of Dhaka city and few in others out side Dhaka. With the increase of traffic jam, Billboards has become very efficient way for branding.

Press advertisements

Sony Ericsson tries to maintain printed visuals in newspapers and magazines to ensure The FM Radio and Non-FM Radio advertisements of J and K series has been going on prints in prime locations of all the major news papers of the country. Apart from these, the company also pays significant attention to gain full coverage of its press conferences in all major newspapers and magazines of the nation.

Event Sponsoring and Participations

Much of its events revolve around maintaining superior relationship with its distributors and retailers. One of its first events since its opening of the Bangladesh branch office last December was its lavish launching of W200i in Radisson for the retailers and distributors, with food, drinks, raffle draws, live music and fashion show. With a slight twist, this summer, it launched its J and K series (the Entry Level Phones), which were specially introduced to cater to Bangladesh’s price sensitive customer base. Rather then calling the retailers from all the major districts of Bangladesh for a big launch event in Dhaka, Sony Ericsson took the launch event to them in 5 major commercial cities (Dhaka, Chittagong, Khulna, Sylhet, and Bogra) of the country. The launching program had everything from fun and games to good food and good music to great success, bringing the brand to the foreground of Bangladesh mobile phone retail scenario.

Sony Ericsson also participates in many events to bring itself into focus with end consumers. Early this year Sony Ericsson sponsored the Telecom Fair in Dhaka and it was a huge success for the organization. There was good press coverage and a lot of people attended the fair to see the major Mobile Handset players of the market. Recently, it sponsored the Dhaka University IBA Fresher’s Day targeting youth segment to create awareness of the brand.

Sony Ericsson also had joined campaigns with several mobile operators, for example Aktel’s World Cup Campaign, Djuice’s James Bond and Drockstar Campaigns and Warid’s Zahi pre-paid campaign.

2.5.2 Trade Marketing/BTL Activities

The Head of Market Unit of Bangladesh, Mr. Neeraj Bansal believes that Trade Marketing will be the key to the future, the “next big thing” in Business. Trade Marketing activities of Sony Ericsson – Bangladesh are supervised by its manager, Tahsin Saeed, who designates all operations to its corresponding agency, Media 8 Communications Limited. The department’s short-term goal has been to gain creative and productive recognition among retailers so as to meet sales goals, while its long-term goal is to become number 1 in Mobile Retailing.

Strategy Focused for BTL Activities/Trade Marketing

• Optimum availability of Sony Ericsson Mobile Phones

• Maximum Visibility of Sony Ericsson (Through shopping place branding and shelf spaces)

• High Consumer Communication

Signage

(within Bangladesh) 300

Shop in the Shop

(within Bangladesh) 50

Exclusive Sony Ericsson Store

(within Dhaka) 3

Target Set for 2007

The Trade Marketing Agency of Sony Ericsson has divided their activities in 3 different parts:

• Permanent Merchandising

• Temporary Merchandising

• Trade Relationship

Permanent Merchandising

This included opening shop in the major shopping malls and Exclusive Sony Ericsson Stores, putting up of Signage and other similar activities. By the end of 2007, Sony Ericsson hopes to open 3 Exclusive Sony Ericsson Stores (Bashundhara Shopping Mall, Rifle’s Square and another one in Gulshan/Mirpur). The Store will only facilitate the Sony Ericsson Customers by having its own service center.

50 Shop in the Shop (within the prime locations in Dhaka, e.g. Grameen Phone Customer Care Center, BanglaLink Customer Care Center, Etc. Stores and in other shops) help Sony Ericsson to increase their coverage and distribution of sales. Through this more and more people will be available to buy Sony Ericsson Mobile Phones from different locations with the specific guaranty of authenticity.

Sony Ericsson plans to have 300 Signage within the country. This will increase the brand image and awareness of the brand within the shopping mall or area.

Temporary Merchandising

This concentrates on placing POS Materials, Bunting, Danglers, Posters, Stickers, Dummy Phones etc. in the mobile shops and malls. These are temporary in nature as the name suggest, and are usually placed to increase brand awareness and association, and to promote particular marketing campaigns. The W200i and the new J and K series mobile phone Posters and other POS Materials that have been flooded in the major mobile markets of Bangladesh this year can be good examples.

