Background of the Study

The dissertation program is a connected part of the MBA program that all the students have to submit. The students are sent to various organizations where they are assigned to one or more projects. At the end of the program, the internees are required to place the accomplishments and findings of the project through the writing of the dissertation report covering the relevant topics. During this program, supervisor guilds each student- one from the university and the other from the organization.

This report is the outcome of a 3 months June to October 2009, dissertation program in AB Bank Limited, Dhaka.

Objectives of the study

This study is intended for providing me invaluable practical knowledge about banking operation system in Bangladesh. The prime objective of the study is to examine the “Overall Performance of AB Bank Limited.: A Comparative Analysis”.

However, the specific objectives are the followings:

- To accomplish the partial requisite of MBA Program and to achieve of good judgment with theoretical base.

- To have a evaluation of AB Bank

- To evaluate the factors affecting performance of AB Bank.

- To make a comparative analysis of the performance of AB Bank is valuation to Southeast Bank and Brac Bank Ltd.

Methodology

For teaming up the data & information collected through primary & secondary sources I have used both qualitative & quantitative method. During my study I followed some methodology to find out the fact & feature of the bank which are given as follows:

* Sources of data/ information: I have collected my information/ data from the following sources, which helped me to make this report. The source has divided by two parts.

Such as, 01. Primary source and 02. Secondary source.

I used both the above sources.

Primary sources: It includes interviews & conversation with offices & executives of the Bank of different divisions/ department and branches.

Secondary sources: It includes annual report, general report, investment manual, and general banking manual. Selected books, journals 5 other publications etc.

Scopes

The report is based on the overall operational functions of AB Bank limited, Financial Institutions & Treasury Division, Financial Division, IT Division, Credit Risk Management , Credit Administration & Merchant Banking Division etc. and how they works to regenerate the Foreign Currency and Foreign revenue from other countries, given Loans & advances to the customers, Foreign trade business and help to establish corporate level of industry and also the managerial techniques to solve the sensitive operation of the banks performance.

Limitations of the Report.

The total report like “Overall Performance of AB Bank Limited: A Comparative Analysis” is vast and not possible to make it over a night. So it is the hard task to prove all the information on that necessary segment which might make report more resourceful and outstanding. I could not prepare the report as the best of my wish because much information could not gathered for the resources of confidentially. During the banking hour there were many customers who has to be served time offered per customer was not adequate to ask about their satisfactory and dissatisfactory level in connection with foreign trade & foreign exchange business, Credit & General Banking which might have helpful to focus in more detail.

Profile OF “AB Bank Limited”

- Name of the Organization: -AB Bank Limited.

- Registered Address: – BCIC Bhaban, 30-31 Dilkusha C/A Dhaka 1000, Bangladesh.

- Commencement of Business: – 27th February 1982.

- Legal Form: – A public limited company incorporated on 31st December 1981 under the Companies Act, 1913 and listed in the Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd.

- Banking Industry: -There are 72 branches in the market of Bangladesh. The market share holds 7% of AB Bank.

Background of AB Bank Limited:

AB Bank Limited, the first private sector bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.As of December 31, 2006; the Authorized Capital and the Equity (Paid up Capital and Reserve) of the Bank are BDT 2700 million and BDT 3110.76 million respectively. The Sponsor-Shareholders hold 50% of the Share Capital; the General Public Shareholders hold 49.43% and the rest 0.57% Shares are held by the Government of the People’s Republic of Bangladesh. However, no individual sponsor shareholder of AB Bank holds more than 10% of its total shares. During the last 26 years, AB Bank Limited has opened 71 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India, two Representative Offices in London and Yangon, Myanmar respectively and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. ATM booth is 24 and employees are 1700.

2.1. Historical Background of ABBL:

With the adoption of new policy in 1951 by the Government of the People’s Republic of Bangladesh to allow private capital to take initiative with regard to the formation of banks. A group of Bangladesh entrepreneurs proceeded to establish the first bank in the private sector with the assistance and support of renowned.

Dubai based Galadari family having stakes in international trade & finance and industry, a foundation was thus laid for the formation of a joint venture bank with Dubai Bank Ltd, the major share holders of which were the esteemed Galadari Brothers. The new bank named Arab Bangladesh Bank Ltd. Was incorporated in Dhaka on December 31st, 1981 and it commenced its banking business from April 12th 1982. Mr. M. Matiul Islam was, made the first chairman of the bank and Mr. Hafizul Islam was its first Managing Director.

In 1986, the Union Bank of the Middle East Ltd. (LIBMR) inherited the shared of Dubai Bank Ltd. and continued as a shareholder till early part of 1987 when they decided to offload their invest in Bangladesh and concentrate their activities in the U.A.E. In terms of articles 23(a) and 23(b) of the articles of association of the company and with necessary approvals of the relevant authorities including Bangladesh Bank, the shared held by them in the company were transferred to group “A” shareholders i.e. Bangladeshi spacers and shareholders.

AB Bank Limited, the first private sector bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982. Dubai Bank Limited (name subsequently changed to Union Bank of the Middleast Limited) decided to off-load their investment in AB Bank Limited with a view to concentrate their activities in the UAE in early part of 1987 and in terms of Articles 23A and 23B of the Articles of Association of the Company and with the necessary approval of the Relevant authorities, the shares held by them in the Bank were sold and transferred to Group “A” Shareholders, i.e. Bangladeshi Sponsor Shareholders.

As of December 31, 2006; the Authorized Capital and the Equity (Paid up Capital and

Reserve) of the Bank are BDT 2000 million and BDT 2582.76 million respectively.

