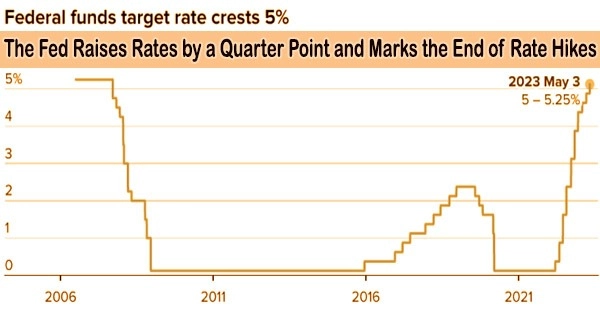

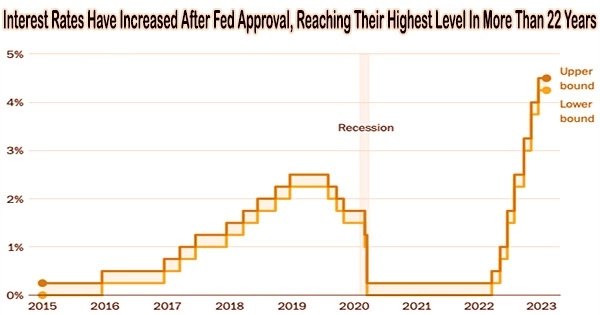

Interest Rates Have Increased After Fed Approval, Reaching Their Highest Level In More Than 22 Years

A highly anticipated interest rate increase by the Federal Reserve was approved on Wednesday, raising benchmark borrowing costs to their highest level in more than…