Trade Relationships

These are trade promotional activities like complementary gifts, retailers’ nights, and other actions, such as the recent Road Shows, which took place for the launch of W200i, and later, the new J and K Series, campaigns. Retailer Training is also a very much part of the trade relationships and very important for the future of Sony Ericsson. If the retailers are unaware of the new brands and its functions, they will not be able to convince the customers about how Sony Ericsson is better than other brands. Keeping good relationship with the retailers also helps motivate to push the product, know about problem related to sales and derive a better picture of what the customers want.

The Trade Marketing Operations in the field level is done on a contractual basis by its Trade Marketing Representatives (TMR), under the supervision of the Trade Marketing Executives, and all of them are supervised and controlled by the Area Managers. This workforce, appointed by Media 8 Communications Limited, is scattered around the most important Mobile Markets of the major 5 Cities of the country. Their responsibility is to regularly provide feedback of the market situations and carrying out different Marketing Activities and Field Works for SE. Upcoming goals for Media 8 has been designed to provide Sony Ericsson with a good team of Brand Promoters and Corporate Sales Officers who will be concentrating in personnel selling and other customer interaction programs.

2.5.3 Sales & Distribution

Sony Ericsson – Bangladesh does not manufacture or import any product in Bangladesh. Its main purpose is to facilitate the business with its parent company and the local distributors, dealers and retailers. However, Sony Ericsson – Bangladesh has a major say over how the business will be run in Bangladesh. For example, which brands to bring in Bangladesh and which campaign to run at which time; deciding on the billboard positions, TVCs, RDCs, press advertisement and other strategic issues that will take the business forward. One of its major areas of responsibility is to ensure its products reach the consumer market as required. For this, it follows a Model Exclusive Distributorship.

Currently in Bangladesh, it has 3 distributors:

• Mobile Zone

• Global Cellular

• Gold Kist

The distributors are responsible for imports of all the Handset Models designated to them exclusively:

Dealer Models MRP

Global Cellular J110 3,650

Global Cellular J220 3,800

Global Cellular J230 4,390

Global Cellular K220i 6,380

Global Cellular K320 7,300

Global Cellular K550 17,900

Global Cellular K610 17,900

Global Cellular K790 24,100

Global Cellular K800 25,490

Global Cellular W700 16,700

Global Cellular W810 19,490

Global Cellular W830 25,490

Global Cellular W880 29,200

Global Cellular Z550 12,300

Global Cellular Z610 20,200

Global Cellular P990 31,850

Mobile Zone J100i 3,450

Mobile Zone J120i 3,999

Mobile Zone K200i 5,825

Mobile Zone K310i 6,380

Mobile Zone K510i 8,280

Mobile Zone K610i 15,800

Mobile Zone K750i 13,080

Mobile Zone K810i 32,000

Mobile Zone P990i 30,000

Mobile Zone W200i 8,599

Mobile Zone W610i 19,999

Mobile Zone W880i 29,500

Mobile Zone W660 20,499

Mobile Zone S500 18,999

Gold Kist Z530 –

Gold Kist W300 –

Trade Marketing Representatives and Executives play an important role in this department also. TMRs keep close contact with the retailers and dealers on a daily basis to see how the sales are going, while TMEs collect the feedback and data from these TMRs and report to the Area Managers, who in return ensure that Sony Ericsson Sets are meeting their individual sales targets, and see which retailer is not performing up to expectations and standards and their reasons why. For every trade marketing activities in a particular shop, SE counts the sales of that shop as its indicator to Return on Investment. Thus Sony Ericsson’s Trade Marketing and Sales & Distributions Team are trying for an integrated approach to making the company’s efforts in Bangladesh work.