The Sponsor-Shareholders hold 50% of the Share Capital; the General Public

Shareholders hold 49.43% and the rest 0.57% Shares are held by the Government of

the People’s Republic of Bangladesh. However, no individual sponsor shareholder of

AB Bank holds more than 10% of its total shares.

Since beginning, the bank acquired confidence and trust of the public and business

houses by rendering high quality services in different areas of banking operations,

professional competence and employment of the state of art technology.

During the last 26 years, AB Bank Limited has opened 71 Branches including one Islami banking branch, one foreign Branch in Mumbai, India also opened two Representative Offices in London and Yangon, Myanmar respectively and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries in the world.

AB Bank Limited, the premier sector bank of the country is making headway with a mark of sustainable growth. The overall performance indicates mark of improvement with Deposit reaching BDT 42076.99 million, which is precisely 3.78% higher than the preceding year. On the Advance side, the Bank has been able to achieve 46.32% increase, thereby raising a total portfolio to BDT 31289.25 million, which places the Bank in the top tier of private sector commercial banks of the country. On account of Foreign Trade, the Bank made a significant headway in respect of import, export and inflow of foreign exchange remittances from abroad.

2.2: Types of Business:

AB Bank was licensed as a scheduled bank. It is engaged in pure commercial banking and providing services to all types of customers ranging from small and medium enterprises to large business organization. It is working for the economic welfare by transferring funds from them surplus economic unit to those who are in deficit.

2.3: Vision:

“To be the trendsetter for innovative banking with excellence & perfection”

2.4: Mission:

“To be the best performing bank in the country”

2.5: Organizing Structure of ABBL:

Arab Bangladesh Bank Ltd. (ABBL) was incorporated on 31st December 1981, under the company’s act-1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 12th April 1982 with the approval of Bangladesh Bank under the guidelines, rules and regulations given for scheduled commercial banks operating in Bangladesh. It was initially a joint venture commercial bank between Bangladeshi sponsors and Dubai Bank Ltd. Dubai (U.A.E.) having respective share holdings as under:

Bangladesh sponsors: 20%

Bangladeshi General Public: 15%

Bangladesh Government: 05%

Dubai Bank Ltd.: 60%

Subsequently, the Union Bank of Middle East Ltd. inherited the shares of Dubai Bank Ltd. In 1986 and continued as its shareholder till early 1987, when they decided to offload their investment in Bangladesh. As per provisions of the bank Articles of Associations, with the approval of Bangladesh Bank and the controller of Capital issue Government of Bangladesh, the shares (60%) held by the Union Bank of Middle East (UBME), were purchase by the Bangladeshi Sponsored Directors, raising total shares of holding to 80% of total share capital. However, as desired by the government of Bangladesh the sponsors.

Directors, who acquired the 60% shareholdings of Union Bank of Middle East (UBME), unclosed 50% of share, purchased by them from UBME to the general public of Bangladesh raising the public share holdings to the 45% of total share capital of the bank. The Objective of the bank is to undertake all kinds of banking and foreign exchange business in Bangladesh as well as abroad through its brandies/correspondents.

2.6: Capital Structure of ABBL:

The authorized capital of AB Bank Ltd. is taka 400.00 crore divided into 4.00 crore ordinary shares of taka 100 each, from the existing Tk. 200.00 crore on 05 march, 2008. The total paid up capital rose to taka 743.00 million at the end of 2007. At present the composition of the existing shareholders of the bank is as under:

1) Bangladeshi sponsors/ Directors: 50%

2) Bangladeshi General Public: 49.43%

3) Govt. of Bangladesh: 0.57%

2.7: ABBL In a Global View:

AB Bank has total 71 branches with in the country as on 29th July 2008. Besides all these, ABBL has its regional office at Agrabad Commercial Area, Chittagong. ABBL has its operation outside the country too. Thus it is providing a prominent role in the growth of foreign trade for the entrepreneurs of the country. ABBL has its overseas branch at Mumbai, India. Subsidiary Company ‘AB International Finance Ltd.’ at Hong Kong. Representative office in United Kingdom and in Myanmar.

2.8: Change of Name & Logo of ABBL:

Arab Bangladesh Bank Ltd. was incorporated on 31st December 1981, under the company’s act-1913. The bank started functioning from 12th April 1982.It is the first

private bank in Bangladesh. Motijheel Branch is the corporate branch of this bank. The branch has enjoyed its 26th anniversary during this year.

Arab Bangladesh Bank Ltd. Changed its name to AB Bank Limited (ABBL) with effect from 14 November 2007 vides Bangladesh Bank BRPD Circular Letter No-10 dated 22 November 2007. Prior to that Shareholder of the Bank approved the change of name in the Extra-Ordinary General Meeting held on 4 September 2007. Effective 1 January 2008, ABBL changed its Logo as well. The cost of arms of the new logo is inspired by traditional ‘Shital Pati’ or ‘Sleeping Mat’.

2.9: Organizational Structure of ABBL:

The board vests the management of the bank on a Board of Directors, for over all supervision and directions on policy matters. The power of general supervision and control of the affairs of the bank is exercised by the President and the Managing Director of the bank who is the Chief Executive. The board consists of 13 members.

Chairman: : Mr. M. Wahidul Haque.

Vice-Chairman: : Mr. Sajedur Seraj.

Directors: : Mr. Salim Ahmed.

: Mr. M. A. Awal.

: Mr. Mishaal Kabir.

: Mr. Mesbahul Hoque.

: Mr. Md. Anawar Jamil Siddqui.

