Strengths, Weaknesses, Opportunities & Threats (SWOT) Analysis for ONE Bank Limited

5.1 Internal Factors

5.1.1 Strengths

- The top management of the ONE Bank Limited who are the key personnel involved from the very beginning of the bank’s operation, has contributed heavily towards the growth and development of the bank.

- The branches of OBL are situated in the important commercial areas of the country, such as Motijheel, Gulshan, Imamgonj, Agrabad and other important areas, where the banking service is mostly required.

- Relationship with existing clients is very strong. OBL have developed professional relationship with their clients and customer orientation is highly acclaimed.

- Installation and use of highly sophisticated, automated system that enables the bank to have on time communication with all branches reduces excessive paperwork and saves time for valued customer transaction.

- Strong network through out the country and provide quality of service to every level of customer.

- Form the very beginning OBL tries to furnish their work surroundings with modern equipment and facilities. Online Banking is one of the main attractions, which gave this bank a better position among private Banks.

- The corporate culture of OBL is very much interactive compare to our other local organizations. Management and owners (directors) share a very good relationship.

- Correlation with foreign banks is very effective. They have relationship with more than 200 foreign banks. The foreign Banks also give preference to this Bank, which helps to give smooth services to the exporter and importer through this bank.

- OBL provides Diversified Product Lines to its clients, which attracts the clients to render the services offered by the bank..

5.1.2 Weaknesses

- Advertising and promotion is one of the weak points of ONE Bank Limited. There is a marketing department but this department has very low exposure and does not have any effective plan for aggressive marketing activities.

- Higher service charge in some areas of banking operation than that of nationalized banks discourages customers from opening or maintaining accounts with this bank.

- Most of the time the management hire employees for high post from other banks instead of promoting the Bank’s employees, which hampers the motivation of the employees.

- Does not have own training institute for the employees. If any training is required, the Bank authority has to look for other training institutes for the employees. This incurs extra cost for the bank.

- Dependency on term deposit. The bank has to depend a lot on the term deposit by the clients rather than any other source.

5.2 External Factors

5.2.1 Opportunities

- Government of Bangladesh has rendered its full support to the banking sector for a sound financial status of the country, as it is becoming one of the vital sources of employment in the country nowadays. Such government concern will facilitate and support the long-term vision for ONE Bank Limited.

- Investment in SME and Agro based industry can give more opportunity for the bank to expand its market share. As new ventures are being undertaken by many entrepreneurs, therefore a new sector in investment is being created. OBL can give loans to start up the business ventures.

- The online Banking and SWIFT facility will open more scope for OBL to reach the clients not only in Bangladesh but also in the global arena. It will also facilitate wide area network in between the Entrepreneurs and the Bank for smooth operations in order to meet the desired need with least deviation.

- OBL can recruit experienced, efficient and knowledgeable workforce as it offers attractive salary packages and good working environment.

- OBL can pursue diversification strategy in expanding its current line of business. The management can consider more options for developing the retail banking sector or diversity in to leasing and insurance. By expanding business portfolio, ONE Bank Limited can shrink business risk.

- The credit and loan facility offered by ONE Bank Limited has attracted security and status conscious Entrepreneurs and as well as service holders with higher income group. Further improvement in the respective sectors can create a loyal customer base.

- The application of Management Information System is continuously developing and development in future process can attract more potential customers

5.2.2 Threats

- Default culture is very much familiar in our country. For a bank, it is very harmful. As ONE Bank Limited is comparatively new than other older banks; it has not faced it seriously yet. However, as the bank grows older it might create difficulties in recovering money from the clients.

- Bangladesh Bank exercises strict control over all banking activities in local banks. Sometimes the restriction imposed, can create barrier in the normal operations and policies of the bank.

- Rival bank can easily copy the product offering of OBL. Therefore the bank is in continuous of product innovation to gain competitive advantage over its Competitors.

- The worldwide trend of mergers and acquisition in financial institutions is causing concentration in the industry and competitors are increasing in power in their respective areas.

- Due to the emergence of new commercial banks in recent years, there is a slight decline in the overall market share for the banking industry.

5.3.1 The Internal Factor Evaluation (IFE) Matrix of ONE Bank Limited

In order to analyze the Internal Factors (Strengths and Weaknesses) of ONE Bank Limited, The Internal Factor Evaluation (IFE) Matrix can be applied. This strategy formulation tool summarizes and evaluates the major strengths and weaknesses in the functional areas of OBL and it provides a basis for identifying and evaluating relationships among those areas.