2.5.4 Customer Services & Exclusive Store

It has been set that the Sony Ericsson Customer Care will be called Sony Ericsson “Sheba” which in Bengali means, “serving” or “taking care of”. The name was selected to connect to the Bangladeshi consumers in a mark of the organization’s effort to blend in with the local culture. While in the beginning of the year, only one Sony Ericsson Customer Center was mapped within the nation, at the 13th Floor Chandrashila Suvastu Tower at Panthopath, Year 2007 promises more of these “Sheba” centers in more convenient locations to promote consumer appreciation and retention. The official technical agent for this Mobile Servicing for Sony Ericsson in Bangladesh is “Discovery”.

Authentic Sony Ericsson handsets come with a one year. Within the initial year of the purchase, the warranty card holder can have their Sony Ericsson Mobile Phone repaired at SE service centers free of charge. In case of an inability to repair a faulty handset, the customer is ensured a replacement their phone. To ensure that more customers have the opportunity to benefit from this facility, SE’s Sales & Distributions Team is continuously trying to minimize grey market for its brand.

New Sony Ericsson Sheba Centers will primarily be within the Sony Ericsson Exclusive stores planned to be opened this year. The Stores will carry only Sony Ericsson Mobile Phones and Accessories with well equipped demo accessories and handsets, attended by specialist Sales Persons, helping customers to personally assess all the features and functions of their chosen model before making their purchase.

2.6 Current Market Scenario (APAC and Bangladesh)

This April, Sony Ericsson (Blue Dotted Line) surpassed Motorola (Red Dotted Line) into taking the number 2 position in terms of Market Share in the Asia Pacific Region. This was due to the recent rapid sales growths in the Indonesian, Malaysian, Pilipino, Singaporean, Taiwanese, Thai, Vietnamese, Pakistani, Indian, and to an extent, Bangladeshi market after the company revamped its marketing strategy in the region. There was a 12.4 % growth for Sony Ericsson, certainly helped by some steady drop in sales from Motorola, and this has made Sony Ericsson the number 2 brand in terms of market share for the last two months in this Asia Pacific region. However, Samsung has also been rising very high with a steady growth rate of 9% in its attempt to catch up with Motorola.

The good news is that since Sony Ericsson started its marketing operation in Bangladesh last December, it incurred an unnatural growth of in its Sales Volume (339%) and Net Sales Growth (279%), as stated by its Global Office. The company is now concentrating on working its way up from its current number 5 position in the Bangladesh Market.

Another industrial threat has recently emerged, not only for Sony Ericsson but other major international mobile phone brands as well. Low-priced Chinese prototype branded Mobile Sets, such as Nokita and Suny Ericsson, has become a nuisance for all the big brands of the market. Due to their very competitive pricing, advanced features and look alike of best selling branded cell phones, these cheap imitations has captured the fascination of a large share of the local market, resulting a drop in market share for big brands like Samsung, Sony Ericsson and others. Although many say that these Chinese “non-brands” are loosing their charm due to their lack of durability and false claim of true quality, the trend has yet to be phased out and should duly be reckoned with by their leading counter-part brands.

Chapter Three

Topic Analysis & Descriptions

3.1 Understanding the Selected Topic

As deliberated before, Sony Ericsson International Communications AB in Bangladesh is an extension of its corporate activities as a Marketing Unit only. Therefore, though it is responsible for ensuring a well-organized distribution system alongside its local marketing campaigns, it has not any undertaking over the manufacturing or importation of mobile phones into the country. As such, the study of this report expects to limit itself to conducting a marketing analysis that will help the company to thoroughly learn the current market environment so as to find attractive opportunities as well as eliminate possible threats. It was thereby instated that the study will, first, analyze the Current Situation of the Handset Market, and second, analyze the Implications of these findings in context to Immediate and Cost-Effective Marketing Opportunities for Sony Ericsson – Bangladesh, all the while keeping in mind the objective of the company itself, that is, creating and maintaining a Desirable Market Attitude and Purchase Trend for the brand. In this section, a step-by-step analysis will be of the topic selected for this research.