: Barr. Syed Afzal Hasan uddin.

: Barr. Faheemul Huq

: Mr. Shishir Ranjan Bose, FCA

: Mr. Md. Salah Uddin

President &

Managing Director: : Mr. Kaiser A. Chowdhury

Company Secretary : Mr. Badrul Haque Khan, FCA

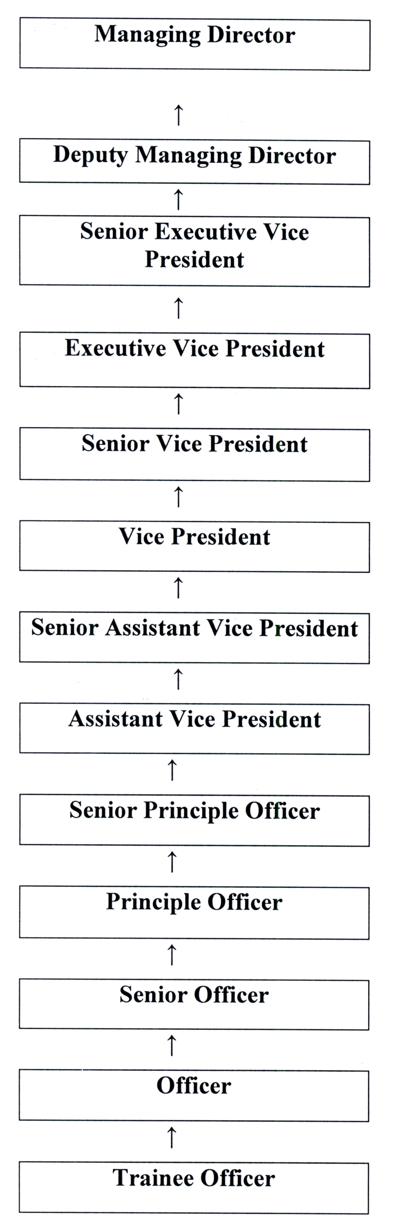

2.10: Carrier Ladder of ABBL:

2.11 :Objectives and functions of AB Bank Ltd:

It is functioning not only in Bangladesh but also all over the world. The main activities of the bank have been discussed as under:

a) Treasury & Investment functions:

Treasury activities both Money Market and Foreign were done separately earlier from April 2007 both activities were merged and both the Officials are working sitting side by side. As a result, Bank’s treasury functions are running smoothly.

b) Loans and Advances:

Following the guidelines of Bangladesh Bank credit facilities have been extended to productive and priority sectors. The Outstanding advance of the Bank is Tk. 40.915.35 million on 31st December 2008. In extending credit facilities, the Bank has given due importance to sectoral needs and requirements of both public and private sectors.

c) Small and Medium Enterprise Loan:

AB Bank Ltd. has been activity involved with financing in SME. To meet the growing need of SME’s loan, AB Bank Ltd. create a separate Division . The outstanding advances in this sector stood at 42.00 crore as on 31st December 2008.

d) Industrial Credit :

AB Bank Ltd. has been playing a vital role in supporting rapid industrialization in the country. The Bank continuous to provide for financing long term loan as well as working capital needs to

industrial project. The Bank also continuous to aggressively invest an in well structured syndicated loans. Sanction, disbursement and outstanding as on 31st December-08 are follows:

e) Foreign Remittance :

Inward remittances from Bangladeshi national working abroad continued to play supporting role in strengthening the current account of Bangladesh Economy. AB bank Ltd. has ensured Quick delivery of remittances by reducing lead-time to the beneficiaries account. The country received Taka 156.36 million during the year 2008. Compared with Taka 131.64M million in the same period of the proceeding year

f) Foreign Trade :

The performance of Foreign Exchange and Foreign Trade business is shown below marked a increase over the last year.

(Taka in Crore)

| Particulars | 2007 | 2008 |

| Import | 4,8441.00 | 50,686.37 |

| Export | 20,677.00 | 21,677.00 |

Major export items were Readymade Garments, Shrimps, Tea and non-traditional items. Import remained confined mainly to Consumers goods, capital machineries & industrial raw materials.

g) Foreign Correspondents:

AB Bank has already established a worldwide network & relationship with International Banking through its 1 representative office its in England, 1 subsidiary “AB International Finance .” in Hong Kong. 1Foreign Branch in Mumbai.

h) Recovery of Non-performing Loans:

The Bank has geared up its efforts to recover the classified loans and ensure sustained declination of classified loans over the years through the branches to keep pace with the global target of the bank to increase its performing assets. To achieve this target, the concern Division (Recovery Division-1) of Head Office co-ordinates the activities of the concerned Division/Branches to accelerate.

(a) Cash Recovery

(b) Settle-up classified loan accounts through interest waiver.

(c) Regularize classified loans through rescheduling.

i) Corporate Social Responsibility :

AB has been active all-through in the sports arena for quite sometime now. From the early part of eighties your Bank curved its niche in the sports arena as one of the prime partner.AB has been organizing “Siraj Smirty Cricket Tournament” an age group competition conducted at the district level for the last 10 years in a now.

Besides the cricket, AB also contributed towards popularizing the Table Tennis and Volleyball in different forms through organizing tournaments or through sponsorship of particular events. Bank wants to be an active partner in development of sports in the country.AB Bank has been sponsoring the Golf Tournament at the Bhatiary Golf Club for the last ten years in a row.