Similar to EFE Matrix, an IFE Matrix can be developed in five steps. The process is followed:

- List the key internal factors as identified in the SWOT identification stage. Include the total factors, comprising only the Strengths and Weaknesses of ONE Bank Limited. List the Strengths first and then the Weaknesses. The factors listed have to be as specific as possible.

- Assign to each factor a weight that ranges from 0.0 (not important) to 1.0 (very important). The weight indicates the relative importance of that factor to being successful. The sum of all weighs assigned to the factors must be equal to 1.0.

- Assign a 1 to 4 rating to each key external factor to indicate whether that factor represents a major weakness (Rating = 1), a minor weakness (Rating =2), a minor strength (Rating = 3) or a major strength (Rating = 4). The strengths must receive a 4 o 3 rating and weaknesses must receive a 1 or 2 rating

- Multiply each factor’s weight by its rating to determine a weighted score for each variable.

- Sum the weighted scores for each variable to determine the total weighted score for OBL.

These are the 5 steps in which an IFE Matrix can be developed for further analysis of OBL

5.3.1 Internal Factors Evaluation Matrix (EFE) of ONE Bank Limited

Factors |

Weight |

Rating |

Weighted Average |

Strengths

1) Top Management’s contribution towards the growth

and development of the bank.

0.07

4

0.28

2) Location of the branches in the important areas.

0.10

4

0.40

3) Strong relationship with the existing clients

0.10

4

0.40

4) Use of automated system enhances faster communication

0.05

3

0.15

5) Strong network through out the country

0.07

3

0.21

6) Designed with modern equipments and fittings

0.08

3

0.24

7) Strong Corporate Culture

0.07

3

0.21

8) Effective correlation with foreign banks.

0.06

3

0.18

9) Availability of diversified Product Lines to the clients

0.05

3

0.15

Weaknesses

0.65

2.22

1) Lack of advertising and promotional campaigns

0.10

1

0.10

2) Higher service charge in some areas of banking operations

0.06

2

0.12

2) Recruiting employees from outside rather than promoting

the existing employees.

0.10

1

0.10

4) Unavailability of Training Institutions

0.05

2

0.10

5) Greater dependency on term deposit rather than any other

sources

0.04

2

0.08

Total

1

2.72

As the grand total from the Weighted Average comes to a value of 2.72, which is greater than the average, it can be commented that the position of ONE Bank Limited is internally strong enough and likely to meet the weaknesses of the firm effectively.

5.3.2 The External Factor Evaluation (EFE) Matrix of ONE Bank Limited

In order to analyze the External Factors (Opportunities and Threats) of ONE Bank Limited, The External Factor Evaluation (EFE) Matrix can be applied.

The EFE Matrix developed is done in five steps. The process is followed:

- List the key external factors as identified in the SWOT identification stage. Include the total factors, comprising only the Opportunities and Threats of ONE Bank Limited. List the Opportunities first and then the Threats. The factors listed have to be as specific as possible.

- Assign to each factor a weight that ranges from 0.0 (not important) to 1.0 (very important). The weight indicates the relative importance of that factor to being successful. The sum of all weighs assigned to the factors must be equal to 1.0.

- Assign a 1 to 4 rating to each key external factor to indicate how effectively OBL’s current strategies respond to the factor, where 4= the response is superior, 3= the response is above average, 2= the response is average and 1= the response is poor. The ratings are based on effectiveness of OBL’s strategies. Both Opportunities and Threats factors can receive a 1, 2, 3 or 4.

- Multiply each factor’s weight by its rating to determine a weighted score for each variable.

- Sum the weighted scores for each variable to determine the total weighted score for OBL.

These are the 5 steps in which an EFE Matrix can be developed for further analysis of OBL.

5.3.2 External Factors Evaluation Matrix (IFE) of ONE Bank Limited

Factors |

Weight |

Rating |

Weighted Average |

Opportunities

1) Support and assistance from Government of Bangladesh.

0.09

2

0.18

2) Expansion of Market Share through investment in SME and

Agro based industries

0.12

4

0.48

3) The online Banking and SWIFT facility will open more

scope for OBL to reach the clients

0.08

3

0.24

4) Recruit experienced, efficient & knowledgeable employees

0.07

2

0.14

5) OBL can pursue diversification strategy in expanding its

current line of business.

0.09

2

0.18

6) The credit and loan facility offered by ONE Bank Limited

has attracted security and status conscious Entrepreneurs.