3.1.1 Desirable Market Attitude and Purchase Trend

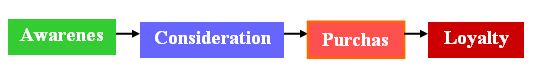

It is, of course, foremost important that the objective of the firm is understood before setting any objective for this study, and all of Sony Ericsson’s marketing campaign currently is set towards creating and maintaining desirable marketing attitude, and thereby, purchase trend. If attitude is a “hypothetical construct that represents an individual’s like or dislike for an item” , then obviously, according to Sony Ericsson’s motives in Bangladesh, a “desirable market attitude” will be a positive recall and association among the target consumers towards the brand itself. Then if purchase decisions are part of the “evaluation stage” of the buyer decision process, where “consumers rank brands and form purchase intentions” , then for Sony Ericsson – Bangladesh, “desirable purchase trend” would be frequent and repetitive purchase consideration and implementation regarding the brand among local consumers. In which case, the marketing objective of the company seeks to increase anything and everything between the stages of brand awareness to purchase consideration to, eventually, the purchase of its product.

First, as purchase trends can only be profitable through increased purchase intentions, which are resultants of consumer attitude towards the product or brand, attitude itself should be understood fully and worked upon. As attitudes are based on judgments (cognitive evaluation of the entity to form the attitude), whereby they can be limited to affected responses (feelings) or be extended to behavioral responses (actions), most attitudes in individuals may be the results of observational learning from their environment. The facility to induce any form of attitude towards a product, then, can be brought on by how the firm positions its products in the market environment, that is, builds its brand image. Market positioning requires the firm to arrange for its product to occupy a clear, distinctive, and desirable place relative to competing products in the minds of the target consumers.

As attitudes can be changed through persuasion, a firm should definitely attempt to motivate the target consumers to become positively biased towards its brand(s)/products. This can be done by providing consumers with stimuli to re-evaluate their current attitude towards not only the concerned brand but all other competing brands in the market as well. These can be done by changing the basic consumer motivation function, associating the product with an admired group or event, resolving two conflicting attitudes, altering components of multi-attribute model, and/or changing consumer beliefs regarding competing brands. Whatever the path(s) chosen, as it is the judgment of product that has to be moved, it is how much knowledge and perception already exists among consumers and how much should be allowed that has to be decided by the firm, and for this, consumer response to various happenings and constitutions of the market has to be studied.

3.1.2 Current Situation of the Handset Market

According to the description provided by Wikipedia.com, “a market is a social structure for exchange of rights, which enables people, firms and products to be evaluated and priced. There are two roles in markets, buyers and sellers.” Therefore, when the study proposes to analyze the current situation of the handset market, it implies to carry out an audit of the marketing environment pertaining to the selling and buying of mobile phones in Bangladesh.

While the marketing environment is also made up of larger societal forces such as the economy, demography, political fluctuations, etc. in the sphere of the macro environment, they are not elements within the control of any single organization. On the other hand, scrutinizing the elements of the microenvironment, such as the company activities and constituencies, the suppliers, marketing intermediaries, customer markets, competitors, etc., which affect a firm’s immediate ability to serve its customers, can better assist a firm to take initiatives to position itself positively in the consumer mind. While broader issues such as technological advancement of the nation of operation may be of concern, evaluation regarding the size, growth, geographic distributions, profit potentials, consumer and supplier dynamics come more to the firm’s focus when calculating what marketing activities to implement if the firm wishes to perform in a utilitarian manner.

Thereby, keeping to the directions set out for Sony Ericsson in Bangladesh, the audit will be limited to task environment of two specific segments of the telecommunication industry: The handset market and, to a relevant extent, that of the network operators. Findings regarding who the competitors are and their activities, strengths and weaknesses as opposed to that of Sony Ericsson, in the context of Bangladesh, and how they effect the relationships between and activities of all the acting members of the market will also be analyzed to help furnish ways to take advantage of opportunities and eliminate (or minimize) threats in the latter stage of the findings and analysis process.

3.1.3 Immediate and Cost Effective Marketing Opportunities

For every marketing mission there is a set marketing budget to abide by. The utilitarian nature of any business demands that marketing plans be constructed and implemented within limits of the granted cost-structure of the organization, and by the principles of economics, it is known that people always “think at margins”. Therefore, the feasibility of any plan should always be assessed before any form of implementation. Here, cost effective refers to this “thinking at the margin”, that is, any marketing strategy should benefit from either direct or indirect increase of market favorability towards the firm’s products/brands. While price-cut always is the easy route to positive market response, it is not always revenue generating. Therefore, strategies and tactics that may help boost the organization’s market response is what are being sought here.