In 2007, AB Foundation participated in disaster relief operations for the Landslide victims in Chittagong, SIDR affected people of the coastal areas and In 2007, AB Foundation participated in disaster relief operations for the Landslide victims in Chittagong, SIDR affected people of the coastal areas and for the flood affected people across the country. Banks also run a media campaign for SIDR rehabilitation program. Foundation also contributed Taka 2.0 lac towards Sabina Yasmeen Chickasha Shahayok Committee fund for treatment of this renowned singer of the soil.

Bank also participated in the Training Academy of the Dhaka Stock Exchange. About Taka 8.0 lac was donated to procure training room equipment for the DSE Training Academy. AB has also been a regular contributor to the Bangladesh Institute of Bank Management.

k) Card Business:

AB Bank Ltd. introduces ready cash card facility. Under this System card holder can reload and refunded money from Our designated Branches Card holder also can pay utility Bills and purchase goods from different POS (point of sale).

Bank has also joined Electro ways Transactions Network (ETN) commonly known as E-cash, recently. This new platform will enable the Card Division to go for mass-based card programs in the future.

Pattern of Cost of Production:

AB bank Ltd. is not a manufacturing Company. The basic principal of this Financial Institution is to take deposit with low cost and providing loans and advances with high rate of profit. A chart of its cost of Deposit, cost of capital, cost of advances, cost of fund and other operating activities have been provided for the assignment:

| Types of Deposit : |

| 01. Currents & others account Deposits:a) Hajj Deposit (without profit basis deposit) |

| 02. Bills Accounts: |

| 03. Savings Bank Deposit:a) Deposit Pension A/c 5 yars to 10 yars. b) STD- Low cost profit basis |

| 04. Term Deposit:a) Short term deposit– i. 03 months to 06 months ii. 06 months to 12 monthsb) Long term deposit – 3 months,6 months, 12 months & above |

Pattern Cost of raw materials:

AB bank Ltd. Does product goods like as a manufacturing Company. It provides loans and advances among the loonies and borrowers.

The objectives of this Financial Institution is to take deposit with low cost and providing loans and advances with high rate of profit.

Following the guidelines of Bangladesh Bank credit facilities have been extended to productive and priority sectors. The Outstanding advance of the Bank is Tk. 1,44,723.90 Million on 31st December 2008. In extending credit facilities, the Bank has given due importance to sectoral needs and requirements of both public and private sectors.

Sector wise advances are shown below:

| SL | Name of Sector | Public | PPrivate | Total | % |

| 1 | Jute Sector | 6085.3 | 2118.1 | 8203.4 | 6 |

| 2 | Textile Ind. & trade | 550.7 | 4414.3 | 4965.0 | 4 |

| 3 | Steel & Engineering | 356.7 | 631.8 | 988.5 | 1 |

| 4 | Food & Allied | 1603.0 | 1298.0 | 2901.0 | 2 |

| 5 | Export Credit | 1300.0 | 12990.3 | 14290.3 | 10 |

| 6 | Import Credit | 25850.0 | 8377.3 | 34227.3 | 24 |

| 7 | Industrial Credit | 14965.3 | 14965.3 | 11 | |

| 8 | Rural ,Micro Enterprise & Special Financing | 70.0 | 10131.8 | 12201.8 | 7 |

| 9 | Housing | — | 1826.7 | 1826.7 | 2 |

| 10 | Others | 4930.0 | 40993.2 | 45923.2 | 33 |

| Grand Total | 45,753.32 | 98,970.58 | 1,44,723.90 | 100 | |

Rural Credit, Micro Ent. & Sp. Program Financing:

In consideration of the importance of rural sector on overall economy of the country, AB Bank has started rural financing since 1990. Bank has been extending rural credit to rural people through its Real Time Online Banking network all over the country on easy terms and conditions. Now under this rural credit portfolio there are 34 products. Position of some important products are shown below-

Sl. No | Name of Product & Services | No of Loaners of Rural Credit & Micro Credit sector. |

1. | Crop Loan Program | 3,64,377 |

2. | Agricultural Implementation & Irrigation Equipment | 2,545 |

3. | Fisheries and Shrimp Culture Credit Program | 1,090 |

4. | Cyber-Cafe Loan | 36 |

5. | Credit for Forestry / Horticulture / Nursery | 709 |

6. | Credit Programmed for Employees | 95,430 |

7. | Financing ”Women Entrepreneurship” | 225 |

8. | Financing Goat & sheep farming | 12,638 |

9. | Gharoa Project | 2,364 |

10 | Doctors Loan | 55 |

11 | Small Business Dev. Loan | 93 |

12 | Credit for disabled People | 194 |

13 | Consumer’s Credit | 4,412 |

| Agro-based Project/Industry | 490 | |

15 | Others | 1,85,342 |

| Total | 6,70,000 | |

2.12: Future Plane in ABBL:

Expansion:

To extend their Merchant Banking services across the country, MBW has already launched its operation in Agrabad (Chittagong). They are going to open 3 new service networks in Mohakhali (Dhaka), Uttara (Dhaka), Progoti Sorony and Sylhet soon.