0.10

3

0.30

7) Development in application of Management Information

System in the banking sector

0.08

2

0.16

Threats

0.63

1.68

1) Risk of defaulters can create difficulties in recovering money

0.05

1

0.05

2) Strict control by Bangladesh Bank can create barriers in the normal operations and activities of the bank

0.07

2

0.14

3) Rival bank can easily copy the product offering of OBL

0.08

3

0.24

4) Competitors are increasing in power in the respective areas.

0.07

2

0.14

5) Emergence of new commercial banks decreases the relative

market share of OBL

0.10

4

0.40

Total

1

2.65

The grand total from the Weighted Average comes to a value of 2.65. This indicates that the position of ONE Bank Limited is just a bit above average of taking advantage of the available opportunities and facing the external threats.

After doing the EFE Matrix (External Factors Evaluation) and IFE Matrix (Internal Factors Evaluation) it is found that, the position of ONE Bank Limited is stronger both externally and internally. The result of EFE Matrix for the OBL is 2.65 which refers that the bank is externally strong enough in taking advantage of available opportunities and facing the external strength. The result of IFE Matrix for the OBL is 2.72 which represents that, the position of the bank is internally stronger enough to overcome the weaknesses by working on the strengths.

By doing the EFE and IFE Matrix, of ONE Bank Limited, it can be recommended that the strategies taken by ONE Bank Limited are executed properly. In order to further develop the position of bank in the market, OBL will have to utilize their available resources and skills at the level best to gain advantage over the competitors and have a greater market share.

Although there are some weaknesses and threats, that OBL might face in the future, but still the bank will have to try its level best to overcome the internal weaknesses and face external threats

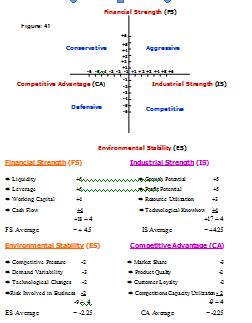

5.4 The Strategic Position and Action Evaluation

(SPACE Matrix) for ONE Bank Limited

The Strategic Position and Action Evaluation (SPACE Matrix), is another important matching tool which is developed for ONE Bank Limited. It is a four quadrant framework indicates whether Aggressive, Conservative, Defensive or Competitive strategies are most appropriate for ONE Bank Limited.

The axes of the SPACE Matrix represent two internal dimensions (Financial Strength [FS] and Competitive Advantage [CA]) and two external dimensions (Environmental Stability [ES] and Industry Strength [IS]. These four factors are the most important determinants of OBL’s overall strategic position. (See Figure 41)

In order to develop a SPACE Matrix, there are some steps that needs to be followed. The steps are:

- Select a set of variables to determine Financial Strength (FS), Competitive Advantage (CA), Environmental Stability (ES) and Industry Strength (IS).

- Assign a numerical value ranging from 1 (Worst) to 6 (Best) for the variables that make up the FS and IS dimensions. Assign a number between –1 (Best) to –6 (Worst) for variables that make up the ES and CA dimensions. On the FS and CA axes, make comparison to competitors. On the IS and ES axes, make comparison to other industries.

- Compute an average score for FS, CA, IS, and ES by summing the values given to the variables and dividing by the number of variables included in each dimension.

- Plot the average scores for FS, IS, ES, and CA on the appropriate axis in the SPACE Matrix.

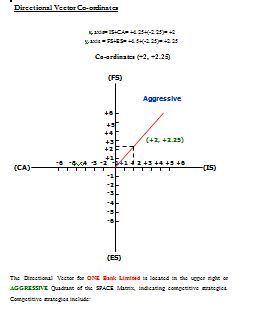

- Add the two scores on the x-axis and plot the resultant point on X. Add the two scores on the y-axis and plot the resultant point on Y. Plot the intersection of the new xy point.

- Draw a directional vector from the origin of the SPACE matrix through the new intersection point. This vector reveals the type of strategies recommended for ONE Bank Limited to choose whether the strategy is Aggressive, Competitive, Defensive or Conservative.25.4 The SPACE Matrix

- As ONE Bank Limited, is located in the Aggressive Quadrant of the SPACE Matrix, the organization is in a good position to use its internal strengths to take advantage of the external opportunities, overcome internal weaknesses and avoid external threats. Therefore the organization can take different strategies to develop the position in the market. Some of the strategies that, OBL can take are:ì Market Penetrationì Market Development

ì Product Development

ì Forward Integration

ì Horizontal Integration

ì Conglomerate Diversification

ì Concentric Diversification

Or a combination strategy all can be feasible, depending on the specific circumstances that OBL can face.