Also, the word “immediate” here holds much significance to the organizational purpose for this study. The industry that this report will hold relevance to is currently in such a transitional phase that predicting what change may come in the supply and consumption dynamism beyond an annual cycle is daunting. Moreover, Sony Ericsson’s marketing campaign in Bangladesh has only stood on its initial leg and therefore, to gain a strong footing, is working on short-term strategies that may lead to long-term possibilities in the future. In which case, while “opportunity” is an operative word here, it means opportunity both to gain competitive advantage and minimize/eliminate threats.

3.2 Theoretical Approaches to the Market Analysis

Now that the selected topic for the study has been elaborated on, what theories could help bringing these ideas into context of the environment in consideration was the next step to gain findings on the study. Given the rate at which the handset market is growing, conducting a market analysis on every one of its facets would have required tremendous amount of time, and not of mention, human force to do it full justice. Therefore, I found that the best way to take the bull by the horns would have been to draw boundaries to the theoretical tools I will use to distinguish the relevant materials from the vast irrelevant materials one comes across when dealing with numerous correspondents during a research.

As already mentioned, the findings and analysis portion of this study has been developed in two stages: First, examining the situation of the entire handset and complimentary network markets’ current condition in relevance to Sony Ericsson’s position and survival in Bangladesh. Second, the implications these industrial circumstances had upon Sony Ericsson in specifics. The first portion was, of course, in direct connection with the field study, summarizing and analyzing the findings made there in general, and therefore, took four of the elements of Porter’s Five Forces into account for the purpose. The second portion was to take on an approach as to actually determine what position SE held in the country and how it could improve on these market environments, and therefore, followed the SWOT Analysis approach for its determinant.

3.2.1 Using Porter’s “Four” Forces

Knowing what information was required was the easy part, deciding how to go about finding and analyzing on such a vast industry required some strain on the brain. However, eventually Porter’s Five Forces (Rivalry among Competing Firms, Potential Entry of New Competitors, Potential Development of Substitute Products, Bargaining Power of Suppliers, and Bargaining Power of Consumers) seemed like the best way to segment all the genre of information required to analyze the market based on what would help Sony Ericsson. However, as this report concerned only SE’s short-term insight into future dealings, Potential Development of Substitute Products was not looked into as one of the primary concerns. Instead, the other four forces were more made use of as the backbone of the study.

Rivalry among Competing Firms

No matter what the dynamics of an industry turns out to be, it is what a firm actually offers the market that decides who is placed in what position in the consumer mind. Therefore, it can easily be said that rivalry among competing firms is usually the most powerful of the Porter’s Five Forces. Here, a firm can take it strategies to any level in a mark of boasting their competitive advantages, which eventually decides the success of any marketing campaign. And retaliatory countermoves like price-cuts, more or better quality features, additional services, increased advertising and what-not can be played by rival firms in their attempt to get at least equal footing in the market if not more. Therefore, Rivalry was the competitive force among the five chosen especially to find and analyze competing products to the particular models of Sony Ericsson being benchmarked in the current market setting. It helped to realize what measures the current brands of firms were applying to their survival and how it affected some of the other forces of the model, like supplier and consumer bargaining powers.

Potential Entry of New Competitors

As the intensity of the rivalry among competing firms is most acutely affected by the number of competitors existing in the market, it is of course, very important to measure how easy it is for competitors to enter the market for an existing firm to predict its future moves for survival. While barriers to entry such as government regulatory policies, lack of access to raw materials, are not always in the hands of existing firms, technological superiority, amount of experience, adequate distributional channels can be some barriers under existing firm’s control. New firm often enter the market with higher-quality products, lower prices, substantial marketing resources, etc., but it is the responsibility of the existing firm’s marketing strategists to monitor the strategies of these new rival firms, place counterattacks as necessary, and capitalize on existing strengths and opportunities. As the handset market in Bangladesh is currently facing a tremendous threat of being saturated by the arrival of many grey market brands, this became an important element to the objective of this study.