New Business: In addition, AB Bank will also expand its operations in the investment banking in the following areas:

| BUSINESS AREA | STATUS |

| Islamic Capital Market Products | Processing. |

| Islamic Capital Market Products | Supporting infrastructure going to be prepares. |

| Asset Management / Mutual Fund | They are planning to launch and manage Mutual Fund in future. |

2.13: Branches of ABBL:

Dhaka 25

Chittagong 23

Khulna 07

Rajshahi 06

Sylhet 08

Barisal 01

Total 70

2.14: Corporate Information of ABBL:

| Name of the Company | : | AB Bank Limited (ABBL) |

| Legal Form | : | A public company incorporated on 31st December, 1981 under the Companies Act, 1913 and listed in the Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd. |

| Commencement of Business | : | 27th February 1982 |

| Registered Office | : | BCIC Bhaban, 30-31 Dilkusha C/A Dhaka 1000, Bangladesh GPO Box: 3522 Phone: +88-02-9560312 Fax: +88-02-9564122, 23 SWIFT: ABBLBDDH Email: info@abbank.com.bd |

| Auditors | : | ACNABINChartered Accountants |

| Legal Retainer | : | A. Rouf & Associates |

| Chittagong Regional Office | : | Spensers Building, 26 Agrabad C/A, Chittagong Tel: (031) 713381-83, 713385-86 Fax: (031) 713384 E-mail: agr@abbank.com.bd |

| Sylhet Regional Office | : | Garden Tower Biswa Road, Shahjalal Uposhohor Point Sylhet 3100, Bangladesh Tel: (0821) 725042, 815085 Fax: (0821) 725042 Ext 104 E-mail: gdnt@abbank.com.bd |

| Khulna Regional Office | : | 4, KDA C/A, Khulna Tel: (041) 72031, 723062, 724090 Fax: (041) 720311 Email: khln@abbank.com.bd |

| Rajshahi Regional Office | : | 102-103 Shaheb Bazar, Rajshahi Tel: (0721) 773261, 774283 Fax: (0721) 773261 E-mail: rjsh@abbank.com.bd |

| Arab Bangladesh Bank Foundation (ABBF) | : | BCIC Bhaban (7th Floor) 30-31, Dilkusha C/A, Dhaka 1000 Tel: +88-02-9553939 Fax: +88-02-9553773 E-mail: abbf@abbank.com.bd |

| AB Bank Limited, Islami Banking Branch | : | 82, Kakrail, Ramna, Dhaka Tel: +88-02-8332235, 37, 38 Fax: +88-02-8332236 Email: ibb@abbank.com.bd |

| Overseas Branch Mumbai Branch | : | Liberty Building, 41-42 Sir Vithaldas Thackersey Marg, New Marine Lines, Mumbai 400020, India Tel: (0091)(22) 22005392-3 Fax: (0091)(22) 22005391 SWIFT: ABBLINBB E-mail: mumbai@abbank.com.bd |

| Subsidiary Company AB International Finance Ltd | : | Hongkong Unit 1201-B, 12/F, Admiralty Centre Tower One, 18 Harcourt Road, Hongkong Tel: (00852) 28668094 SWIFT: ABFLNKHH E-mail: aomrashed@abbank.com.bd |

Literature of Review

Business Automation:

Being the 1st private sector Bank of the country, my bank has prided itself in the quality of the banking services it provides by taking conscious decision to employ the best available banking technology to serve the customers which now stands over 200,000 in all. Core banking system Kapiti was employed along side the manual banking operations ever since 1984.Later on in the year 2004,Misys core banking solution was selected for implementation to take AB in to super highway of real time online banking of today.

Software products from Misys:

Trade Finance Software: Trade Innovation:

TI has been designed with advanced workflow management to streamline the entire transaction lifecycle and the overall workflow of the trade operation. TI allows the bank to define service level agreements to each customer. The bank can apply either customer groupings or bi-lateral agreements for individual customers an environment.

Internet Banking Software: Integrated Financial Module:

Equation IFM offers powerful features for business customers. Customers can administer their own user communities, with different levels of access to customer and account information and transactions. Each user can have a pre-defined authorization limit, simplifying control. and reducing risk.

Credit Rating Report:

Credit Rating Agency of Bangladesh Ltd. (CRAB) has assigned “A1” rating in the long term and “ST-2” in the short term to AB Bank Limited for the year 2008.

| Entry Rating( 2007 ) | Entry Rating( 2008 ) | Defination |

Long Term A2 | Long Term A1 | The Bank rated ‘A1’in the long term has strong capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than the bank in higher-rated categories.’A1’is judged to be of high quality and are subject to low credit risk. |

Short Term ST – 2 | Short Term ST – 2 | The Bank rated ‘ST – 2’in the short term is considered to have strong capacity for timely repayment, characterised with commendable position in terms of liquidity, internal fund generation, and access to alternative sources of funds is outstanding. |

| Date of Rating | 24-May-2009 |

AB BANK LIMITED

By order of the Board

Sd/-

Dated: June 14, 2009 Company Secretary

Presentation of the Financial Statements:

Financial Statements of the Bank comprise the Balance Sheet, Profit and Loss Account, Cash Flow Statement, and Statement of Changes in Equity, Liquidity Statement and relevant notes and disclosures.

Financial Statement of the Bank are made as at 31 December 2008 and are prepared under the historical cost convention except investments and in accordance with the First Schedule (sec-38) of the Bank Companies Act 1991, BRPD circular # 14 dated 25 June 2003, other Bangladesh Bank circulars, the Companies Act 1994, the Securities and Exchange Ordinance 1969, Securities and Exchange Rules 1987 and other laws and rules applicable to a banking company.

Financial Statements of the Bank have been prepared in accordance with the measurement and recognition requirements of the International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) as adopted by the Institute of Chartered Accountants of Bangladesh ( ICAB ).

Functional and Presentational Currency:

Financial Statements of the Bank are presented in Taka, which is the Bank’s functional and presentational currency.