Recommendations

ONE Bank Limited should engage in more promotional activities, it should go for aggressive advertising and promotional activities to get a broad geographic coverage. ONE Bank Limited, Corporate Head Quarter should make some plans for all the branches located in different areas, so that the branches can get the maximum exposure from the surrounding areas. Some recommendations for the general banking services of ONE Bank Limited and the Gulshan Branch are as follows:

More outdoor promotions such as Billboards can be set up in the commercial areas as well as the rural areas to make awareness among the clients. In the Gulshan area and the surrounding area there are very few billboards and advertisements of ONE Bank Limited, so the bank should increase the number of outdoor promotions. Advertisements in the national daily newspapers can be given to make customers aware of the new service features available.

More Personal Selling staffs and employees can be appointed to make more exposure of the bank.

OBL should set up a permanent Retail Banking Department in the Gulshan Branch as the number of customers taking the services of Retail Banking is increasing day by day.

As the Gulshan Branch, is established since the opening of the Bank. The interior and the “Servicescapes” available should have to be renovated and modernized. As in today’s context the decoration of a facility and the interior is to be highly concerned by an organization, therefore ONE Bank Limited, Gulshan Branch will also be take the renovation of the building into consideration.

OBL, Gulshan Branch should focus more on the Small and Medium Enterprises, as this sector has the market potential to grow. Along with the Garments sector, the bank should also encourage businessmen and entrepreneurs to take Loans and invest in different sectors such as Jute Industry, Leather Industry, Chemical Industry etc.

Expand the export business of ONE Bank Limited, Gulshan Branch for more export financing to minimize the difference between export & import financing.

Filing procedure of ONE Bank Limited, Gulshan Branch should be maintained in a definite and clear manner. The filing of the papers submitted by the clients and other related documents should have to maintain in more specific manner than it is followed at this moment. It will save time and energy of the employees and the documents will be secured.

Information system should be more developed. OBL should increase the usage of Internet for local and international correspondence. Computer division needs to be up dated and extensive for the greater welfare of the branches. The use of modern communication software can be used for faster transaction delivery to the clients. The Online Banking of ONE Bank Limited is to be implemented properly.

An uninterrupted network system has to be ensured by the bank. It will save the officials from much hassle and will save time.

Decision making process can be made more decentralized. Participative approach should be adopted to gain prompt and effective result. Group discussion can be practiced in some situations to make quick decision making.

The credit sanction procedure should be made quicker since competition is very hard in today’s business world. People do not want to wait for three to four weeks on an average to get a loan which is even protected by security.

A little more service quality up gradation may help the bank to hold on to old customers and avail more new customers. For this purpose the Bank should open up Customer Service Departments in the Gulshan Branch and Research and Development Division in the Corporate Head Quarter to understand customer needs more accurately.

CONCLUSION

Since the banking service especially the private Banks are doing a good business, so it is clear that the modern people are more concerned about securing their valuable assets and get high-quality and timely services. For this reason lot of new commercial banks has been established in last few years and these banks have made this banking sector very competitive. So, now banks have to organize their operation and do their operations according to the need of the market. Banking sectors no more depends on the traditional method of banking. In this competitive world this sector has trenched its wings wide enough to cover any kind of financial services anywhere in this world. The major task for banks, to survive in this competitive environment is by managing its assets and liabilities in an efficient way.

The study was conducted on the proceedings of the activities carried out by ONE Bank Limited, Gulshan Branch. Analyzing the performance of the various departments over the years of operation is main objective of this study. As the study was concentrated towards the technical aspects of operational efficiency, therefore, few limitations occurred while conducting the study. In spite of having many challenges, adverse economic conditions and market patterns during the years, the bank tried to maintain its growth trend through the indicators like profitability, deposit mobilization, asset creation and network expansion. ONE Bank Limited proved to be successful by offering quality and timely services to its customers.

On the basis of convincing reasons, ONE Bank Limited management believes that in the coming years the Bank will try its level best to sustain its earning capacity and maintain a steady growth. With the current performance of the Bank and with little improvement here and they will certainly make ONE Bank Limited one of the best Private Bank in Bangladesh in the near future.

![Report on One Bank LTD [Part-4]](https://assignmentpoint.com/wp-content/uploads/2013/03/one-bank1.jpg)