Bargaining Power of the Supplier (Intermediaries)

Although in strictly theoretical aspect of the Porter’s Five Forces, when “bargaining power of the suppliers” is considered, it is the suppliers of raw materials or such to the concerned firm that is being referred to. However, as in this instance, the firm being considered is the marketing entity of the brand firm that is participating in the local market, members such as distributors and retailers play the bigger part to the firm’s competitive advantage and survival. The amount of say the suppliers [to the consumers] have over what is sold in the market has much to decide upon the fate of any firm. For example, the larger the number of retailers in the market, the less the control the concerned firm has over the sale of its products to the consumers. Therefore, cordial maintenance of relationship with and systematic control over distributors and retailers play a great part in the success of any one of a firm’s product or the firm itself, as well as that of the competitors in comparison.

Bargaining Power of the Consumer

Bargaining power of the consumer, actually, increases or decreases in relation to a combination of the number of competitors and the number of consumers present in the market. If there are more consumers than can be catered by the existing firms, then consumers bargaining power is less than if the situation was reversed. At the same time, it is the amount of bargaining power controlled by consumers that can decide the tactics competing firms may resort to for their success and survival. Therefore, knowing the amount of influence consumers have, that is, how easy is it – affordably and emotionally – for consumers to switch to a different brand is a very necessary force to study and analyze in order for a firm to decide upon how to eliminate or minimize existing and potential threats and weaknesses towards itself.

3.2.2 Taking the SWOT Analysis Approach

Once the overall industry findings and analysis were performed, and a detailed map of the industry dealings was drawn, it was of course, necessary to determine the course Sony Ericsson – Bangladesh should take based on these findings, that is, it was necessary to decide how well Sony Ericsson can respond to the marketing environment its facing and thus chart a route for the firm to take on the map designed. Thus, a SWOT analysis seemed the best idea to systematically position SE’s standing in the market. All ratings and weights assigned to each piece of element selected here are based on comparative analysis between the selected firms in the industrial findings.

IFE & EFE Matrices

At the first level of our SWOT analysis, we built Internal Factors Evaluation (IFE) and External Factors Evaluation (EFE) Matrices to gauge the firm’s internal position and the ability of its current strategies to respond effectively to environmental and industrial elements, respectively. The IFE Matrix summarizes and evaluates the major strengths and weakness in the functional areas of business. Intuitive judgments are required in developing an IFE Matrix. A thorough understanding of the factors included is more important than the actual numbers. IFE Matrix can be developed in five steps:

1. List key internal factors as identified in the internal-audit process. Include a total of from ten to twenty internal factors, including both strengths and weakness. List the strengths first and then the weakness. Be as specific as possible, using percentages, ratios, and comparative numbers.

2. Assign to each factor a weight that ranges from 0.0 (not important) to 1.0 (all- important). The weight indicates the relative importance of that factor to being successful in the firm’s industry. Regardless of whether a key factor is an internal strength or weakness, factors considered to have the greatest effect on organizational performance should be assigned the highest weights. The sum of all weights must equal 1.0.

3. Assign a 1-to-4 rating to each key internal factor to indicate whether that factor represents a major weakness (rating = 1), a minor weakness (rating = 2), a minor strength (rating = 3), or a minor strength (rating = 4). Note that strengths must receive a 4 or 3 rating and weakness must receive a 1 or 2 rating. Ratings are thus company-based, whereas the weights in step 2 are industry-based.

4. Multiply each factor‘s weight by its rating to determine a weighted score.

5. Sum the weighted scores for each variable to determine the total weighted score for the organization.

Regardless of how many factors listed, the total weighted score can range from a low of 1.0 to a high of 4.0, the average score being 2.5. The more the score derived, the stronger the internal position of the organization.