Cash Flow Statement is prepared principally in accordance with IAS- 7 “Cash Flow Statement” and under the guidelines of Bangladesh Bank BRPD Circular No. 14 dated 25th June 2003. The cash flow statement shows the structure of and changes in cash and cash equivalents during the financial year. It is broken down into operating activities, investing activities and financial activities.

Statement of Changes in Equity:

Statement of Changes in Equity is prepared principally in accordance with IAS-1 “Preparation of Financial Statements” and under the guidelines of Bangladesh Bank BRPD Circular No. 14 dated 25th June 2003.

Liquidity Statements:

The liquidity statements of assets and liabilities as on the reporting date has been prepared of the following basis :

- Balance with other banks and financial institutions, money at call and short notice, etc. are on the basis of their maturity term.

- Investment are on the basis of their respective maturity.

- Loans and advances are on the basis of their repayments maturity.

- Fixed assets are on the basis of the their useful lives.

- Other assets are on the basis of their realization/amortization.

- Borrowing from other banks, financial institutions and agents, etc. are as per their maturity/ repayments terms.

- Deposits and others accounts are on the basis of their maturity term.

- Provision and other liability on the basis of their repayments/ adjustments schedule.

Assets and basis of their valuation:

Cash and cash equivalent include notes and coins on hand, unrestricted balance held with Bangladesh Bank and highly liquid financial assets which are subject to insignificant risk of changes in their fair value, and are used by the bank management for its short term commitments.

Loans and advances :

- Loans and advances are stated at gross amounts at 31 December 2008.

- Interest is not charged on classified loans and advanced from the date of filling money suits against the borrowers.

- Interest charges on loans and advances classified by Bangladesh Bank Inspection Team and by the Bank management as special mention account, sub-standard, doubtful and bad is kept in interest suspense account as per Bangladesh Bank BCD Circular No.34 of 16 November

- Provision for loans and advances is made on the basis of year-end review by the management and of instructions contained Bangladesh Bank Circular No.34 of 16 November 1989, 20 of 27 December 1994, 12 of 4 September 1995,BRPD Circular No. 16 dated 6 December 1998, 9 of 14 May 2001, 02 of 15 February 2005, 9 of August 2005 and 17 of 6 December 2005,BRPD Circular No.05 dated 5 June 2006 and 05 of April 2008. The adopted rate for provisions are stated below:

| Business unit | UCProv.(%) | SMAProv.(%) | SSProv.(%) | DFProv.(%) | BLProv.(%) |

| House building & Professional | 2% | 5% | 20% | 50% | 10% |

| Consumer : Other than Housebuilding & Professional | 5% | 5% | 20% | 50% | 100% |

| Small & Medium | 1% | 5% | 20% | 50% | 100% |

| All Other | 1% | 5% | 20% | 50% | 100% |

The Bank’s investment in treasury bills are stated at present value and interest on treasury bills are recognized as income of the bank as and when profit received from treasury bills on maturity as per BRPD Circular No.15 dated 31 October 15 dated 31 October 2005 and DOS Circular Letter No.03 dated 07 February 2007.

Property , plant and equipment:

- All fixed assets are stated at cost less accumulated depreciation as per IAS-16 “Property, Plant and Equipment”. The cost of acquisition of an asset comprise its purchase price and any directly attributable cost of bringing the asset to its working condition for its intended use inclusive of inward freight, duties and non-refundable taxes.

- The bank recognized in the carrying amount of an item of property ,plant and equipment the cost of replacing part of such an item when that cost is incurred if it is probable that the future economic benefits embodied with the item will flow to the company and the cost of the items can be measured reliably. Expenditure incurred after the assets have been put into operation, such as repairs and maintenance is normally charged off as revenue expenditure in the period in which it is incurred.

- Depreciation on fixed assets is charged using reducing balance method except motor vehicles, computers and photocopies for which straight-line method is used. The rates of depreciation are as follows:

| Name of the Assets | Rate of Depreciation |

| Land | Nil |

| Building | 25% |

| Furniture & Fixtures | 10.00% |

| Electrical appliances | 20.00% |

| Motor vehicles | 20.00% |

| Leasehold assets – vehicles | 20.00% |

- Depreciation for assets addition during the year is charged from the month of addition. Whole month depreciation is charged for the month of addition.

- On the month of disposal of fixed assets no depreciation is charged. The cost and accumulated of depreciation of disposed assets are eliminated from the fixed assets schedule and gain or loss on such disposal is reflected in the income statement.

- Useful life and method of depreciation of fixed assets are reviewed periodically. If useful lives of assets do not differ significantly as it was previously estimated, bank management does not consider to revalue its assets by the meantime.

Leasing:

Where property, plant and equipment have been financed by lease agreements under which substantially all the risks and rewards of ownership are transferred to the bank, they are treated as finance lease as per IAS-17 “Leases”. All other leases are classified as operating leases as per IAS-17 “Leases”.

i. As lessee:

Assets held under finance lease are recognized as assets of the bank at their fair value at the date of acquisition or if lower, at the present value of the minimum lease payments. The corresponding liability to the lessor is included in the balance sheet as a finance lease obligation

Assets held under finance lease are depreciation over their expected useful lives on the same basis as owned assets.

ii. As lessor:

The bank did not grant any lease finance.

Stock of stationery:

Stock of stationery has been shown under other assets and valued at cost.

Liabilities and provision and basis of theirs valuation:

Provision for Taxation:

Income tax represents the sum of the current tax and deferred tax.

i. Current Tax:

This tax currently payable is based on taxable profit for the year.

ii. Deferred Tax:

Deferred tax is recognized on differences between the carrying amounts of assets and liabilities in the financial statements and the corresponding tax bases used in the computation of taxable profit, and are accounted for using the balance sheet liability method. The impact on the account of changes in the deferred tax assets and liabilities has also been recognized in the profit and loss account as per IAS – 12 “Income Taxes”.