An EFE Matrix allows strategists to summarize and evaluate economic, social, cultural, demographic, environmental, political, governmental, legal, technological, and competitive information. However, in this instance, the analysis slightly veers from the conventional elements and sticks to the findings encompassed in the objective to the study, that is, marketing environment only. EFE matrix can be developed in five steps:

1. List key external factors as identified in the external-audit process. Include a total of from ten to twenty factors, including both opportunities and threats that affect the firm and its industry. List the opportunities first and then the threats. Be as specific as possible, using percentages, ratios, and comparative numbers whenever possible

2. Assign to each factor a weight that ranges from 0.0 (not important) to 1.0 (very important). The weight indicates the relative importance of that factor to being successful in the firm’s industry. Appropriate weights can be determined by comparing successful with unsuccessful competitors or by discussing the factor and reaching a group consensus. The sum of all weights assigned to the factors must equal 1.0.

3. Assign a 1-to-4 rating to each key external factor to indicate how effectively the firm’s current strategies respond to the factor, where 4 = the response is superior, 3 = the response is above average, 2 = the response is average and 1 = the response is poor. Ratings are based on effectiveness of the firm’s strategies. Ratings are thus company-based, whereas the weights in step 2 are industry-based. It is important to note that both threats and opportunities can receive a 1, 2, 3 or 4.

4. Multiply each factor‘s weight by its rating to determine a weighted score.

5. Sum the weighted scores for each variable to determine the total weighted score for the organization.

Regardless of how many factors listed, the total weighted score can range from a low of 1.0 to a high of 4.0, the average score being 2.5. The more the score derived, the stronger the abilities of the firm’s current strategies to effectively and efficiently respond to its external threats and opportunities.

Once the firm’s standing in the current market was established and which of its marketing sectors needed to be developed for its growth and survival in the industry was summarized, it was necessary to move on to preparing a Strategic Position and Action Evaluation (SPACE) Matrix, which basically helps determine whether the firm should apply aggressive, conservative, defensive, or competitive strategies. It is a four-quadrant framework, whereby the axes represent two internal dimensions (financial strength [FS] and competitive advantage [CA]) and two external dimensions (environmental stability [ES] and industry strength [IS]). These four factors are the most important determinations of an organization’s overall strategic position. Depending on the type of organization, numerous variables could make up each of the dimensions represented on the axes of the SPACE Matrix. The steps required to develop a SPACE Matrix are as follows:

1. Select a set of variables to define financial strength (FS), competitive advantage (CA), environmental stability (ES), and industry strength (IS).

2. Assign a numerical value ranging from 1 (worst) to 6 (best) for the variables that make up the FS and IS dimensions. Assign a number between –1 (best) to –6 (worst) for variables that make up the ES and CA dimensions. On the FS and CA axes, make comparison to competitors. On the IS and ES axes, make comparison to other industries.

3. Compute an average score for FS, CA, IS, and ES by summing the values given to the variables and dividing by the number of variables included in each dimension.

4. Plot the average scores for FS, IS, ES, and CA on the appropriate axis in the SPACE Matrix.

5. Add the two scores on the x-axis and plot the resultant point on X. Add the two scores on the y-axis and plot the resultant point on Y. Plot the intersection of the new xy point.

6. Draw a directional vector from the origin of the SPACE matrix through the new intersection point. This vector reveals the type of strategies recommended for the organization. Aggressive, Competitive, Defensive, Conservative.

Usually, once the strategy type for the firm was determined, analysts move on to integrating these interpreted data into specific strategic activities in the form of a SWOT Matrix in an attempt to find recommendations. However, as this report mostly concerns promotional steps that can be taken in the immediate future, the SWOT Matrix has been left out.

Chapter Four

Findings and Analysis

This section of the report is an attempt to compile all the relevant information gathered pertaining to the objective of the study. It has been segmented into three parts:

The first is to display the comparative database constructed benchmarking the handset models with their immediate competitors that Sony Ericsson – Bangladesh is currently focusing its marketing efforts most on. The data pertaining to each model will follow a brief analysis of how it is positioned against its competitors in the market, and where need be, how it can improve its marketing strategy. It should be noted earlier that all data represented here are portrayed as retailers portray them to potential customers as far as to their knowledge.