Deposits:

Deposits include various types like current deposits, saving deposits, short term deposits, fixed deposits etc.

Statutory reserve:

Bank Companies Act, 1991 requires the bank to transfer of its current year’s profit before tax to reserve until such reserve equals to its paid up capital.

Retirement benefits to the employee:

The retirement benefits accrued for the employees of the bank as on the reporting date have been accounted for in accordance with the provision of IAS-9 “ Employee benefit”. Bases of enumerating the retirement benefits schemes operated by the bank are outlined below:

i) Provident fund:

There is a provident fund scheme under the defined contribution plan. The fund is operated by a separate board of trustees approved by the National Board of Revenue as per Income Tax Ordinance, 1984.All eligible employees contribution 10% of their basic pay to the fund. The bank also contributes equal of employees contribution to the fund. these contributions are invested separately. Benefits from the fund are given to eligible employees at the time of retirement/resignation as per approved rules of the fund.

ii) Staff gratuity:

The bank has a separate Board of Trustees for operating the staff gratuity fund approved by the National Board of Revenue. Employees of the bank, who served the bank for ten years or above are entitled to get gratuity benefit at rates determined by the Service Rules of the Bank.

iii) Superannuation fund:

The Bank operates a Superannuation Fund as death – cum – retirement benefit for its employees. The fund is operated by a separate Board of Trustees.

Provision for liabilities:

A provision is recognized in the balance sheet when the bank has a legal or constructive obligation as a result of past event and it is probable that an outflow of economic benefit will be required to settle the obligations, in accordance with IAS-37 “Provision, Contingent Liabilities and Contingent Assets”. However, certain provisions on assets and liabilities are maintained in accordance with relevant Bangladesh Bank Circulars issued from time to time.

Revenue recognition:

a) Interest Income:

In terms of the provisions of the IAS-18 “Revenue”, the interest income is recognized on accrual basis. Interest on loans and advances ceases to be taken into income when such advances are classified or treated as SMA as per BRPD Circular No. 5 dated 5 June 2006 and is kept in interest suspense account. Interest on classified advances is accounted for as and when realised.

b) Investment income:

Interest income on investments is recognized on accrual basis except treasury bills. Capital gains on investments in shares are also included in investment income. Capital gain is recognized when it is realised.

c) Fees and commission income:

Fees and commission income on services provided by the bank are recognized as and when the services are rendered. Commission charged to customers on letters of credit and letters of guarantee are credited to income at the time of affecting the transactions.

d) Dividend income on shares:

Dividend income from investment in shares is recognized when the bank’s right to receive dividend is established.

e) Interest paid on deposits and borrowing:

Interest paid on deposits, borrowing etc. is accounted for on accrual basis according to the IAS-1 “Presentation of Financial Statements”.

f) Other operating expense:

All other operating expenses are provided for in the books of the account on accrual basis according to the IAS-1 “Presentation of Financial Statements”.

Reconciliation of book of account:

Book of account in regard to inter-bank( in Bangladesh and outside Bangladesh) and inter-branch transactions are reconciled and no material difference was found which may affect the financial statements significantly. There exist no un-reconciled revenue items in NOSTRO accounts as at 31 December 2008.

Offsetting financial instruments:

No accounts of assets and liabilities were set-off unless these were legally permitted accordingly to the IAS-1 “ Presentation of Financial Statements”.

Earning per share:

a. Basic earning per share:

Basic earning per share have been calculated in accordance with IAS-33 “Earning per Share” which has been shown in the face of the profit and loss account. This has been calculated by dividing the basic earning by the total ordinary outstanding share

b. Diluted earning per share:

No diluted earning per share is required to be calculated for the year as there was no scope for dilution during the year under review.

Off-balance sheet items:

Off-Balance Sheet items have been disclosed under contingent liabilities and other commitments as per Bangladesh bank’s guidelines.

In accordance with BRPD Circular # 08 and 1 dated 07 August 2007 and 18 September 2007 respectively general provision @ 1.00% has been made on the outstanding balance of letter of credit, guarantee and acceptances as at 31 December 2008, while in 2007 general provision @ 0.5% has been made on above mentioned outstanding balance.

Memorandum items:

Memorandum items are maintained to have control over all items of importance and for such transactions where the bank has only a business responsibility and no legal commitment. Stock of travelers cheques, value of saving certificates ( Sanchaya Patra) , Customer’s stock of securities (MBW) and other fall under the memorandum items.

Reporting period:

These financial statements cover one calendar year from 01 January 2008 to 31 December 2008.

Findings & Analysis

Highlight of the overall activities /comparative analysis

of AB Bank Ltd., Southeast Bank Ltd.,& Brac Bank Ltd.

Financial year 2008

A Comparative Financial Statement of Southeast Bank, Brac Bank with AB Bank are shown below :

Sl. No. | Particulars | AB Bank Ltd. | Southeast Bank Ltd. | Brac Bank Ltd. | |

1. | Paid-up capital | 2,229,785,400 | 2,852,197,800 | 1,584,000,000 | |

2 | Total capital | 7,439,796,153 | 7,657,011,723 | 6,116,579,851 | |

3 | Capital surplus | 1,644,359,819 | 773,924,273 | 1,322,264,722 | |

4 | Total assets | 84,53,612,585 | 81,181,527,919 | 72,441,893,391 | |

5 | Total deposits | 68,560,474,323 | 68,714,672,575 | 58,006,887,010 | |

6 | Total loans & advances | 56,708,771,906 | 60,281,260,388 | 52,676,716,740 | |

7 | Total contingent liabilities and commitments | 26,074,330,983 | 31,579,703,610 | 2,160,995,459 | |

8 | Credit-deposit ratio | 82.71 | 87.73% | 90.81% | |

9 | Ratio of classified loans against total loans & advances | 2.99 | 4.12% | 4.69% | |

10 | Profit after tax and provision | 2,300,621,640 | 887,235,037 | 973,450,830 | |

11 | Loans classified during the year | 506,000,000 | 2,484,331,340 | 2,473,011,790 | |

12 | Provision kept against classified loans | 658,205,595 | 1,094,336,047 | 1,637,712,388 | |

13 | Provision surplus (deficit) | 81,600,219 | 35,236 | 682,365,273 | |

14 | Cost of fund | 11.09% | 9.65% | 9.44% | |

15 | Interest earning assets | 68,593,162,817 | 68,950,394,244 | 69,338,491,653 | |

16 | Non-interest earning assets | 15,460,449,768 | 12,231,133.,676 | 3,103,401,738 | |

17 | Return on investments (ROI) | 21.22% | 12.06% | 12.61% | |

18 | Return on assets (ROA) | 3.12% | 1.09% | 1.64% | |

19 | Income from investments | 2,152,888,463 | 1,279,958,931 | 909,126,833 | |

20 | Earnings per share | 13.18 | 31.11 | 62.30 | |

21 | Net income per share | 13.18 | 31.11 | 58.50 | |

22 | Price-earning ratio (Times) | 7.97 | 10.22 | 13.29 | |

- Source : Annual Reports.

Discussion : Discussion of the above finding are given below :

1.) A comparative analysis from the above mentioned Data , we can realized that The AB Bank has total assets position are better then Southeast Bank & Brac Bank .

2.) Total deposits and total Loans and advances position is higher than Brac Bank but lower than Southeast Bank Ltd.

3.)Total Profit after deduction tax & provision is higher then Southeast bank & Brac Bank, not only that AB Bank Ltd. is the second Profit earning Bank in the Bangladesh ( 1st Profit earning bank is Islami Bank (BD) Ltd.)

4.) In the long run Return on investment and Return on assets position ratio is better than Southeast Bank Ltd.and Brac Bank Ltd.

5.)Ratio of classified loans against total loans & advances is better than Southeast Bank and Brac Bank.

6.)But the earning per share & net income per share position is not better than Southeast Bank & Brac Bank Ltd.

7.)Cost of fund is grater than Southeast Bank & Brac Bank ltd. It is not good for AB Bank Ltd.

8.) From the above mentioned description , we can understood that The AB Bank Ltd. is the 2nd profitable Bank in the country. As a 1st generation Bank he can caught his position in the banking market.1st, 2nd ,3rd & 4th generation banks are the competitors of the AB Bank Ltd.

9.)During the last 27 years AB Bank Ltd. ,the premier sector bank of the country is making headway with a mark of sustainable growth.

Recommendation Regarding ABBL

1.) In today’s world we consider time as money. So it needs prompt action in making disbursement and collection of payment. In ABBL introduction of Speed Cash / Western Union money transfer system of Foreign Remittance may resolve this problem. I recommend introducing of Speed Cash/ Western Union money transfer system at the earliest to expedite payment of remittance.

2.) ABBL has Online banking System for which they can provide customer service promptly. Acquiring Foreign Remittance depends on prompt customer service and instant payment, which requires Online banking system.

3.) ABBL maintain database of other banks’ branches for which communication with other bank in connection with payment of Foreign Remittance can be made smoothly. Maintaining of other banks’ database is highly recommended.

4.) Customer always wants smooth banking services. Some banks are providing ATM/ Debit / Credit card and Evening banking facility from any of their branches, but AB Bank does not have ATM/ Credit/ Debit card and Evening banking facilities in all the branches. I recommend AB Bank

5.) The practice of marketing promotion policy is absent in AB Bank which will be a cause to its survival among all other new banks as the other banks are tremendously exercise to improve the marketing promotion practice.

6.) ABBL extends credit only to running and old customers but it does not encourage new entrepreneurs/ customers highly. In this regard increase in efficiency and maximization of profit is crucial. I recommend ABBL should extend credit not only running and old customers but it also should try to increase customer for its improvement and survival in future.

Conclusions

As a student of MBA program, I be enjoyed as the dissertation period to learn it and observe how to make it. As a banker I try to share my knowledge under supervision of my sir Prof. Dr. Md. Arshed Ali Matubber. Chairman, Department of Business Administration.

ABBL should also copy up with globalization as it had already been improved itself in post reform environment.

Primary and secondary data were collected very sincerely and efficiently. Collected data were analyzed; interpreted and essential findings were presented through appropriate research techniques. The study has identified a series of issues to incorporate and take up with the current process and procedure relating the mentioned subject After the introduction of financial sector reform and Banking Company Act 1991, changes in banking sector of the country are very remarkable. Activities of different dimension, modern system and methods of workings and better policies have been taking place in the banks. Successful application and operations for providing efficient services a midge’s keen competition of different banks enhance performance of them.

![Thesis Paper on Performance Analysis and Budgetary Control Activities of Trade Vision Limited [Part-2]](https://assignmentpoint.com/wp-content/uploads/2013/04/images-18-200x100.jpg)